- Home

- »

- Pharmaceuticals

- »

-

Biologics Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Biologics Market Size, Share & Trends Report]()

Biologics Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Microbial, Mammalian), By Product (MABs, Recombinant Proteins, Antisense & RNAi), By Disease Category, By Manufacturing, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-700-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biologics Market Summary

The global biologics market size was estimated at USD 400.02 billion in 2024 and is projected to reach USD 653.34 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2030. Rising burden of cancer, genetic diseases, and autoimmune diseases coupled with the approval of several disease-modifying therapies of these conditions are driving market growth.

Key Market Trends & Insights

- Asia Pacific region is projected to expand at the CAGR of 11.0% during the forecast period.

- North America held the largest revenue share of 44.37% in 2022.

- Based on the disease category, the oncology segment dominated the biologics industry with a share of 28.40% in 2022.

- Based on source, the microbial segment dominated the biologics industry with a share of 58.23% in 2022.

- Based on manufacturing, the in-house segment dominated the market with 84.87% share in 2022.

Market Size & Forecast

- 2024 Market Size: USD 400.02 Billion

- 2030 Projected Market Size: USD 653.34 Billion

- CAGR (2025-2030): 8.5%

- North America: Largest market in 2022

The development of personalized medicine and companion diagnostics further fuels growth of the market. These advancements allow for more targeted and effective treatments, which in turn increases the demand for biologic products.

As per Globocan, the incidence of cancer is projected to rise from 19.3 million in 2020 to 24.6 million in 2030. Moreover, autoimmune diseases are experiencing an annual increase in prevalence ranging from 3% to 9%. Additionally, there is a growing prevalence of neurological conditions such as Alzheimer’s disease and Parkinson’s disease. It is anticipated that the prevalence of Alzheimer's disease will reach 78 million in 2030 and by 2050, it will rise to 139 million. The development of disease-modifying therapies such as monoclonal antibodies for these conditions is driving the biologics industry.For instance, in January 2023, FDA approved Leqembi (lecanemab-irmb) via the Accelerated Approval pathway for the treatment of Alzheimer's disease. It reduces amyloid-β plaques and moderately slows mild cognitive decline in patients with early Alzheimer's disease.

In recent years, novel products such as gene therapy, RNAi therapies, mRNA-based vaccines have already been commercialized successfully. For instance, Pfizer’s Comirnaty, an mRNA-based vaccine for Covid-19, which became the top-selling biologic in 2021 This achievement has paved the way for the development of mRNA-based vaccines targeting other diseases such as RSV and flu. For instance, in September 2022, Pfizer commenced phase 3 trials for its mRNA-base flu vaccine. These advancements highlight the expanding opportunities for mRNA-based vaccines in the medical field.

The approval of biosimilars is a key factor restraining the biologics market. 40 biosimilars have been approved by the U.S. FDA as of 2022. Due to the lower cost of biosimilars, governments encourage prescription and dispensing of biosimilars to reduce overall healthcare spending. For instance, biosimilars led to a saving of USD 7 billion in 2021, in the U.S.

Disease Category Insights

Based on the disease category, the oncology segment dominated the biologics industry with a share of 28.40% in 2022. According to the American Cancer Society, in 2022, approximately 1.92 million new cancer cases and around 609,360 cancer deaths were reported in the U.S. Cancer ranks as the second leading cause of death worldwide, with an estimated 9.6 million deaths in 2020. The advent of biologic medications, especially monoclonal antibodies and immunotherapy therapies has significantly enhanced cancer treatment by improving survival rates and reducing side effect. Biologic medications have made a substantial impact in the field of breast cancer treatment, exemplified by the positive outcomes observed with the use of Herceptin. By 2023, the global market for oncology biologics is anticipated to surpass $100 billion in value.

The hematological disorder segment is expected to expand at the fastest CAGR of 11.7% during the forecast period. The approval of gene therapy of rare blood disorders such as hemophilia is expected to be a major factor driving market growth. For instance, in November 2022, the U.S. FDA approved CSL Behring’s Hemgenix for the treatment of adults with hemophilia B. Additionally, in August 2022, BioMarin’s ROCTAVIAN was also approved for treating hemophilia A in Europe. Pfizer’s PF-07055480 (giroctocogene fitelparovec) and PF-06838435/ fidanacogene elaparvovec are in phase 3 trials for type A & B respectively.

Source Insights

Based on source, the microbial segment dominated the biologics industry with a share of 58.23% in 2022. The majority of currently approved biologics are developed and manufactured in microbial expression systems. Products such as platelet-derived growth factor, recombinant insulin, granulocyte-macrophage colony-stimulating factor, and recombinant interferons are manufactured in microbial expression systems.

The mammalian expression systems segment is expected to expand at a significant CAGR during the forecast period. These expression systems are majorly used for the development of recombinant proteins and viral-vector based vaccines. CHO and HEK are the most commonly used mammalian cell lines. Products such as Perjeta (Pertuzumab), Adcetris (Brentuximab-Vedotin), Shingrix (zoster vaccine), Kadycla (Trastuzumab emtansine), and Aimovig (erenumab) are few of the products manufactured in mammalian expression systems.

Manufacturing Insights

Based on manufacturing, the in-house segment dominated the market with 84.87% share in 2022. Biologic drug manufacturing is more complex as compared to small molecules and involves the utilization of live micro-organism cultures and adheres to strict regulatory requirements. In-house manufacturing offers the advantage of direct control, enabling better monitoring of biologic drugs on a day-to-day basis.

The outsourcing segment is projected to expand at a CAGR of 10.7% during the forecast period. Many CDMOs such as WuXI biologics, Lonza, and Samsung Biologics have established cutting-edge biologic manufacturing facilities. Collaborating with these CDMOs grants companies access to manufacturing experts, ensuring successful downstream process development and the implementation of new technologies. The market growth is significantly influenced by the increasing number of CDMOs and their expansion of production capacity. For instance, in November 2022, WuXi Biologics inaugurated its integrated biologics center in Shanghai. The 1.6 million sq. ft. facility will provide end-to-end biologics development facilities including product development, quality control and manufacturing.

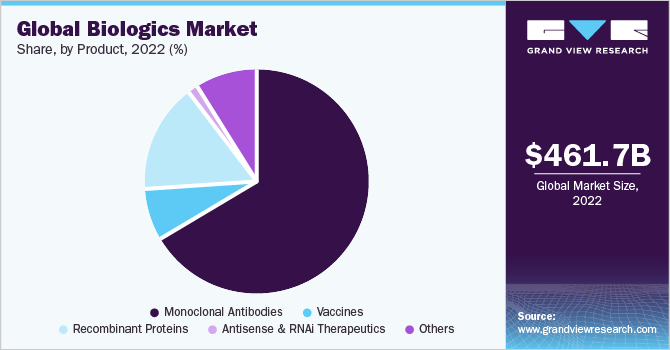

Product Insights

Based on product, the monoclonal antibodies segment accounted for a share of 66.42% in 2022 due to higher usage of this category of drugs in different therapeutic areas. MABs allow targeting of unhealthy cells without harming the healthy cells. Monoclonal antibodies have emerged as the predominant category of approved biologic drugs till now. In 2021, the U.S. FDA achieved a significant milestone by approving its 100th monoclonal antibody product, just six years after approving its 50th product back in 2015. Based on source, the humanized monoclonal antibodies dominated the market. This is due to their lower risk of inducing an immune response when compared to murine or chimeric antibodies.

The antisense and RNAi therapeutics segment is anticipated to expand at a CAGR of 20.6% during the forecast period. These biologic products facilitate targeted and efficient gene silencing, leading to the development and approval of numerous gene silencing drugs for genetic diseases. For instance, in June 2022, Alnylam Pharmaceuticals, Inc. received FDA approval for its RNAi therapeutic AMVUTTRA for the treatment of Polyneuropathy of hereditary transthyretin-mediated amyloidosis.

Regional Insights

North America held the largest revenue share of 44.37% in 2022. This can be attributed to several factors, including the high prevalence of chronic diseases, the presence of numerous leading biopharmaceutical companies, favourable reimbursement policies, and significant investments in R&D. As per an article published in JAMA Network, biologics accounted for 37% of the total drug spending in the U.S. The increasing share of biologic prescriptions and growing investments in the development of targeted drugs are some of the factors contributing for the market growth. Furthermore, the approval of multiple novel biologic drugs, such as gene therapy, antisense, and RNAi therapeutics, is expected to further propel market growth.

Asia Pacific region is projected to expand at the CAGR of 11.0% during the forecast period. The rising burden of diseases such as cancer, diabetes, and cardiovascular diseases in Asia-Pacific, coupled with an increase in the geriatric population, has increased demand for biologics. Market leaders in the industry are prioritizing the fulfilment of this demand and making substantial investments in the development of advanced biologic products. A significant driver of growth in the market in this region is the adoption of biosimilars, which play a crucial role in expanding accessibility and affordability of biologic therapies.

Key Companies & Market Share Insights

Key strategies employed by key players include emphasizing R&D, launching new products, and strategic partnerships to expand their presence in different regions. For instance, in January 2023, the U.S. FDA approved Lecanemab through its accelerated approval pathway, specifically for the treatment of Alzheimer's Disease.

Furthermore, there is a significant focus on the establishment of new biologic manufacturing facilities by companies. In March 2023, Novartis revealed its division Sandoz's plan to invest approximately USD 400 million in the development of a biologics manufacturing facility located in Slovenia. Similarly, in March 2023, Eli Lilly announced its plan to invest an additional USD 500 million for the expansion of its existing 500,000 sq. ft. biologics manufacturing facility in Limerick. Notably, in January 2022, the company had initially announced an investment of USD 500 million for the development of the same facility. Some of the prominent players in the global biologics market include:

-

Samsung Biologics

-

Amgen Inc.

-

Novo Nordisk A/S

-

AbbVie Inc.

-

Sanofi

-

Johnson & Johnson Services, Inc.

-

Celltrion Healthcare Co., Ltd.

-

Bristol-Myers Squibb Company

-

Eli Lilly and Company

-

F. Hoffmann La-Roche Ltd.

Biologics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 426.71 billion

Revenue forecast in 2030

USD 653.34 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, disease category, manufacturing, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Samsung Biologics; Amgen Inc.; Novo Nordisk A/S; AbbVie Inc.; Sanofi; Johnson & Johnson Services, Inc.; Celltrion Healthcare Co., Ltd.; Bristol-Myers Squibb Company; Eli Lilly and Company; F. Hoffmann La-Roche Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biologics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global biologics market report on the basis of source, product, disease category, manufacturing, and region:

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Microbial

-

Mammalian

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Monoclonal Antibodies

-

MABs by Application

-

Diagnostic

-

Biochemical Analysis

-

Diagnostic Imaging

-

-

Therapeutic

-

Direct MAB Agents

-

Targeting MAB Agents

-

-

Protein Purification

-

Others

-

-

MABs by Type

-

Murine

-

Chimeric

-

Humanized

-

Human

-

Others

-

-

-

Vaccines

-

Recombinant Proteins

-

Antisense & RNAi Therapeutics

-

Others

-

-

Disease Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

By Product

-

MABs

-

Vaccines

-

Recombinant Proteins

-

Antisense & RNAi Therapeutics

-

Others (Certain products under trials related to blood products etc)

-

-

-

Infectious Diseases

-

By Product

-

Vaccines

-

MABs

-

Antisense & RNAi Therapeutics

-

Recombinant Proteins

-

Others

-

-

Immunological Disorders

-

Cardiovascular Disorders

-

Hematological Disorders

-

Others

-

-

Manufacturing Outlook (Revenue, USD Billion, 2018 - 2030)

-

Outsourced

-

In-house

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biologics market size was estimated at USD 461.74 billion in 2022 and is expected to reach USD 511.89 billion in 2023.

b. The global biologics market is expected to grow at a compound annual growth rate of 10.3% from 2023 to 2030 to reach USD 1,009.37 billion by 2030.

b. Monoclonal antibodies (MABs) have dominated the product scope with revenue share of 66.42% in 2022 owing to the presence of a substantial number of commercially approved products under this segment and their usage among end-users.

b. Some major entities operating in the biologics market include Eli Lilly & Company, Samsung Biologics, F Hoffman La Roche, Celltrion, Addgene, Amgen, Abbvie Inc., Sanofi, Pfizer Inc., Merck & Co. Inc, Novo Nordisk A/S, and Johnson & Johnson Services Inc.

b. Key factors that are driving the biologics market growth include expanding biomanufacturing facilities and the emergence of contract research organizations that have accelerated biologics manufacturing by addressing the budget and resource constraints of market players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.