- Home

- »

- Clinical Diagnostics

- »

-

Breast Cancer Diagnostics Market Size, Industry Report 2033GVR Report cover

![Breast Cancer Diagnostics Market Size, Share & Trends Report]()

Breast Cancer Diagnostics Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Imaging, Biopsy, Genomic Tests, Blood Tests), By Product (Platform-based, Instrument-based), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-694-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Breast Cancer Diagnostics Market Summary

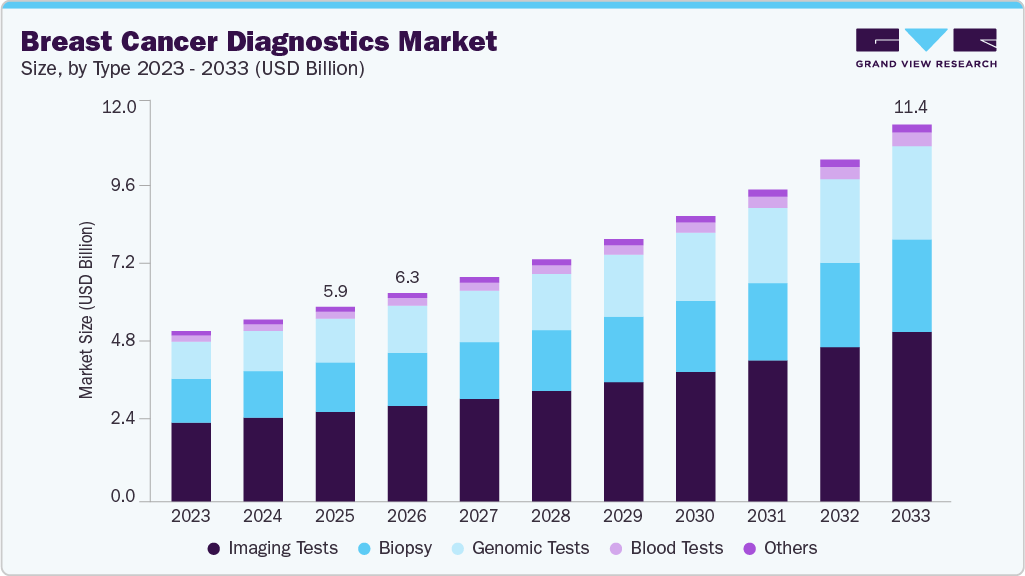

The global breast cancer diagnostics market size was estimated at USD 5.86 billion in 2025, and is projected to reach USD 11.36 billion by 2033, growing at a CAGR of 8.8% from 2026 to 2033. The growth can be attributed to the increasing prevalence of cancer and rising government initiatives to increase the screening and diagnostic rates.

Key Market Trends & Insights

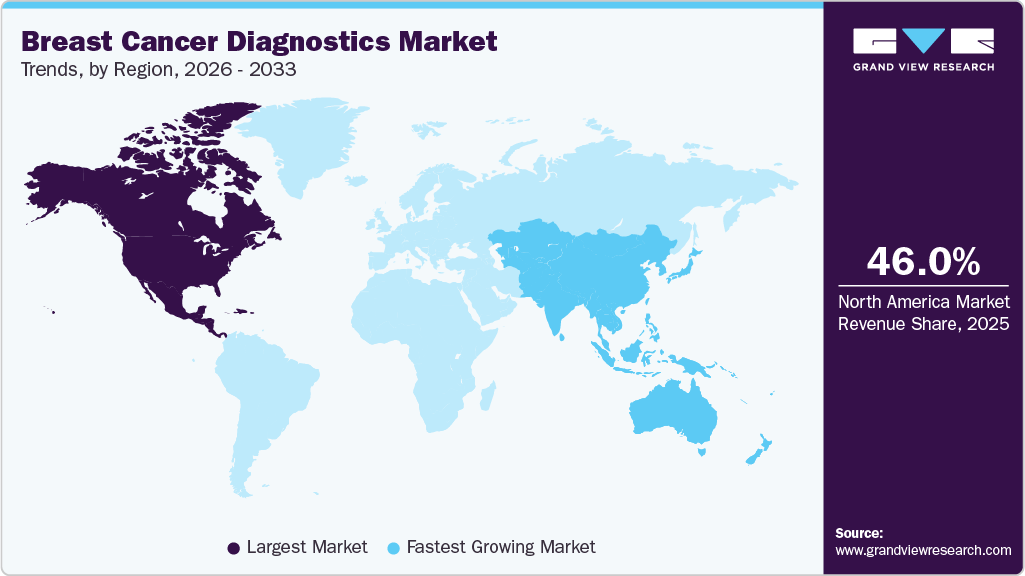

- The North America breast cancer diagnostics industry dominated the global market with a revenue share of 46.01% in 2025.

- By type, the imaging segment held the highest market share of 51.60% in 2025.

- By product, the instrument-based products segment held the largest market share of 71.02% in 2025.

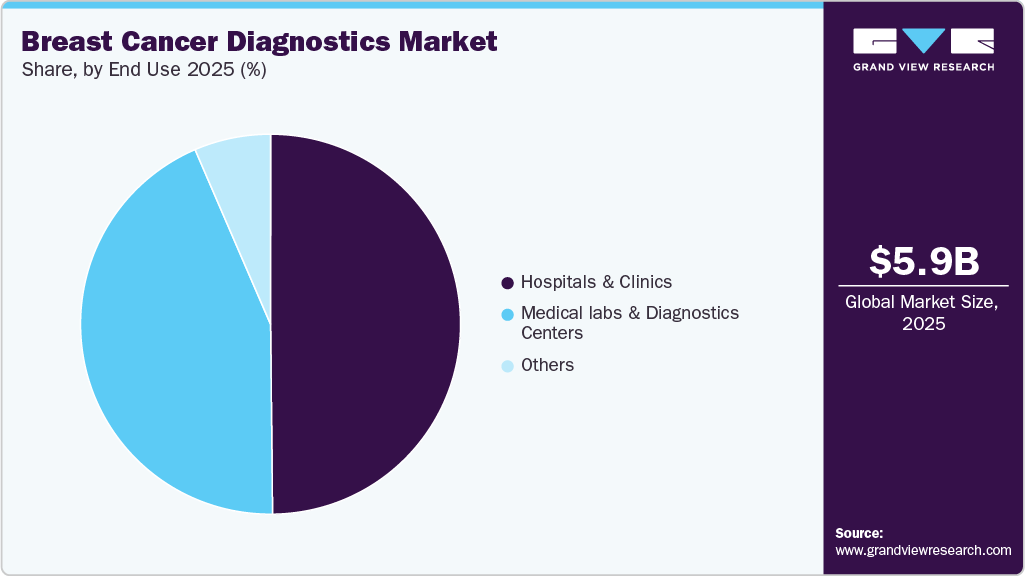

- By end use, the Hospitals & Diagnostic Laboratories segment held the largest market share of 49.84% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.86 Billion

- 2033 Projected Market Size: USD 11.36 Billion

- CAGR (2026-2033): 8.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The increasing incidence of breast cancer is expected to drive the breast cancer diagnostics market. According to the American Cancer Society’s Breast Cancer Facts & Figures 2024, breast cancer remained the most commonly diagnosed cancer among women in the U.S. In 2024, an estimated 310,720 new cases of invasive breast cancer were expected to be diagnosed, along with 55,720 cases of ductal carcinoma in situ (DCIS).Several factors contributed to the increasing incidence of breast cancer, including aging populations, lifestyle changes, genetic predisposition, and environmental influences. As life expectancy increased, more women reached ages where breast cancer risk was higher. In addition, risk factors such as obesity, sedentary lifestyles, hormonal therapies, and delayed childbearing were linked to a greater likelihood of developing breast cancer. Increased awareness and improved screening programs also led to a rise in reported cases, as more cancers were detected at earlier stages. With the growing number of breast cancer cases, the need for effective and accurate diagnostic technologies. Mammography remained the gold standard for breast cancer screening, but advancements in digital breast tomosynthesis (DBT), contrast-enhanced mammography, ultrasound, MRI, and molecular diagnostic tests drove market growth. The integration of AI in imaging interpretation further improved early detection capabilities, enhancing accuracy while reducing false positives and negatives. In addition, liquid biopsy and biomarker-based diagnostics emerged as non-invasive tools for detecting breast cancer and monitoring treatment response.

Healthcare systems worldwide have increased investments in breast cancer screening programs to address the rising burden. Governments and private healthcare providers expanded access to diagnostic services, particularly in developing regions where screening rates had historically been lower. The focus on early detection and personalized medicine accelerated the adoption of next-generation sequencing (NGS), genetic testing, and companion diagnostics. As breast cancer incidence continued to rise, the breast cancer diagnostics market experienced sustained growth. Ongoing advancements in technology, combined with greater awareness and improved accessibility to screening, drove demand for innovative diagnostic solutions that enabled earlier and more accurate cancer detection.

The increasing reimbursement and insurance coverage for breast cancer testing is anticipated to drive market growth. Government agencies in various countries, such as the German Federal Joint Committee, have approved tests for nationwide reimbursement. In the U.S., Medicaid, Medicare, and third-party payer benefit plans cover the cost of breast cancer genetic testing, including BRCA1 and BRCA2 tests, increasing the number of procedures conducted globally. Furthermore, Medicare Part B covers 80% of the cost of one mammogram and digital mammogram screening per year for women aged 40 and older.

Moreover, In February 2025, Agendia, Inc. announced that the National Institute for Sickness and Invalidity Insurance (INAMI-RIZIV) in Brussels has expanded the reimbursement criteria for MammaPrint, now covering its use in the neoadjuvant setting. Effective January 1, 2025, this decision allows full reimbursement for patients with HR+/HER2-negative early-stage breast cancer, enabling genomic testing on core needle biopsies to guide neoadjuvant treatment decisions. This expansion marks a significant step forward in providing patients with more personalized care. Professor Martine Piccart, Honorary Professor of Oncology at the Université Libre de Bruxelles, highlighted the impact of this advancement, stating, "The ability to use MammaPrint on core needle biopsy specimens in Belgium represents a major milestone for personalized breast cancer treatment. The benefits of neoadjuvant therapy are substantial, especially when guided by MammaPrint, as it enables physicians to tailor treatment plans more precisely. This can lead to less extensive surgical procedures when the appropriate treatment is selected."

MammaPrint has demonstrated strong performance in the neoadjuvant setting, particularly through studies like FLEX (NCT03053193), a prospective, real-world observational breast cancer study utilizing whole transcriptome analysis. The assay has shown high concordance between matched surgical resection samples and core needle biopsy specimens, reinforcing its clinical utility. This expanded indication underscores the critical role of genomic testing in breast cancer management, supporting more precise treatment strategies. Chief Executive Officer at Agendia, emphasized the significance of this reimbursement expansion, stating, "The broader reimbursement of MammaPrint represents a major step forward in the fight against breast cancer. This decision ensures that more women in Belgium is expected to have access to Agendia’s advanced diagnostic solutions, which serve as the foundation for personalized treatment decisions. We are grateful for INAMI-RIZIV’s recognition of the importance of precision medicine and look forward to continuing our commitment to improving outcomes for breast cancer patients in Belgium.”

Overall, technological advancements, along with increasing reimbursement and insurance coverage, have significantly improved breast cancer diagnostics, leading to earlier detection, targeted treatments, and improved patient outcomes. Ongoing research and development efforts are essential to further enhance breast cancer diagnostics as technology continues to evolve.

Table 1 Average cost of imaging for breast cancer diagnosis

Imaging Technique

Average Cost

Magnetic Resonance Imaging (MRI)

USD 601 to USD 3,837

X-Ray

USD 72 to USD 92

Mammography

USD 201 to USD 165

Computed Tomography (CT)

USD 300 to USD 6,750

Ultrasound

USD 156 to USD 752

Source: American Cancer Society, Grand View Research

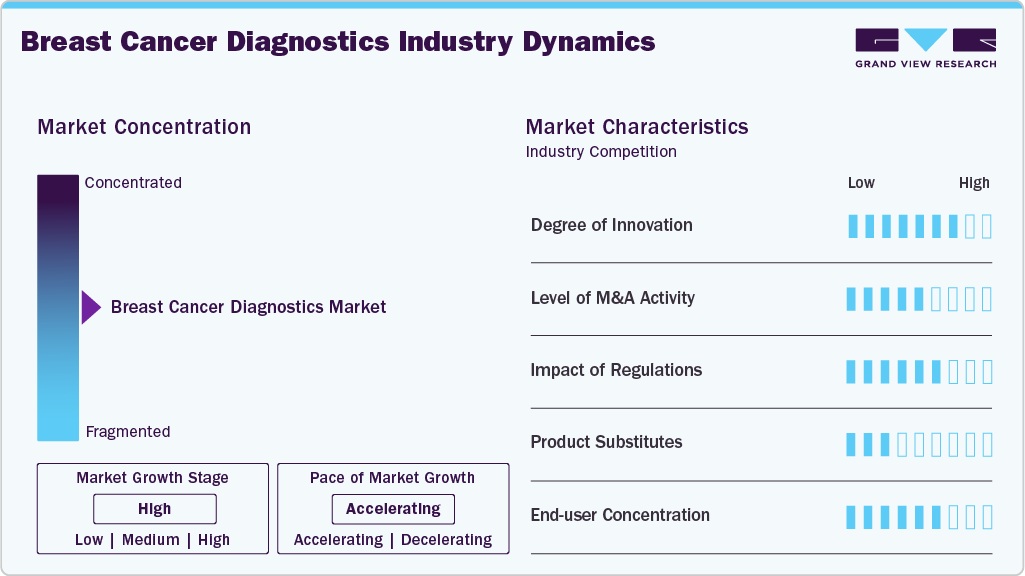

Market Concentration & Characteristics

The degree of innovation in the breast cancer diagnostics market is high, driven by the integration of advanced technologies such as artificial intelligence (AI), liquid biopsy, and multi-omics approaches. Traditional methods, such as mammography and biopsy are now complemented by cutting-edge techniques that offer greater accuracy, earlier detection, and less invasiveness. For instance, Guardant Health's liquid biopsy tests analyze circulating tumor DNA (ctDNA) to detect mutations linked to breast cancer, allowing for early-stage detection and real-time treatment monitoring. Similarly, PathAI employs AI-powered pathology solutions to enhance diagnostic precision. Innovations such as NanoString’s GeoMx Digital Spatial Profiler further exemplify the shift toward spatial biology and personalized diagnostics.

The breast cancer diagnostics market has witnessed a robust level of mergers and acquisitions (M&A) activity, reflecting the industry's drive to consolidate expertise and expand technological capabilities. For instance, Hologic Inc. acquired Biotheranostics for approximately USD 230 million in 2021, gaining access to molecular diagnostic tests that support breast and metastatic cancer detection. Similarly, Exact Sciences Corporation strengthened its position in oncology diagnostics by acquiring Genomic Health in a deal valued at USD 2.8 billion, integrating tests such as Oncotype DX into its portfolio. Siemens Healthineers also bolstered its cancer imaging segment through the acquisition of Novartis’s Advanced Accelerator Applications unit. These strategic deals illustrate how companies are leveraging M&A to accelerate innovation and improve market competitiveness.

Regulation plays a critical role in shaping the breast cancer diagnostics market, influencing product development, approval timelines, market access, and patient safety. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) ensure that diagnostic tools meet stringent standards for accuracy, reliability, and clinical utility. For instance, the FDA’s approval process for companion diagnostics—such as those required for HER2 or BRCA testing adds credibility but also extends the time and cost to market. Regulatory frameworks such as the EU’s In Vitro Diagnostic Regulation (IVDR), effective since May 2022, have increased compliance requirements, pushing companies to invest more in quality assurance and clinical evidence. While such regulations may delay product launches, they ultimately foster trust in diagnostic tools and ensure better patient outcomes by maintaining high standards across the market.

In the breast cancer diagnostics market, product substitutes refer to alternative technologies or methods that can replace or complement traditional diagnostic tools. While mammography remains the standard screening method, substitutes such as magnetic resonance imaging (MRI), ultrasound, and thermography are increasingly used in specific patient populations. For instance, breast MRI is often used for high-risk patients due to its high sensitivity, while 3D tomosynthesis offers improved detection over conventional 2D mammography. In the molecular diagnostics space, liquid biopsy is emerging as a non-invasive substitute for traditional tissue biopsy, enabling real-time monitoring of cancer through circulating tumor DNA. These substitutes can shift diagnostic preferences depending on clinical needs, cost, availability, and patient comfort.

End user concentration in the breast cancer diagnostics market refers to the extent to which demand is dominated by specific user groups, such as hospitals, diagnostic laboratories, and specialty cancer centers. This market shows moderate to high end user concentration, with large hospital networks and diagnostic chains accounting for a significant share of demand. Institutions such as Mayo Clinic, Cleveland Clinic, and large reference labs such as LabCorp and Quest Diagnostics play a pivotal role in adopting and driving the use of advanced diagnostics. These entities often have the financial and technical resources to integrate new technologies like genomic testing and AI-driven imaging tools. Consequently, manufacturers frequently target these high-volume users through strategic partnerships and direct sales efforts, as their adoption can influence broader market uptake.

Type Insights

The imaging segment dominated the breast cancer diagnostics market and held the largest revenue share of 51.60% in 2025. The market witnessed significant growth in 2025 due to the widespread adoption of imaging techniques like mammography, ultrasound, and MRI. These modalities have become the primary tools for breast cancer diagnosis, while advanced technologies such as MBI, CT, 3D breast tomosynthesis, and PET show great potential for transforming breast imaging capabilities.

In September 2024, CDC reported breast cancer to be the second most prevalent type of cancer and second leading cause of death among women in the United States. On October 1, 2024, Barco, a global producer of breast imaging displays, unveiled the Coronis OneLook display solution. This advanced display has been optimized for interpreting 3D cine examinations from CT, ultrasound, and breast MRI. Equipped with Barco's patented RapidFrame technology, it ensures crisp moving images without blur. Moreover, Coronis OneLook offers customizable on-screen touch buttons, enhancing workflow efficiency for radiologists. In addition to the hardware launch, Barco introduced the ConnectCare service, designed to enhance diagnostic display management for healthcare organizations for weekly monitoring and automated compliance reporting.

However, the blood tests segment is anticipated to grow at the fastest CAGR over the forecast period, driven by extensive research studies conducted by research organizations and major players. The high effectiveness of liquid biopsy tests contributes to the growth in the number of blood tests. In March 2025, BCAL Diagnostics Limited, a biotechnology company operating in both Australia and the US, has officially launched BREASTEST plus. The company marks the challenge of detecting leisons in high breast density. This innovative blood test is designed to complement standard imaging methods in breast cancer screening and diagnostics. BREASTEST plus aims to enhance early breast cancer detection by providing a non-invasive alternative to traditional mammograms. In clinical studies, it demonstrated a sensitivity of 90% and a specificity of 85.5%, outperforming existing screening methods. In March 2025, Personalis Inc., along with The Institute of Cancer Research and The Royal Marsden NHS Foundation Trust, highlighted the importance of ultra-sensitive ctDNA for early-stage breast cancer recurrence detection using NeXT Personal. Personalis' NeXT Personal assay is an ultra-sensitive, personalized liquid biopsy test designed to detect minimal amounts of circulating tumor DNA (ctDNA) from the blood of cancer patients and survivors. This information enables the creation of a customized blood test capable of detecting these specific variants with exceptional sensitivity, down to approximately one part per million (PPM) of ctDNA.

Product Insights

The instrument-based products segment dominated the breast cancer diagnostics market and held the largest revenue share of 71.02% in 2025. Instrument-based products offer high precision and accuracy in detecting and diagnosing the disease. These instruments are equipped with advanced imaging technologies and molecular analysis tools that provide detailed and reliable information about the presence, location, and characteristics of tumors. This accuracy is crucial for guiding treatment decisions and ensuring optimal patient outcomes. Instrument-based products play a pivotal role in breast cancer screening and early detection. For instance, Mammography machines are widely used for routine screening due to their ability to detect tumors at an early stage when they are most treatable.

On the other hand, the platform-based products segment is anticipated to grow at the fastest rate over the forecast period. Platform-based products offer comprehensive solutions that encompass multiple diagnostic modalities and technologies within a single integrated system. Furthermore, Platform-based products streamline workflows by consolidating diagnostic procedures, leading to time and cost savings for healthcare providers. Platform-based technologies grew through sequencing and PCR innovation, for instance, in January 2025, Illumina released updated workflows for high-throughput next-generation sequencing that support more accurate breast cancer mutation profiling. In addition, the availability of approved products such as Ion GeneStudio S5 next-generation sequencing systems, Ion AmpliSeq HD panels, and GeneReader NGS system for targeted NGS and QIAseq Panel assays are accountable for segment growth.

Application Insights

The diagnostic & predictive segment dominated the market and held the largest revenue share of 48.71% in 2025. Diagnostic applications play a crucial role in identifying the presence of breast cancer at an early stage. Early detection enables timely intervention, leading to improved treatment outcomes and reduced mortality rates.Diagnostic and predictive applications strengthened with Roche announcing in March 2024 the launch of the Elecsys HER2 Ultra immunoassay, designed to improve HER2-low detection accuracy. Diagnostic methods such as mammography, ultrasound, and MRI help detect abnormalities in breast tissue, guiding healthcare providers in making accurate diagnoses. For instance, in March 2025, GE Healthcare launched Invenia Automated Breast Ultrasound (ABUS) Premium. It is a latest 3D ultrasound offering advanced AI and innovative features that accelerate scanning and drive early cancer detection in dense breasts.

The prognostic segment is anticipated to grow at the fastest rate over the forecast period. The market for prognostic tests in breast cancer is highly competitive, with numerous players vying for the same patient base. The increasing importance of prognostic tests in matching patients with appropriate therapies has significantly improved survival rates. Companion diagnostics, such as BRAC Analysis CDx by Myriad Genetic Laboratories, Inc., PD-L1 IHC 22C3 pharmDx by Dako North America, Inc., and Foundation One CDx by Foundation Medicine, Inc. play a crucial role in this process. Exact Sciences presented novel long-term patient results in multi-cancer early detection and breast cancer recurrence testing at the American Society of Clinical Oncology (ASCO) 2023. Moreover, the study also highlighted the test's prognostic capability for breast cancer-specific mortality in patients with invasive ductal carcinoma and invasive lobular breast cancer.

End Use Insights

The hospitals & clinics segment led the market, accounting for 49.84% of the revenue share in 2025, due to the rising number of hospitalizations and increasing burden of breast cancer. These healthcare facilities play a critical role in conducting biopsy procedures following initial screening tests, while advanced imaging technologies such as PET, CT, & MRI are utilized for effective disease monitoring and treatment evaluation. Hospitals and clinics often have multidisciplinary teams, including oncologists, radiologists, pathologists, surgeons, and nurses, who collaborate to provide comprehensive care for breast cancer patients. This integrated approach ensures that patients receive appropriate diagnostic evaluations, treatment planning, and ongoing management.

However, the medical labs & diagnostics centers segment is anticipated to grow at the fastest rate over the forecast period, owing to high market penetration and procedure volumes. An increase in the number of initiatives undertaken by governments to provide various services, such as reimbursement for diagnostic tests, is expected to boost market growth. Many healthcare institutions are collaborating with laboratories to integrate different tests, such as mammography, ultrasound, and MRI.

In January 2025, the Laredo Medical Center recently inaugurated its Women's Imaging Center, aiming to enhance access to mammograms, diagnostics, and biopsies for women. In previous years, only 40% of women received mammograms due to scheduled backlogs or limited accessibility. This new center seeks to address these challenges by offering advanced diagnostic services, including breast ultrasounds, biopsies, and bone densitometry.

Regional Insights

North America breast cancer diagnostics market accounted for the largest revenue share of 46.01% in 2025. The growth can be attributed to the increasing prevalence of breast cancer and rising government initiatives to increase the screening & diagnostic rate. For instance, according to the American Cancer Society, Breast cancer remains the most prevalent cancer among women in the U.S., excluding skin cancers, accounting for nearly 30% of all new female cancer cases annually. By the end of 2025, an estimated 316,950 new cases of invasive breast cancer and 59,080 cases of ductal carcinoma in situ (DCIS) are expected to be diagnosed. Whereas 42,170 women are expected to die from the disease. The increasing incidence of breast cancer fuels demand for advanced diagnostic technologies such as mammography, genetic testing, and AI-powered imaging. Rising awareness & education, government initiatives, and expanding insurance coverage further stimulate the adoption of screening programs and innovative diagnostics across North America. For instance, in December 2025, Lumicell, Inc., announced a collaboration with a global breast cancer education platform, Learn Look Locate, to educate & empower patients with clear and accessible information throughout their breast cancer detection & treatment journey.

U.S. Breast Cancer Diagnostics Market Trends

The breast cancer diagnostics market in the U.S. held the largest market share in North America. The growth can be attributed to the increasing prevalence of breast cancer and rising government initiatives aimed at enhancing screening & diagnostic rates in the country. For instance, in January 2024, Weill Cornell Medicine received a USD 2.4 million grant from the U.S. Department of Defense to validate the Syantra DX Breast Cancer test, a blood-based diagnostic tool using AI to detect breast cancer at an early stage. This liquid biopsy aims to improve screening, particularly for high-risk women, those with dense breast tissue, and underserved populations, offering a non-invasive alternative to mammograms. The Syantra DX test could revolutionize breast cancer screening by increasing accessibility, especially for women with dense breast tissue and those in remote areas. Its non-invasive, cost-effective nature may lead to earlier detection, reducing the need for aggressive treatments and improving survival rates, while potentially shifting market demand towards liquid biopsy solutions over traditional imaging.

Europe Breast Cancer Diagnostics Market Trends

Europe breast cancer diagnostics market accounts for a considerable revenue share of the global market due to the presence of developed economies, such as Germany, Spain, the UK, France, and Italy. The increasing prevalence of breast cancer diagnostics and rising technological advancements are among the key factors driving the market in the region. The main cause of death in women in Europe is breast cancer.

The UK breast cancer diagnostics market is driven by the increasing prevalence of breast cancer, advancements in technology, and the development healthcare infrastructure. For instance, in June 2024, Researchers from The Institute of Cancer Research, London, have developed an ultra-sensitive blood test using whole genome sequencing (WGS) to detect circulating tumor DNA (ctDNA) in high-risk breast cancer patients. The test accurately predicts cancer recurrence months or even years before relapse, significantly improving early detection and post-treatment monitoring. This breakthrough is expected to drive growth in the UK's breast cancer diagnostics market by increasing demand for advanced liquid biopsy technologies. It could enhance early detection strategies, leading to improved patient outcomes and expanding precision medicine approaches in cancer care.

Breast cancer diagnostics market in Germany is driven by advancements in technology and investments made by various organizations toward breast cancer screening initiatives. The prevalence of breast cancer is significantly growing in Germany as indicated by the data from the University of Lübeck. According to the data, Germany records approximately 78,000 new breast cancer cases annually, making it the most common cancer among women. Similarly, Government support plays a crucial role in advancing breast cancer diagnostics in Germany, ensuring early detection, affordability, and innovation. Germany’s Mammography Screening Program (MSP), established in 2005, offers free biennial mammograms for women aged 50-75 under public health insurance. MSP screens over 3 million women annually, leading to early detection and a 25% reduction in breast cancer mortality.

Asia Pacific Breast Cancer Diagnostics Market Trends

Breast cancer diagnostics market APAC is estimated to show the fastest growth over the forecast period, due to increasing healthcare reforms, rising incidence of breast cancer, significant R&D investments in breast cancer therapies, and advancements in breast imaging technologies. For instance, in October 2025, PrecisionRNA Biotech Ltd., a company based in Hyderabad, India, announced the launch of a microRNA based blood test, Cantel, for cancer screening. A paradigm shift in early breast cancer detection in developing countries such as India is expected to drive the overall Asia Pacific market. Moreover, the rapid increase in population serves as another factor contributing to the growth of breast cancer diagnostics market in the region.

Breast cancer diagnostics market in China is being driven by various factors, including the increasing prevalence of breast cancer, advancements in breast imaging technology, and investments made by different organizations in breast cancer screening campaigns. According to GLOBOCAN data, breast cancer in China is a significant health concern, with a notable increase in incidence and mortality rates over recent years. China reported 357,161 new breast cancer cases in 2022, making it one of the countries with the highest number of cases globally, and this number is projected to reach 481,000 cases by 2040. As breast cancer incidence rises, the demand for breast cancer diagnostics among patients in hospitals across China is expected to grow. This surge is also supported by the growing awareness of and access to breast cancer screening services, which are now being provided to more women in China.

Japan breast cancer diagnostics market is expected to grow at a rapid rate, driven by key factors such as advancements in imaging technology and investments from diverse organizations in breast cancer screening campaigns. Moreover, the increasing prevalence of breast cancer in the country plays a significant role in driving market growth. For instance, according to GLOBOCAN estimates for 2022, Japan reported 91,916 new breast cancer cases among women, with an age-standardized incidence rate (ASR) of 74.4 per 100,000 women. The growing incidence of breast cancer is expected to generate substantial demand for accurate and safe diagnostic methods in the near future. In Japan, there is a need to develop advanced screening techniques or enhance the imaging capabilities of breast cancer diagnosis systems to effectively screen women aged between 40 and 49, as they have higher breast density. This has led to increased adoption of newer digital breast cancer diagnosis systems with improved resolution and imaging capabilities.

Latin America Breast Cancer Diagnostics Market Trends

The Latin America breast cancer diagnostics market has exhibited significant growth in the past few years owing to the increased prevalence of breast cancer in the region. Several surveys by various government and nonprofit organizations revealed that overall cancer mortality in Latin America is almost twice that of high-income countries. Moreover, according to data published by the Pan American Health Organization, breast cancer is the most common form of cancer and the leading cause of cancer-related mortality among women in the Americas. In Latin America and the Caribbean alone, there were over 210,000 new cases of breast cancer reported in 2020, resulting in nearly 68,000 deaths. These factors are expected to contribute to market growth during the forecast period.

Brazil Breast Cancer Diagnostics Market Trends

The breast cancer diagnostics market in Brazil is experiencing growth, as it is the leading form of cancer affecting women in Brazil and is the second leading cause of death among women. According to estimates from the National Cancer Institute (INCA) from 2023 to 2025, there are expected to be approximately 73,610 new cases each year. As breast cancer cannot be entirely prevented, early detection plays a crucial role in achieving a favorable prognosis and a higher likelihood of successful treatment. However, the high mortality rates suggest that access to early diagnosis and treatment remains a significant challenge in the country. This highlights the need for improvements in these areas to ensure that more women receive timely and effective care.

Middle East And Africa Breast Cancer Diagnostics Market Trends

The MEA breast cancer diagnostics market is experiencing moderate growth, owing to the rising prevalence of breast cancer among women in this region. The growing need for improved healthcare infrastructure and high burden of various diseases are expected to increase the demand for oncology diagnostics in the region. In 2022, 71,860.6 cases of breast cancer were diagnosed in South Africa. In the past few years, countries such as the UAE, Morocco, & South Africa have implemented organized cancer screening programs. Collaborations of various companies with government institutes to supply these tests are also expected to boost the market.

Saudi Arabia Breast Cancer Diagnostics Market Trends

Saudi Arabia breast cancer diagnostics market is driven by presence of key players such as BD, Koninklijke Philips N.V., QIAGEN, and Thermo Fisher Scientific, Inc. For instance, in September 2022, an early breast cancer screening program powered by AI was jointly developed by the Saudi Ministry of Health and the Saudi Data and Artificial Intelligence Authority. Furthermore, in October 2022, one of the first Middle Eastern oncology e-platforms was introduced at the Seha Virtual Hospital's headquarters by the Kingdom's Ministry of Health and Saudi Telecom Company. The e-platform is expected to help medical professionals in early cancer diagnosis, driving the market growth during the forecast period.

Key Breast Cancer Diagnostics Company Insights

The major market players operating are focused on adopting strategic initiatives such as launches, mergers & acquisitions, partnerships, etc. Furthermore, several players are focusing on the development of testing services, thereby boosting the demand. Some of the

Key Breast Cancer Diagnostics Companies:

The following are the leading companies in the breast cancer diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Hologic Inc.

- Genomic Health (Exact Sciences Corporation)

- BD

- Danaher

- Koninklijke Philips N.V.

- QIAGEN

- Thermo Fisher Scientific Inc.

- Argon Medical Devices, Inc.

- Myriad Genetics

- F. Hoffmann-La Roche Ltd.

Recent Developments

-

In September 2025, Stratipath and Visopharm announded a strategic partnership to advance the implementation of AI-powered breast cancer diagnostics. The initiative was presented at the European Congress of Pathology (ECP) in Vienna, in October 2025.

-

In February 2025, Myriad Genetics and Gabbi partnered to enhance breast cancer risk assessment by combining Gabbi’s telehealth screening services with Myriad’s MyRisk with RiskScore hereditary cancer test. This collaboration aims to provide early detection, personalized care plans, and improved access to genetic testing for women at high risk.

-

In October 2024, Myriad Genetics launched five research collaborations to evaluate the use of its Precise MRD test for molecular residual disease (MRD) detection in breast cancer. These studies aim to enhance early recurrence detection, guide treatment decisions, and improve monitoring by measuring circulating tumor DNA (ctDNA) levels.

-

In July 2024, BD and Quest Diagnostics have partnered to develop and commercialize flow cytometry-based companion diagnostics (CDx), aiming to enhance personalized medicine for cancer, including breast cancer. The collaboration offers end-to-end CDx solutions for pharmaceutical companies, enabling more precise treatment selection and improved patient outcomes.

Breast Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6.28 billion

Revenue forecast in 2033

USD 11.36 billion

Growth rate

CAGR of 8.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in (USD Million/Billion) and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Norway; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Hologic Inc.; Genomic Health (Exact Sciences Corporation); BD; Danaher; Koninklijke Philips N.V.; QIAGEN; Thermo Fisher Scientific Inc.; Myriad Genetics; Argon Medical Devices, Inc.; F. Hoffmann-La Roche Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Breast Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021-2033. For this report, Grand View Research has segmented the breast cancer diagnostics market by type, product, application end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Imaging

-

Biopsy

-

Genomic Tests

-

Blood Tests

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Platform-based products

-

Next Generation Sequencing

-

Microarrays

-

PCR

-

Others

-

-

Instrument-based products

-

Imaging

-

Biopsy

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Screening

-

Diagnostic & Predictive

-

Prognostic

-

Research

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Medical labs & Diagnostics Centers

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021-2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast cancer diagnostics market size was estimated at USD 5.86 billion in 2025 and is expected to reach USD 6.28 billion in 2025.

b. The global breast cancer diagnostics market is expected to grow at a compound annual growth rate of 8.82% from 2026 to 2033 to reach USD 11.36 billion by 2033.

b. The diagnostics and predictive application segment dominated the global breast cancer diagnostics market and accounted for the largest revenue share of around 48.69% in 2025.

b. The hospitals and clinics segment dominated the global breast cancer diagnostics market and accounted for the largest revenue share of around 49.84% in 2025.

b. The imaging segment dominated the global breast cancer diagnostics market and accounted for the largest revenue share of 51.60% in 2025.

b. North America dominated the global breast cancer diagnostics market and accounted for the largest revenue share of 46.01% in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.