- Home

- »

- Pharmaceuticals

- »

-

Antisense And RNAi Therapeutics Market Size Report, 2030GVR Report cover

![Antisense And RNAi Therapeutics Market Size, Share & Trends Report]()

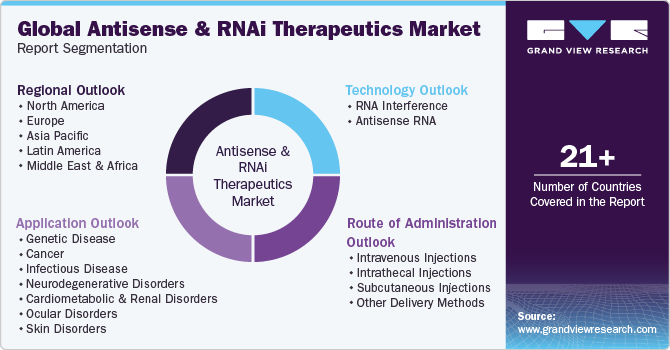

Antisense And RNAi Therapeutics Market Size, Share & Trends Analysis Report By Technology (RNA Interference, Antisense RNA), By Application (Ocular, Genetic), By Route of Administration (Intrathecal, Intravenous), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-805-3

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

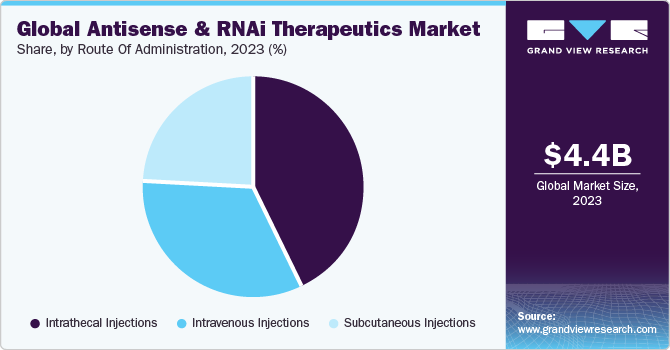

The global antisense and RNAi therapeutics market was estimated at USD 4.38 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 18.72% from 2024 to 2030. Antisense technology is useful for gene expression manipulation, which has been recognized as a successful treatment for a number of medical conditions. Companies are capitalizing on antisense & RNAi technologies by focusing on advancements in this field. For instance, in January 2023, Agilent Technologies Inc. invested USD 725 million to increase the manufacturing capability of therapeutic nucleic acids. This added capacity is expected to help the company meet the strong demand for siRNA and antisense molecules.

Antisense and RNAi therapies for rare diseases have shown improved therapeutic outcomes. For instance, Antisense Oligonucleotides (ASOs) have already been approved to treat rare neurological diseases such as Duchenne muscular dystrophy (DMD) and spinal muscular atrophy (SMA). Thus, it is expected to witness growth in the coming years.

There are very few treatment options available for rare diseases globally. As a result, funding and research projects focused on the development of novel treatments for rare conditions have gradually increased. Companies are undertaking various research activities to discover the treatment for rare diseases. For instance, in August 2023, Agios Pharmaceuticals, Inc. partnered with Alnylam Pharmaceuticals, Inc. to commercialize and develop novel preclinical siRNA targeting TMPRSS6, as a possible disease-modifying therapy for patients suffering from a rare hematologic disorder, polycythemia vera (PV). Such developments by major participants for developing therapeutics for various conditions based on siRNA are expected to propel the industry growth in the coming years.

In addition, several studies were published focusing on antisense oligonucleotide and RNAi therapeutics as promising therapies for treating COVID-19 infections. For instance, in February 2023, PLOS ONE published a research article focusing on antisense oligonucleotides to therapeutically target SARS-CoV-2 infection. Such articles and studies help researchers in their research activities related to antisense and RNAi technologies. Thus, the increasing focus on these therapeutic approaches is anticipated to propel the market growth.

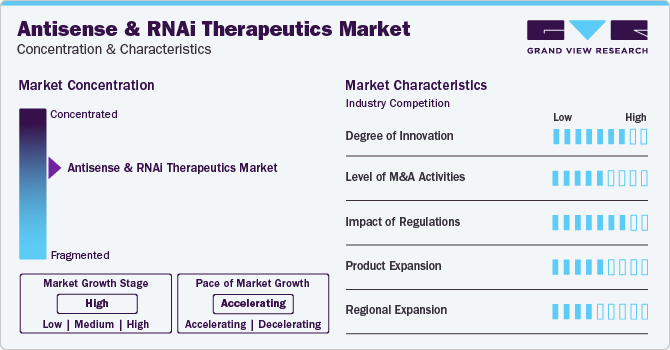

Market Concentration & Characteristics

Market growth stage is high, and the pace of the market growth is accelerating. The market is characterized by a high degree of innovation due to rapid technological advancements in RNAi therapeutics and RNA bioengineering. Companies are entering the market and bringing novel technologies and platforms targeted at antisense and RNAi therapeutics, which is expected to drive innovation in the industry. For instance, in March 2023, Switch Therapeutics, an emerging biotechnology company, announced its launch following USD 52 million of financing. With (Conditionally Activated siRNA) CASi, the company has developed a cell-selective gene knockdown platform that may advance the next generation of RNAi therapies. Due to such developments, the market is expected to witness high innovation.

The antisense & RNAi market is also characterized by the leading players' high level of merger and acquisition (M&A) activity. This is due to several factors, including the desire to gain access to antisense and RNAi technologies and the need to consolidate in a rapidly growing market. Major industry participants are acquiring firms developing RNAi therapeutics. For instance, in July 2023, Novartis acquired DTx Pharma, a biotechnology company focused on developing short-interfering RNA (siRNA) therapies for neuroscience indications. Such acquisitions are expected to propel industry growth in the coming years.

Furthermore, the industry participants operating in the industry are focusing on increasing their presence in several regions and improving access to antisense and RNAi therapeutics across the globe. For instance, in March 2023, Alnylam Pharmaceuticals, Inc. expanded its collaboration with Medison Pharma, a pharma company to provide RNA interference (RNAi) therapeutics in various countries in central and eastern Europe. This multi-regional agreement includes the Czech Republic, Poland, Slovakia, Hungary, Lithuania, Estonia, Latvia, and Israel. Thus, regional expansions by the major players are expected to increase to improve access to these therapeutics.

Technology Insights

Antisense RNA segment accounted for the largest market share in 2023. The antisense RNA has dominated the segment in terms of revenue generation. These molecules are being tested to control various conditions. This technology is used for the regulation of protein expression and gene expression. Furthermore, the wide application of this technology in various areas like cardiovascular, respiratory, neurodegenerative, and genetic disorders is anticipated to boost the segment growth. In addition, several studies are evaluating the antisense therapeutics for numerous disorders. For instance, the study published by the MDPI in August 2023 concluded that antisense oligonucleotide (ASO) therapies hold tremendous potential for treating various disorders, including infectious diseases. Such favorable results and conclusions about antisense therapies are expected to boost the demand for antisense RNA technology over the forecast period.

On the other hand, the RNA interference technology segment is anticipated to witness a higher CAGR of 19.54% over the forecast period. This technique is utilized to study the functions of genes in model organisms and cell cultures. Moreover, it is being utilized to target specific gene sequences that can cause cancer. Furthermore, the wide applications of RNAi technology include treating bacterial diseases, viruses, & parasites and relieving pain.

Application Insights

The neurodegenerative disorders segment accounted for the largest market revenue share of 67.79% in 2023. Participants operating in the industry are undertaking efforts to make advancements in RNAi and antisense therapies to treat neurodegenerative diseases. For instance, in June 2023, Arrowhead Pharmaceuticals announced that the company is seeking approval from regulators in Australia to initiate studying an investigational RNA interference-based (RNAi) therapy in patients with amyotrophic lateral sclerosis (ALS), a neurological disorder. Such initiatives and efforts by major companies targeting neurodegenerative conditions are expected to boost the segment growth.

The genetic disorders segment is expected to grow at the highest CAGR of 19.60% over the forecast period. The area of research on oligonucleotide medicines is quickly expanding, as seen by the growing number of research studies. Companies are undertaking various approaches to develop antisense and RNAi therapeutics for treating genetic diseases. For instance, in June 2023, Charles River Laboratories International, Inc. collaborated with the Korean biotechnology company, Curigin to produce oncolytic ribonucleic acid interference (RNAi) gene therapy.

Route Of Administration Insights

The intrathecal injections segment dominated the market with a share of 43.27% in 2023. It is a path of administration for drugs through an injection into the subarachnoid space or spinal canal to reach the cerebrospinal fluid. This approach is utilized in spinal anesthesia, chemotherapy, pain management, and introducing drugs to combat specific infections, particularly after neurosurgical procedures. One of the most crucial elements of every genetically modified molecule is the route of drug administration.

The subcutaneous injection segment is projected to witness the highest CAGR of 19.96% over the forecast period. This type of injection is delivered in the fatty tissue just beneath the skin. Subcutaneous administration offers flexibility in choosing the infusion site, with options such as the abdomen, thighs, and the back of the arms. In addition, subcutaneous infusion systems can incorporate smaller needle sizes, potentially reducing discomfort during the infusion process. These benefits associated with subcutaneous administration are anticipated to drive the segment growth over the forecast period.

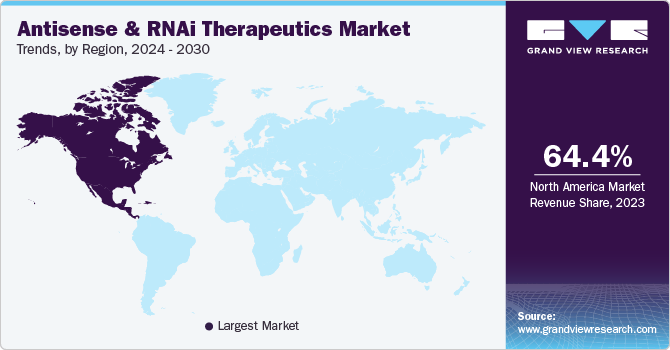

Regional Insights

North America dominated the global market and accounted for a 64.37% share in 2023. It is also expected to witness the fastest CAGR during the forecast period. Various RNAi therapies are being developed in the U.S. Furthermore, most players in the biotechnology sector have made substantial expenses on the innovation of RNAi therapeutics. Major pharmaceutical and biotechnology organizations operating in the region are developing various platforms for this sector. For instance, in May 2023, Codexis, Inc., the U.S.-based organization, introduced an Enzyme-Catalyzed Oligonucleotide (ECO) Synthesis technology platform for manufacturing large-scale RNA oligonucleotide therapeutics. This technology was launched at the TIDES U.S. annual meeting. Such technological innovations across the U.S. are expected to boost the North American market in the coming years.

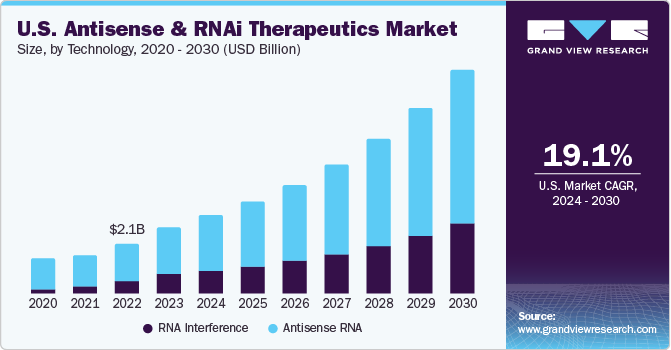

U.S. Antisense & RNAi Therapeutics Market Trends

The U.S. antisense & RNAi therapeutics market has witnessed notable growth, driven by advancements in RNA-based technologies and their applications across various industries. As a crucial component of CRISPR-based systems, antisense & RNA interference (RNAi) therapeutics have found diverse applications in research and potentially therapeutic interventions. Key players in the antisense & RNAi therapeutics market include companies involved in gene editing technologies, biotechnology, and life sciences New product approvals in the country are expected to increase demand for antisense & RNAi therapeutics targeting genes associated with various genetic diseases. For instance, in 2023, the FDA approved Ionis Pharmaceuticals’s product Wainua, which treats transthyretin-related hereditary amyloidosis.

Europe antisense & RNAi therapeutics market is anticipated to witness significant growth in the market. The presence of various companies focusing on antisense and RNAi therapeutics is anticipated to drive regional growth over the forecast period. Moreover, these companies are undertaking numerous initiatives to expand their product portfolio and business avenues. For instance, in March 2023, SciNeuro Pharmaceuticals, the U.S.-based organization, collaborated with the Europe-based Secarna Pharmaceuticals GmbH & Co. KG to generate novel antisense oligonucleotide (ASO) therapies directed at targets that play a critical role in diseases of the Central Nervous System. Thus, the increasing focus of players operating in other regions on the Europe market is expected to boost the regional expansion over the forecast period.

UK Antisense & RNAi Therapeutics Market Trends

The UK antisense & RNAi therapeutics market is a rapidly growing industry that is expected to experience significant growth over the coming years. The demand for antisense & RNAi therapeutics in the UK is driven by several factors, including the increasing prevalence of genetic disorders & diseases, the need for more efficient and effective treatments, and the growing interest in gene-editing technologies among researchers & scientists. In addition, the UK government has been investing heavily in the biotechnology sector, which has helped to spur innovation and growth in the industry.

France Antisense & RNAi Therapeutics Market Trends

The France antisense & RNAi therapeutics market is witnessing a significant burden of cancer which is the leading cause of death. siRNAs hold promise for developing novel anticancer therapies like RNAi drugs. Moreover, cardiovascular diseases are another major health concern in France, and siRNAs are being investigated for their potential in diagnosing & treating conditions like atherosclerosis and heart failure.

Germany Antisense & RNAi Therapeutics Market Trends

The Germany antisense & RNAi therapeutics market is expected to grow due to the strong & sufficiently financed healthcare system in the country which can increase the demand for advanced therapeutic technologies, including antisense & RNAi. This includes applications in personalized medicine and gene therapy. siRNA is gaining traction as a therapeutic agent for various diseases, including cancer, cardiovascular diseases, neurological disorders, and infectious diseases.

China Antisense & RNAi Therapeutics Market Trends

The China antisense & RNAi therapeutics market is anticipated to grow due to the increasing prevalence of genetic diseases and the rising need for personalized medicine. Moreover, the growing investments and favorable government initiatives in the biotechnology sector in China are expected to boost the antisense & RNAi therapeutics market. Moreover, expansion plays a key role in this market. It involves investing in larger and more advanced synthesis facilities. This increased production capacity allows companies to meet the growing demand for oligonucleotides & interference RNA, whether for research or therapeutic applications.

Japan Antisense & RNAi Therapeutics Market Trends

The Japan antisense & RNAi therapeutics market is expected to witness significant growth over the forecast period. Japan has a significant aging population and a high focus on personalized medicine. According to the World Economic Forum, in 2023, the aging population in Japan is rapidly rising, and over 10% of its citizens are now aged 80 or above. It makes Japan the country with the highest proportion of older people globally. This is expected to improve the demand for antisense and RNAi therapies for treating cancer, cardiovascular diseases, & neurological disorders.

Brazil Antisense & RNAi Therapeutics Market Trends

The Brazil antisense & RNAi therapeutics market is witnessing a rising demand for siRNAs due to the expansion of the biotechnology & pharmaceutical sectors. The biotech and pharmaceutical industries in Brazil drive the need for antisense oligonucleotides and RNAi in research and therapeutic applications. As scientific research and genetic studies continue to expand, the demand for antisense & RNAi for applications, such as therapeutics, is expected to improve over the forecast period.

Saudi Arabia Antisense & RNAi Therapeutics Market Trends

The Saudi Arabia antisense & RNAi therapeutics market has been growing due to the increase in investments in biotechnology and life sciences initiatives, including R&D. The growth of these initiatives is expected to drive the demand for antisense & RNAi in various applications, such as genomics and the development of therapeutics. In addition, extensive research studies involving sequencing can help expand the usage rate of advanced sequencing techniques in the country. Hence, implementing such programs is projected to improve the demand for antisense & RNAi therapeutics in the coming decade. Moreover, there is an ongoing clinical trial (phase 3) for Leqvio, an RNAi Therapeutic, used for cardiometabolic disease.

Key Antisense And RNAi Therapeutics Market Company Insights

Key players operating in the antisense & RNAi therapeutics market are undertaking strategic initiatives such as collaborations, new product launch, and acquisitions to strengthen their market position and enhance their market presence. For instance, companies are undertaking the launch of novel therapies to expand their market offerings.

Key Antisense And RNAi Therapeutics Companies:

The following are the leading companies in the antisense and RNAi therapeutics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these antisense and RNAi therapeutics companies are analyzed to map the supply network.

- GSK plc

- Olix Pharmaceuticals, Inc.

- Sanofi

- Alnylam Pharmaceuticals, Inc.

- Arbutus Biopharma

- Benitec Biopharma Inc.

- Silence Therapeutics

- Ionis Pharmaceuticals, Inc

- Sarepta Therapeutics

- Percheron Therapeutics Limited

Recent Developments

-

In August 2023, Sirnaomics Ltd announced the company has completed phase I clinical study of STP707, RNAi therapeutic for treating multiple solid tumors

-

In July 2023, Alnylam Pharmaceuticals, Inc. partnered with Roche; to develop and market, zilebesiran, an investigational ribonucleic acid interference (RNAi) therapeutic to treat hypertension

-

In July 2023, Ionis Pharmaceuticals, Inc. expanded its agreement with AstraZeneca to collaborate on developing and marketing eplontersen in the U.S. As part of the agreement, AstraZeneca was granted exclusive rights to market eplontersen in countries outside the U.S., except certain Latin American countries.

-

In June 2023, Alloy Therapeutics introduced the AntiClastic Antisense Oligonucleotide (AntiClastic ASO) platform to develop potential genetic medicines

-

In March 2023, OliX Pharmaceuticals, Inc. dosed the first patient in a Phase 1 clinical trial of an investigational RNAi therapeutic designed to treat age-related macular degeneration (AMD).

Antisense And RNAi Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.12 billion

Revenue forecast in 2030

USD 14.35 billion

Growth rate

CAGR of 18.72% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, Application, Route of Administration, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, U.K., France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Olix Pharmaceuticals,Inc. GSK plc., Sanofi, Alnylam Pharmaceuticals, Inc., Ionis Pharmaceuticals, Inc., Benitec Biopharma Inc. Silence Therapeutics, Arbutus Biopharma, Sarepta Therapeutics, Inc., Percheron Therapeutics Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antisense & RNAi Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antisense and RNAi therapeutics market report based on technology, application, route of administration, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

RNA Interference

-

Antisense RNA

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Genetic Disease

-

Cancer

-

Infectious Disease

-

Neurodegenerative Disorders

-

Cardiometabolic & Renal Disorders

-

Ocular Disorders

-

Respiratory Disorders

-

Skin Disorders

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous Injections

-

Intrathecal Injections

-

Subcutaneous Injections

-

Other Delivery Methods

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include technological advancements in drug delivery mechanisms, increasing investments and collaborations between drug companies to accelerate new product development in this space

b. The global antisense and RNAi therapeutics market size was estimated at USD 4.38 billion in 2023 and is expected to reach USD 5.12 billion in 2024.

b. The global antisense and RNAi therapeutics market is expected to grow at a compound annual growth rate of 18.72% from 2024 to 2030 to reach USD 14.35 billion by 2030.

b. North America dominated the global antisense and RNAi therapeutics market with a share of 44.62% in 2023. This is mainly attributed to increasing investments in antisense technology and the development of RNAi therapeutics.

b. Some key players operating in the antisense & RNAi therapeutics market include Olix Pharmaceuticals, Inc. GSK plc., Sanofi, Alnylam Pharmaceuticals, Inc., Ionis Pharmaceuticals, Inc., Benitec Biopharma Inc. Silence Therapeutics, Arbutus Biopharma, Bio-Path Holdings Inc., and Antisense Therapeutics Limited.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."