- Home

- »

- Advanced Interior Materials

- »

-

Global Eco Fiber Market Size, Share & Growth Report, 2030GVR Report cover

![Eco Fiber Market Size, Share & Trends Report]()

Eco Fiber Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Organic, Manmade/Regenerated, Recycled) By Application (Textiles/Apparel, Industrial, Medical), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-977-7

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Eco Fiber Market Summary

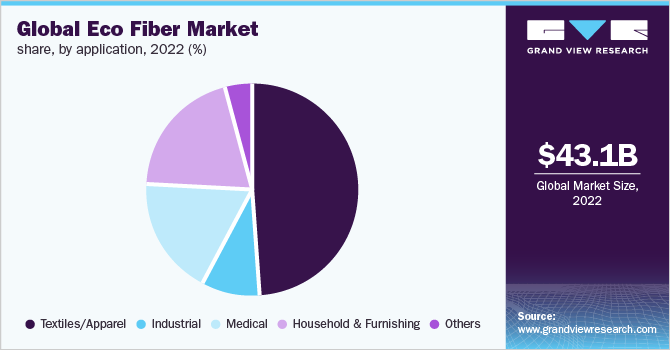

The global eco fiber market size was estimated at USD 43.07 billion in 2022 and is projected to reach USD 77.17 billion by 2030, growing at a CAGR of 7.6% from 2023 to 2030. The market is anticipated to be driven by the rising popularity of organic cotton.

Key Market Trends & Insights

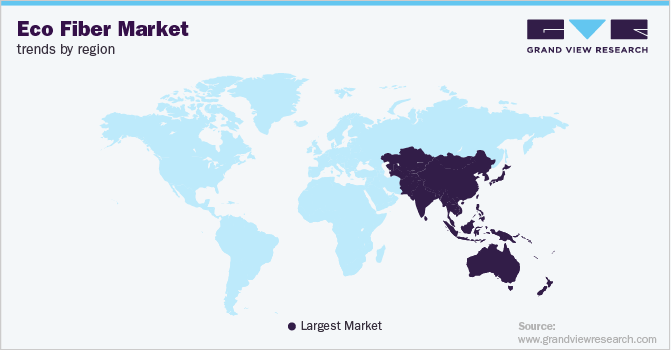

- In terms of region, Asia Pacific dominated the eco fiber market with a revenue of USD 14.90 billion in 2022.

- Country-wise, India is the fastest-growing market in Asia Pacific owing to the growing population.

- In terms of product, Organic eco fibers segment are expected to attain the highest CAGR of 9.6% in the forecast period.

- In terms of application, Textile application segment dominated the eco fiber market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 43.07 Billion

- 2030 Projected Market Size: USD 77.17 Billion

- CAGR (2023-2030): 7.6%

- Asia Pacific: Largest market in 2022

Manufacturers are increasingly opting for organic cotton since its production does not pollute surface water, soil or air. Furthermore, rising concern regarding the harmful environmental impacts of synthetic fibers has been a major factor contributing to the increased demand for organic eco fiber since the past few years.Eco fibers are also rapidly gaining popularity in designer garments and apparel. Continuous advancements in terms of the development of eco fiber textiles offering antimicrobial, hypoallergenic, insulating, UV resistant, highly breathable and absorbent characteristics, are expected to promote their importance in the clothing market.

Rising awareness for ethically produced fabrics has led to a revolution in sustainable clothing in recent years. It not only provides an additional realm of economic profit but also ensures a new market for additional job opportunities as well as a reduction in the usage of virgin resources and raw materials. These trends are further anticipated to contribute significantly to promoting the organic fibers industry in the projected period.

The demand for eco fibers in the U.S. is expected to grow at a significant rate in the forecast period. The U.S. textile industry is one of the largest after China, India, and Germany. The textile companies in the country are focused on restructuring their businesses, developing effective work processes, and investing in niche products and markets, which, in turn, has proven to be conducive to the growth of eco fiber industry.

Raw materials used in the manufacturing of natural and regenerated fibers are widely available across the globe. The raw materials are sourced from different farmers and cooperatives involved in the harvesting of plant fibers and animal farming practices. The major brands involved in the procurement of eco fibers and organic cotton are committed to procuring raw materials from the suppliers on contract basis.

Various technologies and processes are practiced for the manufacturing of eco fibers. Green dyes, which are extracted from plants, arthropods and marine invertebrates, such as sea urchins and starfish; algae, bacteria and fungi, are used in the production of eco fibers. Eco fiber production follows a series of processes including cold pad batch preparation and dyeing; continuous processing of knits; preparation of woven; combined scour and bleach for knit and yarn; foam dyeing, finishing & coating; and pad and drying.

Product Insights

Organic eco fibers are expected to attain the highest CAGR of 9.6% in the forecast period. Organic eco fibers are grown in controlled settings without using herbicides, chemicals, and pesticides. The growing conditions for organic eco fibers are extensively monitored and audited by certified agencies across the world. Organic cotton is the most commonly used eco fiber across various end-use industries owing to its superior characteristics.

Rising concerns regarding harmful environmental effects of using synthetic fibers has boosted the demand for organic eco fiber in the past few years. Organic cotton being a sustainable raw material and is less allergy-prone is widely used in apparels and other applications.

The recycled product segment is accounted for revenue of USD 2.81 billion in 2022 and is expected to expand at a CAGR of 4.2% over the forecast period. Textile industry is increasingly using recycled fiber, yarn, and fabric for developing new products. Over 15% of the fabric used in apparel production is wasted, which adds to the post-industrial waste. Therefore, various key clothing brands including H&M, Hanes, and Adidas have adopted recycling processes in the overall production process and in the supply chain of garments, which helps tackle waste disposal issues.

The reusing and reprocessing of used clothing and fibrous materials have gained popularity at a tremendous pace in recent years. This has resulted in making the textile production chain more sustainable. Consumers in Asia Pacific are significantly adopting recycled fibers owing to the low production cost and less stringent regulations in the region. The shift in trend toward achieving closed-loop production cycle by manufacturers has resulted in the advent of recycled raw materials, which has further boosted the demand for recycled eco fibers in the recent years.

Application Insights

Textile application segment dominated the eco fiber market in 2022 and this trend is expected to continue over the forecast period. The segment accounted for a volume of 5,750.7 kilotons, owing to the rapidly increasing demand for clothes/garments across the globe. Eco fibers are used in several apparel products such as shirts, jackets, and kids wear along with bed sheets, pillow cover, bags, sacks, landfill coverings, and medical textiles.

Textile industry is expected to witness a high demand for casual wear, formal wear, and fashionable clothing among all age groups in the forecast period. Denim, lycra, cotton, silk, and polyester fabrics are highly used for manufacturing fashion textiles and clothing. Additionally, increasing use of luxury and trending fashionable clothes, especially among youth and adult populace, is another significant driving factor for the market.

Industrial application segment accounted for revenue of USD 4.23 billion in 2022. Eco fiber finds application in numerous industrial and construction applications owing to its superior characteristics and sustainability. The product is used in the construction of house structures, dams, and tunnels. Besides, it is preferred for reinforcement of walls, facades, hose wrap, concrete wraps, waterproof membranes, thermal and sound insulation panels, and sewer and pipe linings are other additional uses. Nonwoven glass, polyester fabrics, and acrylic fibers are some of the key raw materials used in industrial applications.

Furthermore, the core infrastructure supportive industries including steel, cement, electricity, natural gas, crude oil, and refinery products are anticipated to grow at a substantial rate in the forecast period in emerging economies such as India and China. In India, government initiatives such as “Make in India” and “Invest India” are expected to drive product demand in industrial applications.

Regional Insights

Asia Pacific dominated the eco fiber market with a revenue of USD 14.90 billion in 2022 and is expected to expand at the highest CAGR of 9.2% over the forecast period. The growing demand for apparels and increased demand for sustainable textiles are expected to propel the market growth over the forecast period. This scenario is likely to be reflected in major economies, including India, China, Japan, and Australia, over the years ahead.

India is the fastest-growing market in Asia Pacific owing to the growing population, per capita consumption of apparels, and increasing foreign investments are some of the major socio-economic factors that are likely to support the market growth in the country. However, the rising use of polyester, acrylic fibers, and viscose for household, technical, and clothing applications is expected to hamper the growth of eco fibers across the region. Additionally, the increasing use of handbags, clothing accessories, and apparels is expected to drive the demand for textiles in fashion & clothing applications over the years ahead.

North America eco fiber market is expected to expand at a CAGR of 6.6% in the forecast period. The market is characterized by high growth in demand for eco fibers in end-use industries such as textiles, industrial, medical textiles, packaging, and household. In addition, the presence of an aging population and initiatives to develop superior sports apparel, are expected to aid the growth of regional market over the forecast period. Furthermore, factors such as growing sustainable practices owing to the increasing awareness regarding environment protection driving eco fiber growth across the region.

Eco fiber market in Canada is expected to flourish over the forecast period due to the increasing demand for textiles due to the rapid rise in population. Increase in the rate of net immigration has led to population expansion, which is expected to result in high demand for the product in textiles & apparel industry. Furthermore, relaxed regulations for migration have led to the immigration of a multi-ethnic population, which is projected to drive the demand for fashion and apparel over the forecast period.

Key Companies & Market Share Insights

Eco fiber industry is fragmented with the presence of large international players. However, the global industry is shifting towards the emerging economies of Asia Pacific owing to the presence of cheap labor and ample raw materials. Innovation and extensive marketing strategies are the key factors for new entrants owing to the high competition in the market. Some prominent players in the global eco fiber market include:

-

Lenzing AG

-

US Fibers

-

Polyfibre Industries

-

Grasim Industries Ltd.

-

Wellman Advanced Materials

-

Shanghai Tenbro Bamboo Textile Co. Ltd.

-

China Bambro Textile (Group) Co., Ltd.

-

Pilipinas Ecofiber Corporation

-

Teijin Limited

-

David C. Poole Company, Inc

-

Foss Performance Materials

Eco Fiber Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 44.95 billion

Revenue forecast in 2030

USD 77.17 billion

Growth Rate

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons and Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; Italy; France; India; China; Japan; Brazil; Saudi Arabia

Key companies profiled

Lenzing AG; US Fibers; Polyfibre Industries; Grasim Industries Ltd.; Wellman Advanced Materials; Shanghai Tenbro Bamboo Textile Co. Ltd.; China Bambro Textile (Group) Co.; Ltd.; Pilipinas Ecofiber Corporation; Teijin Limited; David C. Poole Company, Inc; Foss Performance Materials

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Eco Fiber Market Segmentation

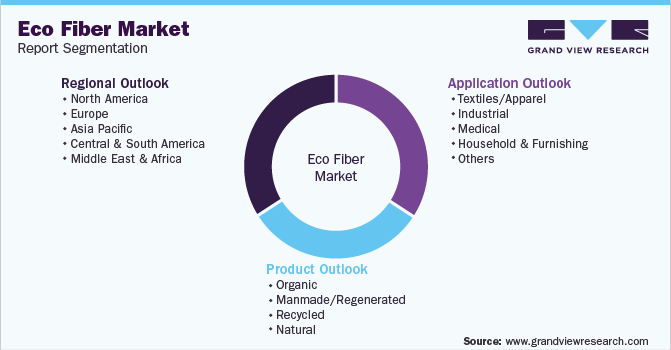

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global eco fiber market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Organic

-

Manmade/Regenerated

-

Recycled

-

Natural

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Textiles/Apparel

-

Industrial

-

Medical

-

Household & Furnishing

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global eco fiber market size was estimated at USD 43.07 billion in 2022 and is expected to reach USD 44.95 billion in 2023.

b. The eco fiber market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 77.17 billion by 2030.

b. Textile industry accounted for the largest application segment with the revenue of USD 19.89 billion in 2022. Textiles industry is the major consumer of eco fibers. Fashion is expected to remain one of the most lucrative application segments in light of product innovation in terms of new apparels and clothing accessories.

b. Some of the key players operating in the eco fiber market include Lenzing AG, US Fibers, Polyfibre Industries, Grasim Industries Ltd., Wellman Advanced Materials, Shanghai Tenbro Bamboo Textile Co. Ltd., China Bambro Textile (Group) Co., Ltd., and Pilipinas Ecofiber Corporation.

b. The key factors that are driving the eco fiber market includes implementation of government regulations on the manufacturing as well as disposal of synthetic sources of fiber production, which has given rise in the demand for bio based alternatives such as organic cotton, hemp, and other sources of eco fibers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.