- Home

- »

- Renewable Chemicals

- »

-

Synthetic Fibers Market Size, Share & Trends Report, 2030GVR Report cover

![Synthetic Fibers Market Size, Share & Trends Report]()

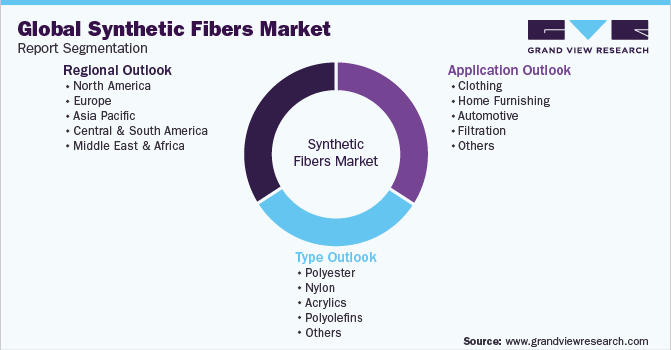

Synthetic Fibers Market Size, Share & Trends Analysis Report By Type (Acrylics, Polyester, Nylon), By Application (Clothing, Home Furnishing, Filtration), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-029-3

- Number of Report Pages: 145

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Synthetic Fibers Market Size & Trends

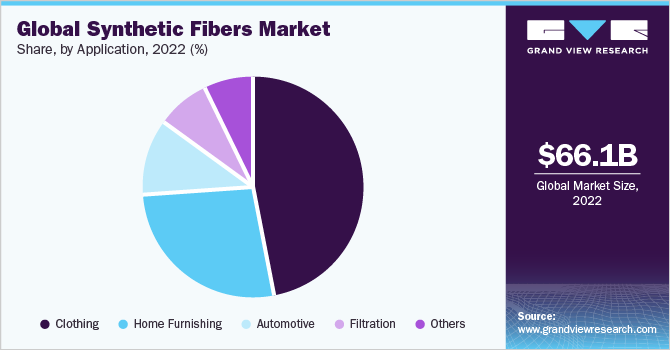

The global synthetic fibers market size was valued at USD 66.11 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. Increasing consumer demand for cost-effective, durable, easy-to-wash, and maintainable fabrics is expected to drive market growth over the forecast period. These types of fabrics are derived from chemical synthesis and possess excellent chemical, mechanical, and physical properties such as strength, softness, elasticity, crease recovery, high luster, and others. Owing to such unique properties, these fibers are preferred in various application industries such as clothing, home furnishing, filtration, automotive, and others.

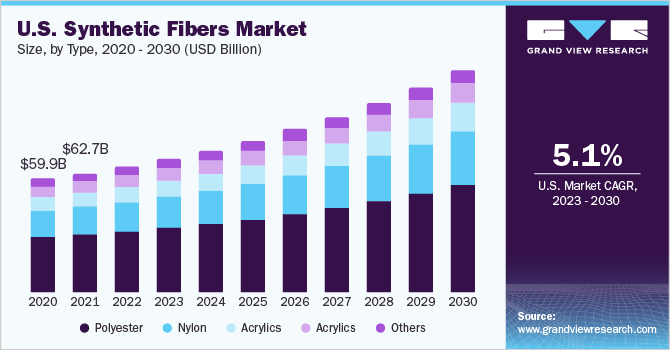

The U.S. is expected to be the largest market for synthetic fibers in the North American region. Rapid changing fashion trends coupled with the increasing demand for home-furnishing products owing to the rise of an e-commerce platform for easy product availability is expected to add growth prospects to the overall synthetic fibers industry.

Several regulations have been enforced in the production of synthetic fibers in various application industries. Organic Chemicals, Plastics and Synthetic Fibers (OCPSF) effluent guidelines and standards by Environmental Protection Agency (EPA) are being implemented to limit and reduce volatile organic compounds (VOC) which are discharged by synthetic fiber production facilities.

The clothing application segment emerged as the highest growth contributor to the synthetic fibers industry. Cloths produced from synthetic fibers such as acrylics, polyester, nylon, rayon, and others find an array of applications in the clothing segment. These fabrics are strong, durable, easy to dye, soft, and act as a highly absorbent material.

However, frequent fluctuations in raw material prices and fiber processing costs may hamper the growth of the market. Synthetic fibers are produced from petroleum-based chemicals or petrochemicals. As a result, synthetic fibers such as polyester, nylon, acrylics, and others follow crude oil prices. Hence, any volatility in oil prices may affect synthetic fiber prices.

Major market players in the industry have adopted various growth strategies such as product launches, partnerships, mergers, and agreements to increase their market shares and enhance product portfolios by adopting various technological advancements. Furthermore, the companies are continuously engaged in offering products through innovation and advancements to cope with the increasing demand for synthetic fibers from various industries.

Type Insights

Polyester led the market and accounted for more than 48.5% share of the global revenue in 2022. The demand for polyester is driven by its useful properties such as chemical and abrasion resistance. In addition, it is much preferable in making dresses and clothing materials due to its easy wash, shape retention, wrinkle-free, and high perspiration properties.

The rise in demand for polyester synthetic fabrics in clothing, home furnishing, and industrial application is expected to drive growth in the market. High usage of industrial polyester fibers in the form of yarns and ropes that are used in car tire reinforcements, safety belts, conveyor belts, and others is likely to add growth in the industrial and automotive segment, in turn adding growth to the synthetic fibers industry.

Nylon-based synthetic fibers are estimated to account for 15,901 kilotons in 2022 owing to their significant use in the home-furnishing and automotive application industry. Increasing consumer interest in home-furnishing products such as blankets, bed linen, upholstery, carpets, and various others due to the rapidly increasing population is likely to add positive growth to the market during the forecast period.

Other synthetic fiber types such as spandex and rayon are also adding growth prospects to the market due to their application in the sports & leisure application industry in the form of clothing and apparel. In addition, the high presence of retail stores and e-commerce platforms serving sports utilities such as high-performance swimming & cycling apparel made from spandex is expected to fuel the growth of synthetic fibers during the forecast period.

Application Insights

The clothing application segment led the market and accounted for more than 46.7% of the global revenue share in 2022, owing to the ever-changing fashion trends influencing the demand for clothing across the world. Increases in demand for convenient, protective, and cost-effective clothing in the wake of the increasing population are expected to drive the demand for clothing during the forecast period.

The presence of different clothing brands to serve the specific needs of customers is another factor impacting the demand positively. The increase in e-commerce platforms in the Asia Pacific region coupled with the consumer awareness of different clothing brands due to the Internet of Things has boosted the sales of online clothing in the region.

Demand for synthetic fibers for home furnishing is expected to grow at a significant rate of 7.6% in terms of revenue over the projected period, owing to the increasing consumer aspiration for better-looking living rooms & bedroom interiors. In addition, the rise in housing and real-estate construction is expected to increase the demand for home-furnishing products such as carpets, cushions & covers, mats, and others over the forecast period.

Other application segments for synthetic fibers include fishing nets, ropes, and construction. Fishing nets are heavily used in the seafood industry which adds significantly to global fish trading. As per, the Food and Agriculture Organization (FAO) 45% of fish that are caught are traded internationally. This is expected to increase in the coming time owing to the increasing use of fishing nets, in turn adding growth to the synthetic fibers industry.

Regional Insights

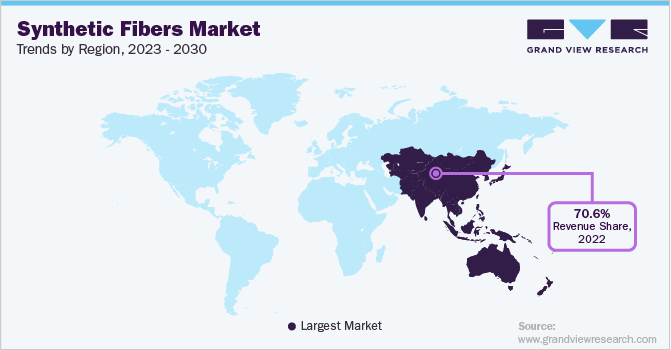

Asia-Pacific dominated the market and accounted for over 70.6% share of global revenue in 2022, owing to the high production of polyester, nylon, acrylics, and others from the countries such as China, South Korea, Taiwan, India, and Japan. The presence of a high population and consumption of clothing and home-furnishing products in the region is further expected to add to the market growth.

The product demand in North America is dominated by the clothing application segment and the trend is expected to ascend over the forecast period. The rising appeal of the ‘Made in U.S.’ initiative coupled with an increasing trend to buy online products for clothing and home furnishing is expected to add significant growth to the market during the forecast period.

The market in Europe was estimated to be 5,862 kilotons in 2022. It is anticipated to rise at a considerable rate over the forecast period, which can be attributed to the rise in product manufacturing from countries such as Italy, Germany, and Turkey. In addition, rising product applications in automobiles for seat covers, cushions, drive belts, airbags, and others are further adding to the market growth.

The demand for synthetic fibers in Central & South America is likely to witness significant growth over the projected period owing to the increasing investment and manufacturing facilities for clothing & apparel, automotive, and construction industries. Rising industrial activities and availability of cheap labor in the region are expected to increase manufacturing activities, in turn adding growth prospects to the market.

Key Companies & Market Share Insights

The market has been witnessing an increasing adoption of advanced technology and methods such as the development of hybrid composites with synthetic and natural fibers. The market players are trying to increase their sales through investment, partnerships, and agreements with brand owners, e-commerce facilitators, and retailers to facilitate overall market growth.

The market is fragmented due to the presence of several companies involved in product manufacturing. The market is characterized by the presence of substantial manufacturing and distribution facilities with a large consumer base across the globe that are significantly adding growth prospects to the market. Some prominent players in the global synthetic fibers market include:

-

Bombay Dyeing

-

E. I. du Pont de Nemours and Company

-

Indorama Corporation

-

Lenzing AG

-

Mitsubishi Chemical Holdings Corporation

-

Reliance Industries Limited

-

China Petroleum Corporation (Sinopec Corp.)

-

Teijin Limited

-

Toray Chemical Korea, Inc.

-

Toyobo Co., Ltd.

Synthetic Fibers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 70.59 billion

Revenue forecast in 2030

USD 117.76 billion

Growth rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, India, Taiwan, Brazil

Key companies profiled

Bombay Dyeing; E. I. du Pont de Nemours and Company; Indorama Corporation; Lenzing AG; Mitsubishi Chemical Holdings Corporation; Reliance Industries Limited; China Petroleum Corporation (Sinopec Corp.); Teijin Limited; Toray Chemical Korea, Inc.; Toyobo Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Fibers Market Report Segmentation

This report forecasts volume & revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global synthetic fibers market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyester

-

Nylon

-

Acrylics

-

Polyolefin

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Clothing

-

Home Furnishing

-

Automotive

-

Filtration

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Taiwan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Polyester dominated the synthetic fiber market with a share of 48.5% in 2022, owing to the shifting fashion trends coupled with the rising urban population with modern living standards are expected to provide opportunities for high-end polyester fibers.

b. Some of the key players operating in the synthetic fiber market include Bombay Dyeing, E. I. du Pont de Nemours and Company, Indorama Corporation, Lenzing AG, Mitsubishi Chemical Holdings Corporation, Reliance Industries Limited, China Petroleum Corporation (Sinopec Corp.), Teijin Limited, Toray Chemical Korea, Inc., Toyobo Co., Ltd.

b. The key factors that are driving the synthetic fiber market include increasing product demand in clothing and home furnishing products such as various types of wearables, bed linens, mats & carpets, cushions & covers, and various others. In addition, the products finds application in automotive and filtration industries.

b. The global synthetic fiber market size was estimated at USD 66.11 billion in 2022 and is expected to reach USD 70.59 billion in 2023.

b. The synthetic fiber market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 117.76 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."