- Home

- »

- Agrochemicals & Fertilizers

- »

-

Humectants Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Humectants Market Size, Share & Trends Report]()

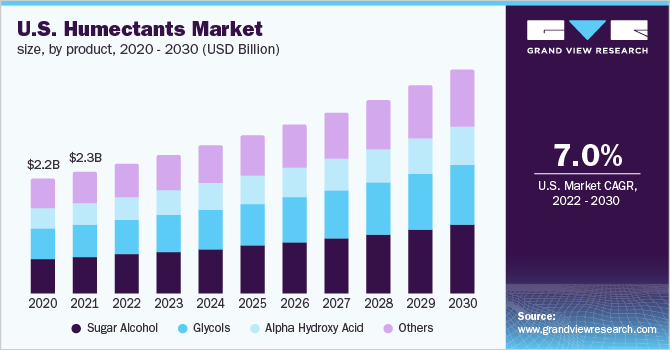

Humectants Market Size, Share & Trends Analysis Report By Product (Sugar Alcohol, Alpha Hydroxy Acid, Glycols), By Application (Food & Beverages, Oral & Personal Care), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-997-5

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

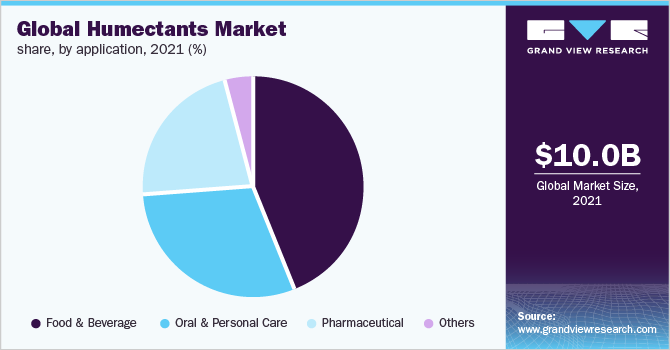

The global humectants market size was valued at USD 10,046.8 million in 2021. It is projected to grow at a compound annual growth rate (CAGR) of 6.5% in terms of revenue from 2022 to 2030. This is largely due to the growing demand from the cosmetic industry and growth in the global cosmetic market. The prominent changes in lifestyle and workforce patterns coupled with increasing demand for enhancing the shelf life of perishable products remain strong drivers of growth. The global market continues to expand due to rising consumer awareness of the health risks associated with sugar consumption. This has fueled growth in low- or zero-calorie foods produced using polyols. Humectants are also preferred by consumers in processed foods and beverages, since they control water activity in foods. This enhances stability & viscosity, maintains texture, and reduces microbial growth.

Humectants are moisturizing substances that draw moisture from the surrounding environment and deliver it to the skin to soften it. The majority of consumers use lotions, shampoos, and other beauty products for their skin and hair that contain humectants. Humectant-containing personal care products are becoming more popular as consumers become more aware of the importance of personal care. Since humectants regulate water activity in foods, they have helped open new opportunities driven by consumer demand for processed foods and beverages.

Humectants in food bind free water molecules to prevent microbial cells from accessing them. Osmotic stress, which occurs in cells that aren't getting enough moisture, can harm cells and prevent the growth of microbial organisms. Therefore, choosing the proper humectant for extending food products' shelf lives is essential for determining their Water Activity (AW). Additionally, humectants continue to be a crucial part of the production of organic substances, which fuels global demand for them.

Product Insights

The sugar alcohol segment held the highest revenue share of nearly 29% in 2021. It is expected to experience rapid revenue growth during the forecast period owing to the increased need for sugar alcohol for the diabetic population. Growing health consciousness among people has driven demand for sugar alcohols for key applications like weight loss. In addition, sugar alcohols are commonly used as sweeteners and thickeners in the food industry. Aside from regulating glycemic index, consumers also prefer sugar alcohol to reduce carbohydrate intake.

Sorbitol is the most widely used sugar alcohol as a humectant and bulk sweetener, sorbitol is a great texturizing agent and can be found in many foods and cosmetics. Sorbitol is helpful for diabetics because it is non-cariogenic in nature. Additionally, it is utilized in cosmetics and pharmaceutical products.

Glycol was the second-largest segment in the market. It accounted for a revenue share of around 26% in 2021. The growth is attributed to its widespread application in cosmetic, haircare, and skincare products such as serums, creams, lotions, and shampoos. Propylene glycol is one of the most commonly used glycols as it is considered a safe ingredient to be used in cosmetics. Propylene glycol is also used in food and beverages like beer, frozen dairy products, packaged baked food, coffee, soda, and nuts.

Application Insights

Food and beverage application dominated the market with a revenue share of around 43% in 2021. This is attributed to the growing customer preference for food products with long shelf life. A rise in hectic schedules and evolving lifestyle promise to continue the growth of the segment during the forecast period.

Ready-to-eat meals also remain popular for the same reason. These are easy to prepare, can be consumed without cooking, and hence, offer tremendous convenience to consumers. Ready-to-eat foods remain the main application for food humectants because they maintain the product's moisture content. To encourage the purchase of goods like frosting, icing, chewing gum, mints, and tablets, a variety of crystalline sorbitol granulations are also provided.

Sorbitol, containing bulk sweeteners made up of as much as 60% ingredient addition in new product releases. The sorbitol manufacturers aim to increase the scale of their manufacturing facilities as it continues to gain a mass appeal. Some of its prominent uses include ingredients to better meet the increasing demand for corn-based sweeteners, starches, and animal feed ingredients.

The oral and personal care market is the second largest segment and accounted for a revenue share of around 29% in 2021. The growth is attributed to the moisture-retaining property of humectants. They are used in a variety of personal care and medical products. Humectants have a variety of skin benefits. Humectants are also used in medicine to treat conditions such as eczema and psoriasis.

The humectant market is expanding largely due to the cosmetics industry. Humectants are ingredients that cosmetics manufacturers use in a wide range of goods. These include skincare creams, lotions, and cosmetics. Additionally, humectants are utilized in hair care products to aid the enhancement of shine and moisture retention.

Regional Insights

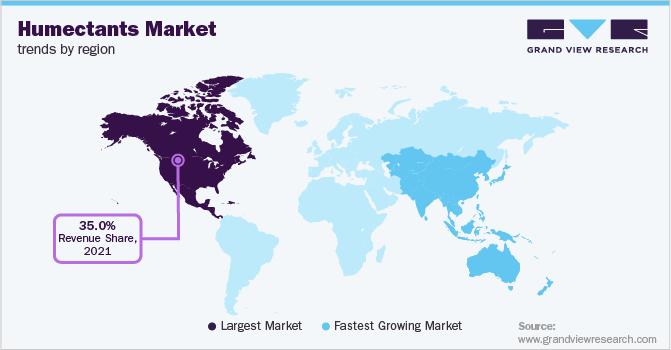

North America accounted for the largest revenue share of around 35% globally in the humectants market in 2021. It is expected to continue its dominance over the forecast period. This can be attributed to the health benefits associated with these products and the growth of the cosmetic and pharmaceutical industry in the region. Also, the increasing demand for ready-to-eat food in North America is a major driver for humectants in the food and beverage industry. Cosmetics and personal care products that contain humectants can retain moisture, which can help maintain skin hydration and prevent dryness. The FDA has approved several health claims about humectants, including a key fact that they can help treat eczema and psoriasis.

Asia Pacific accounted for a revenue share of around 22% globally in the humectants market in 2021 This can be attributed to the growing demand for dietary supplements and functional food items. The market is anticipated to grow at the fastest rate in countries like China and India where there is a high demand for these products. Obesity and diabetes are primarily linked in India to unhealthy food consumption practices. Polyols are used in the production of low- or zero-calorie foods as a result of increased consumer awareness. The health risks associated with sugar consumption continue to open up new opportunities in the country. Growing consumer awareness about food additives is also anticipated to spur market expansion during the anticipated period.

In Europe, natural ingredients are frequently preferred over synthetic ones. This is due to the general perception that natural components are less damaging to the skin than synthetic ones. Compared to other regions of the world, many European nations have stricter laws regarding the use of chemicals in cosmetics. As a result, manufacturers of cosmetics are less likely to include potentially hazardous ingredients in their goods, like synthetic humectants.

Key Companies & Market Share Insights

Market players continue to adopt several key strategies including joint ventures for business expansions, and new product development to increase their market presence. For instance, Roquette Frères introduced Beauté by Roquette PO 160 in September 2022. This moisturizer and COSMOS-humectant have excellent bacteriological properties. With this launch, the business will satisfy the growing consumer demand for natural ingredients that are efficient at soothing skin and scalp irritation while preserving a variety of skin microbes. Some prominent players in the global humectants market include:

-

Archer Daniel Midland Company

-

Ashland Global Holdings Inc.

-

BASF SE

-

Barentz

-

Brenntag AG

-

Cargill Incorporated

-

E.I. Du Pont De Nemours and Company

-

Ingredion

-

Roquette Freres

-

The DOW Chemical Company

Humectants Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 10,646.1 million

Revenue forecast in 2030

USD 17.66 billion

Growth Rate

CAGR of 6.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Russia; China; Japan; India; South Korea; Brazil; South Africa

Key companies profiled

Archer Daniel Midland Company; Ashland Global Holdings Inc.; BASF SE; Barentz, Brenntag AG; Cargill Incorporated; E.I. Du Pont De Nemours and Company; Ingredion; Roquette Freres; The DOW Chemical Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Humectants Market Segmentation

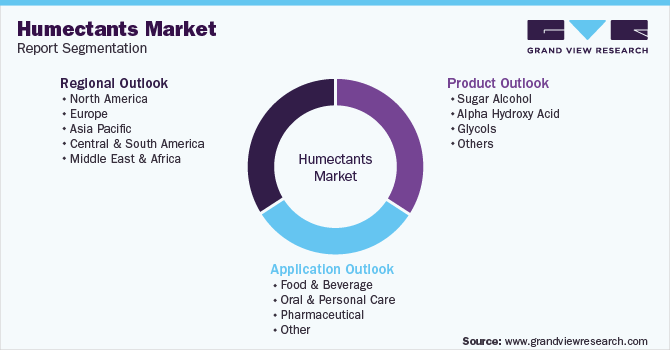

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global humectants market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Sugar Alcohol

-

Alpha Hydroxy Acid

-

Glycols

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Oral & Personal Care

-

Pharmaceutical

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global humectants market size was estimated at USD 10,046.8 million in 2021 and is expected to reach USD 10,646.1 million in 2022

b. The global humectants market is expected to grow at a compound annual growth rate of 6.5% from 2022 to 2030 to reach USD 17.66 billion by 2030.

b. North America dominated the humectants market with a share of 35.26% in 2021. This is attributable to to the health benefits associated with these products and growth of cosmetic and pharmaceutical industry in the region along with increasing demand for ready to eat food in North America

b. Some key players operating in the humectants market include Ashland Global Holdings Inc.BASF SE, Barentz , Brenntag AG, Cargill Incorporated, E.I. Du Pont De Nemours and Company, Ingredion, Roquette Freres, The DOW Chemical Company

b. Key factors that are driving the market growth include increasing demand from cosmetic industry for skincare products due to change in lifestyle of people along with increasing demand for enhancing the shelf life of perishable products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."