- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Sweeteners Market Size, Share, Trends, Industry Report 2033GVR Report cover

![Sweeteners Market Size, Share & Trends Report]()

Sweeteners Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Sucrose, Polyol Sweeteners/Sugar Alcohols, Allulose), By Form (Solid, Liquid), By Application (Beverages, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-940-8

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sweeteners Market Summary

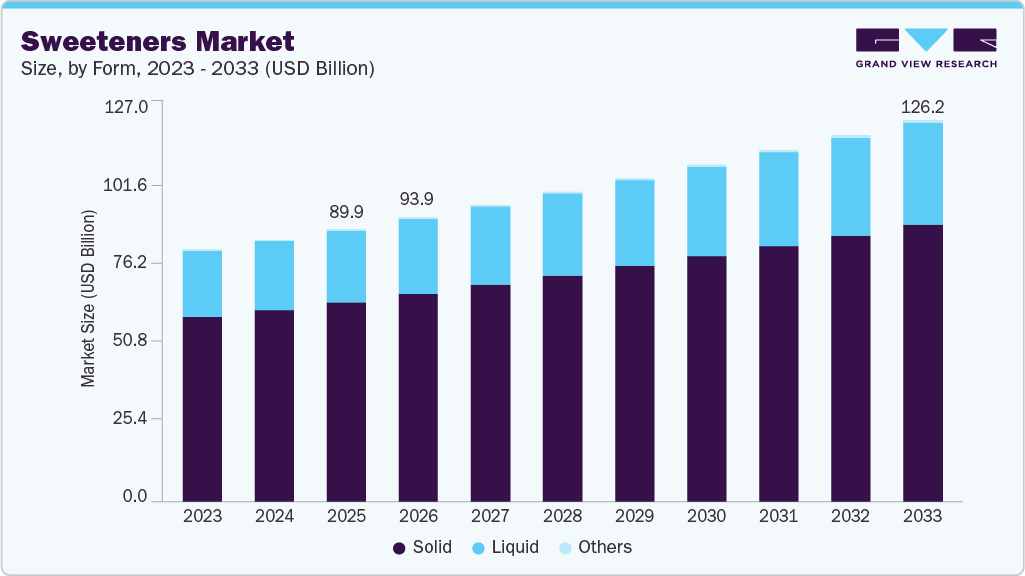

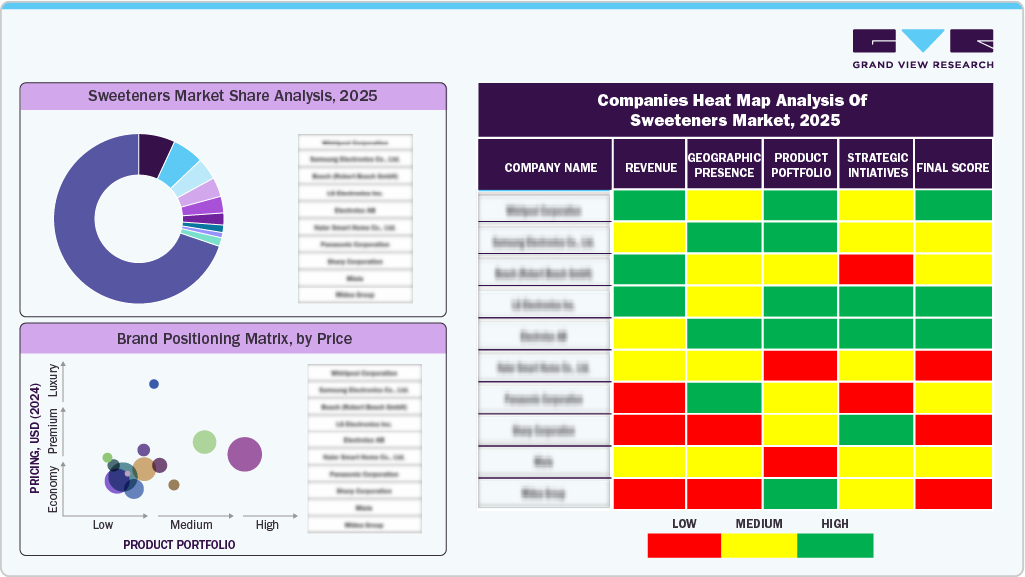

The global sweeteners market size was valued at USD 89.95 billion in 2025 and is anticipated to reach USD 126.15 billion by 2033, growing at a CAGR of 4.3% from 2026 to 2033. The continuously changing lifestyles and food habits among consumers are boosting the growth of the fast-food and bakery industry, which has led to significant growth of the market for sweeteners in recent years.

Key Market Trends & Insights

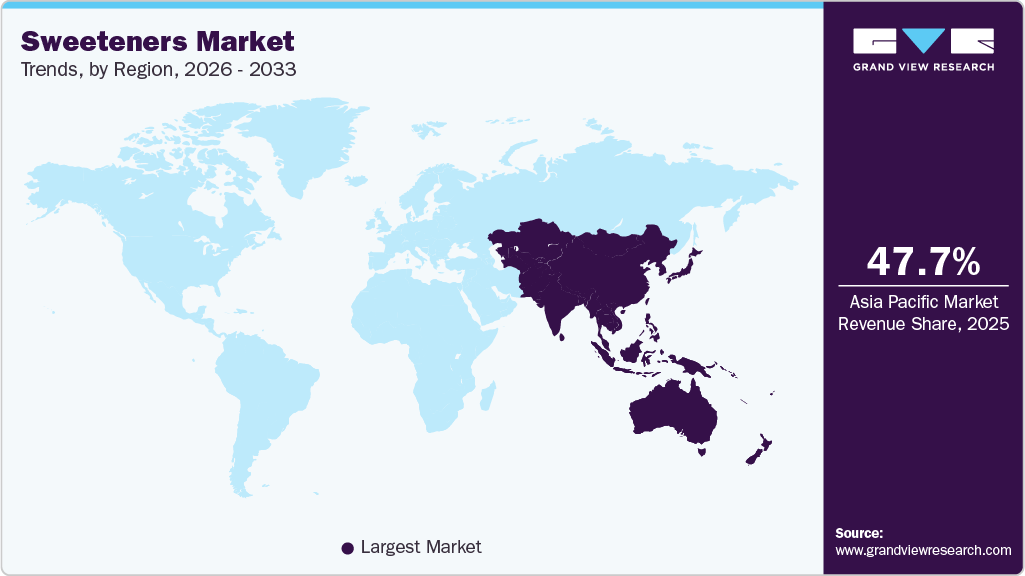

- Asia Pacific dominated the sweeteners market in 2025 with a share of 47.7%.

- The Middle East & Africa sweeteners market is experiencing significant growth with a projected CAGR of 5.8%.

- Based on type, sucrose accounted for a share of 79.1% of the overall sweeteners market in 2025.

- Low-Glycemic agave syrup is expected to witness a CAGR of 11.8% from 2026 to 2033.

- By form, the solid sweeteners market accounted for a share of 73.1% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 89.95 Billion

- 2033 Projected Market Size: USD 126.15 Billion

- CAGR (2026-2033): 4.3%

- Asia Pacific: Largest market in 2025

Sweeteners are used in bakery food products for their sweet flavor and ability to bulk, structure, brown, aerate, fuel, and maintain the product’s moisture, shelf life, and appeal. The growth of honey and artificial sweeteners can be credited to rising health consciousness among consumers, which encourages healthier and more nutritious food around the globe. In addition, the rising inclination toward natural products is propelling the market's growth. Rising health consciousness is encouraging global consumers to seek healthier and more nutritious food alternatives, leading to a surge in the demand for honey and artificial sweeteners. Manufacturers are offering a wide range of sugar substitutes such as xylitol, mannitol, erythritol, stevia, and honey, further favoring the growth of the sweeteners industry. Healthier and safer food products with high nutritional value are also witnessing a surge in demand with changing consumer preferences and inclination toward natural sweeteners.

The demand for sugar substitutes such as polyol sweeteners, high-intensity sweeteners, and rare sugars is also expected to surge over the forecast period. A wide range of sweeteners, including sucrose, is available globally. Consumers opt for high-intensity sweeteners, including aspartame, sucralose, saccharin, and cyclamates, instead of sugar, as they contain negligible or no calories. The rising consumption of carbonated soft drinks is anticipated to boost the demand for sweeteners globally.

Type Insights

The sucrose segment accounted for a revenue share of more than 79.1% in 2025. Sucrose, also known as table sugar, is a disaccharide produced from glucose and fructose. It is naturally found in various fruits, vegetables, and nuts. However, a large quantity of sucrose is produced commercially from sugarcane and sugar beets worldwide using the refining process. Sucrose also offers consistency to baked food products, owing to its wide use in the baking industry. Moreover, sucrose is used in various medicine formulations to impart a pleasant taste to foul-tasting chemicals. Different medicines have been formulated using sucrose in the form of gummies, chewable tablets, syrups, and lozenges owing to its binding properties and sweet taste.

The low glycemic agave syrup segment is expected to grow at the fastest CAGR of 11.8% from 2026 to 2033. Agave syrup contains less glucose than other sweeteners, which may help minimize blood sugar spikes and crashes that trigger cravings. Regular consumption of high-sugar foods can strain the body's insulin response, reducing its ability to metabolize glucose effectively over time. Low-glycemic agave syrup is a natural, vegan-friendly sweetener derived from the agave plant, a succulent native to warm regions such as the southwestern part of the U.S. and Mexico. It has gained popularity as a substitute for table sugar and other sweeteners, especially in the alternative health community. Moreover, its low glycemic index (GI), typically ranging from 10 to 19, helps maintain steady blood sugar levels and avoids sharp spikes.

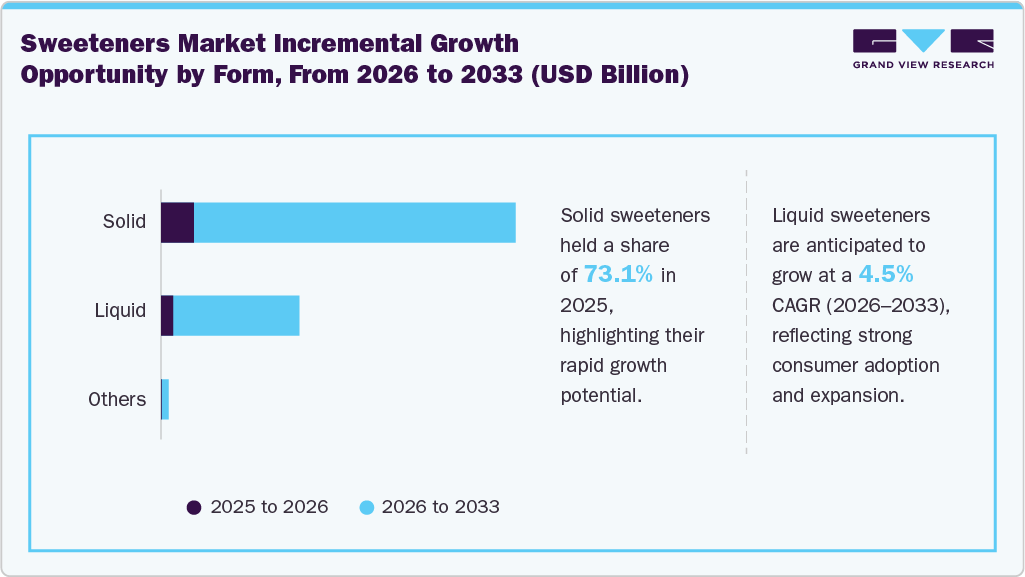

Form Insights

The solid sweeteners segment accounted for a revenue share of 73.1% in 2025. The solid form is in high demand in the global market owing to its feasibility and functional benefits, including ease of transportation, packaging, stability, and a wide scope of application. Most sweeteners are available in solid, crystalline, or powdered forms. They are widely used in the food & beverage industry as coating and bulking agents in confectionery, bakery, and other applications. Ease of use of solid sweeteners, owing to their physical properties, is a key factor contributing to their demand.

The liquid sweeteners segment is estimated to grow at a CAGR of 4.5% from 2026 to 2033. Sweeteners in liquid form offer greater solubility and flexibility for different applications, such as food & beverages, pharmaceuticals, and personal care & cosmetics. Liquid sweeteners are widely used in producing beverages, chewing gums, mouthwashes, cosmetic gels, and pharmaceutical products. Moreover, producing liquid sweeteners requires minimal processing, a key factor driving their demand in end-use industries. Honey is the oldest natural sweetener available in liquid form, which is twice as sweet as sucrose and contains several trace minerals and vitamins B. Maple syrup is another sweetener available in liquid form. It is made from sap extracted from sugar maple trees and tastes twice as sweet as sucrose. High-fructose corn syrup and polyols such as isomalt, sorbitol, and maltitol are also some of the sweeteners available in liquid form.

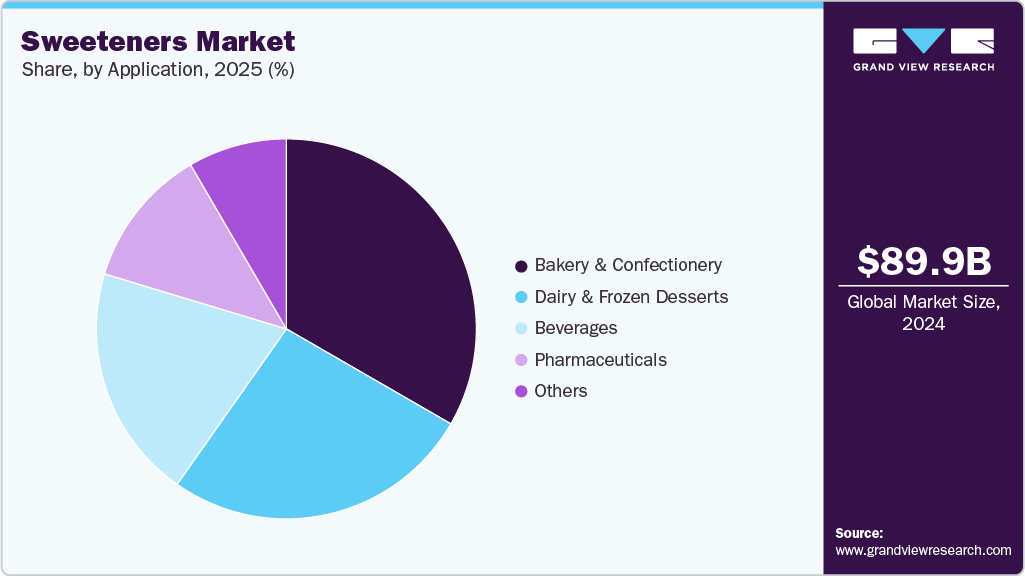

Application Insights

Bakery & confectionery applications accounted for a revenue share of 33.3% in 2025, driven by the need for improved taste, texture, and shelf-life in products ranging from cakes and cookies to chocolates and candies. These natural, low- and zero-calorie options allow manufacturers to offer reduced-sugar or sugar-free variants without compromising sweetness or mouthfeel. Additionally, the rising popularity of keto, paleo, and diabetic-friendly diets has further expanded market opportunities for low-glycemic sweeteners in indulgent treats. Moreover, e-commerce and premium product positioning have empowered niche players to introduce specialty sweeteners in artisanal and functional bakery & confectionery products.

The pharmaceutical segment is estimated to grow at a CAGR of 5.0% from 2026 to 2033, supported by rising demand for palatable drug formulations and increasing consumption of syrups, chewable tablets, lozenges, and pediatric medicines. Sweeteners play a critical role in masking bitterness and improving patient compliance, particularly among children and elderly populations. Growth is further supported by the expansion of nutraceuticals, sugar-free medicines for diabetic patients, and regulatory emphasis on reducing sugar content in pharmaceutical formulations.

Regional Insights

North America sweeteners market is expected to grow at a CAGR of 3.1% from 2026 to 2033. Increasing awareness about sugar alternatives that provide low or no calories has contributed to the market growth in North America. Consumers in the region are shifting toward natural and organic products and reducing the consumption of packaged and heavily processed food, which is expected to drive the demand for natural sweeteners. In 2024, as part of World Day Against Obesity, Universidad Panamericana reinforced its dedication to fostering a healthy and sustainable food culture in Mexico, where childhood obesity remains a significant issue. Such steps are expected to positively impact the expansion of the natural and low-calorie sweeteners market, as food manufacturers adapt to changing consumer preferences and regulatory environments.

U.S. Sweeteners Market Trends

The sweeteners market in the U.S. is expected to grow at a CAGR of 2.8% from 2026 to 2033, driven by steady demand across food & beverages, pharmaceuticals, and personal care applications. Growth is supported by increasing adoption of low-calorie and sugar-reduction solutions, particularly in processed foods and beverages, as manufacturers respond to health-conscious consumers and regulatory pressure. The rising prevalence of diabetes and obesity is further accelerating the use of alternative sweeteners in sugar-free and reduced-sugar product formulations across the country.

Europe Sweeteners Market Trends

The sweeteners market in Europe is expected to grow at a CAGR of 5.2% from 2026 to 2033. Heightened health awareness around high sugar consumption, a preference for cleaner labels, and the rise of lifestyle diseases such as obesity and diabetes are key factors driving the demand for healthier, natural, low-calorie sweeteners in Europe. In response, European (EU) food and beverage companies are increasingly turning to natural alternatives such as steviol glycosides (stevia), coconut sugar, and date sugar to replace traditional sugar in a variety of products, including beverages, bakery items, dairy, confectionery, and tabletop sweeteners.

Germany sweeteners market is expected to grow at a CAGR of 4.9% from 2026 to 2033, driven by strong demand for low-calorie and natural sweetening solutions across food, beverage, and pharmaceutical applications. Rising consumer awareness around sugar reduction, clean-label products, and preventive healthcare is encouraging manufacturers to reformulate products using alternative sweeteners. Additionally, Germany’s robust food processing industry and stringent regulatory standards are accelerating innovation in reduced-sugar formulations, supporting sustained market growth over the forecast period.

Asia Pacific Sweeteners Market Trends

The sweeteners market in the Asia Pacific accounted for the largest share of 47.7% in the global industry in 2025. The region has a large growth potential for the food and beverages industry on account of the presence of some of the fastest-growing economies, such as China and India. Consumers in the region are largely inclined toward convenient yet healthy foods, sugar-free snacks, and diet beverages, which rely on alternative sweeteners. Moreover, Asian economies such as China and India are among the largest producers and consumers of sweeteners such as sucrose. High availability of raw materials required for the production of sucrose, such as sugarcane, and favorable government initiatives aimed at increasing the production of sucrose in these countries are expected to boost the market growth.

China’s sweeteners market is driven by the rapid expansion of the food & beverage industry, rising urbanization, and changing dietary preferences toward packaged and convenience foods. Growing health awareness and increasing prevalence of diabetes are accelerating demand for low-calorie and sugar-reduction solutions, particularly in beverages, dairy products, and nutraceuticals. In addition, strong growth in pharmaceutical and traditional Chinese medicine formulations, along with government initiatives to reduce sugar intake, is encouraging manufacturers to adopt alternative and functional sweeteners, supporting sustained market momentum.

Central & South America Sweeteners Market Trends

The sweeteners market in Central & South America is set to grow at a CAGR of about 4.6% from 2026 to 2033, driven by increasing consumption of processed foods and beverages, rising urban populations, and expanding food manufacturing capacity across countries such as Brazil, Mexico, and Argentina. Growing awareness of sugar-related health issues, including diabetes and obesity, is encouraging the adoption of low-calorie and alternative sweeteners. Additionally, demand from pharmaceutical and beverage applications, along with gradual regulatory support for sugar reduction, is expected to support sustained regional growth.

Middle East & Africa Sweeteners Market Trends

The sweeteners market in the Middle East & Africa is set to grow at a CAGR of about 5.8% from 2026 to 2033, supported by rising consumption of packaged foods and beverages, increasing urbanization, and a growing young population. Heightened awareness of lifestyle-related diseases such as diabetes and obesity is accelerating demand for low-calorie and sugar-reduction alternatives. In addition, expanding pharmaceutical manufacturing, improving food processing infrastructure, and government-led health initiatives aimed at reducing sugar intake are contributing to sustained market growth across the region.

Key Sweeteners Companies Insights

Some of the key companies in the global sweeteners industry are ADM, Ingredion, Roquette Frères, Tate & Lyle, and Cargill, Incorporated. Global sweetener manufacturers have experienced strong year-on-year growth in recent years, driven by increasing consumer preference for low-sugar food products and a wide application scope for sweeteners across various industries. Key companies in the market are offering solutions for the food & beverage, pharmaceutical, and personal care industry players and focusing on introducing plant-based natural sweeteners to meet changing customer demands.

-

ADM is an agricultural processing and food ingredient manufacturing company that produces various products, including oils, sweeteners, proteins, and specialty ingredients. It operates across various sectors, serving food, beverage, animal nutrition, and industrial markets worldwide, focusing on sustainability and innovation.

-

Ingredion produces a variety of starches, sweeteners, and other specialty ingredients for food, beverages, personal care, and industrial applications. It focuses on providing innovative and sustainable solutions that meet customers' evolving needs across diverse industries worldwide.

Key Sweeteners Companies:

The following are the leading companies in the sweeteners market. These companies collectively hold the largest Market share and dictate industry trends.

- ADM

- Ingredion

- Cargill, Incorporated.

- Roquette Frères

- Tate & Lyle

- Foodchem International Corporation

- PureCircle

- Pyure

- Beeyond the Hive

- Kerry Group plc

Recent Developments

-

In July 2025, Bioenergy Life Science (BLS) announced the launch of PureSweet, an ultra‑pure Rebaudioside M (Reb M) sweetener that mimics the clean, sugar‑like taste of sucrose while delivering zero calories, no bitterness and no lingering aftertaste. Designed as a plug‑and‑play solution, PureSweet enables brands to dramatically cut sugar levels without compromising flavor. Its high purity ensures consistent performance, helping manufacturers meet deep‑reduction targets while preserving consumer trust. With PureSweet, companies can confidently offer healthier, great‑tasting products that satisfy today’s demand for clean‑label sweetness.

-

In October 2024, NutraEx Food, Inc. unveiled Bi‑Sugar-a breakthrough dry‑embedding technology that chemically bonds L‑arabinose to conventional sugar and a second natural sweetener. This innovative solution will enable food and beverage manufacturers to elevate their sugar reduction strategies, positioning them as leaders in a competitive market.

Sweeteners MarketReport Scope

Report Attribute

Details

Market size value in 2026

USD 93.85 billion

Revenue forecast in 2033

USD 126.15 billion

Growth rate (revenue)

CAGR of 4.3% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

ADM; Ingredion; Cargill, Incorporated.; Roquette Frères; Tate & Lyle; Foodchem International Corporation; PureCircle; Pyure; Beeyond the Hive; Kerry Group plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sweeteners Market Report Segmentation

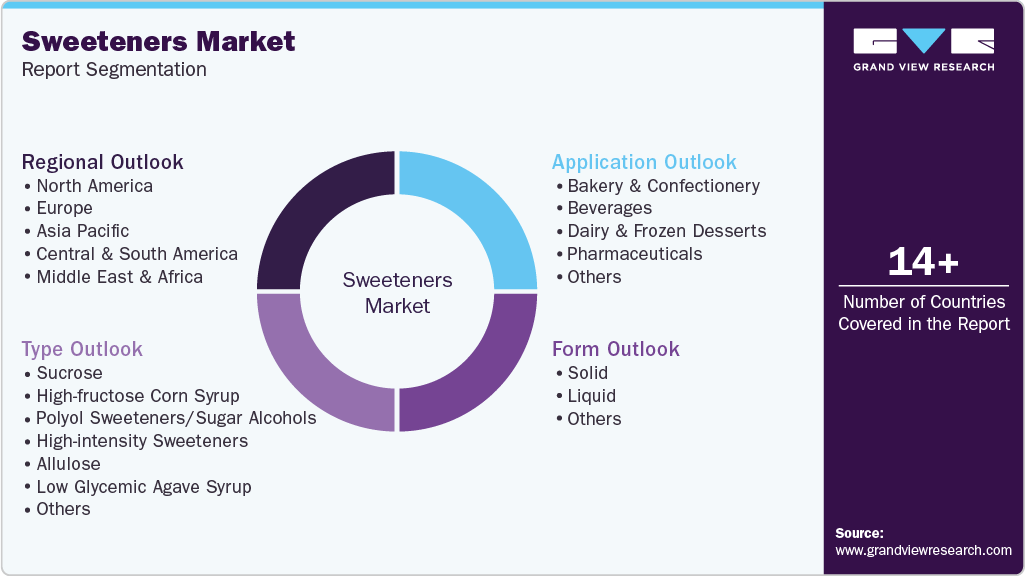

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global sweeteners market report on the basis of type, form, application, and region:

-

Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Sucrose

-

High-fructose Corn Syrup

-

Polyol Sweeteners/Sugar Alcohols

-

Sorbitol

-

Xylitol

-

Mannitol

-

Maltitol

-

Isomalt

-

Erythritol

-

Lyxitol

-

Others

-

-

High-intensity Sweeteners

-

Aspartame

-

Sucralose

-

Saccharin

-

Cyclamates

-

Acesulfame Potassium (Ace- K)

-

Stevia

-

Monk Fruit (Luo Han Guo)

-

Brazzein

-

Others

-

-

Allulose

-

Low Glycemic Agave Syrup

-

Tagatose

-

Cambya

-

Others

-

-

Form Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Solid

-

Liquid

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Bakery & Confectionery

-

Beverages

-

Dairy & Frozen Desserts

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include the rising adoption of natural sweeteners in confectionery, dairy, and bakery products, and the rising health consciousness among consumers to encourage healthier and more nutritious food across the world.

b. The global sweeteners market size was estimated at USD 89.95 billion in 2025 and is expected to reach USD 93.85 billion in 2026.

b. The global sweeteners market is expected to grow at a compound annual growth rate of 4.3% from 2026 to 2033 to reach USD 126.15 billion by 2033.

b. Asia Pacific dominated the sweeteners market with a share of 47.7% in 2025. This is attributable to the increasing demand for premium beverages and confectionery products as younger population in the region is largely influenced by western diets, which has led to increased consumption of sweeteners.

b. Some key players operating in the sweeteners market include ADM, Ingredion, Cargill, Incorporated, Roquette Frères, Tate & Lyle, Foodchem International Corporation, PureCircle, Pyure Brands LLC., Beeyond the Hive, Dabur India Ltd., Kerry Group plc, Ajinomoto Co., Inc., International Flavors & Fragrances Inc., DFI Corporation, Nascent Health Sciences, LLC

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.