- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyols Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Polyols Market Size, Share & Trends Report]()

Polyols Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polyester, Polyether), By Application (Rigid Foam, Flexible Foam) By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-273-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyols Market Summary

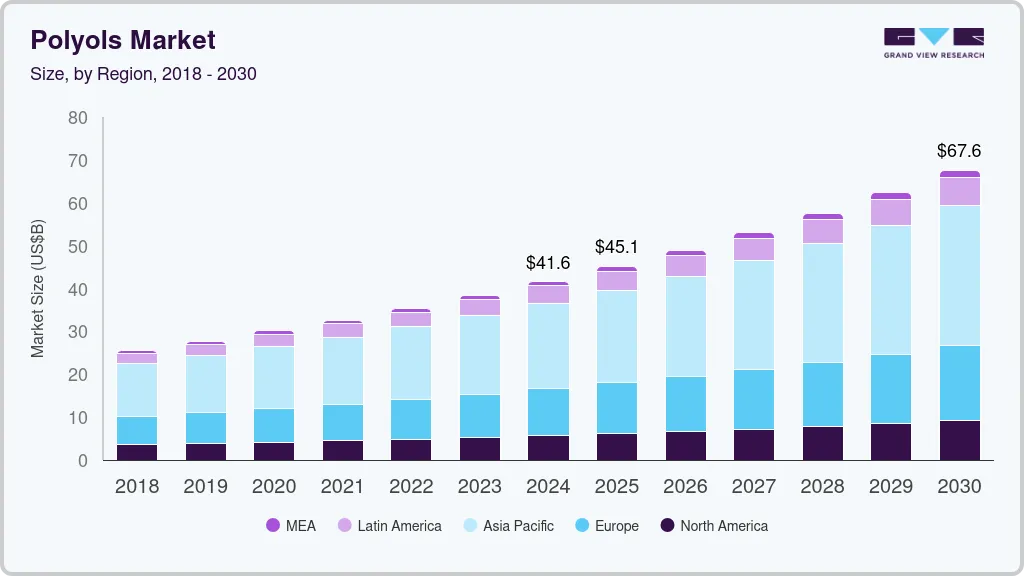

The global polyols market size was estimated at USD 41,625.0 million in 2024 and is projected to reach USD 67,590.0 million by 2030, growing at a CAGR of 8.4% from 2025 to 2030. The market growth is attributed to polyols' beneficial properties, such as strength, resilience, and energy absorption, which make them ideal for commercial and consumer products, including bedding, furniture, transportation, textiles, carpet cushioning, packaging, and fibers.

Key Market Trends & Insights

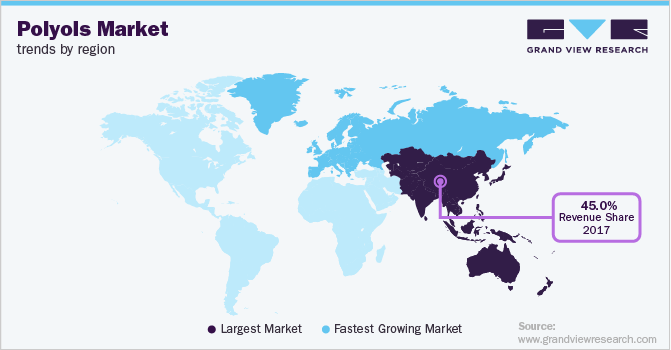

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, polyether accounted for a revenue of USD 34,555.7 million in 2024.

- Polyester is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 41,625.0 Million

- 2030 Projected Market Size: USD 67,590.0 Million

- CAGR (2025-2030): 8.4%

- Asia Pacific: Largest market in 2024

The market is expected to grow, primarily due to the automotive industry's preference for polyol-based polyurethane, which is cost-effective, versatile, and functional. Environmental concerns and regulations also drive rising demand for sustainable packaging solutions, contributing to this growth. Polyols are widely used in producing polyurethane foams and coatings, offering flexibility, durability, and moisture resistance. Furthermore, packaging solutions derived from polyols can help extend the shelf life of various perishable products and provide enhanced protection during storage and transportation.

The growing awareness among consumers about the importance of using sustainable and eco-friendly materials in producing polyurethane foams across various industries is expected to drive growth in the polyols market. Due to increasing environmental concerns and fluctuating raw material prices, major companies are turning to bio-based polyols to reduce their reliance on petrochemical-derived options. Many companies actively explore developing and marketing bio-based polyols, recognizing their potential future benefits, especially as regulatory authorities push for environmentally friendly products.

Drivers, Opportunities & Restraints

The growing demand for bio-based polyols is driven by a shift towards more sustainable and environmentally friendly materials in various industries, including automotive and construction. These polyols, derived from renewable resources, reduce reliance on fossil fuels and lower the carbon footprint of polyurethane products. As consumers and manufacturers become more environmentally conscious, the market for bio-based alternatives continues to expand, fostering innovation and encouraging the development of greener formulations.

Stringent environmental regulations for polyurethane foam production focus on minimizing the impact of harmful chemicals and reducing emissions during manufacturing. These regulations often require safer, low-VOC (volatile organic compounds) materials and promote recycling or sustainable sourcing of raw materials. Compliance with these standards helps protect the environment and drives innovation in developing eco-friendly alternatives within the industry.

Product Insights

The polyether segment accounted for the largest share of the revenue, at 76.7%, in 2024, and it is expected to maintain its dominance throughout the forecast period. Polyether polyols are known for their excellent resistance, hydrolytic stability, and rebound properties, making them ideal for formulating rigid polyurethane foams. Their increasing use in producing flexible foams, commonly found in bedding, furniture, and automotive interiors, is a significant factor driving market growth. Additionally, the rising consumer preference for comfort and luxury in these sectors further boosts the demand for polyether polyols.

Polyester polyols are widely used to create both flexible and rigid foams for furniture. They are valued for their durability, comfort, and structural integrity in mattresses, sofas, and chairs. Additionally, polyester materials are cost-effective, contributing to their popularity in the clothing industry and boosting global market demand. The rise of online clothing retailers has increased the attractiveness of polyester garments, which are known for their durability and low maintenance.

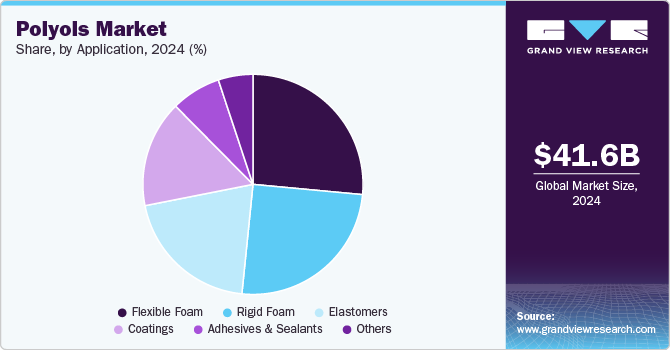

Application Insights

The flexible foam segment dominated the market with a market share of 26.5% in 2024, during the forecast period. This is expected to grow during the forecast period due to its ability to be molded into various shapes. It is commonly used in packaging, bedding, carpet padding, furniture, and upholstery in car interiors. This material offers environmental benefits such as emission-free burning, pollutant filtration, and waste reduction. It is also easily recyclable and eco-friendly. In addition, flexible foam is finding success in other applications, including transportation, sporting goods, and carpet padding. There is a growing trend towards producing flexible foam using bio-based materials instead of traditional petroleum sources.

The demand for coating applications is expected to grow significantly during the forecast period. The demand for the product market in coatings applications is driven primarily by the industrial sector, especially within the automotive, construction, and electronics industries, which require high-performance coatings. Bio-based polyols are favored for their reduced reliance on lower carbon footprints and fossil fuels. Additionally, performance requirements, such as resistance to wear, chemical resistance, and UV stability, contribute to the need for advanced polyols.

Regional Insights

The Asia Pacific polyols market is dominant in the polyols market, Rapid industrialization in the region is anticipated to increase the demand for polyols throughout the forecast period. Additionally, government initiatives to enhance the manufacturing sector in countries like China, India, and South Korea are expected to drive the market.

North America Polyols Market Trends

The polyols market in the North America is experiencing growth. Construction and building activities in the region are experiencing significant growth, driven by rising demand for polyols in various residential, commercial, and industrial projects. Manufacturers are focusing on producing bio-based polyols and improving the recyclability of polyurethane products to comply with environmental standards and address consumer demand for eco-friendly alternatives.

Europe Polyols Market Trends

The European polyols market is witnessing significant growth, fueled by a strong demand for polyols in construction and building activities. The region's focus on sustainability and eco-friendly formulations also increases the attractiveness of polyol products to consumers. Key markets in Europe include the United Kingdom, France, and Germany, which play crucial roles in shaping market trends and consumer preferences.

Latin America Polyols Market Trends

The polyols market in Latin America is expected to experience significant growth, fueled by rising consumer demand for rigid foam, and elastomers products. Key contributors to this growth include Brazil and Argentina, where increasing disposable incomes. Additionally, the market is influenced by trends favoring sustainable and ethically sourced polyols, which aligns with global consumer preferences for eco-friendly products.

Middle East & Africa Polyols Market

The Middle East and Africa polyols market is set for growth. This expansion is fueled by an increasing demand for pharmaceuticals and medical and the rising popularity of elastomers and rigid foam. Key markets in the region include Saudi Arabia and South Africa. Additionally, a significant shift toward sustainable and ethically sourced polyol products aligns with global consumer preferences for eco-friendly options.

Key Polyols Company Insights

Some key players operating in the market include BASF SE and Veolia.

-

BASF SE is a chemical manufacturing company with a presence across Asia Pacific, North America, Central & South America, Europe, and the Middle East & Africa. The company operates through six business segments, namely chemical, material, industrial solutions, surface technologies, agricultural solutions, and nutrition & care. The chemical segment includes petrochemicals and intermediaries. Material segment comprises performance polymers and monomers. The Industrial solutions segment includes performance chemicals and dispersions & pigments. Agricultural solution segment includes products for farming, landscape management, and pest control. Nutrition & care segment is further sub-segmented into nutrition & health and care. The company provides a wide range of surfactants for textile, paint & coatings, homecare, and food processing industries.

-

The Dow Chemical Company, commonly referred to as Dow, is engaged in the production of plastics, agriculture products, and chemicals. It has a presence in over 160 countries and operates through five business units, namely consumer solutions, agricultural sciences, performance plastics, infrastructure solutions, and performance materials & chemicals. The company is engaged in manufacturing and distributing chemicals for various industries including agriculture, automobile, building & construction, consumer goods, electronic materials, energy & water, industrial, infrastructure, packaging, and sports. It offers over 6,000 products that are manufactured in 113 sites located in 31 countries. The company provides a broad range of surfactants under its performance materials & chemicals segment.

Key Polyols Companies:

The following are the leading companies in the polyols market. These companies collectively hold the largest market share and dictate industry trends.

- Covestro AG

- BASF SE

- Dow

- Shell Plc

- Huntsman International LLC

- Coim USA Inc

- Stephan Company

- Palmer Holland, Inc.

Recent Developments

-

In April 2024, Sanyo Chemical Industries announced the signing of a MOU with Econic Technologies to develop CO2-based polyols for carbon neutrality. This collaboration focuses on using captured carbon dioxide as a raw material for producing sustainable polyols, essential for manufacturing polyurethane foams and other materials. The partnership highlights both companies' commitment to innovation and sustainability as they work together to promote eco-friendly solutions in the chemical industry and contribute to global efforts to reduce carbon emissions.

-

In May 2023, Sanyo Chemical Industries and Mitsui Chemicals announced a 50-50 Limited Liability Partnership (LLP) to enhance the production of polypropylene glycols. The partnership seeks to address common productivity and supply stability challenges within Japan's competitive polyurethane market. PPGs are essential raw materials used in various applications, including automotive parts and construction materials. The LLP will focus on operational cooperation and joint procurement of raw materials to strengthen the competitiveness of both companies in the PPG sector.

Polyols Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.14 billion

Revenue forecast in 2030

USD 67.7 billion

Growth rate

CAGR of 8.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; Brazil; Mexico; Saudi Arabia.

Key companies profiled

Covestro AG; BASF SE; Dow; Shell Plc; Huntsman International LLC; Coim USA Inc; Stephan Company; Palmer Holland, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

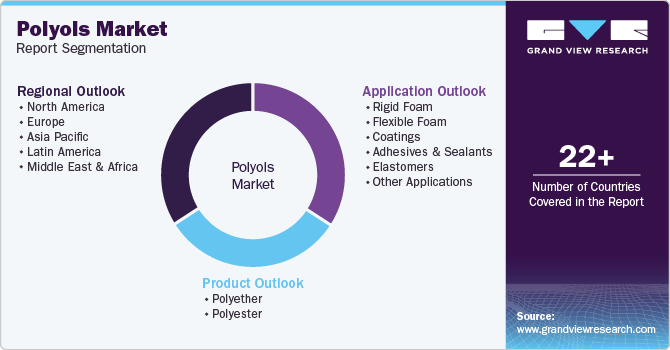

Global Polyols Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyols market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyether

-

Polyester

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rigid Foam

-

Flexible Foam

-

Coatings

-

Adhesives & Sealants

-

Elastomers

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global polyols market size was estimated at USD 41.62 billion in 2024 and is expected to reach USD 45.14 billion in 2025.

b. The global polyols market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2030 to reach USD 67.7 billion by 2030.

b. Asia Pacific dominated the polyols market with a share of 47.9% in 2024. This is attributable to the growing automotive industry and increasing polymer consumption.

b. Some key players operating in the polyols market include Covestro AG, BASF SE, Dow, Shell Plc, Huntsman International LLC, Coim USA Inc, Stephan Company, and Palmer Holland Inc.

b. Key factors that are driving the market growth include rising efforts for energy conservation and propelling demand for rigid foams with high insulation properties, particularly in the building and construction industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.