- Home

- »

- Conventional Energy

- »

-

Lithium-ion Battery Market Size, Share & Growth Report, 2030GVR Report cover

![Lithium-ion Battery Market Size, Share & Trends Report]()

Lithium-ion Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Cobalt Aluminum Oxide), By Application (Automotive, Consumer Electronics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-601-1

- Number of Report Pages: 136

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lithium-ion Battery Market Summary

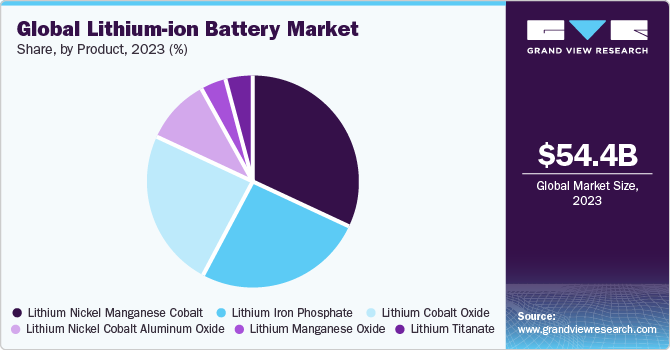

The global lithium-ion battery market size was estimated at USD 54.4 billion in 2023 and is projected to reach USD 182.5 billion by 2030, growing at a CAGR of 20.3% from 2024 to 2030. Automotive sector is expected to witness significant growth owing to the low cost of lithium-ion batteries.

Key Market Trends & Insights

- Asia Pacific dominated the global market and accounted for the largest revenue share of 47.0% in 2023.

- The lithium-ion battery market in Germany is expected to witness steady growth over the forecast period.

- By application, the consumer electronics segment accounted for a revenue share of 31.0% in 2023.

- By product, the lithium cobalt oxide (LCO) segment held the largest market share of over 30.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 54.4 Billion

- 2030 Projected Market Size: USD 182.5 Billion

- CAGR (2024-2030): 20.3%

- Asia Pacific: Largest market in 2023

Global registration of electric vehicles (EVs) is anticipated to increase significantly over the forecast period. The U.S. emerged as the largest market in North America in 2023. Increasing EV sales in the country owing to supportive federal policies coupled with the presence of several players in the U.S. market are expected to drive product demand. Federal policies include the American Recovery and Reinvestment Act of 2009, which established tax credits for purchasing electric vehicles.

New Corporate Average Fuel Economy (CAFE) standards mandated fuel economy standards for passenger cars and Light Commercial Vehicles (LCVs) resulting in the expansion of electric drive technologies. Increasing product demand in smartphones owing to their extended shelf life and enhanced efficiency is expected to drive market growth. The increasing demand for EVs owing to growing consumer awareness about carbon emissions is expected to fuel market growth. A decline in the demand for lead-acid batteries, owing to EPA regulations on lead contamination and resulting environmental hazards coupled with regulations on lead-acid battery storage, disposal, and recycling, has led to an increase in the demand for Li-ion batteries in automobiles. Mexico has been a center of the global automotive industry as companies worldwide are eyeing to invest here.

Mexico is the fourth-largest exporter in automotive industry, after Germany, Japan, and South Korea. Growing automobile production in the country is anticipated to drive product demand. The COVID-19 pandemic has been a major restraint to market growth owing to several factors including reduced operational cost by end-users, coupled with disruption in the availability of spare parts due to sluggish manufacturing activities and logistics issues. Battery providers have taken subsequent steps to ensure efficient services to end-users that have signed long-term contracts with them. Vendors are opting for digital tools and are following prescribed preventative measures including social distancing norms and the use of protective kits in case of an on-site inspection and repair services required by end-users on a case-to-case basis.

Application Insights

Based on applications, the market has been segmented into automotive, consumer electronics, industrial, medical devices, and energy storage systems. The consumer electronics segment led the market in 2023 and accounted for the largest revenue share of more than 31.0%. Portable batteries are incorporated in portable devices and consumer electronic products. Applications of portable batteries range from mobile phones, laptops, computers, tablets, torches or flashlights, LED lighting, vacuum cleaners, digital cameras, wristwatches, calculators, hearing aids, and other wearable devices. The electric & hybrid EV market is projected to be the fastest-growing application segment over the forecast period.

Growing awareness about the benefits of battery-operated vehicles and increasing fossil fuel prices, particularly in emerging regions like Asia Pacific, Europe, and North America, is projected to favor the segment growth. Li-ion batteries are also utilized for providing backup power supply for commercial buildings, data centers, and institutions. Also, lithium-ion battery is preferred for energy storage in residential solar PV systems. These factors will boost the growth of energy storage applications over the forecast period. Li-ion batteries are used in numerous industrial applications, such as power tools, cordless tools, marine equipment & machinery, agricultural machinery, industrial automation systems, aviation, military & defense, electronics, civil infrastructure, and oil & gas.

Regional Insights

Asia Pacific held the largest market share of over 47.0% in 2023. The market in Europe is expected to witness steady growth over the forecast period owing to the increasing use of li-ion batteries in various sectors including medical, aerospace & defense, automotive, energy storage, and data communication & telecom. The market in Germany is expected to witness steady growth over the forecast period owing to the increasing use of Li-ion batteries in energy storage systems, EVs, and consumer electronics.

Germany is the world’s leading market for energy storage systems as well as the development of renewable energies. Rapidly growing market for electric vehicles in Asia Pacific countries, such as India and China, is one of the major factors that is positively influencing the demand for Li-ion batteries. Rise in environmental concerns in China have resulted in the ban on conventional fossil fuel-powered scooters from all its major cities to reduce emission, leading to an increase in the sales of e-scooters.

Market Dynamics

The increasing adoption of electric vehicles (EVs) is catalyzing a remarkable surge in the global lithium-ion battery industry. As governments and industries worldwide prioritize the transition toward sustainable and environment-friendly transportation, the demand for EVs has experienced a substantial upswing. Lithium-ion batteries, renowned for their high energy density and efficiency, have emerged as the cornerstone of this automotive revolution. These batteries power electric vehicles, providing them with the necessary range and performance to compete with traditional internal combustion engine vehicles.

Lithium-ion battery industry is consequently witnessing unprecedented growth, fueled by pivotal role these batteries play in addressing both environmental concerns and the need for reliable energy storage solutions in automotive sector. This trend is poised to reshape the energy landscape, with lithium-ion batteries at the forefront of powering a cleaner and more sustainable future for transportation.

Rising demand for substitutes, including sodium nickel chloride batteries, lithium-air flow batteries, lead acid batteries, and solid-state batteries, in electric vehicles, energy storage, and consumer electronics is expected to restrain the growth of the lithium-ion battery industry over the forecast period. Lithium-air refers to the usage of oxygen as an oxidizer rather than a material. Result is that batteries are five times cheaper and lighter than lithium-ion and can make phones and cars last five times longer.

Moreover, the rising demand for flow batteries is likely to restrain growth of lithium-ion battery industry over the forecast period. Demand for sodium-nickel-chloride batteries is growing because their components, such as aluminum oxide, sodium chloride, and nickel, are readily available in the market and are less expensive to manufacture compared to lithium-ion batteries, which again is expected to hamper its market growth.

Product Insights

Based on products, the industry has been segregated into Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Manganese Oxide (LMO), Lithium Titanate, and Lithium Nickel Manganese Cobalt (NMC). In terms of revenue, the LCO segment accounted for the largest market share of over 30.0% in 2023. High demand for LCO batteries in mobile phones, tablets, laptops, and cameras, on account of their high energy density and high safety level, is expected to augment segment growth over the forecast period. LFP batteries offer excellent safety and a long-life span to product.

Rising demand for lithium iron phosphate batteries in portable and stationary applications is expected to augment industry growth as they require high load currents and endurance. The rising demand for NCA on account of its high specific energy, specific power, and long-life span is expected to augment segment growth over the forecast period. NCA finds use in EV vehicles, medical devices, and industrial applications. Increasing consumption of lithium titanate in various applications including electric powertrains, streetlights, UPS, and solar-powered street lighting is likely to fuel segment growth over coming years. LTO offers various properties including safety, low-temperature performance, and high life-span, which is expected to increase its share over the forecast period.

Key Companies & Market Share Insights

The industry is extremely competitive with key participants involved in R&D and constant product innovation. Key manufactures include Samsung, BYD, LG Chem, Johnson Controls, Exide, and Saft. Several companies are engaged in new product development to improve their global market share. For instance, BYD and Panasonic hold a strong position on account of its increased manufacturing capacities and large distribution network.

Key Lithium-ion Battery Companies:

- BYD Co., Ltd.

- A123 Systems LLC

- Hitachi, Ltd.

- Johnson Controls

- LG Chem

- Panasonic Corp.

- Saft

- Samsung SDI Co., Ltd.

- Toshiba Corp.

- GS Yuasa International Ltd.

Lithium-ion Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 60.3 billion

Revenue forecast in 2030

USD 182.5 billion

Growth rate

CAGR of 20.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in GWh, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Russia; Italy; U.K.; Germany; Spain; France; China; India; Japan; South Korea; Australia; Brazil; Paraguay; Columbia; South Africa; UAE; Egypt; Saudi Arabia

Key companies profiled

BYD Co., Ltd.; A123 Systems LLC; Hitachi, Ltd.; Johnson Controls; LG Chem; NEC Corp.; Panasonic Corp.; Saft; Samsung SDI Co., Ltd.; Toshiba Corp.; GS Yuasa International Ltd.; Narada Power Source Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lithium-ion Battery Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lithium-ion battery market report based on product, application and region:

-

Product Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

-

Lithium Cobalt Oxide (LCO)

-

Lithium Iron Phosphate (LFP)

-

Lithium Nickel Cobalt Aluminum Oxide (NCA)

-

Lithium Manganese Oxide (LMO)

-

Lithium Titanate

-

Lithium Nickel Manganese Cobalt (LMC)

-

-

Application Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Industrial

-

Energy Storage Systems

-

Medical Devices

-

-

Regional Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Spain

-

France

-

U.K.

-

Germany

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Paraguay

-

Columbia

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Egypt

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global lithium-ion battery market size was estimated at USD 54.4 billion in 2023 and is expected to reach USD 60.3 billion in 2024.

b. The global lithium-ion battery market is expected to grow at a compounded annual growth rate of 20.3% from 2024 to 2030 to reach USD 182.5 billion by 2030.

b. The Asia Pacific dominated the lithium-ion battery market with the highest share of about 48.0% in 2023. Growing demand for electric vehicles (EVs) and grid storage as it offers high-energy density solutions and lightweight are expected to propel the market growth.

b. Some key players operating in the lithium-ion battery market include NEC Corporation, Panasonic Corporation, Duracell Inc., Electrochem, an Integer company (Integer Holdings Corporation), SK Innovation Co., Ltd, Energizer, CBAK Energy Technology, Tesla, Renault Group, Samsung SDI Co., Ltd. among others.

b. Key factors driving the lithium-ion battery market growth include the subsequent increase in the registration of EVs and simultaneously, a decrease in Li-ion battery price is estimated to expand market size over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.