- Home

- »

- Renewable Energy

- »

-

Solar PV Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Solar PV Market Size, Share & Trends Report]()

Solar PV Market (2025 - 2030) Size, Share & Trends Analysis Report By Connectivity (On Grid, Off Grid), By Mounting (Ground Mounted, Roof Top), By End Use (Commercial & Industrial, Utility), By Region, And Segment Forecasts

- Report ID: 978-1-68038-063-7

- Number of Report Pages: 93

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solar PV Market Summary

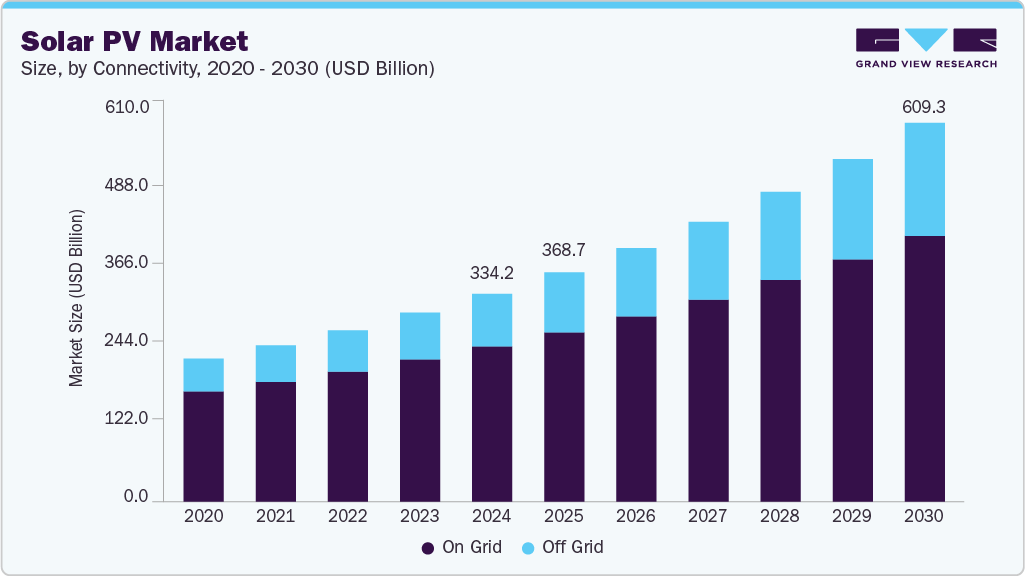

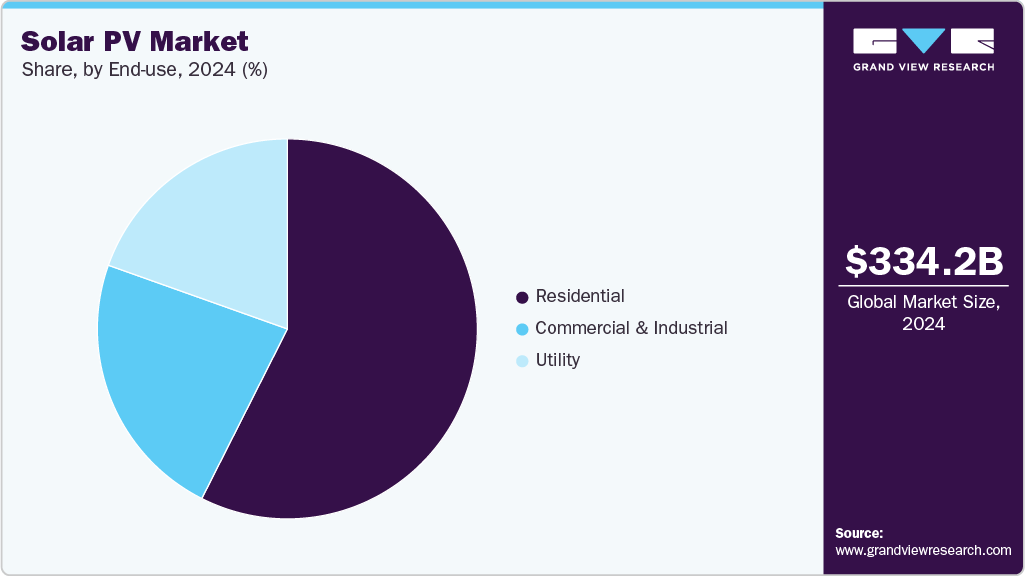

The global solar PV market size was valued at USD 334.21 billion in 2024 and is projected to reach USD 609.30 billion by 2030, growing at a CAGR of 10.6% from 2025 to 2030. Rising global concerns regarding climate change, increased emphasis on sustainable and clean energy solutions, favorable government policies and subsidies, and PV technology innovations have contributed major to market growth.

Key Market Trends & Insights

- Asia Pacific solar PV dominated the global market with the largest revenue share of 55.6% in 2024.

- The solar PV market in China led the Asia Pacific market and held the largest revenue share in 2024.

- By mounting, ground mounted led the market and held the largest revenue share of 62.7% in 2024.

- By end use, the utility segment held the dominant position in the market and accounted for the largest revenue share of 57.3% in 2024.

- By end use, the commercial & industrial segment is expected to grow at the fastest CAGR of 12.1% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 334.21 Billion

- 2030 Projected Market Size: USD 609.30 Billion

- CAGR (2025-2030): 10.6%

- Asia Pacific: Largest market in 2024

Governments worldwide are increasingly shifting towards clean and renewable energy sources to minimize their contribution to global warming and carbon emissions caused by non-renewable sources. Solar energy offers a sustainable and scalable alternative to traditional energy sources, leading to its increased demand worldwide. For instance, according to International Energy Agency, in 2023, global renewable capacity additions surged by nearly 50% to 510 GW, with solar PV alone contributing about 75% of this growth. In 2023, China commissioned solar PV as the entire world did in 2022. By 2028, solar PV and wind are expected to double their share, reaching 25% of global electricity generation. As developing economies gradually adopt renewable energy solutions, an accelerated demand growth for solar PV modules is anticipated over the forecast period.

At the 28th United Nations Climate Change Conference (COP 28) event held in Dubai (UAE), more than 130 countries pledged to triple their renewable energy production by 2030 to keep global warming within an acceptable level. To achieve these targets, governments worldwide are implementing different policies and incentives to promote the use of solar energy, including tax credits, feed-in tariffs, and net metering laws. Additionally, technological advancements, such as bifacial panels and tracker systems, are improving the efficiency and performance of solar PV systems. This has led to the production cost of solar power reaching par with fossil fuels and has fueled demand for solar modules among a larger consumer base seeking to shift to alternative energy sources at affordable costs.

The growing need for energy independence and security, particularly in remote, hilly, and off-grid locations, where energy transmission is difficult and losses are high, is driving the demand for solar PV solutions. Moreover, the increasing adoption of electric vehicles (EVs) and energy storage systems globally creates additional opportunities for higher demand for solar PV systems. For instance, according to the International Energy Agency, global electric car sales reached over 14 million in 2023, a 35% increase from 2022. By 2025, sales are expected to surpass 20 million, accounting for over a quarter of global car sales. A substantial decline in raw material prices and increasing production volumes have significantly reduced manufacturing costs for companies, leading to them offering solar energy solutions at competitive prices to end-users. These factors are collectively driving the global solar PV industry growth.

Connectivity Insights

On-grid connectivity dominated the market with the largest revenue share of 74.5% in 2024, owing to its widespread adoption and integration into existing electrical grids. On-grid solar PV systems, which generate electricity and feed it into the grid, have become the preferred choice for utilities, businesses, and governments seeking to transition to renewable energy sources. In addition, the ability to transfer excess energy back to the grid, generating revenue through feed-in tariffs and net metering programs, has made this type of connectivity popular among consumers. Furthermore, on-grid systems benefit from economies of scale, as larger installations can be developed and connected to the grid, reducing costs and increasing efficiency.

The off-grid segment is expected to grow at the fastest CAGR of 13.4% over the forecast period, attributed to its increasing adoption in remote and underserved regions. Governments and organizations are launching initiatives to promote energy access, and off-grid solar PV systems are becoming a vital solution for powering homes, schools, healthcare facilities, and small businesses. In addition, technological developments, such as energy storage systems and microgrids, have improved the efficiency and reliability of off-grid solar PV systems, making them a viable alternative to traditional energy sources. Furthermore, declining costs and innovative financing models are making off-grid solar PV systems more affordable and accessible, propelling their demand among a large consumer base.

Mounting Insights

Ground mounted led the market and held the largest revenue share of 62.7% in 2024. This is owing to their widespread adoption in utility-scale solar power generation. The segment's dominance is driven by the economies of scale achieved through large-scale installations, which reduce the cost per unit of electricity generated. Furthermore, tracking systems and advanced monitoring technologies can optimize ground-mounted systems for maximum energy production. Moreover, government policies and regulations supporting large-scale solar energy development, such as renewable portfolio standards and tax credits, support the segment demand.

The rooftop segment is expected to grow at a CAGR of 13.7% over the forecast period. Rooftop-mounted solar PV systems, installed on residential and commercial buildings, are becoming an attractive option for individuals and businesses aiming to reduce their energy bills and carbon footprint. Decreasing costs of solar panels have made rooftop installations more economical and accessible. In addition, government initiatives, such as tax credits and net metering laws, provide a financial incentive for property owners to adopt rooftop solar PV systems. Furthermore, growing awareness regarding climate change and environmental sustainability drives demand for clean energy solutions, leading to increased adoption of rooftop-mounted systems.

End Use Insights

The utility segment held the dominant position in the market and accounted for the largest revenue share of 57.3% in 2024. This is attributed to their ability to leverage large-scale projects and drive economies of scale. Utilities, with their extensive infrastructure and access to capital, can invest in massive solar power plants. These projects benefit from lower costs per kilowatt-hour due to economies of scale, making them financially attractive. Furthermore, governments across untapped economies, in partnership with prominent manufacturers, are investing in constructing new manufacturing facilities to meet their emission reduction targets and focus on clean energy solutions, which has led to the high growth rate of the utility sector in this market.

The commercial & industrial segment is expected to grow at the fastest CAGR of 12.1% from 2025 to 2030, owing to the significant adoption of solar energy solutions in such spaces to reduce energy costs and carbon footprint. Businesses, factories, and institutions have been heavily investing in solar PV systems to enable their operations, driven by a need to reduce energy expenses and enhance sustainability. In addition, the sector's high energy consumption and availability of large rooftop spaces make it ideal for solar PV installations, allowing for significant reductions in energy bills and greenhouse gas (GHG) emissions.

Furthermore, this sector is obligated to use renewable energy solutions to meet corporate sustainability goals, comply with environmental regulations, and benefit from government incentives and tax credits. Furthermore, innovative product offerings by manufacturers have created a steady demand for solar PV modules in this segment.

Regional Insights

Asia Pacific solar PV dominated the global market with the largest revenue share of 55.6% in 2024. This growth is attributed to its rapid adoption of solar energy, driven by government policies, declining technology costs, and increasing energy demand. Regional countries like China, Japan, and India have set ambitious renewable energy targets, offering attractive incentives and subsidies to encourage solar PV adoption. In addition, the region's large population, growing economy, and increasing energy requirements have created a vast market for solar energy solutions. Furthermore, favorable solar irradiance and extensive land availability make it an ideal location for utility-scale solar PV projects. For instance, in January 2024, First Solar announced the inauguration of India’s first completely vertically integrated 3.3 GW solar PV module manufacturing facility in Tamil Nadu.

The solar PV market in China led the Asia Pacific market and held the largest revenue share in 2024. This is attributed to a robust manufacturing ecosystem for solar PV modules and equipment in the economy. In addition, global manufacturers are investing heavily in local production facilities. In March 2024, Renesola announced plans to expand its manufacturing capabilities in China by constructing a new solar PV module factory in Yancheng (Jiangsu Province).

Latin America Solar PV Market Trends

Latin America solar PV market is expected to grow at a CAGR of 13.4% over the forecast period, driven by growing electricity demand, abundant solar resources, and declining technology costs. In addition, supportive government incentives, such as tax breaks and feed-in tariffs, encourage investment, while advancements in photovoltaic efficiency and storage solutions make solar projects more viable.

North America Solar PV Market Trends

The solar PV market in the North America is expected to grow significantly over the forecast period, owing to its rapidly expanding solar energy landscape driven by favorable government policies, declining technology costs, and increasing demand for clean energy. Furthermore, reduced costs of solar panels and balance of system components have made solar energy a more viable alternative to fossil fuels, leading to increased adoption. Moreover, partnerships and collaborations, along with new product launches, are also contributing to the high growth rate. For instance, in June 2024, Canadian Solar entered into a partnership with Lifestyle Solar to supply solar energy solutions to the residential sector in California.

The U.S. solar PV market led the North American market and accounted for the largest revenue share in 2024. Solar energy is becoming a vital component of the country's energy mix. Implementing state-level renewable portfolio standards, tax credits, and net metering laws has created a supportive regulatory environment.

In July 2024, First Solar announced the commissioning of a solar R&D facility in Lake Township, Ohio. This facility is considered the largest of its type in the Western Hemisphere for producing thin film and tandem PV module prototypes.

Europe Solar PV Market Trends

The solar PV market in Europe held a significant revenue share in 2024, primarily driven by the region’s strong commitment to reducing GHG emissions and meeting renewable energy targets. Eastern European countries have emerged as a new market for solar energy solutions. Germany's solar PV market accounted for a significant share in the European market in 2024. This is due to the country’s efforts to achieve carbon neutrality for environmental

Key Solar PV Company Insights

Key players in the global solar PV market include RENESOLA, KYOCERA Corporation, Hanwha Group, and others. These companies focus on advancing technology, optimizing manufacturing processes, and expanding production capacity.

-

Jinko Solar specializes in designing, developing, and manufacturing high-efficiency solar photovoltaic (PV) products and energy storage systems (ESS). The company's product offering includes a wide range of solar modules, including monocrystalline, polycrystalline, and bifacial modules, with varying power outputs and efficiency rates. Jinko Solar's product portfolio also includes solar cells, solar inverters, and mounting systems, catering to the diverse needs of residential, commercial, and utility-scale solar energy projects.

-

Hanwha Group offers products and services in various industries, such as aerospace, mechatronics, clean energy, materials, retail, finance, and lifestyle services. Through its subsidiary Hanwha Energy Corporation, the company has developed major solar energy projects worldwide, such as Oberon 1A (the U.S.), Laguna (Mexico), Kitsuki (Japan), and Cam Lam (Vietnam).

Key Solar PV Companies:

The following are the leading companies in the solar PV market. These companies collectively hold the largest market share and dictate industry trends.

- RENESOLA

- KYOCERA Corporation

- Hanwha Group

- REC Solar, Inc.

- Jinko Solar

- JA SOLAR Technology Co., Ltd.

- First Solar

- Wuxi Suntech Power Co., Ltd.

- Canadian Solar

- Trinasolar

- SHARP CORPORATION

- SunPower Corporation

- Yingli Solar

Recent Developments

-

In July 2024, Jinko Solar announced that its subsidiary JinkoSolar Middle East DMCC entered into a joint venture agreement with Renewable Energy Localization Company (RELC) and Vision Industries Company (VI) in Saudi Arabia. The JV has been signed to build & operate a solar module and solar cell manufacturing plant in the economy.

-

In April 2024, RENESOLA announced its partnership with BayWa r.e. to develop and build its sales and marketing activities in Mexico. The two companies are expected work together to increase the presence of RENESOLA’s solutions in the Mexican solar distribution market, capitalizing on their combined strengths in solar energy and aiming to reach the target of distributing 100 MW of solar modules in 2024.

Solar PV Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 368.66 billion

Revenue forecast in 2030

USD 609.30 billion

Growth Rate

CAGR of 10.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

June 2025

Quantitative units

Volume in MW, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Connectivity, mounting, end use, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia.

Key companies profiled

RENESOLA; KYOCERA Corporation; Hanwha Group; REC Solar, Inc.; Jinko Solar; JA SOLAR Technology Co.,Ltd.; First Solar; Wuxi Suntech Power Co., Ltd.; Canadian Solar; Trinasolar; SHARP CORPORATION; SunPower Corporation.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar PV Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global solar PV market report based on, connectivity, mounting, end use, and region.

-

Connectivity Outlook (Volume, MW; Revenue, USD Billion, 2018 - 2030)

-

On Grid

-

Off Grid

-

-

Mounting Outlook (Volume, MW; Revenue, USD Billion, 2018 - 2030)

-

Ground Mounted

-

Roof Top

-

-

End Use Outlook (Volume, MW; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial & Industrial

-

Utility

-

-

Regional Outlook (Volume, MW; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.