- Home

- »

- Medical Devices

- »

-

Hearing Aids Market Size And Share, Industry Report, 2035GVR Report cover

![Hearing Aids Market Size, Share & Trends Report]()

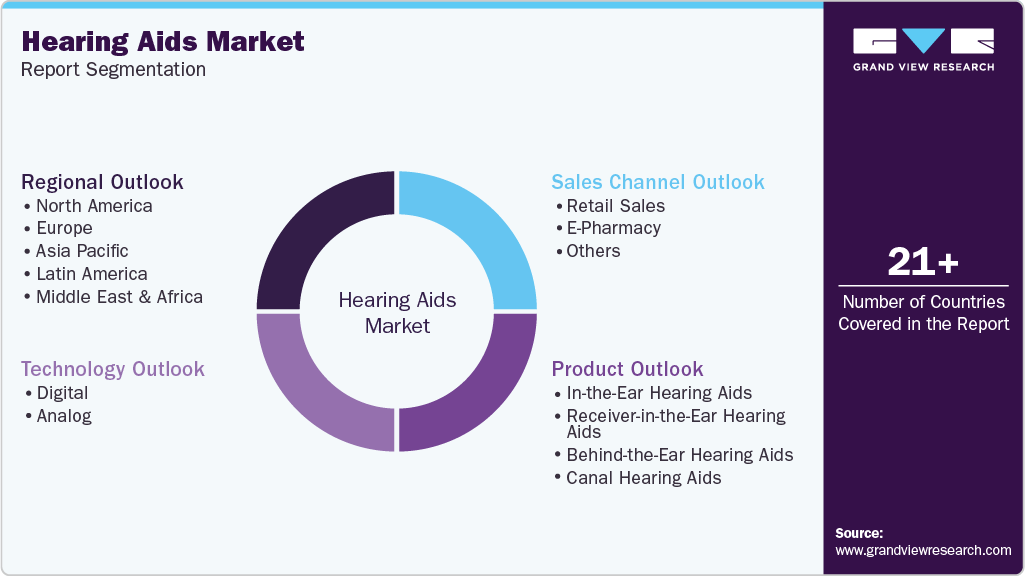

Hearing Aids Market (2026 - 2035) Size, Share & Trends Analysis Report By Product Type (In-The-Ear, Receiver-In-The-Ear, Behind-The-Ear, Canal), By Technology (Digital, Analog), By Sales Channel (Retail Sales, E-pharmacy), By Region, And Segment Forecasts

- Report ID: 978-1-68038-166-5

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2035

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hearing Aids Market Summary

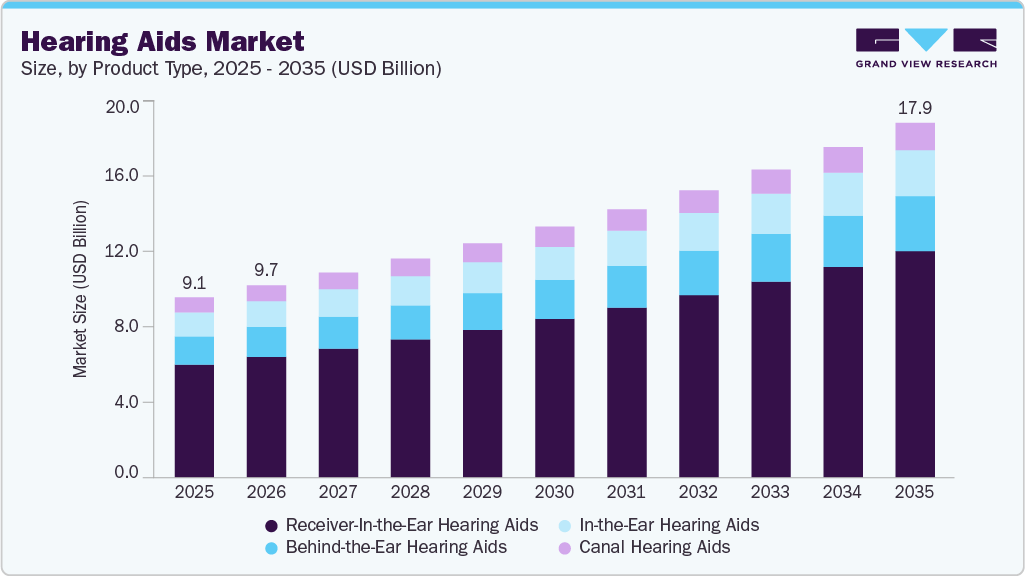

The global hearing aids market size was estimated at USD 9.08 billion in 2025 and is projected to reach USD 17.87 billion by 2035, growing at a CAGR of 7.05% from 2026 to 2035. The market growth can be attributed to strategic initiatives, such as collaborations and expansions, undertaken by key market players and the availability of favorable reimbursement policies.

Key Market Trends & Insights

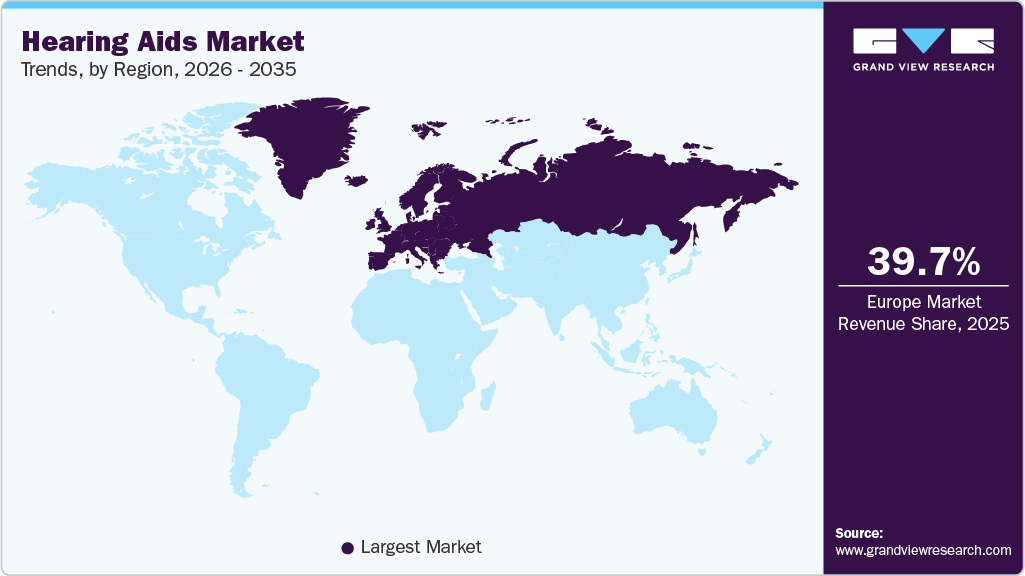

- The Europe market dominated the global market in 2025 and accounted for the largest revenue share of 39.70%.

- The German market is expected to register the fastest growth rate during the forecast period.

- In terms of product type, the receiver-in-the-ear hearing aids segment dominated the market with the largest revenue share of 62.56 % in 2025.

- In terms of technology, the digital hearing aids segment held the largest market revenue share of 93.27% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period.

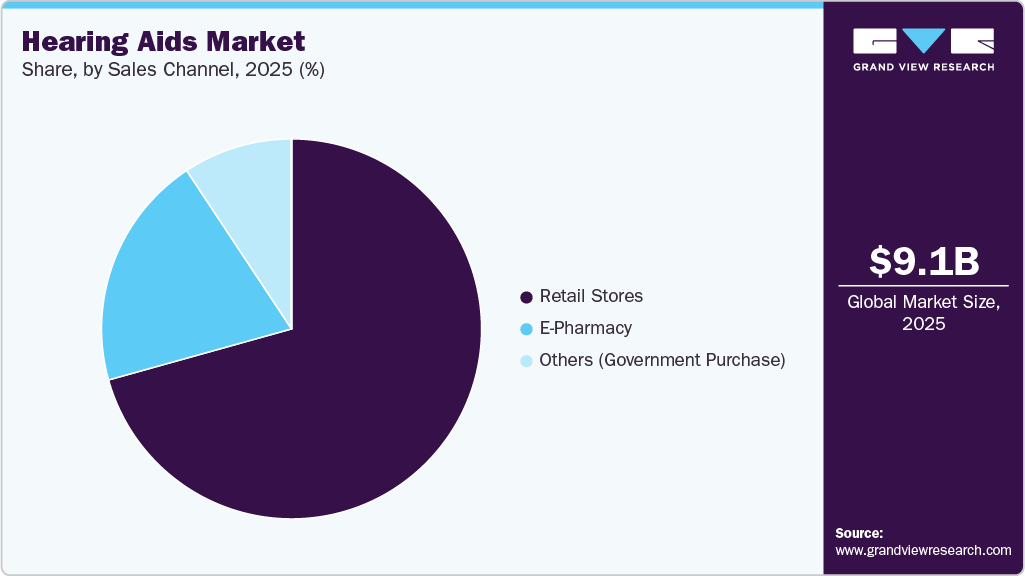

- In terms of sales channels, the retail stores segment led the market with the largest revenue share of 70.63% in 2025, attributed to higher profit margins in retail stores and an increase in the availability of OTC hearing aids in retail stores.

Market Size & Forecast

- 2025 Market Size: USD 9.08 Billion

- 2035 Projected Market Size: USD 17.87 Billion

- CAGR (2026-2035): 7.05%

- Europe: Largest market in 2025

Increasing government efforts to enhance awareness regarding hearing detection and interventions, in the form of campaigns, further contribute to the market growth. Key players are investing in smart hearing aids equipped with Artificial Intelligence (AI) to enhance hearing based on the surrounding environment automatically.

Growing geriatric population

The demand for hearing devices is high among older adults, driven by the growing geriatric population as this age group often require specialized hearing aids and related treatments, which is primarily expected to contribute to market growth. Hearing impairment is a partial or total inability to hear. It is one of the most common conditions affecting the geriatric population. According to the National Institute on Deafness and Other Communication Disorders (NIDCD), about one out of every three people aged 65 to 74 are affected by hearing loss, and 50% of people older than 75 have difficulty hearing. Moreover, an increase in life expectancy has led to a rise in the geriatric population, which is expected to grow over the coming decade. As per the World Health Organization study published in October 2025, 1 in 6 people worldwide are expected to be 60 or older by 2030, increasing from 1 billion in 2020 to 1.4 billion, and this number is projected to double to 2.1 billion by 2050. Furthermore, the population aged 80 years and above is expected to triple during the same period, reaching 426 million.

Countries With the Largest Number of Older Adults

Country

Population Aged 65+ (in millions)

% of Total Population (65+)

China

166.37

11.9%

India

84.90

6.1%

U.S.

52.76

16.0%

Japan

35.58

28.2%

Brazil

17.79

8.5%

Germany

17.78

21.4%

Italy

13.76

22.8%

France

13.16

20.3%

UK

12.24

18.3%

Mexico

9.17

7.2%

Spain

8.99

19.1%

South Korea

7.83

15.1%

Thailand

7.61

11.5%

Canada

6.44

17.2%

Australia

4.00

15.8%

South Africa

3.51

6.0%

Sweden

2.05

19.9%

Source: Population Reference Bureau

High prevalence of hearing loss

Hearing loss and impairment have become a significant public health concern, particularly in developed economies. The prevalence of hearing loss is increasing; it is considered one of the most common conditions affecting patients globally. According to the WHO factsheet of February 2024, around 5% of the global population requires rehabilitation to address their hearing loss. Moreover, around 2.5 billion individuals are projected to have some hearing loss by 2050, and around 700 million are expected to require hearing rehabilitation by 2050. In addition, the increasing life expectancy and the growing noise pollution are expected to contribute to the rise in age-related hearing loss. In low-income countries, common causes of hearing impairment include various infections, such as measles, middle ear infections, and meningitis.

Case Study: Prevalence of Hearing Impairment and Associated Factors among Adults in Rural Chandigarh, India

Published In: Volume 15, Issue 1, 2025

Background

Hearing impairment is a growing public health concern as it significantly affects communication ability, social interaction, academic progress, and overall quality of life. Early identification and timely intervention are key to reducing long-term disability. This study aimed to determine the prevalence of hearing impairment among adults in a rural setting of Chandigarh using a mobile-based screening tool.

Study Design and Methodology

A descriptive cross-sectional study was conducted among adults aged 18 years and above residing in village Dhanas, Chandigarh. A total of 496 participants were enrolled using the Kish selection method, selecting one adult per household from 500 families.

-

Screening Tool: hearWHO Pro mobile application

-

Confirmatory Assessment: Audiometry for 10% of app-screened positive participants

-

Data Collection: Structured interview schedule for demographic and clinical profiling

-

Ethical Considerations: Written informed consent obtained from all participants

Key Findings

-

Mean Age: 35.26 ± 12.08 years

-

Gender Distribution: 58.09% female

-

Prevalenceof Hearing Impairment: 8.9% (as detected via hearWHO Pro app)

Common Symptoms among Screened Positives

-

Frequently asking others to repeat (36.4%)

-

Difficulty understanding conversations in noisy environments (34.1%)

-

Tinnitus/ringing in ears (31.8%)

-

Perception of others mumbling (25%)

-

Dizziness/balance issues (25%)

-

Increasing TV volume frequently (22.7%)

-

Ear pain (20.5%)

-

Ear discharge (13.6%)

Audiometry Findings

All participants who underwent confirmatory audiometry showed bilateral mild to high-frequency sensorineural hearing loss, validating app-based screening accuracy.

Conclusion

The study demonstrates a high prevalence of hearing impairment in the rural Chandigarh population and highlights the effectiveness of mobile-based screening tools for early detection. The findings emphasize the need for regular community-level screening programs, timely referrals, and awareness initiatives to address hearing health. Training frontline community health workers such as ANMs, ASHAs, and Anganwadi workers to use screening tools and educate the population can significantly strengthen early identification and rehabilitation efforts.

Technological advancements in hearing aids

Recent technologies in the hearing aids market focus on providing various benefits compared to traditional hearing aids. Rechargeable hearing aid devices are small, easy to use/user-friendly, and environmentally friendly. In addition, different hearing aids that help patients with hearing loss have been introduced in the market by several key players, such as Starkey and Cochlear Limited. Some of the critical technologies recently launched by players, either through innovation or partnerships, are as follows:

-

In February 2024, GN Store Nord A/S expanded its existing portfolio of ReSound Nexia hearing aids with a new range of styles and connectivity.

-

In February 2024, Sonova launched the Stride V-UP Ultra Power BTE hearing aid to expand its Vivante portfolio.

Moreover, key players invest in technological advancements, such as developing intelligent hearing devices. Smart hearing aids are advanced devices that enhance hearing using digital technology to automatically adjust sound settings based on the environment. They often feature wireless connectivity, allowing users to stream audio directly from smartphones and other devices. For instance, in February 2024, Widex launched the SmartRIC hearing aid, designed to improve natural hearing quality. The L-shaped device strategically places microphones to enhance speech capture and align with the user’s auditory focus. As Widex’s most durable rechargeable Receiver-in-Canal (RIC) model, the SmartRIC provides up to 37 hours of functionality on a single charge. It has microphone inlets that minimize wind & handling noise and has Widex’s portable charging option. Hence, the introduction of such advanced products is anticipated to boost the market over the forecast period.

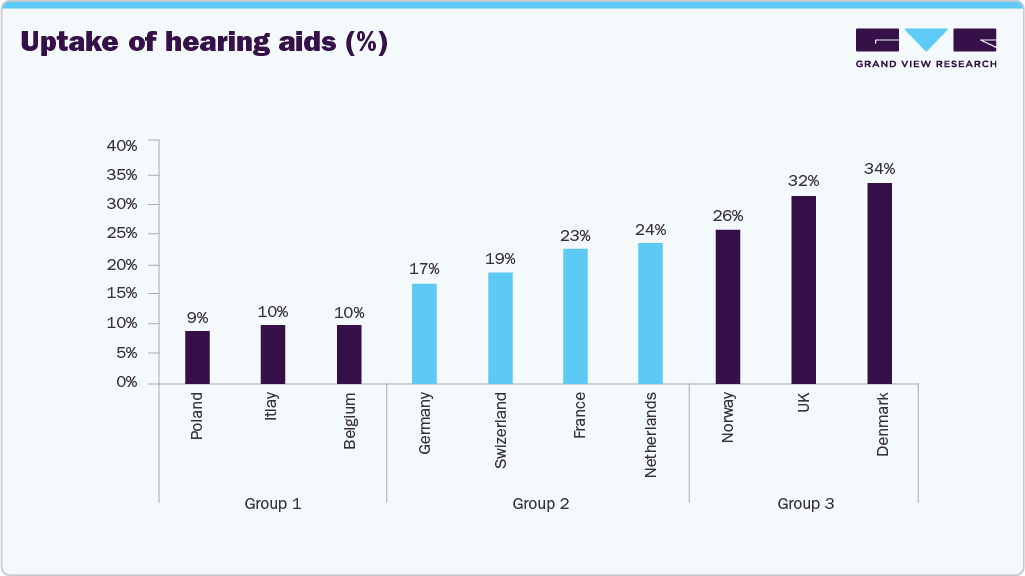

Favorable reimbursement Policies supporting hearing aid adoption

Reimbursement policies significantly drive the adoption of hearing aid by reducing the financial burden on patients. In countries where hearing aids are partially or fully covered by insurance or national health services, uptake rates are higher. These policies make hearing aids more accessible, encouraging individuals with mild hearing loss to seek treatment. A Joint American Economic Association (AEA), European Federation of Hard of Hearing People (EFHOH), and EHIMA report published in March 2024 highlight the differences in the adoption of hearing aids among countries providing reimbursement for hearing aids, as provided in the bar graph below:

Adoption rates of hearing aids among individuals with self-reported mild hearing impairment across 10 European countries that offer reimbursement for hearing aids

Strategic initiatives undertaken by key players

Growth in the market can be attributed to the strategic initiatives undertaken by leading players. The top five key players have most of the market share, consolidating their positions through acquisitions of smaller, promising entities. For instance, in March 2025, hearX and Eargo completed a strategic merger to form a new combined company called LXE Hearing, marking a significant development in the hearing aid market. The merger brings together Eargo’s reputation for innovative, virtually invisible hearing aid designs with hearX’s Lexie Hearing brand and its strong mobile and diagnostic technology, aiming to set a new industry standard in accessible, consumer-focused hearing solutions.

Furthermore, leading players are engaging in campaigns to increase awareness regarding the solutions for hearing loss and enhance market presence. For instance, on World Hearing Day March 2024, Signia launched a global awareness campaign aimed at combating the stigma associated with hearing loss and hearing aid use. The campaign emphasized the importance of early diagnosis and treatment of hearing difficulties, highlighting how modern hearing aids are medical devices and advanced lifestyle technologies that enhance communication, confidence, and overall quality of life. By showcasing innovations such as sleek, discreet designs and AI-powered features, Signia sought to shift public perception from viewing hearing aids as symbols of aging or disability to seeing them as tools for empowerment and wellness. The initiative also encouraged open conversations about hearing health, urging individuals to prioritize regular hearing check-ups just like vision or dental care.

New Market Trends Analysis

Strong Consumers Preference for Quality and Sustainability

German consumers are increasingly prioritizing quality and sustainability in their purchasing choices, reflecting a global trend towards responsible consumption. This emphasis is particularly strong in Germany due to cultural, economic, and regulatory influences. Growing awareness of environmental issues further drives the shift towards sustainable consumption.

Vocational Training Validation and Digitization Act

Germany's new legislation updates the Vocational Training Act to recognize digital training methods, enabling hearing aid retailers to offer flexible online training for their staff. In addition, the government has streamlined the visa process for non-EU professionals, recognized foreign qualifications, and provided language support to promote workforce integration and diversity.

Growing Digitalization & Interconnectivity

The digitalization of health information in Germany is enhancing the hearing aid market by improving patient care and lowering costs. Electronic health records (EHRs) and telehealth enable retailers to access patient data for personalized fittings. This real-time information helps audiologists make better product recommendations and facilitates remote consultations, saving time and reducing costs associated with in-person visits.

Specialized Cluster Networks

Germany boasts over 30 specialized cluster networks in medical technology, fostering collaboration among manufacturers, researchers, and healthcare providers to drive innovation. These clusters provide shared facilities that enable smaller retailers to access high-quality resources, leading to enhanced product offerings and improved customer service through advanced testing equipment and training programs.

Moreover, Hearing Aid UK Ltd. 2025 updates, the hearing aids market is witnessing a major transformation driven by the convergence of AI, biometrics, and next-generation connectivity. A key trend shaping the market is the integration of AI-based sound processing, allowing hearing aids to automatically adjust to changing environments and differentiate speech from background noise with greater precision. This advancement enhances user comfort and communication, particularly in complex auditory situations such as crowded spaces.

Another emerging trend is the incorporation of biometric sensors, enabling hearing aids to monitor health metrics such as heart rate, stress levels, and physical activity, positioning these devices as both hearing and wellness tools. The market is also moving toward eco-friendly and ergonomic designs, with smaller, rechargeable, and sustainably built devices gaining popularity among environmentally conscious consumers.

Furthermore, Bluetooth and Auracast technologies are redefining connectivity, enabling seamless integration with smartphones, televisions, and public audio systems. Auracast is expected to revolutionize accessibility by allowing direct audio streaming in public spaces such as airports, theaters, and stadiums. Together, these developments highlight a clear market trend toward smarter, more connected, and health-oriented hearing aids, reflecting a broader shift in consumer preference for personalized and multifunctional hearing solutions.

Case Study: Improving Social Lives Through Hearing Aids and Cochlear Implants

Hearing Aids and Cochlear Implants Enhance Social Well-being in Adults with Hearing Loss

(Based on a study by the University of Southern California - Health Sciences, published in JAMA Otolaryngology - Head & Neck Surgery, July 2025)

Background:

Hearing loss affects approximately 40 million adults in the U.S., often resulting in communication challenges that lead to social withdrawal, isolation, and emotional distress. Previous research has linked untreated hearing loss to loneliness, anxiety, depression, cognitive decline, and dementia. Despite the availability of hearing devices such as hearing aids and cochlear implants, many adults do not use them, underestimating their broader social and psychological benefits.

Objective:

To determine whether hearing aids and cochlear implants improve the social quality of life and reduce feelings of isolation and loneliness among adults with hearing loss.

Findings:

-

Enhanced Social Engagement: Adults using hearing aids or cochlear implants were more socially active and connected compared to non-users. They participated more comfortably in group conversations and felt less isolated.

-

Reduced Social Handicap: Participants reported fewer frustrations and barriers in communication, especially in noisy or group settings, leading to increased confidence and comfort during interactions.

-

Lower Loneliness Scores: Evidence suggested a reduction in loneliness among hearing device users, though further research is needed for definitive conclusions.

-

Cochlear Implants Showed Greater Impact: Users of cochlear implants experienced the most significant improvement in social quality of life, likely due to the devices’ superior ability to restore hearing in severe cases.

-

Possible Link to Cognitive Health: While not directly measured, improved social interaction may protect against cognitive decline and dementia by keeping the brain more stimulated and engaged.

Implications:

-

For Patients: Encourages early adoption of hearing aids or cochlear implants to enhance emotional and social well-being.

-

For Clinicians: Reinforces the need for proactive discussions about the psychosocial benefits of hearing restoration.

-

For Public Health: Highlights the necessity of accessible hearing care programs to reduce social isolation and its associated health risks.

Key takeaway:

MD, MPH, otolaryngologist with Keck Medicine and lead researcher of the study said:

"These new findings add to a growing body of research showing that hearing health is deeply connected to overall well-being," "We hope this encourages more people to seek treatment and helps clinicians start conversations with patients about how hearing devices can improve their quality of life."

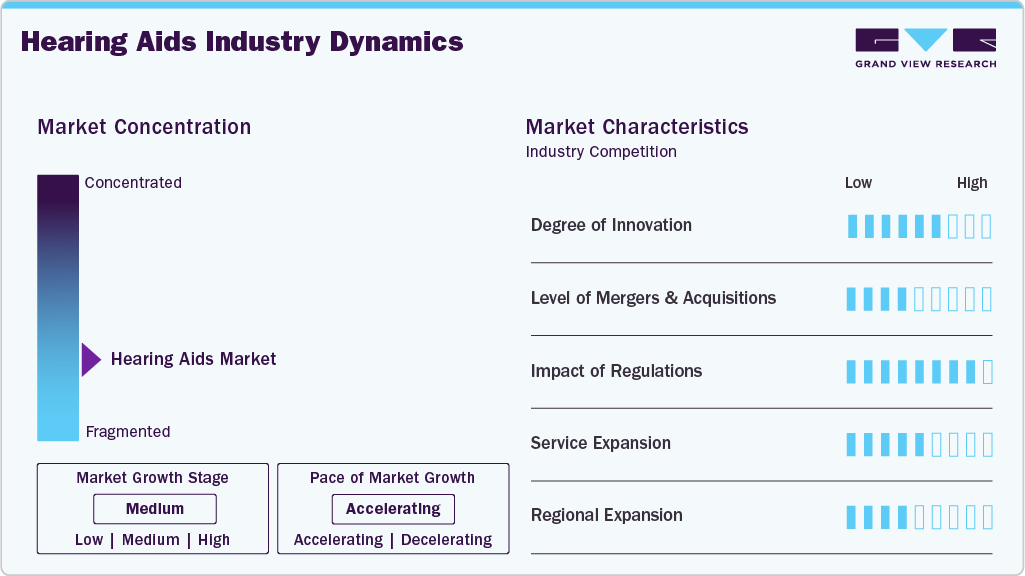

Market Concentration & Characteristics

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The industry is fragmented, with many products and end users entering the market. There is a high degree of innovation, moderate level of merger & acquisition activities, high impact of regulations, and moderate service and market expansion

The degree of innovation is high in the market. Increasing implementation of deep learning algorithms in sound enhancement technologies are significantly improving distinguishing speech from background noise, refining speech clarity under adverse conditions. For instance, in August 2024, Sonova Holding AG introduced two innovative platforms, Audéo Infinio and Audéo Sphere Infinio, under its Phonak brand. These launches signify a progressive step in the hearing aid market, incorporating real-time AI-based technology. The Audéo Sphere Infinio model, in particular, leverages Sonova’s novel dual-chip technology, one of which facilitates real-time AI in sound processing.

The level of merger and acquisition activities in the hearing aids market has been steadily increasing in recent years due to the need for companies to offer more comprehensive and integrated solutions to improve productivity and global reach. For instance, in March 2025, Eargo and hearX officially merged to form a new company called LXE Hearing, backed by an additional USD100 million investments from Patient Square Capital. The new company brings together complementary strengths: Eargo’s direct-to-consumer hearing‐aid design ethos and “virtually invisible” in-ear products, and hearX/Lexie’s digital and mobile hearing‐health technologies (including in-app testing) with Bose-powered devices.

Partner at Patient Square said:

"The vast majority of American adults who suffer from hearing loss currently do not use hearing aids given historical barriers to access and shortcomings with traditional offerings," "We believe that LXE Hearing's innovative technology and unique go-to-market approach, enhanced by the synergies of the business combination, will provide unprecedented solutions to patients in need of hearing care."

Hearing aids activities are health-related and need to adhere to regulations. In September 2024, the FDA approved the first over-the-counter hearing aid software called the "Hearing Aid Feature" (HAF) for Apple AirPods Pro. Designed for adults with mild to moderate hearing loss, it allows users to conduct a self-assessment and adjust the sound output of their AirPods. Clinical trials showed that users benefited similarly to those with professionally fitted devices. This approval aims to enhance the accessibility and affordability of hearing aids, shifting towards more consumer-friendly solutions.

M.D., Ph.D., acting director of the FDA's Center for Devices and Radiological Health said:

“Hearing loss is a significant public health issue impacting millions of Americans,” “Today’s marketing authorization of an over-the-counters hearing aid software on a widely used consumer audio product is another step that advances the availability, accessibility and acceptability of hearing support for adults with perceived mild to moderate hearing loss.”

In the global hearing aids market, the presence of service substitutes is high. Sonova’s announcement of two new hearing aid platforms in August 2024 marks a significant milestone in the evolution of hearing technology, particularly with the introduction of the first hearing aid featuring real-time AI. This system continuously analyses surrounding soundscapes and instantly adapts amplification and filtering to optimize clarity, offering a more natural and effortless listening experience. Beyond sound optimization, the new platforms are expected to enhance connectivity, battery efficiency, and user personalization, reflecting Sonova’s broader focus on intelligent, health-centric hearing solutions.

The hearing aids market is experiencing significant regional expansion. In February 2025, Signia under the WS Audiology group expanded its presence in India with the launch of its BestSound Center in Pune, in collaboration with Aanvii Hearing Solutions. This new center aims to provide advanced hearing care services and access to Signia’s latest range of digital and AI-powered hearing aids. The collaboration focuses on enhancing the accessibility of world-class hearing solutions for people with hearing loss in the region. The BestSound Center is equipped with state-of-the-art diagnostic facilities, personalized fitting services, and expert audiological consultations to ensure optimal hearing outcomes.

Product Type Insights

Based on product type, the receiver-in-the-ear (RIE) hearing aids segment dominated the market in 2025 with a revenue share of 62.56% and is anticipated to grow at fastest growth rate over the forecast period. These devices are preferred due to their small and lightweight design, which provides a more comfortable fit, especially in pediatric fittings. Their design is well-suited for infants, as it ensures comfort and secure placement on smaller, softer ears, enhancing their appeal in the pediatric market. Furthermore, RIE hearing aids effectively improve speech recognition in noisy environments. These devices, equipped with advanced digital wireless technology, have displayed the potential to allow users to achieve better speech recognition in high-noise settings than those with normal hearing, significantly enhancing the overall hearing experience in challenging environments.

The behind-the-ear hearing aids segment is anticipated to grow at a significant growth rate over the forecast period. This is attributed to technological advancements in Behind-the-ear (BTE) hearing aids. The integration of multiple microphones in BTE hearing aids has improved speech intelligibility by leveraging sound source separation techniques. This is particularly essential in noisy environments, where users benefit from enhanced clarity due to the advanced beamforming technologies utilized in these devices. In addition, implementing Digital Noise Reduction (DNR) techniques in BTE hearing aids has significantly improved the user experience. In February 2024, ReSound enhanced its Nexia hearing aid lineup by adding rechargeable behind-the-ear (BTE) and custom in-ear models equipped with Bluetooth LE and Auracast, designed to improve speech clarity in noisy settings.

Technology Insights

Based on technology, the digital hearing aids segment held the largest market revenue share of 93.27% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period. Digital hearing aids can be programmed according to the external environment to amplify sound and reduce noise. These devices are technologically advanced and eliminate background noise, providing an enhanced hearing experience. In addition, companies are developing a new generation of digital hearing aids along with innovative technology and improved compatibility with smartphones, propelling segment growth. Furthermore, increased awareness about digital devices and their usage is expected to facilitate market growth in the U.S.

The analog hearing aids segment is expected to witness the moderate CAGR during the forecast period. Analog hearing aids work by raising the intensity of continuous sound waves. All sounds, including noise & speech, are uniformly amplified by these devices. In some analog devices, a microchip embedded in the device allows the user to program different settings to suit diverse listening environments.

Sales Channel Insights

Based on sales channel the retail stores segment led the market with the largest revenue share of 70.63% in 2025. This can be attributed to higher profit margins in retail stores and an increase in the availability of OTC hearing aids in retail stores. Customers can purchase these devices directly from retail places, either in person, via mail, or online. To sell OTC products, retailers do not require a licensed professional, such as an audiologist. In addition, retailers such as CVS, Walmart, and Walgreens are implementing expansion strategies to enhance the sales of OTC hearing aids. For instance, in October 2022, Walgreens added OTC hearing aids to its 8,000+ retail locations. Some OTC hearing aids available in retail stores like CVS, Walmart, Walgreen, Hy-Vee, Inc., and Sam’s Club are Lexie B1 Self-fitting, Lucid Hearing Enrich PRO, Go Prime OTC Hearing Aids, and Liberty SIE 128, among others.

The E-pharmacy segment is projected to witness a significant CAGR over the forecast period. This can be attributed to the increasing penetration of e-commerce channels and their higher adoption. Furthermore, technological advancements are another major factor expected to significantly boost the online segment's growth. Online platforms provide a seamless shopping experience with various features, such as product recommendations, virtual shopping, and personalized customer support. These advancements have enhanced the online shopping experience for consumers and have contributed to the popularity of the online distribution channel.

Regional Insights

Europe hearing aids market held the largest share of 39.70% in 2025, owing to the increasing prevalence of hearing loss in Europe. According to WHO, in 2023, around 190 million people in the WHO European region had some degree of hearing loss and deafness. This accounts for 20% of the European population. As per the same source, in Europe, 236 million people are expected to suffer from hearing loss by 2050.

In the UK the market is being driven by new initiatives with a growing focus on enhancing accessibility, affordability, and innovation in hearing healthcare solutions. For instance, The Royal National Institute for Deaf People (RNID) is leading a significant initiative in the UK by launching the Hearing Therapeutics Initiative (HTI) summit in 2024. This summit aims to unite the hearing research community to collaborate, share insights, and establish connections to address the challenges associated with developing new treatments for hearing loss & tinnitus. By fostering partnerships and providing guidance & support to researchers, the HTI summit seeks to accelerate the advancement of innovative solutions in the field of hearing therapeutics. Such initiatives are expected to increase market opportunities in the country.

In France the hearing aids market is driven by the growing awareness regarding the use of hearing aids in everyday life to combat hearing loss or impairment. In a JAMA Network cohort study involving 186,460 volunteers from France aged 18 to 75 years, which provided audiometric data, 4% had disabling hearing loss, whereas 25% had hearing loss. Around 37% of those with disabling hearing loss reported using hearing aids. Furthermore, the implementation of a full reimbursement scheme for hearing aids in France has been a significant driver for increasing access to hearing aids.

North America Hearing Aids Market Trends

North America held a significant market share of in 2025. Adoption of next-generation hearing aids in hospitals is boosting growth of the hearing aids market. Furthermore, technological advancements are expected to boost market growth over the coming years in the country. In addition, the growing trend toward personalization and customization in healthcare has influenced the hearing aids market. Some of the companies operating in the North American region are Demant A/S; Sonova Holdings; WS Audiology; and Starkey Laboratories Inc. The key players in the business landscape are focused on new product launches, strategic partnerships, and collaborations to drive growth & innovation in the market. In August 2024, Sonova Holding AG introduced two new platforms, Audéo Infinio and Audéo Sphere Infinio, under the Phonak brand. This marks the beginning of a new generation of hearing aids that are based on real-time Artificial Intelligence (AI).

U.S. Hearing Aids Market Trends

The U.S. hearing aids industryheld the largest share in the North America region in 2025. New product launches, the high demand for hearing aids, and the presence of key manufacturers can be attributed to the prominent share of the region. The favorable government policies and the growing prevalence of hearing disorders among the population are anticipated to be the primary factors driving the market. According to an article published by the National Institute on Deafness and Other Communication Disorders in March 2024, approximately 18% of the U.S. population between the ages of 20 and 69 experiences speech-frequency hearing loss in one or both ears. According to the article, more than 28 million people in the U.S. could benefit from hearing aids, which is expected to contribute to market growth.

The Canada hearing aids marketis driven by new product launches, advancements in auditory products, and the adoption of emerging technologies such as AI and Machine Learning (ML). For instance, in April 2023, Unitron Canada launched its newest leading line of hearing aids, Vivante, engineered to offer upgraded sound quality and individualized user control. The latest hearing aid model integrates advanced sound processing with a fresh design and a suit of “Experience Innovations,” along with the Remote Plus app, to deliver a personalized listening experience.

Asia Pacific Hearing Aids Market Trends

The market in Asia is expected to grow at a significant rate due to the local presence of major players and a large geriatric population. The China hearing aids market is anticipated to witness the fastest growth in Asia during the forecast period, with South Korea and India as some of the key emerging economies. Furthermore, an increase in the prevalence of hearing loss, especially in the geriatric population, coupled with improvements in the distribution network of leading players across the globe, is expected to drive the hearing aids market. Major key players are continually developing improved products, adding to the benefits of hearing aids for hearing-impaired consumers and driving the acceptance of these devices in this region.

In China, hearing loss is common among individuals in China. In a research conducted by NIH in Zhejiang, consisting of 3,754 adults aged 18 to 98, the prevalence of speech-frequency and high-frequency hearing loss were 27.9% & 42.9%, respectively. The usage of hearing aids in China is relatively low, with only a small percentage of the population utilizing them. Despite the benefits of hearing aids, adoption rates among older adults remain very low, and individuals often delay using hearing aids. For instance, data from the ChinaTrak 2023 survey shows that hearing aid adoption rates are low, with just 9.3% of hearing-impaired individuals using hearing aids, representing 0.4% of the total population. However, those who do use hearing aids report high levels of satisfaction, with 95% of users in 2023 expressing satisfaction, up from 92% in 2020.

Latin America Hearing Aids Market Trends

Latin America hearing aids market is expected to grow due to factors such as high decibel exposure, increased noise pollution, and digital enhancement of hearing aids. The region experiences significant noise pollution, which impacts adult hearing ability, leading to a higher demand for hearing aids. The region holds significant growth potential for hearing aids. However, poor socioeconomic conditions and geographic differences hamper the market growth across the region. The penetration rate of hearing aids is low in the region due to insufficient awareness about them.

The Brazil hearing aids industry is experiencing significant growth as rising per capita disposable income is leading to increased expenditure on healthcare. According to the Brazilian Journal of Otorhinolaryngology, in February 2023, the estimated prevalence of hearing loss in children up to 18 years of age was reported to be 18% in the country. This is expected to increase, fueling the demand for hearing aids in Brazil. Furthermore, Solar Ear, a company in Brazil, manufactures affordable solar rechargeable hearing aids that are environmentally friendly and made by deaf workers with high-quality components. These new hearing aid options in Brazil cater to different needs and offer advanced features to enhance the hearing experience for users.

Middle East & Africa Hearing Aids Market Trends

MEA is expected to witness lucrative growth due to the increasing prevalence of hearing loss, rapidly aging population, and growing demand for technologically advanced devices. According to the World Bank, around 26.9 million people were aged 65 and above in 2022. Elderly population is more vulnerable to hearing loss, fueling demand for hearing aid in the region. The UAE and South Africa are the two major and most lucrative markets in the MEA region, driven by increasing government support and growing awareness about hearing disorders.

The South Africahearing aidsmarket is expected to grow due to the increasing prevalence of hearing loss, coupled with the rising government support in the form of awareness programs, is driving market growth. According to an article published by The Conversation in April 2024, approximately 136 million individuals in South Africa are currently affected by hearing loss. This number is projected to increase to 337 million by 2050. Presently, only 2% of those requiring hearing aids utilize them. This issue is partly due to a significant shortage of audiologists, with availability being less than one per million individuals.

Key Hearing Aids Company Insights

The hearing aids market is characterized by the presence of several key players focusing on technological innovation, market expansion, and enhanced customer experiences. Companies such as Audicus, Audina Hearing Instruments, Inc., Eargo, Inc., GN Store Nord A/S, Horentek Hearing Diagnostics, MDHearing, SeboTek Hearing Systems, LLC, Sonova, Starkey Laboratories, Inc., and WS Audiology dominate the market, leveraging a combination of product development, strategic partnerships, and mergers and acquisitions to strengthen their market position. These players are increasingly investing in digital hearing solutions, AI-enabled devices, and direct-to-consumer distribution models to expand their reach.

Key Hearing Aids Companies:

The following are the leading companies in the hearing aids market. These companies collectively hold the largest market share and dictate industry trends.

- Audina Hearing Instruments, Inc.

- GN Store Nord A/S

- Horentek Hearing Diagnostics

- SeboTek Hearing Systems, LLC

- Sonova

- Starkey Laboratories, Inc.

- WS Audiology

- Demant A/S

- Arphi Electronics Private Limited

- IN4 Technology Corporation

- Loreca Hearing Aid

- Earlens Corp.

- Austar Hearing Science and Technology (Xiamen) Co., Ltd.

Recent Developments

-

In June 2025, Starkey and MED-EL launched a groundbreaking collaboration called DualSync, designed to enhance Bluetooth connectivity for individuals using both cochlear implants and hearing aids. This partnership enables seamless bimodal streaming from Apple devices to compatible Starkey hearing aids and MED-EL cochlear implants, providing users with unified and synchronized audio experience.

Co-founder and CEO of MED-EL said:

“By uniting two leading technologies, we are delivering a global solution that gives bimodal users effortless connectivity, clearer sound, and greater control in their daily lives,”“Our shared goal is simple: to make it easier for people everywhere to hear, communicate, and engage with the world - using the most advanced technology available.”

-

In March 2025, Ear Solutions Pvt Ltd, one of India's leading hearing care providers, partnered with Danish technology company Audientes to introduce the world's first truly self-fitting digital hearing aid, Ven. This collaboration aims to make high-quality hearing solutions more accessible to the millions of people worldwide who suffer from disabling hearing loss.

Managing Director, Ear Solutions announced this collaboration:

“I am delighted to partner with Audientes and add Ven to our product portfolio. Already today, there are several cities in our distribution network where I believe Ven will significantly increase my customer conversion rates and add a new type of customer profile to our target groups.”

-

In August 2024, Swiss hearing care company Sonova introduced the Phonak Audéo Sphere Infinio, the world's first hearing aid powered by real-time AI. This groundbreaking device utilizes the proprietary DEEPSONIC chip, marking a significant advancement in hearing aid technology. The chip offers 53 times more processing power than existing industry standards, enabling the hearing aid to instantly separate speech from background noise and enhance speech clarity in complex listening environments.

Hearing Aids Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 9.68 billion

Revenue forecast in 2035

USD 17.87 billion

Growth rate

CAGR of 7.05% from 2026 to 2035

Actual data

2021 - 2025

Forecast period

2026 - 2035

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2035

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, technology, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Belgium; Switzerland; Netherlands; Finland; Austria; Czech; Republic; Iceland; Ireland; Poland; Hungary; Romania; Portugal; Slovakia; Luxembourg; Croatia; Bulgaria; Greece; Ukraine; China; Japan; India; South Korea; Australia; Thailand; Hong Kong; Indonesia; Malaysia; New Zealand; Philippines; Singapore; Taiwan; Vietnam; Bangladesh; Kazakhstan; Pakistan; Uzbekistan; Brazil; Argentina; Chile; Colombia; Peru; Ecuador; Dominican Republic; Venezuela; Costa Rica; South Africa; Saudi Arabia; UAE; Kuwait; Turkey; Qatar; Nigeria; Morocco; Ethiopia; Egypt; Kenya; Angola; Oman; Israel; Algeria

Key companies profiled

Audina Hearing Instruments, Inc.; GN Store Nord A/S; Horentek Hearing Diagnostics; SeboTek Hearing Systems, LLC; Sonova; Starkey Laboratories, Inc.; WS Audiology; Demant A/S; Arphi Electronics Private Limited; IN4 Technology Corporation; Loreca Hearing Aid; Earlens Corp.; Austar Hearing Science and Technology (Xiamen) Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hearing Aids Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Grand View Research has segmented the global hearing aids market report based on product type, technology, sales channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2035)

-

In-the-Ear Hearing Aids

-

Receiver-in-the-Ear Hearing Aids

-

Behind-the-Ear Hearing Aids

-

Canal Hearing Aids

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2035)

-

Digital

-

Analog

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2035)

-

Retail Sales

-

Company Owned

-

Independent Retail

-

-

E-Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2035)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Belgium

-

Switzerland

-

Netherlands

-

Finland

-

Austria

-

Czech Republic

-

Iceland

-

Ireland

-

Poland

-

Hungary

-

Romania

-

Portugal

-

Slovakia

-

Luxembourg

-

Croatia

-

Bulgaria

-

Greece

-

Ukraine

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Hong Kong

-

Indonesia

-

Malaysia

-

New Zealand

-

Philippines

-

Singapore

-

Taiwan

-

Vietnam

-

Bangladesh

-

Kazakhstan

-

Pakistan

-

Uzbekistan

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

Peru

-

Ecuador

-

Dominican Republic

-

Venezuela

-

Costa Rica

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Turkey

-

Qatar

-

Nigeria

-

Morocco

-

Ethiopia

-

Egypt

-

Kenya

-

Angola

-

Oman

-

Israel

-

Algeria

-

-

Frequently Asked Questions About This Report

b. The global hearing aids market size was valued at USD 9.08 billion in 2025 and is expected to reach USD 9.68 billion in 2026.

b. The global hearing aids market is expected to grow at a compound annual growth rate of 7.05% from 2026 to 2035 to reach USD 17.87 billion in 2035.

b. The receiver-in-the-ear (RIE) hearing aids segment dominated the market in 2025 with a revenue share of 62.56%. These devices are preferred due to their small and lightweight design, which provides a more comfortable fit, especially in pediatric fittings.

b. Some key players operating in the hearing aids market include Audina Hearing Instruments, Inc., GN Store Nord A/S, Horentek Hearing Diagnostics, SeboTek Hearing Systems, LLC, Sonova, Starkey Laboratories, Inc., WS Audiology, Demant A/S, Arphi Electronics Private Limited, IN4 Technology Corporation, Loreca Hearing Aid, Earlens Corp., Austar Hearing Science and Technology (Xiamen) Co., Ltd.

b. Key factors that are driving the hearing aids market growth include strategic initiatives, such as collaborations and expansions, undertaken by key market players and the availability of favorable reimbursement policies. Increasing government efforts to enhance awareness regarding hearing detection and interventions, in the form of campaigns, further contribute to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.