- Home

- »

- Plastics, Polymers & Resins

- »

-

Pharmaceutical Packaging Market Size & Share Report 2030GVR Report cover

![Pharmaceutical Packaging Market Size, Share & Trends Report]()

Pharmaceutical Packaging Market Size, Share & Trends Analysis Report By Material (Plastics & Polymers, Paper & Paperboard, Glass, Aluminum Foil, and Others), By Product, By Drug Delivery Mode, By End-use, By Regions, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-488-8

- Number of Pages: 220

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Pharmaceutical Packaging Market Size & Trends

The global pharmaceutical packaging market size was valued at USD 139.37 billion in 2023 and is expected to grow a compound annual growth rate (CAGR) of 9.7% from 2024 to 2030.The enormous growth of the pharmaceutical sector is one of the primary growth factors for the pharmaceutical packaging sector. The pharmaceutical business has been expanding quickly in recent years due to scientific and technological advancements, and this trend is predicted to continue over the projection period, particularly in developing nations like China, India, Saudi Arabia, and Brazil.

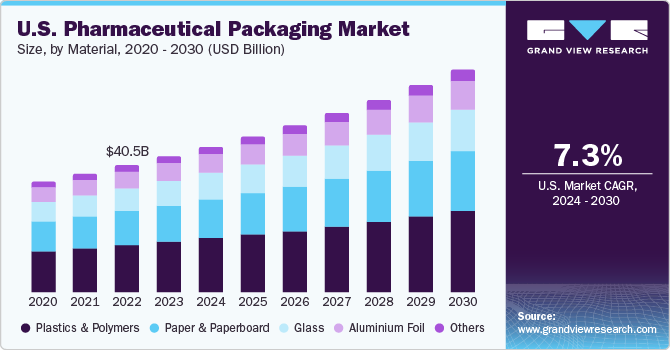

The U.S. accounted for the largest pharmaceutical market worldwide. Large healthcare system, high per capita income, and large investments in drug development in the country are some of the key factors driving the U.S. market. Furthermore, growing importance of generic drugs and access to better healthcare services are anticipated to provide lucrative opportunities for pharmaceutical packaging in the coming years. The 21st Century Cures Act (Cures Act) was signed on December 13, 2016, in the U.S. and is designed to accelerate medical product development. The law is expected to drive new innovations in product developments in pharmaceutical industry. This is expected to drive the demand for pharmaceutical packaging in U.S.

The pharmaceutical industry is primarily driven by the progress in the field of medicine and bioscience. In addition, pharmaceutical industry acts as a key asset to the European economy as it is one of the Europe’s top-performing, high-technology sectors. Pharmaceutical industry is witnessing significant transition and focus on the development of biopharmaceutical drugs has considerably grown over the past few years. Few biotechnology-driven drug therapies are unstable in liquid form and are, therefore, introduced as lyophilized or dry powder dosage forms. Lyophilized drugs demand specialized packaging for their optimal performance, resulting in new opportunities for packaging manufacturers.

Pharmaceutical drugs are majorly offered in tablet, capsule, liquid, and powder forms. Various packaging types, including rigid bottles, standup pouches, flat pouches, sachets, and blister packs, are used for their packaging. Packaging companies are increasingly focusing on the incorporation of dispensing mechanisms, administration aids, sustainable material, tamper-evident properties, and counterfeiting measures into the packaging to enhance their functionality and safety.

Companies are majorly focusing on the utilization of post-consumer recycled (PCR) material and are also developing packaging from compostable material to increase the sustainability of packaging. Gerresheimer AG, a leading pharmaceutical packaging manufacturer, has been offering glass bottles made from PCR glass since several years. In addition, the company is offering bottles made from R-PET and BIO-PET (resins made from sugarcane plants). This trend of sustainable packaging is expected to significantly gain pace in the coming years.

One key opportunity lies in developing intelligent packaging technologies that enhance safety, traceability, and patient adherence. Integrating IoT (Internet of Things) devices into packaging can provide real-time monitoring of temperature, humidity, and other critical parameters, ensuring the integrity of pharmaceutical products during storage and transportation. The rise of personalized medicine and specialty drugs also opens opportunities for customized packaging solutions, catering to unique dosages and administration methods. Pharmaceutical companies that can adapt to these trends and offer innovative packaging solutions are well-positioned to thrive in this dynamic market.

Market Concentration & Characteristics

The pharmaceutical packaging market is highly fragmented with the presence of large and medium-sized international companies as well as small-sized domestic players. Key players include Amcor plc, Becton, Dickinson and Company, AptarGroup, Inc., Drug Plastics Group, Gerresheimer AG, Schott AG, O-I GLASS, INC.., SGD Pharma, West Pharmaceutical Services, Inc., Berry Global Group, Inc., WestRock Company, International Paper, Comar, LLC, CCL Industries, and Vetter Pharma International.

Most of the companies offer primary packaging products, including syringes, bottles, vials, closures, and cartridges, among others. Few players such as International Paper, WestRock Company, and CCL Industries offer secondary packaging products such as folding cartons. The packaging products are majorly utilized to pack injectable drugs, prescription drugs, and non-prescription drugs.

With growing demand patterns, companies such as Amcor Plc have started acquiring small scale companies in the emerging market for higher market share. For instance, In August 2023, Amcor Plc, a prominent player in the creation and manufacturing of sustainable packaging solutions on a global scale, revealed its decision to acquire Phoenix Flexibles Pvt Ltd. This strategic move aims to enhance Amcor's presence in the rapidly growing Indian market by increasing its capacity.

Material Insights

Based on Material, global pharmaceutical packaging material is bifurcated into plastics & polymers, paper & paperboard, glass, aluminum foil, and others.

Plastics & polymers held the highest revenue share of 36.8% in 2023. Various types of plastic resins including PE, PET, PP, PVC, PS, and bioplastic are widely used for manufacturing pharmaceutical vials, bottles, closures, syringes, pouches, sachets, cartridges, tubes, and blister packs. Polypropylene (PP) accounted for the largest revenue share in the plastic & polymers material segment in 2020 as it offers a combination of beneficial properties, such as mechanical, physical, electrical, and thermal characteristics.

Paper & paperboard are majorly used in secondary and tertiary packaging of pharmaceutical products. Excellent printability, low cost, wide availability, and sustainability of paper & paperboard make them lucrative secondary and tertiary packaging options. Paper-based materials are often used as lidding in blister packs on account of their low cost compared to aluminum lidding. International Paper and WestRock Company are some of the leading manufacturers of paper-based packaging.

Glass is impervious to gases, moisture, odors, and microorganisms, thus, is widely employed in the packaging of liquid and semisolid pharmaceutical formulations. Glass is used for manufacturing injectable vials, syrup bottles, cartridges, syringes, and other products. Amber-colored glass is majorly preferred for pharmaceutical packaging as it absorbs the harmful UV wavelengths and protects the medicines from getting damaged.

Aluminum is another commonly used material for pharmaceutical packaging. It is used as a lidding material in blister packs owing to its strong barrier and easy-to-tear properties. It is also used to make flexible strip packs used for packing tablets. In addition, most of the seals used in plastic or glass syrup bottles are made of aluminum on account of their strong barrier properties against oxygen and UV light.

The other material segment primarily includes rubber and cotton. Multiple types of rubber including natural, neoprene, nitrile, butyl, chlorobutyl, bromobutyl, and silicone are used in pharmaceutical packaging to make closures, cap liners, and bulbs for dropper assemblies. Rubber stopper is primarily used for multiple-dose vials and disposable syringes.

Product Insights

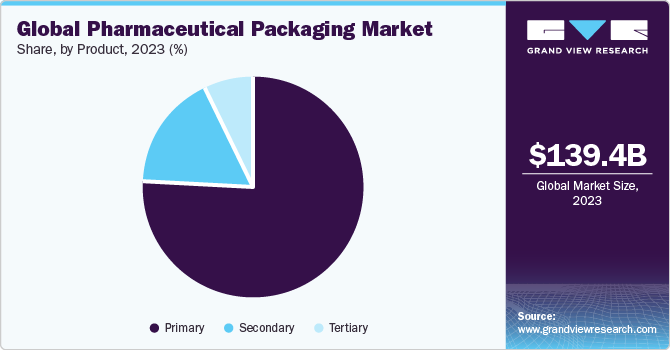

On the basis of product pharmaceutical packaging market is segment into primary, secondary and tertiary. The primary segment accounted for the major share of the market in 2023. Primary packaging, such as bottles, tubes, or blister packs, directly comes in contact with the drug and thereby envelopes the drug and protects it from contamination. In addition, it is often involved in dispensing and dosing drug contents. Packaging companies are focusing on the easy-to-open closures and incorporation of dispensing systems that deliver the right dose at the right time, which can aid the elderly population in drug dosage.

Secondary pharmaceutical packaging is a consecutive covering or package, which stores several groups of pharmaceutical packages together and protecting the packages from external impacts. Secondary packaging is primarily used for branding & display that plays a vital role in the marketing strategy for the product, and logistics, wherein grouping several products together offer ease of handling.

Tertiary packaging is used for wrapping or packaging a set of products. The packaging is used for safe handling and smooth transportation of goods. Some of the examples of tertiary packaging include brown cardboard boxes, shrink-wraps, and plastic bags. The increasing trend of e-pharmacy is expected to further increase the adoption of tertiary packaging in the market over the forecast period.

Drug Delivery Mode Insights

The market is segmented based on drug delivery mode into Oral Drugs, Injectables, Topical, Ocular/ Ophthalmic, Nasal, Pulmonary, Transdermal, IV Drugs, and Others.

The oral drug delivery segment accounted for a significant share of the market in 2023; it plays a crucial role in the pharmaceutical industry by ensuring the safe and effective administration of medications. It protects drugs from environmental factors, maintains stability, and prevents contamination. The packaging also facilitates precise dosing, enhancing patient compliance and overall treatment efficacy. As a critical interface between medication and patients, it contributes to the pharmaceutical industry's goal of delivering reliable and convenient oral drug solutions. Additionally, innovations in this packaging space, such as child-resistant designs and patient-friendly formats, further underscore its importance in promoting safety and patient-centric healthcare experiences.

Injectable drug delivery is also the fastest-growing segment in the market, as it is crucial for ensuring the safety, efficacy, and proper administration of parenteral medications. It protects sensitive pharmaceutical compounds from contamination, light, and environmental factors. The sterile and aseptic nature of injectables demands packaging that maintains product integrity and prevents microbial ingress. Additionally, user-friendly features, such as precise dosing mechanisms and clear instructions, enhance patient compliance and safety.

End-use Insights

Pharma manufacturing is the key end-use segment that accounted for the highest share of 49.9% in 2023 and is expected to witness strong growth from 2024 to 2030. This is owing to the increasing demand for medicines. As per the World Health Organization (WHO), between 2015 and 2050, the proportion of the world’s population of age over 60 years will nearly double from 12% to 22%. The geriatric population requires additional medical assistance, thereby fueling pharmaceutical manufacturing activities. This, in turn, is likely to boost the demand for pharmaceutical packaging.

Market players in the pharmaceutical industry have increased the outsourcing of packaging activities to save their expenses and time. Instead of investing in packaging products, manufacturers are outsourcing packaging operations to specialized and highly capable contractors to ensure efficient packaging. This is expected to push the demand for contract manufacturing and pharmaceutical packaging equipment’s.

Retail pharmacies are increasingly incorporating branding activities on their packaging to differentiate them from others. Polybags and paper pouches are the commonly used packaging products by such retail pharmacies. The increasing penetration of retail, especially in developing countries like India, China, and Brazil, is expected to boost the retail pharmacy end-use segment.

Institutional pharmacies are the pharmaceutical outlets operating within the institutions, such as medical hospitals, nursing care facilities, and assisted living communities. An increasing number of hospitals and nursing homes and rising healthcare spending are likely to have a positive impact on the institutional pharmacy end-use segment.

Regional Insights

North America dominated the market with a revenue share of 35.9% in 2023, wherein pharma manufacturing, which includes in-house production, was the largest end-use segment in the region. The presence of a large number of manufacturers of pharmaceutical plastic bottles in the country, such as AptarGroup Inc., Gerresheimer AG, Amcor Ltd., and Berry Plastics Group, Inc., is likely to have a positive impact on the demand for pharmaceutical plastic bottles over the forecast period.

Asia Pacific is expected to register the fastest CAGR of more than 12% from 2024 to 2030. Growing health awareness among consumers in Asia Pacific, especially in developing countries including China and India, coupled with the rising disposable income levels is anticipated to boost the growth of the pharmaceutical industry over the forecast period augmenting demand for its packaging. China dominated the Asia Pacific regional market in 2020 and will retain the leading position over the coming years owing to increasing government initiatives, such as Healthy China 2020, growing contract-manufacturing activities, and burgeoning aging population.

Europe is expected to have considerable growth owing to the rising research & development activities and introduction of new medicines aimed at improving patient health and their quality of life. Companies, such as BioNTech SE and CureVac, in Europe, have proven success in their vaccines in 2020, which has been further attracting investments in the biotech industry in countries, such as Germany, Russia, and the U.K.

Saudi Arabia Pharmaceutical Packaging Market

Saudi Arabia is the major pharmaceutical markets in the Middle East & Africa. International players are recognizing the potential and value of the Middle East & North Africa pharmaceutical market. For instance, Sanofi is one of the largest pharmaceutical players in Morocco while GlaxoSmithKline is a market leader in Saudi Arabia. In addition, local pharmaceutical players such as SPIMACO and Hikma from Jordan from Saudi Arabia are aiming to become regional leaders. These trends are expected to propel the demand for various pharmaceutical packaging materials over the forecast period.

Key Companies & Market Share Insights

The global market is highly competitive owing to the presence of numerous players across the globe. Moreover, key players are consolidating their market positions mainly by acquisitions, which is further intensifying the competition. Key players directly compete with each other in securing agreements from large-sized pharmaceutical manufacturers. Thus, the competitive rivalry in the global market is observed to be high.

Players are focusing on offering value-added services to attract a greater number of clients. Spray painting, ultraviolet coating, and metallization are the commonly employed processes for coloring packaging containers that are used by packaging manufacturers. In addition, labeling and the incorporation of various anti-counterfeit packaging measures, including overt and covert technologies, such as barcodes, holograms, sealing tapes, and radio frequency identification devices, are often undertaken by the packaging manufacturers.

-

In November 2023, Amcor Plc, a renowned global company known for its development and production of environmentally conscious packaging solutions, revealed a Memorandum of Understanding (MOU) with NOVA Chemicals Corporate, a leading producer of sustainable polyethylene. The agreement includes the procurement of mechanically recycled polyethylene resin (rPE) from NOVA Chemicals Corporate, which will be utilized in the production of flexible packaging films. This initiative aligns with Amcor's dedication to promoting packaging circularity by increasing the utilization of rPE in flexible packaging applications.

-

In July 2023, Constantia Flexibles introduced a new pharmaceutical packaging solution called REGULA CIRC, which utilizes coldform foil. The packaging replaces conventional PVC with a PE sealing layer, resulting in a reduction in plastic content while increasing the proportion of aluminum. This optimization not only enhances the sustainability of the packaging but also improves material recovery during recycling processes.

-

In April 2023, Südpack introduced its PharmaGuard blister, a polypropylene-based blister packaging. This new product offers an outstanding water vapor barrier along with effective barrier resistance against UV and oxygen.

Key Pharmaceutical Packaging Companies:

- Amcor plc

- Becton, Dickinson, and Company

- AptarGroup, Inc.

- Drug Plastics Group

- Gerresheimer AG

- Schott AG

- Owens Illinois, Inc.

- West Pharmaceutical Services, Inc.

- Berry Global, Inc.

- WestRock Company

- SGD Pharma

- International Paper

- Comar, LLC

- CCL Industries, Inc.

- Vetter Pharma International

Pharmaceutical Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 152.17 billion

Revenue forecast in 2030

USD 265.70 billion

Growth rate

CAGR of 9.7% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons; Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, drug delivery mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; Turkey; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa; and Egypt

Key companies profiled

Amcor plc; Becton, Dickinson, and Company; AptarGroup, Inc.; Drug Plastics Group; Gerresheimer AG; Schott AG; Owens Illinois, Inc.; West Pharmaceutical Services, Inc.; Berry Global, Inc.; WestRock Company; SGD Pharma; International Paper; Comar, LLC; CCL Industries, Inc.; Vetter Pharma International

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Pharmaceutical Packaging market report on the basis of material, product, drug delivery mode, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics & Polymers

-

Polyvinyl Chloride (PVC)

-

Polypropylene (PP)

-

Homo

-

Random

-

-

Polyethylene Terephthalate (PET)

-

Polyethylene (PE)

-

HDPE

-

LDPE

-

LLDPE

-

-

Polystyrene (PS)

-

Others

-

-

Paper & Paperboard

-

Glass

-

Aluminium Foil

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary

-

Plastic Bottles

-

Caps & Closures

-

Parenteral Containers

-

Syringes

-

Vials & Ampoules

-

Others

-

-

Blister Packs

-

Prefillable Inhalers

-

Pouches

-

Medication Tubes

-

Others

-

-

Secondary

-

Prescription Containers

-

Pharmaceutical Packaging Accessories

-

-

Tertiary

-

-

Drug Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral Drugs

-

Injectables

-

Topical

-

Ocular/ Ophthalmic

-

Nasal

-

Pulmonary

-

Transdermal

-

IV Drugs

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharma Manufacturing

-

Contract Packaging

-

Retail Pharmacy

-

Institutional Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical packaging market was estimated at USD 127.83 billion in the year 2022 and is expected to reach USD 139.37 billion in 2022.

b. The global pharmaceutical packaging market is expected to grow at a compound annual growth rate of 9.7% from 2022 to 2030 to reach USD 265.70 billion by 2030.

b. North America emerged as a dominating region with a value share of 35.8% in the year 2022 owing to the increased production of branded drugs, strong healthcare system, high per capita income, and large investments in drug development in countries such as the U.S.

b. The key market player in the global pharmaceutical packaging market includes Amcor plc, Becton, Dickinson and Company, AptarGroup, Inc., Drug Plastics Group, Gerresheimer AG, Schott AG, Owens Illinois Inc., West Pharmaceutical Services, Inc., Berry Global Inc., WestRock Company, SGD Pharma, International Paper, Comar, LLC, CCL Industries, Inc, Vetter Pharma International.

b. Key factors that are driving the pharmaceutical packaging market growth include the growing pharmaceutical industry most notably in several emerging economies including China, India, and Brazil on account of increasing population, rising disposable income, and growing focus on increasing life expectancy.

Table of Contents

Chapter 1 Pharmaceutical Packaging Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

1.7. List of Abbreviations

Chapter 2. Pharmaceutical Packaging Market: Executive Summary

2.1. Market Outlook, 2023 (USD Million)

2.2. Segmental Outlook

2.2.1. Material Outlook

2.2.2. Product Outlook

2.2.3. Drug Delivery Outlook

2.2.4. End-use Outlook

2.3. Competitive Landscape Snapshot

Chapter 3. Pharmaceutical Packaging Market: Variables, Trends, and Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.2. Manufacturing Trends

3.2.3. Profit Margin Analysis

3.3. Technology Trends / Timeline

3.4. Regulatory Framework

3.4.1. Standard & Compliance

3.4.2. Safety

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Challenges Analysis

3.5.4. Market Opportunity Analysis

3.6. Business Environment Analysis

3.6.1. Industry Analysis - Porter’s

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Competitive Rivalry

3.6.2. PESTEL Analysis

3.6.2.1. Political Landscape

3.6.2.2. Environmental Landscape

3.6.2.3. Social Landscape

3.6.2.4. Technology Landscape

3.6.2.5. Economic Landscape

3.6.2.6. Legal Landscape

3.6.3. Market Entry Strategies

3.7. Unmet Needs & Challenges in Pharmaceutical Packaging Industry

3.8. Impact of Environmental, Social, and Governance (ESG) initiatives on the Pharmaceutical Packaging Market

3.8.1. Market Differentiation

3.8.2. Regulatory Compliance

3.8.3. Industry Collaboration

3.8.4. Enhanced Brand Value

3.8.5. Addressing Consumer Demands

3.9. Impact 0f Covid-19 Pandemic on the Pharmaceutical Packaging Market

Chapter 4. Pharmaceutical Packaging Market: Market Supplier Intelligence

4.1. Kraljic Matrix (Portfolio Analysis)

4.1.1. Non-Critical Items

4.1.2. Leverage Items

4.1.3. Bottleneck Items

4.1.4. Strategic Items

4.2. Engagement Model

4.3. Negotiation Strategies

4.4. Sourcing Best Practices

4.5. Vendor Selection Criteria

Chapter 5. Pharmaceutical Packaging Market: Price Trend Analysis

5.1. Pricing Trend Analysis, by Material, 2018 - 2030 (USD/Ton)

5.2. Factors Affecting the Pricing Deviation

Chapter 6. Pharmaceutical Packaging Market: Material Estimates & Trend Analysis

6.1. Definition & Scope

6.2. Material Movement Analysis & Market Share, 2023 & 2030

6.3. Plastics & Polymers

6.3.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.3.2. Polyvinyl Chloride (PVC)

6.3.3. Polypropylene (PP)

6.3.4. Polyethylene Terephthalate (PET)

6.3.5. Polyethylene (PE)

6.3.6. Polystyrene (PS)

6.3.7. Others

6.4. Paper & Paperboard

6.4.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.5. Glass

6.5.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.6. Aluminum Foil

6.6.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.7. Others

6.7.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Chapter 7. Pharmaceutical Packaging Market: Product Estimates & Trend Analysis

7.1. Definition & Scope

7.2. Product Movement Analysis & Market Share, 2023 & 2030

7.3. Primary

7.3.1. market estimates and forecasts, 2018 - 2030 (USD Million)

7.3.2. Plastic Bottles

7.3.3. Caps & Closures

7.3.4. Parenteral Containers

7.3.5. Blister Packs

7.3.6. Prefillable Inhalers

7.3.7. Pouches

7.3.8. Medication Tubes

7.3.9. Others

7.4. Secondary

7.4.1. market estimates and forecasts, 2018 - 2030 (USD Million)

7.4.2. Prescription Containers

7.4.3. Pharmaceutical Packaging Accessories

7.5. Tertiary

7.5.1. market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 8. Pharmaceutical Packaging Market: Drug Delivery Mode Estimates & Trend Analysis

8.1. Definition & Scope

8.2. Drug Delivery Mode Movement Analysis & Market Share, 2023 & 2030

8.3. Oral Drugs

8.3.1. market estimates and forecasts, 2018 - 2030 (USD Million

8.4. Injectables

8.4.1. market estimates and forecasts, 2018 - 2030 (USD Million)

8.5. Topical

8.5.1. market estimates and forecasts, 2018 - 2030 (USD Million)

8.6. Ocular/ Ophthalmic

8.6.1. market estimates and forecasts, 2018 - 2030 (USD Million)

8.7. Nasal

8.7.1. market estimates and forecasts, 2018 - 2030 (USD Million)

8.8. Pulmonary

8.8.1. market estimates and forecasts, 2018 - 2030 (USD Million)

8.9. Transdermal

8.9.1. market estimates and forecasts, 2018 - 2030 (USD Million)

8.10. IV Drugs

8.10.1. market estimates and forecasts, 2018 - 2030 (USD Million)

8.11. Others

8.11.1. market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 9. Pharmaceutical Packaging Market: End-use Estimates & Trend Analysis

9.1. Definition & Scope

9.2. End-use Movement Analysis & Market Share, 2023 & 2030

9.3. Pharma Manufacturing

9.3.1. market estimates and forecasts, 2018 - 2030 (USD Million)

9.4. Contract Packaging

9.4.1. market estimates and forecasts, 2018 - 2030 (USD Million)

9.5. Retail Pharmacy

9.5.1. market estimates and forecasts, 2018 - 2030 (USD Million)

9.6. Institutional Pharmacy

9.6.1. market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 10. Pharmaceutical Packaging Market: Regional Estimates & Trend Analysis

10.1. Key Takeaways

10.2. Regional Movement Analysis & Market Share, 2023 & 2030

10.3. North America

10.3.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.3.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.3.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.3.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.3.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.3.6. U.S.

10.3.6.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.3.6.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.3.6.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.3.6.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.3.6.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.3.7. Canada

10.3.7.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.3.7.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.3.7.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.3.7.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.3.7.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.3.8. Mexico

10.3.8.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.3.8.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.3.8.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.3.8.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.3.8.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.4. Europe

10.4.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.4.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.4.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.4.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.4.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.4.6. Germany

10.4.6.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.4.6.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.4.6.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.4.6.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.4.6.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.4.7. U.K.

10.4.7.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.4.7.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.4.7.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.4.7.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.4.7.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.4.8.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.4.8.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.4.8.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.4.8.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.4.8.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.4.9. Spain

10.4.9.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.4.9.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.4.9.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.4.9.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.4.9.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.4.10. Russia

10.4.10.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.4.10.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.4.10.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.4.10.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.4.10.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.4.11. Turkey

10.4.11.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.4.11.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.4.11.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.4.11.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.4.11.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.5. Asia Pacific

10.5.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.5.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.5.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.5.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.5.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.5.6. China

10.5.6.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.5.6.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.5.6.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.5.6.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.5.6.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.5.7. India

10.5.7.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.5.7.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.5.7.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.5.7.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.5.7.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.5.8. Japan

10.5.8.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.5.8.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.5.8.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.5.8.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.5.8.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.5.9. South Korea

10.5.9.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.5.9.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.5.9.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.5.9.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.5.9.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.5.10. Australia

10.5.10.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.5.10.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.5.10.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.5.10.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.5.10.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.5.11. Southeast Asia

10.5.11.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.5.11.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.5.11.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.5.11.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.5.11.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.6. Central & South America

10.6.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.6.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.6.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.6.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.6.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.6.6. Brazil

10.6.6.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.6.6.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.6.6.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.6.6.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.6.6.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.6.7. Argentina

10.6.7.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.6.7.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.6.7.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.6.7.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.6.7.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.7. Middle East & Africa

10.7.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.7.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.7.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.7.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.7.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.7.6. Saudi Arabia

10.7.6.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.7.6.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.7.6.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.7.6.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.7.6.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.7.7. UAE

10.7.7.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.7.7.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.7.7.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.7.7.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.7.7.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.7.8. South Africa

10.7.8.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.7.8.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.7.8.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.7.8.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.7.8.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

10.7.9. Egypt

10.7.9.1. market estimates and forecasts, 2018 - 2030 (USD Million)

10.7.9.2. market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

10.7.9.3. market estimates and forecasts, by product, 2018 - 2030 (USD Million)

10.7.9.4. market estimates and forecasts, by drug delivery, 2018 - 2030 (USD Million)

10.7.9.5. market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Chapter 11. Start-up Ecosystem Evaluation, 2023

11.1. List of Start-up Companies

11.1.1. Progressive Companies

11.1.2. Responsive Companies

11.1.3. Dynamic Companies

11.1.4. Starting Blocks

11.2. Government Funding for Start-ups across the globe

Chapter 12. Competitive Landscape

12.1. Key Global Players & Recent Developments & Their Impact On the Industry

12.2. Key Company/Competition Categorization (Key innovators, Market leaders, emerging players)

12.3. List of key Raw Material Distributors and Channel Partners

12.4. List of Potential Customers, by End-use

12.5. Company Market Share & Position Analysis, 2023

12.6. Company Heat Map Analysis

12.7. Competitive Dashboard Analysis

12.8. Strategy Mapping

12.8.1. Capacity Expansion

12.8.2. Collaboration/ Partnerships/ Agreements

12.8.3. New Product launches

12.8.4. Mergers & Acquisitions

12.8.5. Innovation in Technology/ Material

12.8.6. Others

Chapter 13. Company Listing / Profiles

13.1. Amcor plc

13.1.1. Company Overview

13.1.2. Financial Performance

13.1.3. Product Benchmarking

13.2. Becton, Dickinson, and Company

13.2.1. Company Overview

13.2.2. Financial Performance

13.2.3. Product Benchmarking

13.3. AptarGroup, Inc.

13.3.1. Company Overview

13.3.2. Financial Performance

13.3.3. Product Benchmarking

13.4. Drug Plastics Group

13.4.1. Company Overview

13.4.2. Financial Performance

13.4.3. Product Benchmarking

13.5. Gerresheimer AG

13.5.1. Company Overview

13.5.2. Financial Performance

13.5.3. Product Benchmarking

13.6. Schott AG

13.6.1. Company Overview

13.6.2. Financial Performance

13.6.3. Product Benchmarking

13.7. Owens Illinois Inc.

13.7.1. Company Overview

13.7.2. Financial Performance

13.7.3. Product Benchmarking

13.8. West Pharmaceutical Services, Inc.

13.8.1. Company Overview

13.8.2. Financial Performance

13.8.3. Product Benchmarking

13.9. Berry Global Inc.

13.9.1. Company Overview

13.9.2. Financial Performance

13.9.3. Product Benchmarking

13.10. WestRock Company

13.10.1. Company Overview

13.10.2. Financial Performance

13.10.3. Product Benchmarking

13.11. SGD Pharma

13.11.1. Company Overview

13.11.2. Financial Performance

13.11.3. Product Benchmarking

13.12. International Paper

13.12.1. Company Overview

13.12.2. Financial Performance

13.12.3. Product Benchmarking

13.13. COMAR, LLC

13.13.1. Company Overview

13.13.2. Financial Performance

13.13.3. Product Benchmarking

13.14. CCL Industries, Inc.

13.14.1. Company Overview

13.14.2. Financial Performance

13.14.3. Product Benchmarking

13.15. Vetter Pharma International

13.15.1. Company Overview

13.15.2. Financial Performance

13.15.3. Product Benchmarking

List of Tables

1. Pharmaceutical Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

2. Plastics Pharmaceutical Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

3. Paper & Paperboard Pharmaceutical Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

4. Glass Pharmaceutical Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

5. Aluminum foil Pharmaceutical Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6. Others Pharmaceutical Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

7. Pharmaceutical Packaging market estimates and forecasts, by primary, 2018 - 2030 (USD Million)

8. Pharmaceutical Packaging market estimates and forecasts, by secondary, 2018 - 2030 (USD Million)

9. Tertiary Pharmaceutical Packaging market estimates and forecasts, by tertiary, 2018 - 2030 (USD Million)

10. Pharmaceutical Packaging market estimates and forecasts, by oral drugs, 2018 - 2030 (USD Million)

11. Pharmaceutical Packaging market estimates and forecasts, by injecs, 2018 - 2030 (USD Million)

12. Pharmaceutical Packaging market estimates and forecasts, by topical, 2018 - 2030 (USD Million)

13. Pharmaceutical Packaging market estimates and forecasts, by Ocular/ Ophthalmic, 2018 - 2030 (USD Million)

14. Pharmaceutical Packaging market estimates and forecasts, by nasal, 2018 - 2030 (USD Million)

15. Pharmaceutical Packaging market estimates and forecasts, by pulmonary, 2018 - 2030 (USD Million)

16. Pharmaceutical Packaging market estimates and forecasts, by transdermal, 2018 - 2030 (USD Million)

17. Pharmaceutical Packaging market estimates and forecasts, by IV drugs, 2018 - 2030 (USD Million)

18. Pharmaceutical Packaging market estimates and forecasts, by others, 2018 - 2030 (USD Million)

19. Pharmaceutical Packaging market estimates and forecasts, in Pharma manufacturing 2018 - 2030 (USD Million)

20. Pharmaceutical Packaging market estimates and forecasts, in Contract packaging 2018 - 2030 (USD Million)

21. Pharmaceutical Packaging market estimates and forecasts, in retail pharmacy, 2018 - 2030 (USD Million)

22. Pharmaceutical Packaging market estimates and forecasts, in institutional pharmacy, 2018 - 2030 (USD Million)

23. North America pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

24. North America pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

25. North America pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

26. North America pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

27. North America pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

28. North America pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

29. U.S. pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

30. U.S. pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

31. U.S. pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

32. U.S. pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

33. U.S. pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

34. U.S. pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

35. Canada pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

36. Canada pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

37. Canada pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

38. Canada pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

39. Canada pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

40. Canada pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

41. Mexico pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

42. Mexico pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

43. Mexico pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

44. Mexico pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

45. Mexico pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

46. Mexico pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

47. Europe pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

48. Europe pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

49. Europe pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

50. Europe pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

51. Europe pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

52. Europe pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

53. Germany pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

54. Germany pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

55. Germany pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

56. Germany pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

57. Germany pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

58. Germany pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

59. UK pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

60. UK pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

61. UK pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

62. UK pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

63. UK pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

64. UK pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

65. France pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

66. France pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

67. France pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

68. France pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

69. France pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

70. France pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

71. Italy pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

72. Italy pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

73. Italy pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

74. Italy pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

75. Italy pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

76. Italy pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

77. Spain pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

78. Spain pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

79. Spain pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

80. Spain pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

81. Spain pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

82. Spain pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

83. Russia pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

84. Russia pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

85. Russia pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

86. Russia pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

87. Russia pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

88. Russia pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

89. Turkey pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

90. Turkey pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

91. Turkey pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

92. Turkey pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

93. Turkey pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

94. Turkey pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

95. Asia Pacific pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

96. Asia Pacific pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

97. Asia Pacific pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

98. Asia Pacific pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

99. Asia Pacific pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

100. Asia Pacific pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

101. China pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

102. China pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

103. China pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

104. China pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

105. China pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

106. China pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

107. India pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

108. India pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

109. India pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

110. India pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

111. India pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

112. India pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

113. Japan pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

114. Japan pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

115. Japan pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

116. Japan pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

117. Japan pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

118. Japan pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

119. South Korea pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

120. South Korea pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

121. South Korea pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

122. South Korea pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

123. South Korea pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

124. South Korea pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

125. Australia pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

126. Australia pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

127. Australia pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

128. Australia pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

129. Australia pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

130. Australia pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

131. Southeast Asia pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

132. Southeast Asia pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

133. Southeast Asia pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

134. Southeast Asia pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

135. Southeast Asia pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

136. Southeast Asia pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

137. Central & South America pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

138. Central & South America pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

139. Central & South America pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

140. Central & South America pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

141. Central & South America pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

142. Central & South America pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

143. Brazil pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

144. Brazil pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

145. Brazil pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

146. Brazil pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

147. Brazil pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

148. Brazil pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

149. Argentina pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

150. Argentina pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

151. Argentina pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

152. Argentina pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

153. Argentina pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

154. Argentina pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

155. Middle East & Africa pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

156. Middle East & Africa pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

157. Middle East & Africa pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

158. Middle East & Africa pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

159. Middle East & Africa pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

160. Middle East & Africa pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

161. Saudi Arabia pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

162. Saudi Arabia pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

163. Saudi Arabia pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

164. Saudi Arabia pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

165. Saudi Arabia pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

166. Saudi Arabia pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

167. UAE pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

168. UAE pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

169. UAE pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

170. UAE pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

171. UAE pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

172. UAE pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

173. Egypt pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

174. Egypt pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

175. Egypt pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

176. Egypt pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

177. Egypt pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

178. Egypt pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

179. South Africa pharmaceutical packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

180. South Africa pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (USD Million)

181. South Africa pharmaceutical packaging market estimates and forecasts, by material, 2018 - 2030 (Kilotons)

182. South Africa pharmaceutical packaging market estimates and forecasts, by product, 2018 - 2030 (USD Million)

183. South Africa pharmaceutical packaging market estimates and forecasts, by drug delivery mode, 2018 - 2030 (USD Million)

184. South Africa pharmaceutical packaging market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

List of Figures

1. Information procurement

2. Primary research pattern

3. Primary Research Process

4. Market research approaches - Bottom-Up Approach

5. Market research approaches - Top-Down Approach

6. Market research approaches - Combined Approach

7. Pharmaceutical Packaging Market - Market Snapshot

8. Pharmaceutical Packaging Market - Segment Snapshot (1/2)

9. Pharmaceutical Packaging Market - Segment Snapshot (2/2)

10. Pharmaceutical Packaging Market- Competitive Landscape Snapshot

11. Pharmaceutical Packaging Market: Penetration & Growth Prospect Mapping

12. Pharmaceutical Packaging Market: Value Chain Analysis

13. Pharmaceutical Packaging Market: Porter’s Five Force Analysis

14. Pharmaceutical Packaging Market: PESTEL Analysis

15. Pharmaceutical Packaging market: Material movement analysis, 2023 & 2030

16. Pharmaceutical Packaging market: Product movement analysis, 2023 & 2030

17. Pharmaceutical Packaging market: Drug Delivery mode movement analysis, 2023 & 2030

18. Pharmaceutical Packaging market: End-use movement analysis, 2023 & 2030

19. Pharmaceutical Packaging market: Regional movement analysis, 2023 & 2030

20. Pharmaceutical Packaging Market: Competitive Dashboard AnalysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Pharmaceutical Packaging Material Outlook (Revenue, USD Million, 2018 - 2030)

- Plastics & Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo

- Random

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polystyrene (PS)

- Others

- Paper & Paperboard

- Glass

- Aluminium Foil

- Others

- Plastics & Polymers

- Pharmaceutical Packaging Product Outlook (Revenue, USD Million, 2018 - 2030)

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

- Primary

- Pharmaceutical Packaging Drug Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

- Oral Drugs

- Injectables

- Topical

- Ocular/ Ophthalmic

- Nasal

- Pulmonary

- Transdermal

- IV Drugs

- Others

- Pharmaceutical Packaging End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

- Pharmaceutical Packaging Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Pharmaceutical Packaging Market by Material

- Plastics & Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo

- Random

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polystyrene (PS)

- Others

- Paper & Paperboard

- Glass

- Aluminium Foil

- Others

- Plastics & Polymers

- North America Pharmaceutical Packaging Market by Product

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

- Primary

- North America Pharmaceutical Packaging Market by Drug Delivery Mode

- Oral Drugs

- Injectables

- Topical

- Ocular/ Ophthalmic

- Nasal

- Pulmonary

- Transdermal

- IV Drugs

- Others

- North America Pharmaceutical Packaging Market by End-use

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

- U.S.

- U.S. Pharmaceutical Packaging Market by Material

- Plastics & Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo

- Random

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polystyrene (PS)

- Others

- Paper & Paperboard

- Glass

- Aluminium Foil

- Others

- Plastics & Polymers

- U.S. Pharmaceutical Packaging Market by Product

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

- Primary

- U.S. Pharmaceutical Packaging Market by Drug Delivery Mode

- Oral Drugs

- Injectables

- Topical

- Ocular/ Ophthalmic

- Nasal

- Pulmonary

- Transdermal

- IV Drugs

- Others

- U.S. Pharmaceutical Packaging Market by End-use

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

- U.S. Pharmaceutical Packaging Market by Material

- Canada

- Canada Pharmaceutical Packaging Market by Material

- Plastics & Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo

- Random

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polystyrene (PS)

- Others

- Paper & Paperboard

- Glass

- Aluminium Foil

- Others

- Plastics & Polymers

- Canada Pharmaceutical Packaging Market by Product

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

- Primary

- Canada Pharmaceutical Packaging Market by Drug Delivery Mode

- Oral Drugs

- Injectables

- Topical

- Ocular/ Ophthalmic

- Nasal

- Pulmonary

- Transdermal

- IV Drugs

- Others

- Canada Pharmaceutical Packaging Market by End-use

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

- Canada Pharmaceutical Packaging Market by Material

- Mexico

- Mexico Pharmaceutical Packaging Market by Material

- Plastics & Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo

- Random

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polystyrene (PS)

- Others

- Paper & Paperboard

- Glass

- Aluminium Foil

- Others

- Plastics & Polymers

- Mexico Pharmaceutical Packaging Market by Product

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

- Primary

- Mexico Pharmaceutical Packaging Market by Drug Delivery Mode

- Oral Drugs

- Injectables

- Topical

- Ocular/ Ophthalmic

- Nasal

- Pulmonary

- Transdermal

- IV Drugs

- Others

- Mexico Pharmaceutical Packaging Market by End-use

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

- Mexico Pharmaceutical Packaging Market by Material

- North America Pharmaceutical Packaging Market by Material

- Europe

- Europe Pharmaceutical Packaging Market by Material

- Plastics & Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo

- Random

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polystyrene (PS)

- Others

- Paper & Paperboard

- Glass

- Aluminium Foil

- Others

- Plastics & Polymers

- Europe Pharmaceutical Packaging Market by Product

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

- Primary

- Europe Pharmaceutical Packaging Market by Drug Delivery Mode

- Oral Drugs

- Injectables

- Topical

- Ocular/ Ophthalmic

- Nasal

- Pulmonary

- Transdermal

- IV Drugs

- Others

- Europe Pharmaceutical Packaging Market by End-use

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

- Germany

- Germany Pharmaceutical Packaging Market by Material

- Plastics & Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo

- Random

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polystyrene (PS)

- Others

- Paper & Paperboard

- Glass

- Aluminium Foil

- Others

- Plastics & Polymers

- Germany Pharmaceutical Packaging Market by Product

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

- Primary

- German Pharmaceutical Packaging Market by Drug Delivery Mode

- Oral Drugs

- Injectables

- Topical

- Ocular/ Ophthalmic

- Nasal

- Pulmonary

- Transdermal

- IV Drugs

- Others

- Germany Pharmaceutical Packaging Market by End-use

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

- Germany Pharmaceutical Packaging Market by Material

- U.K.

- U.K. Pharmaceutical Packaging Market by Material

- Plastics & Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo

- Random

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polystyrene (PS)

- Others

- Paper & Paperboard

- Glass

- Aluminium Foil

- Others

- Plastics & Polymers

- U.K. Pharmaceutical Packaging Market by Product

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

- Primary

- U.K. Pharmaceutical Packaging Market by Drug Delivery Mode

- Oral Drugs

- Injectables

- Topical

- Ocular/ Ophthalmic

- Nasal

- Pulmonary

- Transdermal

- IV Drugs

- Others

- U.K. Pharmaceutical Packaging Market by End-use

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

- U.K. Pharmaceutical Packaging Market by Material

- France

- France Pharmaceutical Packaging Market by Material

- Plastics & Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo

- Random

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polystyrene (PS)

- Others

- Paper & Paperboard

- Glass

- Aluminium Foil

- Others

- Plastics & Polymers

- France Pharmaceutical Packaging Market by Product

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories