- Home

- »

- Plastics, Polymers & Resins

- »

-

Blister Packaging Market Size, Share & Trends Report, 2030GVR Report cover

![Blister Packaging Market Size, Share & Trends Report]()

Blister Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Paper & Paperboard, Plastic Film, Aluminum), By Technology, By Type (Carded, Clamshell), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-087-9

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Blister Packaging Market Summary

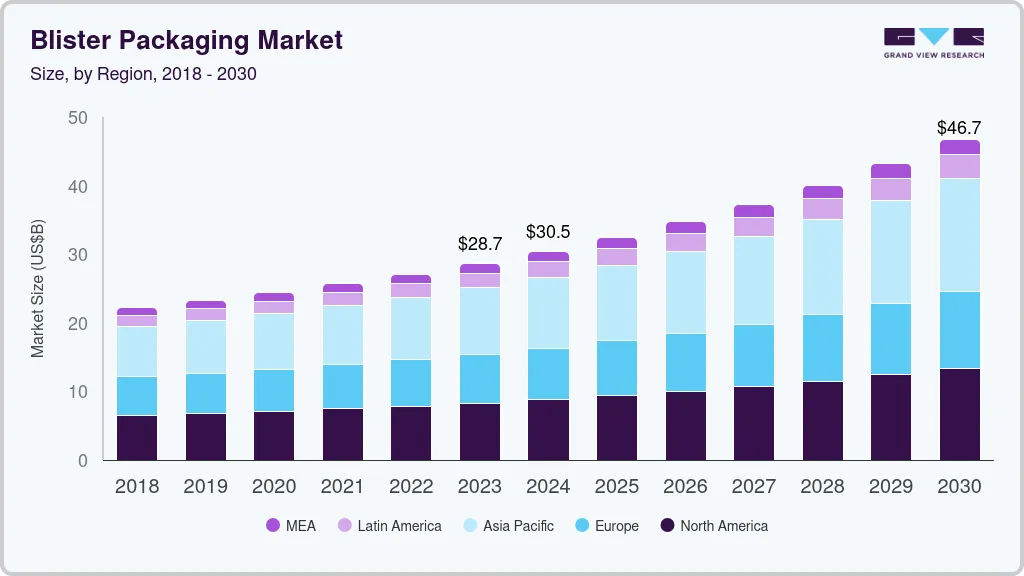

The global blister packaging market size was estimated at USD 28,666.9 million in 2023 and is projected to reach USD 46,719.5 million by 2030, growing at a CAGR of 7.2% from 2024 to 2030. Expanding pharmaceutical and healthcare industry is driving the growth of the global blister packaging industry.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of over 33.0% in 2023

- The blister packaging market of Europeheld a revenue share of over 24.0% in 2023.

- Based on material, the aluminum segment dominated the market with the largest revenue share of over 48% in 2023.

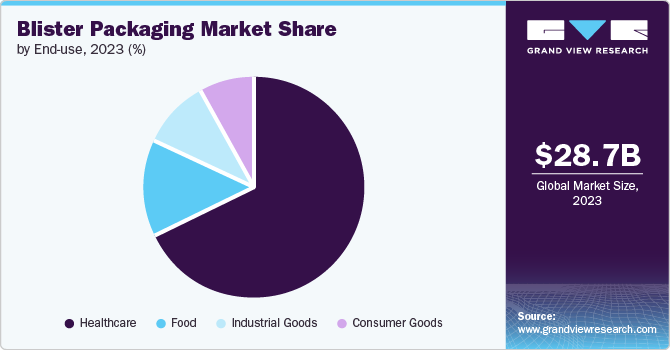

- Based on the end use, the healthcare segment dominated market with the largest revenue share in 2023.

- Based on the type, the carded segment dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 28,666.9 Million

- 2030 Projected Market Size: USD 46,719.5 Million

- CAGR (2024-2030): 7.2%

- Asia Pacific: Largest market in 2023

Moreover, the development of eco-friendly and recyclable blister packaging has addressed sustainability concerns, thus contributing to the market growth. The pharmaceutical and healthcare sectors are major consumers of blister packaging. This packaging solution offers several advantages, including product protection, tamper-evident features, and ease of distribution. Blister packs ensure the safety and integrity of medications, supplements, and medical devices during storage and transportation. Moreover, the ability to include desiccants or moisture-absorbing materials in blister packs helps extend the shelf life of sensitive products.

Blister packs are highly convenient for consumers, especially for on-the-go products. Their compact size and easy-to-carry nature make them ideal for various consumer goods, such as pain relievers, cough drops, and small electronic components. The ability to detach individual doses or units from the blister pack offers portability and ease of use. This convenience factor has driven the adoption of blister packaging in consumer markets, ranging from personal care products to batteries and small hardware items.

Blister packaging offers valuable branding and marketing opportunities for the end-use companies. The clear visibility of the product allows for effective product display and differentiation on retail shelves. Additionally, blister packs can be printed with vibrant graphics, logos, and product information, enhancing brand recognition and consumer appeal. This versatility in branding and marketing has made blister packaging a popular choice for various consumer goods, electronics, and retail products.

Moreover, the industry is constantly evolving, driven by technological advancements and innovative solutions to address sustainability concerns and align with eco-friendly packaging trends. For instance, in July 2023, Südpack launched its latest product innovation, PharmaGuard, at CPHI, a renowned international trade fair for the pharmaceutical industry. This event provided an ideal platform to showcase the innovative and environmentally friendly blister concept for solid applications to a diverse audience of industry experts. An extensive life cycle assessment conducted by Sphera revealed that the new packaging concept significantly reduces the climate impact (measured in CO2-eq) and requires lower energy and water consumption compared to other commonly used blister solutions.

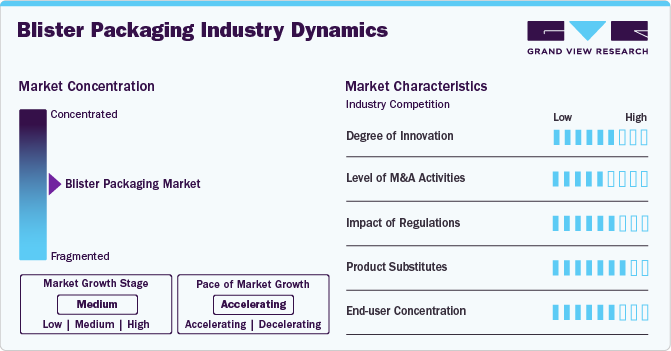

Industry Dynamics

Prominent blister packaging companies operating in the industry include Amcor plc, Constantia Flexibles, UFlex Limited, Sonoco Products Company, WINPAK LTD., WestRock Company, SteriPackGroup, Honeywell International Inc., Klockner Pentaplast, ACG, SÜDPACK, TekniPlex, Blisterpack Inc., Abhinav Enterprises, and YuanPeng Plastic Products Co., Ltd.

Companies are increasingly focusing on the introduction of sustainable packaging products in the blister packaging industry. For instance, in February 2024, Sanofi joined the Blister Pack Collective, a collaborative effort to reduce single-use plastic packaging. The collective aims to develop sustainable blister packaging using dry molded fiber technology, which minimizes CO2 emissions and can be recycled like paper.

In January 2024, TekniPlex introduced a pharmaceutical-grade PET blister film containing 30% post-consumer recycled (PCR) monomers. This film is fully recyclable and meets stringent pharmaceutical quality standards outlined in the European and U.S. Pharmacopoeia.

Material Insights

Based on material, the aluminum segment dominated the market with the largest revenue share of over 48% in 2023. Aluminum is lightweight in nature and highly durable, making it a suitable choice for healthcare blister packaging. Moreover, aluminum blister packs provide a strong defense against tampering, giving consumers confidence in the product's reliability.

The plastic films material segment is expected to witness the fastest CAGR of 7.7% over the forecast period. This is attributed to their lightweight properties which makes them ideal for transportation by reducing the shipping cost. Plastic films from polyvinyl chloride (PVC), polyethylene terephthalate (PET), and polyethylene (PE) provide sturdy packaging that is transparent and protects the product against external environmental factors.

End-use Insights

Based on the end use, the healthcare segment dominated market with the largest revenue share in 2023. This positive outlook is attributed to its increasing usage in packaging of various healthcare products such as prescription drugs, OTC drugs, medical devices, and others. Moreover, the market growth of blister packaging in the healthcare sector is also being driven by the increasing trend of smart blister packaging. This involves tracking a patient's drug intake to improve their compliance by providing medication data based on their activity.

In the consumer goods segment, blister packaging is used for packaging a range of products such as toys, cosmetics, toothbrushes, and personal care products. For instance, Arcade Beauty offers thermoform blister packaging for its wide range of make-up and skin-care products.Moreover, blister packaging is commonly used for packaging small food items such as candies, chocolates, chewing gum, and other confectionery products. It provides a clear view of the product, enhances shelf appeal, and protects the contents from external factors such as moisture and contamination.

Technology Insights

Based on the technology, the thermoforming segment dominated the market with the largest revenue share in 2023. Thermoforming-based blister packaging is a cost-effective packaging solution. It allows for faster production speeds and lower manufacturing costs compared to other technologies, including cold forming, making it an attractive option for end-use companies. Besides, thermoformed blister packs are designed for easy handling.

The cold-forming technology-based blister packaging exhibits the ability to resist oxygen and water completely and provide a longer shelf life to the products owing to the thickness of the aluminum foil in the laminate. Different types of cold form foils, including peelable, push-through, tear-open, child-resistant, and peel-push, are produced based on the specific requirements of end-use companies.

Type Insights

Based on the type, the carded segment dominated the market with the largest revenue share in 2023. The product placed inside the blister with a card sealed to it using adhesive or heat offers visibility, convenience, lower cost, and protection to the product. For example, AAA or AA batteries are sold in blister packaging with a clear plastic blister and a cardboard backing. This packaging protects against damage and moisture, while also allowing the product information and batteries to be visible to consumers.

The clamshells type blister packaging market growth is attributed to its benefits provided such as versatility, higher protection, and attractive packaging design. Clamshell blister packaging is easily customizable and can be manufactured as per the required shape and size. Moreover, these packaging solutions can be designed uniquely by adding graphics and logos to the packaging allowing consumers to differentiate the products from the competitors.

Regional Insights

North America blister packaging market is growing due to the well-established and highly regulated pharmaceutical and healthcare industries in the region, which are major consumers of blister packaging. Companies such as Pfizer Inc., Johnson & Johnson Services, Inc., and Merck & Co., Inc., headquartered in the U.S., extensively use blister packaging for the over the counter (OTC) and prescription drug products. Moreover, the well-developed consumer goods and retail sectors in North America are fueling the demand for blister packaging solutions in the region.

U.S. Blister Packaging Market Trends

The blister packaging market in the U.S. is being driven by well-established pharmaceutical and healthcare industry and increasing healthcare expenditure across the country. According to the National Health Expenditure Account (NHEA), healthcare spending in the U.S. grew by 2.7% in 2021, reaching USD 4.3 trillion or USD 12,914 per person. In terms of the country's Gross Domestic Product (GDP), the healthcare spending represented 18.3% of the total. This increasing healthcare expenditure is projected to positively influence the production of pharmaceuticals and medical devices, presenting growth potential for the blister packaging market in the country.

Canada blister packaging market is expected to witness growth, owing to the escalating demand for biodegradable and eco-friendly packaging solutions. Hence, Canadian companies in the blister packaging industry are actively engaged in research and development activities, exploring new materials, designs, and technologies to improve the functionality, sustainability, and cost-effectiveness of their products. For instance, in December 2021, Jones Healthcare Group introduced sustainable medication packaging products including FlexRx, FlexRx One, and Qube Pro Reseal blister packs. These blister packs are manufactured using Bio-PET, a medically approved bioplastic produced by Good Natured Products, Inc. These packaging solutions aim to assist pharmacies in minimizing their environmental impact and adopting more sustainable practices.

Asia Pacific Blister Packaging Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of over 33.0% in 2023 and is anticipated to progress at the fastest CAGR of 7.9% over the forecast period. Countries such as China, India, and other Asian nations have large populations and a rapidly growing middle class. This translates to increased demand for consumer goods, pharmaceuticals, and other products that commonly use blister packaging. Moreover, the region has witnessed significant industrialization and growth in consumer goods production, particularly in sectors such as electronics, cosmetics, and food. These industries extensively use blister packaging for product protection and presentation, fueling the market's growth in the region.

China blister packaging market is primarily driven by increasing pharmaceutical sales in country. This outlook is due to the rising pharmaceutical per capita expenditures, rising health awareness among the masses, and increasing aging population. Hence, the surging pharmaceutical sales imply the increased consumption of pharmaceuticals resulting in growing demand for secure packaging solutions for oral pharmaceutical drugs, positively impacting the healthcare blister packaging market in China.

Europe Blister Packaging Market Trends

The blister packaging market of Europeheld a revenue share of over 24.0% in 2023. Europe is home to a significant number of major pharmaceutical companies and manufacturing facilities. The pharmaceutical industry is one of the primary consumers of blister packaging solutions for medication packaging. This strong industry presence drives the demand for blister packaging in Europe.

The UK blister packaging market has been at the forefront of sustainability initiatives, including in the packaging industry. The nation has implemented regulations and policies aimed at reducing packaging waste and promoting eco-friendly materials. Hence, UK based blister packaging manufacturers have responded by developing sustainable solutions, such as using recycled or biodegradable materials, which has further strengthened their market position. For instance, in February 2024, The UK pharmacy industry launched a blister pack recycling plan to address the growing issue of plastic waste from medicine packaging. This initiative is part of the broader "Recycle at Boots" program, which currently spans over 100 Boots stores. The plan aims to provide sustainable disposal options for customers and reduce the amount of blister packs that end up in landfills.

Central & South America Blister Packaging Market Trends

The blister packaging market of Central & South America is projected to expand at a moderate CAGR from 2024 to 2030. The food and consumer goods industries in the Central & South America region are growing due to increasing consumer demand for packaged products. Blister packaging is widely used for packaging various food items, confectionery, and consumer goods, creating opportunities for the regional blister packaging market.

Brazil blister packaging market is expected to register a healthy growth rate over the forecast period. Numerous pharmaceutical companies are broadening their footprint in Brazil to secure a portion of the growing pharmaceutical market. For instance, in July 2023, Neuraxpharm, a prominent European specialty pharmaceutical company specializing in the treatment of central nervous system (CNS) disorders, declared the initiation of its affiliates in Brazil and Mexico. These strategic moves mark Neuraxpharm's initial steps in extending its presence beyond the European market and contributing to the growth of the pharmaceutical market. Hence, the entry of Neuraxpharm into Brazil is expected to drive the adoption of international packaging standards, potentially boosting the market growth in the country.

Middle East & Africa Blister Packaging Market Trends

The blister packaging market in the Middle East & Africais influenced by growing pharmaceutical industry and rising demand for the processed and packaged foods. The pharmaceutical industry in the Middle East and Africa region has experienced significant growth driven by factors such as population growth, increasing healthcare expenditure, and the prevalence of chronic diseases.

Saudi Arabia blister packaging market is growing, as according to the National Industrial Development Center (NIDC), in August 2023, Saudi Arabia's pharmaceutical sector was set for substantial growth following the signing of a trilateral memorandum of understanding by the Kingdom's National Industrial Development Center, Jubail Pharma, and RR Holding Co. This agreement aims to enhance the local production of chemical compounds essential for manufacturing pharmaceutical products. Furthermore, the partnership was expected to facilitate the domestic manufacturing of active pharmaceutical ingredients, intermediate materials, and chemicals crucial to the pharmaceutical industry. Hence, the focus on boosting local manufacturing of chemical compounds and pharmaceutical products implies an increase in the production of medications. This outlook is expected to contribute to a higher demand for blister packaging in the country during the forecast period.

Key Blister Packaging Company Insights

The blister packaging market is fragmented, with several major players operating globally. The market has been witnessing a significant number of new product launches and expansions over the past few years.

Key Blister Packaging Companies:

The following are the leading companies in the blister packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Dow

- WestRock Company

- Constantia Flexibles

- Honeywell International Inc.

- Sonoco Products Company

- Klockner Pentaplast

- TekniPlex

- UFlex Limited

- DuPont

- Display Pack

- WINPAK LTD.

- SteriPackGroup

- ACG

- SÜDPACK

- Blisterpack Inc.

- Abhinav Enterprises

- YuanPeng Plastic Technologys Co., Ltd

- Chadpak Co., Inc.

- Formpaks International Co. Ltd

- Uhlmann Group

- Wisser Verpackungen GmbH

Recent Developments

-

In October 2023, WINPAK Films, Inc., a division of WINPAK LTD, acquired approximately 44 acres of land adjacent to its current facility in Senoia, with the intention of potential future expansion. The property was purchased from the Senoia Development Authority for a sum of USD 890,000. This strategic decision reflects WINPAK's objective of broadening its geographical footprint in North America, positioning the company for future growth and enhanced operations in the region.

-

In July 2023, Constantia Flexibles introduced a new pharmaceutical packaging solution called REGULA CIRC, which utilizes coldform foil. The packaging replaces conventional PVC with a PE sealing layer, resulting in a reduction in plastic content while increasing the proportion of aluminum. This optimization not only enhances the sustainability of the packaging but also improves material recovery during recycling processes.

Blister Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.45 billion

Revenue forecast in 2030

USD 46.72 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, technology, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Amcor plc; Constantia Flexibles; UFlex Limited; Sonoco Products Company; WINPAK LTD.; WestRock Company; SteriPackGroup; Honeywell International Inc.; Klockner Pentaplast; ACG; SÜDPACK; TekniPlex; Blisterpack Inc.; Abhinav Enterprises; YuanPeng Plastic Products Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blister Packaging Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blister packaging market report based on material, technology, type, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Paper & Paperboard

-

Solid Bleached Sulfate (SBS)

-

White-lined chipboard

-

Others

-

-

Plastic Films

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Polyethylene (PE)

-

Others

-

-

Aluminum

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Thermoforming

-

Cold Forming

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Carded

-

Clamshell

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Healthcare

-

Consumer Goods

-

Industrial Goods

-

Food

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global blister packaging market was valued at USD 28.66 billion in the year 2023 and is expected to reach USD 30.45 billion in 2024.

b. The global blister packaging market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030, reaching USD 46.72 billion by 2030.

b. Asia Pacific dominated the blister packaging market, with a share of 33.8% in 2023. This is attributed to the increased demand from the personal care, electronics, and healthcare industries for products such as mobile charging cords, testers, generic drugs, and liquid cosmetics.

b. Some key players operating in the blister packaging market include Amcor plc, Constantia Flexibles, UFlex Limited, Sonoco Products Company, WINPAK LTD., WestRock Company, SteriPackGroup, Honeywell International Inc, Klöckner Pentaplast, ACG, SÜDPACK, Tekni Plex, Blisterpack Inc., Abhinav Enterprises, and YuanPeng Plastic Products Co., Ltd

b. Blister packaging market is mainly driving by the rising consumer shift from traditional bottles to blister packs for packaging unit doses in healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.