- Home

- »

- Pharmaceuticals

- »

-

Pharmacy Market Size And Share, Industry Report, 2030GVR Report cover

![Pharmacy Market Size, Share & Trends Report]()

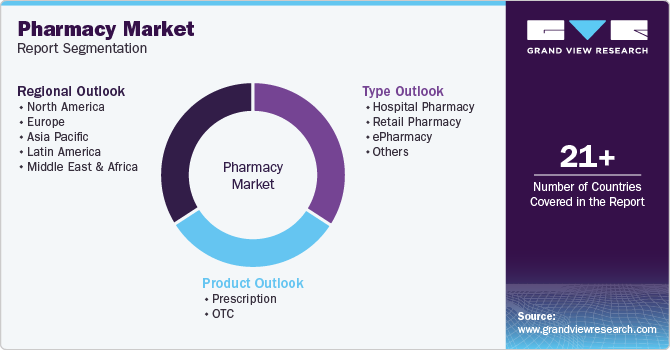

Pharmacy Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Prescription, OTC), By Type (Hospital Pharmacy, Retail Pharmacy (Chain, Independent, Others), ePharmacy, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-701-1

- Number of Report Pages: 142

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmacy Market Summary

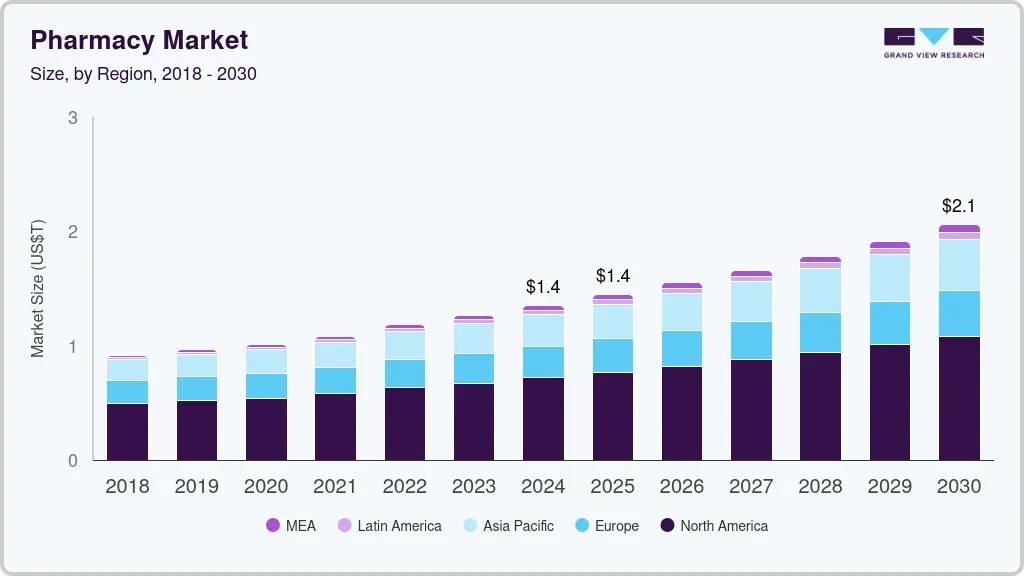

The global pharmacy market size was estimated at USD 1.35 trillion in 2024 and is anticipated to reach USD 2.06 trillion by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The growth of this market is mainly driven by the increasing prevalence of chronic diseases, leading to a rise in healthcare spending.

Key Market Trends & Insights

- North America dominated the global pharmacy market with revenue share of 53.2% in 2024.

- The U.S. pharmacy market held the largest revenue share of the regional industry in 2024.

- By product, the prescription segment dominated the global pharmacy market with a revenue share of 81.3% in 2024.

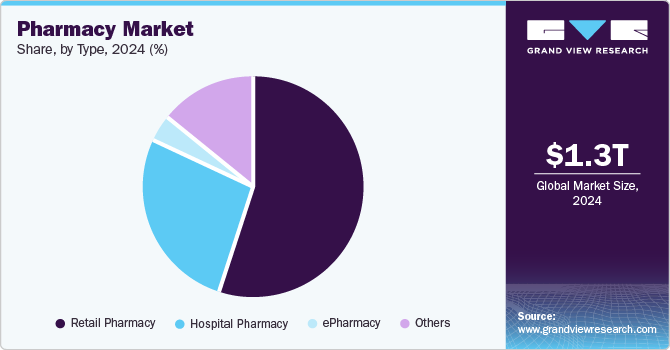

- By type, retail pharmacy held the largest revenue share of the global pharmacy industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.35 Trillion

- 2030 Projected Market Size: USD 2.06 Trillion

- CAGR (2025-2030): 7.3%

- North America: Largest market in 2024

- Middle East And Africa: Fastest growing market

The growing demand for specialty drugs worldwide and increasing prescription drug expenditure in developed countries are also expected to generate novel opportunities. In addition, the increasing occurrence of chronic illnesses such as cancer, diabetes, traumatic brain injuries, and cardiovascular diseases, mainly due to sedentary lifestyles, is fueling further growth. The growing demand for prescription medications is contributing to the industry's growth. As the demand for prescription drugs increases, pharmacies experience a surge in business due to the need to dispense these medications. According to the National Health Service, the current cost of an NHS prescription in England for 2024-2025 is USD 12.65 per item, an increase of USD 0.51 from the previous year. Prescription charges are usually reviewed annually. The cost has increased steadily in recent years, from USD 8.80 in 2015 - 2016 to USD 10.47 in 2024 - 2025.

Moreover, pharmacies are adopting digitalization programs to cater to the growing demand from consumers and provide improved accessibility to patients. The development of comprehensive suites and software solutions by key market participants in the healthcare IT market is expected to facilitate the growth of the pharmacy market over the forecast period. For instance, in December 2024, Cencora, Inc., a healthcare solutions provider, launched Accelerate Pharmacy Solutions, primarily designed to assist hospitals and health systems in optimizing operations and enhancing financial performance. This solution was developed to simplify supply chain management, deliver cutting-edge technology, and enable users with improved capabilities.

Significant growth in the prevalence of chronic diseases worldwide, rising incident rates of accidents and injuries in countries with lower income levels, and increasing demand for effective therapies are expected to support growth trends in this market. Cancer Facts & Figures 2025, published by the American Cancer Society, estimated that nearly 2,041,910 new cancer cases are likely to occur across the U.S. in 2025. In addition, 1 in 8 adults, nearly 853 million individuals, are expected to be diagnosed with diabetes by 2050. Rapid growth in the aging population, continuous increase in road accidents and unintentional injury incidents, rising demand for portable medical devices, and the emergence of various alliances and associations that work for pharmacy industry participants across countries are likely to facilitate growth.

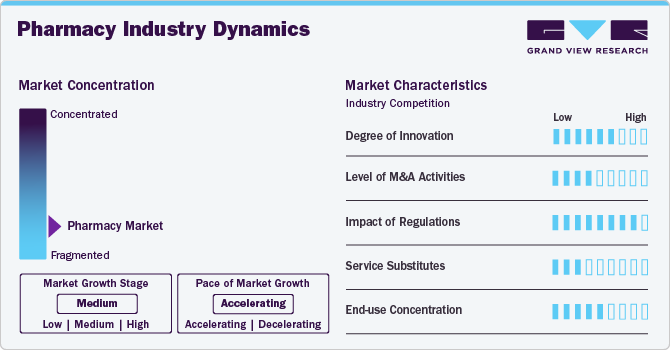

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The presence of multiple businesses in the unorganized retail pharmacy sector, the inclination among specialty and multispecialty hospitals toward providing in-house pharmacy services, and expansions initiated by key global players have developed a fragmented market scenario. Degree of innovation is high in this market as numerous healthcare IT solution providers deliver software solutions equipped with modern technologies such as Internet of Things (IoT), connected devices and AI.

Mergers and acquisitions are moderately common in the global pharmacy industry. Various industry participants equipped with key competencies in specific areas such as infusion, geriatric pharmacy, critical care, and psychiatry are often acquired by global companies to add novel business segments. For instance, in October 2024, Elevance Health, Carelon's parent organization, acquired Kroger Specialty Pharmacy. The acquisition was part of Elevance's broader strategy to strengthen its specialty pharmacy services capabilities.

The impact of regulation is high in the global pharmacy market. Regulatory authorities from various countries, such as the FDA, Health Canada's Pharmaceutical Drugs Directorate (PDD), European Medicines Agency (EMA), and Central Drugs Standard Control Organization (CDSCO), regulate the pharmacy industry. The authorities closely monitor this market regarding the required capabilities to operate retail pharmacies and the validity of products offered through pharmacies. Threat of service substitutes is low for pharmacy market. End use concentration is at moderate level.

Product Insights

The prescription segment dominated the global pharmacy market with a revenue share of 81.3% in 2024. The increasing demand for prescription drugs linked with the treatment of chronic diseases such as diabetes, cardiovascular diseases, respiratory diseases, and blood disorders is driving the growth of the prescription segment. Advancements in diagnostic technologies have led to early-stage detection for numerous patients, enabling timely interventions. Availability of modern imaging technologies, point-of-care testing solutions, and easy accessibility of healthcare services is expected to facilitate the growth of this segment over the forecast period.

The OTC (over-the-counter) segment is expected to experience the fastest CAGR over the forecast period. Cost savings drive the high growth, while factors such as increased information availability regarding treatment of minor ailments, rising expenditure on preventive healthcare, an expanding product range, consumer awareness, and education also contribute to growing adoption. Growing market penetration accomplished by the key market participants in the organized retail pharmacy industry is likely to support the growth of this market in the forecast period.

Type Insights

Retail pharmacy held the largest revenue share of the global pharmacy industry in 2024. Growth of this segment is mainly driven by the factors such as increasing presence of chain pharmacies and independent pharmacies, availability of medications in supermarkets & large retailer stores across countries such as the UK & the U.S. Large chains such as Boots, Walgreens, CVS Health, Lloyd, Shoppers Drug Mart, and Well Pharmacy have a significant presence in countries such as Canada, the U.S., Australia, the UK, and Russia. This concentration of major retailers is promoting the growth of the segment.

ePharmacy is anticipated to experience the fastest CAGR from 2025 to 2030. This segment is primarily influenced by the rising ubiquity of smartphones and connected services, increasing utilization of technology-powered devices, convenience offered by ePharmacy services, and growing adoption in urban areas. In recent years, a large number of companies have entered this segment of the pharmacy industry to address patients' shifting preferences. The focus of key market participants on improving patient engagement through improved services and the use of modern technology-driven tools is expected to generate lucrative opportunities, for instance, in October 2024. Amazon Pharmacy announced it plans to open 20 more pharmacies in various cities across the U.S. by 2025, to expand the service area of its same-day delivery services.

Regional Insights

North America dominated the global pharmacy market with revenue share of 53.2% in 2024. This market is mainly driven by factors such as the presence of multiple major players, the growing adoption experienced by retail pharmacy and e-pharmacy, and the significant increase in demand for effective therapies linked to chronic diseases such as cancer, diabetes, and cardiovascular diseases. The U.S. is home to multiple pharmaceutical and medical device companies, which support the further growth of this regional industry.

U.S. Pharmacy Market Trends

The U.S. pharmacy market held the largest revenue share of the regional industry in 2024. Strong regulatory control, increasing expenditure on preventive healthcare, rising prevalence of chronic diseases across the U.S., and multiple organizations' focus on enhancing market share through the delivery of additional services are some of the key growth-driving factors for this market. In recent years, the increasing incidence rate of cardiovascular diseases, traumatic brain injuries, and other complicated health conditions has been growing in the U.S., which directly influences the demand experienced by the pharmacy industry.

Europe Pharmacy Market Trends

Europe pharmacy market was identified as one of the key regions of global pharmacy market in 2024. The growth of this market is mainly driven by factors such as the increasing prevalence of diseases such as diabetes, rare blood disorders, cancer, and cardiovascular diseases. Europe is home to various companies developing, manufacturing, marketing, and distributing medicines and medical devices. This factor also influences the growth of this regional market.

Middle East And Africa Pharmacy Market Trends

Middle East and Africa pharmacy market is expected to experience fastest CAGR of 10.7% from 2025 to 2030. The growing focus of governments on the availability of high-quality healthcare services and systems in the region, the growth experienced by the medical tourism industry, and increasing healthcare expenditures are some of the major factors that facilitate further growth. Collaborations and partnerships among key market participants and the entry of various global players in the region also contribute to the growth.

Saudi Arabia pharmacy market accounted for the largest revenue share of the regional industry in 2024. The growth of this market is primarily driven by the growing investments by key market players in the country, rising healthcare expenditures, and a significant increase in new entrants. For instance, in September 2024, Aster DM Healthcare, a key healthcare service provider in the region, announced its entry into the Saudi Arabia market through a joint venture with Al Hokair Holding Group and plans to open more than 240 pharmacies.

Key Pharmacy Company Insights

Some of the key companies in the global pharmacy market are CVS Health, Walmart Inc., The Kroger Co, Amazon and others. Major players have been adopting strategies such as launch of new services, service area expansions, and collaborations.

-

CVS Health is a healthcare solutions company that operates in the pharmacy market through CVS Pharmacy. It provides its services through a vast network of stores located across the U.S. in multiple states. Its pharmacy services include mail-order pharmacy, neighborhood pharmacy, prescription delivery, prescription savings, and specialty pharmacy.

-

Walmart Inc. is a global retail organization offering many products and services through its stores and a strong international network. It provides same-day pharmacy delivery services across 49 states in the U.S. It leverages its supply network capabilities through integrating grocery, pharmacy, and general merchandise product lines under a single online order.

Key Pharmacy Companies:

The following are the leading companies in the pharmacy market. These companies collectively hold the largest market share and dictate industry trends.

- Boots Walgreens

- Walmart Inc.

- The Kroger Co.

- Rite Aid Corp.

- MCKESSON CORPORATION

- Well Pharmacy

- Humana

- Matsumotokiyoshi Co., Ltd.

- Apollo Pharmacy

- MedPlusMart.com

- Amazon

Recent Developments

-

In January 2025, Walmart Inc. announced availability of same-day pharmacy delivery service in 49 states of the U.S. Through this strategic advancement, the company has integrated pharmacy, grocery and general merchandise services.

-

In September 2024, CVS Health launched hormonal contraceptive prescribing services through its CVS Pharmacy in Massachusetts. This addition to its service portfolio was part of its commitment to address the changing dynamics of healthcare services and accessibility to birth control methods.

-

In January 2024, Kroger extended its partnership with Centene Corporation's pharmacy network—this extension aimed to provide patients with increased opportunities to save on essential prescriptions. The agreement ensured continued Kroger Family of Pharmacies access for approximately 700,000 Centene members in 2024.

-

In April 2023, Rite Aid Corp launched three new Rite Aid Pharmacies in Craigsville, Greenville, and Scottsville, Virginia. This initiative was part of a pilot program to enhance access to services in “pharmacy deserts” and underserved communities.

Pharmacy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.45 trillion

Revenue forecast in 2030

USD 2.06 trillion

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD trillion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, type, region.

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Colombia, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

CVS Health; Boots Walgreens; Walmart Inc.; The Kroger Co.; Rite Aid Corp.; MCKESSON CORPORATION; Well Pharmacy; Humana; Matsumotokiyoshi Co., Ltd.; Apollo Pharmacy; MedPlusMart.com; Amazon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmacy Market Report Segmentation

This report forecasts revenue growth at global, regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmacy market report based on product, type, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription

-

OTC

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Chain

-

Independent

-

Others

-

-

ePharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.