- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Plant Based Protein Supplements Market Size Report, 2030GVR Report cover

![Plant Based Protein Supplements Market Size, Share & Trends Report]()

Plant Based Protein Supplements Market Size, Share & Trends Analysis Report By Raw Material (Soy, Spirulina, Pumpkin Seed, Wheat, Hemp, Rice, Pea, Others), By Product, By Distribution Channel, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-764-3

- Number of Report Pages: 145

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Market Size & Trends

The global plant based protein supplements market size was USD 2.65 billion in 2023 and is expected to grow at a CAGR of 8.4% from 2024 to 2030. The market's expansion can be attributed to rising consumer awareness of the nutritional values of plant-based products, such as high amino acids and low sodium. Due to concerns about food safety, moral considerations, food allergies, and the adoption of veganism to end animal cruelty, consumers' preferences for plant-based protein supplements have changed. The market is expanding as a result of the rising demand for environmentally friendly proteins. The COVID-19 pandemic had a moderate impact on the plant based protein supplements market. Plant-based foods demand was significantly higher during the pandemic. The sale of retail plant based foods was 35% higher amid panic buying in March and April 2020, as per a survey by the Plant-Based Foods Association.

The pandemic impacted the consuming buying preferences, and there is a growing concern regarding food safety, and people nowadays prefer to buy plant based supplements to improve their overall health as compared to animal-based products. However, the supply chain was affected due to trade restrictions and lockdown, which affected production due to raw material shortages.

The U.S. dominated the North American market for plant-based protein supplements, in terms of revenue, in 2023. A strong presence of leading manufacturers of plant-based protein supplements, rising interest in weight control, and maintaining a vegan as well as healthy and nutritious diet are expected to fuel the market growth in the country. Increasing health issues due to hectic schedules and the nature of work, combined with growing consumer awareness of the relationship between healthy eating and exercise, has increased the demand for plant based protein supplements for sports nutrition and is expected to benefit the growth of the market.

Various awareness campaigns launched by non-governmental organizations, government agencies, and companies have increased consumer understanding of the nutritional benefits of protein supplements, which is expected to drive market growth. Furthermore, some protein supplement manufacturers' product lines include natural and organic products, which is driving the market even further. The use of appealing packaging methods has improved consumer awareness, which has resulted in increased spending on protein supplements to improve overall health and stamina during strenuous physical activities, which is expected to boost the demand for plant based protein supplements market in the coming years.

Consumers are increasingly turning to plant-based diets as their awareness of animal welfare and environmental sustainability grows. The growing prevalence of lactose allergies and intolerance are other factors driving the demand in the plant-based category, most notably the plant-based meat market and plant-based protein supplements market.. Furthermore, because of the higher amino acid content, protein supplements are becoming increasingly popular among fitness enthusiasts for their muscle-building properties. During the forecast period, aggressive promotion and marketing efforts in fitness centers and gyms and the introduction of novel protein supplement products such as ready-to-drink supplements are expected to boost product demand.

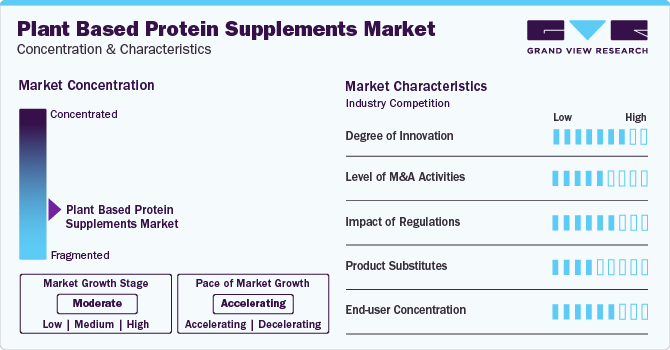

Market Concentration & Characteristics

The key players in the global plant-based protein supplements market are focused on strategies such as product launches and innovations, with the aim of enhancing their brand images and customer loyalty. Acquisitions and collaborations are other major strategies being adopted by the market players to reinforce their competitive positions in the industry.

In response to the latest developments in the regulatory environment, a significant shift towards a system based on protein content and Codex standards is being witnessed in the industry. Verified protein content claims may have a profound influence on the consumers and their preferences for different plant-based protein supplement products.

The plant based protein supplements industry is subject to substitution from their ingredient counterparts, with a growing number of health-conscious consumers adopting plant-based and superfood ingredients in their daily meals. These consumers mainly fall in the age categories within 25 to 44, and are increasingly consuming plant-based protein ingredients or supplement products for functions such as energy management, weight management, fitness & training, etc.

Raw Material Insights

The soy protein segment dominated the market and accounted for the largest revenue share of over 26% in 2023. The increasing popularity of soy protein as a vegetarian protein source and the inclusion of ingredients such as glutamine and BCAAs, which aid in muscle recovery and rapid absorption, contribute to the segment's growth. Furthermore, soy proteins promote bone health, improve immune function, and help to prevent cardiovascular disease. With increased awareness of lactose intolerance and glutamic disorders in developed markets such as the U.S. and Germany, demand for soy-based protein supplements is expected to rise over the projected timeframe.

The pea protein segment is expected to expand at a CAGR of 9.1% during the forecast period on account of its rising popularity among various consumers, such as vegans, those allergic to dairy and egg proteins, and vegetarians. Furthermore, pea protein is hypoallergenic, gluten-, cholesterol-, and fat-free as it is extracted from green peas, thus attracting a larger customer base. Pea proteins are used in manufacturing a number of protein supplements, including energy drinks, shakes, powders, and smoothies, and it is said to be a high-quality protein that is also a good source of iron.

The pumpkin seed segment is expected to grow at a CAGR of 9.4% during the forecast period. Growing consumer demand for pumpkin seed protein as an outcome of product innovation by major producers of protein ingredients is anticipated to support the segment's expansion. Moreover, significant food authorities, including Kosher, have approved the use of pumpkin seed protein as a protein supplement.

The hemp protein supplement segment is expected to expand at a CAGR of over 9% during the forecast period, owing to rising consumer awareness of the health benefits of hemp, as well as its comparable protein content and essential amino acids to animal-based sources such as beef and lamb. Hemp has many unique properties that set it apart in the plant-based foods industry. One of them is that its DNA structure is tightly aligned with human DNA, so it provides nutrition to the body in perfect proportion as a food source. Hemp is naturally non-GMO, gluten-free, free of trypsin inhibitors, as well as virtually free of any residual chemicals, thereby promoting segment growth.

Product Insights

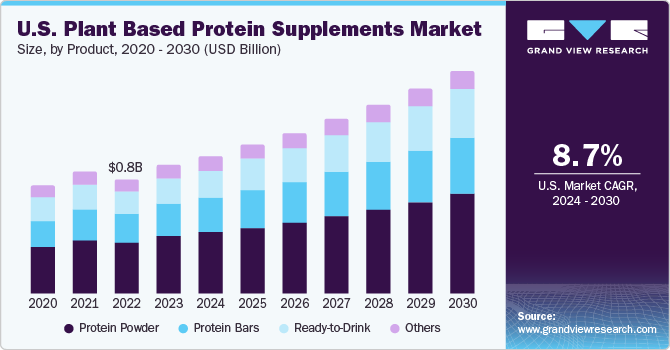

The protein powder market accounted for the largest revenue share in 2023 owing to the wide range of applications and the incorporation of protein powder in end-use sectors such as food & beverages. Mass distribution, increasing online sales, and an increasing number of brands by prominent players such as The Nature's Bounty Co., Iovate Health Sciences International Inc., and Glanbia PLC are factors impacting the expansion of the protein powder segment.

Protein bars are expected to grow at a CAGR of 9.2% during the forecast period, driven by the widespread consumer adoption of protein bars owing to their convenience of grab-and-go possibility. Protein bars help in supporting muscle mass and increase protein synthesis. The hectic lifestyles and no time for cooking balanced and nutritious food have boosted the demand for convenient, on-the-go snacking options with nutritional value. Furthermore, factors such as the instant energy and nutrition provided by protein bars are predicted to propel segment growth.

The ready-to-drink (RTD) segment was valued at USD 544.3 million in 2023 and is predicted to grow at the highest CAGR during the forecast period. A fast-paced and hectic lifestyle, combined with a rise in the number of gyms and fitness centers, has driven consumers to seek out quick and nutritious beverages. This scenario has resulted in the penetration of RTD plant-based protein in taste-enhancing flavors such as coffee, vanilla-infused, and chocolate with organic ingredients, maple syrups, veggies, and others that provide nutrients and promote active lifestyles. The protein drinks market has witnessed a considerable increase in demand, most notably from consumers in the age groups from 25 to 64, for applications such as meal replacement, energy & weight management, etc.

Distribution Channel Insights

The online stores segment accounted for the largest revenue share in 2023 and is expected to expand at a CAGR of 9.2% from 2024 to 2030. As a result of rising customer demands and a focus on core competencies, manufacturers are concentrating on shorter paths to consumers. Easy product availability, simple online purchases, and a wide range of products of various brands to pick from are driving up online sales of plant-based protein supplements. Because of the industry's high fragmentation and low consumer loyalty, online sales of plant-based protein supplements are expected to rise further during the forecast period.

Offline retail stores such as supermarkets, hypermarkets, and pharmacies sell a wide range of dietary supplements, including plant-based protein supplements. One factor driving wellness and health product sales is an improvement in the retail sector. An increasing number of well-established brands prefer supermarkets as a prominent platform for selling plant-based protein supplements owing to the growing penetration of retail giants, including Walmart, Tesco, Target Brands Inc., Sainbury’s, and Asda, among others across the globe. The supplements are sold in most major grocery stores, including Kroger and Lidl. Annual memberships and bulk purchasing discounts are expected to entice customers to purchase products from supermarkets and hypermarkets, boosting market sales.

Application Insights

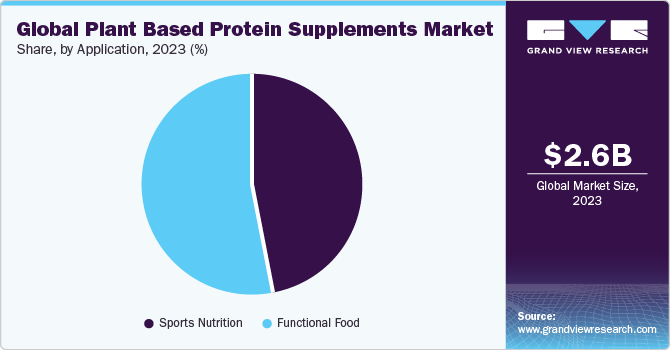

The sports nutrition segment accounted for a revenue share of over 45% in 2023 and is expected to witness a higher CAGR of 9.6% during the forecast period. This development is primarily due to new product launches, an increase in the number of young consumers choosing sports as a career, and an increase in domestic and international sporting events. Strength, core, & endurance athletes and professional athletes are expected to fuel the segment's growth with the rising demand for sports nutritional supplements. In addition, rising demand for sports nutritional products to support lean muscle growth, enhance performance, help with weight loss, and boost stamina, along with an increase in the number of people using the gym, are expected to fuel the expansion of the segment in coming years.

Functional foods accounted for a larger revenue share in 2023 and is expected to dominate over the forecast period. The demand for protein-rich functional foods is rising as consumers become more conscious of living a healthy, active lifestyle and better understand the link between maintaining an active lifestyle as well as eating a nutritious, well-balanced diet. Additionally, it is anticipated that the increasing prevalence of cardiovascular diseases brought on by an inactive and sedentary lifestyle, particularly in people between 30 and 40 years of age, and changing dietary habits will raise consumer awareness of the value of consuming functional protein-rich food, which will help the segment expand.

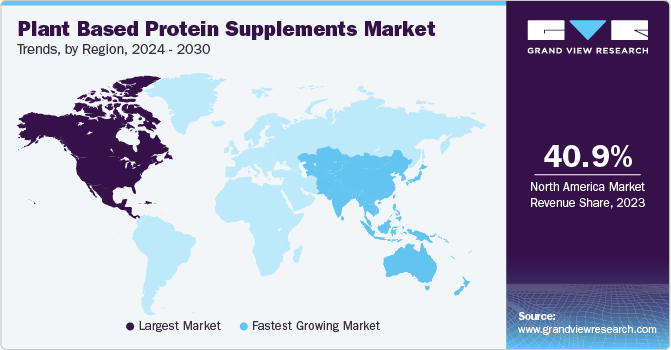

Regional Insights

North America plant based protein supplements market accounted for the highest revenue share in 2023. The growth is attributed to the significant market for sports nutrition products in countries like the U.S. and Canada. The U.S. plant based protein supplements market is projected to grow at a CAGR of 8.7% during the forecast period, driven by a significant shift in consumers’ preferences towards plant-based diets and products. Additionally, a solid foothold of key market players is anticipated to fuel the market's growth, along with the accessibility of raw materials. The Canadian federal government proposed to invest USD 74 million in Merit Functional Foods, a local company that makes plant-based proteins, in June 2020. This initiative aimed to increase the penetration of these products in the country by addressing the rise in demand.

Europe held a market share of over 21.0% in 2021 and is anticipated to expand at a compound annual growth rate of 8.1% from 2022-2030. The demand for these products in the region is anticipated to rise over the forecast period due to factors including a trend toward preventive health care, growing emphasis on healthy living, and rising demand from countries like Germany and the UK due to the region's growing vegan population.

The Asia Pacific plant based protein supplements market is projected to grow at a CAGR of 9.6% during the forecast period. Health-conscious consumers in the Asia Pacific developing countries have led to an increase in the consumption of products. Consumption of these products has increased dramatically in countries such as Indonesia, India, and China, which will help the market expand during the forecast period. Plant-based supplements are anticipated to become significantly more popular as consumers' buying power grows and different brands are made more widely available in these countries.

India plant based protein supplements market

The plant-based protein supplements market in India is expected to grow at a CAGR of nearly 10% during the forecast period, driven by the growing fitness culture and increasing consumer awareness about the importance of balanced diets and meeting daily protein requirements.

Australia plant based protein supplements market

The rising trend of veganism and the growing demand for plant-based products have had a significant impact on the plant-based protein supplements market in Australia, with this market projected to grow at a CAGR of 9.5% during the forecast period.

The Europe plant based protein supplements market is anticipated to expand at a compound annual growth rate of 8.1% from 2024 to 2030. The demand for these products in the region is anticipated to rise over the forecast period due to factors including a trend toward preventive health care, growing emphasis on healthy living, and rising demand from countries like Germany and the UK due to the region's growing vegan population.

Key Companies & Market Share Insights

There has been a significant change in consumer preference for buying plant-based products instead of their animal-based counterparts. Some companies are investing in other businesses that make alternatives to hedge against or prepare for the decline in demand for animal products. Over the past few years, a number of well-known companies and financial investors have invested in or funded the producers of plant protein ingredients in the value chain to sustain evolving consumer needs. Some of the key players are AMCO Proteins, NOW Foods, AMCO Proteins, Quest Nutrition, and Abbott Laboratories, among others.

The rising demand for plant based products compels the key players in the market to focus on R&D and launch new innovative products to keep up with current trends in the market. Additionally, companies are entering into partnerships, acquisitions, strategic mergers, and geographic & capacity expansions to gain a competitive edge. For instance, in May 2020, Danone commercially launched its Vega One range of plant-based protein products in China. It also included Vega One Sport created for athletes. This product comprises various proteins from various foods, such as peas, alfalfa, pumpkin seeds, and sunflower. Some prominent players in the global plant based protein market include:

-

Glanbia plc

-

AMCO Proteins

-

Quest Nutrition

-

NOW Foods

-

The Bountiful Company

-

MusclePharm Corporation

-

Abbott Laboratories

-

IOVATE Health Sciences International, Inc.

-

Transparent Labs

-

WOODBOLT DISTRIBUTION LLC

Recent Developments

-

In October 2022, Optimum Nutrition, a sports nutrition brand of Glanbia, launched a new plant-based protein powder called Gold Standard 100% Plant Protein. The formula is made with 100% vegan ingredients and contains 24 grams of protein to support fitness activities. The launch is in response to the growing trend of plant-based alternatives in the market.

-

In August 2022, Optimum Nutrition announced the launch of a new ready-to-drink Gold Standard Protein Shake. It contains 24 grams of protein per serving and 24 vital vitamins and minerals. It has a low sugar content of just 1 gram, with 130-140 calories per serving.

-

In July 2022, GELITA AG established a biotechnology center in Frankfurt, Germany to develop proteins through biotechnological processes for various applications such as nutrition, cosmetics, pharmaceutical, and medical products. The company aimed to enhance its expertise in biotechnology, ensuring the sustainability of its core business and exploring new, profitable market segments.

Plant Based Protein Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.85 billion

Revenue forecast in 2030

USD 4.62 billion

Growth Rate

CAGR of 8.4% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, distribution channel, application region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Glanbia plc; AMCO Proteins; Quest Nutrition; NOW Foods; The Bountiful Company; MusclePharm Corporation; Abbott Laboratories; IOVATE Health Sciences International, Inc.; Transparent Labs; WOODBOLT DISTRIBUTION LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant Based Protein Supplements Market Segmentations

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global plant based protein supplements market report on the basis of raw material, product, distribution channel, application, and region:

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Soy

-

Spirulina

-

Pumpkin Seed

-

Wheat

-

Hemp

-

Rice

-

Pea

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein Powder

-

Protein Bars

-

Ready-to-Drink

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Online Stores

-

DTC

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutrition

-

Functional Food

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

- South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

- South Africa

-

-

Frequently Asked Questions About This Report

b. The global plant based protein supplements market size was estimated at USD 2.65 billion in 2023 and is expected to reach USD 2.85 billion in 2024.

b. The global plant based protein supplements market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 4.62 billion by 2030.

b. Soy protein dominated the raw material segment with share of 26.0% in 2023 on account of its cost-effectiveness and easy availability of the raw material for plant based protein supplement manufacturers.

b. Some of the key players operating in the plant based protein supplements market include Glanbia plc, AMCO Proteins, Quest Nutrition, NOW Foods, The Bountiful Company, MusclePharm Corporation, Abbott Laboratories, IOVATE Health Sciences International, Inc., Transparent Labs, WOODBOLT DISTRIBUTION LLC.

b. The key factors that are driving the plant based protein supplements market include the rising importance of a vegan diet coupled with an increasing instances of cardiovascular diseases and type 2 diabetes among consumers associated with the consumption of meat products.

Table of Contents

Chapter 1. Plant Based Protein Supplements Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Plant Based Protein Supplements Market: Executive Summary

2.1. Market Snapshot

2.2. Raw Material Snapshot

2.3. Product Snapshot

2.4. Distribution Channel Snapshot

2.5. Application Snapshot

2.6. Regional Snapshot

2.7. Competitive Landscape Snapshot

Chapter 3. Plant Based Protein Supplements Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.2. Manufacturing & Technology Trends

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint Analysis

3.3.3. Industry Challenges

3.3.4. Industry Opportunities

3.4. Business Environment Analysis

3.4.1. Regulatory Landscape

3.4.2. Industry Analysis – Porter’s

3.4.2.1. Supplier Power

3.4.2.2. Buyer Power

3.4.2.3. Substitution Threat

3.4.2.4. Threat from New Entrant

3.4.2.5. Competitive Rivalry

3.4.3. Industry Analysis - PESTEL

Chapter 4. Plant Based Protein Supplements Market: Raw Material Estimates & Trend Analysis

4.1. Raw Material Movement Analysis & Market Share, 2023 & 2030

4.2. Soy

4.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

4.3. Spirulina

4.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

4.4. Pumpkin Seed

4.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

4.5. Wheat

4.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

4.6. Hemp

4.6.1. Market estimates and forecast, 2018 - 2030 (USD Million)

4.7. Rice

4.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

4.8. Pea

4.8.1. Market estimates and forecast, 2018 - 2030 (USD Million)

4.9. Others

4.9.1. Market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 5. Plant Based Protein Supplements Market: Product Estimates & Trend Analysis

5.1. Product Movement Analysis & Market Share, 2023 & 2030

5.2. Protein Powder

5.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

5.3. Protein Bars

5.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

5.4. Ready-to-drink (RTD)

5.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

5.5. Others

5.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 6. Plant Based Protein Supplements Market: Distribution Channel Estimates & Trend Analysis

6.1. Distribution Channel Movement Analysis & Market Share, 2023 & 2030

6.2. Supermarkets/Hypermarkets

6.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

6.3. Online Stores

6.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

6.4. DTC

6.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

6.5. Others

6.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 7. Plant Based Protein Supplements Market: Application Estimates & Trend Analysis

7.1. Application Movement Analysis & Market Share, 2023 & 2030

7.2. Sports Nutrition

7.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3. Functional Foods

7.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 8. Plant Based Protein Supplements Market: Regional Estimates & Trend Analysis

8.1. Regional Movement Analysis & Market Share, 2023 & 2030

8.2. North America

8.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

8.2.2. U.S.

8.2.2.1. Key country dynamics

8.2.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.2.3. Canada

8.2.3.1. Key country dynamics

8.2.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.2.4. Mexico

8.2.4.1. Key country dynamics

8.2.4.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.3. Europe

8.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

8.3.2. Germany

8.3.2.1. Key country dynamics

8.3.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.3.3. UK

8.3.3.1. Key country dynamics

8.3.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.3.4. France

8.3.4.1. Key country dynamics

8.3.4.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.3.5. Italy

8.3.5.1. Key country dynamics

8.3.5.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.3.6. Spain

8.3.6.1. Key country dynamics

8.3.6.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

8.4.2. China

8.4.2.1. Key country dynamics

8.4.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.4.3. India

8.4.3.1. Key country dynamics

8.4.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.4.4. Japan

8.4.4.1. Key country dynamics

8.4.4.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.4.5. South Korea

8.4.5.1. Key country dynamics

8.4.5.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.4.6. Australia & New Zealand

8.4.6.1. Key country dynamics

8.4.6.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.5. Central & South America

8.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

8.5.2. Brazil

8.5.2.1. Key country dynamics

8.5.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.5.3. Argentina

8.5.3.1. Key country dynamics

8.5.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.6. Middle East & Africa (MEA)

8.6.1. Market estimates and forecast, 2018 - 2030 (USD Million)

8.6.2. Saudi Arabia

8.6.2.1. Key country dynamics

8.6.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.6.3. UAE

8.6.3.1. Key country dynamics

8.6.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

8.6.4. South Africa

8.6.4.1. Key country dynamics

8.6.4.2. Market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 9. Competitive Analysis

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Market Positioning

9.4. Company Market Share Analysis, 2023 (%)

9.5. Company Heat Map Analysis

9.6. Strategy Mapping

9.7. Company Profiles

9.7.1. Glanbia plc

9.7.1.1. Company Overview

9.7.1.2. Financial Performance

9.7.1.3. Product Benchmarking

9.7.1.4. Strategic Initiatives

9.7.2. AMCO Proteins

9.7.2.1. Company Overview

9.7.2.2. Financial Performance

9.7.2.3. Product Benchmarking

9.7.2.4. Strategic Initiatives

9.7.3. Quest Nutrition

9.7.3.1. Company Overview

9.7.3.2. Financial Performance

9.7.3.3. Product Benchmarking

9.7.3.4. Strategic Initiatives

9.7.4. NOW Foods

9.7.4.1. Company Overview

9.7.4.2. Financial Performance

9.7.4.3. Product Benchmarking

9.7.4.4. Strategic Initiatives

9.7.5. The Bountiful Company

9.7.5.1. Company Overview

9.7.5.2. Financial Performance

9.7.5.3. Product Benchmarking

9.7.5.4. Strategic Initiatives

9.7.6. MusclePharm Corporation

9.7.6.1. Company Overview

9.7.6.2. Financial Performance

9.7.6.3. Product Benchmarking

9.7.6.4. Strategic Initiatives

9.7.7. Abbott Laboratories

9.7.7.1. Company Overview

9.7.7.2. Financial Performance

9.7.7.3. Product Benchmarking

9.7.8. IOVATE Health Sciences International, Inc.

9.7.8.1. Company Overview

9.7.8.2. Financial Performance

9.7.8.3. Product Benchmarking

9.7.8.4. Strategic Initiatives

9.7.9. Transparent Labs

9.7.9.1. Company Overview

9.7.9.2. Financial Performance

9.7.9.3. Product Benchmarking

9.7.9.4. Strategic Initiatives

9.7.10. WOODBOLT DISTRIBUTION LLC

9.7.10.1. Company Overview

9.7.10.2. Financial Performance

9.7.10.3. Product Benchmarking

9.7.10.4. Strategic Initiatives

List of Tables

1. Plant based protein supplements market - Key market driver analysis

2. Plant based protein supplements market - Key market restraint analysis

3. Soy based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

4. Spirulina based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

5. Pumpkin seed based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

6. Wheat based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

7. Hemp based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

8. Rice based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

9. Pea based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

10. Other protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

11. Plant based protein powder market estimates and forecast, 2018 - 2030 (USD Million)

12. Plant based protein bars market estimates and forecast, 2018 - 2030 (USD Million)

13. Plant based RTD protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

14. Other plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

15. Plant based protein supplements market estimates and forecast through supermarkets/hypermarkets, 2018 - 2030 (USD Million)

16. Plant based protein supplements market estimates and forecast through online stores, 2018 - 2030 (USD Million)

17. Plant based protein supplements market estimates and forecast through DTC, 2018 - 2030 (USD Million)

18. Plant based protein supplements market estimates and forecast through others, 2018 - 2030 (USD Million)

19. Plant based protein supplements market estimates and forecast for sports nutrition, 2018 - 2030 (USD Million)

20. Plant based protein supplements market estimates and forecast for functional foods, 2018 - 2030 (USD Million)

21. North America plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

22. North America plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

23. North America plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

24. North America plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

25. North America plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

26. U.S. plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

27. U.S. plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

28. U.S. plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

29. U.S. plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

30. U.S. plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

31. Canada plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

32. Canada plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

33. Canada plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

34. Canada plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

35. Canada plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

36. Mexico plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

37. Mexico plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

38. Mexico plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

39. Mexico plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

40. Mexico plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

41. Europe plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

42. Europe plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

43. Europe plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

44. Europe plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

45. Europe plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

46. Germany plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

47. Germany plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

48. Germany plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

49. Germany plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

50. Germany plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

51. UK plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

52. UK plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

53. UK plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

54. UK plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

55. UK plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

56. France plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

57. France plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

58. France plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

59. France plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

60. France plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

61. Italy plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

62. Italy plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

63. Italy plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

64. Italy plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

65. Italy plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

66. Spain plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

67. Spain plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

68. Spain plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

69. Spain plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

70. Spain plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

71. Asia Pacific plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

72. Asia Pacific plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

73. Asia Pacific plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

74. Asia Pacific plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

75. Asia Pacific plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

76. China plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

77. China plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

78. China plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

79. China plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

80. China plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

81. India plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

82. India plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

83. India plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

84. India plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

85. India plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

86. Japan plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

87. Japan plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

88. Japan plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

89. Japan plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

90. Japan plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

91. South Korea plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

92. South Korea plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

93. South Korea plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

94. South Korea plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

95. South Korea plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

96. Australia & New Zealand plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

97. Australia & New Zealand plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

98. Australia & New Zealand plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

99. Australia & New Zealand plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

100. Australia & New Zealand plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

101. Central & South America plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

102. Central & South America plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

103. Central & South America plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

104. Central & South America plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

105. Central & South America plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

106. Brazil plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

107. Brazil plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

108. Brazil plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

109. Brazil plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

110. Brazil plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

111. Argentina plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

112. Argentina plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

113. Argentina plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

114. Argentina plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

115. Argentina plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

116. Middle East & Africa plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

117. Middle East & Africa plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

118. Middle East & Africa plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

119. Middle East & Africa plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

120. Middle East & Africa plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

121. Saudi Arabia plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

122. Saudi Arabia plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

123. Saudi Arabia plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

124. Saudi Arabia plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

125. Saudi Arabia plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

126. UAE plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

127. UAE plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

128. UAE plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

129. UAE plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

130. UAE plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

131. South Africa plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

132. South Africa plant based protein supplements market estimates and forecast by raw material, 2018 - 2030 (USD Million)

133. South Africa plant based protein supplements market estimates and forecast by product, 2018 - 2030 (USD Million)

134. South Africa plant based protein supplements market estimates and forecast by distribution channel, 2018 - 2030 (USD Million)

135. South Africa plant based protein supplements market estimates and forecast by application, 2018 - 2030 (USD Million)

136. Vendor landscape

List of Figures

1. Reusable water bottle market segmentation

2. Information procurement

3. Primary research pattern

4. Primary research approaches

5. Primary research process

6. Plant based protein supplements market– Value chain analysis

7. Plant based protein supplements market: Porter’s Five Forces Analysis

8. Plant based protein supplements market: PESTEL Analysis

9. Plant based protein supplements market: Raw Material Share (%) analysis, 2023 & 2030

10. Soy based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

11. Spirulina based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

12. Pumpkin seed based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

13. Wheat based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

14. Hemp based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

15. Rice based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

16. Pea based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

17. Other protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

18. Plant based protein supplements market: Product share (%) analysis, 2023 & 2030

19. Plant based protein powder market estimates and forecast, 2018 - 2030 (USD Million)

20. Plant based protein bars market estimates and forecast, 2018 - 2030 (USD Million)

21. Plant based RTD protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

22. Other plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

23. Plant based protein supplements market: Distribution channel share (%) analysis, 2023 & 2030

24. Plant based protein supplements market estimates and forecast through supermarkets/hypermarkets, 2018 - 2030 (USD Million)

25. Plant based protein supplements market estimates and forecast through online stores, 2018 - 2030 (USD Million)

26. Plant based protein supplements market estimates and forecast through DTC, 2018 - 2030 (USD Million)

27. Plant based protein supplements market estimates and forecast through others, 2018 - 2030 (USD Million)

28. Plant based protein supplements market: Application share (%) analysis, 2023 & 2030

29. Plant based protein supplements market estimates and forecast for sports nutrition, 2018 - 2030 (USD Million)

30. Plant based protein supplements market estimates and forecast for functional foods, 2018 - 2030 (USD Million)

31. Plant based protein supplements market: Regional share (%) analysis, 2023 & 2030

32. North America plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

33. U.S. plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

34. Canada plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

35. Mexico plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

36. Europe plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

37. Germany plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

38. UK plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

39. France plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

40. Italy plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

41. Spain plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

42. Asia Pacific plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

43. China plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

44. India plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

45. Japan plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

46. South Korea plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

47. Australia & New Zealand plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

48. Central & South America plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

49. Brazil plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

50. Argentina plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

51. Middle East & Africa plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

52. Saudi Arabia plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

53. UAE plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

54. South Africa plant based protein supplements market estimates and forecast, 2018 - 2030 (USD Million)

55. Plant based protein supplements market: Company market share (%), 2023What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Product Outlook (Revenue, USD Million, 2018 - 2030)

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Application Outlook (Revenue, USD Million, 2018 - 2030)

- Sports Nutrition

- Functional Food

- Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- North America Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- North America Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- North America Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- U.S.

- U.S. Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Wheat

- Pumpkin Seed

- Hemp

- Rice

- Pea

- Others

- U.S. Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- U.S. Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- U.S. Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- U.S. Plant Based Protein Supplements Market, By Raw Material

- Canada

- Canada Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Canada Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Canada Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Canada Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Canada Plant Based Protein Supplements Market, By Raw Material

- Mexico

- Mexico Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Mexico Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Mexico Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Mexico Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Mexico Plant Based Protein Supplements Market, By Raw Material

- North America Plant Based Protein Supplements Market, By Raw Material

- Europe

- Europe Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Europe Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Europe Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Europe Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Germany

- Germany Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Germany Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Germany Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Germany Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Germany Plant Based Protein Supplements Market, By Raw Material

- U.K.

- U.K. Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- U.K. Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- U.K. Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- U.K. Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- U.K. Plant Based Protein Supplements Market, By Raw Material

- France

- France Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- France Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- France Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- France Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- France Plant Based Protein Supplements Market, By Raw Material

- Italy

- Italy Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Italy Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Italy Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Italy Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Italy Plant Based Protein Supplements Market, By Raw Material

- Spain

- Spain Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Spain Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Spain Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Spain Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Spain Plant Based Protein Supplements Market, By Raw Material

- Europe Plant Based Protein Supplements Market, By Raw Material

- Asia Pacific

- Asia Pacific Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Asia Pacific Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Asia Pacific Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Asia Pacific Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- India

- India Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- India Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- India Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- India Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- India Plant Based Protein Supplements Market, By Raw Material

- China

- China Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- China Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- China Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- China Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- China Plant Based Protein Supplements Market, By Raw Material

- Japan

- Japan Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Japan Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Japan Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Japan Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Japan Plant Based Protein Supplements Market, By Raw Material

- Australia & New Zealand

- Australia & New Zealand Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Australia & New Zealand Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Australia & New Zealand Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Australia & New Zealand Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Australia & New Zealand Plant Based Protein Supplements Market, By Raw Material

- South Korea

- South Korea Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- South Korea Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- South Korea Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- South Korea Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- South Korea Plant Based Protein Supplements Market, By Raw Material

- Asia Pacific Plant Based Protein Supplements Market, By Raw Material

- Central & South America

- Central & South America Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Central & South America Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Central & South America Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Central & South America Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Brazil

- Brazil Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Brazil Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Brazil Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Brazil Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Brazil Plant Based Protein Supplements Market, By Raw Material

- Argentina

- Argentina Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Argentina Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Argentina Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Argentina Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Argentina Plant Based Protein Supplements Market, By Raw Material

- Central & South America Plant Based Protein Supplements Market, By Raw Material

- Middle East & Africa

- Middle East & Africa Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Middle East & Africa Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Middle East & Africa Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Middle East & Africa Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- UAE

- UAE Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- UAE Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- UAE Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- UAE Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- UAE Plant Based Protein Supplements Market, By Raw Material

- Saudi Arabia

- Saudi Arabia Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Saudi Arabia Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- Saudi Arabia Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- Saudi Arabia Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- Saudi Arabia Plant Based Protein Supplements Market, By Raw Material

- South Africa

- South Africa Plant Based Protein Supplements Market, By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- South Africa Plant Based Protein Supplements Market, By Product

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

- South Africa Plant Based Protein Supplements Market, By Application

- Sports Nutrition

- Functional Food

- South Africa Plant Based Protein Supplements Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

- South Africa Plant Based Protein Supplements Market, By Raw Material

- Middle East & Africa Plant Based Protein Supplements Market, By Raw Material

- North America

Plant Based Protein Supplements Market Dynamics

Driver: Positive Outlook Toward Sports Nutrition Industry

Sports nutrition is a specialized field that focuses on the dietary needs of athletes and fitness enthusiasts. It encompasses a variety of nutrients, including proteins, vitamins, minerals, fats, carbohydrates, and organic substances. The products in this sector, such as sports drinks, supplements, and foods, are designed to enhance performance, stamina, muscle growth, and overall health. In recent years, nanoencapsulation and microencapsulation technologies have become increasingly popular. These techniques allow for controlled release and minimal ingredient usage, making them ideal for fortifying food and beverage products. As these technologies continue to evolve, they are expected to open up new markets for sports nutrition ingredients. There is also a growing demand for natural ingredients in sports nutrition products. This trend is driven by rising health concerns about the use of synthetic ingredients. As a result, herbal supplements are becoming more prevalent in the sports nutrition industry. These supplements offer a natural alternative to synthetic products, making them a popular choice for health-conscious athletes and fitness enthusiasts. Sports nutrition is a dynamic and evolving field that combines nutrition science, athletic performance, and innovative technologies. It plays a crucial role in supporting athletes’ health and performance, and its importance continues to grow as new research and technologies emerge.

Driver: Rising Importance Of Plant-Based Nutrition

The demand for plant-based nutrients is on the rise, largely due to the presence of phytochemicals. These biologically active compounds help protect against various forms of cancer, including those affecting the larynx, pharynx, mouth, lung, and esophagus. In Europe, there’s a growing preference for plant-based diets as more individuals are becoming vegan, vegetarian, or flexitarian (those who primarily follow a vegetarian diet but occasionally consume fish or meat). This shift is expected to drive the demand for plant-based protein supplements. Moreover, the demand for vegan and vegetarian products that offer quality nutrition without relying on dairy or meat is increasing. Coupled with innovations in alternative protein products, this trend is expected to create new growth opportunities.

In 2015, the World Health Organization classified processed meats as class 1 carcinogens and red meat as a probable cause of cancer. It’s estimated that 70% of antibiotics in the U.S. and 45% in the UK are used on livestock, potentially leading to antibiotic-resistant infections. With increasing awareness of the benefits of a low-meat diet and a shift towards flexitarian, vegetarian, and vegan diets, the demand for plant-based protein supplements is expected to accelerate.

Restraint: Fluctuating Raw Material Prices

The prices of raw materials, including soybean, are volatile due to supply and demand constraints, impacting the prices of protein supplements. Soybean, a major raw material for soy proteins and soybean oil, has prices closely tied to ethanol and crude oil prices. Over 30% of produced soybean is used for biofuel manufacturing, 25% in the food industry, and the rest in industrial processes like feed and vegetable oil production. Factors such as growing demand from the food & beverage industry, increasing biofuel production, and the popularity of soybean-based personal care & cosmetic products are expected to affect soybean prices. Soy protein is losing market share in Europe due to the crop’s genetic modification. Deforestation in South America for soy cultivation raises sustainability concerns, acting as key restraints for soy protein use in the plant protein market. In 2008, soybean prices were USD 629.4 per ton, fell to USD 375.9 per ton in 2010, and rose to USD 610.1 per ton in 2013. These fluctuations in raw material prices pose challenges to the growth of the soy protein market.

What Does This Report Include?

This section will provide insights into the contents included in this plant based protein supplements market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Plant based protein supplements market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Plant based protein supplements market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the plant based protein supplements market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for plant based protein supplements market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of plant based protein supplements market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.