- Home

- »

- Biotechnology

- »

-

Cell Line Development Market Size, Industry Report, 2033GVR Report cover

![Cell Line Development Market Size, Share & Trends Report]()

Cell Line Development Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Product & Services (Reagents And Media, Equipment, Accessories And consumables), By Source, By Type of Cell Line, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-481-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Line Development Market Summary

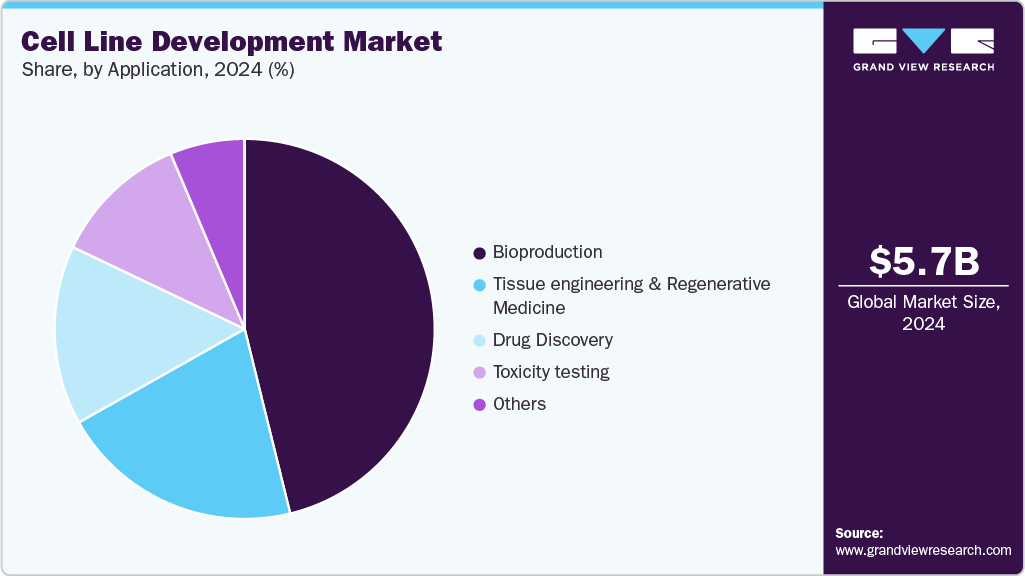

The global cell line development market size was estimated at USD 5.70 billion in 2024 and is projected to reach USD 13.46 billion by 2033, growing at a CAGR of 10.10% from 2025 to 2033. The growth is fueled by rising demand for biopharmaceuticals, increasing R&D investments, and advancements in cell culture technologies.

Key Market Trends & Insights

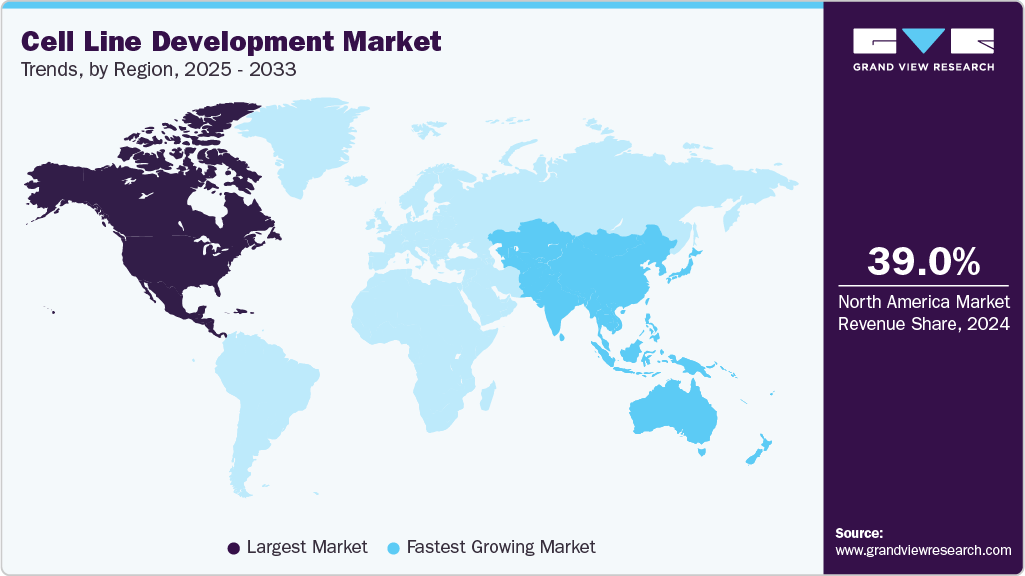

- The North America cell line development market held the largest share of 39% in 2024.

- The cell line development industry in the U.S. is expected to grow significantly over the forecast period.

- By product & services, the reagents and media segment held the highest market share of 43.62% in 2024.

- Based on source, the mammalian cell line segment held the highest market share in 2024.

- By type of cell line, the recombinant cell lines segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.70 Billion

- 2033 Projected Market Size: USD 13.46 Billion

- CAGR (2025-2033): 10.10%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Innovations such as automation, single-use systems, and CRISPR-based editing enhance efficiency, driving adoption through the forecast period.

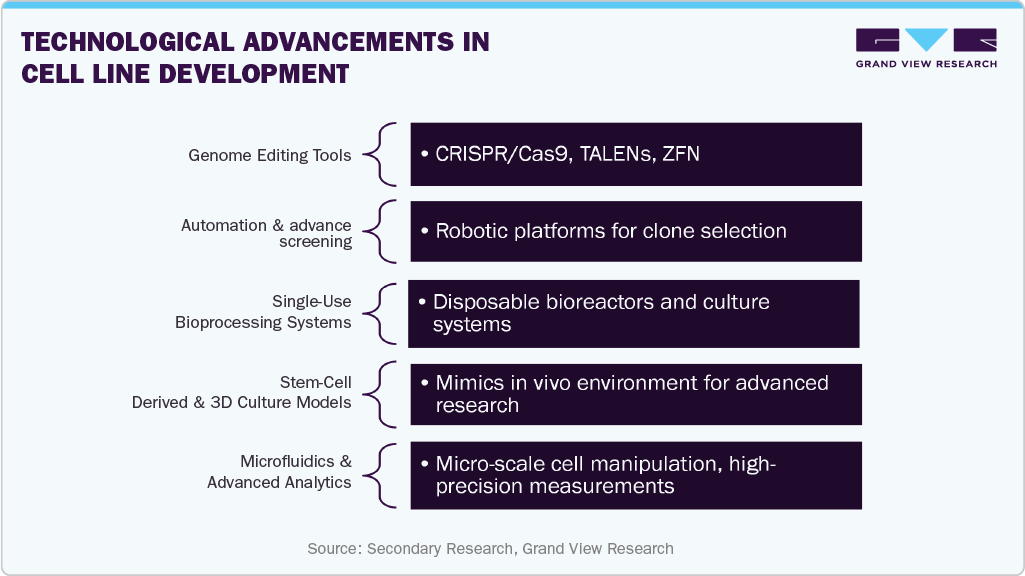

Technological Advancements in Cell Line Development

Rapid advancements in biotechnology are pivotal in driving the cell line development market forward. Innovative tools such as automation, high-throughput screening, and single-use bioprocessing technologies have significantly enhanced cell line generation's speed, efficiency, and cost-effectiveness. Automation and digitalization reduce manual errors, shorten development timelines, and enable large-scale parallel experiments, allowing companies to accelerate product pipelines.

Moreover, cutting-edge genome editing tools like CRISPR/Cas9 are revolutionizing the precision and reliability of cell line engineering. These technologies allow targeted modifications, improved gene expression, and the development of high-yield cell lines with enhanced stability and productivity. Such innovations support the manufacturing of complex biologics and address the growing need for personalized and next-generation therapies. Technological advancements are establishing themselves as a core growth driver by enabling faster turnaround, reduced costs, and greater consistency, ensuring that cell line development remains a critical enabler of progress in the biopharmaceutical industry.

Growing biopharmaceutical production

The global demand for biopharmaceuticals is one of the strongest drivers of the cell line development market. Biologics such as monoclonal antibodies, recombinant proteins, and vaccines have become essential in treating cancer, autoimmune disorders, and infectious diseases. These products are gaining rapid adoption worldwide with their higher specificity and efficacy compared to traditional therapies. As a result, pharmaceutical and biotechnology companies are increasingly investing in developing stable and high-yield cell lines to support large-scale, cost-effective, and regulatory-compliant biologics production. The growing pipeline of biosimilars and novel biologics further amplifies the need for robust cell line development platforms to meet rising demand.

Moreover, advancements in technology are significantly accelerating market growth. Innovative tools such as automation, high-throughput screening, CRISPR-based genome editing, and single-use bioprocessing systems are streamlining the cell line development workflow by improving efficiency, precision, and scalability. These technologies reduce timelines and costs and enhance product quality and consistency, making them highly attractive to manufacturers. Moreover, the rising prevalence of chronic diseases and the shift toward personalized medicine are driving demand for customized cell lines tailored to novel therapeutic applications, reinforcing the central role of cell line development in the future of biopharmaceutical manufacturing.

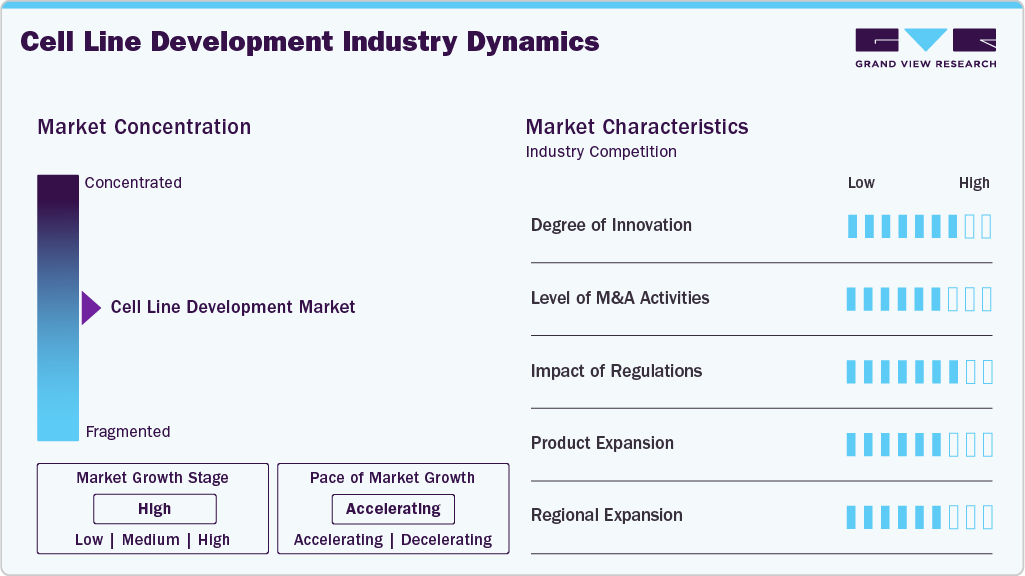

Market Concentration & Characteristics

The industry demonstrates high innovation, driven by advancements such as CRISPR/Cas9 gene editing, automation, advanced screening, and AI-driven platforms that enhance precision, efficiency, and scalability. Adopting single-use bioprocessing systems and data-driven optimization has streamlined workflows, reducing costs and accelerating timelines. For instance, in December 2024, Sphere Fluidics in the UK launched the Cyto-Cellect Fc Fusion Assay Kit, accelerating cell-line development by enabling efficient, high-throughput fluorescent single-cell screening for Fc fusion proteins. Moreover, emerging approaches like synthetic biology, stem-cell-derived lines, and 3D culture models are expanding applications beyond biopharmaceutical manufacturing into drug discovery and personalized medicine, positioning innovation as a core growth catalyst for the market.

The industry has witnessed a moderate to high level of mergers and acquisitions (M&A) activity in recent years, primarily driven by the need to expand biopharmaceutical capabilities, strengthen technology portfolios, and accelerate innovation. Smaller biotech firms with proprietary cell line technologies or niche expertise are frequently targeted, enabling larger companies to rapidly scale capabilities and maintain a competitive edge. For instance, in January 2025, WuXi AppTec in China divested its U.S. and U.K.-based Advanced Therapies (ATU) unit, transferring cell-and-gene-therapy facilities to Altaris LLC amid mounting BIOSECURE Act scrutiny. Overall, M&A activity remains a strategic growth lever in this market, supporting consolidation, innovation, and global expansion.

Regulations play a crucial role in shaping the cell line development industry, as agencies such as the FDA, EMA, and ICH impose strict standards on cell line origin, genetic stability, contamination control, and reproducibility to ensure safety and product quality. While compliance with Good Manufacturing Practices (GMP) and detailed documentation increases costs and extends timelines, it builds trust, standardization, and reliability in biologics production. Moreover, evolving guidelines for biosimilars, advanced therapies, and personalized medicine are driving companies to adopt innovative tools like automation, quality-by-design, and advanced analytics to meet regulatory requirements more efficiently, making regulation both a barrier and a catalyst for market growth.

Product expansion is emerging as a key growth strategy in the cell line development market, with companies broadening their offerings to cater to the rising demand for biologics, biosimilars, and advanced therapies. Leading players are diversifying their portfolios by introducing improved host cell lines, optimized media formulations, and integrated platforms that combine automation, analytics, and genome editing technologies to enhance productivity and efficiency. Expanding into customized cell line solutions for monoclonal antibodies, recombinant proteins, and gene therapies reflects the growing need for flexibility and scalability in biopharmaceutical manufacturing. For instance, in January 2023, Berkeley Lights launched the Beacon Select optofluidic system, tailored for small- to mid-sized biopharma and CDMO/CRO cell-line development, reducing timelines and capital requirements. This continuous product innovation and diversification strengthen competitive positioning and enable companies to meet the evolving requirements of global regulatory standards and personalized medicine.

Regional expansion is a major strategy driving growth in the cell line development industry, as leading companies seek to strengthen their presence in high-potential markets across Asia-Pacific, the Middle East, and Latin America. With North America and Europe already established as mature markets, firms increasingly invest in emerging regions due to rising healthcare expenditures, supportive government initiatives, and the growing demand for affordable biologics and biosimilars. Strategic moves such as setting up local manufacturing facilities, forming partnerships with regional biopharma companies, and expanding service networks allow global players to enhance accessibility, reduce supply chain complexities, and cater to local regulatory requirements. This geographic diversification helps companies tap into new patient populations and positions them to capture long-term growth opportunities in rapidly expanding biopharmaceutical hubs worldwide.

Product & Services Insights

The reagents and media segment held the largest market share of 43.62% in 2024 due to its wide applications in areas such as bio production, regenerative medicines, tissue engineering, drug discovery, and toxicity testing. Reagents and media are indispensable components of cell culture and cell line development and are cost-intensive, propelling the segment's growth.

The services segment is expected to witness the fastest CAGR throughout the forecast period. CLD services are expected to rise over time due to the rising demand for monoclonal antibodies, patent expiration of blockbuster biologics, increasing demand for effective cancer therapeutics, and technological advancement in the field of CLD. For instance, in August 2025, Shanghai-based WuXi Biologics launched the WuXia293 Stable HEK 293 cell-line platform in China, enhancing the development and manufacturing of difficult-to-express molecules with superior titer, stability, and product quality. Moreover, the increasing trend of biologics outsourcing and rising approval and demand for biologics and biosimilars are all providing the market with enormous growth opportunities.

Source Insights

The mammalian cell line segment accounted for the largest market share and is expected to grow with the fastest CAGR over the forecast period. Cell line development typically begins with the selection of cells derived from mammalian or non-mammalian sources, with source selection being a critical step in ensuring the production of stable and commercially viable lines. Mammalian cell lines are preferred over other types owing to their superior ability to perform complex protein modifications and expression. This makes them the most widely used platform for producing monoclonal antibodies, vaccines, and other biologics, reinforcing their dominance in the market.

The non-mammalian cell line segment is expected to grow at a significant rate over the forecast period. These cell lines, derived from insect and amphibian cells, are increasingly gaining traction due to their cost-effectiveness, ease of culture, and scalability in large-scale production. Non-mammalian cell lines are particularly valuable in vaccine manufacturing, gene therapy research, and recombinant protein expression, where simpler post-translational modifications are sufficient. Their ability to reduce production timelines and lower overall costs makes them an attractive alternative to mammalian systems, driving their adoption in emerging biopharmaceutical research and development areas.

Type of Cell Line Insights

The recombinant cell lines segment held the largest market share of 31.61% in 2024 due to its extensive use in biologics production processes, gene activation, and protein interactions. Increased demand is projected to fuel the need for drug screening and toxicity testing in the coming years. The main driver of the rising adoption of recombinant proteins throughout the projection period is the demand for biologics to treat cancer and autoimmune illnesses. These products include enzymes, blood components, hormones, monoclonal antibodies, and chemicals connected to antibodies.

The hybridomas segment is expected to witness the fastest CAGR throughout the forecast period. The market for hybridomas is expected to show lucrative growth over the forecast period due to its advantages, such as the ability to grow continuously, a combination of two different types of cells, and the production of pure antibodies on a large scale. Moreover, continuous advancement in the hybridoma technology, such as using feeder layers consisting of murine peritoneal cells and macrophages derived from mice, is expected to fuel this market growth over the forecast period.

Application Insights

The bioproduction segment held the largest market share of 46.15% in 2024. This is attributed to the increased demand for drugs and vaccine production. The bioproduction technology area comprises the output of biologics-based treatment drugs such as vaccines, therapeutic proteins, cell therapies, and gene therapies. The most common uses of bioproduction are producing biologics and vaccines, and demand is predicted to grow dramatically in the future owing to the increase in viral and communicable illnesses, particularly in developing nations.

The tissue engineering & regenerative medicine segment will witness the fastest CAGR from 2025 to 2033. Growing adoption rates of tissue engineering in patient treatment, such as implantation of bladders, skin grafts, small arteries, trachea, and cartilage, and increasing awareness related to personalized medicine are the factors contributing to the market growth. Moreover, rising awareness about regenerative medicines in which tissue or organs are safely grown in laboratory conditions with the help of cell culture techniques and then implanted, is further expected to provide a growth platform for this segment.

Regional Insights

North America cell line development industry held the largest market share of 39.0% of the global market in 2024, owing to the increasing adoption rates of cell culture techniques due to their advantages, such as cost-effectiveness and high productivity. The presence of sophisticated healthcare infrastructure, growing demand for biologics, and increasing awareness related to cell therapy, coupled with relatively higher healthcare expenditure levels in the region, contribute to the market growth.

U.S Cell Line Development Market Trends

The cell line development market in the U.S. is highly competitive, fueled by strong demand for biologics, a well-established biopharmaceutical industry, and significant investments in research and development. The presence of leading global players, advanced healthcare infrastructure, and supportive regulatory frameworks further intensifies competition. Moreover, the growing pipeline of monoclonal antibodies, biosimilars, and personalized therapies continues to drive innovation, making the U.S. one of the most dynamic and rapidly evolving markets for cell line development.

Europe Cell Line Development Market Trends

The cell line development market in Europe is witnessing steady growth, supported by strong government funding for life sciences research, a well-established biopharmaceutical manufacturing base, and rising demand for biosimilars and advanced therapies. The region benefits from robust regulatory frameworks under the European Medicines Agency (EMA), emphasizing quality, safety, and standardization, thereby driving advanced cell line development platform adoption. For instance, in May 2025, Swiss-based NewBiologix licensed its Xcell-Eng-HEK293 cell-line technology to ReciBioPharm in Europe and the U.S., enabling high-yield, scalable AAV production across global C&G T programs, which further expands the cell line development industry in the region.

The UK cell line development industry is expanding, driven by a strong biotech sector, robust academic research, and government support for life sciences. Rising demand for biosimilars, personalized medicine, and biologics, along with collaborations between universities, startups, and pharmaceutical companies, further strengthen the U.K.’s position as a leading European hub for cell line development.

The cell line development market in Germany is growing, supported by the country’s strong biopharmaceutical manufacturing capabilities, robust academic research ecosystem, and significant investments in biotechnology and life sciences. Germany is home to leading pharma and biotech companies and specialized contract development and manufacturing organizations (CDMOs), which drive demand for advanced cell line development solutions. These factors position Germany as a key European hub for cell line development, contributing significantly to regional market growth.

Asia Pacific Cell Line Development Market Trends

The cell line development market in Asia Pacific is expected to experience the fastest CAGR of 11.54% throughout the forecast period. Key factors such as untapped opportunities, economic development, improving healthcare infrastructure, and favorable initiatives by the government and manufacturers in the biotechnology sector are some factors accounting for this rapid growth. Moreover, the increasing median age of the population, rising production of vaccines, therapeutic proteins, and others are the factors contributing to the overall development of the CLD market.

The China cell line development industry is growing rapidly, fueled by rising demand for biologics and biosimilars, strong government support for biotechnology, and significant investments from domestic and global pharmaceutical companies. Expanding R&D infrastructure, coupled with a large patient base and lower production costs, is accelerating the adoption of advanced cell line development technologies. For instance, in October 2024, Shanghai-based WuXi Biologics launched the WuXia RidGS non-antibiotic CHO expression platform in China, enhancing stable, high-yield (over 6 g/L) production of mAbs and other therapeutic proteins.

The cell line development market in Japan is growing, driven by the country’s advanced biotechnology infrastructure, strong government support for regenerative medicine, and rising demand for monoclonal antibodies, vaccines, and biosimilars. Collaborative efforts between academic institutions, research organizations, and pharmaceutical companies further foster innovation and accelerate the adoption of cutting-edge cell line development technologies.

MEA Cell Line Development Market Trends

The cell line development market in the Middle East and Africa (MEA) is emerging, driven by rising healthcare investments, growing demand for advanced biologics, and government initiatives to strengthen biotechnology and life sciences infrastructure. Increasing partnerships with global pharmaceutical companies and the establishment of research centers and biomanufacturing facilities are further supporting the adoption of modern cell line development technologies across the region.

The Kuwait cell line development market is emerging, driven by increasing government investment in healthcare infrastructure, a growing focus on biotechnology and precision medicine, and rising demand for advanced biologics and biosimilars. Collaborations with international research institutions and pharmaceutical companies further support the adoption of modern cell line development technologies in the country.

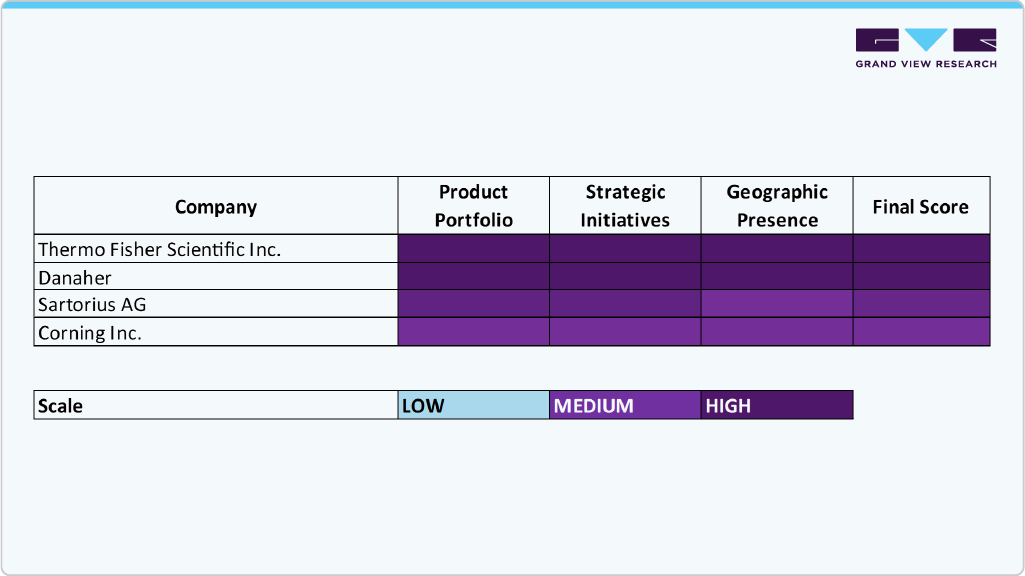

Key Cell Line Development Company Insights

Key players operating in the cell line development market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Cell Line Development Companies:

The following are the leading companies in the cell line development market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Danaher

- Sartorius AG

- Merck KGaA

- Corning Inc.

- Lonza

- Creative BioLabs.

- Creative BioLabs.

- Advanced Instruments

- Berkeley Lights

Recent Developments

-

In May 2025, ProBioGen entered an agreement with Poland’s Polpharma Biologics to deliver high-performance CHO.RiGHT cell-line development services are accelerating the expansion of its biosimilar pipeline.

-

In April 2025, Thermo Fisher Scientific launched an enhanced integrated platform with a high-yield CHO K-1 cell line, reducing IND-filing timelines from 13 to 9 months while improving stability and productivity.

Cell Line Development Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.23 billion

Revenue forecast in 2033

USD 13.46 billion

Growth rate

CAGR of 10.10% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, source, type of cell lines, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Corning Inc.; Lonza; Creative BioLabs.; WuXi PharmaTech; Sartorius AG; Merck KGaA; Advanced Instruments; Berkeley Lights; Danaher

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Cell Line Development Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cell line development market report on the basis of product & services, source, type of cell lines, application, and region:

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Reagents and media

-

Equipment

-

Automated Systems

-

Centrifuges

-

Bioreactors

-

Storage equipment

-

Others

-

-

Accessories & consumables

-

Services

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Mammalian cell line

-

Non-mammalian cell line

-

Insects

-

Amphibians

-

-

-

Type of Cell Lines Outlook (Revenue, USD Million, 2021 - 2033)

-

Recombinant cell lines

-

Hybridomas

-

Continuous cell lines

-

Primary cell lines

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Bioproduction

-

Drug discovery

-

Toxicity testing

-

Tissue engineering & Regenerative Medicine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell line development market size was estimated at USD 5.70 billion in 2024 and is expected to reach USD 6.23 billion in 2025.

b. The global cell line development market is expected to grow at a compound annual growth rate of 10.10% from 2025 to 2033 to reach USD 13.46 billion by 2033.

b. Reagents and media accounted for the largest revenue share of 43.62% in 2024, due to increasing bio-production. Additionally, these products are cost-intensive nature and have repetitive use in the production of biologics hence accounted for the largest revenue share.

b. Some of the key players operating in this market are Thermo Fisher Scientific Inc., Corning Inc., Lonza, Creative BioLabs., WuXi PharmaTech, Sartorius AG, Merck KGaA, Advanced Instruments, Berkeley Lights, and Danaher.

b. The availability of enhanced technologies to manufacture novel cell lines and an increase in demand for monoclonal antibodies and cancer therapies are projected to drive market expansion in coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.