- Home

- »

- Biotechnology

- »

-

High Throughput Screening Market Size & Share Report 2030GVR Report cover

![High Throughput Screening Market Size, Share & Trends Report]()

High Throughput Screening Market (2024 - 2030) Size, Share & Trends Analysis Report By Product And Services (Consumables), By Technology (Cell-based Assays), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-155-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High Throughput Screening Market Summary

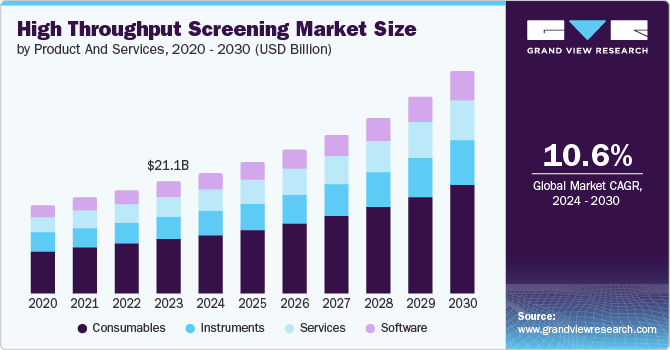

The high throughput screening market size was valued at USD 21.10 billion in 2023 and is projected to reach USD 41.67 billion by 2030, growing at a CAGR of 10.6% from 2024 to 2030. The increase in funding for research and development by multinational companies drives clinical trials and contributes to market growth.

Key Market Trends & Insights

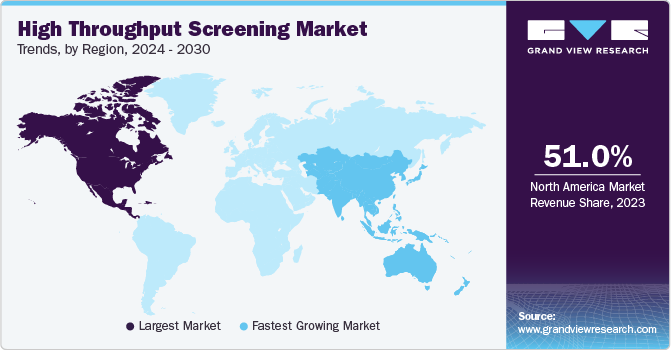

- North America dominated the HTS market with a 51.0% share in 2023.

- The U.S. HTS market dominated the North American market with a share of 82.6% in 2023.

- Based on products and services, consumables products dominated the market with a revenue share of 48.3% in 2023.

- Based on technology, cell-based assay technology accounted for the largest market revenue share of 57.3% in 2023.

- Based on application, drug discovery programs accounted for 56.0% of the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 21.10 billion

- 2030 Projected Market Size: USD 41.67 billion

- CAGR (2024-2030): 10.6%

- North America: Largest Market in 2023

- Asia Pacific: Fastest growing Market in 2023

Due to its superior performance, high throughput screening (HTS) is increasingly being used in stem cell research, toxicology, and other life sciences fields, leading to increased demand and market growth.Open innovation models and continuous technological advancements in HTS are contributing significantly to the growth of the market. These innovative models have allowed research pharmaceutical and biotech companies to engage with academic institutions, research organizations, and technology suppliers, facilitating the acquisition of new technologies and approaches for conducting HTS. This, in turn, has led to improved research efficiency in the drug discovery process. Additionally, this model offers several benefits, including cost and risk sharing, enhanced access to technologies, interdisciplinary collaboration, and overall development among collaborators. The introduction of new models and collaborative efforts are key factors driving the growth of the HTS market in light of increasing developments.

Product And Services Insights

Consumables products dominated the market with a revenue share of 48.3% in 2023. This dominance can be attributed to the extensive use of consumable products in HTS techniques, such as assay kits and reagents. These consumables facilitate automating the screening process of chemical and biological compounds. With beneficial uses in drug discovery, the consumables are also used in toxicology and stem cell research, which gives them a broader adoption use. This makes them increase R&D funds for consumables and has been a driving force for the segment's growth.

The services are projected to be the fastest-growing segment, with a CAGR of 11.0% from 2024 to 2030. This growth can be attributed to the increasing demand for essential services such as advanced data processing software and automation of liquid handling systems, which streamline processes through software. Moreover, the rising demand for consumable products, including assay developments and stem cell research, has further fueled the need for services provided by industry players. These services encompass a wide range of offerings, such as HTS target profiling assays, assay development and data, testing validation, hit validation, and storage facilities, indicating a significant driving force behind the growth of the services segment.

Technology Insights

Cell-based assay technology accounted for the largest market revenue share of 57.3% in 2023. This growth is propelled by the ability of cell-based assays to generate multiple biologically relevant data and assess compound attributes simultaneously, contrasting with the limitations of traditional biochemical assays. The transition from 2-D to 3-D cell culture is gaining momentum as organizations recognize its capacity to provide a more accurate physical environment and precise outcomes in drug screening tests.

Lab-on-a-chip (LOC) technology segment is expected to grow at a CAGR of 11.5% from 2024 to 2030 due to its rapid diagnostics process, ease of use, and applications in detecting COVID-19 antibodies. LOC technologies offer accurate and quick results for chronic disease diagnostics and personalized medicine, driving demand in the healthcare sector. Technological advancements in LOC platforms have made it a better option than other health monitoring technologies, further contributing to its market growth.

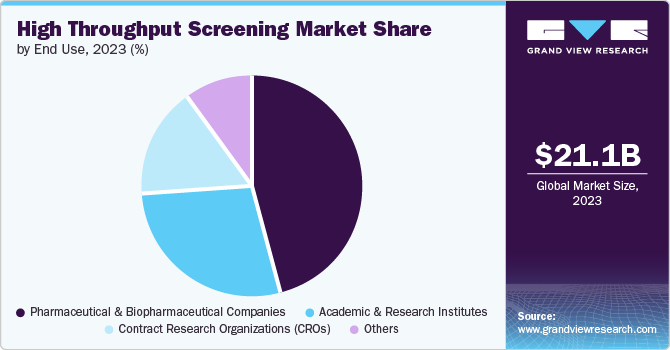

End Use Insights

The pharmaceutical & biopharmaceutical companies contributed the largest share of revenue in 2023. This growth is fueled by heightened competition within the pharmaceutical and biopharmaceutical sectors, resulting in increased outsourced R&D activities and subsequently driving the demand for HTS. The rising cases of chronic diseases like cardiovascular disorders, immunological disorders, metabolic disorders, cancer, and neurological disorders created a pressing need to develop new molecules, consequently amplifying the demand for HTS and significantly boosting the segment growth.

The academic & research institutes segment is anticipated to grow with a CAGR of 11.7% from 2024 to 2030. This growth is driven by the collaborative efforts of these institutes with industry partners. They share resources and expertise to educate and train future technicians and scientists actively engaged in drug delivery and validation projects. HTS technologies and methods enable them to investigate new drug targets, identify potential therapeutic compounds, and study biological pathways. The benefits of HTS are that it increases the demand for this technology in the segment and contributes to significant growth.

Application Insights

Drug discovery programs accounted for 56.0% of the market in 2023. This can be attributed to the rising demand for HTS, which rapidly tests compounds and speeds up the drug discovery process. Pharmaceutical companies are investing more in research and development, leading to increased demand for HTS, particularly in target-based drug discovery. Collaborations and partnerships in the industry are making it easier to acquire HTS technologies, intensifying competition and growth in drug discovery programs.

Biochemical screening is expected to grow fastest, with a CAGR of 11.5% from 2024 to 2030. This growth can be attributed to the increasing number of clinical trials and research and development activities focused on biochemicals, leading to a heightened demand for HTS technology. Furthermore, the rise in demand for precision medicine necessitates biochemical screening, as it enables the identification of pertinent compounds for customized treatments based on individual patient profiles.

Regional Insights

North America dominated the market in 2023 owing to the heightened competition and expanding industries within the region, prompting an increased demand for augmented research and development expenditure, technological progress, and enhanced collaboration among various companies.

U.S. High Throughput Screening (HTS) Market Trends

The U.S. HTS market dominated the North American market with a share of 82.6% in 2023 due to increasing cases of chronic diseases and the growing trend of an open innovation model. Consequently, there has been a rising demand for new and effective drugs, leading to an indirect increase in clinical trials and the overall demand for HTS within the country.

Europe High Throughput Screening (HTS) Market Trends

Europe's HTS market was identified as a lucrative region in 2023. The driving forces behind this are the increasing collaboration and partnership for technological advancement growing the demand for HTS in the region and significantly growing the market.

THE UK HTS market is expected to grow rapidly in the coming years due to the demand for improving the drug discovering process and reducing cost for it, which has led to a rise in the demand for HTS and significantly growing the market in the country.

Asia Pacific High Throughput Screening (HTS) Market Trends

Asia Pacific region is anticipated to witness the fastest growth in the HTS market. With the growth of cases in chronic cases, there is a demand for effective drug development processes, and this has led to an increase in funds for R&D by the industry players and trends of outsourcing drug discovery services led to a rise in demand for HTS and significant growing market in the region.

China's HTS market held a substantial market share in 2023 owing to rising technology advancement and improved efficiency in drug discovery processes, which has led to the rise of the HTS market in the country.

Key High Throughput Screening Company Insights

Some of the key companies operating in the High-Throughput Screening (HTS) market are Danaher Corporation, Tecan Trading AG, Promega Corporation, and many more. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

Key High Throughput Screening Companies:

The following are the leading companies in the high throughput screening market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- Aurora Biomed Inc.

- Tecan Trading AG

- Promega Corporation

- Charles River Laboratories.

- Creative Biolabs.

Recent Developments

-

In April 2024, Metrion Biosciences Limited and Enamine Ltd announced an expansion of Metrion's HTS services by incorporating Enamine's compound libraries. This collaboration enhances Metrion's capabilities in drug discovery and development.

-

In February 2023, PerkinElmer introduced the EnVison Nexus Multimode plate reader to advance research and development endeavors.

High Throughput Screening Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.71 billion

Revenue forecast in 2030

USD 41.67 billion

Growth Rate

CAGR of 10.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products and services, technology, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy; Spain; Denmark; Sweden; Norway; China, Japan, India, South Korea, Australia, Thailand; Brazil, Argentina; Saudi Arabia; UAE; Kuwait, South Africa

Key companies profiled

Agilent Technologies, Inc.; Danaher Corporation; Thermo Fisher Scientific Inc.; PerkinElmer Inc.; Bio-Rad Laboratories, Inc.; Aurora Biomed Inc.; Tecan Trading AG; Promega Corporation; Charles River Laboratories.; Creative Biolabs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Throughput Screening Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the high throughput screening (HTS) market report based on product and services, technology, application, end use, and region:

-

Products and Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumables

-

Reagents & Assay Kits

-

Laboratory Equipment

-

-

Instruments

-

Liquid Handling Systems

-

Detection Systems

-

Other Instruments

-

-

Services

-

Software

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cell-based Assays

-

Fluorometric Imaging Plate Reader Assays

-

Reporter based Assays

-

3D - Cell Cultures

-

2D - Cell Cultures

-

Reporter-based Assays

-

Perfusion Cell Culture

-

-

Lab-on-a-chip Technology (LOC)

-

Label-free Technology

-

Ultra High Throughput Screening

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drug Discovery Programs

-

Chemical Biology Programs

-

Biochemical Screening

-

Cell & Organ-based Screening

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Academic & Research Institutes

-

Contract Research Organizations (CROs)

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.