- Home

- »

- Biotechnology

- »

-

Recombinant Proteins Market Size And Share Report, 2030GVR Report cover

![Recombinant Proteins Market Size, Share & Trends Report]()

Recombinant Proteins Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Cytokines & Growth Factors, Antibodies), By Application (Therapeutics), By End Use, By Host Cell (Mammalian), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-974-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recombinant Proteins Market Summary

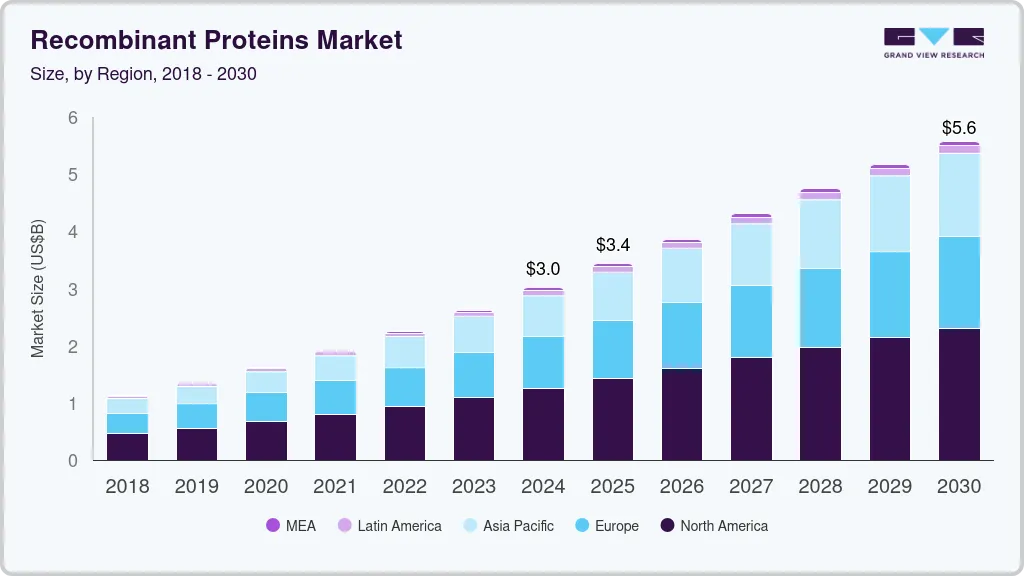

The global recombinant proteins market size was estimated at USD 3.01 billion in 2024 and is projected to reach USD 5.58 billion by 2030, growing at a CAGR of 10.2% from 2025 to 2030. The rising prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders is anticipated to drive market growth.

Key Market Trends & Insights

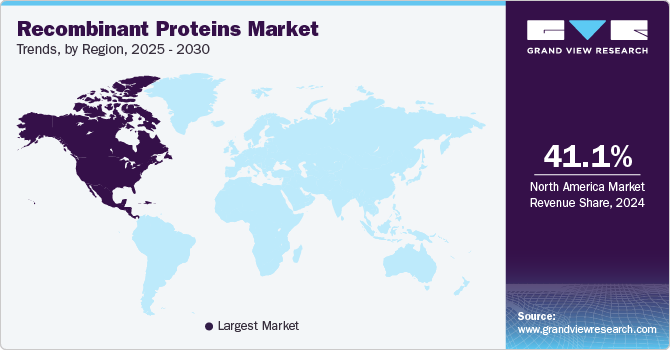

- North America dominated the recombinant proteins market with a share of 41.1% in 2024.

- Recombinant proteins market in the U.S. has emerged as a growing and dynamic sector within the life sciences industry.

- By product, the cytokines & growth factors segment held the largest share of 24.6% of the market in 2024.

- By application, the therapeutics segment dominated the global market with a share of 34.2% in 2024.

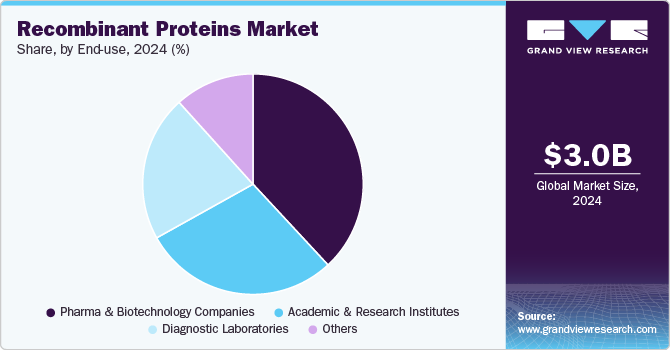

- By end use, the pharma & biotechnology companies segment captured the largest market share of 38.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.01 Billion

- 2030 Projected Market Size: USD 5.58 Billion

- CAGR (2025-2030): 10.2%

- North America: Largest market in 2024

Furthermore, the rising preference for biopharmaceuticals, such as monoclonal antibodies, vaccines, and therapeutic enzymes, are other factors contributing to the growth of the market for recombinant proteins.

The advantages offered by recombinant proteins drive the increasing preference for research over natural proteins. For instance, recombinant proteins can be synthesized with a high protein yield, no animal contaminants, and controlled batch-to-batch variation. Moreover, the amino acid sequences of these proteins can be easily altered, and unnatural amino acids can be incorporated as required. Commonly used recombinant proteins for research applications include growth factors family proteins, such as fibroblast growth factors, vascular endothelial growth factors, and neurotrophins. Similarly, cytokines, such as interferons, chemokines, interleukins, & pro-inflammatory cytokines, and enzymes, such as recombinant proteases, kinases, & nucleases, are used for life sciences research that requires biologically active proteins.

Moreover, as per Global Genes, more than 400 million people around the globe are living with rare genetic diseases. This number explains the dire need for treatments, the betterment of clinical settings, and health awareness. Advanced research and knowledge of drug-targeting mechanisms are crucial tools for medicine development. Many regions have developed biobanks from cohort programs to provide researchers with high-quality samples for revolutionizing treatment efforts. This can result in an increased focus on discovering biomarkers for various conditions. For instance, in September 2024, the U.S. Food and Drug Administration (FDA) granted approval for isatuximab-irfc (Sarclisa), developed by Sanofi-Aventis U.S. LLC, to be used in combination with bortezomib, lenalidomide, and dexamethasone. This treatment is specifically indicated for adults diagnosed with newly diagnosed multiple myeloma who are not candidates for autologous stem cell transplantation.

Key market players in the recombinant proteins marketspace are investing in their R&D programs to increase research productivity and grow their offerings for revenue generation. For instance, in 2023, Merck & Co. significantly increased its investment in research and development, allocating over USD 30 billion. This is more than twice the company's R&D expenditure of USD13.5 billion in 2022. Such instances are expected to support the growth of R&D activities further and demonstrate the vision of companies to deliver a difference to patients. Such initiatives by companies will likely supplement the market growth in the coming years.

The COVID-19 pandemic fueled the research and development race to find treatments and diagnostic tools for the SARS-CoV2 virus. Recombinant technology played a major role during the initial phase, resulting in many recombinant proteins-based COVID-19 vaccines entering the market with emergency use approval. For instance, in December 2021, WHO issued a 9th COVID-19 vaccine for emergency use listing (EUL). This EUL allowed vaccination access in low and middle-income countries such as Turkey, Colombia, Argentina, Mexico, Poland, South Africa, Iran, Ukraine, and others. Similarly, in June 2022, The Drugs Controller General of India (DCGI) approved the Covovax vaccine from the Serum Institute of India (SII) for children aged 7 to 12 years, a recombinant protein-based vaccine.

Intense efforts are being taken by multiple players for therapeutics via accelerated cycles of innovation to bring breakthroughs to patients faster. Furthermore, the demand for effective, efficient, and safe drugs enhanced the popularity of biopharmaceuticals. Moreover, the need for developing a COVID-19 vaccine on a large scale in minimal time, along with its continuous commercial manufacturing activities, had a positive impact and encouraged biologics-based research activities and eventually supported the recombinant proteins market growth.

Product Insights

The cytokines & growth factors segment held the largest share of 24.6% of the market in 2024. This segment is anticipated to grow exponentially throughout the forecast period. This is a result of its extensive use in the fields of cancer, HIV/AIDS, COVID-19, immunology, and neuroscience, among others. Furthermore, growth factors and cytokines play a significant role in cancer research. Studies regarding the use of growth factors in cancer treatment have improved understanding and given rise to new goals for chemotherapy. Additionally, the need for recombinant protein products in regenerative medicine and rising financing for research & development in the fight against cancer are driving up demand globally.

The antibodies segment is expected to witness significant growth during the forecast period. Recombinant antibodies are extensively used in diagnostic assays, including ELISA, western blotting, and immunohistochemistry. Their high specificity and sensitivity make them ideal for detecting biomarkers and disease-related antigens. This has driven their demand for diagnostic applications, particularly for diseases like cancer, infections, and autoimmune disorders.

Application Insights

The therapeutics segment dominated the global market with a share of 34.2% in 2024. The demand for protein-based treatment is anticipated to rise as the prevalence of diseases such as metabolic disorders, cancer, genetic disorders, and immune diseases rises. Additionally, cancer is one of the leading causes of mortality globally, and the World Health Organization (WHO) predicts a large rise in cancer cases in the coming years. As a result, it is projected that the market for therapeutics will experience growth.

The drug discovery & development segment is anticipated to grow significantly during the forecast period. Protein therapeutics offer highly effective treatments for illnesses like diabetes, cancer, infectious disorders, hemophilia, and anemia. As per the International Diabetes Federation, there will be 643 million diabetics worldwide by 2030 and 783 million by 2045. With such growth in the diabetic population, the demand for the development of effective recombinant proteins is likely to show growth in the coming years.

End Use Insights

The pharma & biotechnology companies segment captured the largest market share of 38.1% in 2024. The inclination towards biologics and biosimilars has resulted in a cascade of multi-million investments by bio-manufacturers in R&D to grow the pipeline of products, devise new technologies, and advance bioprocessing tools. The increasing market demand, rising competition among players, and various applications by end users have also contributed to advancements in recombinant protein products.

The academic & research institutes segment is expected to grow significantly over the forecast period. The R&D sector also witnessed increased investments in terms of collaboration & partnerships between academia and industries. For example, Pfizer’s Center for Therapeutic Innovation (CTI) is a platform for collaboration within the healthcare ecosystem. CTI actively collaborates with academic institutes and investigators to tackle the challenges using Pfizer’s concepts. Collaborations like these fuel drug development research and potential therapies for patients, eventually propelling market growth.

Host Cell Insights

The mammalian segment held the largest revenue share of 42.1% of recombinant proteins market in 2024. Mammalian protein expression is becoming increasingly in demand as the market for proteomics & biologics expands. Since they are provided easily, protein expression systems are simple to include in high throughput systems for effective biologics and proteomics investigations.Moreover, the focus on producing biopharmaceutical goods has increased due to factors such as the rising incidence and prevalence of cancer and rising research and development (R&D) efforts, which drive the market's expansion.

The bacterial cells segment is expected to show a lucrative growth rate from 2025 to 2030. The use of bacterial cells as host cells in biotechnology and research has significantly increased. Bacterial cells, mainly Escherichia coli (E. coli), are favorable for protein expression due to their rapid growth, well-characterized genetics, and ease of handling. The growing demand for a wide range of applications, such as drug development and antibodies, is anticipated to propel the growth of bacterial cells over the forecast period.

Regional Insights

North America dominated the recombinant proteins market with a share of 41.1% in 2024 due to rising research spending, the availability of healthcare infrastructure, and several significant market players. In addition, recombinant proteins are one of the tested treatments for such disorders, therefore, the chronic diseases spreading throughout the region are producing a big demand for recombinant protein therapies.

U.S. Recombinant Proteins Market Trends

Recombinant proteins market in the U.S. has emerged as a growing and dynamic sector within the life sciences industry. This growth can be attributed to the expansion of biotechnology, which creates the demand for highly purified and well-characterized proteins for research purposes. The market is further fueled by the pharmaceutical & biopharmaceutical sectors, where protein-based therapies and drug development continue to gain prominence.

Europe Recombinant Proteins Market Trends

The Europe Recombinant Proteins Market is growing interest & investment in biopharmaceuticals necessitates a thorough understanding of protein structures & functions. Recombinant proteins are fundamental in research, fueling their demand in Europe.

The Recombinant proteins market in the UK held a significant share in 2024. Key industry players invest strategically in the UK to capitalize on the expanding biopharmaceutical domain. For instance, in March 2023, the UK government announced plans to allocate USD 295.35 million (£277 million) to support manufacturing projects in medical diagnostics & human medicines of four life sciences companies in the UK. This funding is a combination of government support & private investment aimed at enhancing the manufacturing & innovation capabilities of the UK life sciences sector. These developments are expected to drive market growth within the UK.

Germany recombinant proteins market is anticipated to grow significantly over the forecast period. The growing collaboration among organizations to enhance research studies in Germany propels recombinant proteins market growth.

Asia Pacific Recombinant Proteins Market Trends

The recombinant proteins market in the Asia Pacific is expanding due to increased public and private funding for research and development for recombinant protein studies, favorable government regulations, and the rising prevalence of target diseases with an aging population. In addition, developing advanced techniques in proteomic and genomic research propels the market growth in Asia Pacific.

The recombinant proteins market in China is anticipated to witness exponential growth over the forecast period. This can be attributed to the rising investments in stem cell and cancer research from government & private organizations. These investments help develop infrastructure for academic and research institutes by using the latest technologies.

Japan recombinant proteins market is the largest market in Asia Pacific region and it is expected to exhibit high growth over the forecast period. Increasing clinical research studies and collaborative strategic initiatives are anticipated to propel market growth in Japan.

MEA Recombinant Proteins Market Trends

Middle East and African countries have a very low global market share due to a lack of awareness, infrastructure, and skilled personnel in these regions. Saudi Arabia’s market is anticipated to grow significantly over the forecast period owing to increasing awareness and ongoing economic development.

Saudi Arabia's Recombinant proteins market is expected to grow over the forecast period. The growth of Saudi Arabia's market can primarily be attributed to various initiatives undertaken by the government to expand the biotechnology sector in the country.

The Recombinant proteins market in UAE is anticipated to grow moderately over the forecast period. Rising investments by academic & research institutes to perform biopharmaceutical research are expected to boost the regional market in the coming years.

Key Recombinant Proteins Company Insights

Key players in the recombinant proteins market are implementing various strategies, including partnerships through mergers and acquisitions, geographical expansion, and strategic collaborations to expand their market presence.

Key Recombinant Proteins Companies:

The following are the leading companies in the recombinant proteins market. These companies collectively hold the largest market share and dictate industry trends.

- Sino Biological, Inc.

- Bio-Techne

- GenScript

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Thermo Fisher Scientific

- Proteintech Group, Inc.

- Enzo Life Sciences, Inc.

- Abnova Corporation

- RayBiotech Life Inc.

- STEMCELL Technologies Inc.

Recent Development

-

In September 2024, ScaleReady and Bio-Techne Corporation announced the launch of the G-Rex optimized ProPakTM GMP Cytokines, ideally tailored to high-efficiency closed system cell and gene-modified cell therapy manufacturing.

-

In March 2024, Proteintech, announced the opening of its new state-of-the-art facility, including laboratory and office space in the UK. The new building houses research and development, production, logistics, and administration in an area more than three times larger than its previous space.

-

In August 2023, Danaher Corporation announced that it had signed a definitive contract to acquire Abcam Plc. Under the terms of the agreement, Danaher will acquire all of Abcam's outstanding shares for USD 24.00 per share in cash, for a total company value of approximately USD 5.7 billion, including assumed indebtedness along with net of acquired cash.

-

In January 2023, Thermo Fisher Scientific Inc. completed the acquisition of PeproTech. PeproTech will provide a strategic fit for the company’s biosciences business, allowing it to better serve pharma and biotech customers by adding new capabilities to its existing portfolio.

Recombinant Proteins Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.43 billion

Revenue forecast in 2030

USD 5.58 billion

Growth rate

CAGR of 10.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, host cell, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE.

Key companies profiled

Sino Biological, Inc.; R&D Systems, Inc.; GenScript; Bio-Rad Laboratories, Inc.; Merck KGaA; Thermo Fisher Scientific; Proteintech Group, Inc.; Enzo Life Sciences, Inc.; Abnova Corporation; RayBiotech Life Inc.; STEMCELL Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Recombinant Proteins Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2020 to 2030. For this report, Grand View Research has segmented the recombinant proteins market based on product, application, end use, host cell, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cytokines & Growth Factors

-

Interferons (IFNs)

-

Interleukins (ILs)

-

Others

-

-

Antibodies

-

Immune checkpoint proteins

-

Virus Antigens

-

Enzymes

-

Kinases

-

Metabolic enzymes

-

Others

-

-

Recombinant Regulatory Protein

-

Hormones

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Development

-

Therapeutics

-

Biologics

-

Vaccines

-

Cell & Gene Therapies

-

Others

-

-

Research

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharma & Biotechnology Companies

-

Academic & Research Institutes

-

Diagnostic Laboratories

-

Others

-

-

Host Cell Outlook (Revenue, USD Million, 2018 - 2030)

-

Mammalian systems

-

Insect Cells

-

Yeast & Fungi

-

Bacterial Cells

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global recombinant proteins market size was estimated at USD 3.02 billion in 2024 and is expected to reach USD 3.43 billion in 2025.

b. The global recombinant proteins market is expected to grow at a compound annual growth rate of 10.20% from 2025 to 2030 to reach USD 5.58 billion by 2030.

b. On the basis of products, the cytokines & growth factors segment held the highest share of the market in 2024. This segment is anticipated to grow exponentially throughout the forecast period. This is a result of its extensive use in the fields of cancer, HIV/AIDS, COVID-19, immunology, and neuroscience, among others.

b. Some key players operating in the recombinant proteins market include Sino Biological, Inc., Bio-Techne, GenScript, Bio-Rad Laboratories, Inc., Merck KGaA, Thermo Fisher Scientific, Proteintech Group, Inc., Enzo Life Sciences, Inc., Abnova Corporation, RayBiotech Life Inc., and STEMCELL Technologies Inc.

b. Key factors that are driving the market growth include the rising prevalence of chronic diseases like cancer, diabetes, and autoimmune disorders. Furthermore, the rising preference for biopharmaceuticals, such as monoclonal antibodies, vaccines, and therapeutic enzymes, are other factors contributing to the growth of the market for recombinant proteins.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.