- Home

- »

- Biotechnology

- »

-

Synthetic Biology Market Size & Share, Industry Report, 2033GVR Report cover

![Synthetic Biology Market Size, Share & Trends Report]()

Synthetic Biology Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Enzymes, Cloning Technologies Kits), By Technology (PCR, NGS), By Application (Healthcare), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-182-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Synthetic Biology Market Summary

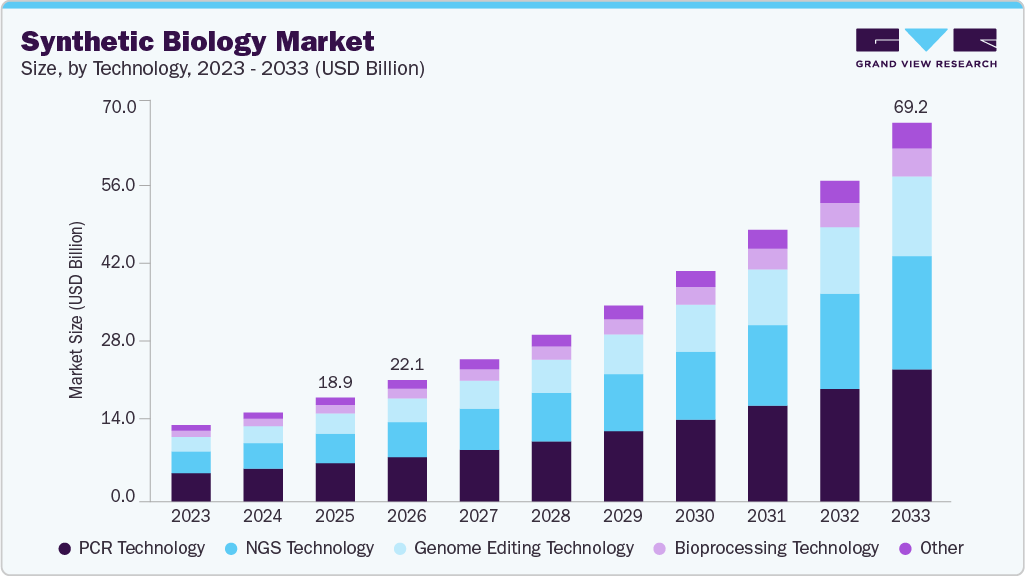

The global synthetic biology market size was estimated at USD 18.94 billion in 2025 and is projected to reach USD 69.18 billion by 2033, growing at a CAGR of 17.7% from 2026 to 2033. Emerging applications of synthetic biology in areas such as multiplexed diagnostics, cellular recording, and therapeutic genome editing are projected to lead to a substantial rise in demand for synthetic products over the forecast period.

Key Market Trends & Insights

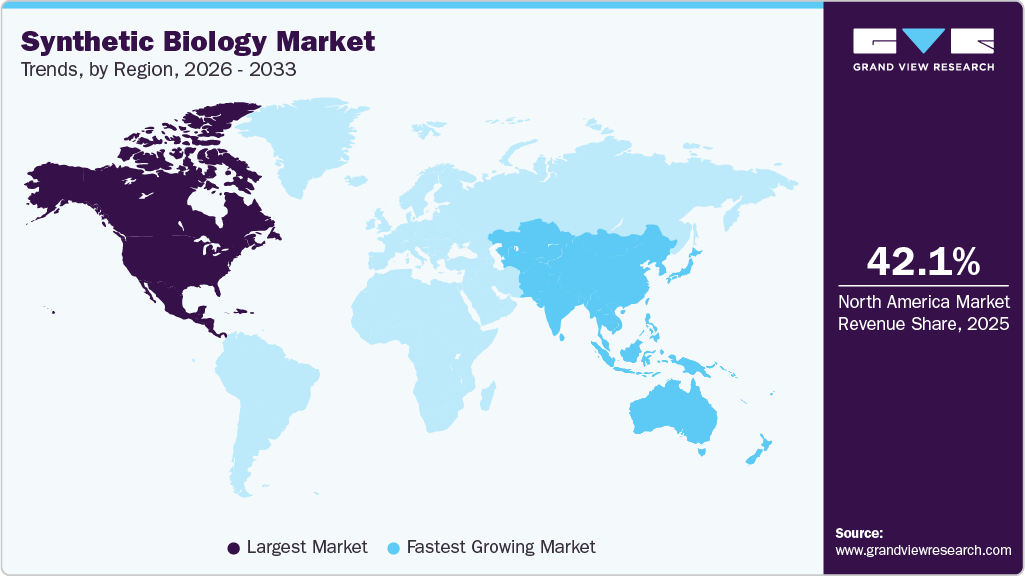

- The North America synthetic biologymarket held the largest share of 42.10% of the global market in 2025.

- The synthetic biology industry in the U.S. is expected to grow significantly over the forecast period.

- By technology, the PCR technology segment held the highest market share of 30.91% in 2025.

- By product, the enzymes segment held the largest market share in 2025.

- By application, the healthcare segment is anticipated to grow at the fastest CAGR over the forecast period.

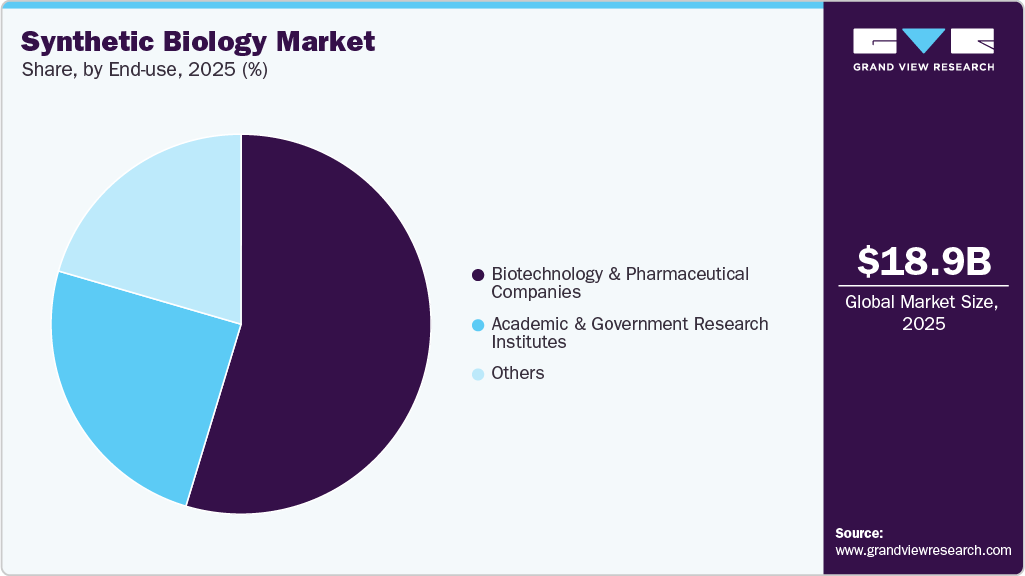

- By end use, biotechnology and pharmaceutical companies segment dominated the 2025.

Market Size & Forecast

- 2025 Market Size: USD 18.94 Billion

- 2033 Projected Market Size: USD 69.18 Billion

- CAGR (2026-2033): 17.7%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Furthermore, the integration of synthetic biology-based products and techniques into sectors such as energy and chemicals is likely to boost overall market growth. As these applications diversify further, the utility of synthetic biology is expected to increase, promoting further adoption and market growth.

Advanced Genetic Engineering Technologies

Technological progress in genetic engineering remains a primary growth driver for the synthetic biology market, fundamentally reshaping how biological systems are designed, engineered, and commercialized. Breakthroughs in gene editing tools, most notably CRISPR-Cas systems, along with zinc finger nucleases and TALENs, have significantly enhanced the precision, speed, and efficiency of DNA modification. These technologies enable targeted genome alterations with reduced error rates, supporting reliable development of engineered organisms for therapeutic, industrial, and agricultural applications. As a result, synthetic biology workflows have transitioned from experimental research toward scalable and commercially viable solutions.

Parallel advancements in DNA sequencing, synthesis, and assembly technologies have further strengthened market momentum. The rapid decline in sequencing and synthesis costs has improved accessibility for startups and established players alike, enabling high-throughput experimentation and faster design-build-test-learn (DBTL) cycles. Automated platforms standardized biological parts, and modular genetic circuits have reduced development timelines while improving reproducibility. This has accelerated innovation across applications such as enzyme engineering, metabolic pathway optimization, cell-based therapies, and synthetic vaccines, reinforcing synthetic biology’s role as a core enabling technology across life sciences.

In addition, the integration of computational tools, artificial intelligence (AI), and bioinformatics with genetic engineering has significantly enhanced predictive design and optimization capabilities. AI-driven modeling allows companies to simulate genetic modifications, predict functional outcomes, and optimize biological systems before physical experimentation, reducing R&D risk and cost. Combined with advanced bioprocessing and scalable fermentation technologies, these innovations support an efficient transition from laboratory-scale research to industrial-scale production. Collectively, ongoing technological advancements in genetic engineering continue to expand the commercial scope of synthetic biology, positioning it as a critical driver of innovation, competitiveness, and long-term growth across healthcare, industrial biotechnology, and sustainable manufacturing sectors.

AI-Driven Bioengineering and Digital Design

The integration of digital tools and AI-assisted design is emerging as a critical driver of growth in the synthetic biology market, significantly improving efficiency, accuracy, and scalability across development workflows. Advanced bioinformatics platforms, machine learning algorithms, and cloud-based modeling tools enable rapid analysis of complex biological data, supporting rational design of genetic circuits, metabolic pathways, and engineered organisms. These digital capabilities streamline the design-build-test-learn (DBTL) cycle, reducing experimental iterations and shortening development timelines for synthetic biology products.

AI-driven predictive modeling further enhances decision-making by forecasting gene expression outcomes, protein functionality, and system-level behavior before laboratory validation. This reduces R&D costs and technical risk while improving success rates in applications such as therapeutic development, enzyme optimization, and bio-based chemical production. As digital automation and data-driven design become more deeply embedded in synthetic biology platforms, companies gain greater scalability, reproducibility, and competitive advantage, reinforcing the market’s transition from research-centric innovation to commercially scalable biomanufacturing solutions.

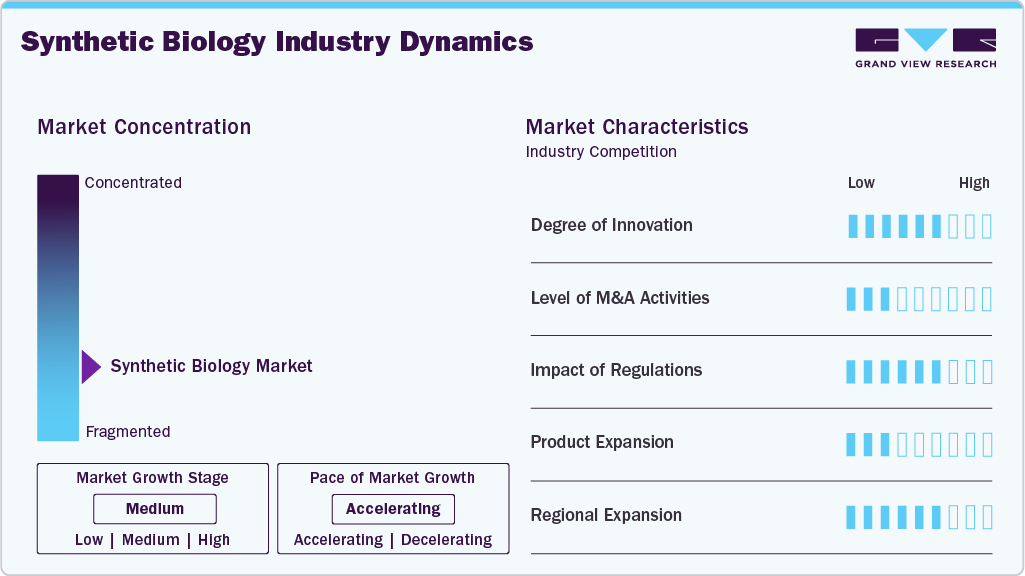

Market Concentration & Characteristics

Innovation intensity in the synthetic biology industry remains moderate, supported by continuous advancements in gene editing technologies, declining DNA synthesis and sequencing costs, and increasing integration of AI-driven design tools. While leading players maintain strong R&D pipelines and proprietary platforms, high capital requirements, regulatory complexity, and scalability challenges temper the pace of disruptive innovation. As a result, innovation is largely incremental and platform-focused, with emphasis on improving efficiency, reproducibility, and commercialization potential across established and emerging applications.

The synthetic biology industry has witnessed a low to moderate level of mergers and acquisitions, primarily driven by established life science companies aiming to acquire specialized technologies, proprietary platforms, and technical expertise. M&A activity remains selective and strategic, focused on enhancing capabilities in gene editing, digital bio-design, and scalable biomanufacturing rather than large-scale market consolidation.

Regulatory frameworks play a significant role in shaping the synthetic biology industry by influencing product development timelines, commercialization strategies, and market entry. Stringent biosafety, biosecurity, and ethical guidelines govern the use of genetically engineered organisms, particularly in healthcare, agriculture, and environmental applications. While clear regulatory pathways support responsible innovation and build stakeholder confidence, regulatory complexity and regional variability can increase compliance costs and slow adoption, impacting overall market growth.

Product expansion in the synthetic biology market is expected to grow moderately, driven by steady innovation in DNA synthesis, gene editing tools, engineered enzymes, and bio-based production platforms. Companies are selectively expanding portfolios to address healthcare, industrial biotechnology, agriculture, and sustainable materials. The focus on modular, scalable, and application-specific solutions supports broader adoption while balancing high R&D costs, regulatory requirements, and commercialization timelines.

Regional expansion in the synthetic biology market is experienced moderate growth, supported by strong adoption in North America and Europe and growing investments across Asia Pacific. Companies selectively entered new regions through partnerships, pilot manufacturing facilities, and localized distribution to manage regulatory complexity and cost risks. Overall, regional expansion is expected to grow steadily as regulatory clarity improves and global demand for bio-based solutions increases.

Product Insights

The enzymes segment dominated the market in 2025 with a share of 36.78%.Enzymes play essential role in various biotechnological processes, including DNA manipulation, protein engineering, and metabolic pathway construction. Enzymes are crucial for applications in pharmaceuticals, agriculture, and biofuels, driving demand for efficient and specific biocatalysts. Their versatility allows for innovations in gene editing and synthetic pathways, making them indispensable in research and industrial applications. In addition, advancements in enzyme engineering and production technologies have enhanced performance and reduced costs, further solidifying their market position. As synthetic biology continues to expand, the reliance on enzymes for diverse applications is expected to grow.

The cloning technologies kits segment is expected to experience the fastest CAGR of 18.8% during the forecast period. These kits streamline the processes of gene insertion, amplification, and modification, making them accessible to both research and commercial applications. The rise of personalized medicine and synthetic biology-driven innovations fuels the need for efficient cloning solutions. Moreover, the growing interest in synthetic organisms and bioengineering projects accelerates adoption. As researchers and companies seek faster, more reliable methods for gene cloning, this segment is expected to experience significant growth in the coming years.

Technology Insights

The PCR segment accounted for the largest market share of 30.21% in 2025, and this trend is expected to persist during the forecast period. Polymerase Chain Reaction (PCR) has become a pivotal technology for the detection and analysis of specific gene sequences. Products such as Real-time PCR assays offer high sensitivity and specificity, making them the preferred choice for numerous genomic studies. This technique finds extensive applications in areas such as DNA cloning, forensic research, and genomics.

The genome editing technology is projected to experience substantial growth at a significant CAGR from 2026 to 2033. The expansion of gene-editing tools can be attributed to various advantages offered by synthetic and genetically modified organisms. The capability of gene editing techniques to create products with specific traits has transformed multiple sectors, including human and animal healthcare, as well as agriculture. As these technologies continue to evolve, their impact on research and development is expected to grow even further.

Application Insights

The healthcare segment led the synthetic biology market in 2025, driven by its crucial role in developing advanced therapies and diagnostics. Innovations in gene editing, personalized medicine, and biopharmaceuticals expanded treatment options for chronic, genetic, and rare diseases, enabling precise interventions and improved efficacy. Strong R&D investments, strategic collaborations, and adoption of cell and gene therapies, engineered biologics, and synthetic vaccines further reinforced its market position. Regulatory support for innovative treatments and growing demand for customized healthcare solutions also contributed to growth, establishing the healthcare sector as a key driver of the synthetic biology market expansion.

The non-healthcare segment is projected to grow at a significant CAGR from 2026 to 2033, due to increasing applications in industries such as agriculture, energy, and materials. Innovations in synthetic biology enable the development of biofuels, sustainable bioplastics, and crop enhancement solutions, driving demand for eco-friendly alternatives. As companies seek to reduce environmental impact and improve efficiency, investments in synthetic biology techniques are expected to rise. This trend reflects a broader commitment to sustainability and resource optimization across various sectors.

End Use Insights

The biotechnology and pharmaceutical companies segment captured the largest revenue share of 54.70% in 2025, driven by its central role in advancing medical innovations and therapeutic solutions. These companies utilize synthetic biology to develop cutting-edge treatments such as gene therapies, monoclonal antibodies, and personalized medicine, targeting complex and rare diseases. Substantial investments in research and development have accelerated the discovery of novel biologics, optimized drug delivery systems, and enhanced therapeutic efficacy. Moreover, strategic collaborations and partnerships have facilitated faster translation of synthetic biology research into commercially viable products, reinforcing the segment’s dominance and its critical contribution to the growth of the overall market.

Furthermore, the academic and research institutes segment is anticipated to grow at a significant CAGR from 2026 to 2033, due to their essential role in driving innovation and discovery. These institutions are at the forefront of research, exploring new applications in gene editing, synthetic genomes, and metabolic engineering. Increased funding and collaboration with industry partners enhance their capabilities, leading to groundbreaking advancements. As the demand for novel biotechnological solutions rises, academic and research institutes will play a crucial role in shaping the future of synthetic biology.

Regional Insights

North America synthetic biology market accounted for the largest market share of 42.10% in 2025, driven by strong investment from both public and private sectors, including significant funding from venture capital and government initiatives. The region's robust research infrastructure, with leading universities and research institutions, accelerates technological advancements. Moreover, a growing demand for sustainable solutions in agriculture, healthcare, and energy encourages the development of synthetic biology applications.

U.S. Synthetic Biology Market Trends

The synthetic biology market in the U.S. is expected to expand in the near future due to the presence of key market players in this country. Furthermore, the presence of leading universities and research institutions fosters innovation and collaboration. A robust regulatory environment encourages biotechnological advancements while addressing safety and ethical concerns. The growing interest in personalized medicine and bio-based products reflects changing consumer preferences, which can contribute to the market growth in the U.S.

Europe Synthetic Biology Market Trends

The synthetic biology market in Europe is experiencing significant growth. Strong public funding and investment from the European Union promote research and innovation. A focus on sustainability and environmental regulations encourages the development of eco-friendly solutions across industries, particularly in agriculture and energy. Europe's well-established academic institutions facilitate collaboration and knowledge sharing. The region's diverse regulatory landscape fosters innovation while ensuring safety, and strategic partnerships among academia, industry, and startups create a vibrant ecosystem for market growth.

The synthetic biology market in the UK held a significant share in 2025. Strong government support, including funding initiatives such as the Biotechnology and Biological Sciences Research Council (BBSRC), is fueling the market. Furthermore, growing scientific awareness and interest in bio-based products in the country is expected to boost the market over the forecast period.

France synthetic biology market is expected to grow remarkably over the forecast period. The French government encourages research and innovation in life sciences through funding initiatives, tax breaks, and infrastructure improvements. This backing boosts investments in areas such as biotechnology, genomics, and personalized medicine, leading to a heightened interest in synthetic biology within these sectors.

The synthetic biology market in Germany is anticipated to grow significantly over the forecast period. The nation has significant investments in biotechnology and a solid research infrastructure. Its emphasis on creating innovative therapies, combined with ample public and private funding, is fuelling the demand for synthetic biology products across various biomedical applications.

Asia Pacific Synthetic Biology Market Trends

The Asia Pacific synthetic biology market is projected to grow at the fastest CAGR of 19.3% over the forecast period. Countries in the Asia Pacific region, including India, China, South Korea, and Japan are witnessing significant industrialization and economic growth, driving demand across various sectors, particularly in pharmaceuticals and biotechnology, both of which increasingly utilize synthetic biology. Major investments from governments and private companies in healthcare infrastructure, pharmaceutical research, and life sciences are boosting the need for synthetic biology solutions.

The synthetic biology market in China is expected to grow over the forecast period. The Chinese government is actively fostering the expansion of its domestic pharmaceutical industry, which includes significant developments in synthetic biology. These initiatives are leading to increased funding for research and development, which is positively impacting the synthetic biology market as a whole. Furthermore, China's aging population is driving a higher demand for treatments for chronic diseases, creating a greater reliance on innovative solutions. This rising need for effective therapies is expected to significantly enhance the growth of the synthetic biology market, as companies focus on developing advanced approaches to meet these healthcare challenges.

Japan synthetic biology market is witnessing significant growth over the forecast period. The synthetic biology market in Japan is experiencing rapid growth, fueled by a rising demand for gene therapies and innovative treatments. Major companies are investing in cutting-edge technologies and facilities to improve production efficiency and scalability. These advancements are establishing Japan as a key center for synthetic biology innovation and the development of biopharmaceuticals.

MEA Synthetic Biology Market Trends

The MEA synthetic biology marketis projected to grow significantly over the forecast period. This expansion is driven by advancements in gene therapy and an increasing emphasis on addressing rare diseases. Enhanced funding from both public and private sectors, along with collaborative research initiatives, is creating a robust ecosystem for innovation. As regulatory frameworks continue to evolve, the region is expected to see a rise in companies offering cutting-edge biomanufacturing solutions.

Saudi Arabia synthetic biology market is set to expand in line with Vision 2033, which prioritizes biotechnology as a key sector. Significant investments in research facilities and partnerships with international companies are strengthening local capabilities. Furthermore, the country's strategic location provides access to emerging markets in the region, further enhancing its manufacturing potential.

The synthetic biology market in Kuwait is also anticipated to grow, driven by increased investments in biotechnology and gene therapy research. Government initiatives aimed at promoting advanced medical technologies, along with collaborations with international research institutions, are bolstering local capabilities and positioning Kuwait as an emerging player in the regional synthetic biology landscape.

Key Synthetic Biology Company Insights

The synthetic biology market is characterized by a highly competitive and innovative-driven landscape, comprising a mix of established life science conglomerates and agile, technology-focused startups. Leading players leverage strong R&D capabilities, proprietary platforms, and extensive intellectual property portfolios to maintain market presence. Large multinational companies benefit from diversified product offerings across reagents, enzymes, DNA synthesis, and bioprocessing tools, enabling them to capture significant revenue share while supporting end-to-end synthetic biology workflows. Their global distribution networks and long-standing relationships with pharmaceutical, biotechnology, and industrial clients further strengthen market penetration.

Mid-sized and emerging synthetic biology companies play a critical role in driving technological disruption and niche innovation. These firms often focus on specialized applications such as cell and gene therapy enablement, metabolic engineering, sustainable materials, and next generation biomanufacturing. By adopting platform-based business models and leveraging AI-driven design, automation, and cloud-enabled biofoundries, these players accelerate product development and commercialization. Strategic differentiation through proprietary strains, engineered pathways, or application-specific solutions allows them to gain traction despite competing with larger incumbents.

Market share dynamics are strongly influenced by strategic collaborations, mergers and acquisitions, and long-term partnerships across the value chain. Leading companies actively engage in alliances with pharmaceutical manufacturers, agricultural firms, chemical producers, and academic institutions to expand application reach and de-risk innovation. Acquisitions of synthetic biology startups by established life science companies are increasingly common, enabling rapid access to novel technologies, talent, and intellectual property. These inorganic growth strategies not only consolidate market share but also accelerate the integration of synthetic biology into mainstream industrial and healthcare applications.

Geographically, North America holds a dominant share of the synthetic biology market, supported by strong funding ecosystems, advanced research infrastructure, and favorable commercialization pathways. Europe follows with robust academic-industry collaboration and increasing emphasis on sustainable biomanufacturing, while Asia Pacific is emerging as a high-growth region due to expanding biotechnology investments, government support, and rising demand for bio-based products. Overall, competitive intensity remains high, with market leadership shaped by technological innovation, scalability of platforms, and the ability to translate synthetic biology research into commercially viable, large-scale solutions.

Key Synthetic Biology Companies:

The following are the leading companies in the synthetic biology market. These companies collectively hold the largest market share and dictate industry trends.

- Bota Biosciences Inc.

- Codexis, Inc.

- Creative Biogene.

- Creative Enzymes.

- Enbiotix, Inc.

- Illumina, Inc.

- Merck Kgaa (Sigma-Aldrich Co. Llc)

- New England Biolabs

- Eurofins Scientific

- Novozymes

- Pareto Bio, Inc.

- Scarab Genomics, Llc

- Synthego

- Synthetic Genomics Inc.

- Thermo Fisher Scientific, Inc.

Recent Developments

-

In September 2025, Maravai LifeSciences, completed the acquisition of Officinae Bio’s DNA and RNA business in Italy. The integration of AI-driven mRNA design with Maravai’s manufacturing capabilities to accelerate nucleic acid therapeutic development.

-

In September 2025, Elegen launched ENFINIA IVT Ready DNA in the U.S., delivering high-fidelity linear DNA templates with poly(A) tails up to 3× faster, accelerating mRNA therapeutic development and reducing plasmid-related bottlenecks.

-

In January 2025, Illumina, Inc. announced a collaboration with NVIDIA to enhance technology platforms for multi-omic data analysis and interpretation, driving advancements in clinical research, genomics AI development, and drug discovery.

Synthetic Biology Market Report Scope

Attribute

Details

Market size value in 2026

USD 22.15 billion

Revenue forecast in 2033

USD 69.18 billion

Growth rate

CAGR of 17.7% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MAE

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bota Biosciences Inc.; Codexis Inc.; Creative Biogene; CREATIVE ENZYMES; Enbiotix, Inc.; Illumina, Inc.; Merck KGaA (Sigma-Aldrich Co. LLC); New England Biolabs; Eurofins Scientific; Novozymes; Pareto Bio, Inc.; Scarab Genomics, LLC; Synthego; Synthetic Genomics Inc.; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Synthetic Biology Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the synthetic biology market on the basis of product, technology, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Oligonucleotide/Oligo Pools and Synthetic DNA

-

Enzymes

-

Cloning Technologies Kits

-

Xeno-Nucleic Acids

-

Chassis Organism

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

NGS Technology

-

PCR Technology

-

Genome Editing Technology

-

Bioprocessing Technology

-

Other Technologies

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare

-

Clinical

-

Bio/Pharmaceuticals

-

Diagnostics

-

-

Non-Clinical

-

-

Non-healthcare

-

Biotech Crops

-

Specialty Chemicals

-

Bio-fuels

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biotechnology and Pharmaceutical companies

-

Academic and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global synthetic biology market size was estimated at USD 18.94 billion in 2025 and is expected to reach USD 22.15 billion in 2026.

b. The global synthetic biology market is expected to grow at a compound annual growth rate of 17.7% from 2026 to 2033 to reach USD 69.18 billion by 2033.

b. The enzymes segment dominated the market in 2025 with a share of 36.78% as enzymes play an essential role in various biotechnological processes, including DNA manipulation, protein engineering, and metabolic pathway construction.

b. Some key players operating in the synthetic biology market include Bota Biosciences; Codexis, Inc.; Creative Biogene; Creative Enzymes; EnBiotix, Inc.; Eurofins Scientific; Illumina; Merck KGaA; New England Biolabs; Novozymes; Pareto Biotechnologies, Inc.; Scarab Genomics ; Synthego ; Synthetic Genomics; Thermo Fisher Scientific Inc.

b. Key factors driving the synthetic biology market growth include the emerging applications of synthetic biology in areas such as multiplexed diagnostics, cellular recording, and therapeutic genome editing, which are projected to lead to a substantial rise in demand for synthetic products over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.