- Home

- »

- Digital Media

- »

-

Electronic Design Automation Software Market Report, 2030GVR Report cover

![Electronic Design Automation Software Market Size, Share & Trends Report]()

Electronic Design Automation Software Market Size, Share & Trends Analysis Report By Product, By Deployment, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-073-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global electronic design automation software market size was valued at USD 11.10 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 9.1% from 2023 to 2030. The market for Electronic Design Automation (EDA) software is witnessing a growth in demand owing to the ability of EDA software to reduce the cost & time associated with the electronic design circuit and eliminate manual errors. Furthermore, the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) techniques in tools for addressing complex design issues and reducing costs is anticipated to propel the growth of the EDA software market in the forecast period.

The growing adoption of smart wearable devices, smartphones, and smart speakers, coupled with the rising preference for connected homes and connected devices, is expected to drive the Electronic Design Automation (EDA) software market growth over the forecast period. Similarly, the continued emergence of autonomous and electric vehicles has also been driving the development of the market, as a modern car is estimated to have 1,500 to 3,000 semiconductors.

Companies in the EDA software market are trying to strengthen their foothold by introducing innovative and advanced product features. For instance, in June 2022, Keysight Technologies launched a new design and simulation software for RF and microwave designers. This design and simulation software can rapidly address complex designs and higher frequencies in the microwave and RF industry.

The rising demand for advanced electronic components to improve the operational efficiency of electronic devices creates a favorable environment for electronic design automation software industry growth. Companies operating in the EDA software market are adopting various business strategies such as integrating advanced technologies in the EDA tools to improve their brand identity.

For instance, in March 2023, Synopsys introduced Synopsis.ai, an AI-driven, full-stack Electronic Design Automation (EDA) suite for chip manufacturers. The integrated AI-driven engine assists chip manufacturers in minimizing production costs without compromising the silicon quality and boosts engineering productivity, supporting the Electronic Design Automation (EDA) software market growth.

Governments of various countries such as India, China, Brazil, Canada, Australia, Saudi Arabia, and France, among others, are undertaking supportive initiatives for the electronics industry to encourage digitization, which is propelling electronic design automation software growth. For instance, in November 2022, the Government of India announced a funding of around USD 122 million to assist chip design startups across the country. This funding amount aims to boost the development of semiconductor design startups in India. Such initiatives by various governments will positively influence the EDA software market through 2030.

Machine Learning (ML) and Artificial Intelligence (AI) are permeating nearly every industry, including healthcare, electronics, automotive, and aerospace and defense. Companies are incorporating AI and ML into their products to boost product offerings across the aforementioned areas. These implementations of the supplied technologies necessitate the use of advanced electronic components and processors, opening up opportunities for EDA providers. The use of AI in software development helps testers go from manual to automated process testing. These factors would supplement the growth of the Electronic Design Automation software Industry in the forecast period.

Evolving industry trends, such as Industry 4.0, smart manufacturing, green electronic component manufacturing, digitization, and wide-scale adoption of IoT-connected devices offer lucrative growth opportunities in the EDA software market. Key players are pursuing various strategic initiatives to strengthen their geographical presence and expand their service offerings. For instance,in September 2022, Zuken launched subscription services for eCADSTAR. The PCB design product for small and medium businesses has been made available in a flexible subscription licensing model (TBL), which could be bought from a European online store; such developments are driving the electronic design automation software industry growth.

Product Insights

The Computer-aided Engineering (CAE) segment accounted for the largest market share of over 30% in 2022 in the EDA software market. The segment growth can be attributed to the increased outsourcing of manufacturing processes to emerging economies, the growing need for integrated software solutions to eliminate multiple prototype products and product recall concerns, and the drastic shift from on-premise computing to cloud-based computing.

Cloud computing lowers the expenses of hardware purchasing, software licensing, installation, and support. This is projected to enhance the use of CAE software even further in the coming years. Furthermore, businesses are using the Hyper-Converged Infrastructure (HCI) platform to establish a private cloud that provides enhanced computational and storage capabilities. These factors would further supplement the growth of the segment during the forecast period.

The services segment is anticipated to grow at a CAGR of 10.6% during the forecast period. In EDA software, services comprise of methodology development, enterprise integration, large-scale deployment, and process design. For instance, In October 2019, Synopsis, Inc. completed the acquisition of QTronic GmbH, a provider of test tools, simulation, and services in the automotive software industry in Germany. This acquisition helped Synopsis, Inc. accelerate the delivery of automotive virtual prototyping solutions required for system and software development across the automotive electronics supply chain. Such developments would further drive the growth of the segment during the forecast period.

Deployment Insights

The on-premise segment accounted for the largest market share of over 50% in 2022 in the Electronic Design Automation (EDA) software market. On-premise deployment helps organizations achieve greater control over sensitive data and processes. The deployment involves the use of dedicated servers and hardware within the organization’s own infrastructure. These servers serve as the foundation for hosting and running automation software and applications.

It includes platforms and tools to automate several business operations and activities. Moreover, with on-premise deployment, businesses can streamline and customize their automation processes to meet their needs and requirements, which can improve productivity and efficiency. Such benefits provided by on-premise deployment would further drive the growth of the segment during the forecast period.

The cloud segment is anticipated to expand at a CAGR of 10.8% during the forecast period. Developing tools and methods to manage increasing computational demands and shorter design cycles have become increasingly crucial. Chip companies and designers are increasingly using cloud-based tools and techniques to upgrade chip systems and design innovations. Cloud computing endows scalability and storage with virtually unlimited storage capacity to chip manufacturers to maintain computing capabilities.

Furthermore, cloud computing enables the organization to run unlimited parallel and regression jobs on-demand while getting results available in minutes. In addition to this, it ensures complete data isolation and encryption and reduces vulnerabilities in code before each release is enabled. Such benefits provided by cloud deployment would further drive the growth of the segment during the forecast period.

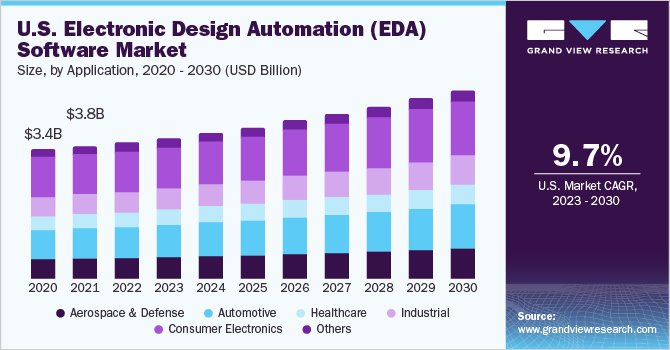

Application Insights

The consumer electronics segment accounted for the largest market share of over 40% in 2022 in the market for Electronic Design Automation (EDA) software.The growing demand for smart devices would encourage IC manufacturers to adopt EDA. As such, consumer electronics OEMs are partnering with some of the leading System-on-Chip (SoC) and IC manufacturers, including Intel Corporation, NXP Semiconductors, Texas Instruments Incorporated, and Qualcomm Technologies, Inc. to enhance the quality of their respective smart products.

For instance, in October 2022, Cadence Design Systems expanded its partnership with Samsung Foundry (a South Korea-based foundry solutions provider), targeted towards accelerating 3D-IC design. The Cadence Integrity 3D-IC platform will be available through the extended partnership with Samsung Foundry's 3D-IC methodology. The Cadence platform enables customers to optimize each die's performance, power, and area.

The healthcare segment is anticipated to expand at a CAGR of 11.5% during the forecast period. The increasing use of advanced electronic components in the healthcare industry, particularly in areas such as Implantable and Wearable Medical Devices (IWMD), is also propelling the EDA software market forward. For instance, in February 2022, Xilinx, Inc., a technology solution provider, was acquired by Advanced Micro Devices, (AMD) Inc. The takeover of Xilinx by AMD was first announced in October 2020.

With the purchase completed, Xilinx has become a part of AMD, and the combined technical knowledge will enable faster advancement in areas such as AI and interconnect technology. Improvements made by EDA software have helped in the development of the healthcare industry, which has resulted in the growth of the healthcare segment of the electronic design automation software industry during the forecast period.

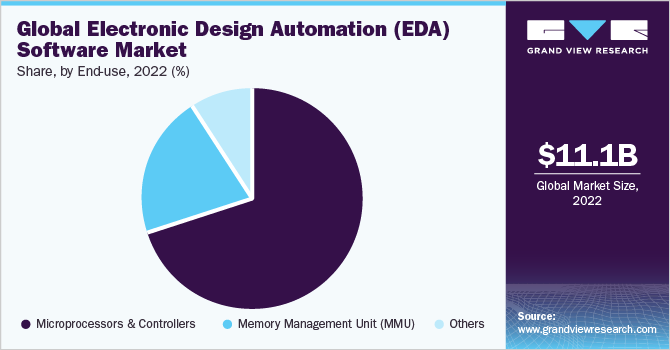

End-use Insights

The microprocessors and controllers segment accounted for the largest market share of 70.50% in 2022 in the market for electronic design automation software. The high market share is attributed to a healthy global demand for home appliances, lighting systems, and medical devices, among others. However, the process of designing, manufacturing, and testing an integrated circuit such as microprocessors & controllers is complex. Such circuits are crucial in a wide array of consumer and business applications involving desktop computers and other electronic devices.

EDA software is essential in the designing and development of such circuits as it simplifies the designing process. Thus, the growing demand for microprocessors & controllers in diverse applications is expected to propel the EDA software market growth. Therefore, microcontroller design upgrades form the core of the product development process, creating favorable avenues for EDA providers in this segment.

The memory management unit segment is anticipated to exhibit a steady growth rate of 8.3% over the forecast period, owing to the rising demand for high storage capacities, the latest operating system and application upgrades, and more. Software vendors are engaged in adding new features to their applications and operating systems through continuous upgrades, which require ample amount of device memory as well as speed to run the applications without any glitches.

For instance, in July 2020, Siemens EDA entered into a partnership with Samsung Foundry. The collaboration focused on creating and building new reference kits to simplify and streamline embedded memory diagnostics, maintenance, and testing in systems-on-chip (SoC). Siemens EDA is expected to get access to Samsung Foundry's large client base as a result of this agreement. As a result of the rising demand for processing speed needs, a favorable scenario for segment expansion has emerged. As a result, increased demand for processing speed requirements is creating a favorable scenario for segment growth.

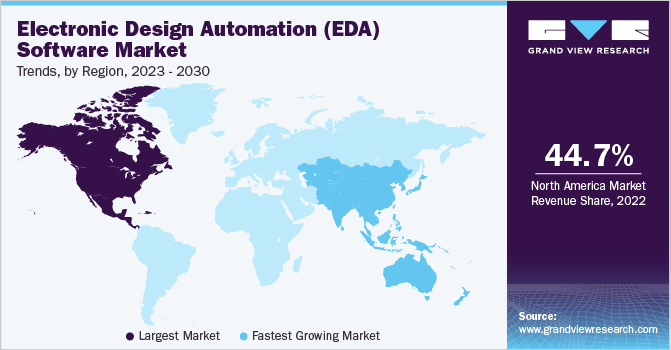

Regional Insights

North America held the major revenue share of 44.72% of the EDA software market in 2022. The regional growth can be attributed to the early adoption of advanced technology, including 5G, machine learning, and artificial intelligence, among others, and the expansion of several industries such as consumer electronics and automotive, among others. This has been a major force contributing to the regional demand.

For instance, in June 2022, Cadence Design Systems, Inc., a U.S.-based EDA solution provider, announced the extension of its collaboration with Arm Limited (a U.S.-based technology solution provider). As part of the collaboration, the companies will be working towards accelerating mobile device silicon development, using Cadence digital and verification tools, as well as Arm Total Compute Solutions 2022 (TCS22). Cadence will offer its RTL-to-GDS digital flow Rapid Adoption Kits for 5nm and 7nm nodes, aimed at helping customers achieve optimized power and improve productivity. North America boasts of a robust wireless infrastructure along with government support, which is expected to favor growth over the forecast period.

Asia Pacific is anticipated to emerge as the fastest-expanding region over the forecast period at a CAGR of 9.6%. The regional growth is attributed to the rise in the number of electronic manufacturing companies, the developing cloud computing sector, the increasing smartphone penetration, and the growing popularity of smart wearable devices. Furthermore, the increasing complexity of SoC architectures has necessitated the incorporation of novel deploy mentalities.

As they are scalable, cloud solutions aid in the resolution of these challenges. The main benefit of cloud-based solutions is that they may be accessed from any place within the corporation. As a result, semiconductor companies are increasingly relying on cloud-based tools to design complicated electronic systems. These factors would further supplement the growth of the region during the forecast period.

Key Companies & Market Share Insights

The key players operating in the market include Siemens EDA, Keysight Technologies, Synopsys, Zuken, Vennsa Technologies, and Aldec. To broaden their product offering, they utilize a variety of inorganic growth tactics, such as partnerships, mergers & acquisitions, and new product launches, among others. For instance, in October 2022, Cadence Design Systems announced its partnership with Samsung Foundry, a South Korea-based foundry solutions provider, targeted towards accelerating 3D-IC design. The Cadence Integrity 3D-IC platform will be available through the extended partnership with Samsung Foundry's 3D-IC methodology. The Cadence platform enables customers to optimize each die's performance, power, and area.Prominent players dominating the global electronic design automation software market include:

-

Advanced Micro Devices, Inc.

-

Aldec, Inc.

-

Altair Engineering Inc.

-

Altium LLC

-

Autodesk, Inc.

-

ANSYS, Inc.

-

Cadence Design Systems, Inc.

-

eInfochips

-

EMA Design Automation, Inc.

-

Keysight Technologies

-

Microsemi

-

Synopsys, Inc.

-

Silvaco, Inc.

-

The MathWorks, Inc.

-

Vennsa Technologies

-

Zuken

Electronic Design Automation Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.11 billion

Revenue forecast in 2030

USD 22.21 billion

Growth rate

CAGR of 9.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Advanced Micro Devices, Inc.; Aldec, Inc.; Altair Engineering Inc.; Altium LLC; Autodesk, Inc.; ANYSYS, Inc.; Cadence Design Systems, Inc.; eInfochips; EMA Design Automation, Inc; Keysight Technologies; Microsemi; Synopsys, Inc.; Silvaco, Inc.; The MathWorks, Inc.;Vennsa Technologies; Zuken

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore Purchase options

Global Electronic Design Automation Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electronic design automation software market report on the basis of product, deployment, application, end-use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Computer-aided Engineering (CAE)

-

IC Physical Design and Verification

-

Printed Circuit Board and Multi-chip Module (PCB and MCM)

-

Semiconductor Intellectual Property (SIP)

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace and Defense

-

Automotive

-

Healthcare

-

Industrial

-

Consumer Electronics

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Microprocessors & Controllers

-

Memory Management Unit (MMU)

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E.

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America accounted for the highest revenue share of 44.72% in 2022 and is expected to retain the dominant position throughout the forecast period in the EDA software market.

b. Some key players operating in the electronic design automation software market include Advanced Micro Devices, Inc, Aldec, Inc., Altair Engineering Inc., Altium LLC, Autodesk Inc., ANSYS, Inc., Cadence Design Systems, Inc., eInfochips, EMA Design Automation, Inc., Keysight Technologies, Microsemi, Synopsys, Inc., Silvaco, Inc., The MathWorks, Inc., Vennsa Technologies, and Zuken

b. Electronic Design Automation (EDA) Software Market is witnessing growing demand owing to the ability of EDA software to reduce the cost & time associated with the electric design circuit and eliminate manual errors. Further, increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) techniques in tools for addressing complex design issues and reducing costs, is anticipated to propel the growth of the EDA software market in the forecast period.

b. The global electronic design automation software market size was estimated at USD 11.10 billion in 2022 and is expected to reach USD 12.11 billion in 2023.

b. The global electronic design automation software market is expected to grow at a compound annual growth rate of 9.1% from 2023 to 2030 to reach USD 22.21 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."