- Home

- »

- Medical Devices

- »

-

Wearable Medical Devices Market Size, Industry Report 2030GVR Report cover

![Wearable Medical Devices Market Size, Share & Trends Report]()

Wearable Medical Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Diagnostic, Therapeutic Devices), By Site (Handheld, Headband, Strap, Shoe Sensors), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-724-7

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wearable Medical Devices Market Summary

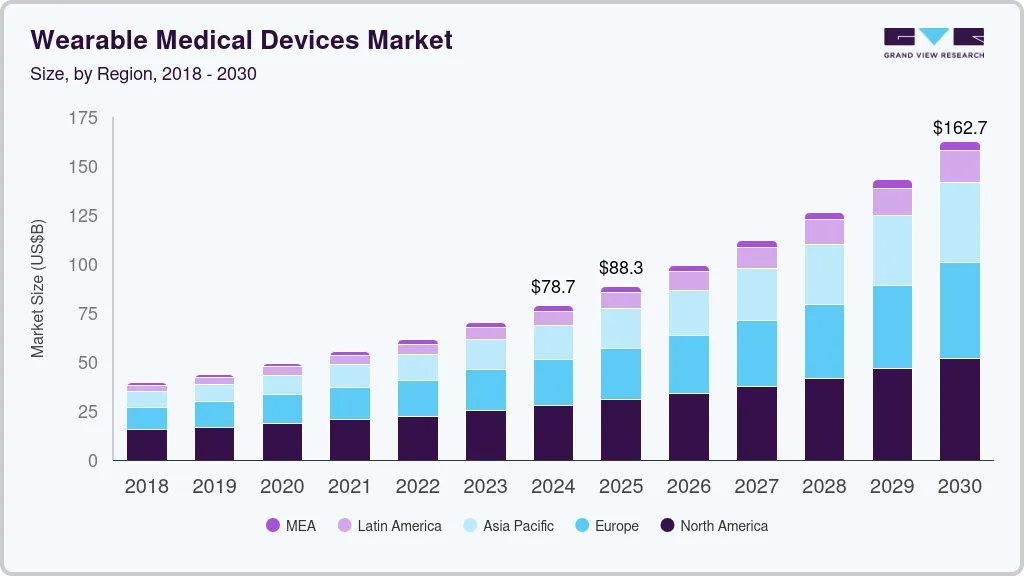

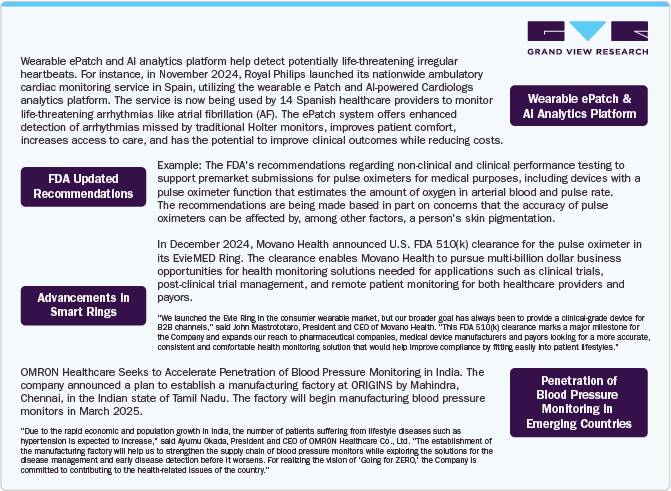

The global wearable medical devices market size was estimated at USD 42.74 billion in 2024 and is projected to reach USD 168.29 billion by 2030, growing at a CAGR of 25.53% from 2025 to 2030. The rise of remote patient monitoring, home healthcare, and a greater emphasis on fitness and healthy living drives the wearable medical devices market.

Key Market Trends & Insights

- North America wearable medical device market accounted for the largest revenue share of 35.76% in 2024

- The wearable medical devices market in the U.S. is expected to dominate the North American market

- By type, the diagnostic devices segment dominated the market and accounted for the largest revenue share in 2024

- By site, the strap/clip/bracelet segment accounted for the largest revenue share in 2024.

- By Application, the home healthcare segment accounted for the largest revenue share of 52.34% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 42.74 Billion

- 2030 Projected Market Size: USD 168.29 Billion

- CAGR (2025-2030): 25.53%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

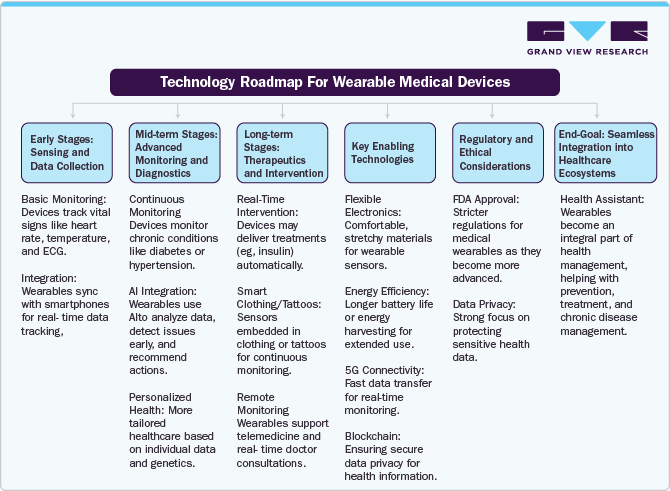

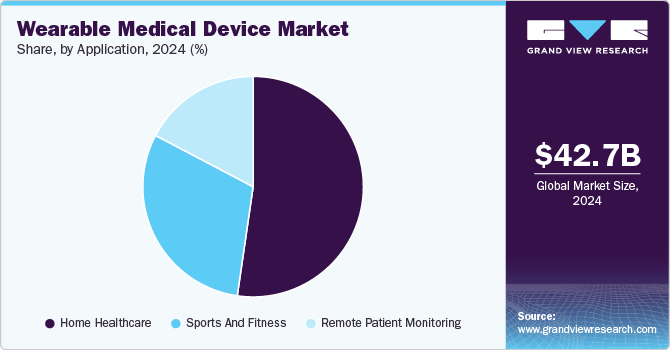

Technological advancements and product innovations are further propelling this growth. For instance, in July 2024, Huntleigh Healthcare launched the SC500 Vital Signs Monitor, designed for spot checks and long-term monitoring. It features integrated Early Warning scoring tools and alarms, ideal for monitoring long-term COVID patients.

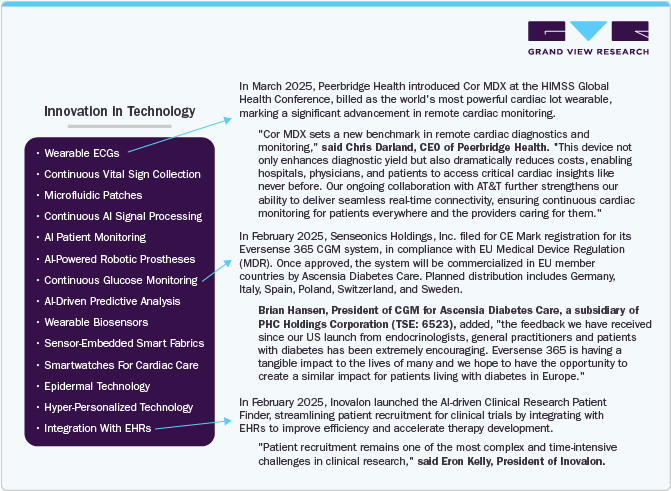

Technological advancement is a major factor in driving the growth of the market. Below graph represents the number of innovations happening in the market:

The integration of wearables in clinical trials has reshaped patient experience and data collection. Recent trials have showcased their remarkable impact in various healthcare domains, demonstrating the potential to transform medical research. For instance,

-

In January 2024, FloPatch, a wearable ultrasound device developed by Flosonics Medical, was utilized in two critical care units at St. Michael’s Hospital. It offers real-time assessments of blood flow to guide fluid resuscitation for critically ill patients.

-

In November 2024, BioIntelliSense announced a study in the Journal of Clinical Medicine showing that its FDA-cleared BioButton wearable device can detect early patient deterioration.

Study Title

Conditions

Interventions

Sponsor

Collaborators

Enrollment

Completion Date

Clinical Data Collection Study Using CPM System

Heart Failure

DEVICE: CPM Device

Analog Device, Inc.

Columbia University

100

12/1/2025

The Apollo Device in Systemic Sclerosis for the Management of fatiguE, Raynaud Phenomenon and qualiTy of Life

Systemic Sclerosis (SSc)

DEVICE: Apollo Neuro Device|DEVICE: Sham device

Robyn T. Domsic, MD, MPH

United States Department of Defense

160

2028-09

Wearable Technology to Characterize and Treat mTBI Subtypes: Biofeedback-Based Precision Rehabilitation

Mild Traumatic Brain Injury, Concussion|Rehabilitation|Balance Impairment

OTHER: Vestibular therapy for mTBI augmented with audio and visual real-time biofeedback|OTHER: Vestibular therapy for mTBI

Oregon Health and Science University

United States Department of Defense

100

9/30/2028

Source: ClinicalTrials.Gov

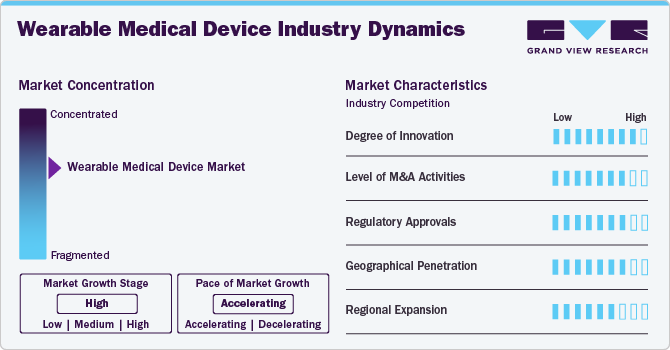

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The wearable medical device market is characterized by a high degree of growth. Dynamic market trends and technological advancements represent the wearable medical device market. The industry showcases a surge in innovation, with devices offering enhanced monitoring, diagnostics, and treatment capabilities. The market is marked by high levels of competition, which is evident in diverse product portfolios and strategic collaborations. Overall, the wearable medical device market is defined by its ever-evolving landscape, emphasizing accessibility, personalization, and advancements in remote patient care.

Key strategies implemented by players in the wearable medical device market are new product launches, regulatory approval, acquisitions, partnerships, and other strategies. For instance, in January 2024, Cloud DX, a North American provider of virtual care and remote patient monitoring platforms, unveiled a significant contract to develop a wrist-based wearable capable of tracking ECG and various vital signs.

This innovative device is poised to play a crucial role in the client's wellness solution, a patented platform designed to monitor multiple vital signs and offer personalized daily recommendations. Anticipated as the commencement of a prolonged and mutually beneficial collaboration, this contract is expected to have a substantial impact on the wearable medical device industry, showcasing advancements in remote patient monitoring and reinforcing the industry's commitment to personalized health solutions.

Rapid advancements in wearable medical technology have paved the way for cutting-edge devices that offer enhanced monitoring, diagnostics, and treatment capabilities. From smartwatches tracking vital signs to implantable devices providing real-time health data, the market is characterized by a surge in novel solutions designed to revolutionize patient care and empower individuals to manage their health proactively. Several research organizations and academic institutions are working to bring innovative devices into the industry. For instance, .in February 2025, Washington State University researchers developed an algorithm to represent and replace missing health data from wearable sensors with estimated data.

Industry players are strategically undertaking acquisitions and mergers to improve their technological capabilities, broaden product portfolios, and secure a competitive advantage. Market players are actively engaged in M&A activities. For instance, in October 2024, Oura, a health-tracking ring maker, revealed its plans to acquire Sparta Science, a data company that offers a platform that collects and analyzes health and performance information.

The industry is navigating a landscape of stringent regulations and standards to ensure the safety, efficacy, and compliance of these innovative devices. Companies are actively engaging with regulatory bodies to secure necessary approvals for their products, reflecting a commitment to meeting industry standards and gaining market trust. As wearable medical devices continue to advance, obtaining regulatory clearances remains a critical step in bringing these technologies to market and contributing to the evolution of personalized healthcare.

Some of the recently approved products are mentioned below:

Company Name

Product Name

FDA Approval Date

Supernus Pharmaceuticals, Inc.

ONAPGO

February 2025

Novocure

Optune Luna

October 2024

Movano Health

EvieMED Ring

May 2024

Source: U.S. FDA, Grand View Research Analysis

The wearable medical device market is witnessing notable regional expansion as companies strategically broaden their geographic footprint. This trend reflects a proactive approach to tap into diverse healthcare needs across different regions, capitalize on emerging opportunities, and establish a stronger market presence. For instance, in November 2024, . Aktiia, the Swiss HealthTech company, launched a 'cuffless' blood monitoring bracelet in Canada as a part of its expansion plan outside Europe.

Type Insights

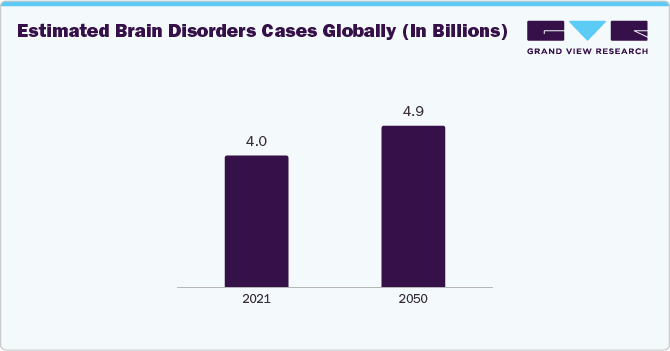

The diagnostic devices segment dominated the market and accounted for the largest revenue share in 2024. The increasing prevalence of neurological disorders is a primary driver for the growth of this segment. The projected prevalence of neurological disorders is demonstrated in the graph below:

Global Burden Of Brain Disorders By 2050

Additionally, increasing awareness among the population about the capability of neurological wearables to continuously assess cognitive capabilities during everyday activities is expected to drive the segment further.

The therapeutic device segment is anticipated to witness the fastest CAGR of 26.71% throughout the forecast period, owing to the increasing influx of therapeutic devices. Furthermore, the market is expected to receive a boost from a robust pipeline of therapeutic devices, including wearable pain reliever devices, intelligent asthma management products, and insulin management devices. In addition, several therapeutic devices are being launched in the market. For instance, in December 2024, Bone Health Technologies announced pre-orders for Osteoboost, the first FDA-cleared, non-drug wearable device designed to treat osteopenia in postmenopausal women by improving bone health.

Site Insights

The strap/clip/bracelet segment accounted for the largest revenue share in 2024. It is also anticipated to grow fastest over the forecast period. Smartwatches, with the capability to monitor parameters like mobility, respiratory rate, and pulse rate, along with Bluetooth and cloud connectivity, are expected to drive growth in this segment. Established and emerging companies such as Apple and Samsung are bringing innovations in this segment. For instance, in January 2024, BramhAnsh Technologies, an Indian startup, launched a SOONYAM mind-reading wristband that reads emotions in real time. Such developments are anticipated to propel the segment's growth.

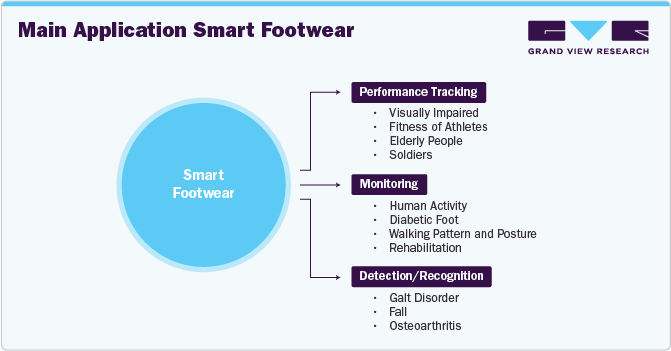

The shoe sensors segment is expected to grow significantly over the forecast period. This growth is being driven by ongoing innovations and expanding applications of smart shoes in healthcare. According to the article published by the MDPI in May 2024, some of the main applications of smart footwear are shown in the pictorial representation below:

Application Insights

The home healthcare segment accounted for the largest revenue share of 52.34% in 2024. The increasing approvals for wearable medical devices intended for home care are expected to drive growth in this segment. Many industry players are focused on obtaining regulatory approvals for these devices for use in home environments. For instance, in February 2024, the U.S. FDA authorized the X-trades System M, a wireless wearable device designed for electrophysiological monitoring. This skin patch-based monitoring platform enables patients to move freely while at home. Such approvals for advanced devices meant for homecare use and supportive regulations are anticipated to boost growth in this segment in the coming years significantly.

The remote patient monitoring segment is anticipated to witness the fastest CAGR over the forecast period. Globally rising geriatric population base and rising incidences of chronic conditions are expected to be high-impact rendering drivers for the growth of remote patient monitoring devices over the forecast period. According to the data reported by the International Diabetes Federation, the age-adjusted prevalence of diabetes among adults living in the U.S. is estimated to increase from 10.7% in 2021 to 12.1% by 2030. This growing health burden is anticipated to drive the demand for efficient remote patient monitoring solutions.

Grade Type Insights

The consumer-grade wearable medical devices segment dominated the market in 2024. These devices offer user-friendly features, focusing on personal health and fitness tracking, making them widely popular among consumers. The convenience, affordability, and increasing health consciousness contribute to the segment's robust performance, establishing it as a key driver in the wearable medical devices market. In addition, emerging companies are increasingly focusing on launching consumer-grade wearable medical devices. For instance, in April 2024, Lava debuted in the smartwatch category with its Prowatch series. This series features health monitoring capabilities with a PPG sensor for heart rate and fitness tracking options.

The clinical grade wearable medical devices segment is anticipated to witness the fastest CAGR over the forecast period. The improvements in clinical wearable medical devices, such as blood pressure and ECG monitors, drive this growth. For instance, Wellysis received FDA approval in August 2023 for its wearable ECG patch, "S-Patch Ex." This device can be used by professionals in clinical settings. The S-Patch Ex is the lightest available patch device, is reusable, and is designed with a patient-centric approach to ensure comfortable use throughout the day. Such developments and approvals in the segment are anticipated to drive the segment's growth..

Distribution Channel Insights

The pharmacy segment accounted for the largest revenue share in 2024 in the wearable medical devices market. This dominance is attributed to pharmacies' widespread accessibility, offering consumers a convenient avenue to purchase these devices. Their ability to provide personalized, informed guidance on health management and product selection makes them valuable touchpoints for consumers seeking wearable solutions.

The online channel segment is projected to experience the fastest CAGR over the forecast period, driven by a growing consumer shift toward digital shopping platforms. This surge in demand is primarily attributed to the convenience, accessibility, and wide range of products offered by major e-commerce platforms like Amazon and Flipkart. In addition, manufacturers such as Samsung and Apple are enhancing their direct-to-consumer reach through dedicated online stores. As online retail continues to expand, the wearable medical devices market is expected to grow due to the seamless and user-friendly purchasing experience provided by online channels.

Regional Insights

North America wearable medical device market accounted for the largest revenue share of 35.76% in 2024, owing to the growing prevalence of cardiovascular disorders, diabetes, and cancer within this region. For instance, according to an American Heart Association article published in January 2024, daily in the U.S., cardiovascular diseases result in about 2,552 deaths each day. In addition, the high adoption of remote patient monitoring and home care devices for regular, continuous, and long-term monitoring of patients and reducing the frequency of hospital visits are anticipated to fuel the market growth over the forecast period. In addition, the presence of various companies such as Abbott, GE HealthCare, Medtronic, OMRON Healthcare Inc., and Dexcom Inc., among others in the region is anticipated to propel the regional market growth.

U.S. Wearable Medical Devices Market Trends

The wearable medical devices market in the U.S. is expected to dominate the North American market over the forecast period due to the presence of key players and rising launches and approvals of wearable medical devices in the U.S. Several industry players are designing and trying to gain approval for wearable medical devices. For instance, according to the study published by Healio in October 2024, AWAK Technologies has received a breakthrough designation from the FDA for its Automated Wearable Artificial Kidney Peritoneal Dialysis (AWAK PD) device.

“We are excited about expanding our activities into the U.S., the largest dialysis market in the world,” said Abel Ang, chairman of AWAK Technologies.

Europe Wearable Medical Devices Market Trends

Europe wearable medical devices market is anticipated to witness significant growth. Increasing healthcare expenditures and favorable reimbursement policies support the growth of Europe's wearable medical devices market. Governments in countries like Spain and Norway promote investments in medical technology and at-home monitoring solutions.

For instance, in May 2024, Koninklijke Philips N.V. launched its ePatch and AI-driven Cardiologs analytics platform across 14 hospitals in Spain to enhance the monitoring of heart patients. This wearable device allows for up to 14 days of continuous tracking, effectively detecting arrhythmias such as atrial fibrillation (AF) that traditional methods often miss. Such developments and growing investments are anticipated to drive the regional market growth.

The wearable medical devices market in the UK is poised for significant growth in the coming years, driven by factors such as the rise in chronic conditions, growing focus on fitness tracking, and increasing investments from government authorities in wearable technology.

Some of the recent investments in wearable technology by the government are mentioned below:

Organization Name

Investment Amount (USD Million)

Date

Department of Health and Social Care & Medicines and Healthcare products Regulatory Agency

11.36

March 2024

UK Government

34.08

October 2023

Source: UK. Gov, Grand View Research Analysis

France wearable medical devices market is expected to grow during the forecast period due to the increasing number of clinical trials and rising adoption of these devices.

Some of the clinical studies conducted for wearable medical devices in France are mentioned below:

Study Title

Conditions

Interventions

Sponsor

Enrollment

Completion Date

Quantifying Gait Alteration in Multiple Sclerosis Using a Wearable Device

Multiple Sclerosis

OTHER: Wearable sensor

Nantes University Hospital

44

5/31/2022

Wearable Grasping Neuroprosthesis Used At Home in Subjects with Post-stroke Hemiparesis

Stroke, Rehabilitation

DEVICE: neuroprosthesis

University Hospital, Toulouse

6

7/23/2023

Benefits of Microcor in Ambulatory Decompensated Heart Failure

Heart Failure

DEVICE: μCor

Zoll Medical Corporation

265

10/30/2023

Source: ClinicalTrials.Gov, Grand View Research Analysis

Asia Pacific Wearable Medical Devices Market Trends

The wearable medical devices market in the Asia Pacific region is expected to witness the highest CAGR in the wearable medical devices market during the forecast period, driven by increased industry focus on emerging markets, intensified R&D, and advancements in manufacturing. A notable example is Murata Manufacturing Co., Ltd., which in November 2024 introduced its innovative Stretchable Printed Circuit (SPC) technology. This flexible and deformable substrate enhances wearable therapeutic and monitoring device design, offering improved accuracy, durability, and comfort. Such technological innovations are set to boost market growth across the region significantly.

China wearable medical devices market is projected to grow throughout the forecast period due to the rising development of these devices and favorable government regulations. In December 2023, the National Development and Reform Commission issued guidance encouraging the innovative development of high-end medical devices, including wearable devices. As of 17 January 2024, the number of innovative medical devices approved in China has reached 251. Thus, rising support for developing innovative and wearable medical devices is anticipated to drive regional market growth.

The wearable medical devices market in India is anticipated to witness significant growth during the forecast period. This growth is driven by the entry of new players in the market. Moreover, several international players are also focusing on expanding their product reach in the Indian market. Some of the recently launched products in the Indian market are mentioned below:

Company Name

Product Name

Launch Date

Lava

Prowatch X

February 2025

Bonatra

Smart Ring X1

September 2023

GOQii

Smart Vital Ultra and GOQii Stream devices

August 2022

Source: Grand View Research Analysis

Latin America Wearable Medical Devices Market Trends

The Latin America wearable medical devices market is projected to experience substantial growth in the coming years, driven by the rising incidence of chronic diseases and increasing collaborations among industry players to bring wearable medical devices into the Latin America market. For instance, in January 2024, Garmin Ltd revealed that Vitalera and VitalAire Brazil are using Garmin wearables to help revolutionise remote monitoring of patients who rely on long-term oxygen therapy, potentially resulting in timely interventions and personalised care. Such adoption of wearable medical devices among patients from several countries, such as Brazil

Middle East and Africa Wearable Medical Devices Market Trends

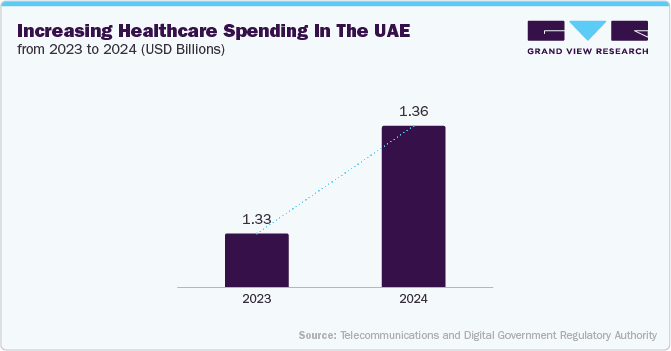

The wearable medical devices market in Middle East and Africa is anticipated to grow significantly in the coming years due to the growing focus on advancing healthcare technologies, medical device manufacturing, and rising healthcare expenditures. For instance, the UAE Government reserves a substantial share of the federal budget for the healthcare sector every year.

Key Wearable Medical Devices Company Insights

Key wearable medical device companies are significantly impacting the market by introducing groundbreaking technologies. Innovations such as advanced wearable medical device sensors, continuous monitoring capabilities, and integration with artificial intelligence are reshaping the landscape. Industry leaders leverage these technologies to enhance the accuracy and range of health metrics that wearable devices can track. Moreover, the incorporation of data analytics and cloud connectivity enables seamless data sharing, improving the overall healthcare ecosystem. This technological evolution not only propels the market's growth but also contributes to improved patient outcomes, personalized healthcare, and the transformation of wearable medical devices into indispensable tools for both consumers and healthcare providers.

Key Wearable Medical Devices Companies:

The following are the leading companies in the wearable medical devices market. These companies collectively hold the largest market share and dictate industry trends.

- Garmin Ltd

- Medtronic

- Abbott

- Koninklijke Philips N.V.

- GE HealthCare

- OMRON Healthcare, Inc.

- Dexcom, Inc.

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- Fresenius Medical Care AG

- Cognita Labs

- AliveCor, Inc.

- EMAY

- VivaLNK, Inc.

- CAIRE Inc

- Ypsomed AG

- Wellue

- Qardio, Inc

- Withings

- iRhythm Technologies, Inc

- OxyGo HQ Florida, LLC.

- LOOKEETech

- VitalConnect

- Boston Scientific Corporation

- Nexstim

- LivaNova PLC

- Neuropace Inc.

- Nevro Corporation

- electroCore, Inc.

- tVNS Technologies GmbH

- Laborie

- Axonics, Inc

- Polar Electro

- Sotera, Inc.

- Samsung

Recent Developments

-

In April 2025, Stanford Medicin and Samsung announced a research partnership aimed at enhancing the Galaxy Watch's sleep apnea detection capabilities and investigating AI-enabled solutions for continuous sleep health management.

-

In April 2025, Somnology teamed up with Samsung to introduce a groundbreaking hybrid sleep care model. This innovative solution combines telehealth services with asynchronous support, delivering a personalized and accessible approach to managing sleep health. By integrating with Samsung’s advanced wearable technology, Somnology’s proprietary sleep reports offer actionable insights that empower users to improve their overall health and well-being.

-

In February 2025, VitalConnec raised USD 100 million to commercialize the heart monitor, which detects arrhythmias. Such investments are anticipated to impact the market growth positively.

-

In January 2025, Smart Meter, a technology and infrastructure supplier in the remote patient monitoring industry, reported substantial milestones in its growth. Since 2022, the company has experienced an impressive 300% sales increase and quadrupled its commercial customer base. Currently, over 350,000 patients are using Smart Meter solutions.

Wearable Medical Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 53.98 billion

Revenue forecast in 2030

USD 168.29 billion

Growth rate

CAGR of 25.53% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, site, application, distribution channel, grade type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Google; Samsung; Garmin Ltd; Polar Electro; Sotera, Inc.; Medtronic; Abbott; Koninklijke Philips N.V.; GE HealthCare; OMRON Healthcare, Inc.; Dexcom, Inc.; Insulet Corporation; Tandem Diabetes Care, Inc.; Fresenius Medical Care AG; Inogen; Cognita Labs; AliveCor, Inc.; EMAY; VivaLNK, Inc; CAIRE Inc; Ypsomed AG; Wellue; Qardio, Inc; Withings; iRhythm Technologies, Inc; OxyGo HQ Florida, LLC.; LOOKEETech; VitalConnect; Boston Scientific Corporation; Nexstim; LivaNova PLC; Neuropace Inc.; Nevro Corporation; electroCore, Inc.; tVNS Technologies GmbH; Laborie; Axonics, Inc.; Polar Electro; Sotera, Inc.; Samsung

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable Medical Device Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wearable medical devices market report based on product, site, application, distribution channel, grade type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Devices

-

Vital Sign Monitoring Devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep trackers

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal And Obstetric Devices

-

Neuromonitoring Devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

-

Therapeutic Devices

-

Pain Management Devices

-

Neurostimulation Devices

-

Others

-

-

Insulin/Glucose Monitoring Devices

-

Insulin Pumps

-

Others

-

-

Rehabilitation Devices

-

Accelometers

-

Sensing Devices

-

Ultrasound Platform

-

Others

-

-

Respiratory Therapy Devices

-

Ventilators

-

Positive Airway Pressure (PAP) Devices

-

Portable Oxygen Concentrators

-

Others

-

-

-

-

Site Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Headband

-

Strap/Clip/Bracelet

-

Shoe Sensors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports And Fitness

-

Remote Patient Monitoring

-

Home Healthcare

-

-

Grade Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer-Grade Wearable Medical Devices

-

Clinical Wearable Medical Devices

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacies

-

Online Channel

-

Hypermarkets

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Central & South America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wearable medical devices market size was estimated at USD 42.74 billion in 2024 and is expected to reach USD 53.98 billion in 2025.

b. The global wearable medical devices market is expected to grow at a compound annual growth rate of 25.53% from 2025 to 2030 to reach USD 168.29 billion by 2030.

b. North America dominated the wearable medical devices market with a share of 35.76% in 2024. This is attributable to the rise in chronic diseases that need routine monitoring and the presence of sophisticated healthcare infrastructure.

b. Some key players operating in the wearable medical devices market include Google, Samsung, Garmin Ltd, Polar Electro, Sotera, Inc., Medtronic, Abbott, Koninklijke Philips N.V., GE HealthCare, OMRON Healthcare, Inc., Dexcom, Inc., Insulet Corporation, Tandem Diabetes Care, Inc., Fresenius Medical Care AG, Inogen, Cognita Labs, AliveCor, Inc., EMAY, VivaLNK, Inc, CAIRE Inc, Ypsomed AG, Wellue, Qardio, Inc, Withings, iRhythm Technologies, Inc, OxyGo HQ Florida, LLC., LOOKEETech, VitalConnect, Boston Scientific Corporation, Nexstim, LivaNova PLC, Neuropace Inc., Nevro Corporation, electroCore, Inc., tVNS Technologies GmbH, Laborie, and Axonics, Inc.

b. Key factors that are driving the wearable medical devices market growth include rising demand for round-the-clock monitoring, growing awareness of fitness, and the advent of technologically advanced products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.