- Home

- »

- Communications Infrastructure

- »

-

System On Chip Market Size, Share & Growth Report, 2030GVR Report cover

![System On Chip Market Size, Share & Trends Report]()

System On Chip Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Digital, Mixed, Analog), By Applications (Home Appliance, ADAS System), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-442-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

System On Chip Market Summary

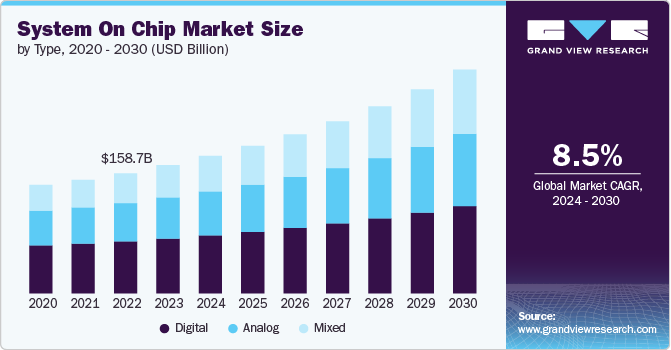

The global system on chip market size was estimated at USD 169.54 billion in 2023 and is projected to reach USD 295.49 billion by 2030, growing at a CAGR of 8.5% from 2024 to 2030. The proliferation of mobile devices is a major driver of the market growth as smartphones, tablets, and wearable devices require compact, powerful chips that can handle multiple functions, such as processing, graphics, and connectivity, within a single, integrated package.

Key Market Trends & Insights

- The System On Chip (SoC) market in North America accounted for the largest global revenue share of nearly 22% in 2023.

- The SoC market in the U.S. is projected to grow at a CAGR of over 8% from 2024 to 2030.

- The SoC market in the Asia Pacific region accounted for the highest revenue share in 2023.

- Based on application, the portable electronic device segment in the market held the largest share of over 23.0% in 2023.

- In terms of type, the mixed segment is expected to witness the fastest CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 169.54 Billion

- 2030 Projected Market Size: USD 295.49 Billion

- CAGR (2024-2030): 8.5%

- North America: Largest market in 2023

This demand for smaller, faster, and more energy-efficient components pushes manufacturers to innovate continuously, leading to significant advancements in system on chip (SoC) technology, which is further boosting market growth. Technological advancements are driving the growth of the system on chip industry, with continuous innovations in semiconductor manufacturing processes, including smaller node sizes and enhanced design architectures. The shift towards multi-core processors and the integration of AI and machine learning capabilities within SoCs is propelling the market growth. These advancements enable SoCs to offer improved processing power, energy efficiency, and versatility, making them suitable for a wider range of applications, from consumer electronics to industrial automation.

Governments worldwide are pivotal in boosting the sales of SoC products by supporting semiconductor research and development, providing subsidies for local manufacturing, and implementing favorable trade policies. In regions such as North America, Europe, and Asia Pacific, governments are investing heavily in semiconductor infrastructure to reduce dependency on imports and enhance domestic capabilities. These initiatives include funding for R&D, tax incentives for companies investing in semiconductor technologies, and collaborations with academic institutions to foster innovation.

Manufacturers operating in system on chip market are increasingly focusing on the development of highly specialized and application-specific SoCs to cater to the growing demands of various sectors, including consumer electronics, automotive, healthcare, and telecommunications. They are investing in innovative research to enhance chip performance, reduce power consumption, and improve integration capabilities. In addition, they are also forming strategic collaborations with technology firms, startups, and research institutions to accelerate innovation and stay competitive in the rapidly evolving market.

The market presents several key opportunities, particularly in emerging technologies such as AI, 5G, and autonomous vehicles. The growing need for edge computing solutions and the integration of SoCs in industrial automation and smart city projects offer vast potential for market expansion. In addition, the increasing focus on energy-efficient and sustainable electronics opens opportunities for developing green SoCs that cater to environmentally conscious consumers and industries. The expansion of the global semiconductor ecosystem, driven by geopolitical shifts and the push for localization, also provides new avenues for market growth.

Type Insights

The digital segment held the largest market share in 2023 due to the high demand for smartphones, tablets, and other consumer electronics that rely heavily on digital SoCs for their processing power and functionality. Digital SoCs are essential for running complex algorithms, supporting high-speed data processing, and enabling connectivity features such as 5G. In addition, advancements in artificial intelligence (AI) and machine learning (ML) technologies have further fueled segmental growth, as these applications require powerful processing capabilities that digital SoCs are well-equipped to provide. The shift towards more connected and smart devices in both consumer and industrial sectors continues to bolster the high share of digital SoCs in the overall market.

The mixed segment is expected to witness the fastest CAGR from 2024 to 2030 due to the increasing integration of both analog and digital functionalities within a single chip. Mixed SoCs have applications such as the Internet of Things (IoT), automotive electronics, and telecommunications, where devices require both analog signals for interfacing with the physical world and digital processing for data manipulation. Mixed SoCs offer the advantage of reducing the overall system size, power consumption, and cost by combining these functions into one chip. The growing demand for advanced driver-assistance systems (ADAS) in vehicles, smart home devices, and wearable technology is significantly contributing to the expansion of the mixed SoC segment.

Application Insights

The portable electronic device segment in the market held the largest share of over 23.0% in 2023 due to the high demand for portable electronic devices, such as smartphones, tablets, and wearable technology, which require high-performance, energy-efficient processing solutions. The miniaturization of electronic components and the integration of multiple functionalities into a single chip have driven the adoption of SoCs in the devices. As consumers demand more powerful and feature-rich portable gadgets, manufacturers are continuously innovating to incorporate advanced processing capabilities, enhanced graphics, and extended battery life into smaller, more compact chips.

The Advanced Driver Assistance Systems (ADAS) segment is anticipated to record a significant CAGR of over 11.0% from 2024 to 2030, owing to the proliferation of autonomous driving technologies coupled with increasing emphasis on vehicle safety and stringent government regulations. ADAS technology relies heavily on SoCs to process data from various sensors, cameras, and radars to provide real-time assistance and safety features, such as lane departure warnings, adaptive cruise control, and automated parking. The rising demand for specialized SoCs in the automotive sector due to their ability to handle complex computations and high-speed data processing is contributing to the segment growth.

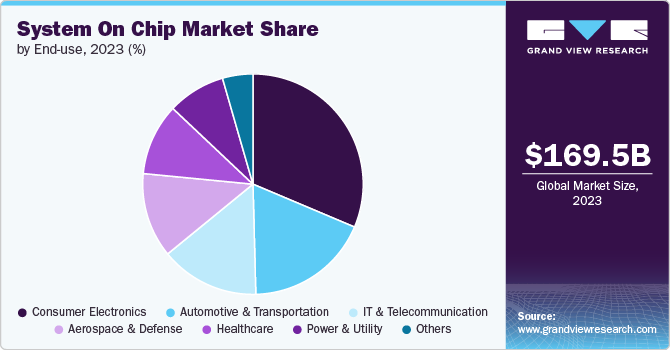

End Use Insights

The consumer electronics segment accounted for the largest market share in 2023. The rapid technological advancements in these consumer products have necessitated the integration of more sophisticated and efficient processing units such as SoCs. With the increasing emphasis on seamless connectivity, enhanced user experience, and multifunctionality in consumer electronics, SoCs have become crucial in enabling manufacturers to meet these demands. The integration of multiple components such as processors, memory, and connectivity functions into a single chip not only reduces the size of devices but also enhances performance and energy efficiency, making SoCs indispensable in consumer electronics.

The automotive and transportation segment is expected to witness the fastest CAGR from 2024 to 2030, propelled by the rising adoption of advanced driver-assistance systems (ADAS), infotainment systems, and the push towards autonomous vehicles. The automotive industry’s shift towards smarter, safer, and more connected vehicles has led to a surge in demand for highly integrated chips that can support complex processing needs while maintaining reliability and efficiency. SoCs are increasingly being used to power the growing array of sensors, cameras, and communication modules in vehicles, which are essential for real-time data processing and decision-making in modern automotive systems.

Regional Insights

The System On Chip (SoC) market in North America accounted for the largest global revenue share of nearly 22% in 2023. The market in North America is experiencing robust growth due to several factors, including the increasing demand for advanced consumer electronics and the expansion of the automotive industry. The region's strong technological infrastructure, coupled with the presence of leading semiconductor companies, has fueled innovation and development in SoCs. Furthermore, the growing adoption of IoT devices and the rapid advancements in AI and machine learning technologies are driving the need for more sophisticated and efficient SoC solutions.

U.S. System On Chip Market Trends

The SoC market in the U.S. is projected to grow at a CAGR of over 8% from 2024 to 2030. The market is driven by the country's leadership in technological innovation and semiconductor manufacturing. The increasing use of SoCs in various industries, including telecommunications, automotive, and consumer electronics, is contributing to this upward trajectory.

Europe System On Chip Market Trends

The SoC market in Europe is anticipated to grow at a notable CAGR from 2024 to 2030. The market growth is credited to the region’s strong emphasis on industrial automation, automotive advancements, and energy-efficient technologies. The integration of SoCs in electric vehicles (EVs) and smart industrial systems is a significant growth driver for the regional market. In addition, the prominence of Industry 4.0 and smart manufacturing across various regional countries is driving the demand for sophisticated SoC solutions that can support high-performance computing and real-time data processing, thereby favoring market growth.

Asia Pacific System On Chip Market Trends

The SoC market in the Asia Pacific region accounted for the highest revenue share in 2023 owing to its extensive electronics manufacturing base and the presence of major semiconductor companies. Countries including China, South Korea, and Taiwan are at the forefront of SoC production, catering to the growing demand for consumer electronics, automotive electronics, and industrial automation. Moreover, the increasing inclination of regional countries toward becoming self-reliant in semiconductor production has led to substantial investments in SoC research & development in the last few years, which is expected to create lucrative growth prospects for the market in the coming years.

Key System On Chip Company Insights

Some of the key players operating in the SoC market include Intel Corporation, Samsung Electronics Co. Ltd, and Toshiba Corporation.

-

Intel Corporation is one of the leading firms in the semiconductor industry, renowned for its innovations in microprocessors and system-on-chips. Intel leverages its advanced manufacturing processes and integrated circuit design expertise to produce high-performance SoCs for a variety of applications, including data centers, IoT devices, and consumer electronics. Intel's SoCs are designed to handle large volumes of data efficiently, catering to the ever-increasing demand for faster processing and real-time analytics. The company's commitment to innovation and its focus on data-driven architectures enable it to maintain a competitive edge in a rapidly evolving market.

-

Samsung Electronics Co. Ltd is engaged in the development of advanced electronics and semiconductor solutions. The company focuses on the production of advanced SoCs that power a wide range of consumer electronics, from smartphones to home appliances. With its state-of-the-art fabrication facilities and a strong emphasis on innovation, the company continues to introduce innovative solutions related to data management and processing within the SoC domain.

Novatek Microelectronics and Huawei Technologies Co., Ltd, among others, are some of the emerging participants in the market.

-

Novatek Microelectronics provides a diverse range of applications, including smartphones, tablets, and TVs. The company’s SoCs are designed with a focus on data processing efficiency, enabling enhanced image processing and data transmission capabilities.

-

Huawei Technologies Co., Ltd. offers a comprehensive range of products and solutions in telecommunications and consumer electronics. It develops high-performance SoCs that power its smartphones, networking equipment, and other smart devices. The company is also focused on integrating artificial intelligence and machine learning capabilities into its SoCs to offer enhanced solutions.

Key System On Chip Companies:

The following are the leading companies in the system on chip market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom Inc.

- Intel Corporation

- Intel Corporation

- Microchip Technology Inc.

- NXP Semiconductors NV

- Qualcomm Incorporated

- Samsung Electronics Co. Ltd

- STMicroelectronics NV

- Toshiba Corporation

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

Recent Developments

-

In June 2024, Intel Corporation revealed its plan to launch the upcoming processor series. The new SoC introduces several improvements over the existing Meteor Lake SoCs, which include Intel Core and Core Ultra processors. It also highlights enhancements such as greater power efficiency, a fourfold boost in NPU processing capability, a 50% faster Intel Arc GPU driven by the next-gen Arc Battlemage architecture, and integrated on-chip memory for a more compact design and quicker memory access.

-

In February 2024, MaxLinear, Inc. introduced the MXL17xxx series, also referred to as the 'Sierra' platform. This system-on-chip (SoC) is engineered specifically for 4G/5G radio units for O-RAN. The Sierra platform offers a flexible, all-in-one solution that can be utilized across a wide variety of RU applications, including traditional macro, massive MIMO, picocell, and integrated small cells.

-

In January 2024, Robert Bosch GmbH and Qualcomm Technologies, Inc. unveiled a vehicle computer that combines infotainment and ADAS capabilities within a single system-on-chip (SoC). This central computer, introduced by Bosch as part of its cockpit and ADAS integration platform, is powered by the Snapdragon Ride™ Flex SoC. The two companies, building on their long-term partnership, continue to innovate in the realm of software-defined vehicle solutions.

System On Chip Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 181.58 billion

Revenue forecast in 2030

USD 295.49 billion

Growth Rate

CAGR of 8.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Component

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Australia, Japan, India, South Korea, Brazil, South Africa, Saudi Arabia, U.A.E.

Key companies profiled

Broadcom Inc., Intel Corporation, Mediatek Inc., Microchip Technology Inc., NXP Semiconductors NV, Qualcomm Incorporated, Samsung Electronics Co. Ltd; STMicroelectronics NV, Toshiba Corporation Taiwan Semiconductor Manufacturing Company Limited (TSMC), among others.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

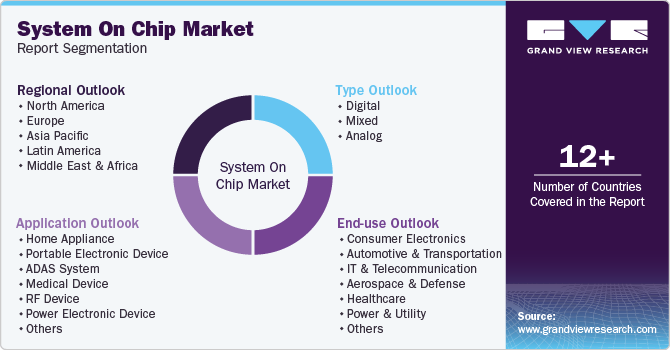

Global System On Chip Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global system on chip (SoC) market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Digital

-

Mixed

-

Analog

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home Appliance

-

Portable Electronic Device

-

ADAS System

-

Medical Device

-

RF Device

-

Power Electronic Device

-

Wired & Wireless Communication Device

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Automotive and Transportation

-

IT & Telecommunication

-

Aerospace & Defense

-

Healthcare

-

Power & Utility

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global system on chip market size was estimated at USD 169.54 billion in 2023 and is expected to reach USD 181.58 billion in 2024.

b. The global system on chip market is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 295.49 billion by 2030.

b. The portable electronic device segment in the market, registered the largest share of over 23.7% in 2023, due to the high demand for the portable electronic devices, such as smartphones, tablets, and wearable technology which requires high-performance, energy-efficient processing solutions

b. Some of the key players operating in the System on Chip market include Broadcom Inc., Intel Corporation, Mediatek Inc., Microchip Technology Inc., NXP Semiconductors NV, Qualcomm Incorporated, Samsung Electronics Co. Ltd, STMicroelectronics NV, Toshiba Corporation Taiwan Semiconductor Manufacturing Company Limited (TSMC), among others.

b. The proliferation of mobile devices is a major driver of the SoC market as smartphones, tablets, and wearable devices require compact, powerful chips that can handle multiple functions, such as processing, graphics, and connectivity, within a single, integrated package. This demand for smaller, faster, and more energy-efficient components pushes manufacturers to innovate continuously, leading to significant advancements in SoC technology which is further boosting the system of chip market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.