- Home

- »

- Next Generation Technologies

- »

-

Simulation Software Market Size & Share Report, 2030GVR Report cover

![Simulation Software Market Size, Share & Trends Report]()

Simulation Software Market Size, Share & Trends Analysis Report By Component (Software, Service), By Deployment, By Application, By End-use (Conventional Automotive, Healthcare, Aerospace & Defense), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-751-3

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Simulation Software Market Size & Trends

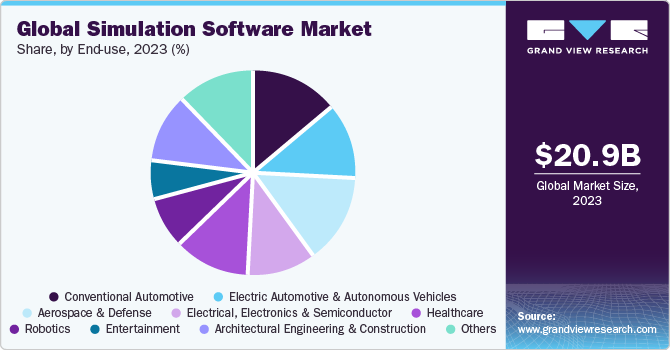

The global simulation software market size was valued at USD 20.96 billion in 2023 and is expected to register a CAGR of 13.8% from 2024 to 2030. Simulation software is a tool used to virtually create a real-time environment to test the applicability and efficiency of different products and processes. Benefits, such as a reduction in production expenditure and reduced costs of training, are expected to drive the market. Furthermore, simulation tools play a major role in determining the effects of military weapons. They also help automotive companies determine the ideal vehicle prototypes for reducing CO2 emissions.

Simulation software is widely adopted by different companies as it helps reduce production costs. The software helps develop several prototypes and test them virtually. Moreover, it helps realize error-free output in a production process, thereby avoiding the production of faulty products and the respective costs involved. It also helps save time spent on R&D activities. All these factors are expected to fuel the market growth. Conventionally, manufacturers incurred huge costs while prototyping products, which involved complex mechanisms. Despite the availability of prototypes, the chances of failure were high, which incurred additional R&D expenses to reduce such product failures.

Expenses incurred on prototypes and curbing faults of the existing products led to increased pre and post-production costs. In such scenarios, the use of simulation software helps reduce the need for manually testing multiple prototypes to subsequently reduce the chances of product failures. This is encouraging companies to make investments in simulation tools. Manufacturers across the globe are making investments to develop AI-related technologies to cope with the Volatile, Uncertain, Complex, and Ambiguous (VUCA) world. Virtual testing techniques are used to test these AI-enabled devices and involve the observation of the behavior of these devices in real-time situations.

The use of the virtual testing method increases the efficiency of a product development process and simultaneously reduces the product development cost. This growing focus on AI devices and products is expected to lead to the adoption of virtual testing tools. Moreover, the industry is witnessing growth owing to the emergence of autonomous vehicles and Electric Vehicles (EVs). Automotive manufacturers are using simulation tools to test the efficiency and effectiveness of these vehicles using real-world situations. They are also using simulation software to meet different industry standards and regulations. In September 2018, BMW Group announced investments of approximately USD 115.0 million to establish a high-fidelity driving simulation center in Munich, Germany.

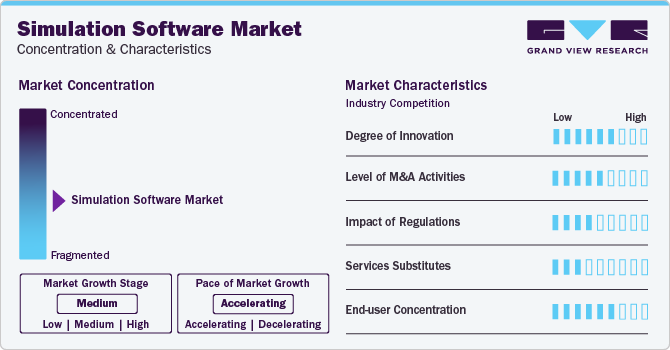

Market Concentration & Characteristics

The simulation software market is characterized by a high degree of innovation, driven by technological advancements and evolving user demands. Continuous improvements in algorithms, computational capabilities, and integration with emerging technologies contribute to the dynamic nature of innovation in this market. Vendors often strive to introduce novel features, such as real-time simulation and artificial intelligence integration, to enhance the accuracy and efficiency of simulations. The pursuit of more realistic and immersive simulation experiences, coupled with the exploration of new application areas, further fuels the ongoing innovation in the simulation software market.

The target market is also characterized by a high level of mergers & acquisitions by the leading players. The high level of mergers and acquisitions (M&A) in the Simulation Software Market is driven by the pursuit of market consolidation and strategic expansion. Companies engage in these transactions to access complementary technologies, broaden their product portfolios, and achieve economies of scale. The dynamic nature of the industry, coupled with the need for innovation and global competitiveness, motivates businesses to pursue mergers and acquisitions as a strategic approach to enhance their position in the evolving Simulation Software Market.

The simulation software market is subject to regulatory scrutiny, with authorities monitoring issues related to data security, intellectual property, and ethical considerations in simulation practices. As the technology evolves, regulators may address concerns regarding the accuracy and reliability of simulations, especially in safety-critical industries such as aerospace and healthcare. Compliance with industry standards and regulations becomes crucial for simulation software providers to ensure the acceptance and trust of their solutions. Ongoing developments in regulations may impact the adoption and deployment of simulation software across various sectors, necessitating continuous adaptation by industry players to meet evolving compliance requirements.

Simulation software faces potential substitutes in the form of alternative technologies and methodologies for modeling and analysis. Some users may opt for physical prototyping or experimentation as substitutes, especially in industries where practical testing is feasible. Additionally, advancements in artificial intelligence and machine learning may offer alternative approaches for certain simulation tasks. Cloud-based simulation services and emerging technologies could also be considered substitutes, providing alternative platforms for simulation activities. Evaluating the cost, accuracy, and efficiency of these substitutes is essential for users in deciding the most suitable approach for their specific needs.

End user concentration is one of the significant factors in the Simulation Software Market. The simulation software market exhibits a notable concentration among end users, with a significant portion of the user base focusing on specific industries. This concentration is characterized by a pronounced presence of users in key sectors such as automotive, aerospace, healthcare, and electronics. The market's dynamics are influenced by the specialized needs of these concentrated end-user segments, shaping the development and customization of simulation software engineering solutions. As a result, vendors in the simulation software market often tailor their offerings to address the unique requirements and challenges prevalent within these concentrated user industries.

Component Insights

The software segment dominated the market and accounted for the largest revenue share of over 69.5% in 2023. The segment is expected to remain dominant throughout the forecast period. The growth of this segment can be attributed to the benefits of software, such as data safety, reliability, and uninterrupted testing. Furthermore, under the software segment, finite element analysis is expected to largely contribute to the growth of the segment. FEA is widely used in industries, such as automotive, aerospace, defense, and electronics, to test product quality, performance, and design.

On the other hand, the service segment is expected to register the fastest growth rate during the forecast period. The growth of the segment can be attributed to the growing awareness of virtually-enabled processes used for product development among companies and governments. Services, such as design and consulting, implementation, and maintenance are gaining popularity among various enterprises. ANSYS, Inc., one of the key players in the market, provides consultation and professional services for simulation workflow improvement and process compression.

Deployment Insights

On the basis of modes of deployment, the global market has been further segmented into on-premises and cloud. The on-premise deployment segment dominated the market in 2023 and accounted for the largest share of more than 71.4% of the global revenue. The high share of this segment was attributed to the early adoption of the software. On-premise deployment is a traditional method of deployment that involves the installation of the software on-site. This method is beneficial for companies that wish to maintain the confidentiality of their data and secure the data from hackers.

These benefits related to data confidentiality and security are the primary factors driving the growth of the segment. The segment is expected to account for the highest market share by 2030. The cloud segment is expected to register the fastest CAGR over the next seven years. The growth of this segment can be attributed to the benefits offered, including easy implementation and cost-effectiveness, as compared to the traditional on-premise software. Since the software is deployed over the cloud, it is easier to maintain and upgrade based on a client’s requirements. Moreover, cloud-based software can be used in applications, such as R&D and training & education.

Application Insights

TThe engineering, research, modeling & simulated testing dominated the market accounted for the largest revenue share of 37.3% in 2023. The high segment share is attributed to the robust adoption of simulation software by prominent end-use companies like Airbus, Boeing, Volkswagen Group, and others for product engineering, modeling, research, and testing purposes. In addition, the segment growth is driven by the client’s requirements for quick and quality improvement in a cost-effective manner, allowing companies to foray into the market with new products fast and lower warranty costs.

Moreover, the shift from actual prototyping towards simulation is ubiquitous across many industries and the demand for modeling, designing, and simulated testing tools is intensified by the massive investments in high-growth applications including 5G, clinical trials, autonomous, electrification, and the Industrial Internet of Things (IIoT). Furthermore, cyber threats have always been a concern for several industries, such as military & defense, enterprise, and others. The introduction of simulation solutions provides organizations with cyber situational awareness. This helps users identify malicious cyber-attacks within that network. Thus, with the rising concerns of cyber threats across the globe, it is anticipated to see massive adoption of cyber simulation tools and help the segment grow at a significant CAGR of 13.4% from 2024 to 2030.

End-use Insights

The automotive segment dominated the market and accounted for the largest revenue share in 2023, owing to the early adoption of virtual tools for product development.The growth was credited to the early adoption of virtual tools for product development. Furthermore, the automotive industry is witnessing a shift toward the use of electric and autonomous vehicles. The use of simulation to enhance production processes in this industry is primarily driving the growth of this segment.

The other segment includes industries and sectors, such as construction, retail, and telecommunications. The aerospace & defense segment is expected to grow at a considerable CAGR over the forecast period due to the use of simulators for designing aircraft as well as defense equipment. Also, simulators are used in the defense industry for the purpose of training soldiers. Growing government concerns regarding terrorism and national security have resulted in increased investments in new and improved defense equipment that require the use of simulation software. This, in turn, has contributed to the growth of this segment.

Regional Insights

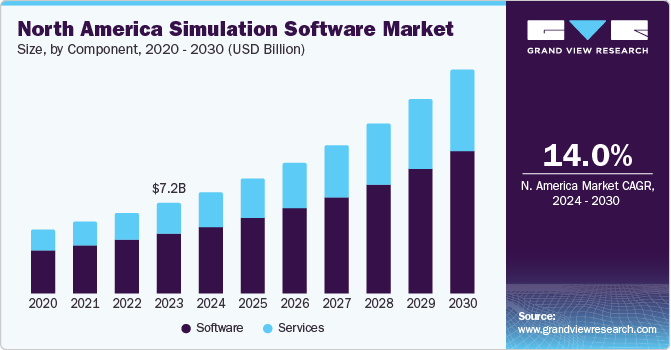

In 2023, North America dominated the target market and accounted for the largest revenue share of 34.2%. The region is expected to continue its dominance over the forecast period on account of the presence of major players in the U.S. and Canada. The companies in these countries have been observed to be investing in research and development activities to introduce technologically advanced products in the market. Moreover, the region is well-known as an early adopter of advanced technologies. In the Asia Pacific, the market is anticipated to witness the fastest CAGR over the forecast period.

The rapid growth can be attributed to the increased manufacturing activities in the regional industries and sectors, such as automotive and healthcare. The growth of the construction and healthcare verticals in countries, such as Japan and India, are subsequently driving the regional market growth. Europe also accounted for a significant share of the market in 2022. Countries, such as Germany and the U.K., primarily contributed to the growth of the regional market. High penetration of AI technology and increasing defense expenditure in the region are some of the key factors driving the market growth.

Key Companies & Market Share Insights

Some of the key players operating in the market include Dassault Systemes and ANSYS, Inc. among others.

-

Dassault Systemes develops 3D designs, product lifecycle management software, and 3D digital mock-up. The company offers various products and services. The company has around 12 brands. The product portfolio including ENOVIA, CATIA, 3DEXCITE, SOLIDWORKS, DELMIA, GEOVIA, BIOVIA, SIMULIA, 3DVIA, EXALEAD, and NETVIBES.

-

ANSYS, Inc. specializes in the development and promotion of engineering simulation software. Utilizing Workbench as a platform for constructing its simulation technologies, the company offers a range of product functionalities. These include 3D design software, electromagnetic field simulation, computational fluid dynamics, optical simulation, semiconductors and structural analysis, as well as systems modeling, simulation, and validation.

-

Bentley Systems, Inc. and The MathWorks, Inc. are some of the emerging market participants in the target market.

-

Bentley Systems, Inc. develops, licenses, and sells computer software and offers services for infrastructure construction, design, and operations. The company’s primary software product line includes ProjectWise, MicroStation, and AssetWise. The company’s products and services include asset lifecycle information management, bridge analysis, asset reliability, building design, hydraulics & hydrology, modeling & visualization, mine design, operational analytics, plant design, reality modeling, and project delivery, among others.

-

The MathWorks, Inc. develops mathematical computing software. The company’s products cater to a variety of applications, including design, simulation, technical computation, visualization, and implementation. The company’s product offerings, such as MATLAB and Simulink, are used across various industries and industry verticals for research & development purposes and modeling and simulation.

Key Simulation Software Companies:

- Altair Engineering, Inc.

- Autodesk Inc.

- Ansys, Inc.

- Bentley Systems, Incorporated

- Dassault Systèmes

- The MathWorks, Inc.

- Rockwell Automation, Inc.

- Simulations Plus

- ESI Group

- GSE Systems

Recent Developments

-

In May 2022, Dassault Systemes announced that it has collaborated with the BMW Group to establish the vehicle development programs with increased efficiency. The two businesses worked together to develop an industry-ready, process-oriented solution for stamping die design and stamped sheet metal component definition that will boost the effectiveness of the parts production and design process with the invaluable assistance of BMW Group's in-depth process and specialist know-how.

-

In June 2022, ANSYS, Inc announced that the company has joined the Intel Foundry Services Cloud Alliance. Intel Foundry Services is a completely vertical, independent foundry company by Intel. This interoperable, semiconductor design workflow enabled with cloud technology is made possible by Ansys products, such as Ansys HFSS, Ansys Totem, Ansys RedHawk-SC, Ansys VeloceRF, Ansys PathFinder, and Ansys RaptorX, and will assist present and prospective Intel customers increase their productivity.

Simulation Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.56 billion

Revenue forecast in 2030

USD 51.11 billion

Growth rate

CAGR of 13.8% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end-use, material, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, China, Japan, India, South Korea, Australia, Mexico, Brazil, KSA, UAE, and South Africa

Key companies profiled

Altair Engineering, Inc., Autodesk Inc., Ansys, Inc., Bentley Systems, Incorporated., Dassault Systèmes, The MathWorks, Inc., Rockwell Automation, Inc., Simulations Plus, ESI Group, and GSE Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Simulation Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global simulation software market report based on component, deployment, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

Simulation Development Services

-

Training and Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Engineering, Research, Modeling & Simulated Testing

-

High Fidelity Experiential 3D Training

-

Gaming & Immersive Experiences

-

Manufacturing Process Optimization

-

AI Training & Autonomous Systems

-

Planning And Logistics Management & Transportation

-

Cyber Simulation

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Conventional Automotive

-

Electric Automotive and Autonomous Vehicles

-

Aerospace & Defense

-

Electrical, Electronics and Semiconductor

-

Healthcare

-

Robotics

-

Entertainment

-

Architectural Engineering and Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global simulation software market size was estimated at USD 18.71 billion in 2022 and is expected to reach USD 20.96 billion in 2023.

b. The global simulation software market is expected to grow at a compound annual growth rate of 13.6% from 2023 to 2030 to reach USD 51.11 billion by 2030.

b. The software segment dominated the simulation software market and accounted for the largest revenue share of more than 69% in 2022. The segment is expected to remain dominant over the forecast period.

b. The on-premises deployment segment held the largest revenue share of 71.8% in 2022 in the simulation software market, owing to the early adoption of the software.

b. North America dominated the simulation software market and accounted for the largest revenue share of 34.2% in 2022. The region is expected to continue its dominance over the forecast period.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Simulation Software Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.1.1. Growing preference for simulation software to optimize performance of electric and autonomous vehicles

3.3.1.2. Growing adoption of simulation tools in aerospace & defense and other industries

3.3.1.3. Growing potential for simulation-assisted digital twins

3.3.2. Market Restraints Analysis

3.3.2.1. Budgetary constraints and lack of skilled personnel restricting adoption of simulation tools

3.3.3. Industry Opportunities

3.3.3.1. Growing adoption of simulation tools in Healthcare Industry

3.3.3.2. Aggressive investments in deploying advanced industrial solutions across various industries

3.3.4. Industry Challenges

3.4. Simulation Software Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

3.5. Use Case Analysis

Chapter 4. Simulation Software Market: Component Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Simulation Software Market: Component Movement Analysis, USD Million, 2023 & 2030

4.3. Software

4.3.1. Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.3.2. Computer Aided Engineering Simulation Software

4.3.2.1. Computer Aided Engineering Simulation Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.3.2.1.1. Finite Element Analysis (FEA) Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.3.2.1.2. Computational Fluid Dynamics (CFD) Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.3.2.1.3. Multibody Dynamics Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.3.2.1.4. Optimization & Simulation Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.3.3. Process Simulation Software

4.3.3.1. Process Simulation Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.3.4. Electromagnetic Simulation Software

4.3.4.1. Electromagnetic Simulation Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.3.5. Training/Human-in-the-Loop (HITL) Simulation Software

4.3.5.1. Training/Human-in-the-Loop (HITL) Simulation Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.3.6. Others

4.3.6.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.4. Service

4.4.1. Service Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.4.2. Simulation Development Services

4.4.2.1. Simulation Development Services Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.4.3. Training and Support & Maintenance

4.4.3.1. Training and Support & Maintenance Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 5. Simulation Software Market: Deployment Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Simulation Software Market: Deployment Movement Analysis, USD Million, 2023 & 2030

5.3. On-Premise

5.3.1. On-Premise Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4. Cloud

5.4.1. Cloud Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 6. Simulation Software Market: Application Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Simulation Software Market: Application Movement Analysis, USD Million, 2023 & 2030

6.3. Engineering, Research, Modeling & Simulated Testing

6.3.1. Engineering, Research, Modeling & Simulated Testing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.4. High Fidelity Experiential 3D Training

6.4.1. High Fidelity Experiential 3D Training Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.5. Gaming and Immersive Experiences

6.5.1. Gaming and Immersive Experiences Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.6. Manufacturing Process Optimization

6.6.1. Manufacturing Process Optimization Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.7. AI Training & Autonomous Systems

6.7.1. AI Training & Autonomous Systems Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.8. Planning and Logistics Management & Transportation

6.8.1. Planning and Logistics Management & Transportation Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.9. Cyber Simulation

6.9.1. Cyber Simulation Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 7. Simulation Software Market: End-Use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Simulation Software Market: End-Use Movement Analysis, USD Million, 2023 & 2030

7.3. Conventional Automotive

7.3.1. Conventional Automotive Simulation Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4. Electric Automotive and Autonomous Vehicles

7.4.1. Electric Automotive and Autonomous Vehicles Simulation Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5. Aerospace & Defense

7.5.1. Aerospace & Defense Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6. Electrical, Electronics and Semiconductor

7.6.1. Electrical, Electronics and Semiconductor Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.7. Healthcare

7.7.1. Healthcare Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.8. Architectural Engineering and Construction

7.8.1. Architectural Engineering and Construction Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.9. Others

7.9.1. Others Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 8. Simulation Software Market: Regional Estimates & Trend Analysis

8.1. Simulation Software Market Share, By Region, 2023 & 2030, USD Million

8.2. North America

8.2.1. North America Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.2. North America Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.2.3. North America Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.2.4. North America Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.2.5. North America Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.2.6. U.S.

8.2.6.1. U.S. Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.6.2. U.S. Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.2.6.3. U.S. Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.2.6.4. U.S. Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.2.6.5. U.S. Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.2.7. Canada

8.2.7.1. Canada Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.7.2. Canada Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.2.7.3. Canada Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.2.7.4. Canada Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.2.7.5. Canada Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.3. Europe

8.3.1. Europe Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.2. Europe Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.3.3. Europe Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.3.4. Europe Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.3.5. Europe Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.3.6. U.K.

8.3.6.1. U.K. Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.6.2. U.K. Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.3.6.3. U.K. Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.3.6.4. U.K. Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.3.6.5. U.K. Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.3.7. Germany

8.3.7.1. Germany Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.7.2. Germany Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.3.7.3. Germany Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.3.7.4. Germany Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.3.7.5. Germany Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.3.8. France

8.3.8.1. France Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.8.2. France Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.3.8.3. France Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.3.8.4. France Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.3.8.5. France Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Asia Pacific Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.2. Asia Pacific Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.4.3. Asia Pacific Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.4.4. Asia Pacific Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.4.5. Asia Pacific Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.4.6. China

8.4.6.1. China Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.6.2. China Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.4.6.3. China Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.4.6.4. China Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.4.6.5. China Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.4.7. Japan

8.4.7.1. Japan Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.7.2. Japan Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.4.7.3. Japan Simulation Software Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

8.4.7.4. Japan Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.4.7.5. Japan Simulation Software Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

8.4.7.6. Japan Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.4.7.7. Japan Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.4.8. India

8.4.8.1. India Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.8.2. India Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.4.8.3. India Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.4.8.4. India Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.4.8.5. India Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.4.9. South Korea

8.4.9.1. South Korea Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.9.2. South Korea Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.4.9.3. South Korea Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.4.9.4. South Korea Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.4.9.5. South Korea Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.4.10. Australia

8.4.10.1. Australia Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.10.2. Australia Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.4.10.3. Australia Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.4.10.4. Australia Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.4.10.5. Australia Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.5. Latin America

8.5.1. Latin America Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5.2. Latin America Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.5.3. Latin America Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.5.4. Latin America Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.5.5. Latin America Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.5.6. Brazil

8.5.6.1. Brazil Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5.6.2. Brazil Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.5.6.3. Brazil Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.5.6.4. Brazil Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.5.6.5. Brazil Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.5.7. Mexico

8.5.7.1. Mexico Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5.7.2. Mexico Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.5.7.3. Mexico Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.5.7.4. Mexico Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.5.7.5. Mexico Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.6. Middle East and Africa

8.6.1. Middle East and Africa Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6.2. Middle East and Africa Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.6.3. Middle East and Africa Simulation Software Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

8.6.4. Middle East and Africa Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.6.5. Middle East and Africa Simulation Software Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

8.6.6. Middle East and Africa Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.6.7. Middle East and Africa Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.6.8. Middle East and Africa Simulation Software Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

8.6.9. KSA

8.6.9.1. KSA Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6.9.2. KSA Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.6.9.3. KSA Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.6.9.4. KSA Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.6.9.5. KSA Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.6.10. UAE

8.6.10.1. UAE Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6.10.2. UAE Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.6.10.3. UAE Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.6.10.4. UAE Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.6.10.5. UAE Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

8.6.11. South Africa

8.6.11.1. South Africa Simulation Software Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6.11.2. South Africa Simulation Software Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

8.6.11.3. South Africa Simulation Software Market Estimates and Forecasts, By Deployment, 2017 - 2030 (USD Million)

8.6.11.4. South Africa Simulation Software Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

8.6.11.5. South Africa Simulation Software Market Estimates and Forecasts, By End-Use, 2017 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Market Positioning

9.4. Company Market Share Analysis

9.5. Strategy Mapping

9.5.1. Expansion

9.5.2. Mergers & Acquisition

9.5.3. Partnerships & Collaborations

9.5.4. New Product Launches

9.5.5. Research And Development

9.6. Company Profiles

9.6.1. Altair Engineering, Inc.

9.6.1.1. Participant’s Overview

9.6.1.2. Financial Performance

9.6.1.3. Product Benchmarking

9.6.1.4. Recent Developments

9.6.2. Autodesk Inc.

9.6.2.1. Participant’s Overview

9.6.2.2. Financial Performance

9.6.2.3. Product Benchmarking

9.6.2.4. Recent Developments

9.6.3. Ansys, Inc.

9.6.3.1. Participant’s Overview

9.6.3.2. Financial Performance

9.6.3.3. Product Benchmarking

9.6.3.4. Recent Developments

9.6.4. Bentley Systems, Incorporated

9.6.4.1. Participant’s Overview

9.6.4.2. Financial Performance

9.6.4.3. Product Benchmarking

9.6.4.4. Recent Developments

9.6.5. Dassault Systèmes

9.6.5.1. Participant’s Overview

9.6.5.2. Financial Performance

9.6.5.3. Product Benchmarking

9.6.5.4. Recent Developments

9.6.6. MathWorks, Inc.

9.6.6.1. Participant’s Overview

9.6.6.2. Financial Performance

9.6.6.3. Product Benchmarking

9.6.6.4. Recent Developments

9.6.7. Rockwell Automation, Inc.

9.6.7.1. Participant’s Overview

9.6.7.2. Financial Performance

9.6.7.3. Product Benchmarking

9.6.7.4. Recent Developments

9.6.8. Simulations Plus

9.6.8.1. Participant’s Overview

9.6.8.2. Financial Performance

9.6.8.3. Product Benchmarking

9.6.8.4. Recent Developments

9.6.9. ESI Group

9.6.9.1. Participant’s Overview

9.6.9.2. Financial Performance

9.6.9.3. Product Benchmarking

9.6.9.4. Recent Developments

9.6.10. GSE Systems

9.6.10.1. Participant’s Overview

9.6.10.2. Financial Performance

9.6.10.3. Product Benchmarking

9.6.10.4. Recent Developments

List of Tables

Table 1 List of abbreviations

Table 2 Simulation software market - Industry snapshot & key buying criteria, 2017 - 2030

Table 3 Simulation software market, 2017 - 2030 (USD Million)

Table 4 Simulation software market, by region, 2017 - 2030 (USD Million)

Table 5 Simulation software market, by component, 2017 - 2030, (USD Million)

Table 6 Simulation software market, by Software, 2017 - 2030, (USD Million)

Table 7 Simulation software market, by computer aided engineering, 2017 - 2030, (USD Million)

Table 8 Component Simulation software market, by region, 2017 - 2030 (USD Million)

Table 9 Simulation software market by service, 2017 - 2030 (USD Million)

Table 10 Simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 11 Deployment Simulation software market, by region, 2017 - 2030 (USD Million)

Table 12 Simulation software market, by application, 2017 - 2030 (USD Million)

Table 13 Application Simulation software market, by region, 2017 - 2030 (USD Million)

Table 14 Simulation software market, by end use, 2017 - 2030 (USD Million)

Table 15 End-use Simulation software market, by region, 2017 - 2030 (USD Million)

Table 16 Simulation software market, by industrial, 2017 - 2030 (USD Million)

Table 17 North America simulation software market, 2017 - 2030 (USD Million)

Table 18 North America simulation software market, by component, 2017 - 2030 (USD Million)

Table 19 North America simulation software market, by software, 2017 - 2030 (USD Million)

Table 20 North America simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 21 North America simulation software market, by service, 2017 - 2030 (USD Million)

Table 22 North America simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 23 North America simulation software market, by application, 2017 - 2030 (USD Million)

Table 24 North America simulation software market, by end use, 2017 - 2030 (USD Million)

Table 25 U.S. simulation software market, 2017 - 2030 (USD Million)

Table 26 U.S. simulation software market, by component, 2017 - 2030 (USD Million)

Table 27 U.S. simulation software market, by software, 2017 - 2030 (USD Million)

Table 28 U.S. simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 29 U.S. simulation software market, by service, 2017 - 2030 (USD Million)

Table 30 U.S. simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 31 U.S. simulation software market, by application, 2017 - 2030 (USD Million)

Table 32 U.S. simulation software market, by end use, 2017 - 2030 (USD Million)

Table 33 Canada simulation software market, 2017 - 2030 (USD Million)

Table 34 Canada simulation software market, by component, 2017 - 2030 (USD Million)

Table 35 Canada simulation software market, by software, 2017 - 2030 (USD Million)

Table 36 Canada simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 37 Canada simulation software market, by service, 2017 - 2030 (USD Million)

Table 38 Canada simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 39 Canada simulation software market, by application, 2017 - 2030 (USD Million)

Table 40 Canada simulation software market, by end-use, 2017 - 2030 (USD Million)

Table 41 Europe simulation software market, 2017 - 2030 (USD Million)

Table 42 Europe simulation software market, by component, 2017 - 2030 (USD Million)

Table 43 Europe simulation software market, by software, 2017 - 2030 (USD Million)

Table 44 Europe simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 45 Europe simulation software market, by service, 2017 - 2030 (USD Million)

Table 46 Europe simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 47 Europe simulation software market, by application, 2017 - 2030 (USD Million)

Table 48 Europe simulation software market, by end-use, 2017 - 2030 (USD Million)

Table 49 U.K. simulation software market, 2017 - 2030 (USD Million)

Table 50 U.K. simulation software market, by component, 2017 - 2030 (USD Million)

Table 51 U.K. simulation software market, by software, 2017 - 2030 (USD Million)

Table 52 U.K. simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 53 U.K. simulation software market, by service, 2017 - 2030 (USD Million)

Table 54 U.K. simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 55 U.K. simulation software market, by application, 2017 - 2030 (USD Million)

Table 56 U.K. simulation software market, by end-use, 2017 - 2030 (USD Million)

Table 57 Germany simulation software market, 2017 - 2030 (USD Million)

Table 58 Germany simulation software market, by component, 2017 - 2030 (USD Million)

Table 59 Germany simulation software market, by software, 2017 - 2030 (USD Million)

Table 60 Germany simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 61 Germany simulation software market, by service, 2017 - 2030 (USD Million)

Table 62 Germany simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 63 Germany simulation software market, by application, 2017 - 2030 (USD Million)

Table 64 Germany simulation software market, by end-use, 2017 - 2030 (USD Million)

Table 65 France simulation software market, 2017 - 2030 (USD Million)

Table 66 France simulation software market, by component, 2017 - 2030 (USD Million)

Table 67 France simulation software market, by software, 2017 - 2030 (USD Million)

Table 68 France simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 69 France simulation software market, by service, 2017 - 2030 (USD Million)

Table 70 France simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 71 France simulation software market, by application, 2017 - 2030 (USD Million)

Table 72 France simulation software market, by end-use, 2017 - 2030 (USD Million)

Table 73 Asia Pacific simulation software market, 2017 - 2030 (USD Million)

Table 74 Asia Pacific simulation software market, by component, 2017 - 2030 (USD Million)

Table 75 Asia Pacific simulation software market, by software, 2017 - 2030 (USD Million)

Table 76 Asia Pacific simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 77 Asia Pacific simulation software market, by service, 2017 - 2030 (USD Million)

Table 78 Asia Pacific simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 79 Asia Pacific simulation software market, by application, 2017 - 2030 (USD Million)

Table 80 Asia Pacific simulation software market, by end-use, 2017 - 2030 (USD Million)

Table 81 China simulation software market, 2017 - 2030 (USD Million)

Table 82 China simulation software market, by component, 2017 - 2030 (USD Million)

Table 83 China simulation software market, by software, 2017 - 2030 (USD Million)

Table 84 China simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 85 China simulation software market, by service, 2017 - 2030 (USD Million)

Table 86 China simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 87 China simulation software market, by application, 2017 - 2030 (USD Million)

Table 88 China simulation software market, by end use, 2017 - 2030 (USD Million)

Table 89 India simulation software market, 2017 - 2030 (USD Million)

Table 90 India simulation software market, by component, 2017 - 2030 (USD Million)

Table 91 India simulation software market, by software, 2017 - 2030 (USD Million)

Table 92 India simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 93 India simulation software market, by service, 2017 - 2030 (USD Million)

Table 94 India simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 95 India simulation software market, by end use, 2017 - 2030 (USD Million)

Table 96 Japan simulation software market, 2017 - 2030 (USD Million)

Table 97 Japan simulation software market, by component, 2017 - 2030 (USD Million)

Table 98 Japan simulation software market, by software, 2017 - 2030 (USD Million)

Table 99 Japan simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 100 Japan simulation software market, by service, 2017 - 2030 (USD Million)

Table 101 Japan simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 102 Japan simulation software market, by application, 2017 - 2030 (USD Million)

Table 103 Japan simulation software market, by end use, 2017 - 2030 (USD Million)

Table 104 South Korea simulation software market, 2017 - 2030 (USD Million)

Table 105 South Korea simulation software market, by component, 2017 - 2030 (USD Million)

Table 106 South Korea simulation software market, by software, 2017 - 2030 (USD Million)

Table 107 South Korea simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 108 South Korea simulation software market, by service, 2017 - 2030 (USD Million)

Table 109 South Korea simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 110 South Korea simulation software market, by application, 2017 - 2030 (USD Million)

Table 111 South Korea simulation software market, by end use, 2017 - 2030 (USD Million)

Table 112 Australia simulation software market, 2017 - 2030 (USD Million)

Table 113 Australia simulation software market, by component, 2017 - 2030 (USD Million)

Table 114 Australia simulation software market, by software, 2017 - 2030 (USD Million)

Table 115 Australia simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 116 Australia simulation software market, by service, 2017 - 2030 (USD Million)

Table 117 Australia simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 118 Australia simulation software market, by application, 2017 - 2030 (USD Million)

Table 119 Australia simulation software market, by end use, 2017 - 2030 (USD Million)

Table 120 Latin America simulation software market, 2017 - 2030 (USD Million)

Table 121 Latin America simulation software market, by component, 2017 - 2030 (USD Million)

Table 122 Latin America simulation software market, by software, 2017 - 2030 (USD Million)

Table 123 Latin America simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 124 Latin America simulation software market, by service, 2017 - 2030 (USD Million)

Table 125 Latin America simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 126 Latin America simulation software market, by application, 2017 - 2030 (USD Million)

Table 127 Latin America simulation software market, by end-use, 2017 - 2030 (USD Million)

Table 128 Brazil simulation software market, 2017 - 2030 (USD Million)

Table 129 Brazil simulation software market by component, 2017 - 2030 (USD Million)

Table 130 Brazil simulation software market, by software, 2017 - 2030 (USD Million)

Table 131 Brazil simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 132 Brazil simulation software market, by service, 2017 - 2030 (USD Million)

Table 133 Brazil simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 134 Brazil simulation software market, by application, 2017 - 2030 (USD Million)

Table 135 Brazil simulation software market, by end use, 2017 - 2030 (USD Million)

Table 136 Mexico simulation software market, 2017 - 2030 (USD Million)

Table 137 Mexico simulation software market, by component, 2017 - 2030 (USD Million)

Table 138 Mexico simulation software market, by software, 2017 - 2030 (USD Million)

Table 139 Mexico simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 140 Mexico simulation software market, by service, 2017 - 2030 (USD Million)

Table 141 Mexico simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 142 Mexico simulation software market, by application, 2017 - 2030 (USD Million)

Table 143 Mexico simulation software market, by end use, 2017 - 2030 (USD Million)

Table 144 MEA simulation software market, 2017 - 2030 (USD Million)

Table 145 MEA simulation software market, by component, 2017 - 2030 (USD Million)

Table 146 MEA simulation software market, by software, 2017 - 2030 (USD Million)

Table 147 MEA simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 148 MEA simulation software market, by service, 2017 - 2030 (USD Million)

Table 149 MEA simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 150 MEA simulation software market, by application, 2017 - 2030 (USD Million)

Table 151 MEA simulation software market, by end use, 2017 - 2030 (USD Million)

Table 152 KSA simulation software market, 2017 - 2030 (USD Million)

Table 153 KSA simulation software market by component, 2017 - 2030 (USD Million)

Table 154 KSA simulation software market, by software, 2017 - 2030 (USD Million)

Table 155 KSA simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 156 KSA simulation software market, by service, 2017 - 2030 (USD Million)

Table 157 KSA simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 158 KSA simulation software market, by application, 2017 - 2030 (USD Million)

Table 159 KSA simulation software market, by end use, 2017 - 2030 (USD Million)

Table 160 UAE simulation software market, 2017 - 2030 (USD Million)

Table 161 UAE simulation software market, by component, 2017 - 2030 (USD Million)

Table 162 UAE simulation software market, by software, 2017 - 2030 (USD Million)

Table 163 UAE simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 164 UAE simulation software market, by service, 2017 - 2030 (USD Million)

Table 165 UAE simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 166 UAE simulation software market, by application, 2017 - 2030 (USD Million)

Table 167 UAE simulation software market, by end use, 2017 - 2030 (USD Million)

Table 168 South Africa simulation software market, 2017 - 2030 (USD Million)

Table 169 South Africa simulation software market by component, 2017 - 2030 (USD Million)

Table 170 South Africa simulation software market, by software, 2017 - 2030 (USD Million)

Table 171 South Africa simulation software market, by computer aided engineering, 2017 - 2030 (USD Million)

Table 172 South Africa simulation software market, by service, 2017 - 2030 (USD Million)

Table 173 South Africa simulation software market, by deployment, 2017 - 2030 (USD Million)

Table 174 South Africa simulation software market, by application, 2017 - 2030 (USD Million)

Table 175 South Africa simulation software market, by end use, 2017 - 2030 (USD Million)

Table 176 Participant’s Overview

Table 177 Financial Performance

Table 178 Product Benchmarking

Table 179 Key companies undergoing expansion

Table 180 Key companies involved in mergers & acquisitions

Table 181 Key companies undertaking partnerships and collaboration

Table 182 Key companies launching new product/service launches

List of Figures

Fig.1 Simulation Software Market - Industry Snapshot & Key Buying Criteria, 2017 - 2030

Fig.2 Segmentation Outlook

Fig.3 Simulation Software market segmentation

Fig.4 Simulation Software market, 2017 - 2030 (USD Million)

Fig.5 Value Chain Analysis

Fig.6 Market Dynamics

Fig.7 Market Driver Impact Analysis

Fig.8 Market Restraint Impact Analysis

Fig.9 Market Opportunity Impact Analysis

Fig.10 Simulation Software - Key Opportunities Prioritized

Fig.11 Simulation Software Market - Porter’s Five Force Analysis

Fig.12 Simulation Software Market - PEST Analysis

Fig.13 Simulation Software Market, By Component, 2023 & 2030 (USD Million)

Fig.14 Simulation Software Market, By Deployment, 2023 & 2030 (USD Million)

Fig.15 Simulation Software Market, By Application, 2023 & 2030 (USD Million)

Fig.15 Simulation Software Market, By End-Use, 2023 & 2030 (USD Million)

Fig.16 Simulation Software Market, By Region, 2023 & 2030

Fig.17 Simulation Software Market Regional Analyst Notes, 2023 & 2030

Fig.18 Key Company Market Share Analysis, 2023

Fig.19 Company market Position Analysis, 2023

Fig.20 Strategy Analysis, 2023What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Simulation Software Component Outlook (Revenue, USD Million, 2017 - 2030)

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- Simulation Software Deployment Outlook (Revenue, USD Million, 2017 - 2030)

- On-Premise

- Cloud

- Simulation Software Application Outlook (Revenue, USD Million, 2017 - 2030)

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- Simulation Software End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- Simulation Software Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- North America Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- North America Simulation Software Market, By Deployment

- On-Premise

- Cloud

- North America Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber SimulationOthers

- North America Simulation Software Market by End-Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- U.S.

- U.S. Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- U.S. Simulation Software Market, By Deployment

- On-Premise

- Cloud

- U.S. Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- U.S. Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- U.S. Simulation Software Market, By Component

- Canada

- Canada Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- Canada Simulation Software Market, By Deployment

- On-Premise

- Cloud

- Canada Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- Canada Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- Canada Simulation Software Market, By Component

- North America Simulation Software Market, By Component

- Europe

- Europe Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- Europe Simulation Software Market, By Deployment

- On-Premise

- Cloud

- Europe Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- Europe Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- U.K.

- U.K. Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- U.K. Simulation Software Market, By Deployment

- On-Premise

- Cloud

- U.K. Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- U.K. Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- U.K. Simulation Software Market, By Component

- Germany

- Germany Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- Germany Simulation Software Market, By Deployment

- On-Premise

- Cloud

- Germany Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- Germany Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- Germany Simulation Software Market, By Component

- France

- France Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- France Simulation Software Market, By Deployment

- On-Premise

- Cloud

- France Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- France Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- France Simulation Software Market, By Component

- Europe Simulation Software Market, By Component

- Asia Pacific

- Asia Pacific Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- Asia Pacific Simulation Software Market, By Deployment

- On-Premise

- Cloud

- Asia Pacific Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- Asia Pacific Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- China

- China Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- China Simulation Software Market, By Deployment

- On-Premise

- Cloud

- China Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- China Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- China Simulation Software Market, By Component

- India

- India Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- India Simulation Software Market, By Deployment

- On-Premise

- Cloud

- India Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- India Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- India Simulation Software Market, By Component

- Japan

- Japan Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- Japan Simulation Software Market, By Deployment

- On-Premise

- Cloud

- Japan Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- Japan Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- Japan Simulation Software Market, By Component

- South Korea

- South Korea Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- South Korea Simulation Software Market, By Deployment

- On-Premise

- Cloud

- South Korea Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- South Korea Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- South Korea Simulation Software Market, By Component

- Australia

- Australia Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- Australia Simulation Software Market, By Deployment

- On-Premise

- Cloud

- Australia Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- Australia Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- Australia Simulation Software Market, By Component

- Asia Pacific Simulation Software Market, By Component

- Latin America

- Latin America Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- Latin America Simulation Software Market, By Deployment

- On-Premise

- Cloud

- Latin America Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- Latin America Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- Brazil

- Brazil Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- Brazil Simulation Software Market, By Deployment

- On-Premise

- Cloud

- Brazil Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- Brazil Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- Brazil Simulation Software Market, By Component

- Mexico

- Mexico Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- Mexico Simulation Software Market, By Deployment

- On-Premise

- Cloud

- Mexico Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- Mexico Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment

- Architectural Engineering and Construction

- Others

- Mexico Simulation Software Market, By Component

- Latin America Simulation Software Market, By Component

- MEA

- MEA Simulation Software Market, By Component

- Software

- Services

- Simulation Development Services

- Training and Support & Maintenance

- MEA Simulation Software Market, By Deployment

- On-Premise

- Cloud

- MEA Simulation Software Market, By Application

- Engineering, Research, Modeling & Simulated Testing

- High Fidelity Experiential 3D Training

- Gaming and Immersive Experiences

- Manufacturing Process Optimization

- AI Training & Autonomous Systems

- Planning and Logistics Management & Transportation

- Cyber Simulation

- MEA Simulation Software Market, By End Use

- Conventional Automotive

- Electric Automotive and Autonomous Vehicles

- Aerospace & Defense

- Electrical, Electronics and Semiconductor

- Healthcare

- Robotics

- Entertainment