- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycled Polyethylene Terephthalate Market Report, 2030GVR Report cover

![Recycled Polyethylene Terephthalate Market Size, Share & Trends Report]()

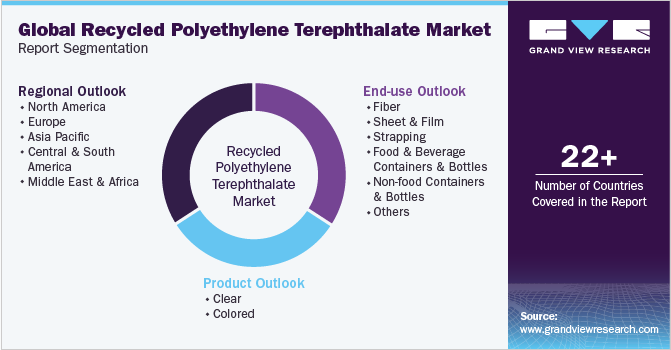

Recycled Polyethylene Terephthalate Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Bottles & Containers, Films & Sheets), By Grade (Grade A, Grade B), By Form (Flakes, Chips), By Product, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-938-8

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycled Polyethylene Terephthalate Market Summary

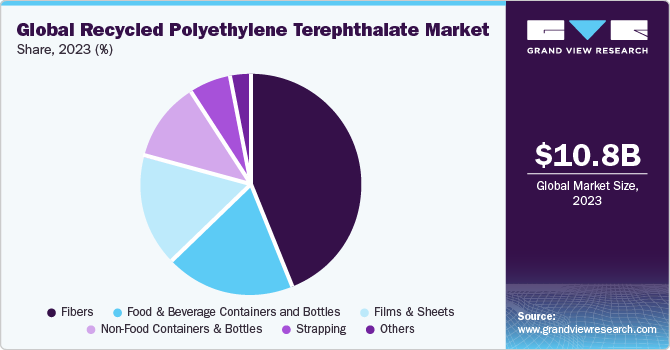

The global recycled polyethylene terephthalate market size was estimated at USD 10.8 billion in 2023 and is projected to reach USD 18.7 billion by 2030, growing at a CAGR of 8.5% from 2024 to 2030.The growth of the market can be attributed to rising sustainability measures undertaken by food & beverage and packaging companies.

Key Market Trends & Insights

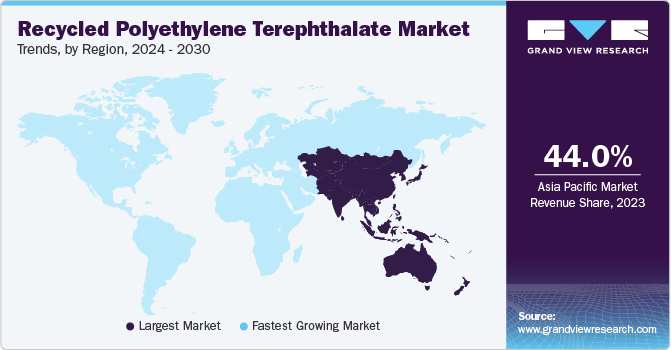

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, UAE is expected to register the highest CAGR from 2024 to 2030.

- By source, the bottles & containers formed the largest source segment for the rPET market in 2023.

- Based on grade, the grade A rPET segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.8 Billion

- 2030 Projected Market Size: USD 18.7 Billion

- CAGR (2024-2030): 8.5%

- Asia Pacific: Largest market in 2023

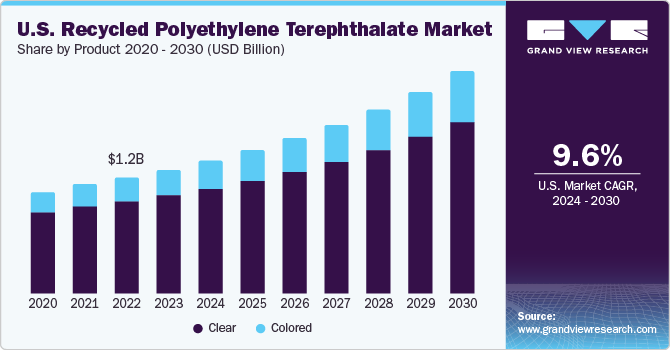

Growing efforts for a circular economy by end-users and increasing adoption of recycled plastics in the packaging, textiles, and other end-use industries are also anticipated to drive the demand for recycled polyethylene terephthalate (PET) during the forecast period. Furthermore, recycled polyethylene terephthalate (rPET) is used for developing both colored and clear (white/non-colored) products.

However, clear rPET products are the most sought after by both recyclers and end-use industries owing to their lower costs than colored rPET products. Colored rPET is preferred by packaging product and bottle manufacturers as it gives them brand identity and ensures the development of products with improved aesthetics. According to the U.S. Environmental Protection Agency, single-use plastics constitute 50% of the total plastic demand in the country. The plastic recycling rate in the U.S. is low as the plastic waste generated is exported to other countries for recycling. After the recent ban on plastic waste imports in China, the U.S. is exporting its plastic waste to Southeast Asian countries.

Companies, such as Adidas America Inc., Allbirds, Inc., Everlane, Patagonia, Inc., and Nike, Inc., are some of the potential customers of rPET in the country. In addition, the rising demand for electric vehicles (EVs) in the country is likely to augment the need for lightweight and durable plastic components to enhance vehicle efficiency. This, in turn, is projected to propel the product demand over the forecast period. The U.S. has a robust automobile manufacturing sector, which paves the way for increased demand for rPET bumpers, mattresses, and other auto components from OEMs. In addition, rPET is heavily used in the production of sofa covers, mattresses, and textiles in the U.S.

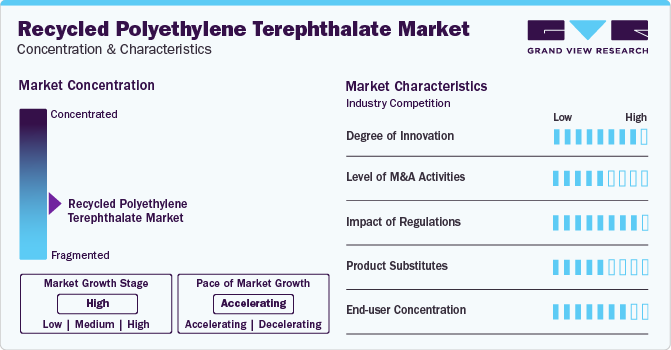

Market Concentration & Characteristics

High cost of plastics recycling is a major challenge affecting unit economics of companies operating the rPET market. Recycling of polyethylene terephthalate involves post-consumer waste collection, sorting & cleaning, processing (chemical or mechanical). Each of these stages are heavily cost and technology intensive. In addition, compliance costs in the of form of quality standards and food-grade packaging regulations add to the already high cost of producing recycled PET.

Investments in waste collection processes, adoption of waste management & recycling technologies, and improvements in recycling infrastructure shall provide relief to companies, as advancements in these areas will provide an impetus for stakeholders to achieve scalability levels where the cost factor of rPET is competitive to virgin PET.

A lack of regulatory framework with respect to plastic waste disposal, collection, segregation, and recycling in various countries also deters market participants from entering the rPET marketspace. A structured framework for the industry and government incentives in the form of rebates, tax breaks, technology access, and simplification of compliance norms would pave way for new market entrants and maintain a healthy competition in the sector.

Source Insights

Bottles & containers formed the largest source segment for the rPET market in 2023. A large portion of PET recycled into flakes and chips is sourced from bottles and food containers, wherein the waste collection process at household, businesses and municipal levels plays a crucial role in the rPET supply chain. At present, there are various chemical and mechanical processes in-place to convert these post-consumer PET bottles & containers into monomers and BHET (the precursor to PET). Therefore, recycling of polyethylene terephthalate bottles & containers are largely dependent on the waste collection & sorting processes at the waste generation stage.

Films & sheets form a niche area of rPET sources. Since films & sheets made from PET have a longer lifecycle compared to quick use & discard patterns observed in bottles & containers, the former’s contribution as a source of rPET remains relatively lesser compared to the latter.

Grade Insights

Grade A rPET held the largest revenue share in 2023, with the segment characterized by high collection and recycling rates of beverage bottles and consequent availability in the form of bales. This grade of recycled polyethylene terephthalate products are converted into fibers and bottles and deemed to as food-grade, which enables them to re-enter the food & beverage packaging ecosystem as a means of substitute for virgin PET resins. Greater adoption of recycled PET by bottlers across the globe, as a result of sustainability initiatives, shall be a key driving force being the demand for Grade A rPET over the forecast period.

Form Insights

Recycled polyethylene terephthalate flakes held a significant market share in 2023 and are considered a valuable material in the PET circular economy. rPET flakes are used across a plethora of applications that include manufacturing of new PET containers, fibers & fabrics for the textiles sector, production of strapping & packaging materials, production of films & sheets. Furthermore, rPET flakes are processed into insulation products and carpet backings, geotextiles, and fiberfills, all of which find usage in the construction industry. A considerable proportion of the rPET flakes demand also arises from the automotive sector, wherein, the material is used to produce interior components such as seat upholstery, acoustic insulation parts, and floor carpets.

From an environmental sustainability perspective, production of recycled PET flakes is less energy intensive than producing virgin PET resins. Furthermore, by re-entering the PET supply & usage ecosystem, apart from reducing the dependency on virgin PET resins, recycling & processing of polyethylene terephthalate into flakes lowers the amount of plastic entering landfills.

Product Insights

The clear rPET segment led the market with a revenue share of over 76% in 2023 owing to its durability, lightweight, non-reactive nature, and shatterproof properties. Moreover, low energy requirements and ease of bottle-to-bottle recycling are expected to drive the growth. Clear rPET resists the growth of fungi, mold, and bacteria. It is commonly used in the packaging of food, beverage bottling, cosmetics, pharmaceuticals, and electronics. Asia Pacific accounted for a high market share owing to significant investments in recycling facilities in China over the past ten years. The high production capacity of rPET flakes in China, coupled with the lower cost of production, have been significant factors driving the market growth in the region. Asia Pacific is expected to record the highest CAGR over the forecast period, followed by North America and Europe.

The colored segment will register a CAGR of approximately 9.5% from 2024 to 2030. Major end-use areas of colored rPET are automotive trays, in-process protective packaging, electronics & electrical packaging, containers, transit trays, healthcare packaging, and other plastic trays. Colored rPET is used in the production of fabrics & clothing and various packaging end-uses. Colored rPET has been gaining prominence among various food and non-food beverage manufacturers due to its ability to add a striking visual. In addition, colored packaging helps in brand differentiation and imparts a unique look. Recent trends in the market have shown that milk and personal care packaging manufacturers are shifting from HDPE to colored rPET to cut down on costs and move toward sustainability.

End-use Insights

The fiber segment accounted for the largest revenue share of nearly 40% in 2023. Various types of clothing, such as t-shirts and jackets, use fiber produced from rPET. It is also used in the manufacturing of automobile seat covers, sofa & chair seat covers, and carpets. The low production cost of clothing along with favorable government regulations are expected to drive the demand for rPET. Increasing investments in sports activities globally are augmenting the growth of the sports clothing & accessories market, which, in turn, are expected to drive the demand for recycled PET fibers. Jerseys for sports teams are the most common type of products manufactured using rPET fiber. The demand for jerseys has witnessed a strong growth in Asia Pacific over the past 10 years owing to increased sports activities in the region, especially in China and India.

The food & beverage containers & bottles segment will register a CAGR of nearly 9% from 2024 to 2030. Increasing usage of food containers in emerging economies of Asia Pacific, Middle East, and Central & South America is expected to drive the product demand in sheet & film end-uses. These containers offer thermal insulation and aesthetic appeal to stored products. Microwave-safe containers are paving the way for the growth of the sheet & film segment. Customers in developed countries prefer microwave-compatible food containers to save preparation time. These containers are commonly used in offices as they are heat-resistant, which saves time. The demand for sheets and films in roof flooring is increasing as they help limit leakage and save buildings from extremely high and low temperatures.

They also give a smooth texture to the roof and require a less quantity of paint and cement to achieve a finished look with improved aesthetic appeal. The growing goods transportation market, coupled with the high tensile strength of rPET straps, is expected to fuel the product demand. The strap is commonly used for packaging, bundling, and banding goods to combine, stabilize, reinforce, hold, and fasten the products and reduce the risk of damage during transportation. Recycled PET strap does not damage or contaminate packaging goods, has high shock absorption, puts less pressure on the edges of packages, retains strap tension despite the shrinking of packages, and can be handled easily.

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of over 44% in 2023. The regional market is characterized by the presence of several players. The market in the Asia Pacific region is characterized by the availability of a significant amount of skilled labor at low cost and the easy availability of land. The shift in the production landscape toward emerging economies, particularly China and India, is expected to positively influence the market growth over the forecast period. The region is home to several rapidly expanding industries, such as construction, automotive, and electronics, that present vast potential for rPET manufacturers.

China Recycled Polyethylene Terephthalate Market

The market in China is well-established; however, the import ban on plastic waste is expected to hamper its growth. China was the largest importer of plastic waste in the world before the ban in December 2018. Citing environmental and health concerns at the World Trade Organization in July 2017, the country announced that it is going to stop the import of 24 types of waste, 5 of which were different types of plastic. This has redirected plastic waste to Southeast Asian countries in huge quantities, which has compelled the recyclers in China to relocate to Southeast Asian countries. Thus, the ban is anticipated to negatively impact the market growth in the country in the coming years.

Europe Recycled Polyethylene Terephthalate Market

In Europe the recycled PET market is characterized by high collection rates of beverage bottles and initiatives by regional bottlers to substitute virgin PET materials with recycled PET. The region accounted for nearly a quarter of global rPET demand in 2023, with its growth driven by EU regulations regarding plastic waste disposal and collection as well as policy schemes in terms of recycling targets in the form of EU Green Deal. With some of the member states such as Germany, Austria, Denmark and the Netherlands banning plastic landfilling, recycling of PET is expected to gain momentum and subsequently translate into greater substitution rates of virgin PET resins.

Key Companies & Market Share Insights

Major players have integrated their raw material production and distribution operations, ensuring product quality and expanding their regional presence. This strategic move grants them a competitive edge by lowering costs and boosting profit margins. To remain at the forefront, these companies are actively engaging in R&D, developing innovative products that meet evolving market demands and end-user requirements.

-

On April 26, 2023, Biffa announced the acquisition of Esterpet Ltd, a North Yorkshire-based PET recycling firm, to strengthen its PET recycling division. Furthermore, on March 16, 2023, the company signed a purchase agreement to commence mass production of recycled PET materials in Asia Pacific with Shuye Electronics Co. Ltd., a China-based company. Research activities focused on new materials, which combine several properties, are projected to gain wide acceptance in this industry in the coming years.

Key Recycled Polyethylene Terephthalate Companies:

- Placon

- Clear Path Recycling LLC

- Verdeco Recycling, Inc.

- Indorama Ventures Public Ltd.

- Zhejiang Anshun Pettechs Fibre Co., Ltd.

- PolyQuest

- Evergreen Plastics, Inc.

- Phoenix Technologies

- Libolon

- Biffa

Recent Developments

-

In October 2023, Axens, IFPEN and JEPLAN announced the commissioning and start of their innovative recycling unit, Rewind PET. The unit is a modified and expanded facility of JEPLAN’s Kitakyushu Hibikinada Pilot demonstration plant in Japan. The commissioning and construction of the 1,000 tons per year facility was supported by French Environment and Energy Management Agency (ADEME).

-

In September 2023, Indorama Ventures has announced an increase in PET recycling capacity at its facility located in Juiz de Fora, Minas Gerais, Brazil, from 9,000 tons to 25,000 tons per year.

-

In March 2023, SK Chemicals signed a USD 98.4 million agreement to acquire a chemical recycling and PET production facility from Shuye Environmental Technology. The facility enables SK Chemicals to produce chemically recycled PET at a capacity of 50,000 tons per year. The facility uses depolymerization technology to chemically break down post-consumer plastic waste to monomers and produce recycled bis-hydroxyethyl terephthalate (rBHET), a precursor to rPET.

Recycled Polyethylene Terephthalate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.8 billion

Revenue forecast in 2030

USD 18.8 billion

Growth rate

CAGR of 8.5% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons; Revenue in USD Million, and CAGR (%) from 2024 to 2030

Report coverage

Revenue and volume forecast, company profiles, competitive landscape, growth factors, and trends

Segments covered

Source, Grade, Form, Product and End-use

Region scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Sweden; UK; Italy; France; Spain; Poland; China; Japan; India; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; and South Africa

Key companies profiled

Placon; Clear Path Recycling LLC; Verdeco Recycling, Inc.; Indorama Ventures Public, Ltd.; Zhejiang Anshun Pettechs Fibre Co., Ltd.; PolyQuest; Evergreen Plastics, Inc.; Phoenix Technologies; Libolon; and Biffa

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Polyethylene Terephthalate Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2024 to 2030. For the purpose of this study, Grand View Research has segmented the recycled polyethylene terephthalate market report on the basis of product,source, grade, form, end-use, and regions:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bottles & Containers

-

Films & Sheets

-

Others

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Grade A

-

Grade B

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

rPET Flakes

-

rPET Chips

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Clear

-

Colored

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fibers

-

Films & Sheets

-

Strapping

-

Food & Beverage Containers and Bottles

-

Non-Food Containers and Bottles

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Sweden

-

UK

-

Italy

-

France

-

Spain

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global recycled polyethylene terephthalate market size was estimated at USD 10.1 billion in 2022 and is expected to reach USD 10.7 billion in 2023. Changing consumer behavior toward higher sustainability is anticipated to propel market growth during the forecast period.

b. The global recycled polyethylene terephthalate market is expected to grow at a compound annual growth rate of 8.3% from 2023 to 2030 to reach USD 18.7 billion by 2030.

b. Asia Pacific dominated therecycled polyethylene terephthalate market with a share of 44.05% in 2022. This is attributable to the availability of a significant amount of skilled labor at low cost and easy availability of land coupled with a shift in production landscape towards emerging economies, particularly China and India.

b. Some key players operating in the recycled polyethylene terephthalate market include Placon; Clear Path Recycling LLC; Verdeco Recycling, Inc.; M&G Chemicals; Zhejiang Anshun Pettechs Fibre Co., Ltd.; PolyQuest; Evergreen Plastics, Inc.; Phoenix Technologies; and Libolon.

b. Key factors that are driving the market growth include recycled polyethylene terephthalate application in FMCG, consumer goods, automobiles, and its application for packaging in the food and beverages industry.

b. The clear product segment dominated the global recycled polyethylene terephthalate market in 2022 accounting for a market share of more than 76.53%, owing to the major demand from application areas including automotive trays, in-process protective packaging, electronics and electrical packaging, containers, transit trays, healthcare packaging, and other plastic trays

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.