- Home

- »

- Personal Care & Cosmetics

- »

-

Personal Care Packaging Market Size & Share Report, 2030GVR Report cover

![Personal Care Packaging Market Size, Share & Trends Report]()

Personal Care Packaging Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Flexible, Rigid Plastics, Paper, Metal, Glass), By Packaging Type (Bottles, Jars, Cans, Cartons, Tubes, Pouches), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-734-6

- Number of Report Pages: 126

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Personal Care Packaging Market Summary

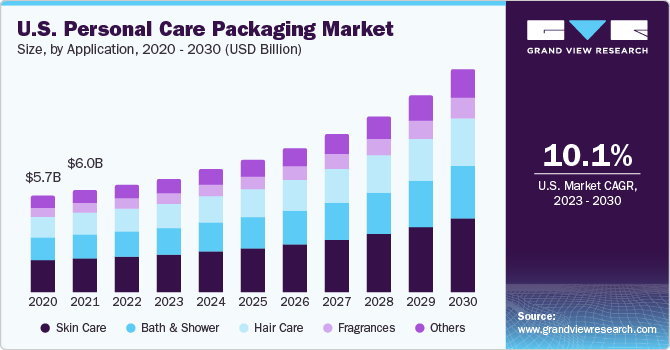

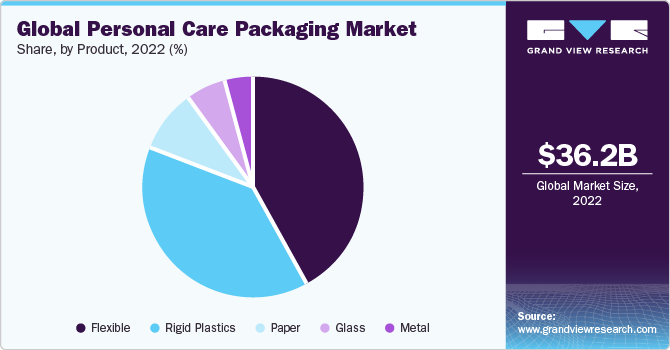

The global personal care packaging market size was valued at USD 36.20 billion in 2022 and is projected to reach USD 79.14 billion by 2030, growing at a CAGR of 10.7% from 2023 to 2030. Increasing focus on improving the aesthetic design of personal care products to attract consumers is expected to drive demand.

Key Market Trends & Insights

- Asia Pacific dominated the personal care packaging market and accounted for the largest revenue share of 40.7% in 2022.

- By application, the skin care segment accounted for the largest revenue share of 33.1% in 2022.

- By packaging type, the bottles segment accounted for the largest revenue share of 30.2% in 2022.

- By product, the flexible segment accounted for the largest revenue share of 42.3% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 36.20 Billion

- 2030 Projected Market Size: USD 79.14 Billion

- CAGR (2023-2030): 10.7%

- Asia Pacific: Largest market in 2022

Increasing consumer awareness towards sustainable and compact durable product packing solutions is expected to have a positive impact on market growth. Surging demand for hair care and skin care products on account of increasing consumer awareness toward healthy lifestyle habits is expected to fuel industry expansion. Rising consumption of perfumes, aftershaves, and nail paints is expected to fuel demand. Rapid industrialization leading to the establishment of numerous cosmetic manufacturing units particularly in India and China is expected to stimulate industry growth over the next seven years.

Technological innovations aimed at improving the manufacturing process of flexible packaging to minimize raw material consumption and lower energy costs are expected to promote industry expansion over the forecast period. However, volatile raw material prices of HDPE and PP are expected to hinder growth over the next seven years.

Increasing R&D investments, growing utilization of bioplastics along ongoing product development to improve packaging performance are expected to open new avenues over the forecast period.

Application Insights

The skin care segment accounted for the largest revenue share of 33.1% in 2022 and is expected to grow at the fastest CAGR of 11.3% during the forecast period. On account of growing awareness regarding beauty, increasing consumer concerns regarding the harmful effects of pollution and global warming. Also, increasing preference among male consumers for skin care products along with high requirements of anti-aging creams will propel growth.

The bath & shower was a prominent segment accounting for 19.3% of the market share in 2022 and is expected to witness a rise owing to increasing awareness about health and hygiene among consumers, particularly in the Middle East and Asia Pacific. Also, an increasing shift towards the use of body washes, shower gels, bars, and liquid soaps will drive growth. Moreover, superior antibacterial properties in soaps will create immense industry potential over the forecast period.

Packaging Type Insights

The bottles segment accounted for the largest revenue share of 30.2% in 2022. The segment is expected to continue to lead the market on account of high usage in hair care, skincare, and bath & shower products. Cans are expected to lose market share over the forecast period as a result of their harmful environmental impacts, high manufacturing costs along heavy weight.

The pouches segment is expected to grow at the fastest CAGR of 11.7% during the forecast period. The factors driving the pouch packaging segment include consumer preferences for convenience and aesthetics, market trends such as portable consumption and environmentally friendly packaging, technological advancements in materials and printing methods, and environmental concerns related to resource utilization and waste reduction.

Product Insights

The flexible segment accounted for the largest revenue share of 42.3% in 2022 and is expected to grow at the fastest CAGR of 11.2% during the forecast period, on account of various advantages including container variety, less raw material requirement, easy disposal, and lightweight. The emergence of bioplastics as packaging solutions with improved durability and shelf life is expected to create immense opportunities for the personal care packaging sector over the forecast period.

Heavyweight, high storage costs, negative environmental impact, and corrosion are some of the technical issues owing to which demand for metal packaging is likely to reduce over the forecast period. However, high consumption of deodorants and hair sprays in various countries including China, India, the U.S., Germany, Saudi Arabia, and Brazil is expected to augment demand for aerosol cans.

Regional Insights

Asia Pacific dominated the personal care packaging market and accounted for the largest revenue share of 40.7% in 2022 and is expected to grow at the fastest CAGR of 12.6% during the forecast period.

This trend is expected to continue on account of the growing demand for personal care products with lightweight packing, thus, driving the flexible packaging market in countries including India, Indonesia, Sri Lanka, and Vietnam. Also, rising grooming awareness particularly among men, increasing income levels along with rising consumption of gels, hair serums, skin creams, perfumes, tanning lotions, and sunblock will propel industry development.

Key Companies & Market Share Insights

The industry is extremely competitive with key companies involved in R&D activities and constant product innovation.

Key Personal Care Packaging Companies:

- Amcor plc

- Mondi

- Sonoco Products Company

- Albea Group

- Ardagh Group S.A.

- Ampac Holding

- Crown

- ITC

- WestRock Company

Recent Developments

-

In June 2023, Albéa Tubes and Oriflame joined forces to introduce the Duologi line. Oriflame selected Albéa’s (Re)flex 2 technology for their innovative hair care range. This new line encompasses two conditioners: "Light Crème Conditioner" and "Rich Crème Conditioner", both elegantly presented in metallized PBL tubes featuring a PP low-profile cap and a sleeve free of aluminum. Albéa's (Re)flex 2 technology has been acknowledged for its complete compatibility with the rigid high-density polyethylene recycling stream in Europe.

-

In May 2023, Albéa Cosmetics & Fragrance unveiled a novel refillable jar called Twirl. The concept behind Twirl emerged from the necessity to create a refilling jar with a fresh approach. The teams collaborated to devise a solution that is visually appealing, user-friendly, and environmentally friendly.

-

In May 2023, Amcor plc, Mars, Delterra and Procter & Gamble together announced a strategic alliance to combat plastic pollution in the global south region. Together, these prominent players will invest USD 6 million across five years to develop upstream initiatives aimed at a circular plastics economy.

-

In March 2023, ITC's Savlon Glycerin Soap pioneered a significant modification in soap packaging. The PET film used to cover Savlon Glycerin Soap by ITC Savlon is the first in its category to employ 70% recycled plastic material. The initiative represents a major breakthrough in integrating sustainability into Indian customers' daily routines.

-

In December 2022, WestRock Company announced the successful completion of the acquisition of Grupo Gondi's remaining interests. This strategic acquisition is intended to bolster the company's position in the growing markets of corrugated packaging, consumer goods, and paperboard in the Central and South American region.

-

In July 2022, OnTop Cosmetics introduced its Renewal Oil Cream with copolyester packaging under the Eastman Chemical Company Cristal Renew label. In January 2022, the Renewal Oil Cream version 2.0 was recognized as an "Innovative Product" by Mintel. The primary packaging for the product was developed in collaboration with WWP Beauty.

-

In August 2022, Toly, a manufacturer of beauty packaging, expanded its production capabilities in Asia with the inauguration of a new plant in South Korea. This manufacturing facility integrates stretch injection blow molding equipment from Aoki, a company based in Malta. The equipment is used to produce PET (polyethylene terephthalate) bottles and jars for the cosmetics sector.

-

In January 2022, WOW Skin Science, an Indian company under the Body Cupid umbrella, launched a paper tube packaging for its popular product, the Vitamin C face wash. Through its #WOWGreenHands initiative, the company furthered its environmental awareness campaign, aligning with its objective of evolving into a fully green and plastic-positive brand. One of the initial strategies employed in this campaign involved creating new packaging for its products using recycled materials, while ensuring the continued convenience of use.

-

In March 2022, AptarGroup, Inc. unveiled the world's first certified beauty packaging made from recycled plastic. This achievement was validated by the International Sustainability and Carbon Certification (ISCC). This recycled plastic is suitable for packaging cosmetics and food products. In terms of brightness, transparency, aesthetic potential, and flexibility, it is visually comparable to virgin plastic.

-

In December 2022, Amcor plc Packaging Solutions announced the official opening of its new state-of-the-art manufacturing facility in Huizhou, China. Covering an area of 590,000 square feet, this factory stands as the largest flexible packaging facility in China in terms of production capacity. The establishment represents an investment of around USD 100 million and is poised to enable Amcor to effectively address the growing demand for its products in the region.

Personal Care Packaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 38.78 billion

Revenue forecast in 2030

USD 79.14 billion

Growth Rate

CAGR of 10.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, packaging type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Thailand; Indonesia; Malaysia; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Amcor plc; Mondi ; Sonoco Products Company; Albea Group; Ardagh Group S.A.; Ampac Holding ; Crown; ITC; WestRock Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personal Care Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global personal care packaging market based on application, product, packaging type, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Care

-

Hair Care

-

Bath & Shower

-

Fragrances

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flexible

-

Rigid Plastics

-

Paper

-

Metal

-

Glass

-

-

Packaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Cartons

-

Jars

-

Tubes

-

Pouches

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global personal care packaging market size was estimated at USD 36.20 billion in 2022 and is expected to reach USD 38.78 billion in 2023.

b. The global personal care packaging market is expected to grow at a compound annual growth rate of 10.7% from 2023 to 2030 to reach USD 79.14 billion by 2030

b. Asia Pacific dominated the personal care packaging market with a share of 41% in 2022. This is attributable to rising grooming awareness particularly among men, increasing income levels along rising consumption of gels, hair serums, skin creams, perfumes, tanning lotions, and sunblock.

b. Some key players operating in the personal care packaging market include Amcor, Bemis Company, Mondi plc, Sonoco, and Albea Group. Other players include Ardagh Group, Ampac Holding and Crown Holdings, Inc., ITC, and WestRock Company.

b. Key factors that are driving the market growth include surging demand for hair care and skin care products on account of increasing consumer awareness toward healthy lifestyle habits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.