- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycled PET Flakes Market Size, Industry Report, 2033GVR Report cover

![Recycled PET Flakes Market Size, Share & Trends Report]()

Recycled PET Flakes Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Clear, Colored), By End Use (Fiber, Sheet & Film, Strapping, Food And Beverage Bottles & Containers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-015-9

- Number of Report Pages: 128

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycled PET Flakes Market Summary

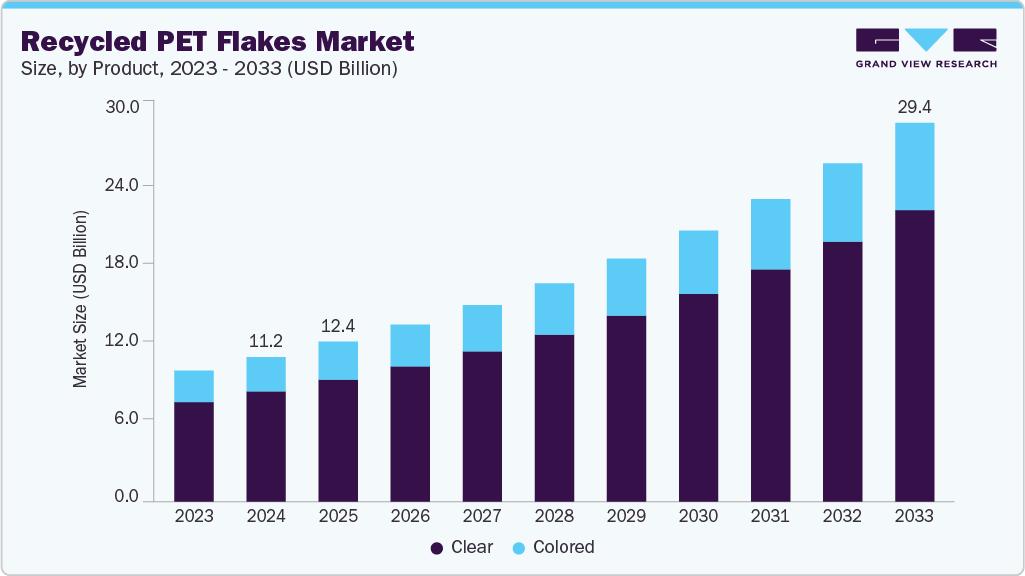

The global recycled PET flakes market size was estimated at USD 11.23 billion in 2024 and is projected to reach USD 29.42 billion by 2033, growing at a CAGR of 11.38% from 2025 to 2033. The growth of this industry can be attributed to the consolidated development of food & beverages, household appliances, and personal care products sub-segments.

Key Market Trends & Insights

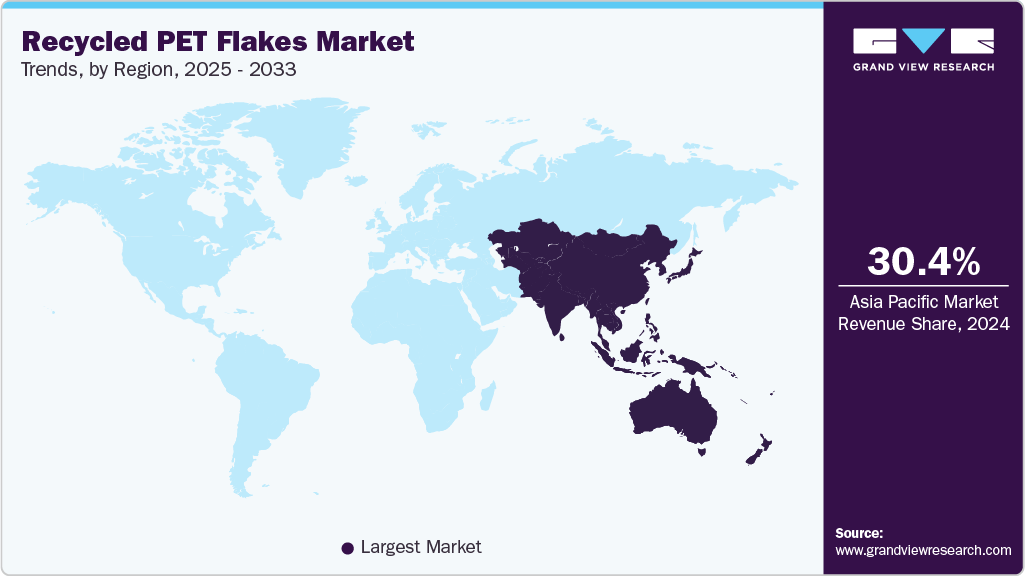

- Asia Pacific dominated the rPET flakes market with the largest revenue share of 30.37% in 2024.

- The rPET flakes market in GCC countries is expected to grow at a substantial CAGR of 12.21% from 2025 to 2033.

- By product, the clear segment is expected to grow in revenue at a considerable CAGR of 11.51% from 2025 to 2033.

- By end use, the revenue of the non-food bottles and containers segment is expected to grow at a considerable CAGR of 11.89% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 11.23 Billion

- 2033 Projected Market Size: USD 29.42 Billion

- CAGR (2025-2033): 11.38%

- Asia Pacific: Largest market in 2024

Changing consumer lifestyle worldwide has resulted in high demand for ready-to-eat food products. This, in turn, is fueling the demand for recycled plastic-based food packaging products. Recycled polyethylene terephthalate (rPET) flakes are used in fibers to produce various types of clothing, such as t-shirts and jackets. They are also used in the manufacturing of automobile seat covers, sofa & chair covers, carpets, etc. The low production costs of clothing developed from rPET flakes and the favorable government regulations are expected to drive the demand for rPET flakes worldwide. The aforementioned factors will likely create demand for rPET flakes in the forecast period.Changing consumer lifestyle worldwide has resulted in high demand for ready-to-eat food products. This, in turn, is fueling the demand for recycled plastic-based food packaging products.The Recycled Polyethylene Terephthalate Flakes Market in the U.S. is projected to witness significant growth over the coming years. The rising demand for electric vehicles in the U.S. is anticipated to augment the requirement for lightweight and durable plastic components to enhance efficiency. This, in turn, is projected to contribute to the demand for recycled polyethylene terephthalate (rPET) flakes in the U.S. from 2024 to 2033.

Companies such as ALLIANCE FIBRES LTD., Sorema, Circularix, and Macquarie Group Limited are some of the potential customers of recycled polyethylene terephthalate (rPET) flakes in the country. In addition, the rising demand for electric vehicles in the U.S. is anticipated to augment the requirement for lightweight and durable plastic components to enhance their efficiency. Furthermore, various government initiatives for recycling plastics, coupled with high investments, have resulted in the market growth in the region.

Several key market players have into strategic mergers & acquisitions, joint ventures, and new product development to expand their market presence in the global market. In the past few years, the joint venture has been an integral part of the recycled polyethylene terephthalate (rPET) flakes industry, allowing market players to strengthen their global market position. For instance, in October 2024, in collaboration with Coca-Cola, Indorama Ventures built a polyethylene terephthalate (PET) recycling facility in the Philippines as a part of the Coca-Cola Company's World without Waste Campaign, aiming to collect and recycle the equivalent of every bottle sold by 2033.

Market Concentration & Characteristics

The growth stage of the rPET flakes market is high, and the pace is accelerating. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies like Biffa, Clear Path Recycling LLC, AMAANI POLYFLAKES, Verdeco Recycling, Inc., Indorama Ventures Public Ltd., AlEn USA, PolyQuest, Evergreen Plastics, Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and end uses to meet evolving industry demands.

In many end‑use sectors, especially packaging and textiles, rPET flakes face competition from virgin PET resin and alternative polymers such as polypropylene (PP) and polyethylene (PE). Virgin PET offers consistent properties and easier processing, making it appealing when price gaps are narrow. Meanwhile, producers of PP and PE have optimized their sustainability messaging, using lower costs to position these as credible alternatives, especially for applications with less stringent clarity or barrier requirements.

Tightening global regulations, such as the EU’s Single Use Plastics Directive and increasing Extended Producer Responsibility (EPR) schemes, are pushing brands to integrate high‑quality rPET in packaging. Mandatory recycled content targets are reshaping supply chains, forcing converters and recycling infrastructure to scale rapidly. This regulatory environment is accelerating capital investment in advanced sorting and washing facilities to meet compliance and avoid penalties.

Product Insights

Clear rPET flakes dominated the application segment in the market and accounted for more than 76.18% of the total market share, in terms of revenue, in 2024. This market segment is projected to witness high growth in the coming years, owing to the increased durability of clear recycled polyethylene terephthalate (rPET) flakes. Moreover, these lightweight and non-reactive flakes are shatterproof. They possess properties that resist the growth of fungi, mold, and bacteria. Clear recycled polyethylene terephthalate (rPET) flakes are majorly used in the packaging of food products, beverages, cosmetics, pharmaceuticals, and electronic goods.

Clear recycled polyethylene terephthalate (rPET) flakes are used in various applications owing to their widespread utilization in food and non-food applications and their low associated processing costs. Most manufacturers prefer clear recycled polyethylene terephthalate (rPET) flakes to produce containers and bottles rather than opaque or colored recycled polyethylene terephthalate (rPET) flakes. In addition, clear flakes help in the easy detection of variations in products packaged inside containers and bottles developed from them. These factors are anticipated to drive the demand for clear recycled polyethylene terephthalate (rPET) flakes over the forecast period

Moreover, the gaining prominence among various global end use industries such as food & beverages, textiles, and consumer goods owing to their ability to add a striking visual to products. In addition, colored packaging products help in brand differentiation and impart a unique look to packaged goods. Colored recycled polyethylene terephthalate (rPET) flakes are used in milk and personal care products' packaging due to their low costs and sustainability.

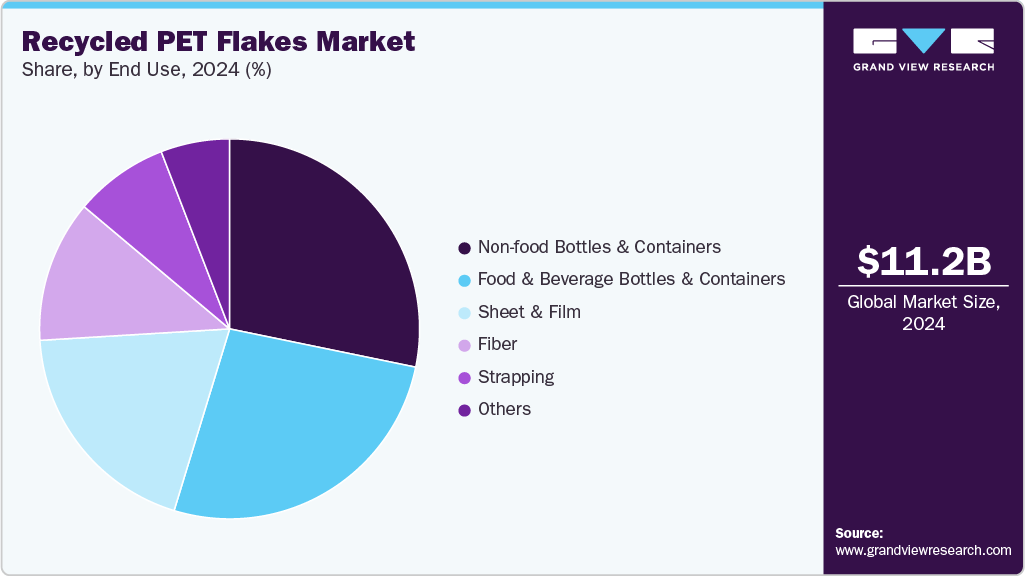

End Use Insights

Non-food bottles & containers dominated the global recycled PET flakes industry and accounted for more than 28.23% of the total market share, in terms of revenue, in 2024. Increasing spending on the commissioning of manufacturing units, particularly in Asia Pacific, is expected to surge the demand for recycled polyethylene terephthalate (rPET) flakes used for developing non-food bottles & containers. Government subsidies in the form of tax incentives to various industries in countries such as China, India, Vietnam, Indonesia, and Thailand for promoting the use of recycled polyethylene terephthalate (rPET) flake-based bottles & containers are expected to drive the growth of the market in the coming years.

The establishment of bottled water manufacturing plants with state-of-the-art technologies and the boom in tourism activities, especially in Asia Pacific, are projected to propel the demand for bottled water, thereby fueling the consumption of recycled polyethylene terephthalate (rPET) flakes for developing food and beverage bottles & containers. These factors are expected to drive the growth of the segment of the market during the forecast period.

Furthermore, the low production costs of clothing developed from recycled polyethylene terephthalate (rPET) flakes and favorable government regulations are expected to drive the demand for recycled polyethylene terephthalate (rPET) flakes worldwide. Increasing investments in sports activities globally are augmenting the growth of the sports clothing and accessories market. This, in turn, is expected to drive the demand for fibers based on recycled polyethylene terephthalate (rPET) flakes.

Region Insights

Asia Pacific dominated the rPET flakes market in 2024 and accounted for 30.37% of the overall market revenue share. Owing to the easy availability of low-cost skilled labor on a large scale. The region also has abundant land. The shift in the global production landscape toward emerging economies of Asia Pacific, including China and India, is expected to positively influence the growth of the market in the region over the forecast period. Asia Pacific is home to several rapidly expanding industries, such as construction, automotive, and electronics, that present significant growth potential for manufacturers of recycled polyethylene terephthalate (rPET) flakes.

North America Recycled PET Flakes Market Trends

Demand in North America is propelled by a surge in sustainable packaging mandates and heightened consumer preferences for circular economy products. Major food and beverage brands are committing to 50% recycled content in PET packaging by 2030, prompting increased industrial-grade rPET production. Meanwhile, public-private partnerships are bolstering advanced recycling infrastructure to close supply‑demand gaps. This is attracting CAPEX across collection, sorting, and washing operations.

U.S. Recycled PET Flakes Market Trends

In the U.S., legislative momentum, such as the Break Free From Plastic Pollution Act and state-level EPR schemes (e.g., in California and New York), creates clear economic incentives for rPET uptake. Fast‑moving consumer goods (FMCG) companies are entering off‑take agreements to secure feedstock, improving market visibility. Investment in near‑infrared sorting and bottle‑to‑bottle recycling technologies is enhancing flake quality and yield.

Europe Recycled PET Flakes Market Trends

Europe’s rPET market is driven by the EU’s Packaging and Packaging Waste Regulation, which mandates ≥30-50% recycled PET content in bottles by 2030-2035. This regulatory clarity spurs strategic capital deployment into chemical recycling pilots and scaling mechanical recycling networks across the EU‑27. Premium rPET pricing achieved through Green Dot and Ecolabel schemes reinforces investment viability. Circular procurement measures by governments and retailers further elevate volume demand.

China Recycled PET Flakes Market Trends

China’s strategy to reduce plastic waste via a “resource‑centered” policy framework has led to tight control of scrap export and steep investment in domestic recycling logistics. The implementation of extended EPR in key provinces has driven local converters to adopt high‑quality rPET flakes. Additionally, booming domestic demand for rPET in textile and non‑food packaging sectors is incentivizing leading recyclers to vertically integrate collection, sorting, and flaking operations.

Key Recycled PET Flakes Company Insights

The key players operating in the recycled PET flakes market include Biffa, Clear Path Recycling LLC, AMAANI POLYFLAKES, Verdeco Recycling, Inc., Indorama Ventures Public Ltd., AlEn USA, PolyQuest, Evergreen Plastics, Inc., and others, owing to the presence of top regional players. Due to the increasing demand for the production of rPET flakes for various end use including fiber, food, and beverage bottles & containers, key manufacturers are developing new polymers for the production of rPET flakes.

The key global companies are expected to develop their product offerings to North America, Asia Pacific, the Middle East & Africa, and Latin America, owing to the market demand in these regions, given the expansion of the rPET flakes market.

Key Recycled PET Flakes Companies:

The following are the leading companies in the recycled PET flakes market. These companies collectively hold the largest market share and dictate industry trends.

- Clear Path Recycling LLC

- Verdeco Recycling

- Indorama Ventures Public Ltd.

- PolyQuest

- Evergreen Plastics, Inc.

- Biffa

- GSM Plastic Industries

- RCS Entsorgung GmbH

- TOMRA System ASA

- Polyvim LLC

- Veolia Umweltservice GmbH

- AMAANI POLYFLAKES

- Pashupati Polytex Pvt. Ltd.

- AlEn USA

- RAHSAM Co.

- LANGGENG JAYA GROUP

Recent Developments

-

In May 2025, Chemco Group and Kandoi Group formed a joint venture with a total investment of approximately USD 54 million to establish two greenfield manufacturing plants in Vapi and Dahej, Gujarat. These facilities were designed to produce Flexible Intermediate Bulk Container (FIBC) bags entirely from (rPET), using a closed-loop system that includes PET bottle collection, washing, tape extrusion, weaving, and bag fabrication. The plants aimed to recycle over 10 million PET bottles daily (about 3.6 billion annually) and operate fully on renewable energy, providing a low-carbon alternative to traditional packaging materials.

-

In November 2024, the Coca-Cola Company completed the nationwide rollout of 20-ounce bottles made from 100% recycled polyethylene terephthalate (rPET) for its Coca-Cola, Diet Coke, Coke Zero, and other Coke flavors across the US. This initiative helped avoid the use of nearly 80 million pounds of virgin PET in 2024, equivalent to almost 2 billion bottles, reducing energy use and carbon emissions.

Recycled PET Flakes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.42 billion

Revenue forecast in 2033

USD 29.42 billion

Growth rate

CAGR of 11.38% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in Tons, Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, and region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Clear Path Recycling LLC; Verdeco Recycling; Indorama Ventures Public Ltd.; PolyQuest; Evergreen Plastics, Inc.; Biffa; GSM Plastic Industries; RCS Entsorgung GmbH; TOMRA System ASA; Polyvim LLC; Veolia Umweltservice GmbH; AMAANI POLYFLAKES; Pashupati Polytex Pvt. Ltd.; AlEn USA; RAHSAM Co.; LANGGENG JAYA GROUP

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled PET Flakes Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the recycled PET flakes market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

Clear

-

Colored

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

Fiber

-

Sheet & Film

-

Strapping

-

Food & beverage bottles & containers

-

Non-food bottles & containers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.