- Home

- »

- Next Generation Technologies

- »

-

U.S. Pet Wearable Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Pet Wearable Market Size, Share & Trends Report]()

U.S. Pet Wearable Market Size, Share & Trends Analysis Report By Technology (RFID, GPS, Sensors), By Product, By Animal Type, By Component, By Sales Channel, By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-534-2

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Pet Wearable Market Size & Trends

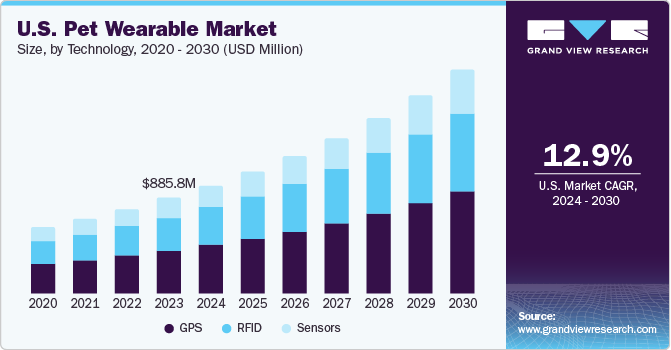

The U.S. pet wearable market size was estimated at USD 885.8 million in 2023 and is expected to grow at a CAGR of 12.9% from 2024 to 2030. The growth of the market can be attributed to the growing emphasis of pet owners on the health and safety of their pets. This emphasis is further fueled by continuous advancements in wearable technologies customized specifically for pets, introducing features such as GPS trackers and health monitors. Moreover, the rising pet ownership is highlighting the demand for attentive and interconnected pet care, which is propelling the growth of the market.

Pet wearables offer advanced features such as controlling, tracking, monitoring, treatment, medical diagnosis, security, and safety; facilitating the well-being of pets. Several veterinary professionals in the U.S. rely on technologies such as telehealth. This helps them remotely observe their patient’s health while also gaining health-related data stored in wearables, which can be used for medical diagnosis. The ability of pet wearables to monitor and record various animal behaviors such as vital signs, sleep patterns, licking, resting, scratching, and more is expected to increase the adoption of these devices among pet owners.

The increase in spending on pet products is expected to drive market growth. According to data published by the American Pets Products Association (APPA), spending on pet products amounted to USD 147 billion in 2023, an increase from USD 123.6 million in 2021. Pet owners are expected to invest in smart technologies such as wearables to secure their pets’ health. As such, companies are investing heavily in introducing feature-loaded products offering multiple functionalities such as voice commands, vibration, sound alerts, and gentle electric shocks, which help keep the pets within a specified zone. Such technological advancements are anticipated to appeal to pet owners and drive them to purchase pet wearables, thereby contributing to market growth.

Key players in the market include Datamars, FitBark, Link My Pet, Loc8tor Ltd., and PetPace LLC. These companies are pursuing various initiatives, such as strategic partnerships, mergers & acquisitions, new product launches, and hosting seminars, as part of the efforts to attract new customers. For instance, in May 2022, FitBark, a data-driven pet technology company in the U.S., launched the FitBark GPS 2nd Generation, an advanced pet wearable designed to provide reliable coverage for pets. This product offers pet owners a reliable and versatile tracking solution, ensuring comprehensive nationwide coverage, improved accuracy, and long-lasting performance for effective pet monitoring.

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The U.S. pet wearable market is fairly concentrated. The U.S. pet owners are exhibiting a growing interest in ensuring the safety and well-being of their pets, leading to a surge in the adoption of pet wearables, particularly those offering GPS tracking and real-time positioning features. The market is characterized by the presence of several players introducing innovative products to maintain a competitive edge in the market. With the increasing demand for pet wearables, several new players are emerging to capitalize on the emerging trend in the pet market.

As of 2022, there are about 284 pet wearable companies globally. Some prominent players are investing heavily in R&D to introduce new and improved products to stay competitive. For instance, in February 2022, Garmin Ltd. introduced two new dog tracking devices, TT 15 X and T5X. These devices have a long battery life of up to 80 hours and improved tracking functions, which enable pet owners to track dogs from a distance of nine miles.

Additionally, implementing stricter regulations to mitigate such occurrences has further fueled this trend. For example, governmental initiatives such as mandatory microchipping and specialized registries for lost pets have been introduced in various states. For instance, starting August 2024, pet owners residing within the City of Las Vegas must comply with a new mandatory microchip ordinance. Enacted by the city council in October 2023, this regulation mandates that all dogs and cats aged over four months and residing within the city limits must be microchipped. This measure aims to enhance pet identification and reunification efforts in the event of lost or missing pets, ensuring a more efficient and effective means of tracking and locating them. Furthermore, with the integration of cutting-edge technologies and an increasing focus on pet health and safety, the pet wearable devices market in the U.S. is expected to have significant growth.

Pet wearables serve as valuable supplements to traditional pet care practices such as veterinary care and professional training. These devices, equipped with features such as health monitoring and activity tracking, provide pet owners with additional insights into their pet's well-being and behavior. Pet wearables enhance overall pet care, but they're designed to complement existing services, not replace them entirely. This ensures an inclusive approach to pet well-being. Veterinary care and professional training remain integral components of pet care, and the integration of wearables adds a layer of convenience and real-time data for pet owners to participate in their pets' health and training routines actively.

Technology Insights

The GPS segment accounted for the largest share of around 45% of the U.S. pet wearable market in 2023. GPS tags are mounted on pet collars to track the location of pets in real-time. GPS allows pet owners to set geofenced areas and alerts them when pets step out of that confined area. Furthermore, GPS technology can be easily installed in devices such as smartphones and smartwatches, which display the pet's location. Such technological integration into smart devices is expected to trigger consumer interest, thereby driving its integration of GPS into pet wearables.

The RFID segment is expected to register strong growth over the forecast period. According to a survey conducted by the American Pet Products Association (APPA) in 2021, approximately 154.3 million households in the U.S. own pets such as cats, dogs, and horses. RFID tags help owners and veterinary professionals identify their pets and gather health-related parameters such as pulse rate, heartbeat, body temperature, and calorie intake, which help analyze pets' health conditions. Therefore, the increasing need to monitor pets’ health conditions in real-time to ensure pet well-being is anticipated to increase the adoption of RFID-based wearables.

Product Insights

The smart collar segment led the market and accounted highest revenue share of 43.8% in 2023. Advancements in technology, including the integration of artificial intelligence and machine learning algorithms, are improving the accuracy and effectiveness of smart collar functionalities, driving adoption among tech-savvy consumers. Moreover, the increasing availability of pet insurance plans that offer coverage for wearable devices is incentivizing pet owners to invest in smart collars, further fueling market growth.

The smart harness and vest is anticipated to witness the fastest CAGR of 14.1% from 2024 to 2030 in the market. Smart harnesses and vests equipped with sensors offer comprehensive health monitoring for pets by tracking vital signs such as heart rate, respiratory rate, and temperature. These advanced wearables enable pet owners to continuously monitor their pet's health, providing real-time data and alerts. By detecting anomalies early, such as changes in heart rate or body temperature, these devices help identify potential health issues before they become serious. This proactive approach to pet health management enhances the ability to address illnesses promptly, ensuring better overall well-being for pets and peace of mind for their owners.

Animal Type Insights

The cats segment led the market and accounted highest revenue share of 44.8% in 2023. The increasing awareness among cat owners regarding the importance of monitoring their pets' health and behavior is fueling demand for wearable devices tailored specifically for cats. Similarly, cat owners are increasingly concerned about the safety and security of their pets, particularly if they let them roam outdoors. GPS-enabled pet wearables offer peace of mind by allowing owners to track their cats' whereabouts and quickly locate them if they wander off or get lost. Some GPS pet wearables allow owners to set virtual boundaries or geofences. If the cat strays beyond these predefined boundaries, the owner receives an alert on their smartphone, enabling them to take immediate action to retrieve the cat before it ventures too far.

The dogs segment is anticipated to witness significant growth from 2024 to 2030 in the market. Advancements in technology, such as the development of lightweight and durable wearable devices, as well as battery life and data analytics capabilities, are making these products more accessible and appealing to a wider range of consumers. The increasing availability of pet insurance plans that cover wearable devices is also driving market growth by reducing the financial barrier to adoption.

Component Insights

The connectivity integrated circuit segment led the market and accounted highest revenue share of 22.5% in 2023 as pet owners seek personalized solutions to monitor and manage their pets' health and behavior. Connectivity integrated circuits enable the development of customizable pet wearable devices that can cater to specific needs and preferences, driving adoption among consumers. Some manufacturers of connectivity integrated circuits for pet wearables have formed strategic partnerships with Internet of Things (IoT) platform providers to leverage cloud-based services for storing and analyzing pet health data collected by wearables.

The processors segment is anticipated to witness fastest CAGR of 15.7% from 2024 to 2030 in the market. Technological advancements leading to more energy-efficient processors are likely to address concerns related to power consumption in pet wearables. As newer processors become more power-efficient while maintaining high performance levels, they offer improved battery life and overall usability in pet wearable devices. This development is expected to drive adoption rates among consumers who value longer-lasting and reliable pet monitoring solutions.

Sales Channel Insights

The online segment led the market and accounted highest revenue share of 57.6% in 2023. The convenience and ease of purchasing pet wearables online through e-commerce platforms contribute to the online segment's expansion. The convenience of browsing a wide range of products, comparing features, and reading reviews online has made it a preferred channel for pet owners to research and purchase wearable devices for their pets. Moreover, the COVID-19 pandemic has accelerated the adoption of online sale across various sectors, including pet care, leading to growth of the online segment.

The offline segment is anticipated to grow at a CAGR of 11.4% from 2024 to 2030 in the market. The growth of pet specialty stores and veterinary clinics across the U.S. has expanded the distribution channels for these devices, making them more accessible to a wider consumer base. Furthermore, advancements in technology, such as improved battery life and enhanced connectivity options, are making pet wearables more reliable and user-friendly, contributing to their growing popularity in the offline segment.

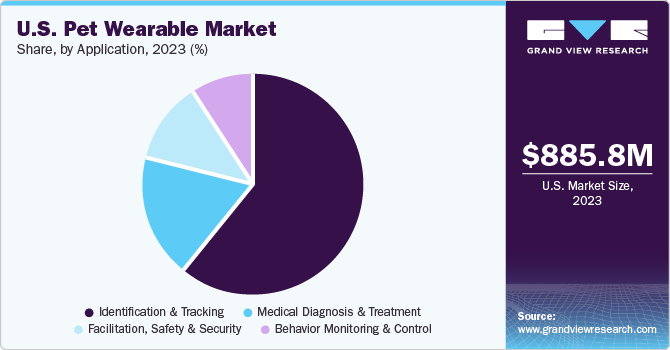

Application Insights

The identification and tracking segment held the highest market share in 2023. As such, pet wearable devices prevent pets from getting lost by providing a real-time location to the pet owners, which is anticipated to drive the adoption of these devices over the forecast period. According to the data published by the American Humane Association, as of 2021, there were approximately 135 million cats and dogs in the U.S., and around 10 million of these get lost or stolen every year. Out of all the missing pets, more than 80% of pets are never found. Therefore, pet wearable devices prevent pets from getting lost by providing a real-time location to pet owners, which is anticipated to drive the adoption of these devices over the forecast period.

The medical diagnosis and treatment segment is anticipated to register the highest CAGR of 15.8 % from 2024 to 2030. The growth of this segment can be attributed to the increasing demand for devices to track pets’ physical activity and health conditions and detect any health issues to ensure their safety. Several pets suffer from common health issues such as skin allergies, infections, obesity, arthritis, chronic kidney disease, and excessive thyroid syndrome, which deteriorate pets’ health and incur heavy veterinary expenses. As such, wearables enable pet owners to monitor and keep track of their pet’s health in real-time, thereby maintaining pet health and cutting down on medical expenses.

Key U.S. Pet Wearable Company Insights

Garmin Ltd., Tractive and Whistle Labs, and others are some of the prominent participants operating in the market:

-

Garmin Ltd. is a technology company that specializes in the design, development, and manufacturing of navigation, communication, and information devices. The company's product portfolio includes GPS-enabled devices for automotive, aviation, marine, outdoor, and sports activities. The company's pet wearable devices are designed to provide pet owners with real-time location tracking, health monitoring, and safety features.

-

Tractive is one of the major players in the U.S. Pet Wearable Market, specializing in GPS tracking devices for dogs and cats. In addition to live tracking, Tractive's devices offer virtual fence settings, alerts, activity and fitness tracking, and the ability to monitor a pet's activity, sleep, and motion data to detect potential health issues early. Tractive collaborates closely with veterinarians and researchers to ensure accurate monitoring of pets' health metrics.

-

Whistle Labs is a company that makes smart devices and apps for pets. They offer for people who receive pets from MARS PETCARE BIOBANK. With this offer, people get a free Whistle Health smart device and app subscription. This smart device and app uses advanced AI to understand pet behavior and give detailed health insights. It can track a pet's location using GPS, monitor health and fitness, and share reports with its care team. In addition, a feature called Ask a Vet to get advice from a veterinarian.

Key U.S. Pet Wearable Companies:

- Allflex USA Inc.

- Avid Identification Systems, Inc.

- Datamars

- FitBark

- Garmin Ltd.

- GoPro Inc.

- Halo

- Invisible Fence

- Link My Pet

- Loc8tor Ltd.

- PawTracker

- PETFON

- PetPace LLC

- Trovan Ltd.

- Whistle Labs, Inc.

- Tailr

- Qalo

- Byte Tag

- Crumb

- Ring

- HeyBuddy Club

Recent Developments

-

In April 2024, Tractive launched the Base Station, a device that extends the battery life of their health trackers and GPS. The Base Station creates a Power Saving Zone with patchy Wi-Fi for trackers and homes.

-

In March 2024, PetPace LLC announced the launch of its next-generation Health 2.0 smart dog collar, which offers features such as early symptom detection, location tracking, disease management, and continuous health monitoring. PetPace's AI-powered life-saving technology facilitates pet owners of sick, at-risk, or old pets with medical insights that often go overlooked.

-

In November 2023, PetPace announced a partnership with Veterinary Health Research Centers (VHRC) to research Canine Alzheimer's Disease. The initiative has been named Dogs Overcoming Geriatric Memory and Aging (DOGMA). For carrying out this study, the biometric collars of PetPace were used to monitor and analyze the health and behavior of aging dogs to identify similarities between Alzheimer's disease in humans and canines.

U.S. Pet Wearable Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.0 billion

Revenue forecast in 2030

USD 2.07 billion

Growth rate

CAGR of 12.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Technology, product, animal type, component, sales channel, application

Country scope

U.S.

Key companies profiled

Allflex USA Inc.; Avid Identification Systems, Inc.; Datamars; FitBark; Garmin Ltd.; GoPro Inc.; Halo; Invisible Fence; Link My Pet; Loc8tor Ltd.; PawTracker; PETFON; PetPace LLC; Trovan Ltd.; Whistle Labs, Inc.; Tailr; Qalo; Byte Tag; Crumb; Ring; HeyBuddy Club

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pet Wearable Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pet wearable market report based on technology, product, animal type, component, sales channel, and application:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

RFID

-

GPS

-

Sensors

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Collar

-

Smart Camera

-

Smart Harness and Vest

-

Others (Trackers, monitors)

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals (Horses, Small Mammals, Reptiles, Amphibians, Fish)

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

GPS Chips

-

RFID Chips

-

Connectivity Integrated Circuit

-

Bluetooth Chips

-

Wi-Fi Chips

-

Cellular Chips

-

-

Sensors

-

Processors

-

Memory

-

Displays

-

Batteries

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Identification & Tracking

-

Behavior Monitoring & Control

-

Facilitation, Safety & Security

-

Medical Diagnosis & Treatment

-

Frequently Asked Questions About This Report

b. The U.S. pet wearable market size was estimated at USD 885.8 million in 2023 and is expected to reach USD 1 billion in 2024.

b. The U.S. pet wearable market is expected to grow at a compound annual growth rate of 12.9% from 2024 to 2030 to reach USD 2.07 billion by 2030.

b. GPS segment dominated the U.S. pet wearable market with a share of 44.84% in 2023. The growing demand for pet wearable devices for monitoring and security purposes has been driving the growth of the segment.

b. Some key players operating in the U.S. pet wearable market include Allflex USA Inc.; Datamars; Avid Identification Systems, Inc.; FitBark; Intervet Inc.; Garmin Ltd.; Invisible Fence; Konectera Inc.

b. Key factors that are driving the U.S. pet wearable market growth include growing awareness among pet owners about ensuring the wellbeing of their pets. Individuals are increasingly adopting pets for various purposes, including entertainment, companionship, fitness, and mental wellbeing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."