- Home

- »

- Sensors & Controls

- »

-

Pet Wearable Market Size, Share & Growth Report, 2030GVR Report cover

![Pet Wearable Market Size, Share & Trends Report]()

Pet Wearable Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (RFID, GPS, Sensors), By Product, By Animal Type, By Component, By Application, By Sales Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-729-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Wearable Market Summary

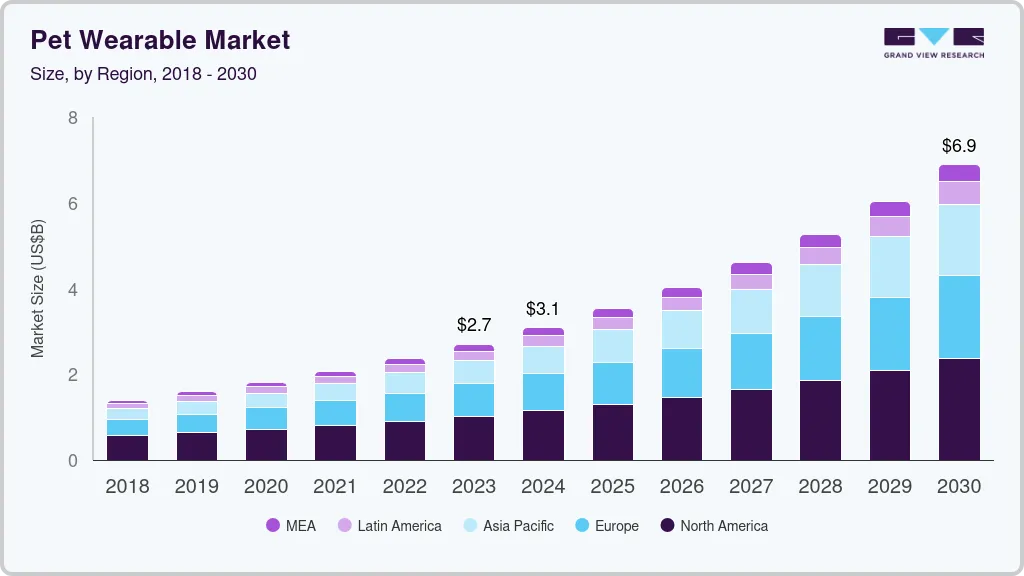

The global pet wearable market size was estimated at USD 2.70 billion in 2023 and is projected to reach USD 6.89 billion by 2030, growing at a CAGR of 14.3% from 2024 to 2030. The market growth is supported by awareness among owners regarding the well-being of their pets.

Key Market Trends & Insights

- The North America pet wearable market held the highest market share nearly 38.0% in 2023.

- The pet wearable market in the U.S. is projected to witness growth at a CAGR of around 12.9% from 2024 to 2030.

- By technology, the RFID segment in the pet wearable market recorded the highest revenue share of 40.03% in 2023.

- By product, the smart collar segment in the pet wearable market recorded the highest revenue share of 61.58% in 2023.

- By animal type, the dogs segment in the pet wearable market recorded the highest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.70 Billion

- 2030 Projected Market Size: USD 6.89 Billion

- CAGR (2024-2030): 14.3%

- North America: Largest market in 2023

Further, the pet wearable industry has attracted considerable funding over the last couple of years for an array of technology-enhanced products for pets, including cameras and wearables. The pet wearable industry is still in its initial stages of development. However, it is still characterized by increasing competition among key stakeholders and the threat of new entrants. The focus of OEM will be the development of products with the capability of efficiently collecting health metrics.

IoT will play a crucial role in driving market growth in the future. The connectivity offered by these devices will support transmitting real-time data concerning pet health to veterinarians or pet owners. The noninvasive wearable sensor system combining photoplethysmograph (PPG), electrocardiogram (ECG), and inertial measurement units (IMU) is used to continuously monitor the health condition of pets integrated with wireless technology, and handheld devices.

Advancements in technologies, including sensors, cameras, GPS, etc., will further elevate market demand in the future. Technology plays an important role in any electronic device; therefore, any advancements in the aforementioned fields will be conducive to the growth of the pet wearables industry. Short battery life and high power consumption may reduce the usage and adoption of the technology. Moreover, compliance with stringent government regulations is expected to hamper the pet wearable technology market growth.

The rising investment and advancement of technology results in increased purchase of products, which includes wearable tracking technology that enables both pet owners and brands to delve into a pet's peculiar needs. Enterprises' specializations in pet health and wellness are utilizing insights into pet behavior as more comprehensive data is available. Moreover, effective monitoring and a better understanding of the pet enable companies to easily identify new health conditions and potential health-related issues with insights into exercise, nutrition, and sleep patterns. These attributes enable companies to manufacture solutions that are in line with the wearable pet technology market demand.

Regulatory compliance and consumer education are major factors that have been challenged as far as the pet wearable devices market is concerned. Regulatory compliance has been a concern that has been troubling the companies operating in the pet care market, especially for the pet care companies operating in the food segment, owing to various restrictions that are sometimes conflicting by country/region/state. Even among pet care companies offering pet foods, products that contain meat substances are subject to additional regulations. A majority of pet owners need to learn about the intricacies of pet wellness, which has resulted in brands investing in educational efforts aimed at assisting consumers understand the importance of holistic pet products.

Market Concentration & Characteristics

Pet owners are increasingly concerned with the safety and security of their pets, which has resulted in the increased growth of wearable technologies, especially for products such as GPS tracking and live positioning functionalities. Moreover, the increasing number of missing pets has also increased pet safety awareness among pet owners. Moreover, stricter safety regulations are also being imposed to curb events such as missing pets. For instance, the Peruvian government launched initiatives that included chip placement for lost pet searches and a special registry for dogs. Initiatives of this kind have spurred the adoption of pet wearable devices across Latin America, especially in Peru and Argentina. Further, the integration of advanced technologies and the increasing concerns related to pets' health and safety are expected to create increased opportunities for companies operating in pet wearable devices market.

The ease of collecting certain pet health metric data has fueled the interest of pet owners in these products. Moreover, the increasing trend of healthier pet lives, primarily focused on feeding and obesity control,has increased demand for wearable devices with real-time monitoring capability. Moreover, according to a survey by the Association of Pet Obesity and Prevention, around 56% of dogs and 60% of cats are clinically overweight, which has been fueling the adoption of pet wearable products.

The active engagement of established technology firms, contributing to a continuous wave of innovation within the dynamic pet care industry, is also driving the growth of the regional market. To facilitate the requirement of real-time decision-making among veterinarians, leading pet wearable companies are focused on the development of devices that are integrated with cloud-based analytics. Location tracking is another major feature that has been once the preferred functionality among pet owners. Manufacturers are integrating sensors into their pet wearable solutions, enabling pet owners to track the activities of their pets via smartphones.

The companies are pursuing various initiatives, such as strategic partnerships, mergers & acquisitions, new product launches, and hosting seminars, as part of their efforts to attract new customers. For instance, in January 2024, Tractive introduced pet insurance policies. The insurance policies can be accessed only by dog and cat owners in the UK following the establishment of Tractive Pet U.K. Ltd, a subsidiary of the Austrian company Tractive, which focuses on pet tracking and health solutions. Tractive offers pet insurance with comprehensive coverage for accidents, illness, and dental treatment.

Technology Insights

The RFID segment in the pet wearable market recorded the highest revenue share of 40.03% in 2023. Reliability and accuracy are the two key features contributing to the segment’s growth. RFID trackers monitor parameters concerning health, such as variability in heart rate, calorie intake, body temperature, and pulse. These benefits play a key role in maintaining segment growth, a trend expected to continue from 2024 to 2030.

The GPS enabled devices segment is projected to grow at a CAGR of 15.0% from 2024 to 2030. Growing demand to monitor pet activities while ensuring security is creating avenues for GPS-based pet wearable devices. Growth in real-time positioning, increasing penetration of smartphones, and growth in mapping portals worldwide are estimated to fuel demand. Moreover, GPS providers have established strategic alliances with stores, mobile phone manufacturers, and application developers to increase GPS usage in new applications.

Product Insights

The smart collar segment in the pet wearable market recorded the highest revenue share of 61.58% in 2023. With the growing trend of the Internet of Things (IoT), the advancement in pet wearables is increasing. Medical device companies are utilizing this opportunity to develop products that provide pet owners with valuable data about their pet's health. Manufacturers are developing innovative smart dog collars that can track pets’ behavior and translate the data to improve clinical interventions.

The smart camera segment is projected to grow at a CAGR of 15.3% from 2024 to 2030. Key companies in the market are launching and updating new features in cameras with advanced technologies that are propelling the market growth. The growing advancements in smart cameras enable features such as pet activity tracking, sleep pattern monitoring, 360° rotation, and voice recognition.

Animal Type Insights

The dogs segment in the pet wearable market recorded the highest revenue share in 2023. Wearables that monitor pets’ activity levels, sleep patterns, and heart rate are gaining traction as pet owners become cautious about pets’ health. The data published by Forbes Advisor survey in January 2024 reveals the relationship of U.S. families with their pets. According to the survey, 66% of households have at least one pet, with dogs leading the pack at 65.1 million households. This is one of the key factors driving the growth of the pet care market.

The cat segment is projected to grow at a CAGR of 12.4% from 2024 to 2030. The global cat population is growing, and more people are treating their feline companions like family. This growing pet parent population is increasing the demand for cat-specific wearables. Further, features such as light shows and interactive games could stimulate and entertain other animals, such as fish, enhancing their well-being.

Component Insights

The connectivity integrated circuit segment in the pet wearable market recorded the highest revenue share in 2023. The rising demand for comprehensive and convenient pet care solutions, Connectivity Integrated Circuits (ICs) are transforming the pet wearable market. These chips, encompassing Bluetooth, WiFi, and cellular capabilities, are powering exciting trends that redefine how we care for our furry companions. WiFi chips unlock features like live pet camera streaming, detailed data analysis, and smart home integration within home networks.

The processor segment is projected to grow at a highest CAGR nearly of 17% from 2024 to 2030. The adoption of edge computing in pet wearables is a notable trend, leveraging processors to perform data analysis directly on the device. This approach enhances real-time processing, reduces dependence on cloud services, and addresses privacy concerns by keeping sensitive data localized.

Sales Channel Insights

The online segment in pet wearable devices recorded the highest revenue share of 55.60% in 2023. Online retailers offer a vast selection of pet wearables from various brands, all accessible from the comfort of your home. This allows for easier price comparisons and browsing through a wider range of features than local pet stores might carry. E-commerce platforms provide in-depth product descriptions, specifications, and user reviews. This empowers pet owners to make informed decisions based on their pets' needs and other users' experiences.

The offline sales channel segment is projected to grow at a CAGR of 13.0% from 2024 to 2030. Pet stores allow pet owners to see, touch, and try on pet wearables for their furry companions. This can be crucial for ensuring a proper fit and comfort level, especially for new or complex wearables. Additionally, in-store staff can provide valuable expertise and answer questions about product features and suitability for specific pets.

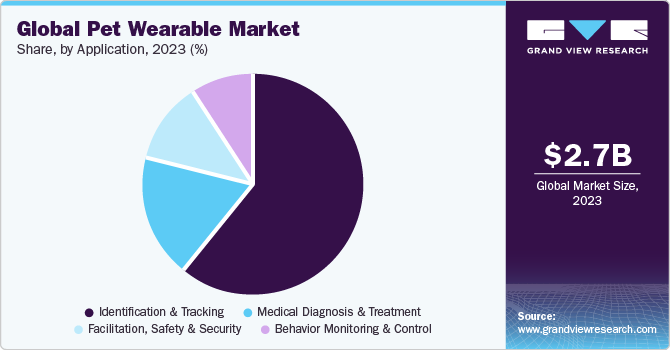

Application Insights

The demand for identification & tracking pet wearable devices held a revenue share of 61.58% in 2023. Access to location history and weight & dimensions are key features driving the segment’s growth. These devices offer pet owners a secure and easy way to monitor pet activity contributing to the segment's popularity. Key factors, such as sleep patterns, activity levels, location, fitness, and even emotional well-being, are propelling the growth of the segment's market. These features offer pet owners a secure and convenient way to monitor their pet's activities and address safety concerns.

Apart from activity monitoring, the demand for pet wearables for medical diagnosis & treatment is projected to witness growth at a CAGR of around 16.0% from 2024 to 2030. The expenditure on pet health diagnostics is creating opportunities for segment growth. Without a doubt, we can say that pet wearables have a bright future, with pet owners spending more daily. To a certain extent, this spending is driven by emotional motives such as increasing emotional attachment as well as dependence on pets for entertainment, companionship, and mental well-being.

Regional Insights

The North America pet wearable market held the highest market share nearly 38.0% in 2023. The availability of sophisticated technologies in the region, along with increasing spending on pet healthcare, is anticipated to drive the regional pet wearable industry growth.

The U.S. Pet Wearable Market Trends

The pet wearable market in the U.S. is projected to witness growth at a CAGR of around 12.9% from 2024 to 2030. As pet owners prioritize the well-being of their pets, they are increasingly seeking smart pet wearables based on the latest technologies. The trend is encouraging market players to introduce innovative pet products supporting voice commands, delivering vibration alerts, and providing boundary enforcement, among other advanced features. Continued advancements toward this end are expected to encourage pet owners to spend more on their pets, thereby contributing to the growth of the regional market.

Europe Pet Wearable Market Trends

The pet wearable market in Europe held a market share of 27.81% in 2023. The growth of the pet wearable market in Europe can be attributed to factors such as increased demand for pet monitoring and technical improvements, increased acceptance of IoT, and increased acceptance of pets’ physical and mental wellness.

The U.K. pet wearable market held a market share of 16.00% in the European pet wearable market in 2023. The growth of the pet wearable market in the U.K. can be attributed to factors that include the capability to track pets using GPS technology, check the health aspects of pets, and monitor, track, and receive information and alerts on pets.

The pet wearable market in Germany held a market share of 23.98% in 2023 in the European pet wearable market. The growth of the pet wearable market in Germany can be attributed to factors such as the country being a major player in the sensor market. Moreover, the humanization trend among pet owners for demanding advanced and top-class pet wearable products has also been fueling the growth of the region market.

France pet wearable market held a market share of 19.53% in 2023 in the European pet wearable market. The growth of the pet wearable market in France can be attributed to factors such as advancements in wireless area networks, adoption of digital maps, and development of mobile applications, among others.

Asia Pacific Pet Wearable Market Trends

The Asia Pacific pet wearable market held a market share of 20.33% in the global pet wearable market in 2023. The growth of the pet wearable market in the Asia Pacific region can be attributed to the rising incidence of chronic diseases in pets, growing expenditure on pets owing to high disposal income, and increasing wearable technology penetration.

The China pet wearable market held a market share of 41.05% in the global pet wearable market in 2023. The growth of the pet wearable market in China can be attributed to increased investment in R&D activities, increased concern for pet health and wellbeing, and growing expenditure on pets.

The pet wearable market in India is expected to register a growth rate of 18.9% from 2024 to 2030. The growth of the pet wearable market in India can be attributed to increasing investment in pet technologies, increasing awareness about animal health, and integration of AI and ML algorithms, among others.

Japan pet wearable market is expected to grow by 16.5% from 2024 to 2030. This growth can be attributed to companies based in the country that have developed advanced pet wearable solutions.

Middle East & Africa Pet Wearable Market Trends

The Middle East & Africa pet wearable market is expected to occupy a market share of 6.15% in 2023. The driving factors of the pet wearable market in the Middle East & Africa include growing demand for pet monitoring, technological advancement, and growing expenditure on pets, among others.

The pet wearable market in KSA is expected to register a growth rate of 14.1% from 2024 to 2030, which can be attributed to increasing pet adoption, technological advancement, an increasing number of veterinary clinics, and expanding IoT adoption, among others.

Key Pet Wearable Company Insights

Some of the key players operating in the pet wearable market include Datamars, FitBark Service, Garmin Ltd., and among others.

-

Datamars is a Swiss technology company that specializes in identification, tracking, and monitoring solutions for a variety of industries, including the pet industry. They offer a variety of products and services for pets, including ID tags, GPS trackers, and activity monitors. Datamars also offers a variety of software solutions for the pet industry, including pet tracking software and pet management software. The presence of such major companies in the European region has been crucial in driving the growth of the Europe pet wearable market.

-

FitBark is a company that makes pet wearables, including the FitBark 2 and the FitBark GPS. The FitBark 2 is an accelerometer that is used to measure physical activity in dogs. The FitBark GPS is a tracker that can be used to track the location of a dog. Both the FitBark 2 and the FitBark GPS are designed to be low-cost and have a long battery life. The FitBark 2 has a battery life of about six months, while the FitBark GPS has a battery life of about three days. The FitBark 2 is a small, lightweight device that is attached to the collar of a dog. It uses a 3-axis accelerometer to measure the amount of activity that the dog is doing. The data from the accelerometer is then sent to the FitBark app, which can be used to track the dog's activity levels over time.

PETFON, Link my Pet, and LATSEN are some of the emerging market participants in the pet wearable market.

- PETFON is a pet GPS tracker that uses a combination of GPS, WiFi, Bluetooth, and long-distance wireless technologies to track your pet's activity and pinpoint its location in real time. It is designed for outdoor use, such as camping or hiking. The tracking distance varies from 0.1-3.5 miles depending on the user's environment. PETFON consists of two modules, Controller and Tracker. The owner carries the Controller, and the Tracker is attached to the dog. To use PETFON, you need to download the PETFON app and follow the instructions. With the app, you can view your pet's activities and pinpoint their location at any time. The presence of such companies in the North American region has played a pivotal role in the growth of the North America pet wearable market.

- Link My Pet is a health and wellness platform for pets that uses algorithms to develop solutions. The Link Smart Pet Wearable is a lightweight, waterproof collar attachment that connects pet parents to their pet's health, safety, and well-being. The app's algorithm offers customized activity targets by size, breed, size, and behavior aimed at making sure the pet gets enough exercise. The app can also be used to monitor the ambient temperature of the pet's location and get alerts if the temperature gets too hot or cold.

Key Pet Wearable Companies:

The following are the leading companies in the pet wearable market. These companies collectively hold the largest market share and dictate industry trends.

- Avid Identification Systems, Inc.

- Barking Labs

- Datamars

- Felcana

- FitBark Service

- Garmin Ltd.

- GoPro Inc.

- LATSEN

- Link My Pet

- Loc8tor Ltd.

- Mars, Incorporated

- PETFON

- PetPace

- PetTech.co.uk.Ltd.

- Tractive

Recent Developments

-

In January 2024, Tractive introduced pet insurance policies. The insurance policies can be accessed only by dog and cat owners in the UK following the establishment of Tractive Pet U.K. Ltd, a subsidiary of the Austrian company Tractive, which focuses on pet tracking and health solutions. Tractive offers pet insurance with comprehensive coverage for accidents, illness, and dental treatment.

-

In November 2023, PetPace announced a partnership with Veterinary Health Research Centers (VHRC) to research Canine Alzheimer's Disease. The initiative has been named Dogs Overcoming Geriatric Memory and Aging (DOGMA). For carrying out this study, the biometric collars of PetPace would be used to monitor and analyze the health and behavior of aging dogs to identify similarities between Alzheimer's disease in humans and canines.

-

In October 2023, PetPace announced the launch of its next-generation Health 2.0 smart dog collar, which offers features such as early symptom detection, location tracking, disease management, and continuous health monitoring. PetPace's AI-powered life-saving technology enables pet owners of sick, at-risk, or old pets with medical insights that often go overlooked. The company's Health 2.0 measures all major vital signs and health-related biometrics, including heart rate variability (HRV), activity, posture, sleep quality, pulse, behavior, respiratory rate, and internal temperature, in addition to features such as wellness index, health profile, pain indicator, and workout intensity assessment.

-

In May 2023, Datamars announced the acquisition of Kippy S.r.l. of a successful acquisition. The transaction is coordinated by growth capital. With this partnership, Datamars is strengthening its market-leading identification and matching solution, which has identified more than 50 million pets and connected thousands of lost animals with their owners. Equipped with GPS, the Kippy collar monitors the activity and location of animals and communicates with pets via a smartphone application. In addition, pet owners can locate their pets in real-time and can easily understand if their pets is getting enough physical activity. The solution offered by Kippy combines GPS/activity tracking with engagement and communication features such as personal messaging and in-app social networking.

Pet Wearable Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.09 billion

Revenue forecast in 2030

USD 6.89 billion

Growth rate

CAGR of 14.3% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Technology, product, animal type, component, application, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; and South Africa

Key companies profiled

Avid Identification Systems, Inc.; Barking Labs; Datamars; Felcana; FitBark Service; Garmin Ltd.; GoPro Inc.; LATSEN; Link My Pet; Loc8tor Ltd.; Mars; Incorporated; PETFON; PetPace; PetTech.co.uk.Ltd.; and Tractive

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Wearable Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet wearable market report based on technology, product, component, animal type, sales channel, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

RFID

-

GPS

-

Sensors

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Collar

-

Smart Camera

-

Smart Harness and Vest

-

Others

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

GPS Chips

-

RFID Chips

-

Connectivity Integrated Circuit

-

Bluetooth Chips

-

Wi-Fi Chips

-

Cellular Chips

-

-

Sensors

-

Processors

-

Memory

-

Displays

-

Batteries

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Identification & Tracking

-

Behavior Monitoring & Control

-

Facilitation, Safety & Security

-

Medical Diagnosis & Treatment

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet wearable market size was estimated at USD 2.70 billion in 2023 and is expected to reach USD 3.09 million in 2024.

b. The global pet wearable market is expected to grow at a compound annual growth rate of 14.3% from 2024 to 2030, reaching USD 6.89 million by 2030.

b. North America dominated the pet wearable market with a share of 37.80% in 2023. Factors such as high penetration of activity and fitness monitoring devices for pets and rising awareness of pet health drives the regional market growth.

b. Some key players operating in the pet wearable market include Allflex USA Inc.; Avid Identification Systems, Inc.; Datamars; Fitbark; Garmin Ltd.; Intervet Inc.; Invisible Fence; Konectera Inc.; Nuzzle; PetPace LLC; Tractive; Trovan Ltd.; Whistle Labs, Inc.; and Voyce.

b. Key factors that are driving the pet wearable market growth include increasing pet expenditure owing to rising disposable income in emerging countries, and increasing awareness concerning animal health across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.