- Home

- »

- Next Generation Technologies

- »

-

Radio Frequency Identification Technology Market Report, 2030GVR Report cover

![Radio Frequency Identification Technology Market Size, Share & Trends Report]()

Radio Frequency Identification Technology Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Tags, Antennas, Readers, Middleware), By System (Active RFID, Passive RFID), By Frequency, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-465-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Radio Frequency Identification Technology Market Summary

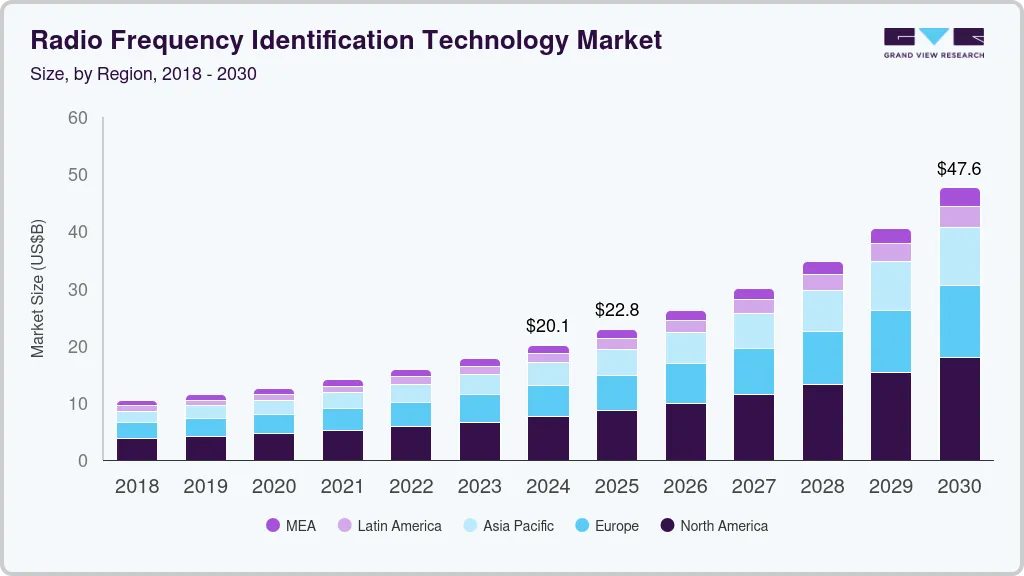

The global radio frequency identification technology market size was estimated at USD 20.10 billion in 2024 and is projected to reach USD 47.63 billion by 2030, growing at a CAGR of 15.8% from 2025 to 2030. The market is poised to witness steady growth over the forecast period due to the growing demand for asset tracking, inventory management, resource optimization, and monitoring assets of security and safety.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, the radio frequency identification technology market in U.S. held a dominant position in 2024.

- Based on component, the tags segment accounted for the largest share of 37.4% in 2024.

- Based on system, the passive RFID segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.10 Billion

- 2030 Projected Market Size: USD 47.63 Billion

- CAGR (2025-2030): 15.8%

- North America: Largest market in 2024

Moreover, the proliferation of Real Time Location Systems (RTLS), sensor networks, 5G, and the Internet of Things (IoT) has made radio frequency identification (RFID) devices more significant in the connected world. RFID devices are anticipated to be increasingly important in capitalizing on these technologies, contributing to the market’s growing demand.

The RFID systems deployed in the market are composed of three major components: tags, readers, and middleware. The RFID tags form the largest part of the market and are subject to prime development activities. While the deployment of passive tags is the largest in the industry, active tags are also gaining momentum as numerous new applications have sprung up in recent years, and the tag size has persistently been reducing. The market growth can also be attributed to the benefits provided by RFID tags, including identifying objects without being in direct line of sight, the ability to scan objects from a large distance, real-time data updates, and less than 100 milliseconds per tag reading time.

The significant trends aiding in adopting RFID technology are automation, supply chain management, real-time intelligence, asset tracking & payments, and NFC. The government mandates for using RFID tags to track various industry products, such as defense, livestock, and data centers, are also essential factors in the industry’s development. Moreover, technological advancements in UHF technology, the convergence of RFID with other communication technologies, and the growth in semi-passive and printed tags are anticipated to drive market growth in the coming years.

As the industry grows, efforts have increased to standardize industry products and frequency bands. Organizations such as Electronics Product Code Global Incorporated (EPCglobal), the International Organization for Standardization (ISO), and the International Electrotechnical Commission (IEC) are at the forefront of regularizing the market. Product licensing, intellectual property rights, innovations, and a well-developed supply chain are the key factors that are anticipated to shape the future of organizations over the forecast period, thereby harnessing market regularization and driving growth. While the market has grown significantly in recent years, some constraints limit product adoption and market expansion.

One of the main constraints is the high initial cost of implementing RFID technology, which includes the cost of tags, readers, and software systems. This can be a significant barrier, particularly for SMEs. In addition, concerns about data privacy and security remain challenging for the widespread adoption of RFID technology, particularly in sensitive industries such as healthcare and finance. However, rapid technological advancements are making RFID technology more sophisticated, which is anticipated to eliminate these challenges and, thus, boost market growth.

Component Insights

The tags segment accounted for the largest share of 37.4% in 2024. RFID tags are used to store and transmit data wirelessly via radio waves, enabling them to be read and identified remotely by RFID readers. Some standard applications of RFID tags include inventory management, asset tracking, equipment tracking, vehicle tracking, access control in security, contactless payment, and enhancing customer service. These benefits are significantly contributing to the segment’s increasing share. In addition, technological advancements are reducing the size of RFID tags day by day, making them easy to install/attach in many applications. They are reducing the cost, which bodes well for the segment’s growth.

Middleware is expected to grow at a significant CAGR during the forecast period. Middleware RFID technology is a software product type that bridges RFID hardware and enterprise-level software systems. Middleware can filter, aggregate, and transform raw RFID data into a more usable format, which can be integrated with other business systems, such as ERP, WMS, and CRM. This segment’s growth can be attributed to the demand for actionable intelligence in many application industries. In addition, middleware is anticipated to play a significant role in smart factories, the IoT, and smart wearables, which is expected to drive the segment’s growth over the forecast period.

System Insights

The passive RFID segment held the largest market share in 2024. These systems consist of RFID tags that do not require a power source, relying instead on the energy emitted by RFID readers to activate and transmit information. The adoption of passive RFID technology is increasing due to its cost-effectiveness, small form factor, and ease of integration into existing processes. Key players are taking strategic initiatives to strengthen their passive RFID system portfolio to cater to the growing demand. For instance, in May 2022, HID Global announced its acquisition of Vizinex RFID to strengthen its high-performance passive RFID tags portfolio. The acquisition strengthened HID Global's industry position and enhanced its presence in key application markets.

Such initiatives are anticipated to drive the segment's growth over the forecast period. The active RFID system segment will also grow significantly over the forecast period. An active RFID system consists of a reader, an active tag, and an antenna. An active tag has its power supply, usually an integrated long-life battery that allows it to transmit data continuously and uninterruptedly. The adoption of active RFID technology is increasing due to its longer read ranges, robust performance in challenging environments, and advanced features like real-time location tracking. Moreover, active RFID can provide accurate and reliable data, enhance security, and enable more advanced applications, such as real-time inventory management, condition monitoring, and predictive maintenance.

Frequency Insights

The high-frequency segment dominated the market in 2024. High-frequency RFID technology (HF RFID) operates at frequencies between 13.56 MHz and 27.5 MHz and is commonly used in applications such as access control, contactless payment, and inventory management. There has been a growing trend toward adopting HF RFID technology in recent years, particularly in the retail and healthcare industries. The high-frequency RFID segment is anticipated to witness significant growth over the forecast period, driven by the increasing adoption of IoT and the need for efficient and secure data exchange.

The ultra-high frequency segment is projected to grow at the fastest CAGR over the forecast period. This growth can be attributed to their growing demand in inventory management, pharmaceutical applications, and wireless device configurations. Ultra-high-frequency RFID has overtaken high-frequency tags in terms of volume; however, owing to the high cost of high-frequency tags, they still generate large revenue for the vendors. The varied applications of ultra-high frequency RFID devices in supply chain management, asset tracking, healthcare device tracking & monitoring, livestock monitoring, and security and access control further harness the segment’s growth.

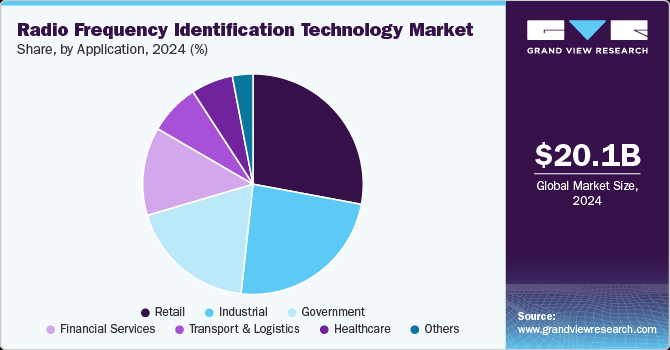

Application Insights

The retail segment dominated the market in 2024. The retail industry benefits from RFID technology through its multiple applications, including inventory tracking and control, retail item tagging, supply chain, and access control, to name a few. These benefits are driving critical retail market players to adopt RFID technology. For instance, in early 2022, Walmart, a large retail corporation, announced the expansion of its RFID mandate program. The program mandated suppliers to tag sporting goods, home goods, electronics, and toys with RFID by September 2022, with plans to extend the requirement to more categories. This initiative aimed to give Walmart more control over its inventory in the store and ultimately provide a better customer experience.

Such initiatives are harnessing the retail segment’s growth in the market. The industrial segment is anticipated to witness the fastest growth over the forecast period. RFID technology has a massive potential to automate and streamline industrial processes. RFID enables real-time data, improves decision-making, increases efficiency, and reduces human errors. Wirelessly identifying and tracking objects or assets is invaluable in improving operational efficiency, inventory management, and supply chain visibility. CYBRA Corporation, distributors & manufacturers who adopt RFID technology into their supply chain, saw an 80% improvement in shipping/picking accuracy. Thus, the significant benefits of RFID technology drive its adoption in various industrial applications, including manufacturing, logistics, warehousing, and asset allocation.

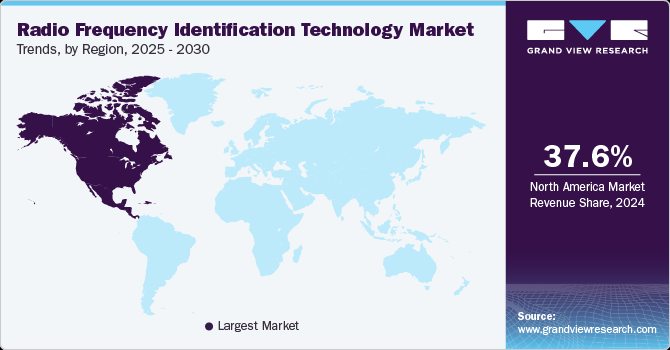

Regional Insights

The North America radio frequency identification technology market accounted for a 37.6% share of the overall market in 2024. The region is expected to witness increasing adoption of RFID technology as industries mature, and COVID-19 pushes the need for contactless solutions. The retail sector in North America is witnessing significant demand for RFID technology. According to an article published by the Loss Prevention Magazine (LPM), over 93% of surveyed retailers in North America reported using RFID technology in various stages of deployment. Thus, the large-scale use of RFID tags in retail contributes to the regional market’s growth.

U.S. Radio Frequency Identification Technology Market Trends

The radio frequency identification technology market in U.S. held a dominant position in 2024. The push for real-time inventory tracking, enhanced supply chain visibility, and asset management is fueling demand. Retail giants such as Walmart and Amazon are integrating RFID to improve operational efficiency, while the healthcare sector is leveraging the technology for patient tracking and pharmaceutical authentication.

Europe Radio Frequency Identification Technology Market Trends

The radio frequency identification technology industry in Europe was identified as a lucrative region in 2024. Europe's RFID market is expanding due to strict regulatory requirements and the region’s focus on sustainability and digital transformation. Industries such as manufacturing, automotive, and pharmaceutical are implementing RFID to improve operational efficiency and comply with stringent EU regulations on product traceability and anti-counterfeiting. The rise of Industry 4.0 and smart factories across Germany, France, and Italy is also driving RFID investments, particularly in warehouse automation and predictive maintenance.

The UK radio frequency identification technology market is largely fueled by the retail and logistics sectors, with major players such as Tesco and Marks & Spencer utilizing the technology for inventory accuracy and theft prevention. The transportation industry is also integrating RFID into ticketing and toll collection systems. In addition, the NHS (National Health Service) is increasingly leveraging RFID for patient identification and asset tracking in hospitals, supporting improved healthcare efficiency and safety.

Asia Pacific Radio Frequency Identification Technology Market Trends

The radio frequency identification technology industry in Asia Pacific held a significant share in 2024. Favorable government mandates from emerging countries, including China and India, are anticipated to fuel market growth. For example, in February 2021, the Government of India mandated using RFID-based tags, known as ‘FASTag,’ on all vehicles for electronic toll collection at national highway toll plazas. Moreover, the government announced that over 350,000 railway wagons would be RFID tagged to track them easily. Such initiatives contribute to the country’s demand and growth of the regional market. Furthermore, the presence of many manufacturers and OEMs in the region is also supporting market growth.

China radio frequency identification technology market held a substantial market share in 2024. China is experiencing a surge in RFID adoption due to government-led initiatives in smart infrastructure, urban mobility, and digital payments. The rapid expansion of e-commerce platforms such as Alibaba and JD.com is also accelerating demand for RFID in warehousing and logistics. Furthermore, the Chinese government’s push for food safety and anti-counterfeiting measures in pharmaceuticals is driving RFID deployment for product authentication and tracking.

The radio frequency identification technology industry in Japan held a significant share in 2024. Japan’s RFID market is advancing due to its focus on automation, robotics, and smart retail. Retailers like Uniqlo and convenience store chains are deploying RFID to enable cashier-less checkout systems and enhance customer experience. The technology is also widely used in Japan’s public transportation sector for contactless ticketing. In addition, Japan’s manufacturing sector utilizes RFID for precision tracking components in high-tech production lines, ensuring quality control and efficiency.

Key Radio Frequency Identification Technology Company Insights

Some of the major players in the market include Zebra Technologies Corp., AVERY DENNISON CORPORATION, and Honeywell International Inc., among others. These companies are driving advancements in quantum technologies and aim to secure their competitive position through strategic initiatives such as partnerships, investments in research and development, and collaborations with academic and governmental institutions. By focusing on innovation and expanding their product portfolios, these firms seek to address the growing demand for secure communication solutions in a rapidly evolving digital landscape.

-

Zebra Technologies Corp. is strengthening its market position by investing in R&D and product development. The company provides comprehensive RFID solutions, including readers, printers, and software, which are widely used across various industries, such as retail, healthcare, and manufacturing.

-

AVERY DENNISON CORPORATION is known for its extensive portfolio of RFID inlays and tags. Avery Dennison continues to innovate with sustainable RFID products and advanced technologies to cater to the evolving needs of its diverse clientele.

Key Radio Frequency Identification Technology Companies:

The following are the leading companies in the radio frequency identification technology market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- Zebra Technologies Corp.

- AVERY DENNISON CORPORATION

- Nedap

- IMPINJ, INC.

- NXP Semiconductors

- Unitech Electronics Co., LTD.

- HID Global Corporation

- Invengo Information Technology Co., Ltd.

- Datalogic S.p.A.

Recent Developments

-

In June 2024, Zebra Technologies Corp. launched Zebra FXR90, a new UHF RFID Fixed Reader series. This new line of fixed RFID readers is notable for its ultra-rugged design and endurance to harsh weather conditions with dual IP 65/67 sealing. The FXR90’s dual sealing IP rating certifies it as IP 67 for temporary submersion and IP 65 for resistance to dust and moisture. In addition, these readers can operate in a wider temperature range of -40 °C to +65 °C, which is 20 °C colder than the typical RFID fixed readers available today. The Zebra FXR90 RAIN RFID Readers can read up to 1,300 RFID tags per second, featuring a maximum receive sensitivity of -92 dBm and a peak transmit power of 33 dBm. With an optimal RFID tag and equipment configuration, the Zebra FXR90 RAIN Readers can achieve a maximum read distance of 100 feet (30.5 meters) using the integrated antenna.

-

In April 2024, AVERY DENNISON CORPORATION announced the expansion of its AD Pure s, eries, featuring a collection of inlays and tags that are completely free of PET plastic. The AD Pure inlays and tags are produced sustainably using advanced antenna manufacturing techniques. The antennas and chips are applied directly to paper, ensuring the range is entirely plastic-free. These inlays and tags deliver significant carbon footprint reduction of 70% to 90% compared to traditional inlay production methods, as confirmed by independent Life Cycle Analysis (LCA) studies. The product lineup includes the AD Midas Flagtag U9 Pure, AD Dogbone U9 Pure, AD Belt U9 Pure, AD Web U9 Pure, and AD Miniweb U9 ETSI Pure.

Radio Frequency Identification Technology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.84 billion

Revenue forecast in 2030

USD 47.63 billion

Growth rate

CAGR of 15.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, system, frequency, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Honeywell International Inc.; Zebra Technologies Corp.; AVERY DENNISON CORPORATION; Nedap; IMPINJ, INC.; NXP Semiconductors; Unitech Electronics Co., LTD.; HID Global Corporation; Invengo Information Technology Co., Ltd.; Datalogic S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radio Frequency Identification Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global radio frequency identification technology market report based on component, system, frequency, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Tags

-

Antennas

-

Readers

-

Middleware

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Active RFID System

-

Passive RFID System

-

-

Frequency Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Frequency (LF) RFID

-

High Frequency (HF) RFID

-

Ultra-high Frequency (UHF) RFID

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Financial Services

-

Healthcare

-

Industrial

-

Government

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global radio frequency identification technology market size was estimated at USD 20.10 billion in 2024 and is expected to reach USD 22.84 billion in 2025.

b. The global radio frequency identification technology market is expected to grow at a compound annual growth rate of 15.8% from 2025 to 2030 to reach USD 47.63 billion by 2030.

b. The North America region dominated the market in 2024. The region is expected to witness increasing demand for the adoption of RFID technology as industries mature and COVID-19 pushes the need for contactless solutions. The retail sector in North America is witnessing significant demand for RFID technology.

b. Some key players operating in the radio frequency identification technology market include Honeywell International Inc., Zebra Technologies Corp., AVERY DENNISON CORPORATION, Nedap, IMPINJ, INC., NXP Semiconductors, Unitech Electronics Co., LTD., HID Global Corporation, Invengo Information Technology Co., Ltd., and Datalogic S.p.A.

b. The radio frequency identification technology market is poised to witness steady growth over the forecast period due to the growing demand for asset tracking, inventory management, resource optimization, and monitoring assets of security and safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.