- Home

- »

- Market Trend Reports

- »

-

Navigating The Biktarvy Market: Patent Expiry, Generics, And Market Shifts

Overview

The Biktarvy market is experiencing notable developments, influenced by evolving regulatory standards, increasing demand, and shifting competitive dynamics within the pharmaceutical industry. As the market expands, it is essential to consider factors impacting its growth trajectory, emerging trends, and strategies employed by competitors. This report provides a detailed analysis of current market conditions, competitive positioning, and potential growth opportunities, delivering key insights to support strategic business decisions and investment opportunities within the pharmaceutical sector.

Key Report Deliverables

-

Analyze the Biktarvy market landscape, detailing its current size, growth drivers, and key industry trends shaping the pharmaceutical sector.

-

Evaluate the competitive environment, identifying key players, their strategic moves, and the distribution of market share to understand competitive positioning.

-

Forecast market growth by projecting future trends, highlighting emerging opportunities, and assessing potential risks to growth.

-

Identify regulatory and market barriers, providing insights into challenges that could impact future market expansion and product development.

-

Concurrent Competitive Landscape, Assessing the current competitive environment, examining both direct and indirect competitors within the market.

Biktarvy’s Projected Revenue Erosion and Market Shifts Leading Up to Patent Expiry

The patent cliff analysis of Biktarvy’s revenue erosion profile follows a staged and progressive pattern that mirrors historical trends seen with high-value antiretrovirals. In the near-term, specifically between 2026 and 2027, the erosion is projected to be minimal, at or below 2%. This is largely attributed to the strength of Biktarvy’s core patents, which are expected to remain intact, and the relatively limited impact of localized contractual settlements that may affect only specific markets. This period is characterized by stability, with the product continuing to generate robust sales as the competitive environment remains relatively unchanged.

From 2028 to 2029, the revenue erosion begins to show signs of softening, with a projected decline of between 2% and 6%. This decline will be driven primarily by payer negotiations, where insurers and public health systems may push for lower prices or more favorable reimbursement terms. Additionally, registry activity and early-stage regulatory filings in select regions are expected to contribute to a more competitive landscape. Although the erosion will be moderate, it marks the beginning of a trend that is expected to intensify in the following years.

The erosion is anticipated to widen significantly between 2030 and 2031, with a projected decline ranging from 6% to 18%. Several factors will contribute to this broader erosion, including the expiration of Supplementary Protection Certificates (SPCs) in certain regions, which will allow for earlier entry of generic alternatives. The pressure from contracting payers, coupled with increasing competition from other antiretrovirals, will likely accelerate this decline. Additionally, early challenges, such as the introduction of biosimilars and generics in specific markets, will impact Biktarvy’s revenue in price-sensitive regions, particularly in Europe.

The period from 2032 to 2033 is projected to see the most significant revenue erosion, with a potential decline ranging from 18% to 50%. This is largely due to the expiry of Biktarvy’s core composition patents, which will enable the introduction of biosimilars and generics into major markets. The most pronounced effects are expected in Europe, where biosimilar competition is expected to be most intense. As these generic alternatives become available, both price and market share pressures are expected to drive substantial revenue erosion.

Overall, the revenue erosion trajectory for Biktarvy is characterized by a clear near-term stability, followed by a moderate decline in the mid-period, and an accelerated decline in the later stages. Near-term projections are supported by patent clarity and historical precedents, providing a higher degree of confidence. However, longer-term projections carry increased uncertainty, as the timing of patent expirations and regional regulatory changes could lead to varying outcomes across different geographies.

After 2033, Biktarvy’s market landscape will be shaped by the entry of biosimilars, particularly in regions like Europe, where the expiration of core composition patents will allow for increased competition. As these alternatives become available, price pressures and market share losses are expected to increase, resulting in a notable erosion of Biktarvy’s revenue. Generic and biosimilar products will likely capture a significant portion of the market, leading to a shift in payer dynamics and prescribing patterns. In this post-patent environment, Biktarvy’s ability to maintain a competitive position will depend on factors such as its remaining market exclusivity in certain geographies, pricing strategies, and the emergence of new treatment options. Overall, the market will experience heightened competition, with Biktarvy's revenue stream facing significant pressures from lower-cost alternatives and evolving market dynamics.

Current Market Scenarios

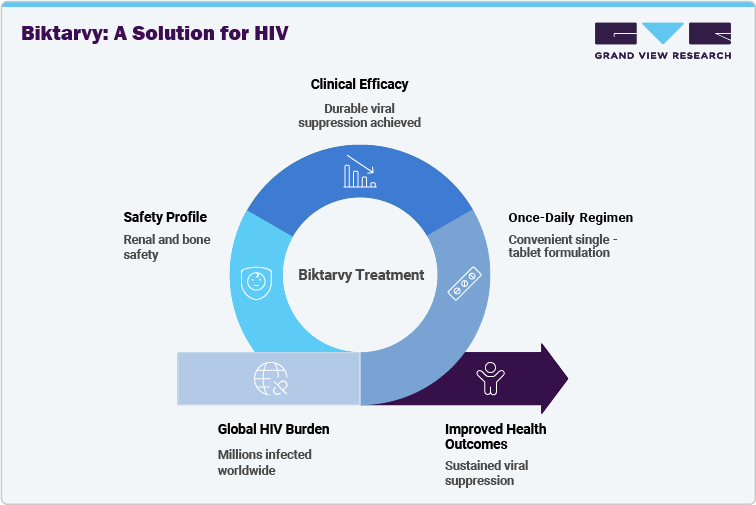

The Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide) market is witnessing significant growth due to the ongoing global burden of HIV, which remains a major public health challenge. While Sub-Saharan Africa continues to have the highest prevalence, considerable patient populations are also found in North America, Europe, and Asia-Pacific. With more than 39 million people living with HIV worldwide, the demand for therapies that are effective, safe, and easy to adhere to is substantial. Biktarvy’s once-daily single-tablet regimen combines three potent antiretrovirals, providing efficacy, tolerability, and convenience in a single formulation, addressing adherence challenges for patients globally.

Clinical evidence underscores Biktarvy’s robust efficacy and safety profile, demonstrating durable viral suppression, a high resistance barrier, and minimal adverse effects across diverse populations. Pivotal trials have shown its effectiveness not only in treatment-naïve patients but also in individuals switching from other antiretroviral therapies, emphasizing versatility in real-world settings. Its favorable safety profile includes renal and bone safety advantages, contributing to long-term patient adherence. These attributes reinforce Biktarvy’s position as a reliable treatment option, ensuring sustained viral suppression and improved health outcomes for people living with HIV worldwide.

Market Dynamics

Biktarvy’s simplified, potent HIV treatment with improved adherence

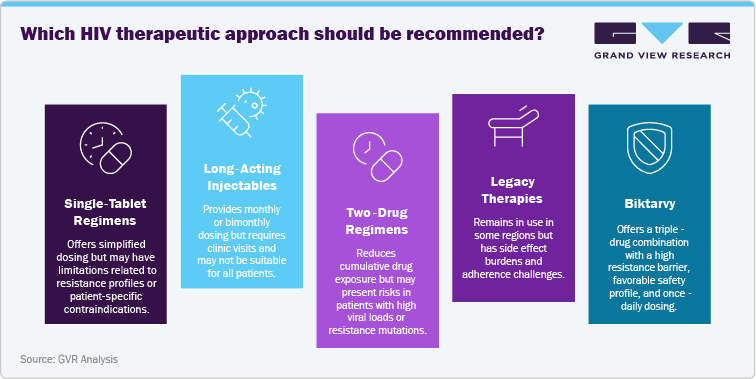

Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide) stands out in the HIV treatment landscape through its once-daily single-tablet regimen (STR) that combines three potent antiretroviral agents into one convenient dose. This simplifies therapy for patients and addresses one of the most critical challenges in HIV management long-term adherence.

-

Bictegravir (INSTI): Bictegravir is a potent integrase strand transfer inhibitor that prevents viral DNA integration into the host genome, providing durable viral suppression and a high barrier to drug resistance.

-

Emtricitabine (NRTI): Emtricitabine blocks viral reverse transcriptase, reducing replication and enhancing long-term viral control.

-

Tenofovir alafenamide (NRTI): Tenofovir alafenamide delivers strong antiviral activity with reduced renal and bozne toxicity compared to earlier tenofovir formulations, supporting improved safety and tolerability.

This triple combination offers a comprehensive treatment solution compared to older multi-pill regimens. By integrating high efficacy, improved safety, and simplified dosing into a single formulation, Biktarvy provides a significant therapeutic advantage that strengthens adherence, improves patient outcomes, and maintains its strong market position in HIV treatment guidelines globally.

Side Effects and Risks Associated with Biktarvy

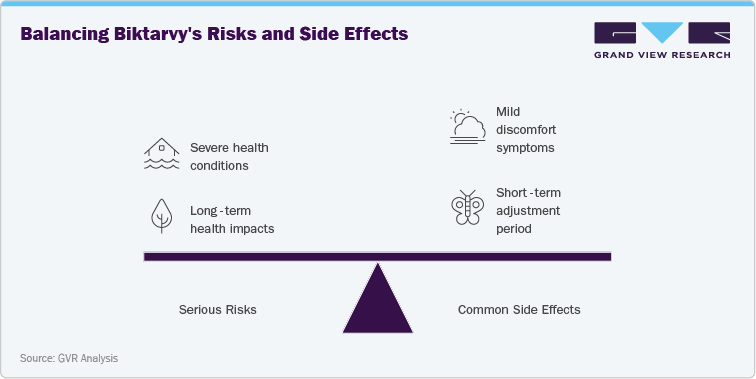

Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide) is generally well-tolerated; however, certain serious risks have been identified. In rare cases, patients may experience lactic acidosis and severe hepatomegaly with steatosis, conditions linked to nucleoside analogs. Renal impairment and acute kidney injury have also been reported, especially in patients with pre-existing kidney disease. Long-term use may cause bone mineral density reduction, although the tenofovir alafenamide component is associated with lower risk compared to earlier formulations. Biktarvy is contraindicated in patients with known hypersensitivity to any of its components, and caution is advised in those with advanced hepatic impairment. Regular monitoring of liver and renal function is recommended throughout treatment.

The more common side effects of Biktarvy are generally mild to moderate. These include diarrhea, nausea, headache, fatigue, and abnormal dreams. Such effects are most often seen during the early phase of therapy as the body adjusts to the regimen. Gastrointestinal symptoms and fatigue tend to diminish with continued use, while abnormal dreams are usually transient. Although these side effects rarely lead to treatment discontinuation, they can influence patient adherence, making it essential for healthcare providers to counsel patients on managing these issues to ensure sustained treatment success and viral suppression.

Gilead’s Strategy for Biktarvy: Expanding Access and Leadership in HIV Treatment

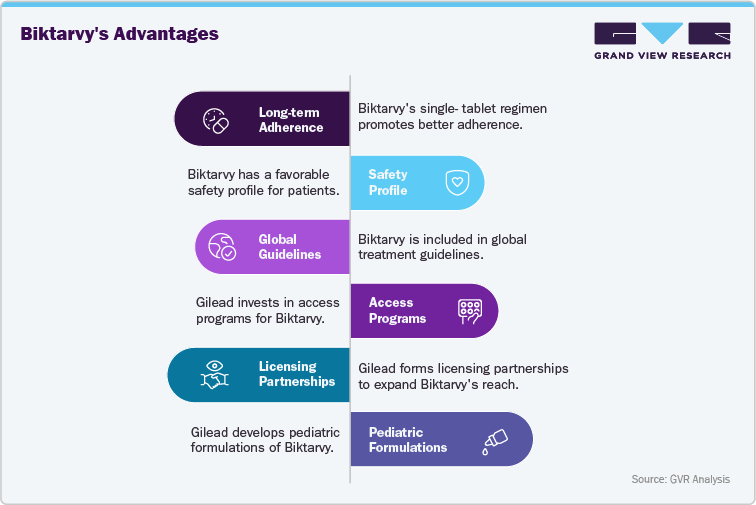

Gilead Sciences’ strategy for Biktarvy focuses on sustaining its global leadership in the HIV treatment market through regulatory approvals, access programs, and manufacturing scalability. The company has invested heavily in ensuring broad availability of Biktarvy across developed and emerging regions, leveraging partnerships with public health organizations and voluntary licensing agreements to enhance access in low- and middle-income countries. This approach positions Biktarvy to maintain strong growth while balancing supply-demand dynamics and supporting global HIV treatment goals.

Biktarvy’s single-tablet regimen (STR), combining three potent antiretrovirals, provides a distinct competitive edge by simplifying adherence and improving patient outcomes. Its inclusion in major treatment guidelines across the U.S., Europe, and other regions underscores its role as a first-line therapy. As HIV prevalence remains high in Sub-Saharan Africa and steadily affects millions in Asia-Pacific and Latin America, the global demand for simplified, effective regimens is rising. These regions represent substantial growth opportunities, supported by expanding diagnostic programs and international donor funding. Furthermore, Biktarvy’s expanding global footprint, ongoing real-world evidence, and lifecycle management strategies-such as pediatric formulations-reinforce its position as a dominant therapy in the global HIV market, well-placed to capture continued demand in the years ahead.

“Biktarvy Market Thrives with Global Expansion”

- Growing Preference for Single-Tablet Regimens (STRs):

Biktarvy, as a once-daily single-tablet regimen combining three potent antiretrovirals, is benefiting from the increasing trend toward simplified HIV therapies. As patients and healthcare providers recognize the importance of adherence in long-term viral suppression, Biktarvy’s streamlined dosing offers a strong competitive edge, positioning it as the preferred choice in many treatment guidelines.

- Rising Demand for Safer and More Tolerable Therapies:

With HIV patients living longer due to improved treatment, there is a growing demand for therapies that combine high efficacy with improved safety. Biktarvy addresses this need through its favorable renal and bone safety profile compared to older regimens. This makes it an attractive option for both treatment-naïve patients and those switching from existing therapies, driving its widespread adoption globally.

- Shift Toward Long-Term, Low-Burden Treatment Solutions:

The trend toward long-term, low-burden treatment regimens continues to shape the HIV market. Biktarvy’s once-daily pill reduces treatment complexity, supporting better patient adherence and sustained viral suppression. This convenience enhances quality of life for patients and strengthens Biktarvy’s positioning as a patient-friendly, durable solution in the highly competitive antiretroviral therapy landscape.

Competitive Landscape

Gilead Sciences, the sole authorized manufacturer of Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide), has strategically strengthened its global presence to sustain its leadership in the HIV treatment market. Recognizing the ongoing global burden of HIV, Gilead has invested heavily in manufacturing capacity, licensing partnerships, and global access initiatives to ensure a steady supply of its flagship single-tablet regimen.

A cornerstone of Gilead’s strategy is its voluntary licensing program with the Medicines Patent Pool (MPP) and multiple generic manufacturers in India. This initiative expands access to low- and middle-income countries, particularly in Sub-Saharan Africa and South Asia, where the demand for cost-effective HIV treatment is highest. These partnerships allow widespread availability of generic versions of Biktarvy while maintaining Gilead’s market leadership in high-income regions.

In developed markets such as the U.S. and Europe, Gilead continues to protect its commercial position through patent exclusivity, lifecycle management, and regulatory approvals. The company has also invested in new pediatric formulations, expanding treatment access to younger populations and strengthening Biktarvy’s role as a first-line therapy in global guidelines.

Internationally, Gilead’s collaborations with governments, non-profits, and organizations like PEPFAR and UNAIDS align with its mission to broaden treatment accessibility. By integrating innovative manufacturing, robust supply chains, and equitable pricing strategies, Gilead reinforces Biktarvy’s position as the cornerstone of modern HIV therapy.

These strategic efforts highlight Gilead’s commitment to global accessibility, market sustainability, and patient-centered care, ensuring Biktarvy remains a leading therapy in the competitive antiretroviral landscape.

Analyst Perspective

“Biktarvy’s single-tablet regimen, combining three potent antiretrovirals, provides a strong competitive advantage in the HIV treatment landscape by addressing one of the most critical factors-long-term adherence. Its favorable safety profile and broad inclusion in global treatment guidelines reinforce its position as a first-line therapy in both developed and emerging markets. Gilead’s ongoing investments in access programs, licensing partnerships, and pediatric formulations ensure Biktarvy’s sustained global reach, solidifying its role as a cornerstone therapy with significant long-term market potential.”

Project Objective

A leading global life sciences client approached us to assess the market potential and commercialization strategy for GLP-1 receptor agonist therapies across type 2 diabetes and obesity indications. The project aimed to support strategic planning for a novel, oral GLP-1 pipeline candidate, with a focus on launch timing, competitive positioning, and regional expansion.

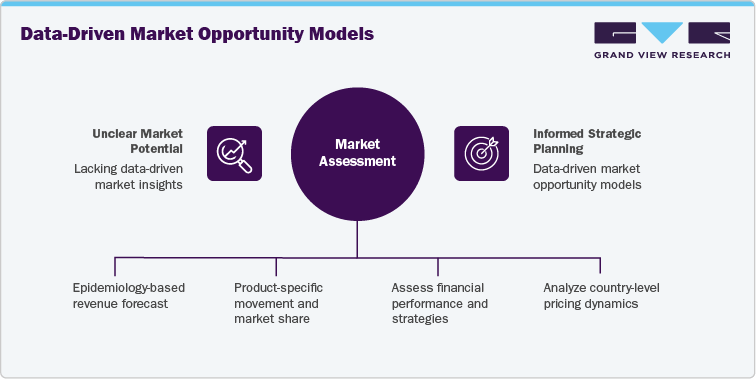

GVR Solution

-

Conducted an epidemiology-based revenue forecast (2021-2036) using patient flow and analogue modeling approaches across North America, Europe, Asia Pacific, and the Middle East.

-

Delivered product-specific movement and market share analysis for:

-

Biktarvy - used as a reference analogue for uptake modeling

-

Orforglipron (pipeline) - projected using analogue-based scenarios from comparable oral GLP-1 launches

-

-

Benchmarked key players such as Eli Lilly and Novo Nordisk across financial performance, product pipeline, and global rollout strategies.

-

Assessed country-level pricing, regulatory, and reimbursement dynamics, supported by a custom launch timeline and uptake forecast for Orforglipron, modeled analogously to prior GLP-1 innovations.

-

Provided outputs (Excel, PPT, dashboard) and ongoing strategic support tailored to the client’s internal planning and commercialization team needs.

Impact for Client

-

Created market models for launch planning and portfolio prioritization.

-

Guided product strategy with pricing, uptake, and competitor insights.

-

Identified growth markets and shaped regulatory and launch plans.

Why this Matters

-

Build analogue-based forecasts for emerging therapies

-

Provide product insights for pipeline drugs with no historical sales

-

Offer strategic guidance on market entry, launch, and clinical-commercial integration

We bring the same level of analytical rigor, therapeutic market expertise, and consultative flexibility to your assessment of the pancreatic cancer microbubble-based therapy market.

Share this report with your colleague or friend.

Pricing & Purchase Options

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPA norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified