- Home

- »

- Market Trend Reports

- »

-

India Healthcare Services Market By City (Hyderabad, Kollam, Malappuram)

Market Overview: India Healthcare Services Market

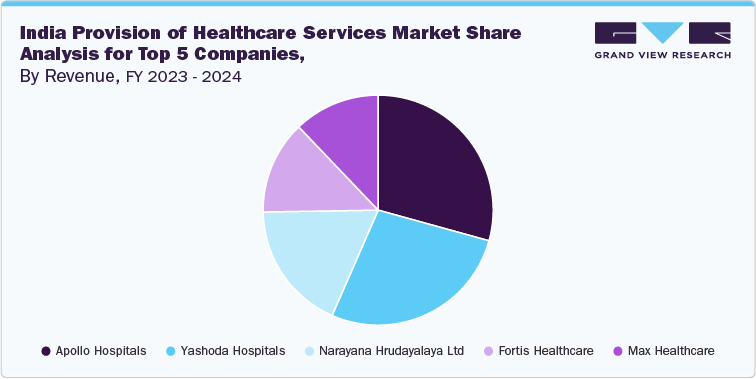

India's healthcare services market is evolving, driven by demographic shifts, rising chronic disease burden, technological innovation, and increasing public and private investments. The market is structured across four key levels of care-primary, secondary, tertiary, and quaternary care-each playing a distinct role in the patient care continuum. Moreover, the healthcare landscape is transitioning toward more integrated and tech-enabled service delivery, with cities such as Hyderabad leading innovation and districts such as Kollam and Malappuram reinforcing the public-private care model in semi-urban India.

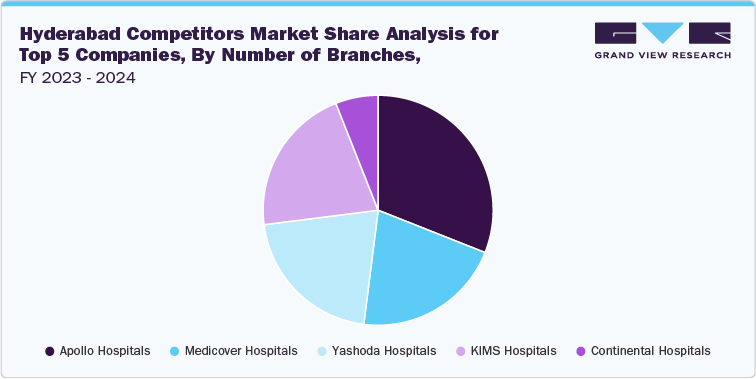

Hyderabad's healthcare sector is rapidly evolving. This competitive landscape is characterized by significant investments, advanced technologies, and a focus on patient-centric care. Hyderabad has experienced significant population growth, with an increase of nearly 5 million over the past decade, driving a rising demand for hospital services. This surge has driven the expansion of healthcare facilities across the city. Smaller budget hospitals are emerging to cater to the needs of the growing population, while larger corporate hospitals continue to extend their networks within the region.

Small and budget hospitals with capacities of around 50 beds are rapidly being established across Hyderabad. Simultaneously, numerous medium-sized and large hospitals with capacities exceeding 200 beds have either recently opened or are in the process of setting up facilities. Established corporate hospitals have also expanded their operations to different parts of the city, increasing bed capacity.

India Hospital Services Market: Estimated Operational Bed Capacity, by City

City Name

Bed Capacity

Hyderabad

18,057

Kollam

7,594

Malappuram

6,240

Hyderabad Competitors’ Market Share Analysis for Top 5 Companies, By Operational Bed Count, FY 2023-2024

Company Name

Bed Capacity

Market Shares

(FY 2023-2024)

Yashoda Hospital

(4 hospitals in Somajiguda, Secunderabad, Malakpet, Hitec City)

4,000

22.15%

Rainbow Children’s Hospital

1,935

10.72%

Continental Hospital

Basavatarakam Indo-American Cancer Hospital & Research Institute

Virinchi Hospital

Others

Similarly, Kollam, a city in Kerala, is experiencing significant changes in its healthcare sector, marked by the emergence of new players and the enhancement of existing facilities. The competitive landscape is characterized by private hospitals, multispecialty centers, and specialized clinics. In addition, Kollam has a substantial number of private hospitals, enhancing competition within the healthcare market.

Moreover, recent developments in hospital services in Kollam highlight significant investments and new facilities aimed at enhancing healthcare delivery in the region. For instance, in March 2024, the Kollam District Hospital announced that it is undergoing substantial upgrades with the construction of new buildings, including a general tower, utility complex, and diagnostic center. This initiative is part of an INR 144 crore project funded by the Kerala Infrastructure Investment Fund Board (KIIFB) aimed at modernizing healthcare facilities.

Provision of Healthcare Services through Hospitals/Clinics

Primary Care

Primary care services are the initial point of contact between patients and the healthcare delivery system. They encompass preventive, promotive, curative, and rehabilitative care, typically administered by primary care providers such as general practitioners, family physicians, or community health workers.

In Hyderabad, the growth of primary care services is driven by rapid urbanization and a burgeoning metropolitan population exceeding 10 million. This growth increases the demand for outpatient consultations, chronic disease management, and preventive care. For instance, there are a total of 3,786 primary care points (hospitals/clinics/dispensaries) in Hyderabad.

Moreover, Kollam benefits from Kerala’s strong public health infrastructure and its legacy of high health literacy. The district is supported by a robust network of Primary Health Centers (PHCs), Community Health Centers (CHCs), and upgraded family health centers under the Aardram Mission, which aims to enhance the quality of care at the primary level. A significant portion of the Kollam population is elderly, leading to an increasing demand for chronic disease management and geriatric care services. Non-communicable diseases (NCDs) such as hypertension, diabetes, and heart disease are prevalent in the area, making primary care a crucial touchpoint for health services.

Company Name

Number of Branches

Market Shares

(FY 2023-2024)

Apollo Hospitals

6

0.16%

Medicover Hospitals

Yashoda Hospitals

KIMS Hospitals

Continental Hospitals

Secondary/Tertiary Care

Hyderabad

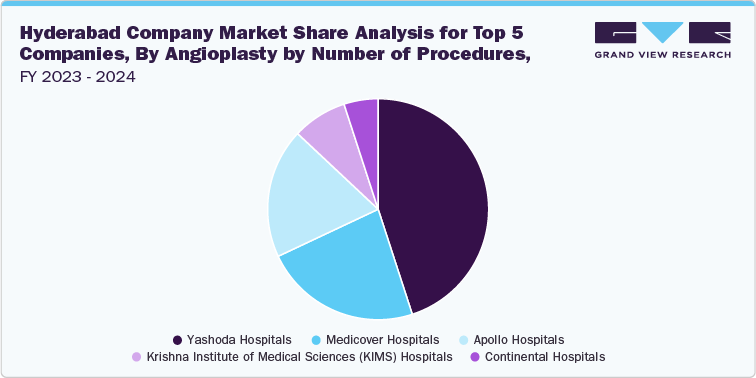

Hyderabad Cardiology Surgeries, FY 2023-2024 (Units Procedure)

Cardiology Surgeries

FY 2023-2024

Units Procedure

Angioplasty

53,176

CABG

Total

Company Name

Estimated Number of Procedures (Units)

Market Share (%)

Yashoda Hospitals

7,920

14.89%

Medicover Hospitals

Apollo Hospitals

Continental Hospitals

Krishna Institute of Medical Sciences (KIMS) Hospitals

Similar analysis will be provided for the following diseases at each city level:

Hydrabad

Kollam

Malappuram

Orthopedics

Orthopedics

Cardiology

Oncology

Neurology

Orthopedics

General Surgery

Nephrology & Urology

Plastic Surgery

Nephrology & Urology

Obstetrics/Gynecology/Pediatrics

Neurology

Obstetrics/Gynecology/Pediatrics

General Surgery

Oncology

Neurology

ENT Surgery

General Surgery

Others

Others

Others

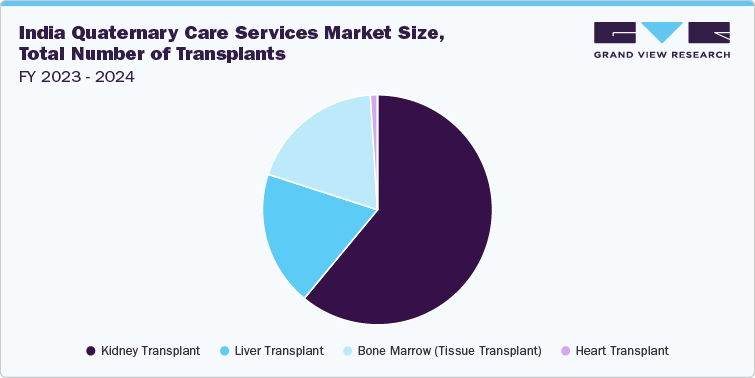

Quaternary Care

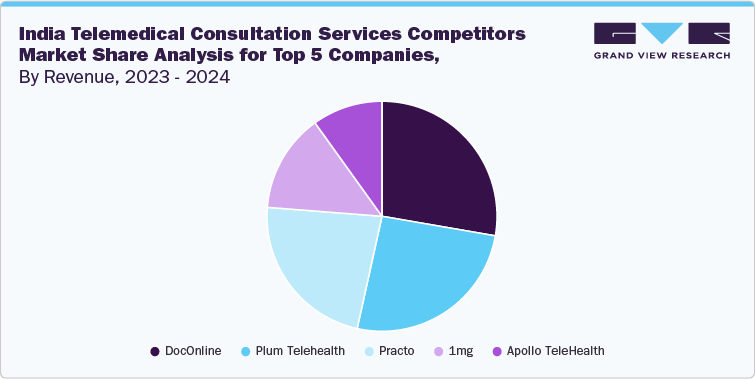

Tele-Medical Consultation Services

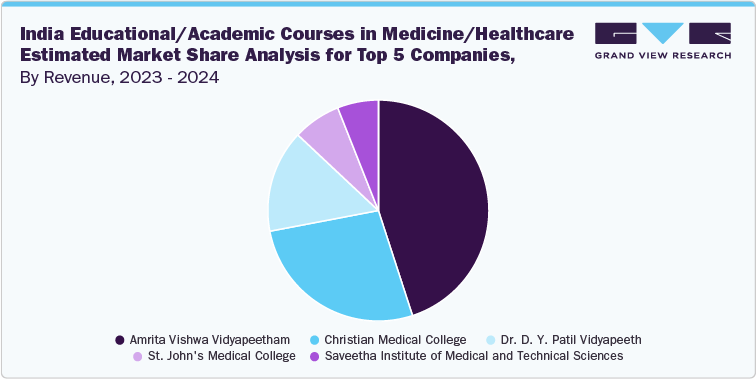

Educational/Academic Courses in Medicine/Healthcare

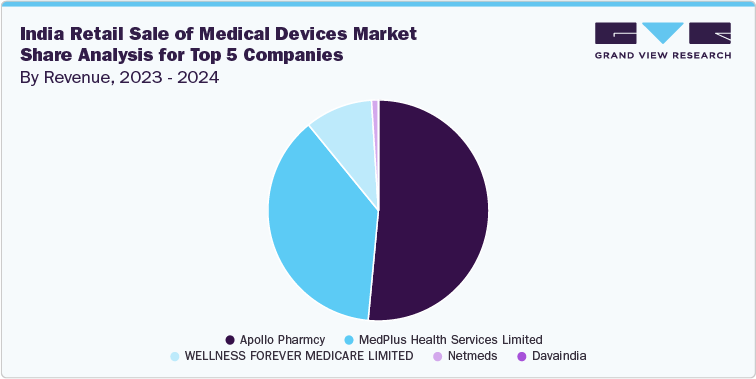

Retail Sale of Medical Devices

List of a Few Notable Hospitals, By City

Hyderabad

Kollam

Malappuram

Adithya Hospital

Bishop Benziger Hospital

Ahalia Foundation Eye Hospital

Prime Hospital

Meditrina Hospital

Korambayil Hospital and Diagnostic Centre Limited

Apollo Hospital

Holy Cross Hospital

Dr. P. Alikutty's Kottakkal Ayurveda & Modern Hospital

Care Hospital

Vijaya Hospital

Moulana Hospital

Geetha Maternity And Nursing Home

KIMSHEALTH Hospital

MES Academy of Medical Sciences

Global Hospitals (Gleneagles Global)

Shankar's Institute of Medical Science (SIMS)

MIMS Hospital

Hope Childrens Hospital

Upasana Hospital

ALMAS Hospital

Basavatarakam Indo American Cancer Hospital & Research Institute

Lotus Heart Hospital

Nadakkavil Hospital

Krishna Institute of Medical Sciences Ltd (KIMS)

KERF Hospital

MB Hospital

L V Prasad Eye Institute

Sankars Hospital

PMSA Memorial Malappuram District Co-Operative Hospital

Matrika Hospital

Dr. Nair’s Hospital

Supriya Speciality Hospital

Poulami Hospitals

Ashtamudi Hospital And Trauma Care Centre

Malabar Ayurveda Siddha Naturopathy Hospital and Wellness Centre

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified