Cloud Kitchens And The Transformation Of F&B Delivery In Gulf Cities

A Region Rewriting The Rules Of Digital Food Service

Gulf cities, including Dubai, Riyadh, Jeddah, and Doha are experiencing a structural transformation in food consumption, driven by the rapid acceleration of cloud kitchens. Once considered experimental, these delivery-only, digitally optimized production hubs are now embedded at the center of the region’s F&B ecosystem. Strong regulatory modernization, hyper-connected consumers, platform-led ordering behaviors, and the entry of capital-backed operators have enabled the Gulf to emerge as one of the world’s most advanced testbeds for cloud-kitchen innovation. Beyond operational efficiency, cloud kitchens are actively reshaping culinary demand itself. As delivery-first dining becomes the primary consumption mode in many urban districts, the success of operators increasingly depends on not just “how” food is produced and delivered, but “what” cuisines are prioritized. Today, cloud kitchens are both responding to and influencing the mix of cuisines that dominate the Gulf’s digital food economy, making cuisine strategy a critical lever for growth, differentiation, and consumer loyalty.

For operators, aggregators, and investors evaluating expansion, the Gulf represents a unique opportunity:

-

High delivery penetration

-

Streamlined licensing frameworks

-

Dense urban demand

-

Infrastructure-led scalability

-

A regulatory environment designed to professionalize food preparation.

This is not a “ghost kitchen” trend, it is a re-engineering of the food-delivery value chain.

The Shift: From Dining Rooms To Delivery-Driven Consumption

Gulf consumers today eat more meals prepared outside the home than ever yet fewer are consumed on-premises. Increasingly, the meal is not experienced in a restaurant but through a delivery bag at home, in offices, or in cars.

This shift isn’t temporary. It’s a structural transformation driven by three forces:

-

Convenience-first lifestyles among young, urban populations

-

Extreme menu diversity expectations (24/7 availability, global cuisines)

-

Digital adoption accelerated by super apps and aggregator platforms

Instead of adding dining space, brands are adding cloud kitchen nodes designed to produce high-quality food solely for delivery. As a result, the kitchen is replacing the dining room as the core of the business model.

Proof Of Change: What The Gulf Market Is Signaling

Evidence from local regulatory and industry bodies paints a clear picture:

-

Dubai DET’s Gastronomy Report (2024) emphasizes that delivery-led business models are now a strategic cornerstone of the emirate’s food economy.

-

Delivery aggregators like Talabat, Deliveroo, Careem Food, and Noon Food command a majority share of meals consumed outside the home in cities like Dubai.

-

A rising share of newly issued foodservice permits in Dubai and Riyadh correspond to delivery-only and hybrid kitchens, not traditional dine-in formats.

-

Hotels, malls, and airports, once dine-in strongholds, now partner with virtual brands to compensate for lower in-house consumption.

Most incremental foodservice consumption growth in Gulf cities is being captured by delivery-first ecosystems.

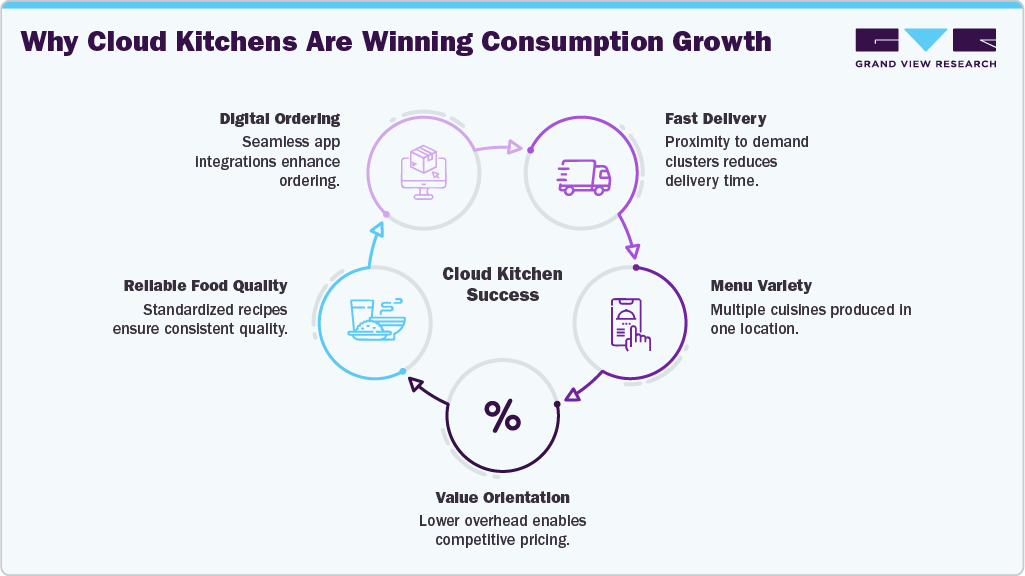

Why Cloud Kitchens Are Winning Consumption Growth

Cloud kitchens are engineered for high-volume, multi-brand food production, matching the Gulf’s changing consumption needs:

Cloud kitchens not only react to consumption trends, but they are also reshaping them by making more cuisines more available, more often, and more affordably.

Operational Blueprint: How Leaders Maximize Delivery-Driven Consumption

-

Data-Led Menu Engineering

Meal consumption peaks vary by micro-location. Using aggregator analytics, top operators:

-

add high-velocity items

-

reduce low-performing SKUs

-

create daypart-specific sub-brands (breakfast, late night, office lunch)

This leads to higher order frequency and better contribution margins.

-

Distributed Kitchen Networks

Instead of serving a city from one large kitchen, leaders deploy multiple small nodes close to neighborhoods — ensuring:

-

faster delivery

-

hotter food on arrival

-

reduced logistics cost

-

improved customer satisfaction (repeat ordering)

-

Packaging as Part of the Meal

In delivery consumption, packaging = product experience.

Operators are upgrading:

-

thermal retention

-

leak-proofing

-

brand presentation

-

sustainability alignment with government directives

Because how food arrives directly affects whether consumers re-order.

-

Multi-Brand Monetization of a Single Kitchen

-

One kitchen catering to five to ten specialized brands

-

Targeting different tastes, cuisines, and price points

-

More ways to meet diverse consumption needs leading to higher kitchen utilization and increased revenue per sq. ft.

Cloud Kitchen Operational Models Emerging in the Gulf

|

Model |

Description |

Real-World Example (Publicly Reported) |

|

Satellite Kitchens |

Fully managed facilities for multiple brands |

Jahez IPO Model |

|

Kitchen-as-a-Service (KaaS) |

Operators lease compliant kitchen spaces |

Co Kitchens (Saudi) |

|

Aggregator-Owned Kitchens |

Delivery platforms run kitchens for partner brands |

Jahez, Talabat Kitchen Initiatives |

|

Brand-Owned Dark Kitchens |

Restaurant chains operating delivery-only sites |

Large QSR chains in UAE/Saudi |

|

Hybrid Virtual Brands |

Operators scale multiple digital-only brands under one roof |

Co Kitchens, local UAE startups |

Evolving Consumer & Operational Dynamics

-

“Experience-Free” Dining → Higher Delivery Volume & Stable AOV

As consumers in GCC increasingly see delivery as just as good as dining, they prioritize speed, consistency, and reliability. This behavior drives up order frequency on delivery platforms, which is reflected in the high online delivery demand reported GCC market.

Source: Grand View Research Internal Analysis

*Note: Demand Trend = Estimated order volume index, which is based on the order volume. Online delivery orders include both food and grocery deliveries. Online delivery companies included in this chart: HungerStation, Keeta, MrSool, Talabat, and ToYou.

According to Grand View Research internal database, Saudi Arabia’s online delivery demand trend grew over 30.0% CAGR based on order volume throughout 2020 to 2024.

2. Cloud-Kitchen Consolidation - Efficiency, Scale & Cost Savings

-

The cloud kitchen operators in the GCC are consolidating, creating roll-ups and alliances. This allows for leaner operations, lower rent burden, and shared resources. Over time, these cost savings can improve margin per order.

-

More efficient kitchens can also better manage menu mix and optimize for high-AOV items (premium or high-margin cuisine), helping push up the AOV.

-

These consolidated players can also scale faster, tapping into growing delivery demand as reported in the Measurable AI report and sustaining expansion.

3. Food Safety as a Competitive Differentiator - Building Trust & Willingness to Spend

-

Emphasizing HACCP certification, traceability, and digital hygiene logs helps cloud kitchens, QSRs, and delivery-only brands to build consumer trust—a key factor in a region where food safety is critical.

-

This trust likely encourages consumers to place larger orders or order more frequently, because they are confident about food quality. This could contribute to higher AOV over time.

-

Strong food-safety credentials also give these operators a branding edge, enabling them to charge a premium or upsell.

4. Menu Localization for GCC Tastes - Demand for Premium or Customized Items

-

Tailoring menus to the GCC palate, including healthy bowls, fusion Middle Eastern cuisine, premium desserts, and high-quality Asian food; meets local demand more precisely.

-

These localized and premium offerings can boost AOV, because consumers are likely to order more “special” or high-margin items.

-

Also, distinctive menu options help these delivery-first (or hybrid) operators differentiate themselves in a crowded marketplace, attracting repeat orders and driving scale.

Strategic Pathways For Entry & Expansion In Gulf Cloud Kitchens

-

Market Opportunity & Strategic Imperatives

The Gulf region represents a vast and under-penetrated growth opportunity for digitally enabled foodservice models. Strong demographics, rapid urbanization, and the world’s highest online food delivery penetration are reshaping how food is produced and consumed across the region.

Why the GCC Market Is Poised for High-Velocity Expansion:

-

~92% urbanization densely demands clusters

-

Food delivery contribution expected to grow 4x faster than overall retail foodservice

-

~99% internet penetration enables seamless digital ordering

-

72% of the population with high purchasing power smartphones

-

Retail food and grocery moving aggressively online

- Market Size & Value Pools:

Grand View Research estimates that the region’s food service and grocery retail categories will continue to expand at around 10% CAGR through 2030, supported by:

-

Large Total Addressable Market (TAM) still shifting toward digital consumption

-

Rapid onboarding of new users into delivery ecosystems

-

Rising demand for convenience-driven, quality-controlled food supply

The structural shift from dine-in to delivery unlocks a significant share-capture opportunity for cloud-kitchen operators.

-

International Foodservice Brands — Entry Strategy

-

Partnerships with licensed operators + cloud kitchen hubs

-

Delivery-first brand launches for faster market testing

-

Localized menus aligned to Gulf taste profiles

-

Influencer-led digital customer acquisition

-

-

Regional Operators — Growth Strategy

-

Expand to Tier-2 cities with growing demand density

-

Multi-brand operations from single kitchen footprints

-

Centralized commissaries to optimize supply chain costs

-

Advance hygiene-tech and operational transparency

-

-

Aggregator Platforms — Ecosystem Expansion

-

Rollout of platform-backed kitchens for efficiency

-

Data-driven incubation of virtual brands

-

Subscription-based loyalty to boost retention

-

Micro-kitchens for <15-minute delivery service zones

-

Conclusion: A Defining Decade For Gulf Cloud Kitchens

Gulf cities are undergoing one of the fastest F&B infrastructure transitions globally, driven by:

-

Regulatory modernization

-

High delivery penetration

-

Operator professionalization

-

Platform-led demand density

-

International brand entry

Cloud kitchens are not a supplementary model; they are becoming the core engine of urban foodservice.

The winners will be those who move early, comply deeply, and innovate relentlessly, shaping the future of food delivery in the Gulf.