Consolidation Wave: How M&A is Reshaping the Life Sciences and MedTech Ecosystem in the Middle East

The Middle East stands at a pivotal juncture in healthcare transformation, characterized by accelerated investments not only in hospitals and digital health technologies but, more critically, by a marked uptick in mergers and acquisitions across the life sciences and MedTech sectors. This surge is propelled by ambitious national agendas focused on localizing manufacturing, expanding biotech capabilities, strengthening device self-sufficiency, and advancing precision medicine-all in alignment with long-term health and economic resilience goals.

Distinct from global M&A cycles, which are often influenced by interest rate changes or broader macroeconomic shifts, healthcare deal activity in the Middle East reflects unique structural imperatives. Governments, sovereign wealth funds, and leading healthcare operators are proactively reshaping the region’s scientific and industrial foundations, transitioning from import-dependent models to cultivating robust, localized value chains. Recent transactions range from landmark, high-profile deals to strategic mid-market investments, collectively signaling a determined move to build advanced capabilities and position the Middle East as both a regional and global leader in innovative healthcare.

Trends in Mergers, Acquisitions and Asset Transactions in Middle East, 2020-2024

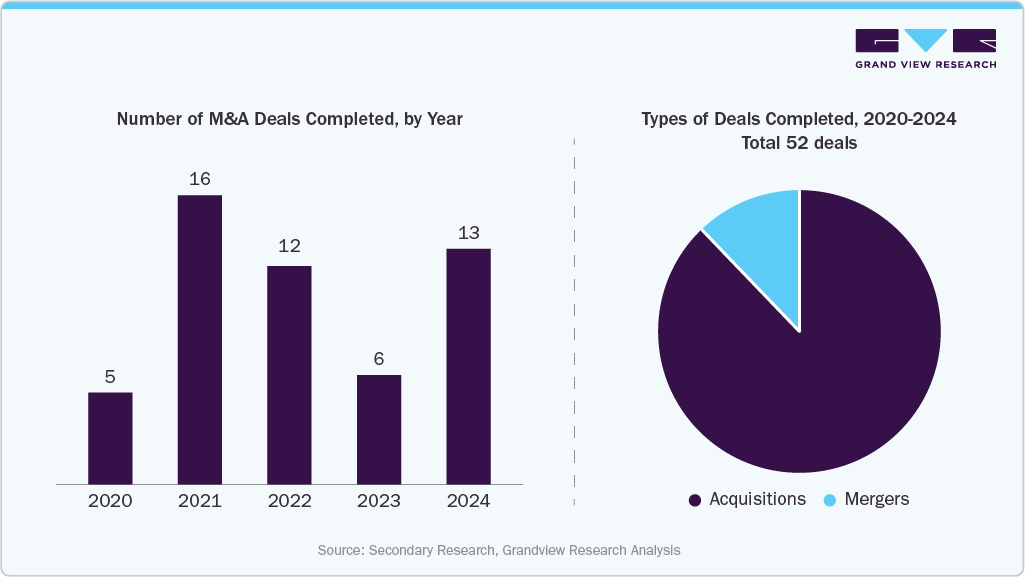

M&A Deals in the MedTech Sector

Since 2020, mergers and acquisitions activity within the Middle East’s medical devices sector has remained moderate but notably concentrated, with a total of 52 documented transactions predominantly driven by acquirers from the U.S. and Europe. Israel has established itself as the leading focal point in the region, accounting for nearly 80% of acquisition targets, followed by Saudi Arabia and the UAE, which hold smaller yet growing proportions of deal activity. While the overall volume of transactions is relatively limited, this concentrated activity underscores an intensifying global interest in the Middle East’s evolving healthcare innovation ecosystem.

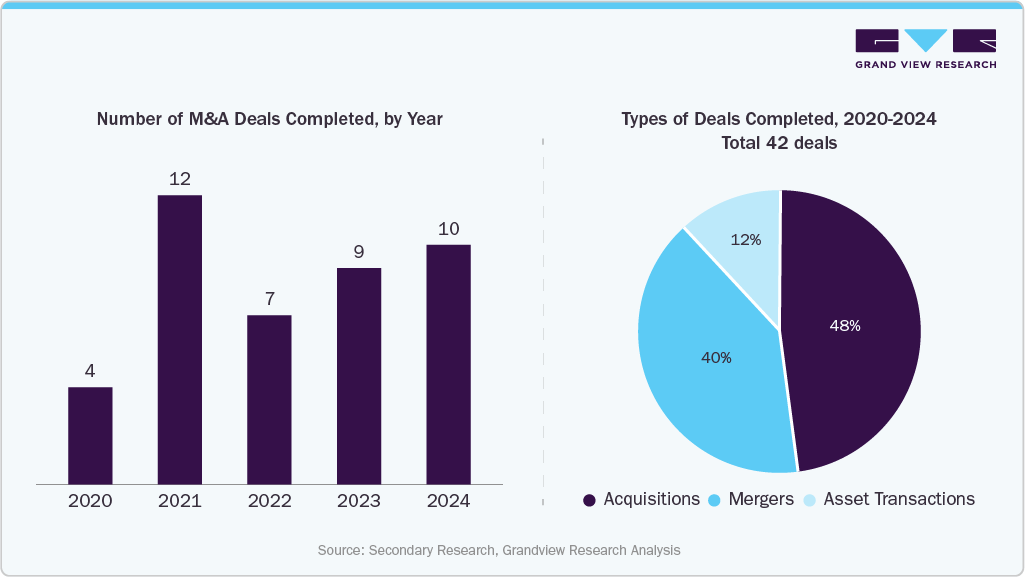

M&A Deals in the Pharmaceutical Sector

Mergers and acquisitions in the Middle Eastern pharmaceutical sector have demonstrated a consistent upward trajectory since 2020, highlighted by a significant spike in deal volumes during 2021-the region’s record year for transaction activity. Acquisition-led strategies continue to dominate, reflecting a pronounced emphasis on portfolio diversification, capability building, and market consolidation among key players.

Most of these transactions have been concentrated in Israel, the UAE, Egypt, and Saudi Arabia, underscoring the maturity and increasing investment appeal of these markets. Notably, therapeutic fields such as central nervous system (CNS) disorders, oncology, and gastrointestinal diseases have attracted the greatest M&A interest, propelled by substantial unmet clinical needs and a robust pipeline of innovative products.

Importantly, nearly 40% of acquiring companies are based outside the Middle East, underscoring the region’s growing stature as a strategic entry point for international firms looking to tap into dynamic, high-growth healthcare markets.

Key Merger and Acquisition Developments in Middle East Life Sciences and MedTech

|

Company |

Year |

Month |

Description |

|

Trinity |

2025 |

November |

The company acquired EVERSANA’s advisory services business in Middle East (APACME) region and the Asia-Pacific. This move positions Trinity to further strengthen its global footprint and enhance its ability to support pharma, biotech, and medtech clients with advanced strategy, insights, and analytics. Through this acquisition, EVERSANA’s APACME advisory operations will transition to Trinity, reinforcing the company’s mission to deliver integrated, technology-driven commercialization solutions worldwide. |

|

Mubadala |

2024 |

December |

The investment company acquired 80% stake in Global Medical Supply Chain (GMSC) and Al Ittihad Drug Store (IDS). GMSC serves more than 200 medical facilities across the UAE and is a key provider of supply chain solutions to hospitals, clinics, and healthcare organizations. With the integration of GMSC and IDS into our portfolio, we are positioned to build a fully vertically integrated life sciences ecosystem in the UAE. |

|

Mubadala |

2024 |

October |

Mubadala Investment Company PJSC has strengthened its specialty pharmaceuticals platform by acquiring a 100% stake in four GlobalOne Healthcare Holding (GHH) assets: Bioventure, Bioventure Healthcare, Gulf Inject, and Wellpharma. This strategic consolidation enhances Mubadala’s position across the life sciences value chain, accelerates the growth of the UAE’s life sciences sector, and advances the nation’s ambition to become a global industry leader while contributing to long-term economic diversification. |

|

Dallah Health |

2024 |

August |

Dallah Healthcare announced the acquisition of Al-Salam Hospital and Al-Ahsa Hospital in the Eastern Province. The acquisition is being executed through a capital increase at Dallah Healthcare, achieved by issuing new shares to Ayyan Investment Company. |

|

Abdul Latif Jameel IPR Company Limited |

2024 |

January |

The company announced the strategic acquisition of a majority stake in Genpharm, a leading rare-disease market access partner in the Middle East. This milestone strengthens both organizations’ commitment to putting patients first, advancing healthcare inclusivity, and accelerating access to modern, life-changing medical therapies for those who need them most. |

|

Cipla |

2023 |

October |

Cipla sold 51% stake in Saba Investment to Shibam Group Holdings for USD 6.50 Mn |

Source: Secondary Research, Grandview Research Analysis

The Role of Global Players in Advancing Regional Healthcare Innovation

Global MedTech and life science companies are significantly enhancing their local presence as regional M&A activity reshapes the Middle East healthcare landscape. These multinational organizations establish benchmarks and stimulate domestic consolidation by operating hospitals, diagnostic laboratories, and innovation centers equipped with advanced technologies and clinical expertise. This dynamic creates fertile ground for strategic partnerships and acquisitions driven by capability-building. Recognizing which global players are active in the region helps local companies and investors refine their M&A strategies to achieve scale, access cutting-edge technology, and adopt best-in-class operational practices.

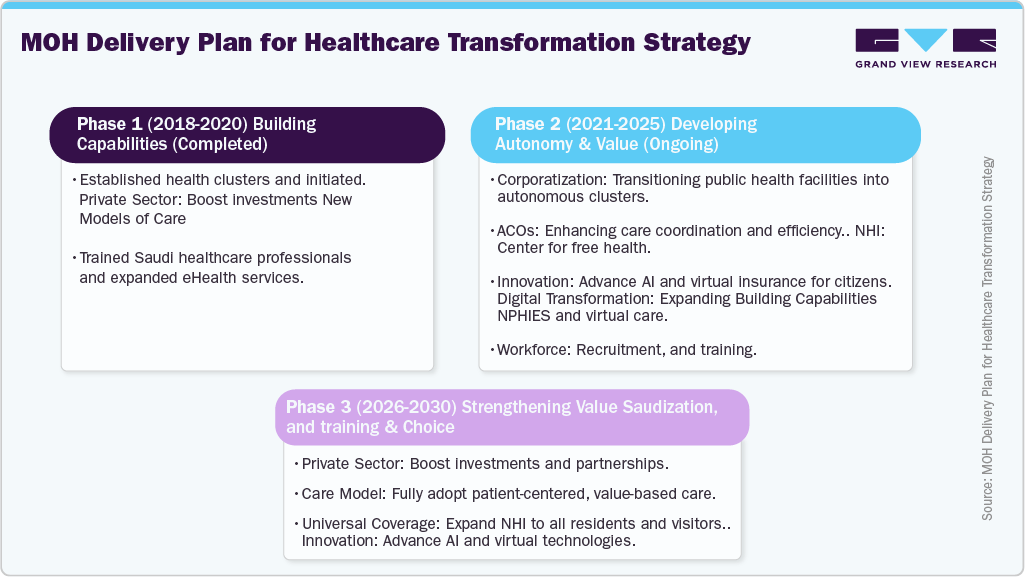

The Roadmap to Healthcare Transformation

The Middle East is pursuing a structured healthcare transformation agenda aimed at building resilient, patient-centered, and digitally enabled systems across the region. Early phases focused on establishing foundational capabilities, including the formation of health clusters, workforce training, and the expansion of digital health services to improve access and operational efficiency. The current phase emphasizes autonomy and value creation, with governments corporatizing public health facilities, implementing advanced care coordination models, and integrating AI and virtual care platforms to enhance service delivery. Looking ahead, the region is preparing to adopt value-based care models, expand health coverage, and strengthen private-sector partnerships, while investing in workforce development and the adoption of technology. Collectively, these initiatives reflect a strategic shift toward sustainable, innovation-driven healthcare systems designed to meet the growing needs of the population and regional ambitions for medical and life sciences self-reliance.

The Middle East’s healthcare landscape is undergoing a transformation driven by deliberate capability-building and strategic consolidation. M&A activity in life sciences and MedTech is emerging as a key mechanism to bridge innovation gaps, enhance domestic manufacturing and R&D capacity, and modernize clinical and digital infrastructure. This approach is enabling both local and international stakeholders to create integrated, resilient healthcare systems while reducing reliance on imports and accelerating the adoption of advanced technologies.

The sustained presence of global MedTech and life sciences leaders further amplifies this transformation, offering benchmarks for best practices, opportunities for collaboration, and pathways for technology transfer. Moreover, a deliberate, capability-driven approach to M&A paired with strategic investments in talent, infrastructure, and digital health will be crucial for the region to achieve resilient, patient-centered, and innovation-led healthcare systems.

The convergence of local ambition, strategic acquisitions, and global expertise positions the Middle East to emerge as a hub for advanced healthcare, MedTech innovation, and life sciences excellence, creating long-term value for patients, investors, and the broader economy.