Biologics & Biosimilars: The Next Growth Wave in the Middle East Pharmaceutical Market

The New Growth Engine of Middle East Pharma

The pharmaceutical landscape in the Middle East is undergoing a decisive transformation. For decades, regional healthcare systems have relied mainly on imported small-molecule drugs and branded generics. Today, the focus is shifting toward specialty care—driven by biologics and biosimilars. With chronic disease prevalence rising, healthcare reforms accelerating, and localization becoming a policy priority, biologics and biosimilars are poised to redefine the region’s healthcare economics over the next decade.

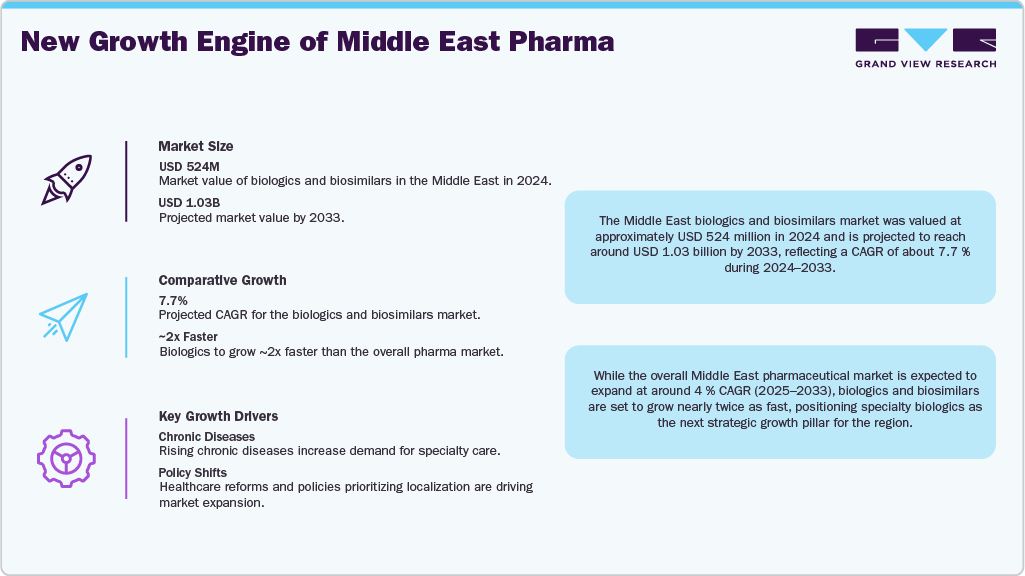

The Middle East biologics and biosimilars market was valued at approximately USD 524 million in 2024 and is projected to reach around USD 1.03 billion by 2033, reflecting a CAGR of about 7.7 % during 2024-2033.

While the overall Middle East pharmaceutical market is expected to expand at around 4 % CAGR (2025-2033), biologics and biosimilars are set to grow nearly twice as fast, positioning specialty biologics as the next strategic growth pillar for the region.

The Core Challenge

Despite strong potential, several structural barriers continue to limit biologics adoption:

-

Cost pressure: Advanced biologics often exceed USD 20 000 per patient annually, stressing public payers and private insurers.

-

Import dependency: Most biologics are still imported from Europe or the U.S., exposing systems to supply and pricing volatility.

-

Regulatory lag: Inconsistent biosimilar approval pathways and limited interchangeability guidance slow clinical acceptance.

- Skill and infrastructure gaps: Only a few facilities currently support upstream bioprocessing or have GMP-certified biologics engineers.

As a result, access remains uneven. The region’s growing cancer, autoimmune, and metabolic-disease burden continues to outpace domestic biologics capacity gap that requires coordinated structural action.

Governments and private sectors have begun addressing these constraints through focused investment and collaboration:

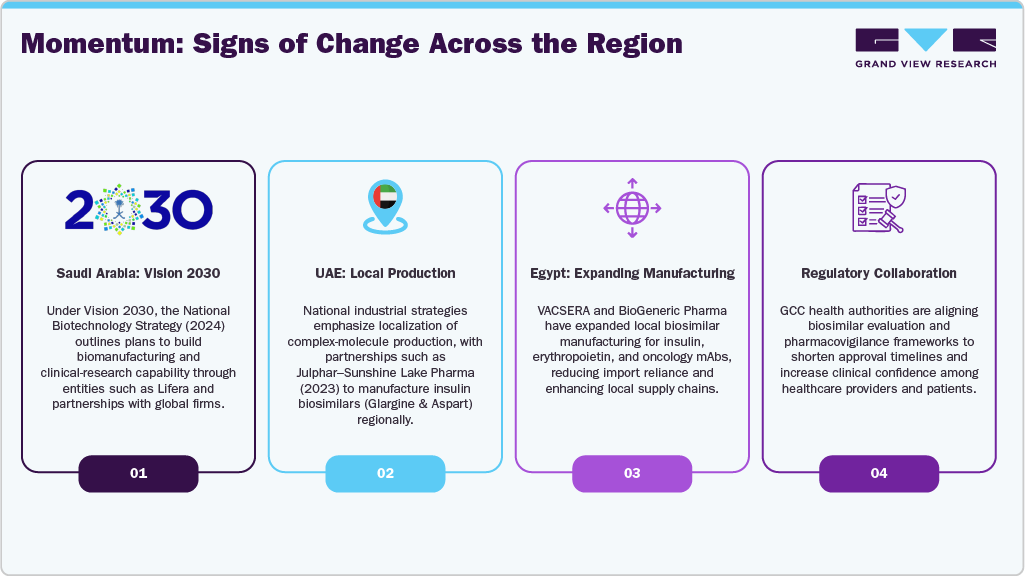

- Saudi Arabia: Under Vision 2030, the National Biotechnology Strategy (2024) outlines plan to build biomanufacturing and clinical-research capability through entities such as Lifera and partnerships with global firms.

-

United Arab Emirates: National industrial strategies emphasize localization of complex-molecule production, with partnerships such as Julphar-Sunshine Lake Pharma (2023) to manufacture insulin biosimilars (Glargine & Aspart) regionally.

-

Egypt: VACSERA and BioGeneric Pharma have expanded local biosimilar manufacturing for insulin, erythropoietin, and oncology mAbs, reducing import reliance.

- Regulatory collaboration: GCC health authorities are aligning biosimilar evaluation and pharmacovigilance frameworks to shorten approval timelines and increase clinical confidence.

Case Instance: Julphar’s 2023 partnership with Sunshine Lake Pharma to produce insulin Glargine and Aspart biosimilars locally marked a major step toward improving affordability and supply security in the UAE and the wider region. Although no official import-reduction figure has been released, analysts expect this initiative to meaningfully enhance patient access over the next few years.

Localization through Partnerships and CDMOs

The region is moving from simple fill-finish operations to integrated biomanufacturing. Public-private partnerships enable technology transfer, regulatory compliance, and export readiness—examples include SaudiVax, Lifera, and Julphar.

Regulatory Confidence and Clinical Education

Cross-country harmonization of biosimilar review processes, combined with hospital-based interchangeability pilots and clinician education programs, is strengthening trust in biosimilars—particularly across oncology and autoimmune indications.

Affordability through Value-Based Procurement

Biosimilars generally lower therapy cost by 25-50 % versus reference biologics. Centralized tenders (e.g., Saudi NUPCO) and early moves toward value-based reimbursement are demonstrating how pricing linked to outcomes can expand patient coverage.

Ecosystem Development

Biotech hubs such as King Abdullah University of Science & Technology (KAUST) and Dubai Science Park are building specialized training pipelines in bioprocess engineering and quality control—an essential step toward self-reliant manufacturing ecosystems.

Analyst Perspective

“Unlike the generics revolution of the 2000s, the Middle East biologics story depends on government-backed localization and global-local collaboration. Markets that align manufacturing capability, regulation, and clinician trust will lead the biosimilar era.”

Outlook 2025-2033 (Middle East Biologics & Biosimilars)

-

Market size (base year 2024): USD 524 million

Projection (2033): USD 1.03 billion → CAGR ≈ 7.7 % (2024-2033).

-

Context vs. broader pharma: Middle East pharma overall ≈ 4 % CAGR (2025-2033); biologics & biosimilars will grow nearly 2× faster, becoming a key growth engine.

-

Biosimilars’ contribution to incremental growth: estimated at 35-45 %, driven by payer pressure for affordability and strong policy support for interchangeable use.

-

Country concentration: Saudi Arabia, UAE, and Egypt together expected to represent ≈ 70 % of regional consumption by 2033, reflecting their scale and localization initiatives.

-

Therapy areas: Oncology, autoimmune, and metabolic diseases remain the dominant growth drivers in line with regional disease burden and payer priorities.

Key Takeaways

-

Localization = Sustainability: Building regional supply chains improves resilience and economic diversification.

-

Collaboration > Isolation: Global-local alliances accelerate technology transfer and regulatory credibility.

-

Policy as Catalyst: Coordinated GCC regulation and value frameworks will boost biosimilar uptake.

-

Affordability Enables Access: Biosimilars expand treatment reach while reducing health-system spending.

- Human Capital Matters: Trained GMP talent is foundational to sustained biologics independence.

Biologics and biosimilars are no longer peripheral to the Middle East’s healthcare vision—they are central to achieving affordable, innovation-driven medicine. The next decade will determine whether the region merely consumes global innovation or creates it. Those who integrate policy, partnership, and production will define the Middle East’s biologics future.