Unlocking Growth: The Middle East’s Rise as a Global BPO Hub

A New Hub in the Making

The global Business Process Outsourcing (BPO) industry is undergoing a strategic rebalancing, with the Middle East fast emerging as the newest growth engine. Traditionally, countries like the Philippines and India dominated the outsourcing landscape with their massive talent pools and cost advantage. However, as enterprises worldwide accelerate their digital transformation and seek multilingual capabilities and regional resilience, the Middle East, especially the UAE, Saudi Arabia, Egypt, and Bahrain, has emerged as the next hubs for outsourcing services.

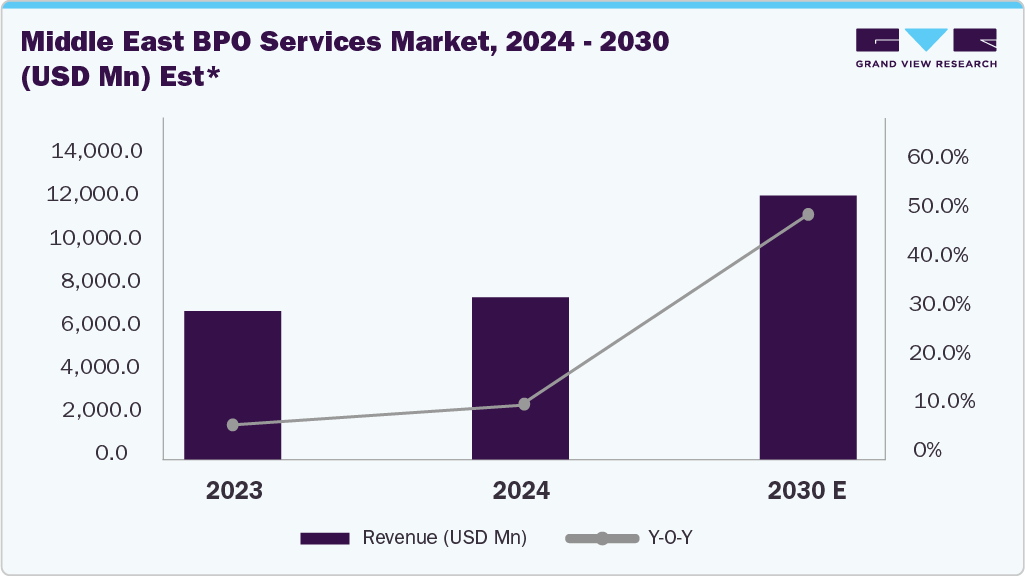

Backed by visionary government initiatives, robust infrastructure, and an increasingly skilled workforce, the region’s BPO sector is transitioning from a cost-driven model to one centered on digital innovation, high-quality delivery, and proximity to global markets. Recent estimates published by Grand View Research project a double-digit annual growth rate for BPO services in the Middle East between 2025 and 2030, reaching USD 12.24 billion by 2030, as the region prepares for smart city projects and digital transformation.

Key Enablers of BPO Adoption in the Middle East

a) The Strategic Advantage: Location Meets Vision

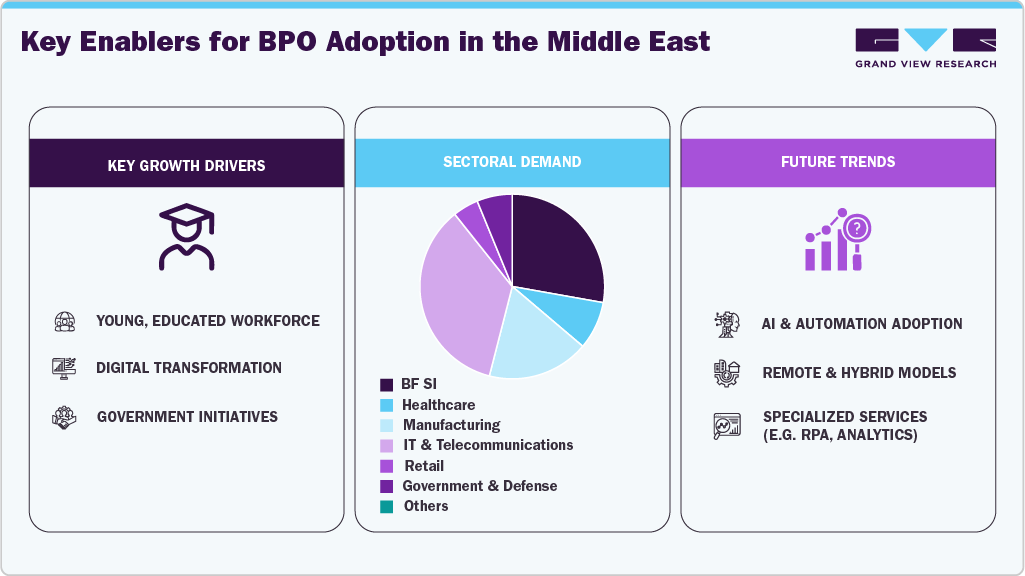

One of the biggest drivers of BPO growth in the Middle East is its strategic location. Located at the crossroads of Asia, Africa, and Europe, the region offers global enterprises a time-zone advantage and an ideal bridge between Western and Asian operations. Cities like Dubai, Riyadh, and Cairo are positioning themselves as regional service hubs for shared services, customer experience (CX), and IT-enabled outsourcing. This is complemented by massive government investments under initiatives such as Saudi Vision 2030, the UAE’s Digital Government Strategy 2025, and Egypt Vision 2030, all of which prioritize private sector growth, tech innovation, and digital employment creation.

b) Digitalization: The Core of Modern BPO Growth

Digitalization is the driving force behind the growth of the BPO industry in the Middle East. Cloud computing, AI, and automation are redefining outsourcing services, moving beyond back-office work to full-scale digital operations management. In Dubai and Riyadh, AI-powered customer experience centers now handle voice and chat support with real-time sentiment analysis and multilingual translation. Similarly, BPO providers are investing heavily in cybersecurity, data analytics, and robotic process automation (RPA) to enhance accuracy, reduce costs, and improve response times.

This digital-first mindset is a key differentiator for the Middle East. Unlike traditional outsourcing hubs, the region’s strength lies in combining advanced infrastructure, government-backed innovation, and strategic proximity to Western and African markets. In effect, it is emerging not as a low-cost alternative, but as a high-value digital operations hub. BFSI leads the BPO adoption owing to stringent compliance demands and volume-driven customer service needs in the region. Telecom, healthcare, retail/e-commerce, government, and hospitality sectors are also accelerating outsourcing to enhance operational agility and improve service standards. The market is also witnessing strong growth in public sector outsourcing, as governments adopt private delivery models for digital services, thereby creating new opportunities for domestic and international BPO players.

c) Talent Transformation: From Transactional to Tech-Driven

The Middle East is rapidly transforming its workforce to meet global digital standards. Governments across the GCC are investing in vocational upskilling, AI literacy, and multilingual education to prepare the next generation of professionals. Initiatives such as Saudi Arabia’s Human Capability Development Program and Dubai’s Digital Economy Strategy aim to build a digitally fluent workforce capable of handling complex, analytics-driven processes.

The region’s demographics also work in its favor, with over 50% of the population under 30, and exposure to global service standards. Combined with strong proficiency and proximity to Arabic and French-speaking markets, the Middle East has an enviable multilingual advantage, making it ideal for regional customer service and CX operations.

Expanding Service Portfolios: Beyond Call Centers

The Middle East’s BPO landscape is undergoing rapid diversification. Although customer support and call center operations are still at the core, BPO providers in the region are increasingly shifting toward more knowledge-intensive services.

Key growth segments include:

-

Finance & Accounting Outsourcing (FAO): As enterprises across Saudi Arabia and the UAE modernize ERP systems, FAO services are growing fast, supported by regional fintech integration

-

Human Resource Outsourcing (HRO): Payroll, recruitment, and employee engagement services are in demand, particularly as regional labor laws evolve

-

IT and Cloud Management Services: Cloud migration, managed IT support, and cybersecurity monitoring are becoming mainstream

-

Analytics & Business Intelligence: BPO firms are offering advanced data analytics and Power BI integration to drive decision-making for enterprise clients

Emerging BPO Hubs: Egypt, UAE, and Saudi Arabia Lead the Pack

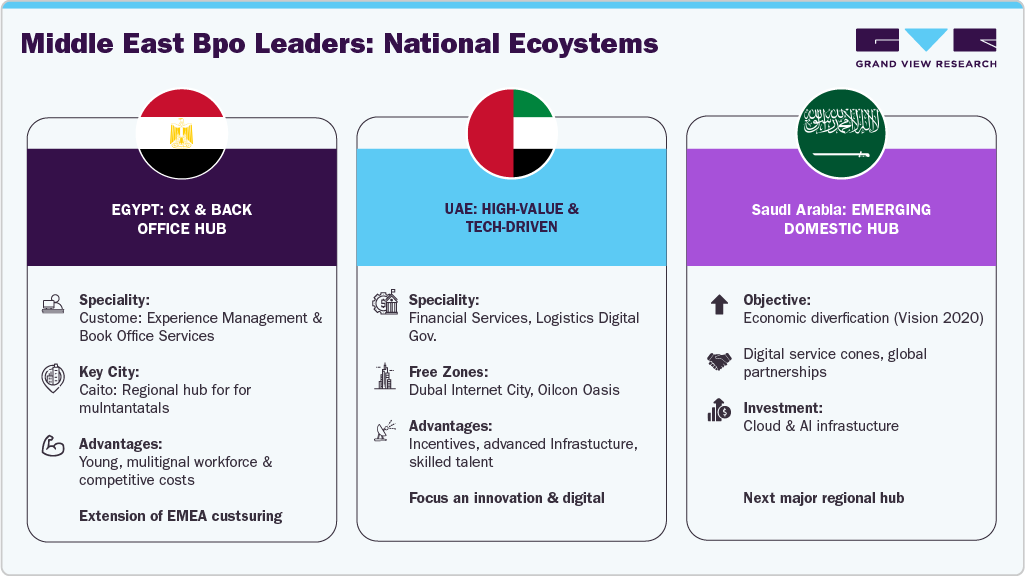

Among Middle Eastern economies, Egypt, the UAE, and Saudi Arabia are leading the way in establishing comprehensive BPO ecosystems.

-

Egypt has built a strong reputation in customer experience management and back-office services, with Cairo serving as a regional hub for multinational players like Teleperformance and Concentrix. Its young, multilingual workforce and competitive costs make it a natural extension of the EMEA outsourcing network.

-

UAE focuses on high-value, tech-driven outsourcing, particularly in financial services, logistics, and government digital operations. Free zones such as Dubai Internet City and Dubai Silicon Oasis offer incentives, advanced infrastructure, and access to skilled professionals.

-

Saudi Arabia, meanwhile, is rapidly developing a domestic BPO industry to support its economic diversification goals. The establishment of digital service zones, partnerships with global outsourcing firms, and heavy investment in cloud and AI infrastructure are positioning the Kingdom as the next major outsourcing hub in the region.

Global outsourcing giants are increasingly forming joint ventures with GCC-based IT and telecom companies, combining international expertise with localized operations. Governments across the region are actively supporting these collaborations through pro-business regulations, tax benefits, and investment programs aimed at boosting digital employment. At the same time, private equity and venture capital firms are showing strong interest in BPO startups specializing in AI-driven automation, data labeling, and customer experience analytics, particularly in Saudi Arabia and the UAE.

The Road Ahead: A Digital BPO Powerhouse in the Making

The next few years will be pivotal for the Middle East’s BPO trajectory. The BPO industry stands at the cusp of a new era, transitioning from cost-centric operations to strategic, technology-enabled service delivery. Driven by digital transformation, favorable government policies, and rapidly growing domestic and regional demand, the BPO sector is poised for sustained and robust growth over the next decade. Success will also depend on addressing certain structural challenges, such as talent scalability, data security frameworks, and ensuring cost competitiveness against mature markets in Asia.