Regulatory Forces Reshaping Clinical Diagnostics Strategy in the Middle East

Policies and regulations in the Middle East significantly shape the rapidly evolving clinical diagnostics landscape, creating a high-growth environment driven by national healthcare visions, mandatory screening policies, and an accelerating push toward localized manufacturing. Governments across the region, particularly in the Gulf states, are aligning regulatory frameworks with broader health security goals, emphasizing quality assurance, digitalization, and cost containment in diagnostic services. Policies such as Saudi Arabia’s Vision 2030 health privatization program and the UAE’s adoption of international accreditation standards are reshaping market access pathways for laboratories, equipment suppliers, and test-kit manufacturers.

At the same time, evolving reimbursement mechanisms and localized product registration requirements are influencing the pace of innovation, investment decisions, and competitive dynamics within the diagnostics value chain. As these regulations mature, the market is at a critical inflection point, where compliance, affordability, and technological advancement must converge to unlock scalable, sustainable diagnostic capacity across the region.

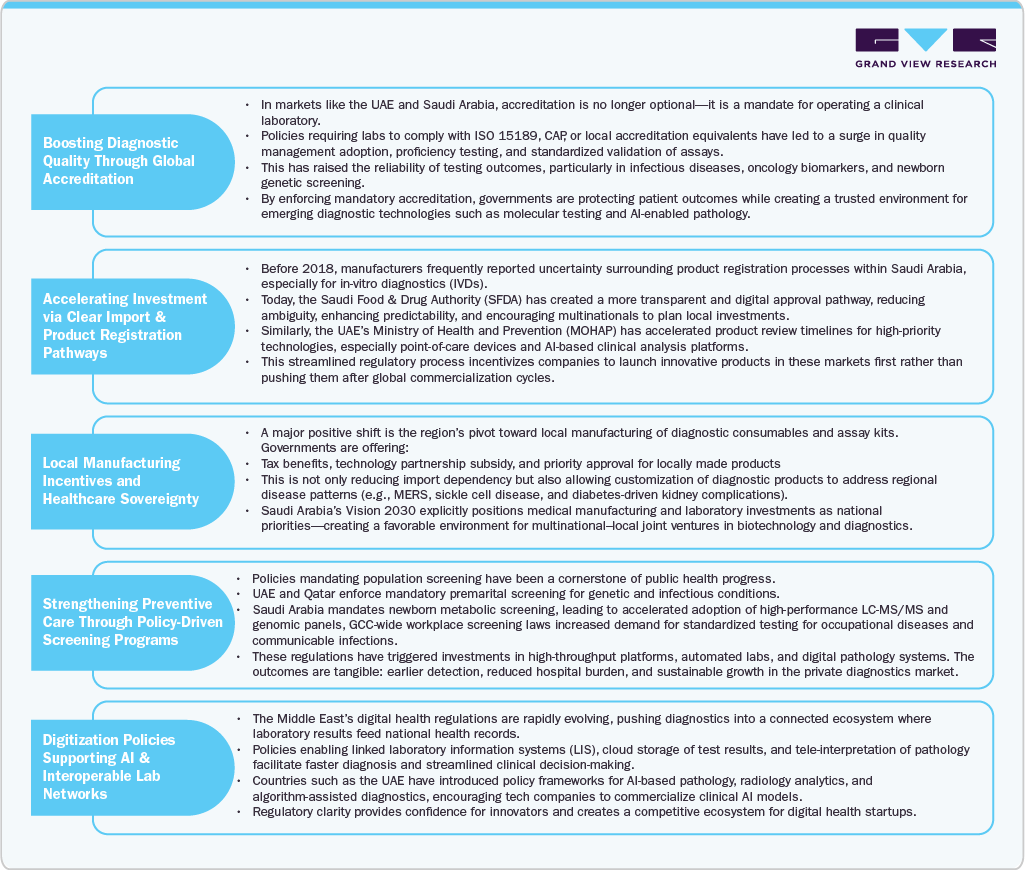

The table below provides a clear view of the policies in Middle East countries and their impact on the market.

Regulations as Catalyst

While regulatory shifts in the Middle East often dominate discussions around compliance burden and market delays, there is a growing and equally powerful narrative of progress. Across the Gulf states, governments are leveraging policy frameworks not simply to control market practices, but to accelerate quality diagnostics, attract foreign investments, and enhance disease surveillance capacity. Instead of functioning as roadblocks, regulations are increasingly acting as catalysts that encourage laboratory modernization, stimulate domestic manufacturing of test kits, and foster public-private partnerships in screening and early disease detection.

The Problem: Navigating Regulatory Fragmentation and Opacity

For diagnostic companies, the primary challenge in the Middle East is not market demand, but the path to market. The regulatory environment is highly varied, with each nation establishing its own distinct rules, standards, and approval pathways. Unlike the relatively harmonized EU or U.S. markets, the MENA region requires a bespoke approach for every country-Saudi Arabia, the UAE, Qatar, Egypt, and others all operate under different systems.

This fragmentation creates a threefold problem:

-

Delayed Market Entry: Companies face extended timelines and increased costs due to redundant documentation and separate submission processes for each country.

-

Operational Complexity: Maintaining compliance across multiple, differing sets of regulations demands significant internal resources and expertise.

-

Uncertainty and Risk: Evolving guidelines, particularly for novel technologies such as the AI-powered diagnostics and liquid biopsies, can create unpredictability, making long-term investment decisions difficult.

The core issue is that while many Middle Eastern regulatory bodies reference international standards (such as GHTF or EU guidelines), their local interpretation and implementation differ substantially. For example, obtaining a CE mark often streamlines SFDA (Saudi Food and Drug Authority) approval, but local safety data requirements and specific classifications may still apply, creating nuanced hurdles.

A Solutions-Oriented Approach: Navigating the Maze

Based on different case studies, success in the Middle East requires a proactive, localized, and multi-phased strategy that transforms regulatory challenges into competitive advantages. The approach involves developing regional regulatory intelligence, fostering local partnerships, and adopting flexible market entry strategies.

Case Story 1: The 'GCC Gold Standard' Strategy

Consider the case of 'Apex Bio,' a U.S.-based advanced POCT (Point-of-Care Testing) device manufacturer. Apex Bio faced initial paralysis due to the complexity of regulations across KSA, UAE, and Qatar. Rather than pursue all markets simultaneously, they developed a 'GCC Gold Standard' strategy:

-

Prioritize Key Markets: Apex Bio prioritized entry into the UAE and Saudi Arabia first, leveraging their relatively defined and internationally-aligned regulatory pathways (DHA/DoH in the UAE and SFDA in KSA).

-

Leverage Local Partnerships: Apex Bio partnered with a large, well-established local distributor in Riyadh. This partner provided invaluable on-the-ground regulatory intelligence and navigated the SFDA submission process, which often involves nuanced local interpretations of international standards and specific in-country testing requirements.

-

Phased Rollout: After successful registration and initial market penetration in KSA and UAE, the approval dossiers were used as a "master file" to expedite applications in smaller GCC markets such as Qatar and Bahrain, positioning Apex Bio as a regionally validated player.

This approach turned a two-year potential market-entry delay into an 18-month successful launch across the region, demonstrating that strategic regulatory engagement is a powerful business accelerant.

Case Story 2: Burjeel Holdings and OncoHelix: Pioneering Molecular Diagnostics in UAE

Burjeel Holdings, a leading UAE healthcare provider, partnered with Canadian precision oncology firm OncoHelix to launch a state-of-the-art molecular diagnostics and immune profile testing facility in Abu Dhabi in May 2024, marking a strategic market entry amid rising chronic disease burdens. This venture addressed gaps in advanced genomic testing, leveraging the UAE's MOHAP regulatory framework to secure rapid approvals through local operations and tech integration.

Regulatory Navigation and Challenges Overcome

Entering UAE required navigating MOHAP's stringent device registration via the e-services portal, including bioequivalence data, stability certificates, and Arabic labeling compliance-common pitfalls causing delays for 30-40% of applicants. Burjeel mitigated this by establishing OncoHelix as a local technical operator, pre-submitting pharmacovigilance (PV) plans with a UAE-resident QPPV, and aligning with DOH Abu Dhabi for Class II/III IVD classifications. Product misclassification risks were avoided through early EDE guideline consultations, cutting approval from typical 6-9 months to under 4.

Initial hurdles included integrating imported analyzers with UAE's vigilance database and securing Halal/GMP certifications, inflating setup by 15-20%. The partnership used Dubai Healthcare City's regulatory sandbox for pilot testing, expediting HTA dossiers, and enabling managed entry for high-risk oncology panels.

Strategic Execution and Market Penetration

Burjeel selected a 5,000 sq. ft. site in Abu Dhabi Medical City, investing AED 20 million in automated sequencers and LIMS for 500+ daily tests, targeting oncology (40% focus) and infectious diseases. Marketing emphasized insurance tie-ups with Daman and Oman Insurance, plus corporate wellness for ADNOC clients, capturing 10% Abu Dhabi molecular diagnostics share in six months.

Digital integration via app-based reporting and AI triage reduced turnaround from 72 to 24 hours, aligning with the UAE's preventive health push. Local hiring met Emiratization quotas, unlocking government tenders worth AED 5 million annually.

Financial and Operational Results

The facility hit break-even in 9 months, generating AED 15 million revenue in year one from 100,000 tests, with 60% from immune profiling amid post-COVID demand. Cost savings hit 25% via localized ops versus imports, with ROI projected at 18% CAGR through 2030, matching UAE IVD market's 5.2% growth to USD 574 million. Patient outcomes improved: 30% faster therapy matching for 500+ oncology cases.

Recap: Key Takeaways for Decision-Makers

The regulatory landscape in the Middle East clinical diagnostics domain is a dynamic force shaping market entry and growth. For decision-makers in the diagnostic industry, the following takeaways are critical:

-

Harmonization is the Future, but Fragmentation is the Present: While initiatives towards regional harmonization exist, market players must budget for the current reality of country-specific compliance and regulatory pathways.

-

Regulatory Intelligence is a Strategic Asset: Invest in granular, up-to-date knowledge of each market's specific requirements. This is as important as R&D or sales strategy.

-

Local Partnerships are Key Enablers: Collaborating with established local entities can bridge knowledge gaps, accelerate approval timelines, and build trust with local health authorities.

-

Policy is a Market Driver: Engage with national health visions (like Saudi Vision 2030 or UAE national strategies) to align product offerings with government priorities, such as preventive care and AI integration, which can create faster regulatory pathways.

By transforming regulatory compliance from a mere hurdle into a strategic roadmap, companies can effectively navigate the Middle East market and capitalize on its immense potential for enhancing regional healthcare outcomes.