Holiday 2025 Playbook: Winning the Middle East’s Fastest-Growing E-Commerce Season

The Middle East’s e-commerce sector continues to evolve at an accelerated pace, driven by widespread digital transformation, strong internet penetration, and a rapidly expanding base of online consumers. Over the past few years, the region has witnessed substantial investments in logistics infrastructure, digital payment systems, and omnichannel retail models, positioning it as one of the most dynamic and high-potential e-commerce markets globally. Major economies such as the UAE, Saudi Arabia, and Egypt are spearheading this transformation, supported by young, tech-savvy populations and government initiatives aimed at fostering digital economies.

Against this backdrop, Middle East retailers are poised to capitalize on unprecedented opportunities during the 2025–2026 holiday shopping season. The convergence of rapid e-commerce expansion, growing digitization trends, and evolving consumer purchasing behaviors is expected to create a highly favorable business environment. Retailers that strategically leverage digital channels, personalization technologies, and omnichannel sales models can maximize profitability and strengthen consumer engagement throughout this pivotal retail period.

E-commerce Momentum Is Accelerating

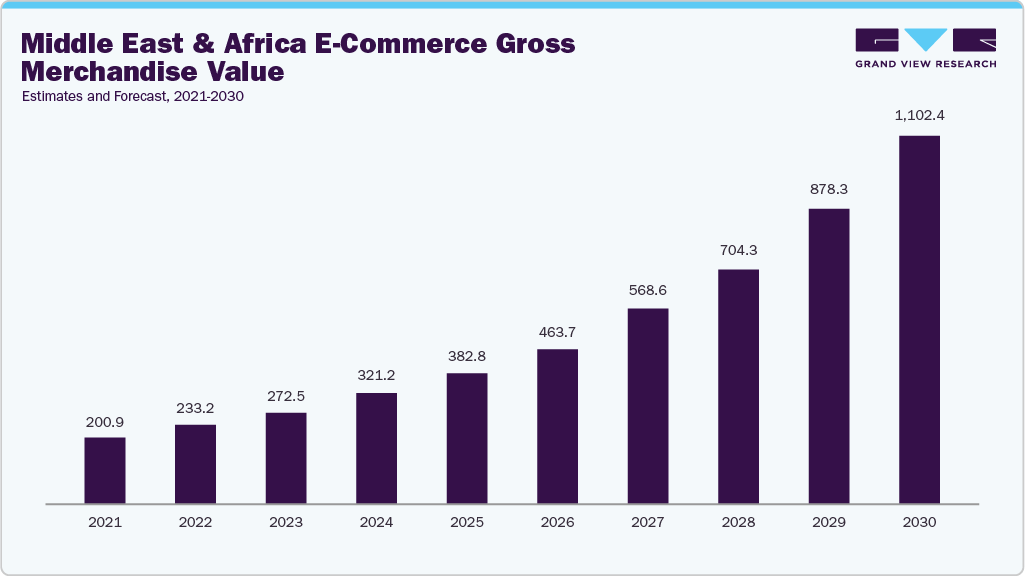

As per Grand View Research’s estimates, the e-commerce market in the Middle East and Africa is estimated to grow at a CAGR of 23.6% from 2025 to 2030.

Retailers in the Middle East should be prepared for accelerated growth: MENA's e-commerce market soared by over 30% in 2024, far exceeding global averages, with Saudi Arabia and the UAE emerging as regional powerhouses for online retail. While online orders grew across the MENA region, the UAE posted a 7% rise and Saudi Arabia a 9% jump, demonstrating resilient consumer confidence and a rapid shift to digital platforms. The region's average order value (AOV) increased from USD 30 in 2023 to USD 35.6 in 2024, fueled by higher discretionary spending, with the UAE reaching USD 102 and Saudi Arabia USD 52.5 for average online purchases. This momentum is set to continue owing to robust economic activity, surging mobile commerce, and government-driven digital economies.

Top Categories: Gaming, Fashion, and Gifting Lead

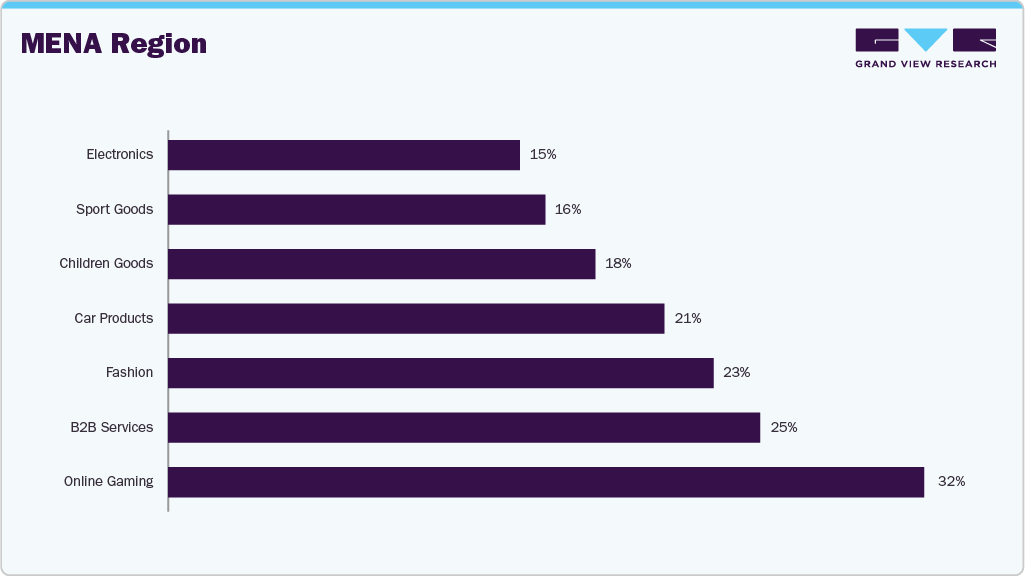

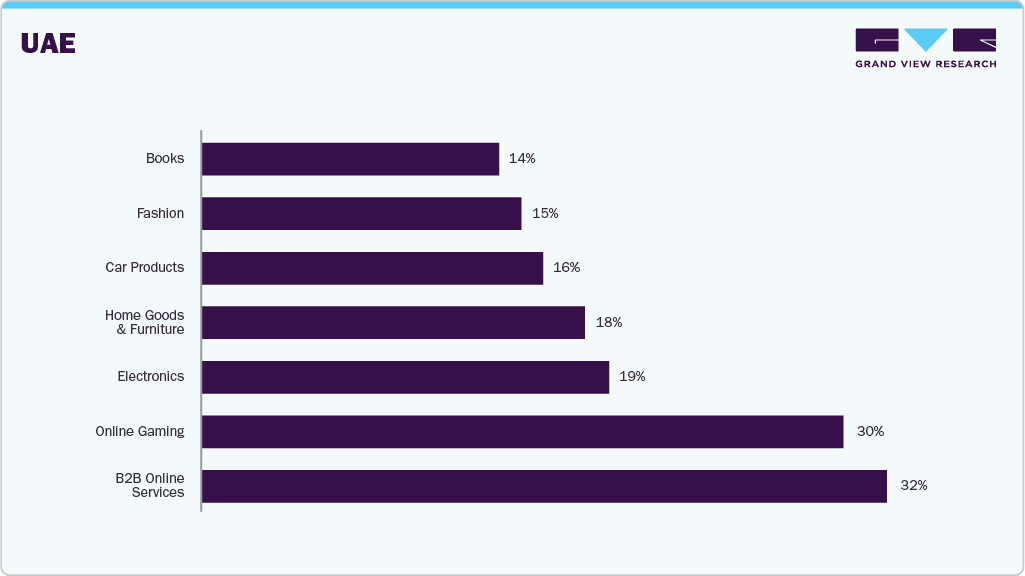

Online gaming, B2B services, and fashion emerged as the fastest-growing product categories in MENA e-commerce for 2024, posting YOY order surges of 32%, 25%, and 23%, respectively. In the UAE, B2B services (+32%), online gaming (+30%), electronics (+19%), home goods (+18%), and car products (+16%) saw the biggest gains. Retailers looking to win this holiday season should tailor their assortments, inventory, and marketing toward these high-growth sectors, amplifying the appeal for digitally savvy, younger consumers.

Gifting: A Transformative Opportunity

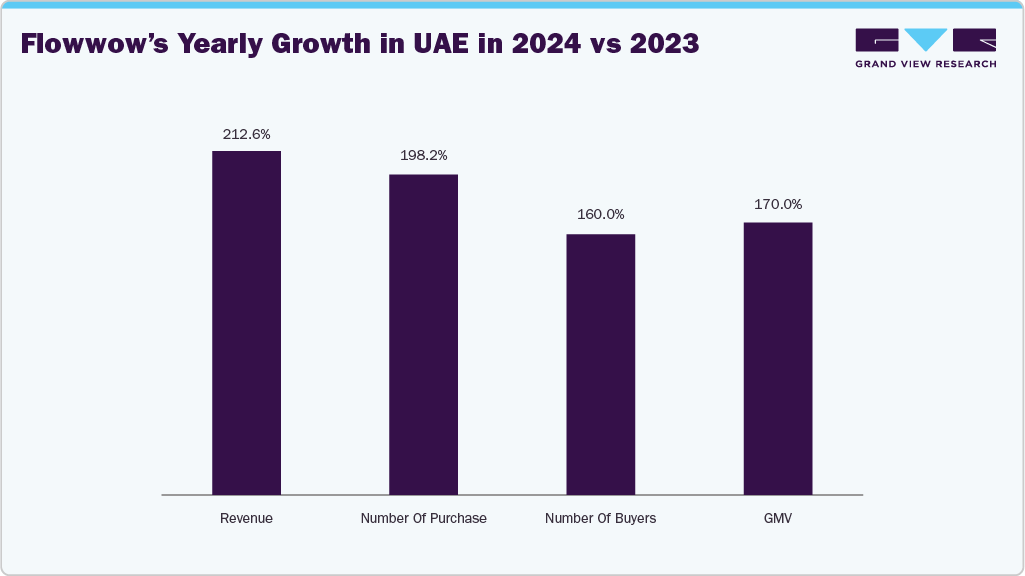

The online gifting segment in the Middle East, once mainly associated with key holidays such as Eid, has rapidly expanded and now represents a significant growth opportunity during the festive season. In the UAE, the online gifting market experienced remarkable acceleration in 2024, evidenced by a 200% year-on-year increase. For example, platforms like Flowwow handled 20,782 gift orders from more than 13,000 unique customers, underscoring the rising adoption of digital gifting solutions. The gross merchandise value (GMV) for the gifting marketplace soared by 170%, with projections indicating the potential for over 300% year-on-year growth in 2025.

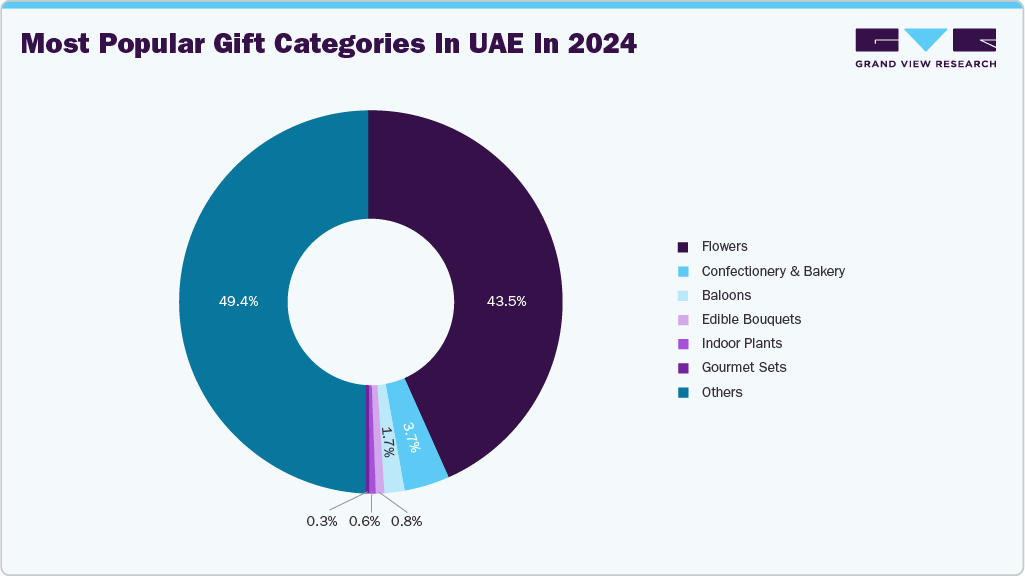

Flowers accounted for 43.5% of all online gifting purchases in 2024, but there is growing interest in a variety of other categories including confectionery, bakeries, bento cakes, and balloons, all of which benefit from high average order values. To fully capture this momentum, retailers are advised to expand their product assortments, introduce premium and personalized gift options, and align their offerings with prominent local cultural events to enhance the overall gifting experience.

Opportunities within Cross-Border Gifting:

The UAE’s deeply rooted gifting culture is rapidly evolving, with cross-border gifting emerging as one of its fastest-growing expressions of connection among globally dispersed communities. New data from Flowwow, a UAE-based gifting marketplace operating in more than 30 countries, shows that international gifting has surged from 13% in 2022 to 20.1% in 2024, a clear sign of how residents are increasingly using gifting to maintain emotional ties across borders.

Flowwow’s analysis of January–September 2024 reveals a 22% rise in total gifting activity, driven largely by the UAE’s diverse population of 9.9 million expatriates, many of whom rely on gifts to bridge physical distance with loved ones abroad. This shift underscores the UAE’s role as a global hub for e-gifting, enabling frictionless sending of flowers, hampers, sweets and more to destinations worldwide.

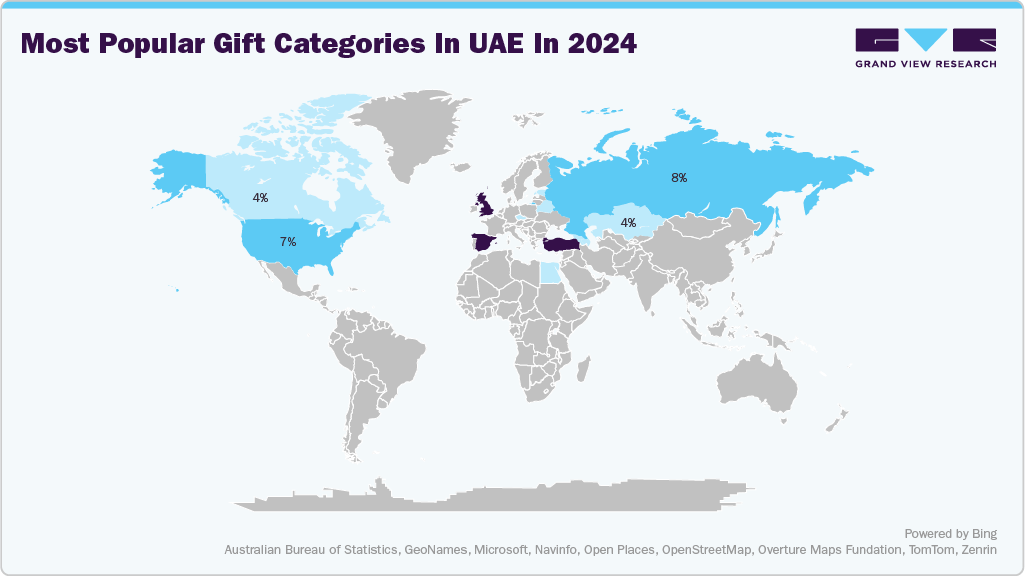

The UK, Spain and Turkey emerged as the top international gifting destinations, reflecting strong expatriate communities and cultural ties. The UK alone accounted for 13% of overseas orders, with UAE residents spending an average of AED 505, significantly higher than the domestic average of AED 257, highlighting the premium consumers are willing to spend when gifting across borders.

Despite the international surge, domestic gifting still represents 80% of total orders, with residents celebrating birthdays, holidays and major milestones through a wide mix of curated gifts. Internationally, markets such as Russia, the U.S., and Egypt also showed strong demand, mirroring the UAE’s multicultural demographic and the traditions of maintaining long-distance family bonds.

Digital Transformation and Personalization

Government-led digital economy initiatives, such as the UAE’s Digital Economy Strategy and Saudi Arabia’s Vision 2030 are fundamentally reshaping the retail sector by accelerating the adoption of advanced technologies like artificial intelligence, prioritizing mobile-first strategies, and advancing omni-channel customer engagement. These policies are cultivating a highly digital, youthful consumer base eager for seamless, innovative shopping experiences and driving retailers to integrate AI-driven personalization, automated customer service, and advanced analytics throughout the shopping journey.

Personalization and community-centric commerce now stand out as core pillars for future retail success, with platforms actively leveraging social media hubs including TikTok and Pinterest, to connect with Gen Z shoppers and create interactive, content-driven engagement. To capitalize on these trends during the holiday season, retailers should invest in intelligent marketing pixels, robust data-driven recommendation engines, and content formats specifically tailored to the preferences and behaviors of younger, mobile-native audiences. A bold commitment to these technologies and strategies will be crucial for maximizing impact, elevating brand relevance, and driving sustained growth in an increasingly competitive market environment.

Five Strategic Moves for 2025 Holiday Success

-

Optimize for Mobile and Social Commerce: Prioritize mobile-first design, shoppable social feeds, and platform-driven engagement to reach digital-native segments.

-

Expand High-Growth Categories: Focus on gaming, fashion, gifting, and electronics—allocating shelf space, inventory, and ad spend where demand is proven.

-

Leverage Personalization and Dynamic Bundling: Use AI and data analytics to offer personalized discounts, curated bundles, and festival-specific promotions tailored to local tastes and gifting occasions.

-

Champion Local Sellers and SMEs: Collaborate with local entrepreneurs to broaden product variety, build community trust, and ensure rapid, reliable fulfillment.

-

Anchor Marketing Around Cultural Moments: Craft campaign calendars around Ramadan, Eid, and other national holidays, deploying timely, themed messaging and limited-edition collections.

Conclusion

The 2025 holiday shopping season in the Middle East is set to deliver record-breaking performance across both e-commerce and traditional retail channels, fueled by strong consumer confidence, wide-scale digital enablement, and an ongoing culture of celebration. Retailers that strategically adopt advanced personalization, prioritize mobile and social commerce channels, and curate their offerings to target high-growth product categories will be best positioned to achieve outsized business growth and to cultivate lasting customer loyalty in this rapidly evolving landscape.