The Middle East Eyewear Revolution: Unlocking Value In A $2B+ Underpenetrated Market

A Region on the Edge of Category Redefinition

The Middle East eyewear sector is entering a defining decade-one shaped not by incremental growth, but by structural transformation. While global attention gravitates toward mature Western markets or high-velocity Asian economies, the Middle East markets are quietly rewriting the eyewear narrative: affluent consumers with unmet needs, rising clinical demand, rapid digitization, and a widening shift from fashion consumption to growing demand for smart products.

For brands, investors, and innovators evaluating market entry or expansion, this is not merely a “growth market.” It is a market in transition, where understanding consumer psychology, regulatory nuance, and technological readiness is essential.

The Middle East eyewear market, comprising primarily Saudi Arabia and the United Arab Emirates, has established itself as a significant regional player with distinct characteristics that differentiate it from both developed Western markets and emerging Asian economies.

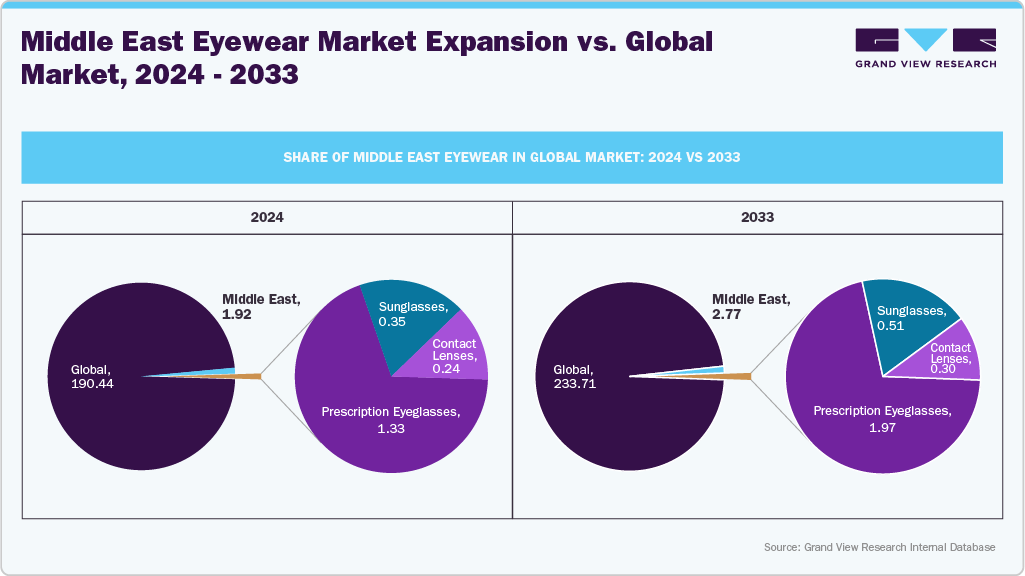

According to Grand View Research, the Middle East eyewear market is expected to reach USD 1.92 billion by 2024. Yet these headline numbers only scratch the surface. Beneath them lies a deeper, faster-moving shift-driven by the prevalence of refractive errors, changing lifestyle patterns, the adoption of omnichannel strategies, and early acceleration in smart eyewear.

The Middle East faces a growing public health challenge that simultaneously represents a significant commercial opportunity. Refractive errors-including myopia, presbyopia, hyperopia, and astigmatism-now affect approximately 40% of the region's population, projected to reach 42% by 2030.

Exhibit 2: Middle East Prescription Glasses - Demand Gap Analysis (2024 vs. 2030F)

|

Metric |

FY 2024 |

FY 2030F |

|

Population (Mn) |

45 |

49 |

|

Prevalence of Refractive Errors (RE) |

40% |

42% |

|

Population with RE (Mn) |

~18.0 |

~20.6 |

|

Prescription Eyeglasses Penetration |

60% |

64% |

|

Population with Prescription Eyeglasses (Mn) |

10.8 |

13.2 |

|

Population with RE but without Prescription Eyeglasses (Mn) |

7.2 |

7.4 |

|

Untapped Demand (USD Mn) |

1,231.2 |

1,481.8 |

Source: Grand View Research Internal Database

The region’s lower penetration is further amplified by lifestyle shifts, increased screen exposure, growing awareness of eye health, and a young, digitally native demographic willing to upgrade eyewear as a fashion and functional accessory. Together, these factors create a dual opportunity for players: closing the correction gap through accessible, omni-channel eye-care solutions, and capturing premiumization potential through stylish, high-quality frames and lenses. The decade ahead is thus defined by unmet needs, rising demand density, and a fast-maturing consumer base-setting the stage for a transformative growth cycle in Middle Eastern eyewear.

Opportunities if the Middle East Landscape Evolves

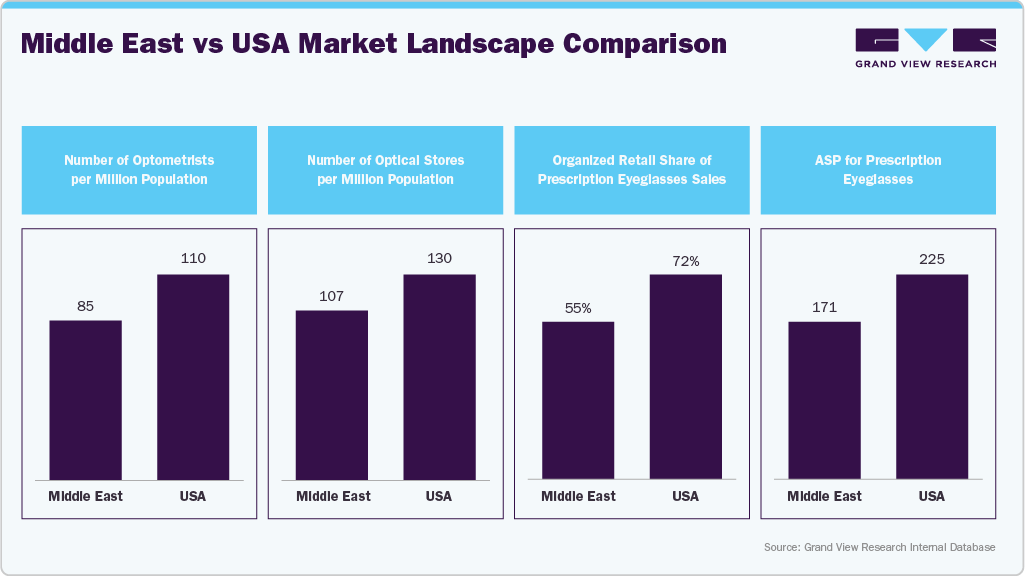

The Middle East eyewear sector is underdeveloped relative to the U.S. benchmark, but this gap represents a large and actionable opportunity. By improving clinical density, modernizing retail, and enhancing category education, the region can unlock stronger penetration, higher ASPs, and a more sustainable, professionalized eyewear ecosystem.

-

Expand Clinical Infrastructure: Growing the density of optometrists and modern eye-care centers can significantly improve diagnosis rates, shrink the uncorrected vision population, and lift prescription conversion-unlocking a multi-billion-dollar demand pool.

-

Increase Retail Footprint and Omni-Channel Penetration: More stores, better distribution, and digitally integrated models (online refraction, virtual try-on, home eye checks) can improve access, reduce friction, and expand category participation.

-

Drive Premiumization and Assortment Sophistication: Improved diagnostics and higher trust in retail formats typically increase adoption of advanced lenses (progressives, blue-light, high-index), enabling ASP uplift similar to the U.S. trajectory.

-

Professionalize the Consumer Journey: Standardized testing protocols, transparent pricing, and consistent service quality can boost conversion, reduce abandonment, and increase lifetime value.

-

Strengthen Category Education: Awareness campaigns around eye health, screen fatigue, and early correction can help replicate the U.S.’s higher clinical conversion rates and boost prescription eyeglasses’ share of sales.

The smart glasses category has experienced explosive growth, with Ray-Ban Meta glasses sales more than tripling in the H1 of 2025, demonstrating unprecedented consumer appetite for this technology. Meta's Ray-Ban smart glasses have sold two million pairs since their October 2023 debut, with the company planning to sell 10 million glasses annually by the end of 2026 Entrepreneur. This success has validated the category and encouraged brands to pursue international expansion. In September 2024, Innovative Eyewear secured an exclusive distribution agreement with Ecom Gulf FZCO covering the GCC countries, including the United Arab Emirates, Saudi Arabia, Kuwait, Qatar, Bahrain, and Oman. There is a growing demand for luxury eyewear brands in the GCC, with consumers willing to pay premium prices for high-quality and stylish frames, making it an ideal market for higher-priced smart eyewear products. The region represents a significant opportunity with its tech-forward consumers and robust retail landscape, creating receptive conditions for AI-enabled products.

By the third quarter of 2025, companies like Innovative Eyewear demonstrated confidence in building a more globally focused business with significant distribution outside the U.S., with the Middle East expansion representing a key pillar of this strategy.

The convergence of proven global demand, premium-oriented consumers, and technology adoption makes the Middle East a strategic priority for smart eyewear brands seeking their next growth frontier.

Evolving Consumer Dynamics and Retail Transformation in Middle East Eyewear

Rise of Omnichannel as the Core Growth Engine

The region has quickly transitioned from traditional retail to digitally integrated omnichannel formats. Middle Eastern consumers expect seamless navigation across store, digital, and social commerce touchpoints. Adoption of virtual try-ons, online vision tests, and appointment-led in-store experiences is accelerating, driven by a young, digitally native demographic.

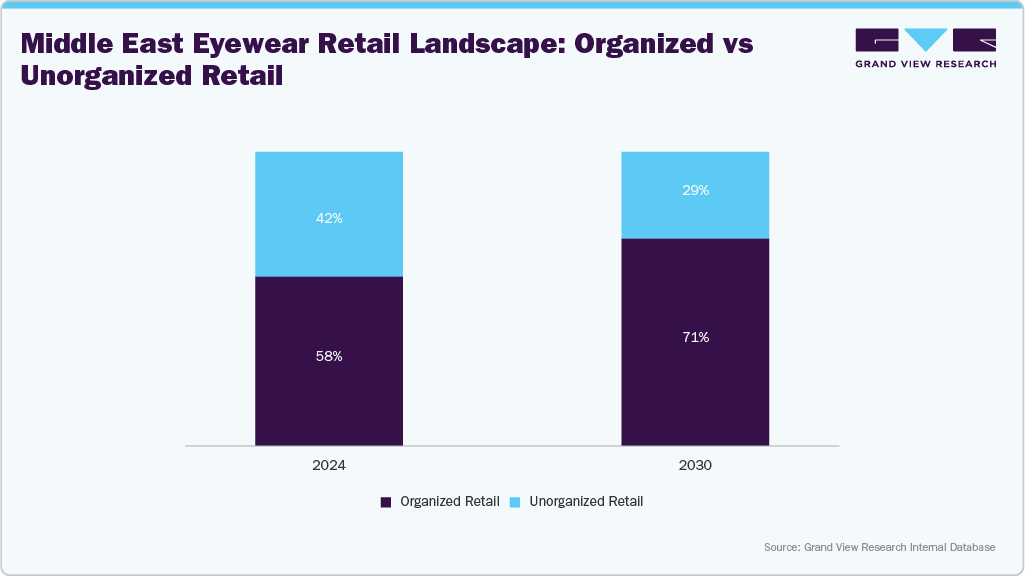

Omnichannel is no longer an optional enhancement but a category-defining differentiator. Retailers that successfully blend experience-led stores with digital convenience are capturing a disproportionate share of wallet, particularly among premium and value-hybrid consumers. The consolidation of retail is inevitable. Smaller unorganised players lack digital capabilities, supply chain sophistication, and brand equity-creating an opportunity for regional roll-ups and franchise-led expansion models.

What’s driving this acceleration?

-

Greater trust in clinical accuracy and certified optometrists

-

Wider assortment and transparent pricing

-

Integrated supply chains enabling faster fulfilment

-

Loyalty programs and subscription plans are gaining traction

-

Expansion of modern retail in Tier-2 and Tier-3 GCC cities

Increasing Demand for Localized and Climate-Specific Eyewear

There is a white space in “Middle East-first” design innovation. Brands that embed climate adaptation into R&D, coupled with aesthetics, will unlock premium pricing and stronger brand stickiness. The region’s harsh climate conditions-intense UV exposure, high temperatures, and frequent dust-are shaping product innovation. Brands are experimenting with:

-

UV+ dust-shield sunglasses designed for desert environments

-

Heat-resistant lightweight materials that avoid warping

-

Sweat-resistant nose pads and coatings improve durability and comfort

-

Aesthetic cues inspired by Middle Eastern design codes, such as geometric patterns, ornate detailing, and gold-accented luxury styling

THE ROADMAP AHEAD

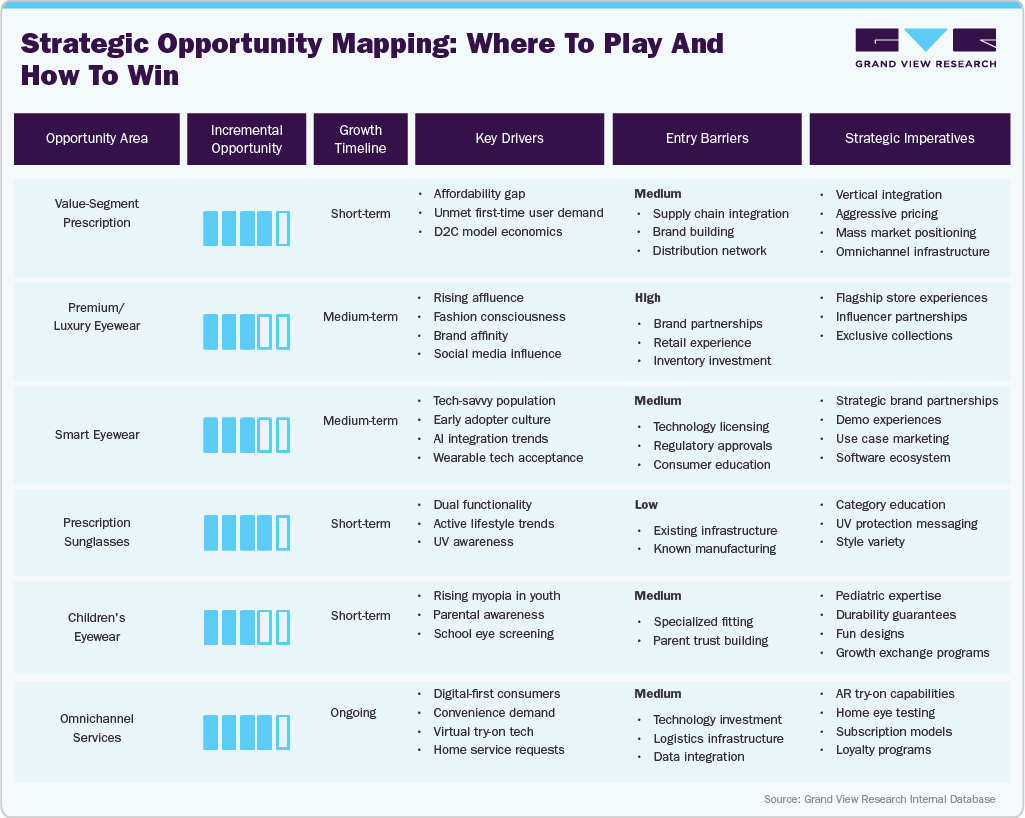

The Middle East eyewear sector is entering a decade of high-velocity transformation. To unlock the region’s full potential, players must focus on five critical shifts:

-

Strengthen Clinical Density: Expand optometrist networks, standardize testing, and use tele-optometry to close the diagnosis gap and unlock the region’s largest demand pool.

-

Build Omnichannel-First Retail: Integrated digital + store journeys, faster fulfilment, and service-led formats will define the next wave of market leaders as consolidation accelerates.

-

Double Down on Premium & Luxury: Affluent, experience-driven consumers in the GCC are fueling premiumization. Curated assortments, flagship stores, and localized luxury design will drive disproportionate share.

-

Lead in Smart Eyewear Early: With proven global demand and a tech-forward population, the Middle East is primed to become an early adopter. Category education, powerful use-case marketing, and strong retail partnerships will be essential.

-

Localize for Climate & Culture: Heat-resistant materials, UV+dust protection, hijab-compatible designs, and culturally inspired styling will differentiate brands in a competitive market.

CONCLUSION: THE REGION’S DEFINING EYEWEAR DECADE

The Middle East eyewear market is no longer a peripheral opportunity; it is a category in the midst of structural transformation. Rising refractive errors, a youthful population, digital maturity, and accelerating premiumization have created a market hungry for innovation and underserved by legacy infrastructure.

Over the next decade, a modern, clinically anchored, and technologically enhanced eyewear ecosystem will emerge that blends global best practices with regional nuances. The winners in this landscape will be those who move early, invest boldly, and localize intelligently. They will not only meet existing demand but shape new behavior, define new categories, and elevate eyewear from a functional accessory to a lifestyle, wellness, and technology statement.