Transforming Healthcare Facilities in the Middle East: A New Era of Distributed Care

For decades, the Middle East’s healthcare systems have been built on a single model-large, centralized hospitals designed to handle acute care, surgeries, and specialist treatments. These monumental facilities have become symbols of progress, reflecting the region’s rapid development. However, as the region’s healthcare needs evolve, the focus is shifting away from traditional hospital beds and toward more distributed care models. The future of healthcare infrastructure in the Middle East is no longer about simply building more hospitals; it's about creating integrated care networks that extend beyond the traditional walls of hospitals, reaching homes and outpatient centers.

This transformation is being driven by the need to manage chronic diseases, address the challenges of aging populations, and respond to the increasing demand for patient-centric care that is not only more accessible but also affordable and sustainable. Governments and private investors are coming together to create smarter, more flexible healthcare ecosystems that connect hospitals, outpatient centers, rehabilitation units, and home-care services into a seamless, integrated healthcare continuum.

The Shift from Hospital-Centric Care to a Connected Ecosystem

While the Middle East has increased its hospital bed capacity by over 70% since 2010, 60% - 70% of hospital admissions are still related to chronic non-communicable diseases (NCDs) such as diabetes, heart disease, and chronic respiratory conditions. These long-term conditions require ongoing management, not just one-off treatments.

According to the World Health Organization (WHO), NCDs account for 36–40% of total healthcare expenditure in the GCC countries. The growing prevalence of these diseases, coupled with an aging population and the rising cost of healthcare, is prompting a shift away from traditional hospital-centric models. The region is focusing more on decentralized care, value-based care models, and home and outpatient care programs.

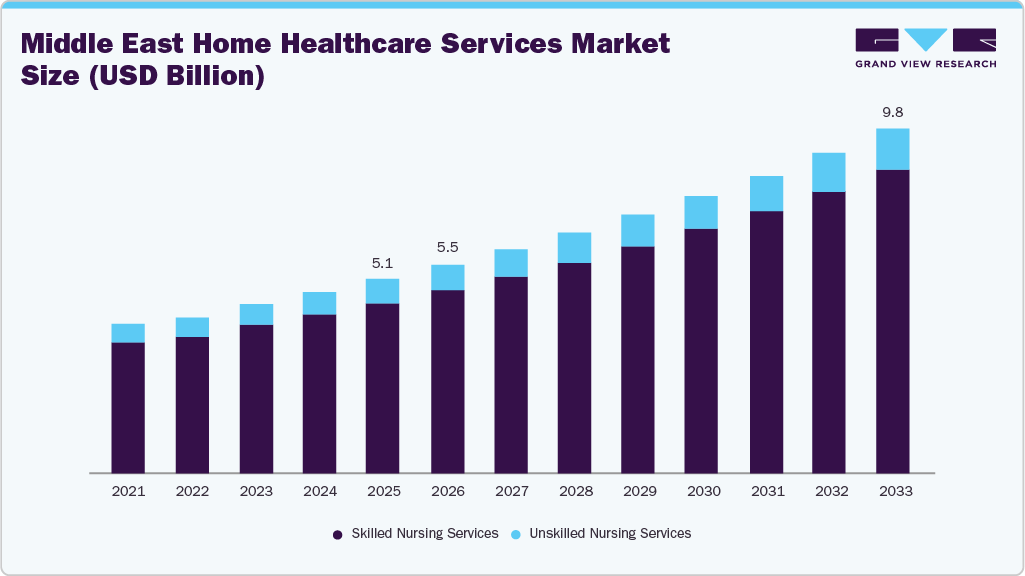

The Middle East home healthcare services market is valued at USD 5.15 billion in 2024, is expected to grow at a 7.38% CAGR through 2033. This reflects the growing demand for home-care services and outpatient care, a model already proven to be more cost-effective and patient-friendly compared to traditional inpatient care.

Saudi Arabia: Leading the Transition to Home-Based Ecosystems

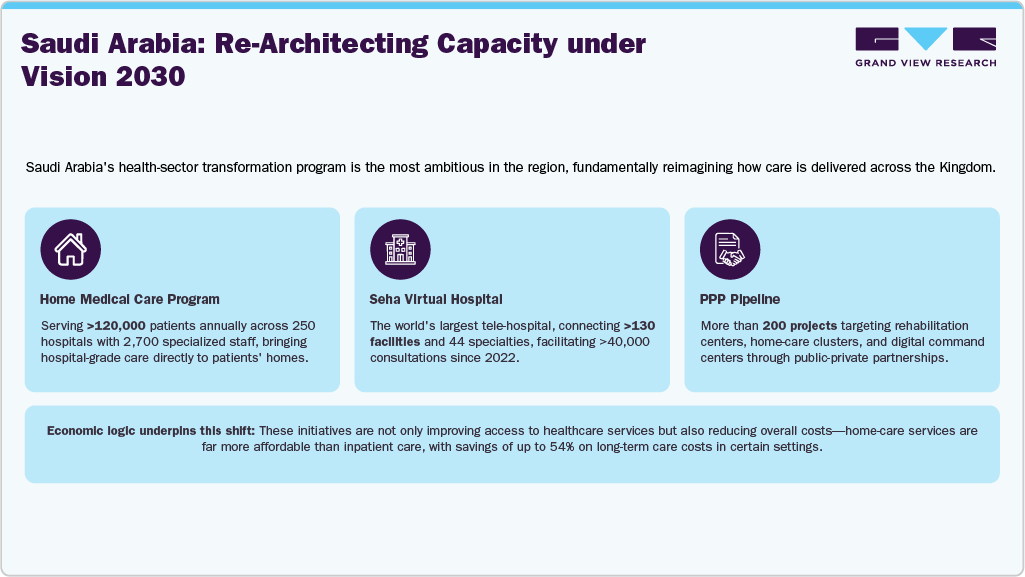

Saudi Arabia’s Vision 2030 is setting the pace for this transformation. The Kingdom is reimagining its healthcare system by focusing on outpatient care, rehabilitation, and home-based services. In line with the Vision, Saudi Arabia is working to expand its healthcare infrastructure by incorporating distributed care models that are more accessible and cost-effective than traditional hospital settings.

UAE: A Model for Digitally Regulated Outpatient Care

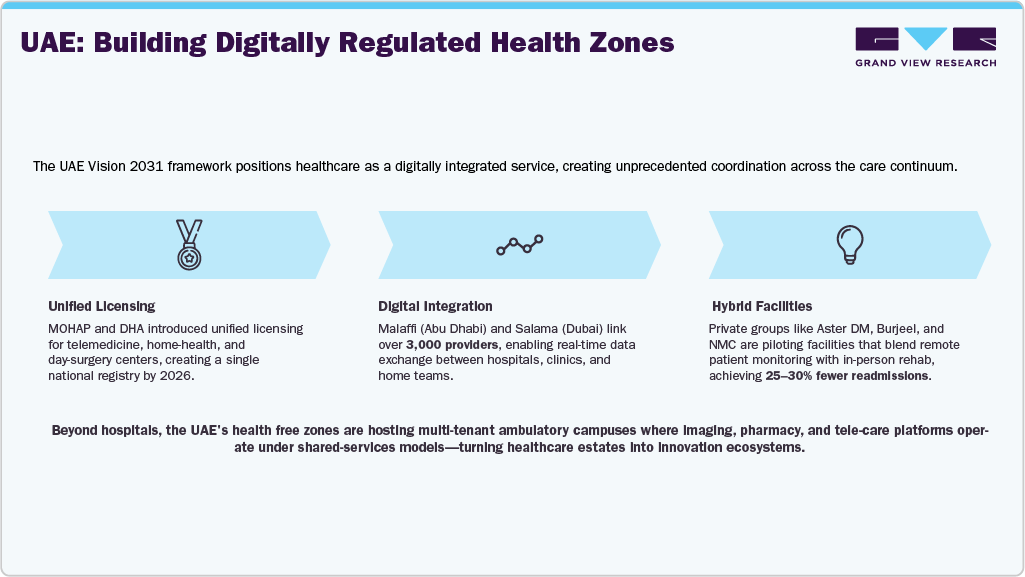

The UAE is following a similar path, investing heavily in the digitalization of healthcare and expanding the role of outpatient and home-care models. The country is establishing itself as a leader in healthcare innovation with initiatives aimed at integrating digital health platforms, telemedicine, and home-health services.

The Economics of Outpatient Transformation

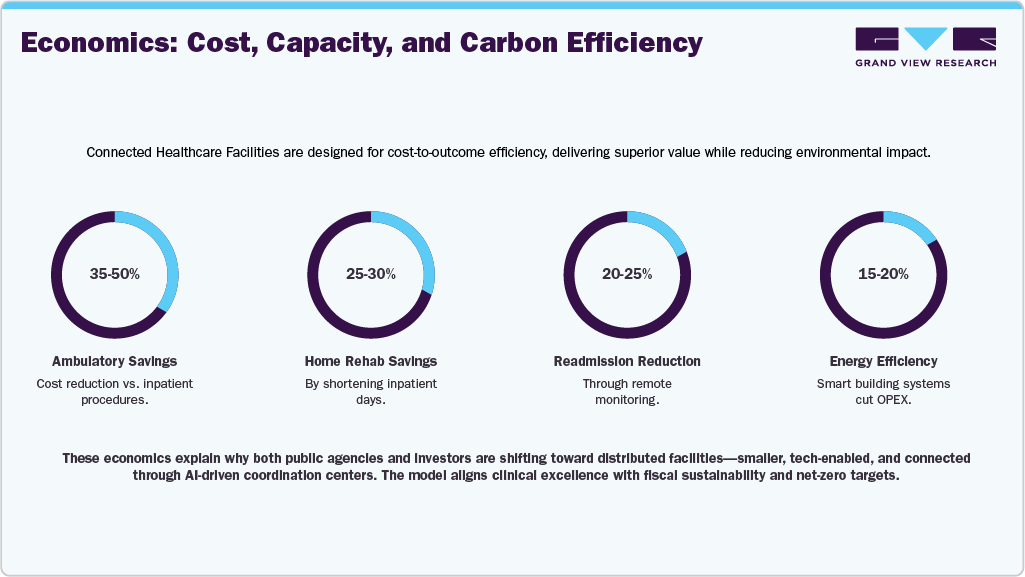

The rationale behind this shift is compelling. Ambulatory surgical centers and home-based rehabilitation typically reduce per-episode costs by 30–50% compared to inpatient care. Studies from OECD markets indicate that same-day orthopedic and ophthalmic procedures maintain equal clinical outcomes with shorter recovery times.

Technology as the New Clinical Infrastructure

The convergence of IoT, AI, and data platforms is redefining care delivery.

-

Remote Patient Monitoring (RPM): Adoption is accelerating across diabetes and cardiac segments. Smart glucometers, BP cuffs, and ECG patches integrated with national EHRs enable early intervention.

-

AI and Predictive Analytics: AI models now analyze real-time vitals to alert physicians to potential deterioration.

-

Tele-Pharmacy and e-Prescriptions: Platforms like UAE’s Smart Pharmacy Network and Saudi’s Wasfaty ensure drug delivery and compliance tracking.

-

Virtual Care Platforms: Startups such as Cura (KSA), Altibbi (Jordan/UAE), and Healthigo (UAE) have collectively facilitated over 5 million teleconsultations since 2020.

These technologies turn every household into a node in the health network-creating a connected continuum of care that is scalable, measurable, and cost-effective.

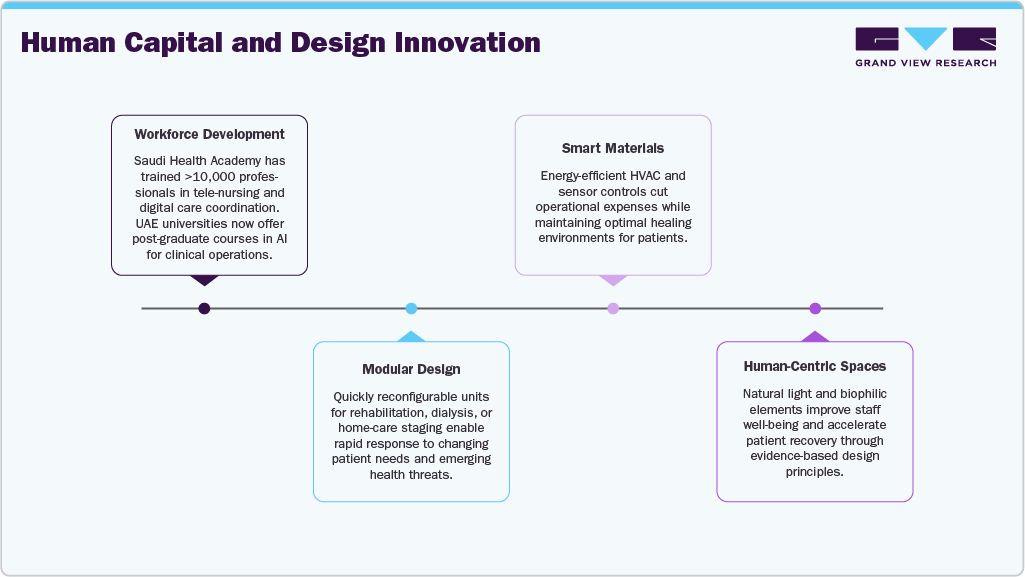

Human Capital and Design Innovation

Facility modernization is as much about people as technology. The region is investing heavily in workforce transformation and architectural excellence.

Public–Private Partnerships (PPP) Accelerating Capacity Expansion

A key enabler of this shift towards integrated, digital healthcare models is the growing role of public-private partnerships (PPPs). Governments across the region are using PPPs to build and manage healthcare facilities that incorporate both advanced technology and cost-efficiency.

In Saudi Arabia, the government has allocated over USD 4 billion in investments to PPP healthcare projects, focusing on the development of rehabilitation centers, LTC units, and home-health facilities. The UAE has also adopted similar models, with new PPP laws allowing the private sector to co-invest in healthcare infrastructure and digital platforms.

These partnerships not only help expand healthcare access but also bring in expertise from the private sector to enhance service delivery, patient experience, and operational efficiency. By combining government funding with private-sector expertise, the region is able to scale healthcare solutions that would otherwise be cost-prohibitive.

Challenges Ahead: Regulation, Reimbursement, and Trust

While the shift to outpatient and home-care models offers significant benefits, several challenges remain.

-

Regulatory Fragmentation: Inconsistent licensing and regulation of telemedicine and home-health services across the GCC countries create barriers for cross-border expansion.

-

Reimbursement Models: Most insurance schemes are still hospital-centric, with limited reimbursement for home-based and outpatient services.

-

Data Interoperability: Despite advancements in digital health infrastructure, many health systems still struggle with data silos and lack seamless integration across platforms.

To address these challenges, regional regulatory harmonization will be key, as will the expansion of value-based reimbursement models that prioritize outcomes over volume. Governments and healthcare providers will need to align on shared data standards to ensure continuity of care across all settings.

Outlook: From Episodic to Continuous, Value-Based Care

By 2033, healthcare in the Middle East will look radically different from today. Traditional hospitals will no longer be the dominant infrastructure; instead, smarter, connected healthcare ecosystems will be the norm.

-

More than half of the routine procedures will take place in connected care settings.

-

Telemedicine and remote monitoring will be as commonplace as in-person visits, with digital health solutions empowering patients to manage their own care.

-

Smart healthcare facilities will become hubs for innovation, driving better health outcomes and lowering operational costs.

The Middle East’s healthcare infrastructure evolution is moving from episodic, hospital-based care to continuous, patient-centric models. By embracing digital health, outpatient care, and home-based services, the region is positioning itself to offer more sustainable, efficient, and accessible healthcare for decades to come.