Experiential Luxury - How Middle Eastern Hotels Are Redefining Five-Star Service

A Region Redefining Experiential Luxury

Across the Middle East, luxury hospitality is undergoing a fundamental transformation-one that is redefining global benchmarks rather than simply keeping pace with them. As travelers increasingly seek depth over display and meaning over material excess, hotels in the UAE, Saudi Arabia, Qatar, and Oman are repositioning luxury as an experience that is curated, intentional, and emotionally resonant. Supported by ambitious national tourism agendas and an influx of high-value visitors, the region has evolved into a proving ground for elevated service concepts, immersive cultural programming, and next-generation personalization.

What is emerging is not an evolution of five-star service, but an entirely new interpretation-crafted in the Gulf and rapidly influencing the future of luxury worldwide.

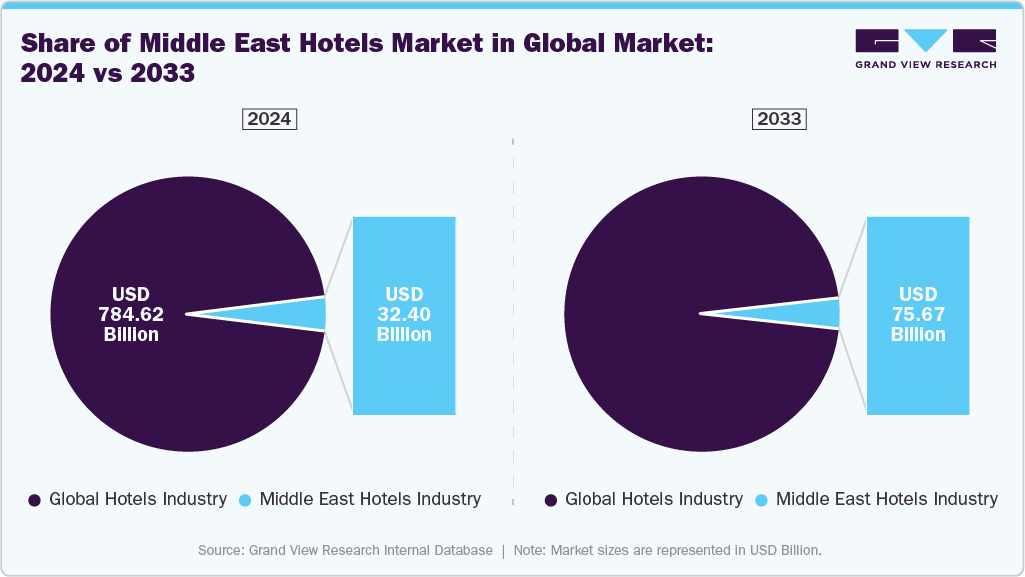

According to Grand View Research, the Middle East hotel market is expected to reach USD 75.67 billion by 2033. Robust inbound tourism, a surge in high-spending international visitors, and sustained regional travel have reinforced demand across luxury, upscale, and extended-stay segments. Simultaneously, government-led tourism transformations-most notably Saudi Arabia’s Vision 2030, Dubai’s continued infrastructure expansion, and Qatar’s post–World Cup acceleration-are unlocking large-scale investment pipelines and creating new destination clusters. As the region diversifies its economic base and positions hospitality as a strategic growth engine, hotel operators are benefiting from premium ADRs, record pipeline additions, and rising traveler appetite for immersive experiences. Together, these forces are shaping one of the fastest-growing and most resilient hotel markets globally.

Global Demand Rebalances: Dubai’s Visitor Momentum Accelerates In 2024

Dubai’s 2024 visitor data highlights a tourism landscape that is not only recovering-but expanding in both scale and quality of demand. With consistent year-on-year growth across nearly all major regions, the city continues to demonstrate its unique ability to attract a globally diverse traveller base. Western Europe remains the highest contributor at 3.74 million visitors, signalling the region’s enduring trust in Dubai as a winter-sun, lifestyle, and experiential destination. South Asia and the GCC follow closely, collectively reinforcing Dubai’s strong short-haul and repeat-visitor market, which remains critical for stabilizing occupancy across shoulder months.

![Dubai Visitor Performance [Total Volume by Region (‘000 Visitors Jan – Dec 2024)] Dubai Visitor Performance [Total Volume by Region (‘000 Visitors Jan – Dec 2024)]](/static/img/research/dubai-visitor-performance.webp)

The sharp increases from Northeast and Southeast Asia, the CIS, and Africa reflect broader macro shifts-rising disposable incomes, increased aviation capacity, and Dubai’s targeted efforts to position itself as the gateway between East and West. These markets are also generally characterized by younger, digitally savvy travellers who demonstrate higher affinity for unique experiences, branded hospitality, and curated itineraries-aligning directly with Dubai’s push toward experiential luxury.

For the luxury hospitality sector, this broad-based demand profile is strategically transformative. It fuels higher occupancy for premium inventory, strengthens ADR resilience, and supports the creation of multicultural, multi-segment guest experiences. It also reinforces Dubai’s position as a testbed for the future of luxury-one where personalization, cultural storytelling, culinary innovation, and wellness-centric design can be deployed to meet the expectations of an increasingly international audience.

Policy As A Catalyst: How Government Frameworks Are Reshaping The Future Of Middle Eastern Hospitality

Across the Middle East, policy has become one of the most decisive forces accelerating the transformation of the tourism and hospitality landscape. National agendas-ranging from Saudi Arabia’s Vision 2030 and Dubai’s Tourism Strategy 2030 to Qatar’s Tourism Sector Strategy and Oman’s 2040 Vision-are not merely guiding frameworks; they are comprehensive, investment-backed engines designed to diversify economies and elevate global competitiveness. These policies are enabling an unprecedented pipeline of luxury hotels, mixed-use resorts, eco-tourism assets, and cultural districts, all supported by enhancements in aviation capacity, visa reforms, infrastructure connectivity, and regulatory liberalization.

Crucially, government-driven tourism bodies are fostering a coordinated ecosystem where private-sector operators, developers, and global brands can scale innovation in guest experience, sustainability, wellness, and cultural immersion. As a result, the Middle East has shifted from being a high-performing tourism region to a strategic model of policy-enabled transformation-where bold national visions are actively shaping demand patterns, redefining service expectations, and positioning the region as the global benchmark for next-generation experiential luxury.

A Market Firmly In Balance: Dubai’s Hotel Inventory Shows Healthy Supply–Demand Alignment In 2024

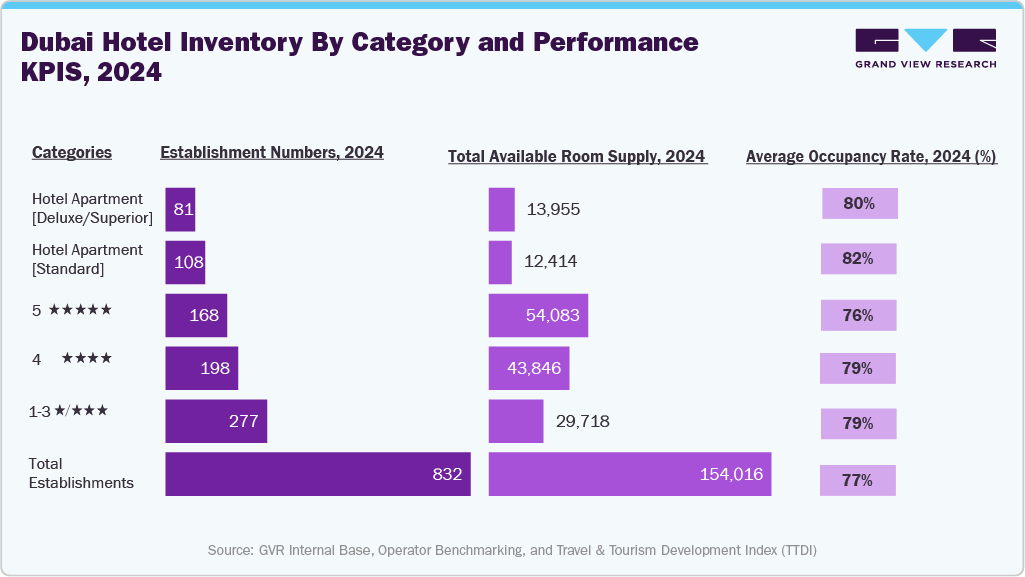

Dubai’s 2024 hotel inventory data reflects a market that has achieved one of the most stable and strategically balanced supply–demand dynamics globally. With 832 total establishments and more than 154,000 rooms across the city, Dubai continues to maintain a diversified hospitality portfolio that caters to luxury travellers, extended-stay guests, corporate visitors, and value-focused segments. Notably, the luxury and upscale tiers dominate room availability, with 5-star properties accounting for over 54,000 rooms and 4-star hotels contributing nearly 44,000 rooms-together forming the backbone of Dubai’s premium hospitality positioning.

Occupancy performance underscores the market’s strength: despite robust supply, hotels have sustained consistently high occupancy rates, with standard and deluxe hotel apartments leading at 82%–80%, and midscale to luxury hotels tracking closely at 76%–79%. These figures highlight two critical insights. Long-stay and serviced apartment formats continue to perform strongly, supported by Dubai’s growing base of remote workers, corporate travellers, and long-term tourists. The resilience of luxury and upper-upscale categories-where occupancy nears 80%-reinforces Dubai’s status as a global magnet for high-value travellers seeking elevated, experience-driven stays.

The data paints the picture of a market operating at optimal capacity: supply growth has been absorbed without compromising profitability, demand remains broad and internationally diversified, and performance KPIs indicate strong revenue potential across segments. For luxury operators, this environment provides strong ground to push further into experiential innovation, knowing the city’s visitor base is both expanding and increasingly receptive to differentiated, high-touch hospitality offerings.

The Evolving Luxury Guest: How Customer Expectations Are Redefining Service In The Middle East

The Middle East has rapidly evolved into one of the world’s most dynamic hubs for experiential luxury, driven by a combination of strategic national tourism visions, aggressive hotel development pipelines, and a discerning guest profile that prioritizes personalization and cultural immersion over conventional five-star standards. Across the GCC-particularly the UAE, Saudi Arabia, and Qatar-hospitality brands are shifting from purely service-led propositions toward experience-led value creation, blending hyper-luxury with authenticity, sustainability, wellness, and technology-enabled seamlessness.

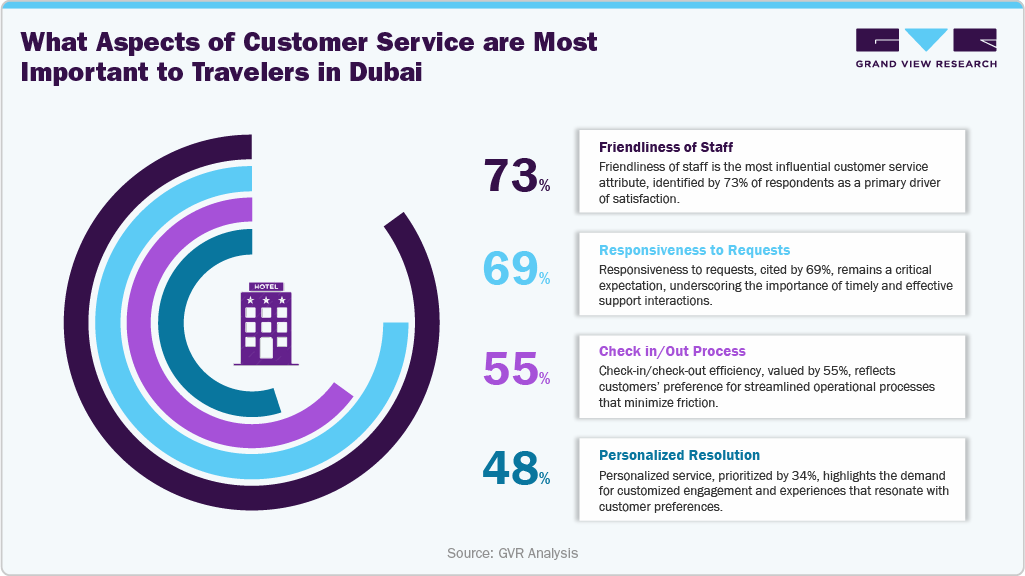

Consumer behavior in Dubai’s hospitality market is shifting toward expectations that blend emotional connection, operational efficiency, and tailored service design. The data illustrates a clear hierarchy of what today’s travelers value most-and it aligns closely with global trends toward experiential luxury, but with distinct regional nuances. At the top of the list, 73% of travelers prioritize friendliness of staff, signaling that despite rapid digitalization, high-touch human interaction remains the cornerstone of guest satisfaction. This preference underscores the continued importance of emotional intelligence, warmth, and cultural awareness in service delivery-traits that differentiate Dubai’s hospitality workforce and support its reputation for welcoming, people-led luxury.

Responsiveness to requests, cited by 69%, reinforces guests’ rising expectations for immediacy and seamless resolution. In an environment where travelers are accustomed to frictionless digital experiences, delays or inconsistencies can significantly influence perception. For hoteliers, this translates into the need for agile service models, empowered frontline staff, and technology that anticipates needs rather than simply responding to them. The check-in/check-out process, valued by 55%, highlights travelers’ desire for operational efficiency and minimal friction. Whether through mobile check-in, biometric authentication, or concierge-free room access, guests increasingly expect that transactional processes feel effortless-allowing more time to engage with the experiential dimensions of their stay.

Middle East Performance Pulse: A Market Shaping the Future of Global Hospitality

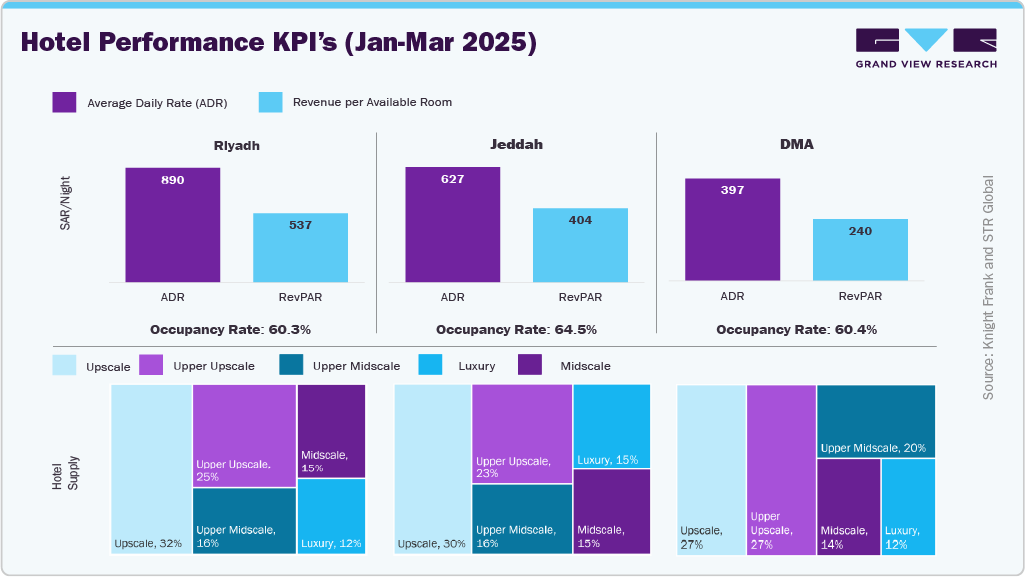

The latest performance indicators from Riyadh, Jeddah, and the DMA (Dammam Metropolitan Area) illustrate a region in the midst of a powerful hospitality transformation-one defined by premium pricing power, demand resilience, and an evolving supply mix strategically geared toward upscale and upper-upscale segments. Together, these metrics reinforce the Middle East’s positioning as one of the world’s fastest-advancing hotel markets, fuelled by structural reforms, giga-projects, diversified tourism pipelines, and a rapidly expanding business–leisure (“bleisure”) ecosystem.

* Luxury: The highest tier of hospitality, offering exceptional service, premium amenities, bespoke experiences, and refined design standards. Typically positioned at the top end of ADR and service delivery.

** Upper Upscale: High-end hotels delivering elevated comfort, sophisticated design, extensive facilities (multiple F&B outlets, wellness, business services), and premium guest experiences-without reaching the exclusivity of full luxury.

*** Upscale: Well-appointed hotels offering high-quality accommodation, superior comfort, and a strong suite of services and amenities. Positioned for travellers seeking elevated standards at more accessible price points.

**** Upper Midscale: A step above midscale, offering enhanced comfort, improved room features, and select premium touches. Designed for value-driven travellers wanting quality without the cost of upscale tiers.

***** Midscale: Functional, affordable hotels that provide the essential services-clean rooms, reliable service, and basic amenities-targeting budget-conscious leisure and business travellers.

Strong ADR Leadership Reflecting Rising Market Confidence

Average Daily Rates (ADR) in Q1 2025 remain robust across key cities-Riyadh at SAR 890, Jeddah at SAR 627, and DMA at SAR 397.

This upward movement signals high confidence among operators in sustained demand from both domestic and international travellers. Riyadh’s elevated ADR underscores its growing role as a global business and events hub, supported by infrastructure enhancements and high-profile conferences under the Kingdom’s Vision 2030 agenda.

RevPAR Performance Highlights Demand Stability

Revenue per Available Room (RevPAR) remains healthy-SAR 537 in Riyadh, SAR 404 in Jeddah, and SAR 240 in DMA-reflecting a well-balanced recovery in both occupancy and room pricing.

Jeddah’s comparatively higher RevPAR-to-ADR alignment points to strong conversion efficiency within its leisure and religious tourism segments, supported by continued pilgrim inflows and improved mobility infrastructure connecting the broader Makkah region.

Occupancy Rates Show Sustained Visitor Momentum

Occupancy levels-60.3% (Riyadh), 64.5% (Jeddah), and 60.4% (DMA)-indicate persistent demand despite rapid supply additions. Jeddah’s leading occupancy confirms its enduring attractiveness as a coastal leisure destination and a gateway to diversified tourism clusters emerging under Saudi Arabia’s Western Region development initiatives.

Supply Mix Signals Strategic Pivot Toward Upscale & Experiential Hospitality

The hotel supply composition across all three cities reveals a deliberate shift:

-

Upscale segment leads with ~27–32%

-

Upper-upscale footprint is strong at 23–27%

-

Luxury continues to expand, holding 12–15% market share

- Midscale remains relevant, but now plays a supporting role

This rebalancing of supply emphasises a regional hospitality strategy focused on experience-led, design-driven, and globally benchmarked accommodation formats, catering to rising expectations of domestic travellers and the influx of experience-seeking international visitors.

Conclusion

The Middle East’s hospitality sector is now transitioning from a phase of accelerated expansion to one of strategic sophistication, where structural demand, elevated traveller expectations, and long-horizon national visions increasingly shape performance metrics. The strength of ADRs, healthy occupancy levels, and a deliberate shift toward upscale and luxury supply collectively illustrate a market that is no longer cyclical, but confidently future-oriented. As mega-projects materialise, air connectivity intensifies, and policy frameworks continue to unlock diversified tourism flows, the region is poised to redefine global benchmarks in experiential, premium, and sustainable hospitality.

“The Middle East is no longer merely catching up with global hospitality hubs; it is actively setting new standards in luxury positioning, guest experience, and destination development.”