Indoor Farming in the Middle East: From Desert Scarcity to Year-Round Harvests

The Middle East has long been characterized by extremes: severe heat, limited freshwater resources, and heavy reliance on imported food. Yet, in the last decade, the region has emerged as a proving ground for indoor farming, including greenhouses, vertical farms, and containerized CEA (controlled-environment agriculture) systems that can grow fresh, high-quality produce year-round, using a fraction of the land and water required by traditional farming. Food security is a national priority across the Gulf Cooperation Council and neighboring states. The Middle East imports over 90% of its cereals, 60% of its meat, and 50% of its vegetables, making it highly vulnerable to global supply disruptions. Limited arable land and the fact that many staple foods are imported make local production a politically and economically viable option. Indoor farming offers a climate-resilient solution by enabling controlled environmental agriculture (CEA) that is not dependent on arable land or predictable weather.

Indoor farming delivers three compelling strategic benefits:

-

Climate resilience: These systems decouple production from outdoor weather extremes and heatwaves.

-

Water efficiency: CEA systems such as hydroponics, aeroponics, and modern greenhouses use significantly less water than open-field farming.

- Supply-chain sovereignty: Local production reduces reliance on long, geopolitically exposed import routes and cuts post-harvest losses.

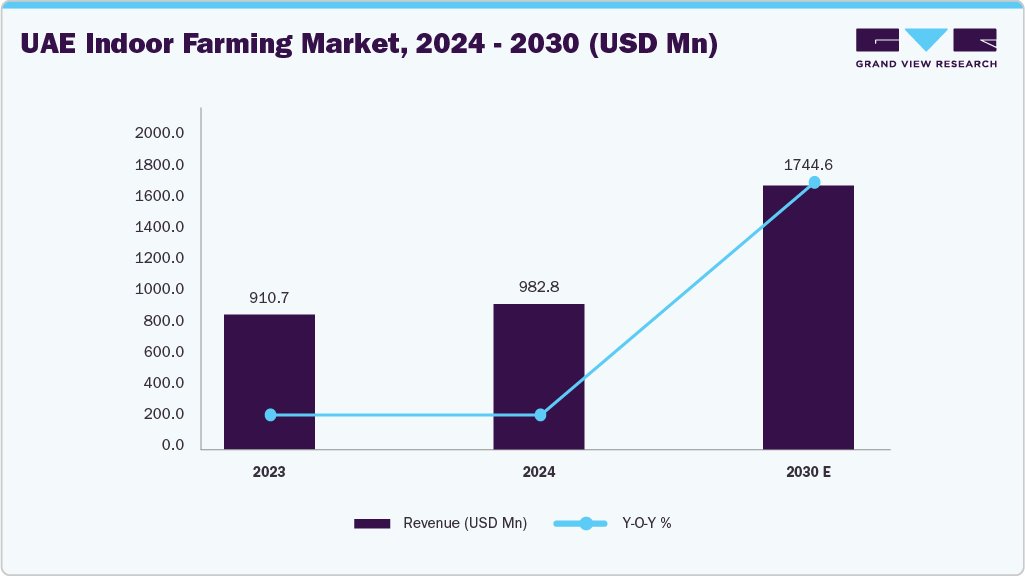

The region's acute water scarcity, combined with political commitment and abundant capital, is a key factor driving demand for indoor farms. Overall, the indoor farming market in the Middle East is poised for substantial growth, transforming the region's food production landscape toward greater self-sufficiency and sustainability. Recent estimates by Grand View Research project a double-digit annual growth rate in the UAE's indoor farming market, with the market expected to surpass USD 1.7 billion by 2030.

Policy & Strategic Enablers: Governments Stepping Up

What differentiates the Middle East from many other regions is the willingness of governments and national development funds to treat indoor farming as strategic infrastructure. Policy moves include:

-

Direct investment and partnership facilitation: Sovereign-linked funds and state-owned enterprises are participating in JVs and providing land or concession structures for large farms.

-

Agritech innovation hubs: Initiatives such as food-tech valleys and incubators attract global technology providers to pilot and localize systems.

- Water and energy policy alignment: Recognizing the energy intensity of CEA, several states are exploring renewable energy subsidies or dedicated tariff structures to improve project economics.

Financiers and local industrial conglomerates are willing to back capital-intensive indoor farms when they are structured as part of national food-security strategies.

Flagship Projects: What Scale Looks Like on the Ground

Several headline projects illustrate how indoor farming is being applied at scale:

-

NEOM / Oxagon (Saudi Arabia): Large greenhouse and indoor production facilities in NEOM’s Oxagon are designed for high throughput and extreme water efficiency. One completed greenhouse in Oxagon (an 800,000-sq-ft facility) has the capacity to produce approximately 1,972 tons of fruit and vegetables annually, while delivering around 93% water savings compared to conventional agriculture. These projects are designed to meet the demand of resorts and residents, while also demonstrating export potential.

-

Plenty–Mawarid Abu Dhabi farm: Planned to produce millions of pounds of strawberries per year and built with significant initial capital, this project typifies the JV model aimed at rapid scale and local substitution of imports

-

UAE homegrown growth: Pure Harvest, Badia Farms, and a wave of smaller containerized and rooftop farms are proliferating in the UAE and wider GCC, supplying hotels, supermarkets, and distribution hubs with leafy greens, tomatoes, strawberries, and herbs. These operators combine greenhouse technology, vertical racks, and bespoke climate controls to maximize yield from minimal land.

Food Systems Impacts: Local Supply Chains and Consumer Trends

Indoor farms are reshaping supply chains in three ways:

-

Shorter, fresher supply to urban centers: Proximity cultivation reduces transit times and spoilage, improving freshness and reducing food waste.

-

New B2B channels: Hotels, resorts, and grocery chains are entering into offtake agreements with indoor farms to secure consistent supplies, creating a model that ensures more stable revenues for growers.

- Consumer willingness to pay for traceability: Urban consumers in Gulf capitals are willing to pay premium prices for pesticide-free, ultra-fresh produce grown locally, creating a retail niche that helps improve profit margins.

Indoor farming is not yet a replacement for all food sources, as cereals and staple crops will likely continue to rely on imports. However, with sufficient scale, it can effectively replace a substantial portion of fresh produce imports.

Future Trends in Indoor Farming in the Middle East

-

Expansion of vertical farming in urban areas will optimize limited space, allowing multi-layer cultivation of crops close to consumers, reducing transportation emissions and costs.

-

Hybrid greenhouses integrating smart glass and climate control technologies will reduce energy needs while maximizing light utilization in harsh desert climates.

-

Increased use of desalination and water-recycling technologies integrated into farm operations will address water scarcity issues.

-

Growth in Agritech startups and R&D initiatives focused on bio stimulants, tissue culture, and gel substrates will enhance productivity and plant resilience.

-

Automation using AI-driven robots for planting, harvesting, and inspection will boost efficiency and reduce reliance on manual labor

Conclusion: From Proof of Concept to Strategic Food Infrastructure

Indoor farming in the Middle East has reached a crucial turning point. What was once a luxury mainly available in wealthy cities is now becoming a well-organized, large-scale industry. This growth is fueled by joint ventures, major government initiatives, and partnerships with leading food retailers. Despite challenges such as high costs, energy consumption, and severe water shortages, indoor farming has become both economically feasible and strategically vital, thanks to strong government backing, substantial investment, and favorable conditions.

Thanks to advances in policy, finance, and technology, including renewable energy, desalination systems, and automation, indoor farming is poised to transform how fresh food is produced in the region. The Middle East is shifting away from a heavy reliance on imports toward building resilient, climate-adapted, and locally managed farming hubs. For governments and investors, the important question is no longer whether indoor farming will expand across the region, but how quickly and effectively it will be implemented.