Logistics 4.0: Building Intelligent Infrastructure for a Diversified Middle East Economy

For decades, the Middle East’s logistics strength came from geography: ports at the crossroads of Asia, Europe, and Africa. Today, that advantage is being re-engineered through technology. Across Saudi Arabia, the UAE, and Egypt, the region is embracing Logistics 4.0 — a digital, data-driven, and automated model designed to power economic diversification and sustainability. What was once a network of warehouses and highways is becoming an intelligent ecosystem where sensors, analytics, andartificial intelligence move goods as efficiently as oil once moved energy wealth.

From Energy Gateways to Smart Trade Corridors

Economic diversification strategies such as Saudi Vision 2030, UAE Vision 2031, and Oman Vision 2040 share a common objective: to convert the region’s geographic advantage into an integrated logistics powerhouse. Saudi Arabia’s National Transport and Logistics Strategy aims to make the Kingdom a global logistics hub connecting three continents. More than USD 150 billion has been committed to logistics infrastructure, ports, and airports under public-private partnerships.

According to Grand View Research, the Middle East & Africa logistics market is projected to reach USD 680.3 billion by 2030, expanding at a 6.8 % CAGR. That growth is no longer driven by freight alone but by the convergence of digital platforms, automation, and data connectivity that define Logistics 4.0.

Defining Logistics 4.0

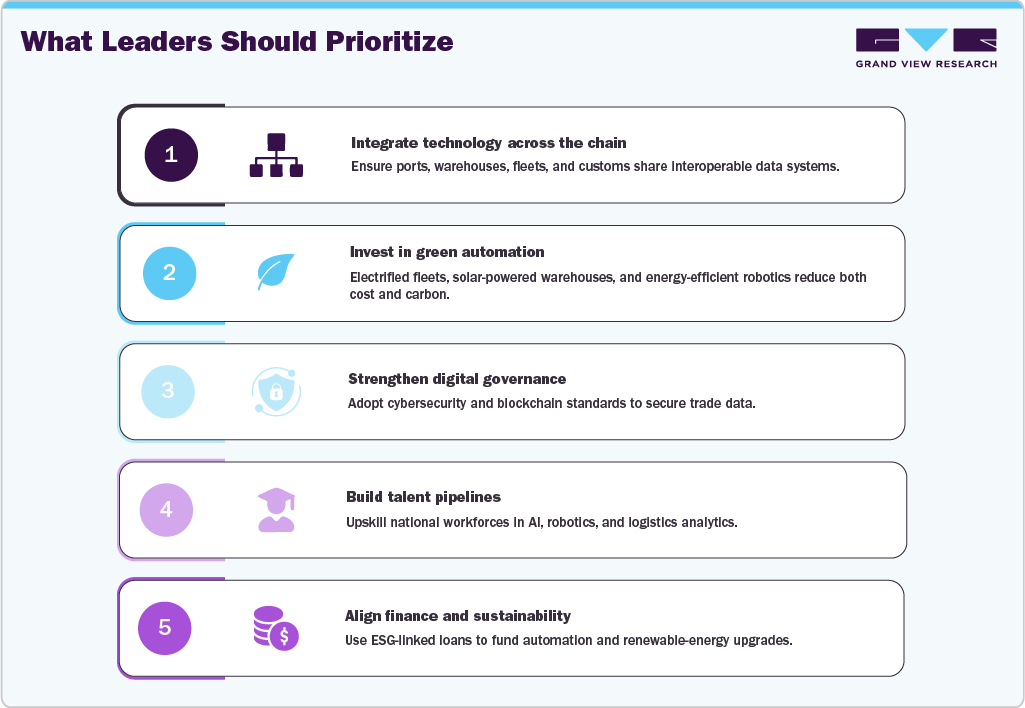

Logistics 4.0 merges the physical and digital worlds of transport and supply-chain management. It uses Internet of Things (IoT) sensors, AI analytics, blockchain documentation, and robotic automation to create visibility and efficiency across every node. In this new model, ports are data hubs, warehouses think for themselves, and fleets optimize their own routes.

The region’s digital logistics market is valued at USD 1.41 billion in 2024 and is expected to grow nearly 19 % annually through 2030 (Grand View Research). That trajectory reflects government policies and private-sector innovation aligning to create smart, sustainable, and responsive supply chains.

Smart Ports, Smart Data

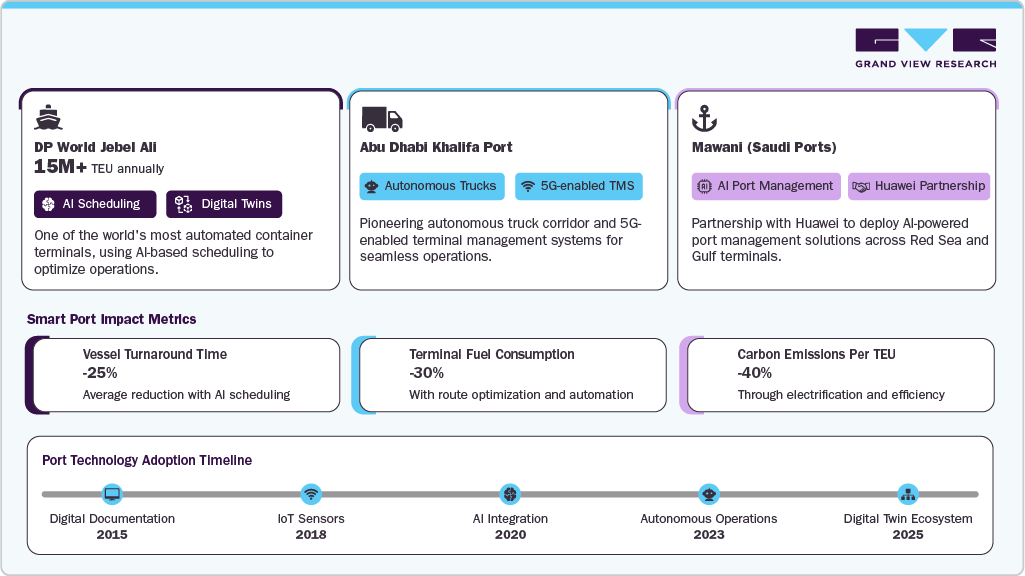

At the center of Logistics 4.0 are the ports that handle nearly 80 % of regional trade. DP World, Abu Dhabi Ports, and Saudi Ports Authority (Mawani) are leading a new generation of smart terminals.

-

DP World Jebel Ali operates one of the world’s most automated container terminals, using AI-based scheduling and digital twins to track over 15 million TEU annually.

-

Abu Dhabi Ports’ Khalifa Port has launched an autonomous truck corridor and a 5G-enabled terminal management system.

-

Mawani recently partnered with Huawei to deploy AI-powered port-management solutions across the Red Sea and Gulf terminals.

These initiatives go beyond throughput. They reduce turnaround time, cut fuel use, and lower carbon emissions per shipment, linking efficiency directly to sustainability.

Warehouses That Think

Smart warehousing is another pillar of Logistics 4.0. The Middle East smart warehouse market, part of the regional warehouse automation segment, is expanding rapidly as e-commerce and manufacturing require faster fulfillment.

Companies such as LogiPoint in Jeddah and Dubai South Logistics District are introducing robotic picking systems, automated storage and retrieval (AS/RS) solutions, and predictive maintenance analytics. In Dubai, Amazon’s fulfillment center uses machine learning to manage inventory and reduce energy consumption, while Aramex’s “Warehouse of the Future” integrates IoT sensors to monitor real-time temperature and humidity.

Automation is also redefining employment: warehouse workers are being upskilled into data operators, robotics technicians, and systems analysts, supporting national workforce localization goals.

Digital Platforms and Blockchain Integration

Logistics 4.0 depends on connectivity. The region is rapidly digitalizing trade documentation, customs, and payments to eliminate friction across borders. Dubai Trade Portal, Bayan System (KSA), and Nafith (Jordan) provide unified gateways for cargo clearance.

Blockchain in supply-chain platforms, valued globally at USD 3.3 billion in 2023, are being localized in the Gulf to ensure transparency and traceability. IBM and Maersk’s TradeLens platform, piloted at Jebel Ali Port before its closure, helped reduce customs processing times by more than 40 %. Building on that success, new regional systems are emerging that use smart contracts to authenticate shipments and cut administrative bottlenecks.

Intelligent Fleets and Green Logistics

Fleet digitalization is transforming how goods move within and between cities. Telematics, route optimization, and EV fleet adoption are at the forefront.

In Saudi Arabia, STC’s Logistics Cloud integrates GPS data, vehicle telematics, and predictive analytics to improve fleet utilization. Emirates Post and Fetchr have begun deploying electric delivery vans, while Trukker and Udrive offer app-based platforms that match drivers and shipments in real time.

According to Grand View Research, the MEA last-mile delivery market stood at USD 15.6 billion in 2023 and continues to expand rapidly, supported by e-commerce and urban logistics policies. These companies demonstrate that digital efficiency and environmental responsibility can progress together.

Financing the Future of Intelligent Infrastructure

Building Logistics 4.0 requires capital and collaboration. Governments are increasingly using public-private partnerships (PPP) to finance automation, renewable energy for logistics zones, and smart-mobility infrastructure.

The Saudi Logistics Hub, backed by PIF, and UAE’s Green Logistics Strategy 2030 both link decarbonization with technology investment. Multilateral banks such as the IFC and EIB are financing digital-infrastructure projects that lower emissions while enhancing regional trade efficiency.

Human Capital and Skills Development

Technology adoption must be matched with human capability. GCC countries are introducing specialized training programs in logistics engineering, AI, and data analytics. The Saudi Logistics Academy, founded in 2021, has already trained over 10,000 students in supply-chain digitization and warehouse automation.

Universities across the UAE and Egypt are partnering with private firms to develop curricula focused on intelligent transport systems, creating a workforce ready for the digital supply chain.

The Bottom Line: From Infrastructure to Intelligence

Logistics 4.0 marks the transition from physical infrastructure to intelligent infrastructure. The Middle East’s ports, roads, and warehouses are no longer just assets; they are becoming digital platforms that power trade diversification and economic growth.

The region’s vision is not merely to move goods faster but to move them smarter, cleaner, and more transparently. As Logistics 4.0 scales across the Gulf, it will become the invisible engine of diversification — linking energy, manufacturing, retail, and technology into a seamless, sustainable economy.

The same geography that once defined trade routes is now defining data routes. The Middle East is not just connecting continents; it is connecting the future of global trade.