Luxury Retail's Eastern Shift: Why The Middle East Is The New Frontier For Premium Brands

A Region Reshaping the Luxury Landscape

Luxury retail is undergoing a geographic reset. While global markets deal with macro slowdown, inflationary pressure, and shifting consumer priorities, the Middle East-particularly the UAE and Saudi Arabia-is emerging as the world’s most resilient and opportunity-rich luxury hub. The region’s rapid wealth creation, powerful tourism economy, large youth demographic, and cultural appetite for premium lifestyles have positioned the Gulf as the next strategic battleground for global luxury brands.

The outcome is clear: luxury is no longer just flowing eastward toward China-it is swinging southeast toward the Gulf.

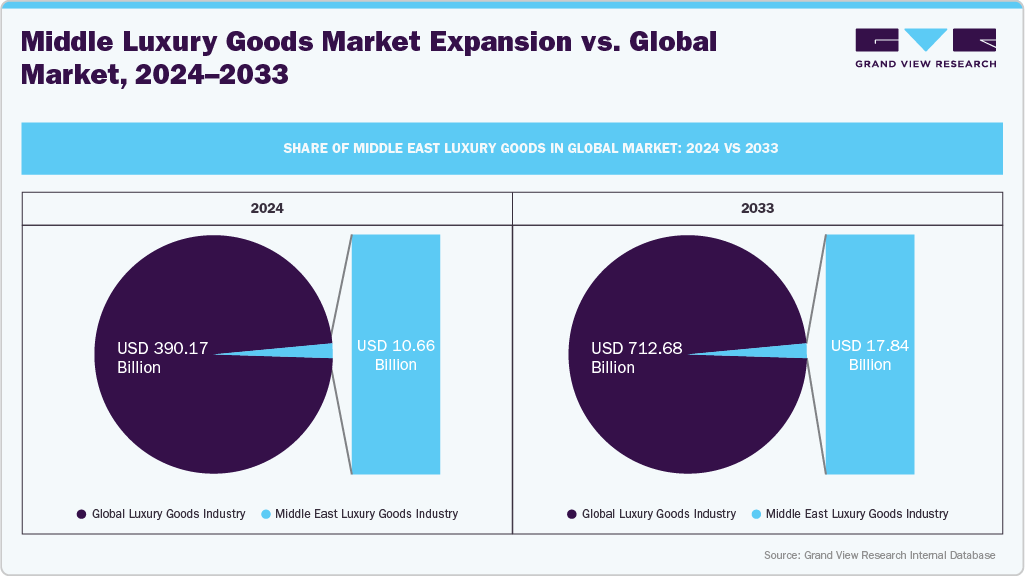

According to Grand View Research, the Middle East luxury goods market is expected to reach USD 10.66 billion by 2024. But this figure captures only the surface of a much larger transformation. Beneath the topline growth is a powerful shift reshaping the region’s luxury landscape-fueled by a surge in high-net-worth households, record-breaking tourism inflows, the rise of a young digital luxury consumer, and an accelerated appetite for premium fashion, fine jewelry, beauty, and lifestyle experiences. The Gulf is no longer just buying luxury; it is becoming one of the world’s most influential engines of luxury demand.

Surging High-Net-Worth Population

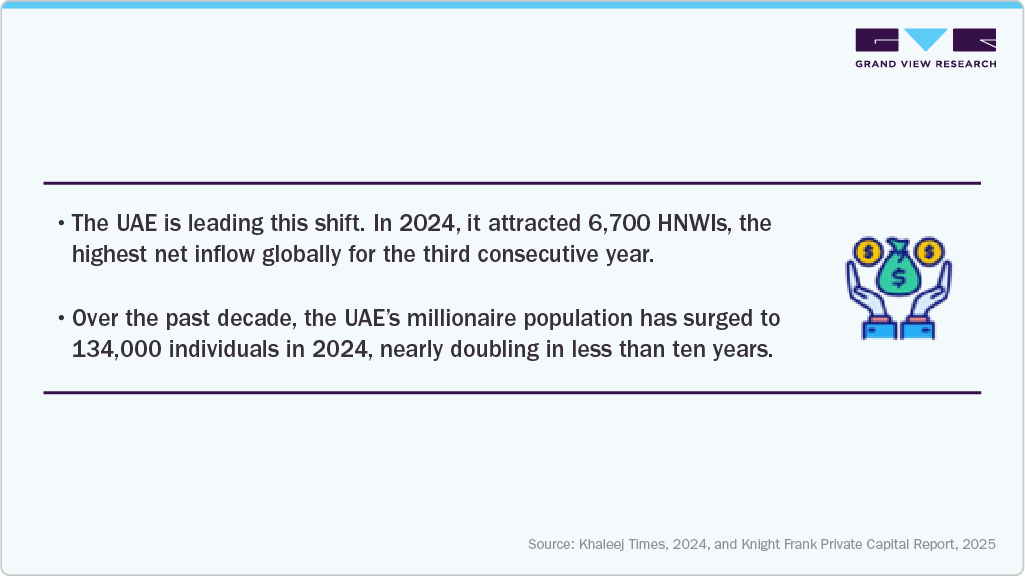

The most transformative force behind the Middle East’s luxury acceleration is the unprecedented growth in its high-net-worth and ultra-high-net-worth populations. Unlike most global markets-where millionaire migration has slowed or reversed-the Gulf is experiencing a net inflow of wealth at a scale unmatched anywhere in the world.

For brands, the implications are profound:

-

Consistent Demand Outperformance: HNWIs in the Gulf maintain luxury spending even during global downturns, making this region a hedge against volatility in China, Europe, and the U.S.

-

Higher Average Transaction Values: Shopping behaviors in the Middle East tend to skew toward high-ticket purchases, driven by gifting culture, event-driven buying, and a preference for premium and ultra-luxury SKUs.

-

Early Adoption of Flagship Concepts: Wealth concentration enables the successful launch of haute couture salons, private client programs, artisanal experiences, and high-jewelry exhibitions that may struggle in other regions.

- Regional Influence on Global Trends: Gulf-based HNWIs are increasingly shaping global luxury demands through travel retail, personal shopping experiences in Europe, and cross-market spending patterns.

Tourism Powering Premium Consumption:

Tourism has become one of the most powerful accelerators of luxury retail in the Middle East, fundamentally reshaping demand dynamics across fashion, jewelry, beauty, and premium accessories. Dubai alone welcomed 17.15 million international visitors in 2023, positioning it among the world’s most visited luxury shopping destinations. Saudi Arabia is witnessing an even sharper rise, recording 30 million international arrivals in 2024 and surpassing 100 million total visitors ahead of its Vision 2030 timeline. This influx of global travelers directly translates into high-value retail spending, with Saudi Arabia generating SR 153.6 billion (US$41 billion) in inbound tourist expenditure in 2024. Tourism has now grown to contribute 11.5% of Saudi Arabia’s GDP, underscoring its strategic importance in the country’s non-oil diversification efforts.

For luxury brands, these tourism dynamics create a uniquely potent demand engine. High-spend international visitors-particularly from Europe, China, India, and affluent neighbouring Gulf countries-drive strong conversion rates for premium categories such as watches, fine jewelry, couture fashion, fragrances, and leather goods. Mega retail destinations like the Dubai Mall, which attracts over 100 million visitors annually, anchor this ecosystem by offering world-class flagships, exclusive collections, and experiential luxury formats. Combined, these factors position tourism not just as a supporting metric but as a core driver of luxury consumption, ensuring consistent footfall, elevated basket values, and resilient year-round demand across the region.

Shifting Consumer Behavior & Demographics:

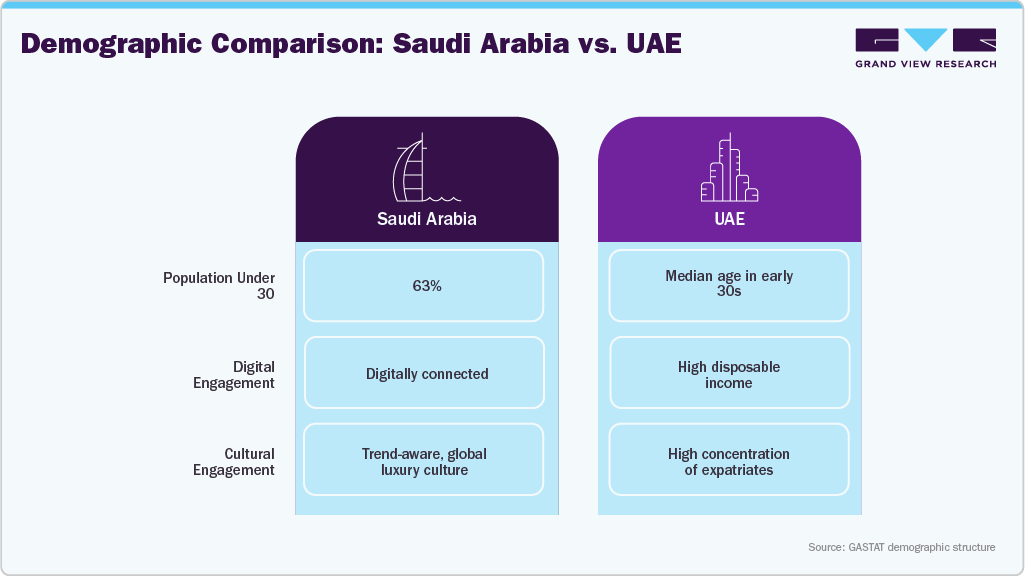

The Middle East’s rise as a luxury retail hub is not driven only by tourism and economic diversification. Consumer behavior and demographic dynamics-supported by government data-are rapidly transforming the region into a prime destination for premium brands.Below is an evidence-based look at how these shifts are reshaping demand.

Saudi Arabia Household Spending

-

GASTAT’s Household Expenditure and Income Survey reports rising spending in categories such as apparel, personal items, grooming, travel, and leisure-areas closely linked to luxury retail.

-

The government attributes this to economic reforms, increased female workforce participation, and higher tourism activity.

UAE Household Consumption Patterns

- UAE statistics indicate rising household expenditure on non-essential retail goods, reflecting a shift toward lifestyle and experiential consumption.

Digital Adoption & E-Commerce Growth

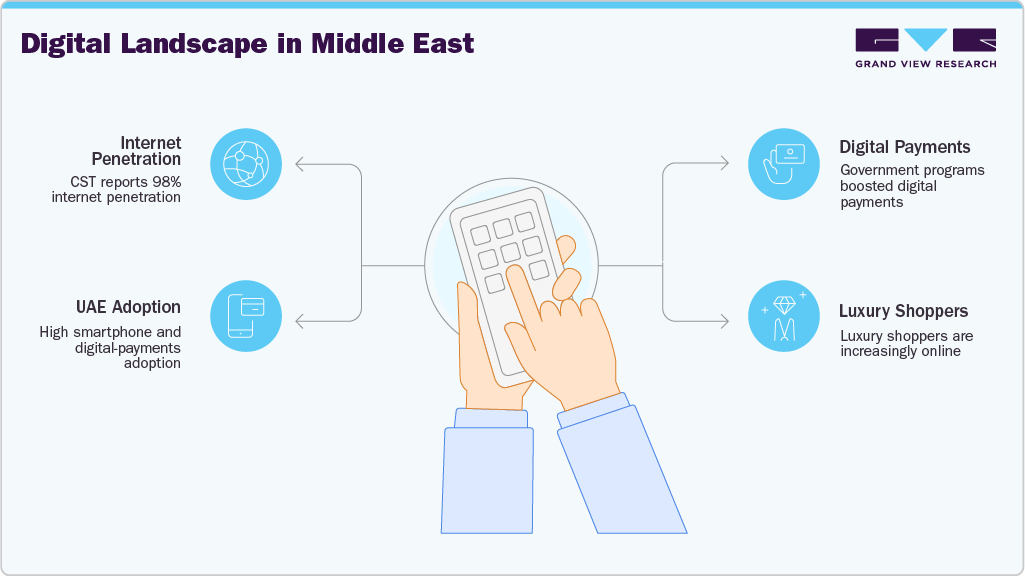

While specific luxury e-commerce data isn't published by governments, digital-usage stats show the foundation for online luxury demand.

The Middle East’s luxury retail evolution is strongly supported by rapid digital adoption, which is reshaping how consumers discover, evaluate, and purchase premium products. According to the Saudi Communications, Space & Technology Commission, internet penetration in Saudi Arabia reached 98%, making the Kingdom one of the most digitally connected societies globally. This high connectivity enables young consumers-who form the majority of the population-to seamlessly integrate online research and social media influence into their shopping journeys. In the UAE, government digital transformation reports show consistently high smartphone usage rates and some of the world’s strongest adoption of cashless, contactless, and mobile wallet payments.

A Structural, Government-Led Luxury Transformation

The Middle East’s rise as a luxury retail powerhouse is not a spontaneous market trend but a direct outcome of long-term, government-led economic transformation programs aimed at diversifying national economies, driving tourism, and elevating lifestyle sectors. In Saudi Arabia, this shift is anchored in Vision 2030, a national blueprint introduced by the government to reduce dependence on oil and create new high-value industries such as tourism, entertainment, culture, and retail.

Saudi Arabia - Vision 2030-Driven Transformation

-

27.42 million international tourists in 2023 (Saudi Tourism Authority).

-

Up from 16.6 million in 2022 → 65% annual growth.

-

Tourism contribution reached 11.5% of GDP (GASTAT & Ministry of Tourism).

-

88.9 million domestic trips in 2023 (Ministry of Tourism).

-

Female labor-force participation increased from 19% (2016) to 34% (2023) (GASTAT).

-

Government-led mega-projects include NEOM, Red Sea Global, and Diriyah Gate, all integrating luxury districts.

UAE - D33 Agenda & Luxury Positioning

-

17.15 million international overnight visitors in 2023 (Dubai Department of Economy & Tourism).

-

77.4% hotel occupancy, surpassing pre-pandemic levels (DET).

-

Dubai’s D33 Strategy aims to double the economy by 2033, with luxury tourism and retail as core pillars.

-

The UAE is among the highest global adopters of digital payments (UAE Government Digital Reports).

Qatar-Post-World Cup Tourism Push

-

4.05 million international visitors in 2023 (Qatar Tourism).

-

Government investment in luxury-forward districts: Lusail City, Msheireb Downtown Doha, and new cultural museums.

-

Digital Transformation Affecting Luxury Retail

-

Saudi Arabia’s internet penetration: 98% (Saudi CST Commission).

-

The UAE has one of the world’s highest smartphone usage rates (UAE Gov Digital Reports).

-

Saudi Vision 2030’s Financial Sector Development Program accelerated the adoption of cashless transactions, surpassing 2023 targets.

Conclusion

By using official government data, we see that the Middle East’s luxury opportunity is not just hype - it’s deeply structural. Tourist arrivals and spending are surging; governments are investing massively in tourism infrastructure; and economic strategies explicitly prioritize tourism as a key growth engine.

For premium and luxury brands, this isn’t a side bet - it’s a strategically aligned market. The Middle East offers scale, capital backing, and a rapidly maturing high-spend customer base. Those who invest now - with an eye on both retail and experiential luxury - are likely to reap long-term benefits.