Middle East MedTech Distributors: Current Challenges and Strategic Solutions

The MedTech landscape in the Middle East is fundamentally distributor-driven, with multinational manufacturers maintaining only limited direct operations in the region. In most markets, global MedTech companies rely heavily on local distributors to navigate regulatory requirements, manage tender submissions, build clinical relationships, provide after-sales service, and ensure cold-chain or high-complexity logistics. As a result, distributors act as the main driving force of the sector, shaping market access, product availability, and clinical adoption across the Middle East region.

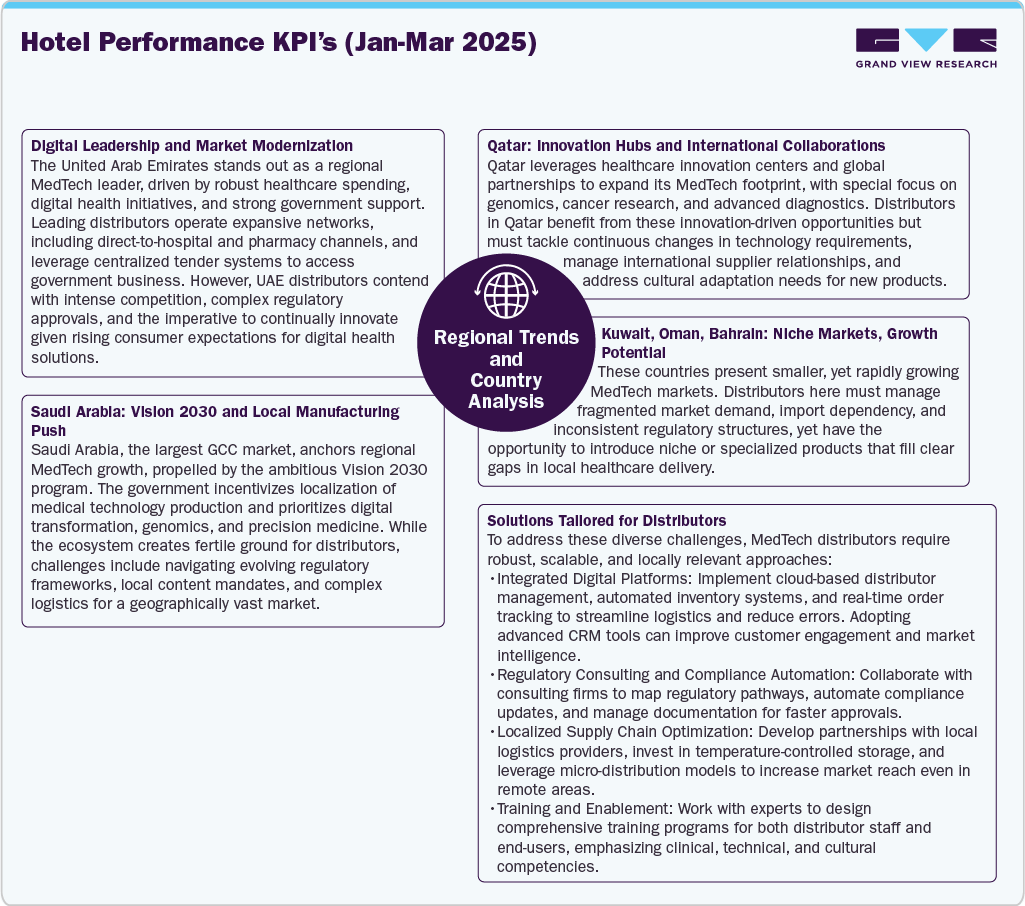

MedTech distribution in the Middle East is driven by digitalization, government modernization programs, and global partnerships. At the same time, distributors face regulatory complexity, infrastructure disparities, supply-chain constraints, market fragmentation, talent gaps, and data/privacy demands.

This report gives a country-wise view, summarizes key challenges, and offers practical solutions—with real examples and a snapshot of who the major distributors are.

Regional Overview:

-

Digital-first health systems: e-tenders, e-procurement, AI/IoT-enabled devices.

-

Localization push (esp. KSA): assembly, packaging, and service to meet local-content rules.

-

Specialized hubs (Qatar, UAE): advanced diagnostics, imaging, and precision medicine.

-

Pan-GCC operating models: distributors scaling across Kuwait–Oman–Bahrain using UAE hubs

Country Deep Dives:

UAE: Digital Leadership & Market Modernization

These instances highlight how distributors and healthcare entities in the UAE are executing on the modernization and digital health mandates.

|

Distributor Name / Event |

Year |

Month |

Description |

KOL / Key Person |

|

Mediclinic Middle East |

2025 |

November |

Mediclinic Middle East launched a fully redesigned, comprehensive patient-facing mobile application, integrated with UAE Pass, to facilitate teleconsultations, appointment booking, and access to medical records, signifying the move toward a "digital front door" for private care. |

Dr. Sara Alom Ruiz, Chief Commercial Officer, Mediclinic Middle East |

|

AstraZeneca / Gulf Drug LLC |

2025 |

September |

AstraZeneca partnered with Gulf Drug LLC, one of the region's largest distributors, to launch a new line of specialized oncology pharmaceuticals and associated digital patient support programs across the UAE. This highlights the synergy between traditional distribution and digital patient services. |

Senior Management from Gulf Drug LLC |

|

Metromed / Digital Transformation |

2025 |

Q4 |

Metromed, a leading medical distributor, invested heavily in upgrading its Warehouse Management System (WMS) and Last-Mile Delivery tracking for temperature-sensitive diagnostic supplies, emphasizing efficiency and cold-chain integrity required by the demanding UAE market. |

Logistics/Supply Chain Director at Metromed |

|

DoH Abu Dhabi / Genomic Partnership |

2025 |

July |

The Department of Health (DoH) Abu Dhabi signed a strategic partnership with a US-based academic medical center to establish the first advanced Genetic Surgery and Therapy Center in the Emirate, driving demand for specialized distributors in gene therapy and personalized medicine logistics. |

DoH Abu Dhabi Leadership |

|

Cleveland Clinic Abu Dhabi / Siemens Healthineers |

2025 |

Q3 |

Cleveland Clinic Abu Dhabi (CCAD) signed a major long-term strategic partnership with Siemens Healthineers for the supply and maintenance of advanced medical imaging equipment and digitalization services. This deal demands a highly skilled, direct-service distribution model capable of 24/7 support. |

Dr. Mohamad Hamade, Chief Executive Officer, CCAD |

|

PureHealth |

2025 |

March |

PureHealth, the UAE's largest healthcare group, announced a multi-year partnership with a leading global AI firm (e.g., Google Cloud, which has a regional partnership) to integrate Generative AI across its network for administrative efficiency, clinical decision support, and patient experience. |

Senior Digital/AI Leadership, PureHealth |

|

Dubai Health Authority (DHA) / E-Tender Platform |

2025 |

January |

The DHA announced the full transition to a mandatory Centralized E-Tender and Procurement System for all government hospitals and clinics. This mandates that distributors must be fully digitally compliant to access the vast public sector business. |

DHA Procurement Leadership |

Saudi Arabia: Vision 2030, Localization & AI Integration

The following instances demonstrate how global companies and local entities are executing on the Vision 2030 mandates for localization and digital health integration.

|

Distributor Name / Event |

Year |

Month |

Description |

KOL / Key Person |

|

RapidAI / Health Holdings Company (HHC) / Ascend Solutions |

2025 |

November |

RapidAI (deep clinical AI) partnered with HHC (largest healthcare provider) to implement its AI-powered intelligent imaging and workflow platform across 20 health clusters, with local partner Ascend Solutions providing on-the-ground integration and support, highlighting a focus on AI localization and on-the-ground support. |

Nasser Al Huqbani, CEO, Health Holdings Company |

|

Persivia / National Health Intelligence Initiative |

2025 |

November |

US-based AI healthcare intelligence firm Persivia launched its National Health Intelligence Initiative (NHI) at GHE 2025, licensed by the Ministry of Investment, to deploy its AI platform for national-scale population health and value-based care, underscoring the drive for AI and data localization. |

Dr. Mansoor Khan, CEO, Persivia |

|

BD (Becton Dickinson) / Localization Investment |

2025 |

October |

At the Global Health Exhibition (GHE), BD announced a major investment and multi-year commitment (e.g., $266M) to establish or expand local manufacturing and assembly of medical technologies in the Kingdom, in direct alignment with the SFDA's local content requirements. |

Senior Management, BD |

|

GE Healthcare / Al Faisaliah Group |

2025 |

Q4 |

GE Healthcare (global MedTech leader) and the Al Faisaliah Group (AFG) announced a major expansion of their local manufacturing and assembly joint venture in Riyadh. This focuses on locally assembling high-demand medical devices, directly addressing the government's local content mandate. |

Hisham Al Humaidi, CEO, Al Faisaliah Medical Systems (FMS) |

|

Siemens Healthineers / King Faisal Specialist Hospital |

2025 |

Q2 |

Siemens Healthineers and the King Faisal Specialist Hospital & Research Centre (KFSH&RC) launched a strategic collaboration focused on Digital Health and AI applications in radiology and oncology. The initiative aims to integrate advanced predictive diagnostics across the hospital network, driving demand for distributors with high-tech IT integration capabilities. |

Prof. Dr. Majed Al Fayyadh, CEO, KFSH&RC |

|

AliveDx Suisse S.A. / MediServ |

2025 |

August |

AliveDx Suisse S.A. (AliveDx) signed a strategic distribution agreement with Medical Supplies and Services Co. Ltd. (MediServ). This agreement enables MediServ to distribute the MosaiQ and LumiQ solutions (diagnostics) across Saudi Arabia, highlighting the continuing need for strong, geographically skilled local partners. |

Khaled Hamed, Head of Global Emerging Markets, AliveDx |

|

SFDA (Saudi Food & Drug Authority) |

2025 |

January |

The SFDA announced new guidelines for the Local Content in Medical Devices. The regulations specify a minimum threshold for local value-added services (e.g., local assembly, packaging, and after-sales maintenance) required for products to be prioritized in public sector tenders. |

Dr. Hisham Aljadhey, CEO, SFDA |

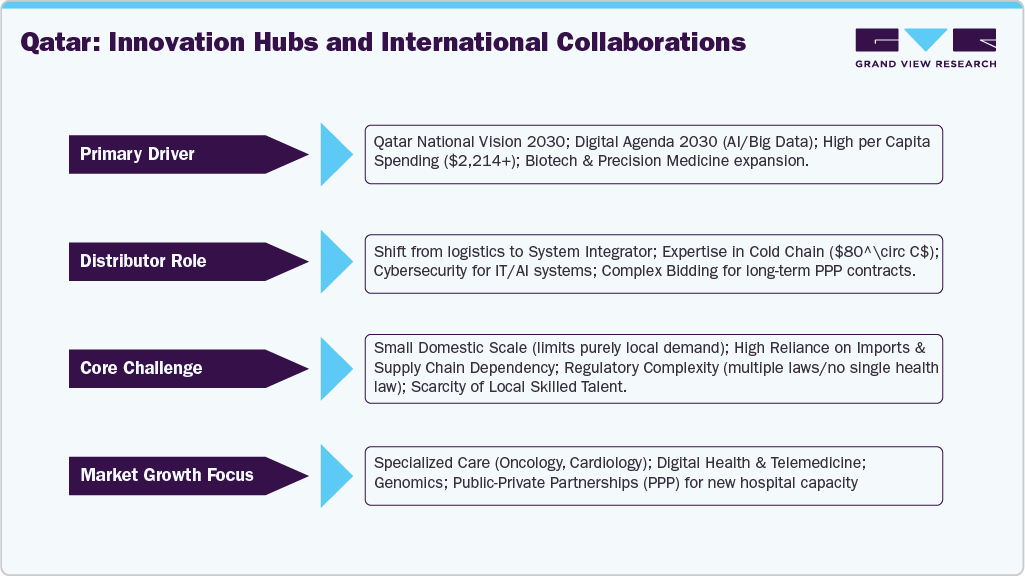

Qatar: Innovation Hubs and International Collaborations

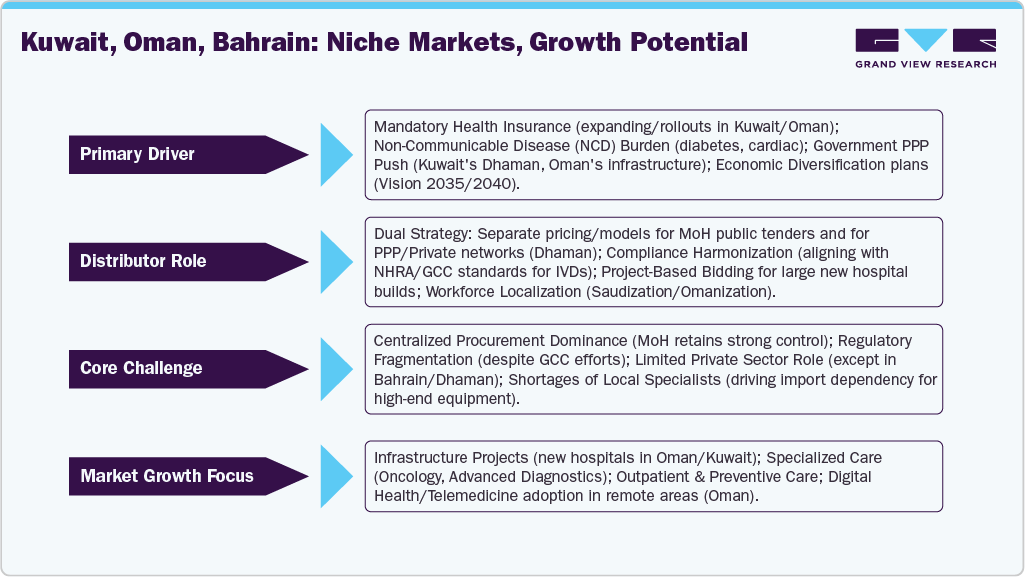

Kuwait, Oman, Bahrain: Niche Markets, Growth Potential

Key Challenges for Middle East MedTech Distributors

|

Challenge |

Description |

Primary Impact |

Strategic Solution |

|

Regulatory Complexity |

Rules and paperwork differ in Saudi Arabia (SFDA), UAE (MoHAP), Qatar (MoPH), etc., creating delays. |

Slow Time-to-Market and high compliance costs. |

Compliance Automation: Use digital tools to manage paperwork across multiple borders simultaneously. |

|

Infrastructure Disparity |

World-class hospitals in Dubai/Riyadh contrast with limited facility coverage and poor road/digital networks in remote areas. |

Uneven Market Access and high logistical costs. |

Micro-Distribution: Use small, localized partners for "last-mile" delivery to remote clinics. |

|

Supply Chain Constraints |

Long import procedures and the need for controlled, cold-chain storage for high-value devices (e.g., diagnostics, vaccines). |

Inventory Errors and risk of device damage/expiry. |

Real-Time Digital Tracking: Implement IoT and cloud systems for 24/7 visibility into product location and temperature. |

|

Market Fragmentation |

Too many small, independent markets (Kuwait, Oman, Bahrain) prevent distributors from achieving scale. |

High Cost of Entry for new products and duplication of effort. |

Pan-GCC Strategy: Treat the entire region as one market, standardizing processes and leveraging regional hubs (like UAE). |

Regulatory Quick View

|

Country |

Avg. Approval Time (Months) |

Local Testing/Mandates |

Post-Market Surveillance (PMS) Burden |

|

Saudi Arabia (SFDA) |

8-12 (High) |

Mandatory Localization Focus |

High and Evolving |

|

UAE (MoHAP/DHA) |

4-6 (Moderate) |

Specific Digital Health Requirements |

Moderate, Data-driven |

|

Qatar (MoPH) |

5-7 (Moderate) |

Focus on Specialized/Advanced Tech |

Moderate/High |

|

Kuwait, Oman, Bahrain |

6-10 (Variable) |

High Import Dependency |

Low/Fragmented |

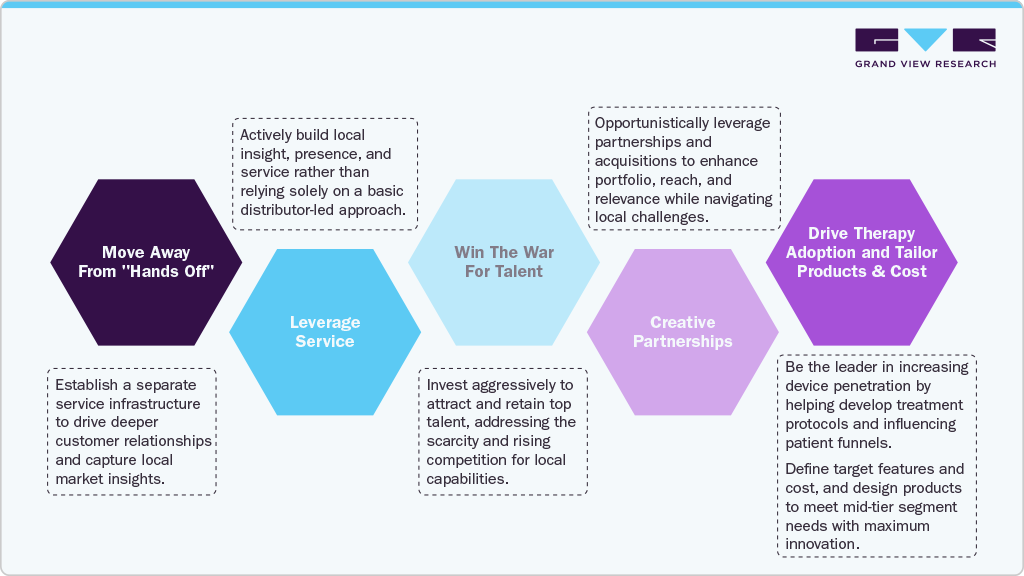

Solutions Tailored for Distributors: To capture growth in the critical mid-tier and emerging segments, distributors must shift their operational focus.

-

Digital-by-default tendering: eTender readiness, automated bid libraries, and price/contract governance.

-

RegOps & RA PMO: centralize submissions, monitor rule changes, and reuse dossiers across GCC.

-

Cold-chain excellence: IoT sensors, live temperature/location, and exception workflows.

-

Hub-and-spoke logistics: UAE/KSA hubs with micro-distributors for remote last mile.

-

Clinical adoption engine: in-service education, KOL programs, and outcomes documentation.

-

Local content strategy (KSA): evaluate assembly/packaging/service investments; track SFDA thresholds.

-

Cyber & data governance: secure interfaces, vendor-neutral integration, and privacy compliance.

-

Pan-GCC commercial model: one playbook, one CRM, unified contracts, and shared training.

|

Country |

Distributor Name / Event |

Year |

Month |

Description |

Distributor-Specific Solution Mandate |

|

Saudi Arabia |

MoH / Efficio Procurement & Supply Chain Excellence MoU |

2025 |

November |

The Ministry of Health (MoH) signed an MoU with procurement consultancy Efficio to jointly advance supply chain, procurement, and local content excellence. This targets efficiency and value-based purchasing across the public sector. |

Requires: Distributors to adopt advanced spend analytics and data-driven inventory management (e.g., consignment models) that align with MoH cost-reduction targets, moving away from simple transactional supply. |

|

UAE |

MOCCAE / Digital Traceability Mandate (Health/Food Focus) |

2025 |

September |

The Ministry of Climate Change and Environment (MOCCAE) mandates fully digital traceability for controlled goods, often setting a precedent for temperature-sensitive medical supplies. Records must be secure and electronic, eliminating paper systems. |

Requires: Integration of IoT sensors in warehouses and fleets for real-time environmental data capture, secure electronic records (potentially blockchain-backed), and automated reporting to government portals for full chain of custody. |

|

Saudi Arabia |

Expansion of SEHA Virtual Hospital (Connecting 150+ Sites) |

2025 |

September |

The continuous, rapid expansion of the SEHA Virtual Hospital demands seamless logistical and technical support for connected medical devices and telehealth endpoints across a vast, integrated network. |

Requires: Distributors of connected devices (imaging, diagnostics, remote monitoring) to provide IT integration consulting, 24/7 remote diagnostics support, and the logistics capacity for rapid deployment to hospitals in new, sometimes remote, health clusters. |

|

Saudi Arabia |

Health Cluster Privatization & Operating Model Shift |

2025 |

Q3 (Ongoing) |

The transformation of regional hospitals into Health Clusters operating under a financially independent structure mandates that procurement shifts to value-based, performance-linked contracts at the cluster level. |

Requires: Distributors to develop localized service agreements (SLA), dedicated technical teams within each cluster region, and the ability to demonstrate product/service contribution to measurable patient outcomes (e.g., reduced readmission rates). |

|

Saudi Arabia |

SFDA / Local Content Service Compliance Check |

2025 |

July |

Following the new Local Content guidelines, the SFDA began actively auditing distributors' operations to verify compliance with the minimum local value-added services threshold for public tender prioritization. |

Requires: Significant investment in local assembly, refurbishment/repair centers, and highly-skilled Saudized technical staff to perform after-sales maintenance and demonstrate measurable local economic contribution. |

|

Saudi Arabia |

Saudization Policy for Healthcare |

2025 |

April |

New official policies increasing the employment of Saudi nationals in healthcare roles came into effect. This mandates that all healthcare companies and distributors must have robust localization strategies for their workforce (Saudization) to remain competitive. |

Requires: Significant investment in local assembly, refurbishment/repair centers, and highly-skilled Saudized technical staff to perform after-sales maintenance and demonstrate measurable local economic contribution. |

|

UAE |

UAE Customs / PLACI Program Enforcement |

2025 |

April |

The UAE began enforcing new Pre-Loading Advance Cargo Information (PLACI) requirements for all air cargo. This mandates that detailed, digitally-submitted shipment data (including 6-digit HS codes) must be provided before cargo is loaded at origin. |

Requires: Advanced digital documentation, real-time data integration (API) with customs systems, and internal data governance to ensure 100% accurate product classification (HS codes) and shipper details. |

|

UAE |

Federal Tax Authority (FTA) / E-Invoicing Mandate |

2025 |

Q1 (Phased) |

The FTA is rolling out a mandatory e-invoicing law, requiring all VAT-registered businesses, including distributors, to issue and transmit invoices in a structured digital format (PINT AE standard). |

Requires: Immediate upgrade of ERP/accounting systems, integration with FTA-accredited service providers, and adoption of the Peppol network standard for B2B transactions. |

|

UAE |

UAE Federal Medical Products Law (Marketing Holder Requirement) |

2025 |

January |

The new Federal Decree-Law No. 38 of 2024 to regulate medical products came into force, explicitly requiring a Marketing Authorisation Holder (MAH) to appoint at least two importers and one or more distributors per product. |

Requires: Distributors to enhance their value proposition beyond simple logistics, emphasizing specialized technical support, direct service models, and exclusive access to niche market segments to secure MAH partnerships. |

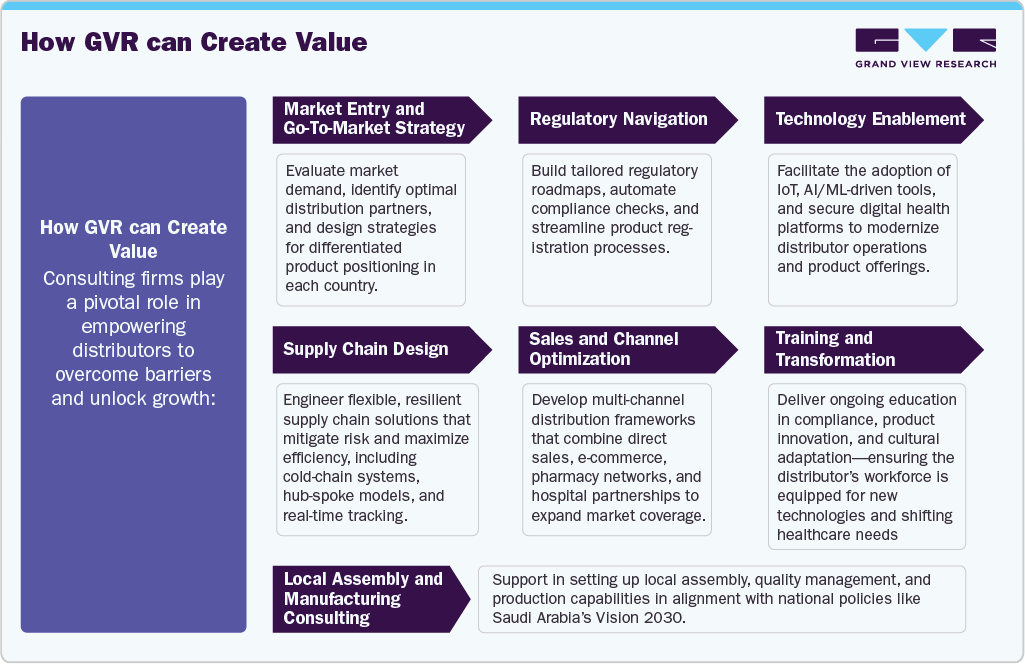

How GVR can Create Value

Real World Examples

-

UAE: Metromed’s collaboration with major technology providers enabled streamlined distribution of AI-powered imaging and rapid diagnostics, demonstrating the value of direct-to-hospital and centralized tender approaches.

-

Saudi Arabia: Distributors working within the Vision 2030 framework have partnered with local manufacturing units, allowing for faster regulatory approvals and increased self-sufficiency in medical device supply.

-

Qatar: International alliances have brought cutting-edge gene therapy tools to innovation centers, with distributors acting as implementation partners for global brands.

-

Kuwait, Oman, Bahrain: Zahrawi Group’s pan-GCC strategy showcases effective expansion across disparate markets by introducing digital health solutions tailored to local infrastructure and preferences.

-

Cross-border Solutions: Consulting firms such as YCP and MEDIcept have helped distributors digitalize inventory systems, automate compliance, and integrate telehealth-ready devices, accelerating market access and operational sophistication.

Conclusion

MedTech distributors in the Middle East operate in a dynamic, fast-changing environment marked by opportunity and complexity. By adopting digital technologies, optimizing regulatory strategies, building resilient supply chains, and leveraging consulting expertise, distributors can overcome country-specific challenges and deliver innovative healthcare solutions across the region. The key lies in flexibility, local relevance, and a strategic partnership mindset—turning obstacles into actionable growth opportunities for better health outcomes and sustainable business success.

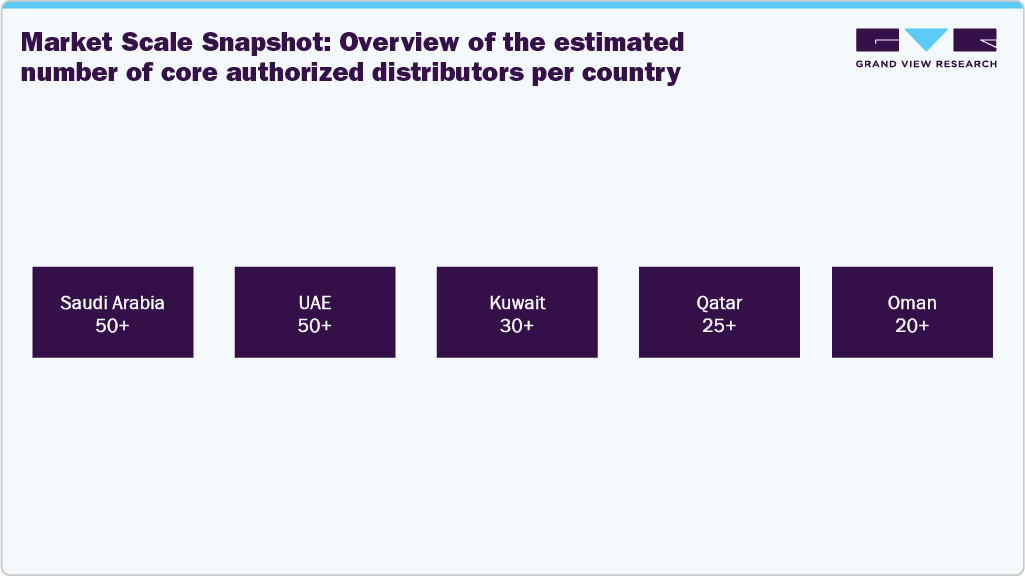

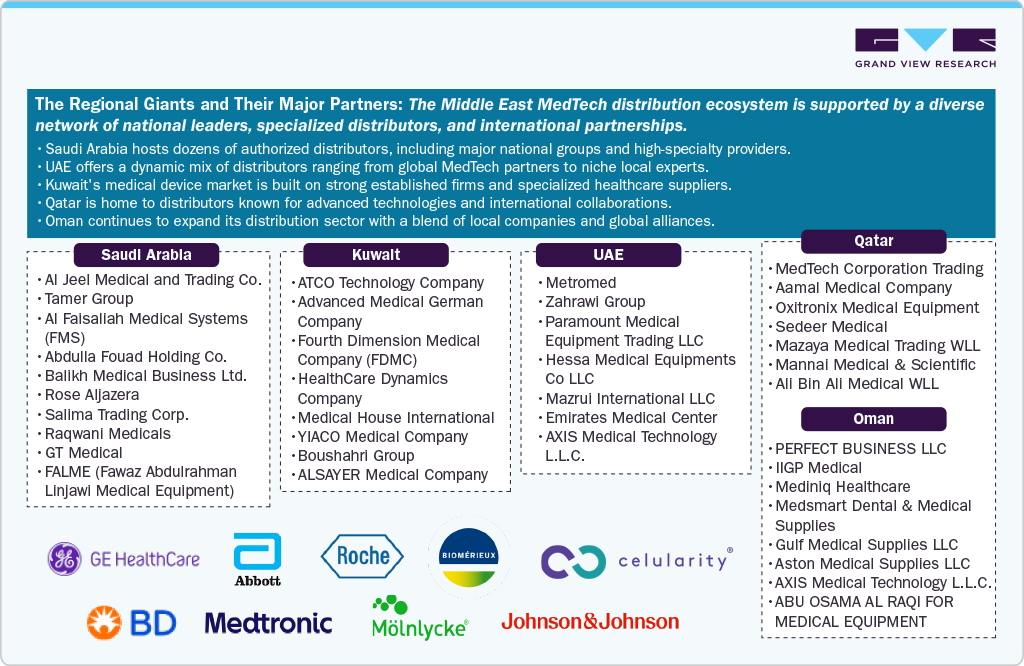

A current list of notable medical device distributors in Saudi Arabia, UAE, Kuwait, Qatar, and Oman, along with a general indication of the number and scale of key players in each country. Distributors range from long-established leaders to specialized or emerging suppliers. The lists below highlight major regional players, helping illustrate the breadth and diversity of the distribution ecosystem.

Market Scale Snapshot: Overview of the estimated number of core authorized distributors per country

Below table provides a country-wise overview of major MedTech distributors in the Middle East, summarizing their year of establishment, product focus, key global partnerships, and the regulatory frameworks they operate under.

|

Country |

Distributor |

Year of Origin |

Product Focus |

Key Partnerships |

Regulations & Guidelines Followed |

|

Saudi Arabia |

Al Jeel Medical |

1975 |

Critical care, anesthesia, maternity, diagnostic cardiology |

GE Healthcare, BioMerieux, Roche, Illumina, Abbott, Steris |

Saudi FDA regulations, SFDA Medical Device Guidelines |

|

Saudi Arabia |

Tamer Group |

1925 (legacy) |

Regenerative biomaterials, hospital equipment, CSSD |

Celularity, Mölnlycke Care |

Saudi FDA regulations, ISO 13485, Vision 2030 compliance |

|

Saudi Arabia |

Zahrawi Group |

1989 |

Surgical, cardiovascular, diagnostic, analytic lab systems |

Medtronic, Smith & Nephew, Johnson & Johnson Vision, BD |

ISO 9001, ISO 13485, Saudi FDA regulations |

|

UAE |

Metromed |

1990 |

Pharmaceuticals, medical devices, diagnostics |

More than 50+ brands including global pharma and medtech |

UAE Ministry of Health regulations, GCC MedTech guidelines |

|

UAE |

Zahrawi Group (UAE ops) |

1989 |

Surgical, ophthalmology, physiotherapy, medical imaging |

Medtronic, Johnson & Johnson Vision, BD |

UAE MoH, ISO certifications |

|

Kuwait |

ATCO Technology Co. |

2006 |

Medical equipment, consumables, customized healthcare |

Multiple global brands (not specified) |

Kuwaiti Ministry of Health, GCC regulations |

|

Kuwait |

Fourth Dimension Medical |

2007 |

Orthopedic, surgical instruments, respiratory care |

Regional suppliers |

Kuwaiti MoH Medical Devices requirements |

|

Qatar |

MedTech Corporation |

Not specified |

Medical devices, diagnostic tools |

Global brands focused on advanced diagnostics |

Qatar Ministry of Public Health approvals |

|

Qatar |

Aamal Medical |

Not specified |

Bioscience, laboratory, environmental labs equipment |

International laboratory brands |

Qatari regulatory compliance |

|

Oman |

PERFECT BUSINESS LLC |

Not specified |

Dental, medical, surgical supplies |

Not specified |

Oman Ministry of Health medical devices regulations |

|

Oman |

ATC (Al Jazeera Trading) |

1990s+ |

Distribution and logistics of medical and consumer products |

Large international brands (Food & non-food) |

Oman Ministry of Health, GCC regulations |

Key Regulatory Compliance Notes:

-

Saudi Arabia distributors follow strict Saudi FDA rules (SFDA) and increasingly ISO standards like ISO 13485 for medical device quality and safety.

-

UAE distributors comply with UAE Ministry of Health (MOH) medical device regulations aligned with GCC standards.

-

Kuwait and Oman distributors adhere to respective Ministry of Health medical device registration and distribution rules.

-

Qatar distributors follow Ministry of Public Health regulations and international standards for advanced diagnostics and bioscience equipment.

Examples of Partnerships:

-

Al Jeel Medical (KSA) is a leading GE Healthcare partner focused on delivering critical care and diagnostic solutions aligned with Saudi Vision 2030.

-

Tamer Group (KSA) collaborates with Celularity for regenerative biomaterials and has a joint venture with Mölnlycke for surgical trays manufacturing.

-

Zahrawi Group (UAE & KSA) partners with over 200 global brands including Medtronic, Johnson & Johnson Vision, and BD for surgical, cardiovascular, imaging, and lab devices.

-

Metromed (UAE) partners with 50+ international pharmaceutical and medical device brands, distributing across governmental and private sectors.

-

Kuwait distributors such as ATCO and Fourth Dimension Medical focus on orthopedic, surgical, respiratory, and customized healthcare solutions.

-

Qatar distributors like MedTech Corporation serve as authorized dealers for advanced diagnostic and medical equipment international brands.