Regulatory Affairs Outsourcing in the Middle East: Catalyzing Convergence, Compliance, and Competitiveness

As the Middle East accelerates its transformation into a regional hub for life sciences innovation, regulatory affairs are no longer a back-office function-they are a strategic enabler of market access, quality assurance, and global alignment. Across the Gulf Cooperation Council (GCC), particularly in Saudi Arabia and the United Arab Emirates, governments are streamlining regulatory procedures and digitalizing health systems to attract biopharma investments, drive local manufacturing, and advance clinical innovation.

This changing environment has increased the demand for outsourcing regulatory affairs, with specialized partners such as CROs, CDMOs, and dedicated regulatory consulting firms helping sponsors navigate complex and evolving compliance requirements.

Evolving Regulatory Landscape: From Fragmentation to Harmonization

The regional regulatory transformation, once fragmented across national agencies, is now moving toward harmonization and reliance.

-

Reliance frameworks such as the Gulf Health Council (GHC) initiative and GCC-DR mechanisms enable regulators to depend on peer-reviewed assessments such as EMA and FDA approvals, significantly reducing review timelines.

-

Digital platforms launched by the Saudi Food and Drug Authority (SFDA) and the UAE’s MOHAP enable e-submissions, product traceability, and post-market surveillance through data integration.

-

The COVID-19 pandemic accelerated the use of reliance-based approvals for vaccines and medical devices, now also applied to pharmaceuticals and biologics.

By 2025–2026, the focus will be on regulatory convergence, utilizing reliance models and digital tools to reduce review times and maintain quality standards align with global benchmarks. This trend positions the Middle East as a testing ground for regulatory innovation, where international best practices intersect with regional flexibility and adaptability.

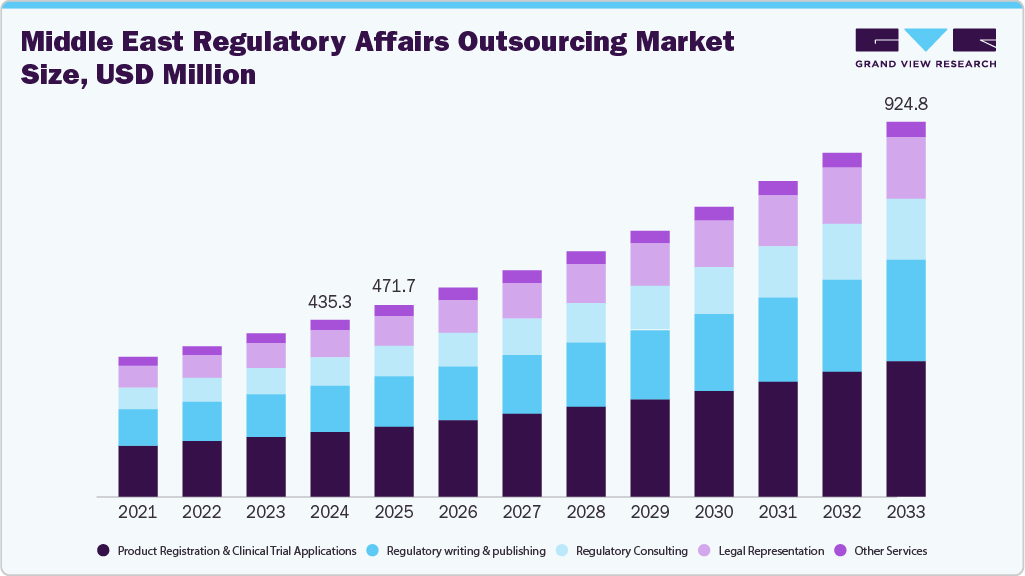

The Middle East regulatory affairs services market, valued at USD 453.3 million in 2024, is projected to experience steady and sustained growth over the coming decade, driven by increasing complexity in global health regulations and rising R&D activities across the pharmaceutical and medical device industries. Market analysts highlight expanding opportunities for both established providers and specialized consultancies, as more companies seek efficient support for regulatory submissions, product registrations, and compliance management.

Why Outsourcing is Becoming Strategic

For sponsors-pharmaceutical, biopharmaceutical, and medical device companies, regulatory affairs outsourcing is no longer a cost-saving exercise. It is a strategy for speed, scalability, and compliance assurance.

-

Complex Multinational Submissions: Companies face varied documentation formats, language requirements, and divergent post-approval change management rules across GCC countries. Outsourcing partners provide centralized submission management, validation checks, and lifecycle management, all aligned with ICH and WHO guidelines.

-

Accelerated Market Entry Needs: As localization policies such as Saudi Vision 2030 mandate domestic manufacturing and quick approvals, regulatory consultancies and CROs fill the operational gaps.

-

Evolving Modalities: Novel developments like cell and gene therapies, radiopharmaceuticals, and AI-enabled diagnostics require specialized regulatory expertise, areas where global consultancies such as ProPharma, ICON, and IQVIA are growing their regional presence through partnerships and local teams.

Market Dynamics and Value Chain Integration

From a clinical trials perspective, the Middle East is quickly emerging as a strategic hub driven by harmonized regulations, digital adoption, and cross-border collaboration. Over the past decade, regional regulators such as the Saudi FDA, UAE MoHAP, and Egypt’s EDA have transitioned from fragmented oversight to structured frameworks aligned with ICH and WHO Good Reliance Practices (GReP). The adoption of reliance and streamlined review pathways, coupled with electronic submission systems (eCTD) and decentralized trial pilots, has significantly shortened approval timelines and boosted sponsor confidence.

Moreover, increasing focus on Good Clinical Practice (GCP) E6 R3, data integrity, and patient-centric trial models is enabling global biopharma and CROs to conduct adaptive, hybrid, and real-world data-supported trials within the region. As Saudi Arabia and the UAE develop advanced therapy and AI/ML governance frameworks, and Egypt and Jordan deepen regional harmonization, the Middle East is positioning itself not only as a cost-effective trial destination but also as a hub of regulatory innovation that encourages faster, ethical, and technology-driven clinical development.

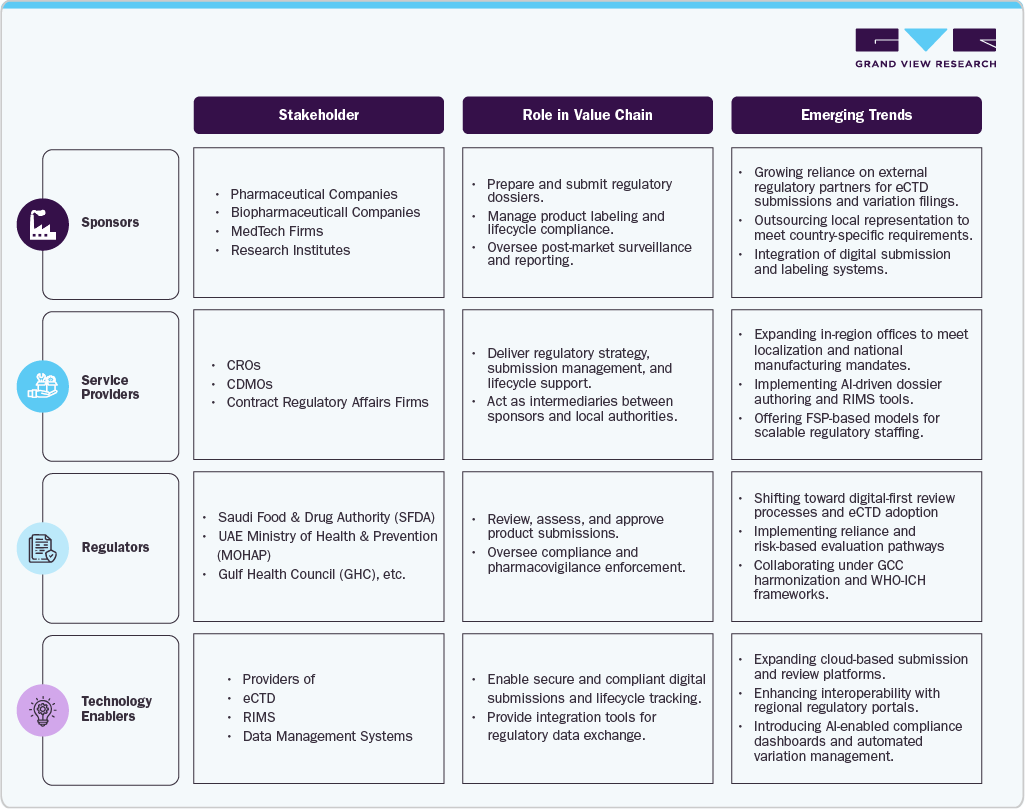

The regulatory outsourcing value chain in the Middle East integrates multiple layers of expertise:

Data point: Industry indicators suggest that a majority of sponsors are adopting hybrid outsourcing models-using regional regulatory consultants for local submissions while maintaining global oversight for core lifecycle management.

Case in Point: Saudi Arabia’s Regulatory Acceleration

Saudi Arabia exemplifies the regulatory modernization wave shaping the region. The SFDA’s Regulatory Transformation Program, under Vision 2030, emphasizes digital submissions, electronic labeling, and global reliance pathways.

-

Accelerated review frameworks now meet EMA and FDA standards.

-

Reliance agreements with EMA, WHO PQ, and Swissmedic shorten market authorization timelines by 30–40%.

-

The SFDA’s integration with the Gulf Health Council has created a unified pharmaceutical pathway, enabling sponsors to seek approvals in multiple countries with one submission.

Regulatory outsourcing partners are essential for helping sponsors organize data packages, verify electronic traceability, and maintain compliance during post-market surveillance. This service is increasingly in demand from foreign entrants and regional manufacturers alike.

Evolving Business and Pricing Models: From Transactional Outsourcing to Strategic Regulatory Partnerships

The business and pricing models for healthcare regulatory affairs outsourcing in the Middle East are shifting toward hybrid, partnership-driven structures that balance cost efficiency with strategic value. Traditionally dominated by project-based engagements for dossier preparation, submission management, and post-approval activities, the market is now shifting toward retainer-based and outcome-driven models. Global CROs, CDMOs, and regulatory consultancies are increasingly providing end-to-end lifecycle management packages that integrate regulatory intelligence, pharmacovigilance, and compliance monitoring within long-term frameworks-especially in high-value markets such as Saudi Arabia, the UAE, and Egypt.

Pricing structures are becoming more tiered and modular, often based on submission type (new drug vs. variation), therapeutic area complexity, and technology enablement, such as eCTD automation, RIM integration, or IDMP compliance. Local firms typically operate under competitive fee-for-service models, leveraging regional expertise and expedited pathways to attract multinational sponsors seeking faster market entry. Meanwhile, larger global players adopt strategic partnership models or shared-service centers to support multinational submissions and post-market surveillance at scale. As regulatory digitalization accelerates, value-based pricing-linked to time-to-approval, compliance accuracy, or accelerated access outcomes-is gaining traction, signalling a shift from transactional outsourcing to performance-driven regulatory partnerships across the Middle East.

Regional Landscape: Country-Level Dynamics and Market Access Outlook

The MENA regulatory landscape remains highly fragmented, with nearly 60 independent authorities enforcing distinct submission, review, and documentation requirements, which often cause launch delays, particularly for biologics and innovative medical devices. While the GCC is advancing harmonization and joint review frameworks, full convergence is still distant. However, modernization is accelerating: Saudi Arabia, the UAE, and Jordan have implemented eCTD systems, online portals, and fast-track reviews recognizing U.S. FDA or EMA approvals. Leading agencies such as the Saudi FDA and Emirates Drug Authority now hold WHO-listed status and participate in ICH and ICMRA initiatives. These advancements, alongside e-labeling and digital review tools, are streamlining approvals while also increasing compliance complexity, driving both multinational and local sponsors to rely more heavily on regulatory outsourcing partners for market entry efficiency.

Across the Middle East, regulatory modernization and rapid healthcare transformation are redefining the competitive balance between global and local regulatory service providers.

Overall, global firms dominate high-value regulatory consulting, pharmacovigilance, and clinical trial submissions, while local providers are gaining traction in registration support, documentation, and post-market compliance through flexible pricing and faster on-the-ground execution. The convergence of digital health regulations has accelerated approvals, and government-backed access frameworks are making the Middle East an increasingly strategic market for regulatory outsourcing partnerships.

Industry Challenges and Outsourcing Solutions

Stakeholders report several urgent issues in Middle East regulatory affairs:

-

Fragmented requirements: Multiple health authorities, each with unique submission templates, labeling rules, and approval cycles. This fragmentation delays cross-border filings and increases resource needs.

-

Rapidly changing guidelines: Countries are updating regulations (on pharmacovigilance, e-labels, post-market surveillance, etc.) to meet international standards. Staying current requires ongoing monitoring and adaptability.

-

Talent shortages: Qualified regulatory affairs professionals, especially those with local expertise, are scarce. One recent engagement noted that a sponsor struggled to find enough RA specialists for Gulf and EMEA operations. Recruiting and training new staff can take months.

- Cost pressures: Building and maintaining an in-house RA department is costly-covering salaries, training, and infrastructure. Companies must weigh this against the benefits of flexibility and risk mitigation.

Key Opportunities Ahead (2025–2033)

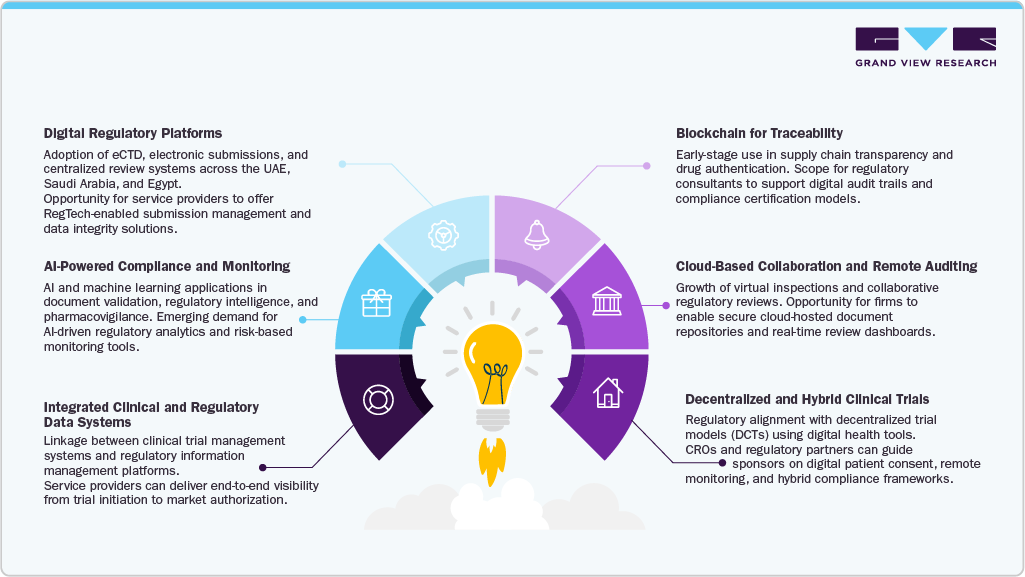

As the Middle East evolves into a key hub for the life sciences, regulatory agility becomes a crucial differentiator. The next decade is expected to witness a surge in opportunities for regulatory consulting and outsourcing firms as the region moves toward convergence, digitalization, and alignment with local manufacturing.

-

Regulatory Convergence Services: Increasing demand for experts capable of managing multi-country submissions under reliance and harmonization models, especially within GCC and Levant markets.

-

Specialized Modalities Expertise: Growing demand for advisory services supporting complex modalities like cell and gene therapies (CGT), radiopharmaceuticals, and AI-based medical devices.

-

RegTech Integration: Expansion of AI-driven dossier preparation, automated variation tracking, and data integrity platforms, creating efficiency and transparency across submission lifecycles.

-

Localization Support: Increasing value for consultancies guiding compliance with domestic manufacturing incentives in Saudi Arabia and the UAE, helping sponsors align with evolving nationalization goals.

-

Post-Market Compliance Outsourcing: Outsourced lifecycle monitoring, pharmacovigilance, and labeling management services powered by digital infrastructure and e-labeling platforms.

-

Strategic FSP/Staffing Models: Global CROs and consultancies are adopting flexible functional service provider (FSP) approaches to deploy regulatory experts across markets rapidly. For instance, a medical device firm achieved 14% cost savings and faster execution by scaling its FSP team from 25 to 60 specialists across EMEA within months.

-

Local Regulatory Partnerships: Collaborating with local consultants knowledgeable about SFDA, MOHAP, and GCC processes ensures faster submissions, compliant documentation, and access to required authorized representation.

-

Digital Infrastructure and Data Systems: Investment in eCTD publishing, electronic labeling, and cloud-based regulatory information management systems (RIMS) enables harmonized submissions and streamlined compliance across Saudi Arabia, UAE, Bahrain, and Jordan.

-

Reliance and Sequencing Strategies: Outsourced regulatory partners use intelligence on mutual recognition pathways-such as FDA/EMA reliance mechanisms adopted in Jordan and Egypt-to accelerate reviews from years to months.

Together, these dynamics are transforming the region’s regulatory outsourcing ecosystem-where technology, local insight, and cross-border expertise come together to enable compliant, faster, and more cost-effective market access.

Conclusion

The Middle East is transitioning from fragmented regulatory systems to a more harmonized, technology-driven ecosystem, creating lucrative opportunities for healthcare regulatory outsourcing. As sponsors pursue faster, compliant market access across diverse jurisdictions, partnerships with specialized CROs, CDMOs, and regulatory consultancies are becoming essential. The convergence of digital transformation, local manufacturing mandates, and changing reliance frameworks will redefine competitive advantage. Service providers that combine regional expertise, AI-enabled compliance tools, and strategic collaboration models will be best positioned to lead this next phase of regulatory modernization in the Middle East.