The Silent Revolution in Middle East Healthcare: Strategic Pivot to Remote Patient Monitoring

Strategic Imperative for Digital Transformation

The healthcare sector across the Middle East is amid a profound transformation, moving rapidly from traditional, reactive models to digitally driven, proactive care. This shift is not merely an evolutionary trend; it is a strategic imperative, explicitly supported by national visions like Saudi Arabia’s Vision 2030 and the UAE’s Smart Hospital 2025 Program.

While the initial wave of change was defined by basic telemedicine, the focus is now hardening on a far more impactful domain: Remote Patient Monitoring (RPM). RPM, coupled with advanced telehealth services, is fundamentally addressing the region's core healthcare challenges: fragmented care delivery, the prevalence of chronic diseases, and the drive for cost-effective, high-quality patient outcomes.

Accelerated Adoption: From Pandemic Necessity to National Strategy

The catalyst for this shift was the COVID-19 pandemic, but the sustained growth is rooted in deliberate governmental and institutional investment. The adoption rates of digital health solutions in the Middle East over the past four years are testament to this successful acceleration.

Our analysis of regional trends reveals a powerful surge:

-

Telehealth Usage: Overall Telehealth Usage across the region has quadrupled, skyrocketing from approximately 7% of the population in 2020 to an estimated 29% by 2024.

- RPM Penetration: The penetration of Remote Patient Monitoring among chronic disease patients has seen a similar vertical climb, increasing from approximately 5% in 2020 to a commanding 22% by 2024.

This growth is fueled by strong government mandates for virtual follow-ups, robust infrastructure investments (especially in 5G networks), and a rapidly increasing patient and provider acceptance of connected devices and mobile apps.

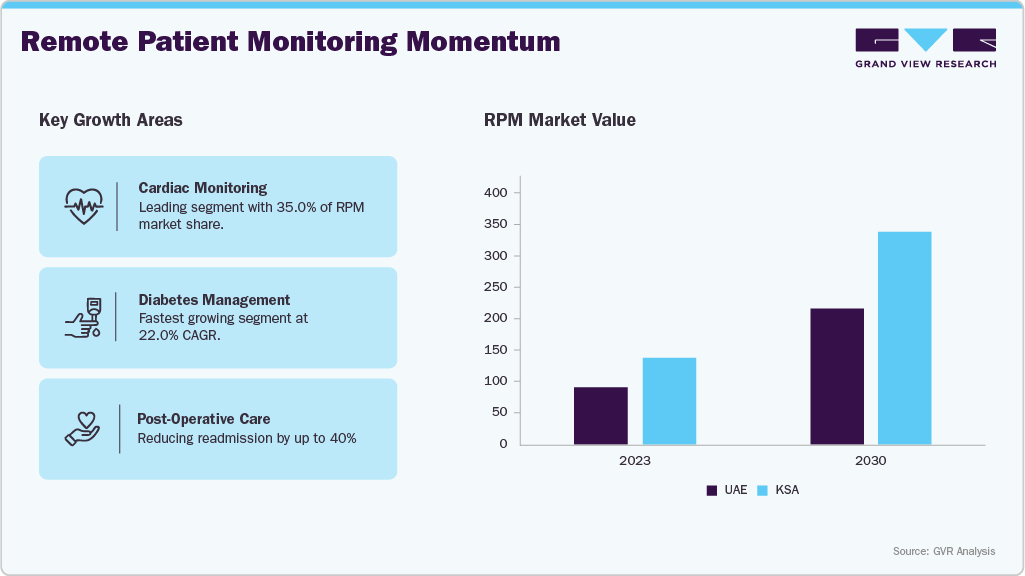

The RPM Mandate: Local Leadership in Chronic Care

The Middle East faces a significant burden of chronic conditions, particularly diabetes, cardiovascular diseases, and hypertension, which RPM is uniquely positioned to manage. By shifting the focus of care from the hospital back to the patient's home, RPM ensures continuous oversight, enabling preemptive interventions that reduce costly hospital readmissions and emergency room visits.

Within the GCC, certain nations have emerged as clear leaders in this transformation:

|

Country |

RPM Penetration (2024) |

Telehealth Adoption (2024) |

|

UAE |

~30% |

~40% |

|

Saudi Arabia |

~24% |

~32% |

|

Qatar |

~20% |

~28% |

|

Country |

Market Size* (2024) (Million) |

CAGR (2025-2030) (%) |

|

UAE |

99.6 |

13.5% |

|

Saudi Arabia |

153.1 |

13.9% |

|

Kuwait |

76.3 |

13.2% |

*Market size of Remote Patient Monitoring Systems, as per GVR estimates

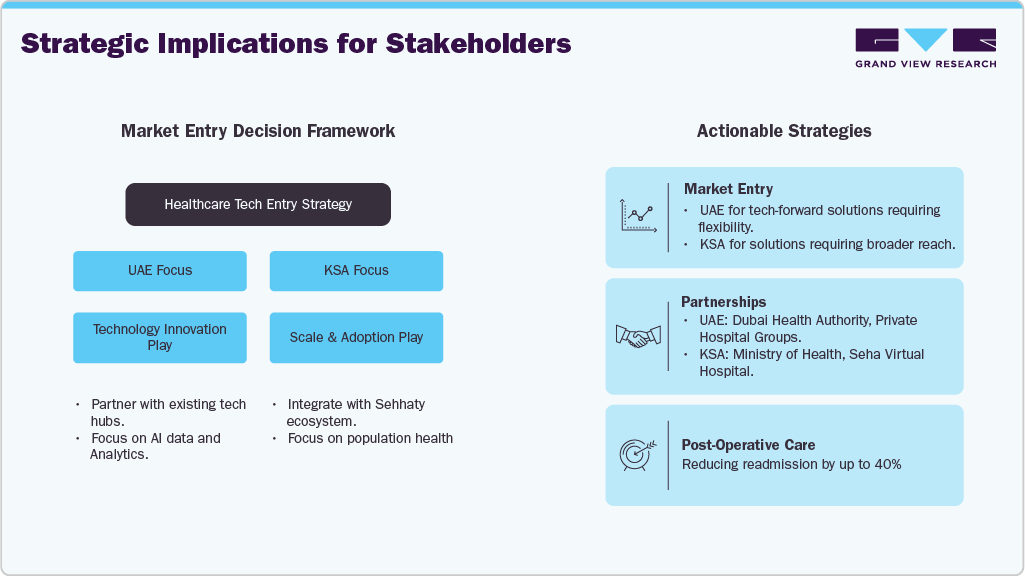

The UAE, with the RPM penetration of nearly 30% of its chronic patients and a telehealth adoption rate of 40%, sets the regional benchmark. This success is directly linked to initiatives by entities like DHA and SEHA, which have mandated virtual clinics and integrated RPM systems into their core service offerings. Similarly, Saudi Arabia’s eHealth expansion, enshrined in Vision 2030, has driven its strong 24% RPM penetration, leveraging platforms like the Sehha App to scale virtual care.

The Next Frontier: Predictive AI and the 5G Backbone

While initial adoption focused on basic device integration, the future of RPM in the Middle East is defined by two interlocking technologies: Artificial Intelligence (AI) and 5G connectivity.

-

Predictive RPM with AI: The goal is no longer merely collecting data, but extracting actionable, localized intelligence. Upcoming focus areas include using AI to generate preemptive alerts based on complex patient vitals and behavioral data. Localized AI doctor tools and Natural Language Processing (NLP) for regional languages will be crucial to making these solutions culturally and linguistically relevant, driving both patient and provider engagement.

-

5G-Enabled Home-Based Diagnostics: The rollout of 5G across the GCC—a key driver noted in 2024—is critical for next-generation telehealth. High-bandwidth, low-latency 5G enables sophisticated, real-time diagnostics from home, facilitating everything from integrated RPM kits (glucometers, BP cuffs, ECG patches) to remote procedural supervision.

During 2025–2030, the market is also expected to be increasingly shaped by Insurance-led Adoption, with major regional and international payers recognizing the proven cost benefits of preventative, monitored care. Integrating RPM and virtual visits into policy benefits will be the final push needed to transition RPM from a niche service to the standard of care.

Strategic Imperatives for Healthcare Leaders

The foundation for a digitally advanced healthcare system is firmly established in the Middle East. For healthcare leaders and policymakers looking ahead, three strategic imperatives must be prioritized:

-

Seamless Integration: Mandate the integration of RPM data streams with Electronic Health Records (EHR) and national health databases to enable unified, longitudinal patient records.

-

Regulatory Harmonization: Continue streamlining licensing and cross-border regulatory frameworks to allow specialist expertise to be leveraged region-wide, especially in specialized tele-consulting.

- Localisation of AI: Invest strategically in local startups and research that can develop AI tools and RPM systems specifically tailored to the regional disease profile, language, and cultural context.

As the Middle East continues its ambitious journey toward digital transformation, Remote Patient Monitoring and Telehealth are no longer supporting players—they are the core engines driving superior patient outcomes and operational excellence. The silent revolution is complete; the era of intelligent, connected care has begun.

Future Outlook of RPM & Telehealth in the Middle East: 2025 and Beyond

The future of RPM and Telehealth in the Middle East is accelerating toward true integration, driven by sovereign wealth investment and national digital mandates. Beyond basic virtual consultations, the focus shifts to predictive, AI-enabled patient care. For instance, the UAE's M42 platform, a global tech-enabled health company, is leading the charge in deploying Generative AI healthcare agents to handle non-diagnostic tasks like appointment scheduling and follow-ups across its network in the UAE and Oman, effectively supporting personalized care. Similarly, Saudi Arabia is leveraging its Vision 2030 goals with major initiatives like the expansion of the Seha Virtual Hospital, which now connects specialized remote care across a vast network of facilities, including potential partnerships with neighboring countries like Bahrain. This cross-border collaboration, combined with Qatar’s heavy investment in AI diagnostics and personalized medicine under its National Health Strategy, indicates a regional pivot towards high-tech, proactive care models that promise greater efficiency, reduced hospitalizations, and globally competitive health outcomes by 2030.