- Home

- »

- Sector Reports

- »

-

Blockchain-oriented Services Industry Data Book, 2023-2030

![Blockchain-oriented Services Industry Data Book, 2023-2030]()

Blockchain-oriented Services Industry Data Book - Decentralized Finance, Blockchain Messaging Apps, Decentralized Identity, Non-fungible Token, Web 3.0 Blockchain Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Feb, 2023

- Report ID: sector-report-00135

- Format: Electronic (PDF)

- Number of Pages: 210

Database Overview

Grand View Research’s blockchain-oriented services industry databook is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The following data points will be included in the final product offering in 5 reports and one sector report overview:

Blockchain-oriented Services Industry Data Book Scope

Attributes

Details

Research Areas

- Decentralized Finance (DeFi) Market

- Blockchain Messaging Apps Market

- Decentralized Identity Market

- Non-fungible Token (NFT) Market

- Web 3.0 Blockchain Market

Details of Product

- 5 Individual Reports - PDF

- 5 Individual Reports - Excel

- 1 Sector Report - PPT

- 1 Data Book - Excel

Cumulative Country Coverage

20+ Countries

Cumulative Product Coverage

25+ Level 1& 2 Product

Highlights of Datasets

- Type Revenue, by Countries

- Application Revenue, by Countries

- End-user Revenue, by Countries

- Competitive Landscape

- Regulatory Guidelines, by Country

- Reimbursement Structure, by Countries

Total Number of Tables (Excel) in the bundle

420

Total Number of Figures in the bundle

180

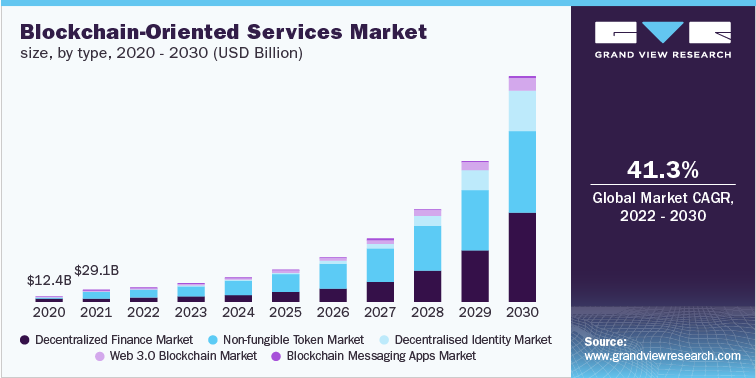

Blockchain-oriented Services Industry Data Book Coverage Snapshot

Markets Covered

Blockchain-oriented Services Industry

USD 29.09 billion in 2021

41.3% CAGR (2022-2030)

Decentralized Finance (DeFi) Market Size

USD 11.78 billion in 2021

42.5% CAGR (2022-2030)

Blockchain Messaging Apps Market Size

USD 0.02 billion in 2021

43.6% CAGR (2022-2030)

Decentralized Identity Market Size

USD 0.38 billion in 2021

88.2% CAGR (2022-2030)

Non-fungible Token (NFT) Market Size

USD 15.54 billion in 2021

33.9% CAGR (2022-2030)

Web 3.0 Blockchain Market Size

USD 1.36 billion in 2021

44.9% CAGR (2022-2030)

The global blockchain-oriented services industry generated over USD 29.09 billion in 2021 and is expected to grow at a CAGR of 41.3% over the forecast period. The market is segmented based on type, application, end users, and industry. BFSI segment held the largest share of blockchain-oriented services revenue. Leveraging blockchain technology in businesses can improve operational efficiency in BFSI sector. For instance, digital asset owners such as cryptocurrency holders can earn interest on their assets without giving up control of their assets. Contrary to the traditional system, wherein depositors rely on banks to hold assets, digital asset owners leverage non-custodial wallets to hold their funds, representing an account on the blockchain network.

One of the key elements expected to drive the growth of the market include the growing investments from venture capital firms in blockchain-oriented services companies. Additionally, the legalization of cryptocurrency encourages investors and business owners to invest more in blockchain-oriented services market. BTL Group Ltd, Chain, Inc, Circle Internet Financial Limited, and DeloitteTouche Tohmatsu Limited are some of the key players spearheading the growth of these applications.

Decentralized Finance (DeFi) Market Analysis & Forecast

The global Decentralized Finance (DeFi) market size was valued at USD 11.78 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 42.5% from 2022 to 2030. The rising popularity of Decentralized Finance (DeFi) can be attributed to its use in enabling financial transactions without the need for intermediaries such as banks, brokers, and insurance providers. Furthermore, DeFi platforms are easily accessible by retail investors and borrowers lacking a credit history. The only prerequisites are a smartphone and a stable internet connection, making it an attractive alternative to traditional financial institutions.

The global Decentralized Finance (DeFi) market is segmented based on component and application. The component segment is further divided into this technology, Decentralized Applications (dApps), and smart contracts. This segment dominated the global Decentralized Finance (DeFi) market in 2021. The growth of the blockchain technology segment can be attributed to early adoption of blockchain technology by organizations in the U.S. and other countries and emergence of numerous blockchain technology providers across the globe.

Top 10 countries in DeFi adoption (2021 Global DeFi Adoption Index)

Country

Index Score

U.S.

1.00

Vietnam

0.82

Thailand

0.68

China

0.62

U.K.

0.60

India

0.59

Netherlands

0.55

Canada

0.52

Ukraine

0.49

Poland

0.46

The application segment is classified into assets tokenization, marketplaces & liquidity, payments, compliance & identity, data & analytics, prediction industry, decentralized exchange, stablecoins, and others. The data & analytics segment dominated the application segment in Decentralized Finance (DeFi) market in terms of revenue share in 2021. DeFi protocols provide considerable advantages in decision-making and data processing. DeFi protocols aid in risk management and provide economic prospects due to their transparency in data and network activity. Users may compare yield and liquidity, as well as analyze platform risks, utilizing various dashboards and tools provided by DeFi platforms. Furthermore, the payments segment is predicted to increase at the fastest rate during the projected period.

Based on region, North America dominated the global (DeFi) market in 2021 and accounted for the largest share of the overall revenue. The dominance of the region can be ascribed to the presence of prominent players, such as Compound and Uniswap. However, Asia Pacific regional market is expected to grow at the highest rate during the forecast period. The growth of the Asia Pacific can be attributed to the strong economic growth and rapid technology adoption in Asian countries.

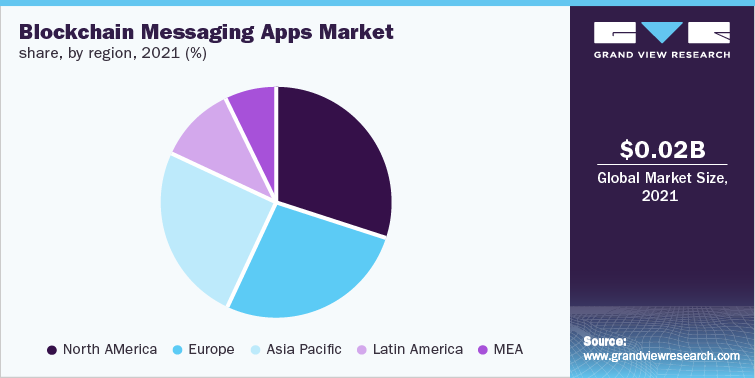

Blockchain Messaging Apps Market Analysis & Forecast

The global blockchain messaging apps market was valued to be USD 0.02 billion in 2021 and is anticipated to witness growth at a rate of 43.6% over the forecast period. The fast increase in internet access and rapid advances in internet speed with the implementation of 5G and 6G technologies are also predicted to boost market expansion. Rising need for data privacy and improvements in Web 3.0 throughout the world are expected to boost market expansion. For instance, as per the Electric Capital Developer Report 2021, there are over 18,416 monthly active Web 3.0 developers working on Web 3.0 and open source crypto projects.

The global blockchain messaging apps market is segmented based on operating system, application, and end-user. Based on operating system, the market is divided into android, iOS, and others. The android segment dominated the market in 2021. The growth of android segment can be attributed to the factors, including its dominance in the mobile operating system globally. According to the Business of Apps, a media and information brand, Android operating system is the most popular in the world, with about 2.5 million active users spread across 190 countries. However, the iOS segment is anticipated to grow at a significant CAGR over the forecast period. The iOS operating system dominates the North American area owing to the large number of Apple smartphone users, which is anticipated to drive the segment's growth.

Based on application the global blockchain messaging apps market is divided into payment and message. The message segment led the market in 2021, owing to the multiple market players throughout the world introducing blockchain messaging apps designed to improve the privacy and security of the texts sent on messaging apps. The payment category is predicted to develop significantly throughout the forecast period due to reasons such as the growing popularity of bitcoin around the world.

North America dominated the market in 2021. The growth of the region can be attributed to the presence of the market players, including Signal and Dust, among others. The Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. The expanding population and increasing smartphone and internet penetration across the countries are likely to drive regional market growth. According to the GSM Association's research titled The Mobile Economy Asia Pacific 2021, smartphone use in the area was at 68% in 2020 and is anticipated to rise to 83% by 2025.

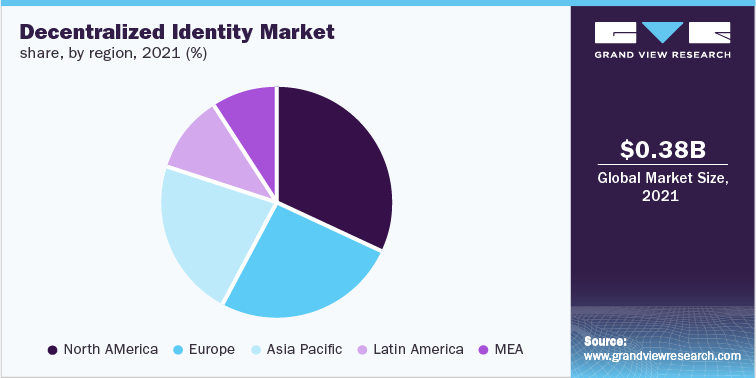

Decentralized Identity Market Analysis & Forecast

The global decentralized identity market size was valued at USD 0.38 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 88.2% from 2022 to 2030. The growth of the market can be attributed to the ineffectiveness of conventional identity management practices and rising incidences of security breaches. Furthermore, the increasing adoption of applications based on blockchain identity worldwide is anticipated to drive the market's growth over the forecast period.

The global decentralized identity market is segmented into identity type, end-user, enterprise size, and vertical. The identity type segment is further divided into biometric and non-biometric segments. The biometric segment dominated the market in 2021. Customers' increasing need for safe onboarding, fraud protection, and risk and compliance management are projected to fuel growth in this segment. However, the non-biometric segment is anticipated to witness the substantial growth over the forecast period. The increasing demand for non-biometric identity within consumers owing to convenience and easy portability bode well with the growth of the segment.

Based on end-user segment the market is divided into individual and enterprises. The enterprises segment dominated the market in 2021. The growing concern to reduce business risk is a significant factor driving the segment. However, the individual segment is expected to register the fastest growth over the forecast period. Individual user segment is expected to grow over the forecast period owing to growing adoption of decentralized identification solutions by individual for generating and preserving their identities.

Based on enterprise size the decentralized identity market is divided into large enterprises and small & medium enterprises. The large enterprises segment accounted for the highest revenue share in 2021. The need for decentralized identification is increasing among major organizations, who are working hard to prevent identity risk. For instance, in August 2022, Litentry, a multi-chain identification system, established a collaboration with Node Real, a blockchain infrastructure solution provider. As a result of this collaboration, Litentry will be able to use NodeReal's MegaNode, which provides strong real-time and historical data indexing on the Ethereum and BinanceChain networks. However, the small and medium enterprises segment is anticipated to register significant growth over the forecast period.

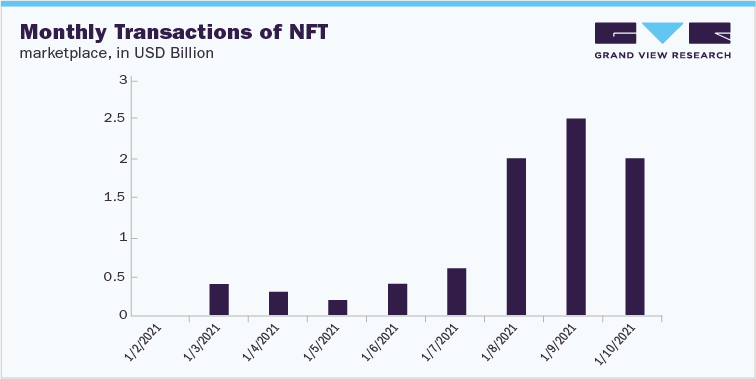

Non-fungible Token (NFT) Market Analysis & Forecast

The Non-fungible Token (NFT)market was valued at USD 15.54 billion in 2021 and is expected to grow at a CAGR of 33.9% from 2022 to 2030. The rise in demand for cryptocurrency is driven by the increasing demand for low-cost digital payment options. The increased awareness about cryptocurrencies has created a need for crypto investments, which is further fueling the growth of the Non-Fungible Token (NFT) market. Furthermore, NFTs are considered as digital assets which can be bought and sold online using cryptocurrency. Furthermore, the company uses NFTs to maintain electronic records of the loan. The use of NFTs solves the problem of fake and duplicate receipts and other issues that lenders face. Owing to these benefits, the market is witnessing significant growth.

The Non-fungible Token (NFT)market is segmented based on type, application, and end use. Based on type it is divided into physical asset and digital asset. The digital asset segment held a highest share in 2021 and is anticipated to grow at the significant CAGR over the forecast period. The digital asset segment includes various types of NFTs, such as digital art, music, video games, and trade cards, among others. The increasing technological advancements are encouraging investors to invest in NFTs.

The end use segment is classified into personal and commercial segments. The personal segment dominated the end use segment in Non-Fungible Token (NFT) market in terms of revenue share in 2021 due to factors such as the increasing traction of Metaverse and Web3.0 platforms. The commercial segment is expected to witness the fastest growth over the forecast period owing to technology companies worldwide investing heavily in NFTs to increase their digital assets and gain a competitive edge over their competition.

North America dominated the global industry in 2021 and accounted for the maximum share of the overall revenue. The dominance of region is attributed to the presence of several prominent players in the region, such as Opensea (Ozone networks, Inc.) and Cloudflare Inc. However, the Asia Pacific is expected to grow at a fastest CAGR over the forecast period. The increasing adoption of cryptocurrencies and rising awareness about the blockchain is expected to drive the growth of the regional market.

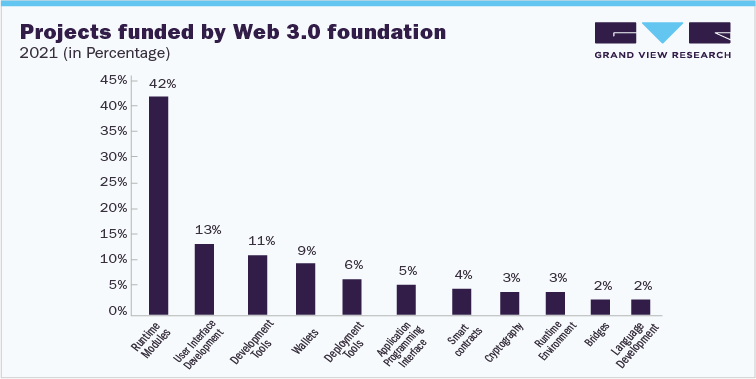

Web 3.0 Blockchain Market Analysis & Forecast

The global web 3.0 blockchain market was valued at USD 1.36 billion in 2021 and is anticipated to witness growth at a rate of 44.9% over the forecast period. Web 3.0 brings about significant transformation in infrastructure over Web 2.0 applications with the use of technologies such as artificial intelligence and machine learning. For instance, Web 3.0 can provide real-time data quickly and more accurately using artificial intelligence and tailoring it to the filters provided by the users. Web 3.0 also enhances data structuring and arrangements using advanced metadata systems, making the data readable for machines and human beings, thereby anticipated to drive the growth of the market over the forecast period.

The web 3.0 blockchain market is divided into segments based on type, application, and end use. Based on type it is divided into public, private, consortium, and hybrid segments. The public segment dominated the market in 2021 owing to the ability of the public blockchain networks enabling users across the globe to participate in the network without any restrictions. Furthermore, public blockchain provides total transparency, high security, an open environment, decentralization, and better distribution which is resulting in growth of the segment.

Based on end-use, the market is further segmented into BFSI, IT & Telecom, Media & Entertainment, retail & e-commerce, pharmaceuticals, and others. The BFSI segment dominated the market in 2021 owing to factors such as increasing demand for Web 3.0 blockchain for better transaction speed, scalability, and reduced processing costs in the BFSI sector. Additionally, transactions enabled by Web 3.0 blockchain technology eliminate the need for third-party payment gateways to allow faster financial communications. Moreover, Web 3.0 allows companies operating in insurance to maintain decentralized data, thus preventing cybercrimes.

Competitive Landscape

The key players in the market are focused on strategies, such as mergers & acquisitions, partnerships, and collaboration to strengthen their market position. For instance, in December 2020, Ripple announced its partnership with Novatti, a fintech and digital payments company based in Australia. This partnership helped Novatti to enable real-time remittance between Asia and Australia. Additionally, they have obtained approvals to launch their products across various countries. In May 2019, Microsoft Corporation launched Azure Blockchain Services. The services helped users in the formation, management, and governance of consortium blockchain networks and allowed businesses to build applications based on the blockchain technology.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified