- Home

- »

- Pharmaceuticals

- »

-

Bioanalytical Testing Services Market Size Report, 2033GVR Report cover

![Bioanalytical Testing Services Market Size, Share & Trends Report]()

Bioanalytical Testing Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Molecule (Small, Large), By Test (ADME, PD, PK), By Workflow, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-946-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioanalytical Testing Services Market Summary

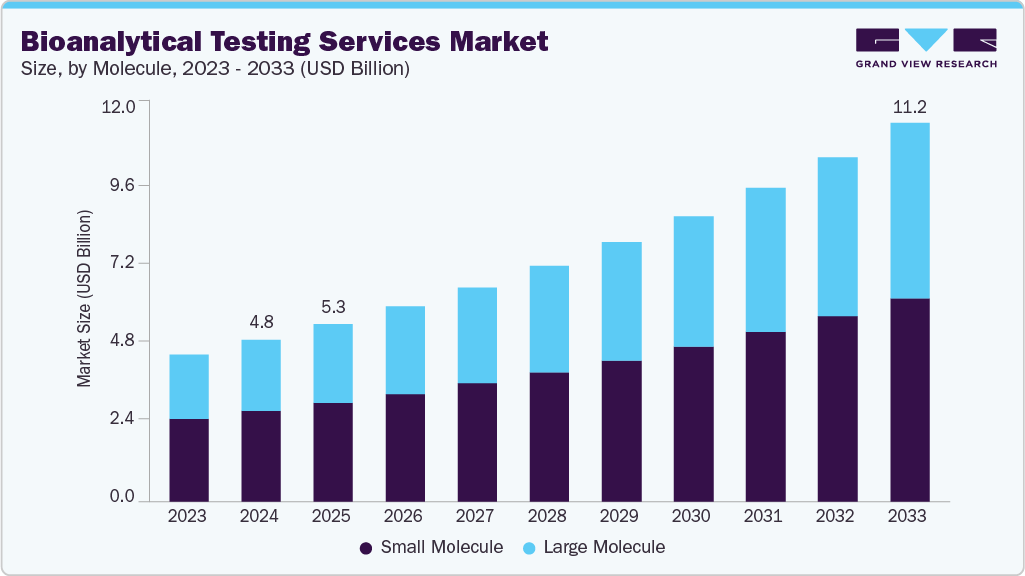

The global bioanalytical testing services market size was estimated at USD 4.80 billion in 2024 and is projected to reach USD 11.24 billion by 2033, growing at a CAGR of 9.93% from 2025 to 2033. The market growth is due to increasing drug development activities and drug approval processes, increasing complexity of therapeutics, and the rise in outsourcing of testing services.

Key Market Trends & Insights

- North America dominated the bioanalytical testing services market with the largest revenue share of 47.40% in 2024.

- The bioanalytical testing services industry in the U.S. accounted for the largest market revenue share in 2024.

- By molecule, the small molecule segment led the market with the largest revenue share of 55.67% in 2024.

- By test, the bioequivalence segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.80 Billion

- 2033 Projected Market Size: USD 11.24 Billion

- CAGR (2025-2033): 9.93%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

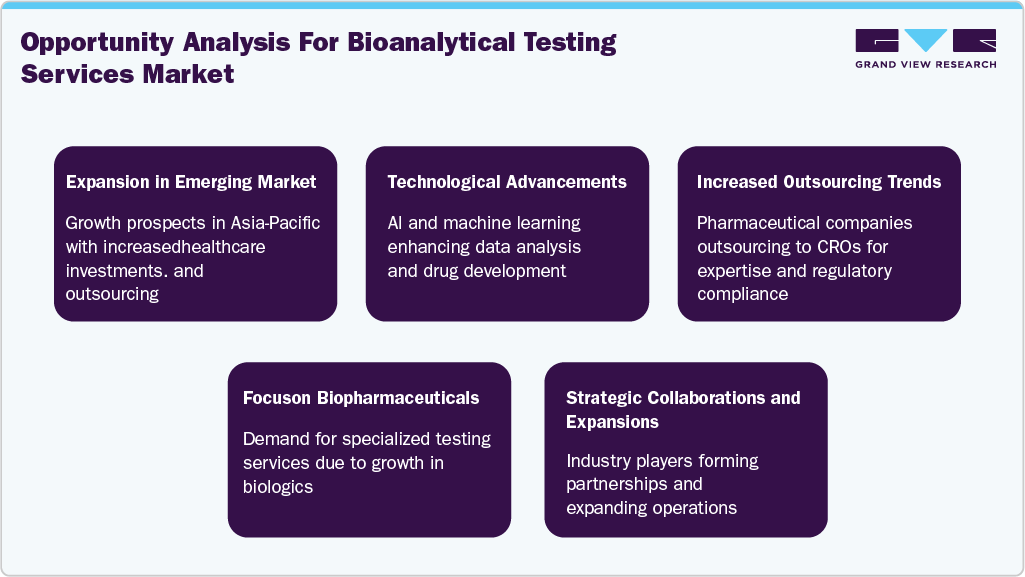

The development of complex therapeutic modalities, such as gene therapies and biologics, has created a need for specialized bioanalytical testing services. Furthermore, growing technological advancements and increasing R&D investments are also some of the key factors driving market growth. The continuous developments of cutting-edge technologies, such as High-Throughput Screening (HTS), liquid chromatography-mass spectrometry (LC-MS), and Next-generation Sequencing (NGS), have significantly enhanced the precision, speed, and sensitivity of bioanalytical testing. These innovations assist service providers in conducting more complex studies and gaining accurate data on drug efficacy, safety, and pharmacokinetics, among others. Moreover, the integration of automation and Artificial Intelligence (AI) into bioanalytical workflows has streamlined processes, reduced human error, and improved throughput.

In addition, increasing regulatory control and awareness regarding the importance of bioanalytical testing are also fueling the demand for bioanalytical testing services. The introduction of stringent guidelines on drug development, particularly in areas of pharmacokinetics, pharmacodynamics, and bioequivalence testing by several regulatory agencies, such as the U.S. FDA and EMA, has led to a rising preference for outsourcing. These guidelines highlight the need for precise and reliable bioanalytical methods to enhance the safety and efficacy of new drugs & biosimilars.

Opportunity Analysis

Technological Advancements

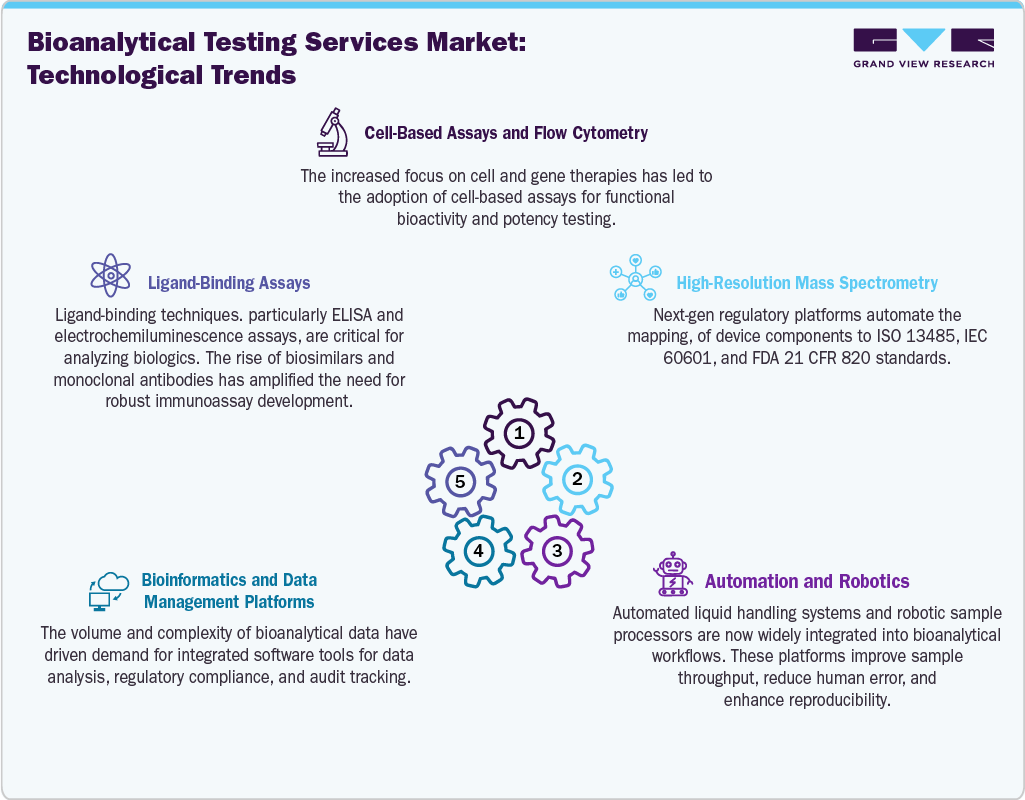

The bioanalytical testing services industry is undergoing significant transformation driven by constant technological innovations. Cell-based assays and flow cytometry have gained adoption due to the growing focus on cell and gene therapies, supporting functional bioactivity and potency evaluations. High-resolution mass spectrometry, including tools like orbitrap and time-of-flight instruments, has enabled precise quantification of small and large molecules, biomarkers, and therapeutic proteins. Ligand-binding assays, especially ELISA and electrochemiluminescence platforms, remain essential for biologics analysis, particularly in biosimilar and monoclonal antibody development.

Bioinformatics and data management platforms are becoming increasingly critical in handling the complex and voluminous datasets generated, offering support for regulatory compliance and audit tracking. Automation and robotics have further streamlined workflows by enhancing sample throughput, reducing manual errors, and improving reproducibility across testing processes.

Pricing Analysis

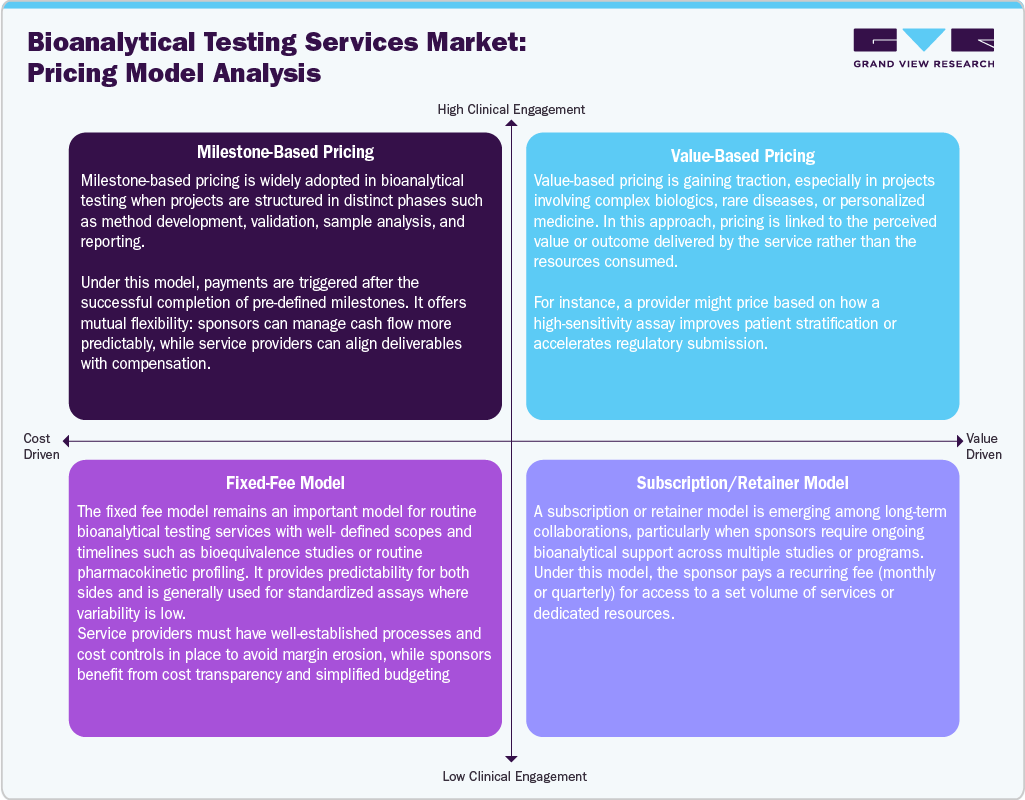

The bioanalytical testing services industry employs a variety of pricing models, each tailored to specific project needs and client engagement levels. Milestone-based pricing is commonly used for projects with clearly defined phases, such as method development and sample analysis, allowing payments to be tied to the successful completion of deliverables. This model offers predictability for sponsors while aligning compensation with progress for service providers.

Fixed-fee models are favored for routine testing services, including bioequivalence and pharmacokinetic studies, where standardization ensures low variability. These models offer cost transparency and help maintain margins through structured pricing. Value-based pricing is gaining popularity in high-impact areas like oncology or personalized medicine, where compensation is based on the outcome or perceived value of the service. Subscription or retainer models are increasingly adopted for long-term partnerships, giving sponsors recurring access to services or dedicated teams across multiple studies.

Molecule Insights

The small molecule segment led the market with the largest revenue share of 55.67% in 2024. The growth of the segment can be attributed to medical breakthroughs related to small molecules and unmet medical needs. Besides, bioanalytical testing of small molecules is crucial for gaining insights into their ADME (Absorption, distribution, metabolism, and excretion) properties, determining the appropriate dosage, evaluating the therapeutic effectiveness, and safeguarding patient well-being.

The large molecule segment is projected to grow at the fastest CAGR during the forecast period, due to the rising development and commercialization of biologics and biosimilars. Unlike small molecules, large molecule drugs such as monoclonal antibodies, therapeutic proteins, and gene therapies require highly specialized and sensitive analytical techniques for accurate assessment of pharmacokinetics, immunogenicity, and stability.

Test Insights

The bioavailability segment accounted for the largest market revenue share in 2024. The segment’s growth is mainly driven due to its significant role in drug development and regulatory approval activities. Bioavailability studies are essential in determining how efficiently and quickly a drug reaches systemic circulation, directly influencing dosage design, therapeutic efficacy, and safety profiles. This segment is particularly vital for evaluating both new chemical entities and generic formulations, ensuring they perform consistently and meet required bioequivalence standards.

The bioequivalence segment is expected to grow at the fastest CAGR during the forecast period. The growth is due to the rising emphasis on generic drug development across global pharmaceutical pipelines. Regulatory agencies require bioequivalence studies to confirm that generic formulations match the safety, efficacy, and pharmacokinetic profiles of their branded counterparts. This has made bioequivalence testing a viable option for cost-effective drug development.

Workflow Insights

The sample analysis segment accounted for the largest market revenue share in 2024. This segment includes several procedures, such as quantification of active pharmaceutical ingredients, detection of metabolites, and stability testing, each vital for regulatory submissions and clinical trial progression. As drug pipelines grow more complex, particularly with biologics and targeted therapies, the demand for precise and high-throughput sample analysis will also increase.

The sample collection and preparation segment is expected to grow at the fastest CAGR during the forecast period. The growth is due to the increasing complexity of drug development processes, which necessitate precise and efficient sample preparation techniques to ensure accurate analytical results. Advancements in automation and miniaturization are enhancing the efficiency and reliability of sample preparation, making it a critical component in bioanalytical workflows.

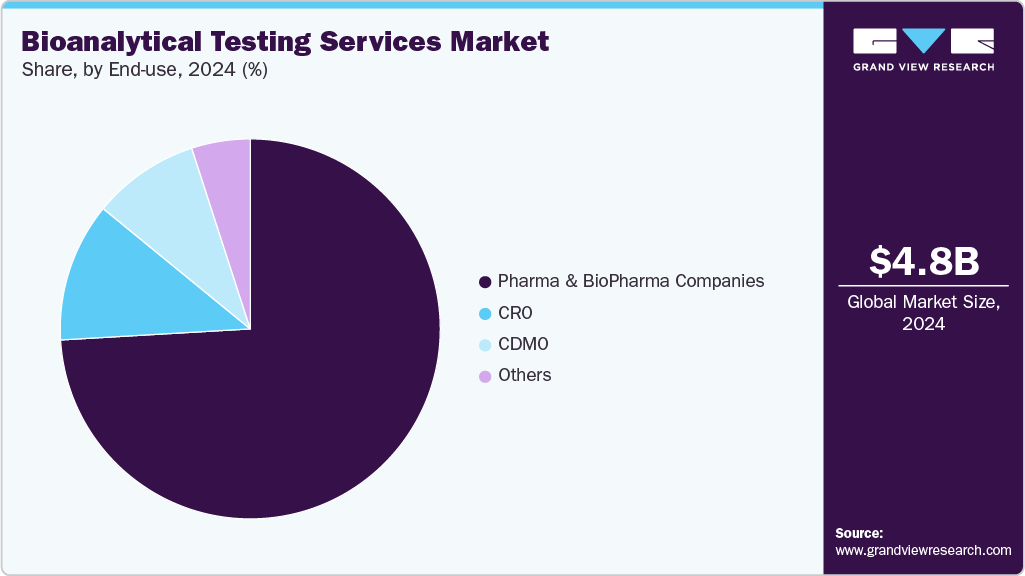

End Use Insights

The pharma & biopharma companies segment accounted for the largest market revenue share in 2024. The market growth is due to the rising need for outsourcing specialized testing across the drug development lifecycle. These companies increasingly rely on external service providers to manage the complex and highly regulated nature of bioanalytical workflows, including pharmacokinetic studies, immunogenicity assessments, and biomarker validation. Outsourcing enables them to accelerate timelines, reduce in-house infrastructure costs, and gain access to technical expertise and advanced platforms.

The CRO segment is expected to grow at the fastest CAGR during the forecast period, due to the increasing demand for flexible, scalable, and cost-effective bioanalytical solutions. As drug development becomes more complex and time-sensitive, pharmaceutical and biopharmaceutical companies are turning to CROs to manage key stages of research and regulatory testing. CROs offer specialized expertise, access to cutting-edge technology, and the ability to quickly adapt to evolving project requirements, making them a suitable option in the dynamic drug development environment.

Regional Insights

North America dominated the global bioanalytical testing market with the largest revenue share of 47.40% in 2024. The growth in the region is mainly due to the increasing demand for biopharmaceuticals, constant technological advancements, and increasing investment in R&D of new drugs. Furthermore, growing innovations in mass spectrometry, chromatography, and other analytical methods have enhanced the sensitivity, specificity, and throughput of testing processes. These technologies have enabled laboratories to conduct more precise and efficient analyses, facilitating faster drug development timelines and reducing costs.

U.S. Bioanalytical Testing Services Market Trends

The bioanalytical testing services market in the U.S. is driven due to the presence of several pharmaceutical and biotechnology companies and outsourcing firms in the country. Company such as Alcami Corporation, a U.S.-based CDMO offering analytical development services, supports various therapeutic modalities varying from small molecules to biologics.

Europe Bioanalytical Testing Services Market Trends

The bioanalytical testing services market in Europe is experiencing growth owing to advancements in technology, an increasing number of clinical trials, and the presence of key players offering advanced analytical testing solutions. Europe has become a hub for clinical research due to its diverse patient populations and well-established regulatory frameworks.

The UK bioanalytical testing services market held a significant share in 2024. The country’s market growth is driven by extensive R&D initiatives and clinical trials being undertaken to address the challenges posed by various infectious diseases. These companies often require bioanalytical testing services to assess their pharmaceutical products' safety, efficacy, and quality, contributing to market growth.

The bioanalytical testing services market in France is driven due to the country’s growing demand for biologics, such as gene therapies, cell-based therapies, and monoclonal antibodies is significantly driving the bioanalytical testing services industry.

The Germany bioanalytical testing services market is anticipated to grow at a significant CAGR during the forecast period, due to increasing demand for outsourcing services from major companies such as Novartis, Sanofi, Roche, GlaxoSmithKline, and AstraZeneca.Furthermore, several strategic initiatives, such as expansion and mergers and acquisitions by outsourcing firms, are also driving the demand for bioanalytical testing services in the country.

Asia Pacific Bioanalytical Testing Services Market Trends

The bioanalytical testing services market in the Asia Pacific is projected to grow at the fastest CAGR over the forecast period. The market growth is due to owing to increasing pharmaceutical & biotechnology activities, rising healthcare expenditure, and increasing investments by pharmaceutical and biotechnology companies.

The China bioanalytical testing services market is growing rapidly and has become an attractive destination for outsourcing clinical trials due to its large population, diverse patient pool, and cost-effectiveness. As a result, both domestic and international pharmaceutical companies outsource their clinical trials to CROs in China, driving the demand for bioanalytical testing services.

The bioanalytical testing services market in Japan is anticipated to grow at a significant CAGR over the forecast period. The country’s growth is due to the expanding biopharmaceutical sector, a strong focus on precision medicine, and rising demand for biologics and biosimilars. The aging population and increasing prevalence of chronic diseases are fueling the development of complex therapeutic agents that require advanced testing solutions.

The India bioanalytical testing services market is expected to witness at a considerable CAGR during the forecast period, and the growth is attributed to low costs, the availability of industry experts, and the presence of WHO-cGMP-compliant facilities. India has become one of the most preferred sites for clinical trials due to its largest patient pool, developing healthcare sector, educated physicians, and cost competitiveness.

Latin America Bioanalytical Testing Services Market Trends

The bioanalytical testing services market in Latin America is projected to grow at a moderate CAGR over the forecast period. The growth in the region is due to expanding pharmaceutical and biotechnology sectors, increased clinical trial activity, and rising demand for both small and large molecule drug testing. Countries like Brazil are emerging as key hubs due to their growing R&D infrastructure, favorable regulatory environments, and diverse patient populations that support efficient clinical research.

The Brazil bioanalytical testing services market growth is driven by the expanding pharmaceutical industry, increasing number of clinical trials, and rising investment in biologics and biosimilars. Brazil’s favorable regulatory reforms, along with growing participation in global drug development, are encouraging both domestic and international CROs to strengthen their testing capabilities in the region.

Key Bioanalytical Testing Services Company Insights

Key players in the bioanalytical testing services industry are actively expanding their service portfolios, investing in advanced analytical technologies, and pursuing strategic partnerships to strengthen their global presence. Leading contract research organizations (CROs) and specialized laboratories are enhancing capabilities in complex assay development, large molecule analysis, and cell and gene therapy testing to meet evolving client needs. For instance, in August 2024, SGS introduced its new specialized bioanalytical testing services in Hudson, New Hampshire, North America. Through these services, the company provides advanced bioanalytical services to both biopharmaceutical and pharmaceutical companies.

Key Bioanalytical Testing Services Companies:

The following are the leading companies in the bioanalytical testing services market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc (PPD, Inc.)

- ICON Plc

- Charles River Laboratories International

- IQVIA

- Syneos Health

- SGS SA

- Labcorp

- Intertek Group Plc

- Pace Analytical Services LLC.

Recent Developments

-

In September 2024, Thermo Fisher Scientific announced it to expand its bioanalytical testing services in Europe. The expansion aims to offer services to pharmaceutical and biotech customers with advanced laboratory services.

-

In June 2024, SGS Birsfelden Laboratory announced the addition of new stability studies to its biopharmaceutical service portfolio in Switzerland. This introduction broadened the company’s service portfolio and customer reach in this significant market.

-

In June 2024, Pace Analytical Services announced the acquisition of Lebanon, a New Jersey laboratory facility, from Curia. The acquisition aimed to support emerging drug development partners by providing rapid and expert development and commercial analytical laboratory services across the biopharma industry.

Bioanalytical Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.27 billion

Revenue forecast in 2033

USD 11.24 billion

Growth rate

CAGR of 9.93% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Molecule, test, workflow, application, end use

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Germany; France; Italy; Spain; Netherlands; Switzerland; Denmark; Sweden; Norway; China; Japan; India; Indonesia; Malaysia; South Korea; Taiwan; Australia; Thailand; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait, Oman; Qatar; Israel

Key companies profiled

Thermo Fisher Scientific Inc.; ICON Plc; Charles River Laboratories International; IQVIA; Syneos Health; SGS SA; Labcorp; Intertek Group Plc; Pace Analytical Services LLC.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioanalytical Testing Services Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global bioanalytical testing services market report based on molecule, test, workflow, end use, and region:

-

Molecule Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Molecule

-

Large Molecule

-

LC-MS Studies

-

Immunoassays

-

Pharmacokinetics (PK)

-

ADA Assay

-

Other

-

-

Other Large Molecule Tests

-

-

-

Test Outlook (Revenue, USD Million, 2021 - 2033)

-

ADME

-

In-vivo

-

In-vitro

-

-

Pharmacokinetics (PK)

-

Pharmacodynamics (PD)

-

Bioavailability

-

Bioequivalence

-

Biomarker Testing

-

Cell-based Assay

-

Virology Testing

-

Other Tests

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Sample Collection and Preparation

-

Sample Collection, Handling and Storage

-

Protein Precipitation

-

Liquid-Liquid Extraction

-

Solid Phase Extraction

-

Others

-

-

Method Development and Validation

-

Sample Analysis

-

Hyphenated technique

-

Chromatographic technique

-

Electrophoresis

-

Ligand Binding Assay

-

Mass Spectrometry

-

Spectroscopic Techniques

-

Nuclear Magnetic Resonance (NMR)

-

Others

-

-

Genomic and Molecular Techniques

-

Polymerase Chain Reaction (PCR)

-

Next-Generation Sequencing (NGS)

-

Others

-

-

-

Other processes

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharma & BioPharma Companies

-

CDMO

-

CRO

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Netherlands

-

Switzerland

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Indonesia

-

Malaysia

-

Singapore

-

South Korea

-

Thailand

-

Taiwan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global bioanalytical testing services market size was estimated at USD 4.80 billion in 2024 and is expected to reach USD 5.27 billion in 2025.

b. The global bioanalytical testing services market is expected to grow at a compound annual growth rate of 9.93% from 2025 to 2033 to reach USD 11.24 billion by 2033.

b. North America dominated the bioanalytical testing services market with a share of 47.40% in 2024. This is attributable to the fact that it is one of the top manufacturing hubs of highly reliable, complex, and high-end pharmaceuticals.

b. Some key bioanalytical testing services market players are PPD, Inc.; Laboratory Corporation of America Holdings; ICON plc.; Charles River Laboratories International; IQVIA; SGS SA; Intertek Group; and Pace Analytical Services, LLC., among others

b. Key factors that are driving the bioanalytical testing services market growth include the increasing frequency of outsourcing R&D activities by the major pharmaceutical companies to focus on their core competencies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.