- Home

- »

- Clinical Diagnostics

- »

-

Cell-based Assays Market Size, Share, Growth Report, 2030GVR Report cover

![Cell-based Assays Market Size, Share & Trends Report]()

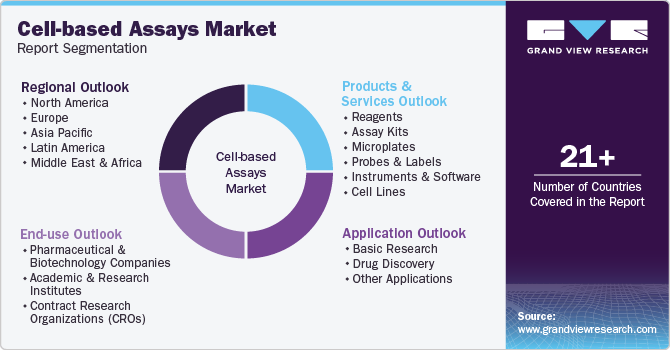

Cell-based Assays Market (2025 - 2030) Size, Share & Trends Analysis Report By Products & Services (Reagents, Assay Kits), By Application (Basic Research, Drug Discovery), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-984-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell-based Assays Market Summary

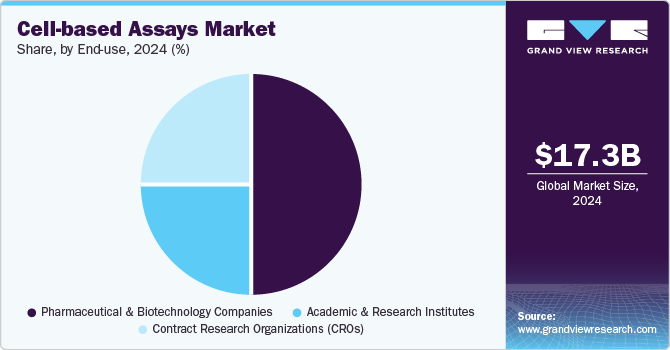

The global cell-based assays market size was estimated at USD 17.26 billion in 2024 and is projected to reach USD 28.56 billion by 2030, growing at a CAGR of 8.8% from 2025 to 2030. The market is witnessing substantial growth driven by factors like the rising need for drug discovery, expanding research efforts in biotechnology, and the increasing incidence of infectious diseases, cancer, autoimmune disorders, and genetic conditions.

Key Market Trends & Insights

- The North America Cell-based Assays market dominated the overall global market and accounted for 41.34% of revenue share in 2024.

- Based on products & services, the assay kits dominated the market and accounted for a revenue share of 38.2% in 2024.

- Based on application, the drug discovery segment dominated the market, capturing a 40.0% revenue share in 2024.

- Based on end-use, the pharmaceutical and biotechnology companies segment led the market, accounting for 50.2% of the revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.26 Billion

- 2030 Projected Market USD 28.56 Billion

- CAGR (2025-2030): 8.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The launch of new products is likely to fuel market growth in the coming years. For instance, in September 2024, Ncardia announced the launch of new cell-based assays for screening neurodegenerative diseases including Parkinson's disease.

Significant growth is expected in the cell-based assays market during the forecast period, driven by the increasing focus on drug development worldwide. Cell-based assays play a critical role in early drug discovery, enabling the evaluation of compound efficacy, toxicity, and safety profiles. The ongoing demand for new drugs, coupled with the expanding pharmaceutical and biotechnology industries, continues to boost the need for cell-based assays.

These assays are widely used in drug discovery to validate the effectiveness of potential drug candidates, as well as lead profiling, cellular signaling, and toxicity assessments. As a result, the market is highly competitive, with major players offering a wide range of products and services, including reagents, assay kits, instruments, and contract research. Continued advancements, product innovations, strategic collaborations, and the increasing application of cell-based assays in various research fields are expected to further drive market expansion in the coming years.

The drug discovery sector is poised for significant growth, driven by increased R&D funding from biopharmaceutical companies and government initiatives, a growing focus on personalized medicine, and the expansion of the pharmaceutical and biotechnology industries. Additionally, the rising prevalence of chronic diseases such as cancer, osteoarthritis, cardiovascular conditions, and diabetes is amplifying the demand for cell-based assays in the quest for new drug innovations, thereby playing a key role in the market's expansion.

Products & Services Insights

Assay kits dominated the market and accounted for a revenue share of 38.2% in 2024. The segment is anticipated to experience rapid growth due to its effectiveness across a variety of biopharmaceutical applications. These kits are essential for examining multiple aspects of cellular behavior, such as cell cycle progression, movement, and infiltration. They also play a key role in evaluating the levels of critical cellular components, which are commonly used to assess cell viability and responses to different stimuli.

The reagents segment is projected to grow rapidly with a CAGR of 9.7% during the forecast period. Reagents are critical for analyzing various properties of living cells, and supporting assays for cell growth, differentiation, apoptosis, and signal transduction. Their widespread use by biopharmaceutical and biotechnology companies creates a strong demand for consumable products essential to cell development and production processes.

Application Insights

The drug discovery segment dominated the market, capturing a 40.0% revenue share in 2024 owing to the rising demand for innovative therapies, growing competition for regulatory approvals, and significant R&D investments. The sector's growth is further supported by initiatives from governments and biopharmaceutical companies, the introduction of novel medications, and the increasing incidence of chronic diseases like cancer, cardiovascular disorders, and diabetes.

The basic research segment is projected to grow at a lucrative CAGR of 9.3% from 2025 to 2030. Cell-based assays are crucial in this area, allowing researchers to investigate the effects of drugs, compounds, and environmental factors on specific cell types. These assays offer valuable insights into biological pathways and potential therapeutic targets. The rising prevalence of chronic diseases, such as cancer and neurodegenerative disorders, has intensified the need for basic research using cell-based assays to explore disease mechanisms and develop innovative treatment strategies.

End-use Insights

The pharmaceutical and biotechnology companies segment led the market, accounting for 50.2% of the revenue share in 2024. This segment growth is anticipated to increase further from 2025 to 2030, fueled by its critical role in these industries. Biotech and pharma companies rely on precise, high-throughput screening techniques to assess cell toxicity and mobility. In addition, the rising focus on personalized medicine and targeted therapies is driving demand for cell-based assays, which are integral to the development of advanced treatments and innovations in biotechnology and pharmaceuticals.

The academic and research institutes segment is expected to be the fastest-growing segment with a projected CAGR of 9.5% over the forecast period. This growth is largely driven by the increasing use of cell-based assays in research and the development of innovative assay-based diagnostics. These institutes are consistently working on advancements in cell-based assay technologies, aiming to improve their accuracy, efficiency, and applicability in various research areas, which is fueling their rapid expansion in the market.

Regional Insights

The North America Cell-based Assays market dominated the overall global market and accounted for 41.34% of revenue share in 2024. The region is expected to maintain its leadership position and continue expanding at a steady growth rate throughout the forecast period. The market's strong performance can be largely attributed to the collaborative efforts between academic research institutes and pharmaceutical companies, which have driven extensive research across various institutions in the region. These partnerships have fostered innovation and advancements in cell-based assay technologies, contributing to the region’s sustained market growth.

U.S. Cell-based Assays Market Trends

The cell-based assays market in U.S. held a significant share of the North American market in 2024, fueled by the presence of key players and a large end user base. Market growth is significantly driven by the high incidence of chronic diseases, including cancer, diabetes, arthritis, and cardiovascular diseases. In addition, the increasing emphasis on personalized medicine and the rapid expansion of the biopharmaceutical and biotechnology industries in the region are also key factors contributing to this growth. Together, these elements create a robust demand for cell-based assays, which are essential for developing innovative therapies and improving patient outcomes.

Europe Cell-based Assays Market Trends

The Europe Cell-based assays market is experiencing significant growth. This market is driven by several factors, including increased research initiatives, a strong pharmaceutical sector, and the high prevalence of chronic illnesses. Additionally, advancements in technology, government support, the presence of key market players, and the ongoing shift toward personalized medicine further contribute to this expansion. With these elements in place, the market is projected to experience continued growth in the region.

The cell-based assays market in UK is experiencing significant growthdue to healthcare improvements and technological advancements. The presence of numerous pharmaceutical and biotech companies in the UK significantly drives the adoption of cell-based assays for drug discovery. Additionally, the country is home to well-established academic and research institutions that actively engage in basic research utilizing these assays. Government initiatives, such as the Life Sciences Sector Deal, along with a pool of skilled researchers and advanced infrastructure, position the UK as an attractive hub for research and development in cell-based assays. This combination of factors supports ongoing innovation and growth within the sector.

Germany cell-based assays market is experiencing significant growth, driven by robust pharmaceutical and biotechnology industry, with numerous companies engaged in drug discovery and development. This creates a high demand for cell-based assays, which are essential for evaluating drug efficacy and safety.

Asia Pacific Cell-based Assays Market Trends

The cell-based assays market in Asia Pacific is experiencing the fastest growth,driven by significant advancements in healthcare infrastructure and technology. Asia-Pacific is witnessing robust growth in its pharmaceutical and biotechnology sectors, particularly in countries like China, India, Japan, and South Korea. The increasing focus on drug discovery and development drives demand for cell-based assays across the region. With the growing interest in personalized medicine in Asia-Pacific, there is a rising demand for cell-based assays to aid in the development of patient-specific therapies. These assays help in tailoring treatments based on individual cellular responses, making them integral to personalized healthcare approaches.

The China cell-based assays market is growing, driven by the rapid expansion of its biotechnology and pharmaceutical industries. The country's growing investment in drug discovery and development has significantly increased the demand for cell-based assays, which are essential for evaluating drug efficacy, toxicity, and safety. China's emphasis on innovation in healthcare, supported by government initiatives and the rising prevalence of chronic diseases, has further bolstered the adoption of these assays, positioning China as a key player in the global market.

Latin America Cell-based Assays Market Trends

The cell-based assays market in Latin America is experiencing significant growth, owing to increasing investments in pharmaceutical and biotechnology sectors, particularly in countries like Brazil, Mexico, and Argentina. The rising prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular conditions, has amplified the need for innovative drug discovery and development, where cell-based assays play a crucial role. Additionally, the region is seeing growing support from governments and international organizations through funding and initiatives to enhance research capabilities. Latin America's expanding academic and research institutions are also contributing to the adoption of advanced cell-based assay technologies

Middle East and Africa (MEA) Cell-based Assays Market Trends

The MEA cell-based assays market is expanding driven by increased investment in healthcare and life sciences, especially in countries like South Africa, Saudi Arabia, and the UAE.

The cell-based assays market in Saudi Arabia is expanding due to increased healthcare investment and improved infrastructure. The government’s Vision 2030 initiative, which emphasizes diversification and investment in healthcare infrastructure, has boosted research and development activities in biotechnology and pharmaceuticals.

Key Cell-based Assays Company Insights

The competitive scenario in the market is high, with key players such as Bio-Rad Laboratories, Inc.; Corning Incorporated; Merck KGaA; Lonza Group AG; Charles River Laboratories; and Becton, Dickinson, and Company (BD) holding significant positions. Prominent market participants are focusing on increasing their customer base using mergers, acquisitions, and partnerships with other major companies.

Key Cell-based Assays Companies:

The following are the leading companies in the cell-based assays market. These companies collectively hold the largest market share and dictate industry trends.

- Bio-Rad Laboratories, Inc.

- Corning Incorporated

- Merck KGaA

- Lonza Group AG

- Charles River Laboratories

- Becton, Dickinson and Company (BD)

- Danaher Corporation

- Promega Corporation

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd. (Roche Holdings AG).

- Perkin Elmer Inc.

Recent Developments

-

In October 2024, Sphere Fluidics unveiled Cyto-Mine Chroma, the second generation of its Cyto-Mine platform, offering enhanced features such as multiplexing and increased assay flexibility. This advanced platform is designed to improve the efficiency and precision of single-cell functional analysis workflows, making it a valuable tool for researchers in drug discovery and biotechnology applications.

-

In September 2024, Ncardia introduced a set of ready-to-use cell-based assays designed to streamline the screening and selection of potential treatments for neurodegenerative conditions like Parkinson's disease. These assays utilize induced pluripotent stem cells (iPSCs) derived from human sources. iPSCs are capable of transforming into nearly any cell type. The process begins by obtaining cells from healthy individuals or patients and then reprogramming them into a stem-cell-like state in the laboratory.

Cell-based Assays Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.72 billion

Revenue forecast in 2030

USD 28.56 billion

Growth rate

CAGR of 8.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products & services, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bio-Rad Laboratories, Inc.; Corning Incorporated; Merck KGaA; Lonza Group AG; Charles River Laboratories; Becton, Dickinson and Company (BD); Danaher Corporation; Promega Corporation; Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd. (Roche Holdings AG); Perkin Elmer Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell-based Assays Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell-based assays market report based the products & services, application, end-use, and region:

-

Products & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents

-

Assay Kits

-

Cell Growth Assays

-

Reporter Gene Assays

-

Cell Death Assays

-

Second Messenger Assays

-

-

Microplates

-

Probes & Labels

-

Instruments & Software

-

Cell Lines

-

Primary Cell Lines

-

Stem Cell Lines

-

Immortalized Cell Lines

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Basic Research

-

Drug Discovery

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Contract Research Organizations (CROs)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell-based assays market size was estimated at USD 17.26 billion in 2024 and is expected to reach USD 18.72 billion in 2025.

b. The global cell-based assays market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2030 to reach USD 28.56 billion by 2030.

b. North America dominated the cell-based assays market with a share of 41.34% in 2024. This is attributable to extensive research carried out in various research institutes collaboratively sponsored by academic research institutes and pharmaceutical giants.

b. Some key players operating in the cell-based assays market include Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Corning Inc., Charles River Laboratories, Danaher Corporation, Hoffmann-La Roche Ltd. (Roche Holdings AG), Lonza Group AG, Merck KGaA, Promega Corporation, Thermo Fisher Scientific Inc.

b. Key factors that are driving the market growth includes growing demand for drug discovery, rising need for research in biotechnology, increasing incidence of infectious diseases, cancer, autoimmune, and genetic disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.