- Home

- »

- Food Additives & Nutricosmetics

- »

-

Functional Ingredients Market Size And Share Report, 2030GVR Report cover

![Functional Ingredients Market Size, Share & Trends Report]()

Functional Ingredients Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Probiotics, Rice Protein), By Application (Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-686-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Functional Ingredients Market Summary

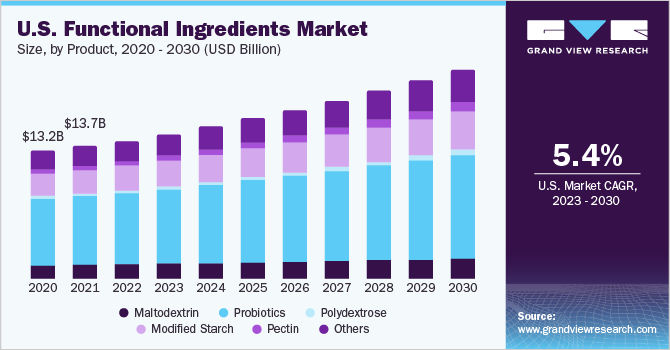

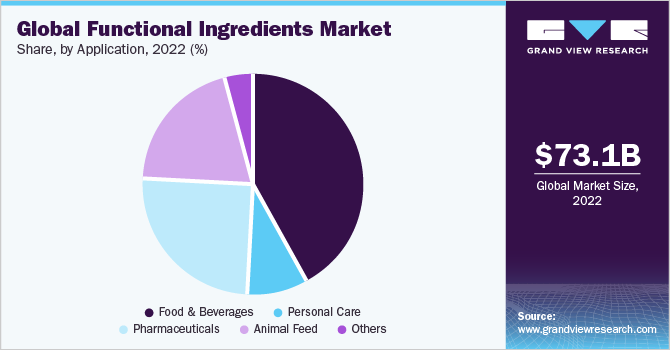

The global functional ingredients market size was valued at USD 73.1 billion in 2022 and is expected to grow at a CAGR of 6.6% from 2023 to 2030. This is attributed to increasing consumer awareness about the health benefits of functional ingredients, growing demand for functional food and beverage products, and increasing investment in research and development.

Key Market Trends & Insights

- North America region dominated the market with the highest revenue share of 32.2% in 2022.

- By product, the probiotic segment dominated the market with the highest revenue share of 51.6% in 2022.

- By application, the food & beverage segment dominated the market with the highest revenue share of 44.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 73.1 Billion

- 2030 Projected Market Size: USD 122.3 Billion

- CAGR (2023-2030): 6.6%

- North America: Largest market in 2022

Additionally, the rise in the number of health-conscious consumers and the increasing incidence of chronic diseases are also expected to contribute to market growth. Key functional ingredients include probiotics, vitamins, minerals, fibers, and amino acids, which are widely used in food and beverage, dietary supplements, and animal feed industries.

The U.S. functional ingredient industry is expected to witness a significant growth rate due to several factors. One of the major factors driving the market growth is the advancement in technology and subsequently, innovations in functional ingredients. Companies are constantly developing new ingredients that offer a wide range of health benefits, such as reducing the risk of cancer and improving cognitive function. For instance, Cargill, Inc., another major player in the market, has developed a new line of plant-based proteins that can be used in functional food and beverage products.

The rising demand for functional probiotic ingredients is playing a significant role in driving the growth of the market. Probiotics are live microorganisms that, when consumed in adequate amounts, can provide health benefits. They are considered functional ingredients because of their ability to improve gut health, boost the immune system, and prevent or manage chronic diseases.

The COVID-19 pandemic had a moderate impact on the market. The pandemic led to a heightened awareness of health and immunity among consumers, which increased the demand for ingredients that can boost immunity and overall health. For instance, there has been an increase in demand for vitamins, minerals, and probiotics, which are known to support the immune system.

Product Insights

The probiotic segment dominated the market with the highest revenue share of 51.6% in 2022. This is attributed to rising awareness among consumers about the potential health benefits of probiotics. Consumers continue to look for new ways to adopt these in their daily diets. This has led to a growing demand for probiotic-rich food and beverage products, such as yogurt, kefir, and probiotic supplements. The increasing popularity of these products is driving the demand for probiotic ingredients and, in turn, is favoring the growth of the market.

Moreover, the increasing research on probiotics and the discovery of new strains of probiotics with a wide range of health benefits, such as reducing the risk of cancer, improving cognitive function, and reducing the symptoms of allergies, are driving the demand for functional probiotic ingredients. In addition, the growing trend of clean labels and organic food, consumer preference for plant-based products, and the increasing number of e-commerce platforms are also driving the growth of the market.

The modified starch product segment is expected to register healthy growth over the forecast period. As it is a functional ingredient that is widely used in the food and beverage industry due to its unique properties and ability to improve the texture, stability, and quality of food products. The increasing use of modified starch in food and beverage products favors market growth.

Modified starch is used as a thickening, binding, and texturizing agent in a wide range of food and beverage products, such as sauces, soups, gravies, frozen desserts, and baked goods. The ability of modified starch to improve the texture and stability of these products is a key reason for its growing use in the food and beverage industry. Additionally, modified starch is also used as a fat replacer, which makes it a popular choice for low-fat and fat-free food products. This is because modified starch can provide the same textural properties as fat while reducing the calorie content of the food product.

Application Insights

The food & beverage segment dominated the market with the highest revenue share of 44.8% in 2022. This is attributed to vitamins such as minerals, fibers, and amino acids, which are widely used in the food and beverage industry to improve the nutritional value of food products and to provide specific health benefits. As consumers become more health conscious, the demand for functional food and beverages will increase, which in turn will contribute to the product demand in the near future.

The pharmaceutical segment is expected to register growth over the forecast period owing to the increasing focus on personalization and precision medicine. This approach involves tailoring treatment and prevention strategies to the individual patient based on their genetic makeup, lifestyle, and other factors. As a result, companies are developing functional ingredients that are targeted to specific populations and health conditions. For example, there are probiotic supplements targeted at gut health, omega-3 supplements for heart health, and Vitamin D supplements for bone health.

Another trend that is driving the growth of the market is the increasing use of functional ingredients in over-the-counter (OTC) products. Consumers are showing greater concern for their health and well-being and are looking for OTC products that can provide specific health benefits. Companies are developing OTC products that are fortified with these ingredients, such as omega-6, omega-3 (EPA, DHA, ALA), and pectin to meet this demand.

Regional Insights

The North America region dominated the market with the highest revenue share of 32.2% in 2022. In the North American functional ingredient industry, functional food and beverages are expected to hold a major share of the market due to the increasing demand for fortified food and beverages. The dietary supplements segment is also expected to witness a significant growth rate in the coming years due to the increasing demand for dietary supplements for health and wellness.

Key players operating in the North American market include DuPont de Nemours, Inc.; Cargill, Inc.; Kerry Group; Arla Foods; and DSM. These companies are focusing on new product launches, collaborations, and partnerships to expand their market presence. For instance, DuPont de Nemours, Inc. recently launched a range of new probiotic ingredients that can be used in a variety of food and beverage applications.

Additionally, the demand for sports nutrition in Europe is growing rapidly due to functional ingredients that can help to improve athletic performance. Companies are developing ingredients such as amino acids, creatine, and beta-alanine that can be used in sports nutrition products. For example, companies are introducing functional supplements that contain a combination of ingredients that can help to improve muscle mass and strength.

Manufacturers in the functional ingredient space are taking various strategic initiatives and innovations to stay competitive in the market. For example, Kerry Group has partnered with food and beverage companies to supply functional ingredients for their products, such as fibers, vitamins, and minerals. DSM has developed a new functional ingredient that is a natural source of Omega-3 fatty acids that can be used in functional food and beverage products, dietary supplements, and animal feed.

Key Companies & Market Share Insights

The global functional ingredients industry is becoming increasingly consolidated, with a few large companies controlling a large share of the market. This is driven by mergers and acquisitions, as well as partnerships and collaborations between companies. Companies are investing heavily in research and development to develop new functional ingredients that can provide a wide range of health benefits. This includes developing ingredients that can help to prevent or manage chronic diseases such as diabetes, heart disease, and cancer.

Companies are investing in digitalization and automation to improve their production process, traceability, and distribution of these ingredients. For instance, Archer Daniels Midland Company (ADM) announced in 2020 the launch of a new range of plant-based protein ingredients for food and beverage applications. The new products are aimed at meeting the growing demand for plant-based protein options. Some prominent players in the global functional ingredient market include:

-

ADM

-

Ingredion Incorporate

-

Cargill, Incorporated

-

ate & Lyle

-

Roquette Frères

-

Golden Grain Group Limited

-

FMC Corporation

-

Plasma Nutrition Inc.

-

NutriBiotic

-

Omega Protein Corporation

Functional Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 77.7 billion

Revenue forecast in 2030

USD 122.3 billion

Growth Rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Volume in kilotons, Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; India; Thailand; Brazil,

Key companies profiled

ADM; Ingredion Incorporate; Cargill, Incorporated; Tate & Lyle; Roquette Frères; Golden Grain Group Limited; FMC Corporation; Plasma Nutrition Inc.; NutriBiotic; Omega Protein Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Functional Ingredients Market Report Segmentation

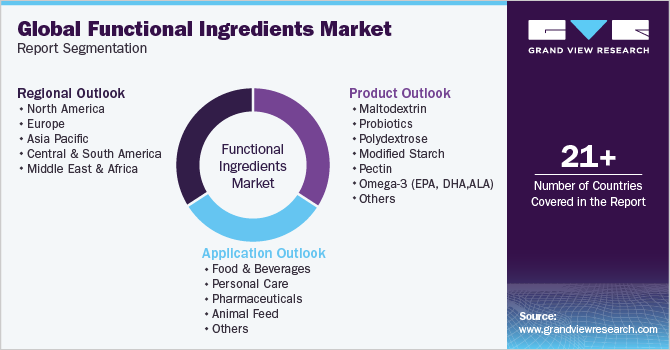

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global functional ingredients market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Maltodextrin

-

Probiotics

-

Polydextrose

-

Modified starch

-

Pectin

-

Omega-3 (EPA, DHA,ALA)

-

Omega-6

-

Conjugated linoleic acid

-

Rice protein

-

Protein hydrolysate

-

Mung bean protein

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & beverages

-

Personal care

-

Pharmaceuticals

-

Animal feed

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Probiotics led the market and accounted for more than 51% share of the global revenue in 2022. Probiotics products exhibit a vital growth area within the functional ingredient group, and strong research efforts are underway to improve dairy products into which probiotic organisms such as Bifidobacterium and Lactobacillus species are integrated.

b. Some of the key players operating in the functional ingredients market Archer Daniels Midland Company, Ingredion Incorporated, Golden Grain Group Limited, FMC Corporation, Omega Protein Corporation, NutriBiotic, Cargill Incorporated, Tate & Lyle plc, and Roquette Frères.

b. The key factors that are driving the functional ingredients market includes increasing consumption of the product owing to health concerns and health issues such as obesity, diabetes, and digestive disorders.

b. The global functional ingredients market size was estimated at USD 73.10 billion in 2022 and is expected to reach USD 77.7 billion in 2023.

b. The global functional ingredients market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 122.3 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.